In This Guide, I Explain How To Screen For And Find The Best High-Yield Dividend Stocks And Which Tools And Screening Parameters To Use.

10 Great Tips How To Find High Yield Dividend Stocks.

Disclaimer: I’m not a financial advisor. No content is meant to be a recommendation. Please do your own research. Pages might contain affiliate links. Please read my Disclaimer page.

Table of Contents

Best Tips To Find High Yield Dividend Stocks.

You decided you like to take matters into your own hands and become a DIY investor. Excellent, a great choice. No one else will care more about your money than you – make your money work hard, even while you sleep. But how to go about it? Where to start? Let’s dive in.

What Is The Best Free Dividend Stock Screener?

The first key tool you as a DIY investor need is a good stock screener, allowing you to easily find high yield dividend stocks. There are several free and stock screeners, allowing you to look for a multitude of attributes.

Let’s take a look at the best stock screeners out there:

Finviz

The recommended and best free stock screener, allowing you to screen for simply put all relevant attributes.

Gurufocus

The creme de la creme when it comes to stock screeners. Whatever you are looking for, this screeners has is all!

Investing

One of the first screeners I ever used to find high yield dividend stocks – a good choice if you try to find U.S. based companies.

MarketBeat

Love the simplicity of it. Using it at least once a month. Limited amount of parameters , but still a solid and good choice.

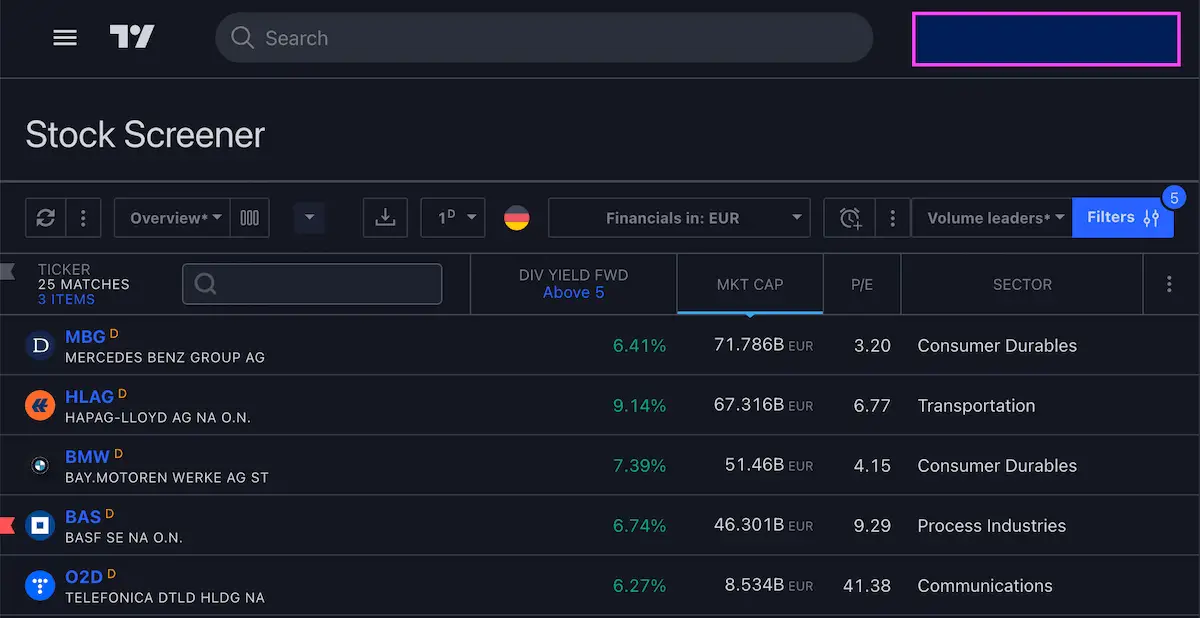

Tradingview

Everyone’s favorite charting tool these days, and their stock screener is also not bad – but also not really great either.

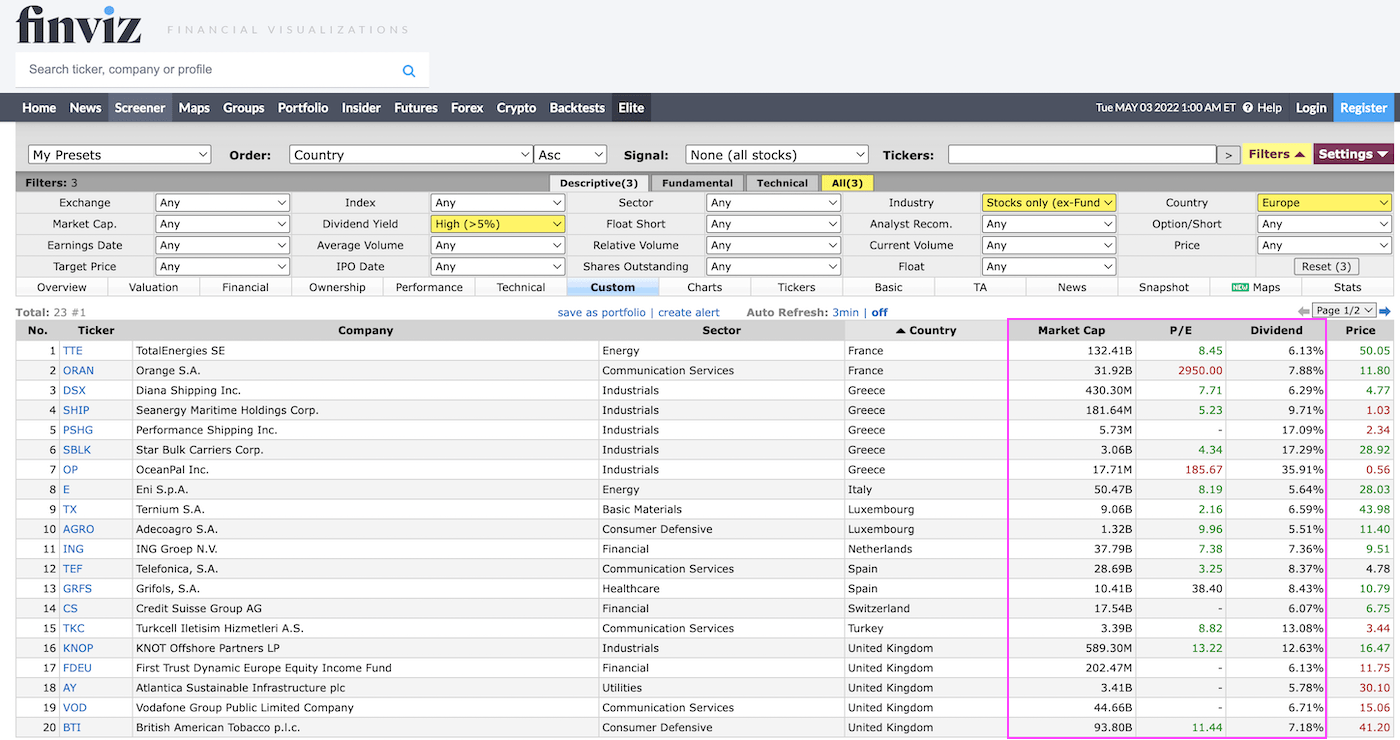

Finviz Stock Screener

This one is one I have been using for a long time and it’s solid. Covers most countries, and has a good and wide variety of attributes. A solid and good choice, allowing you to screen for the most important attributes such as PE, dividend yield, and growth.

–> Link

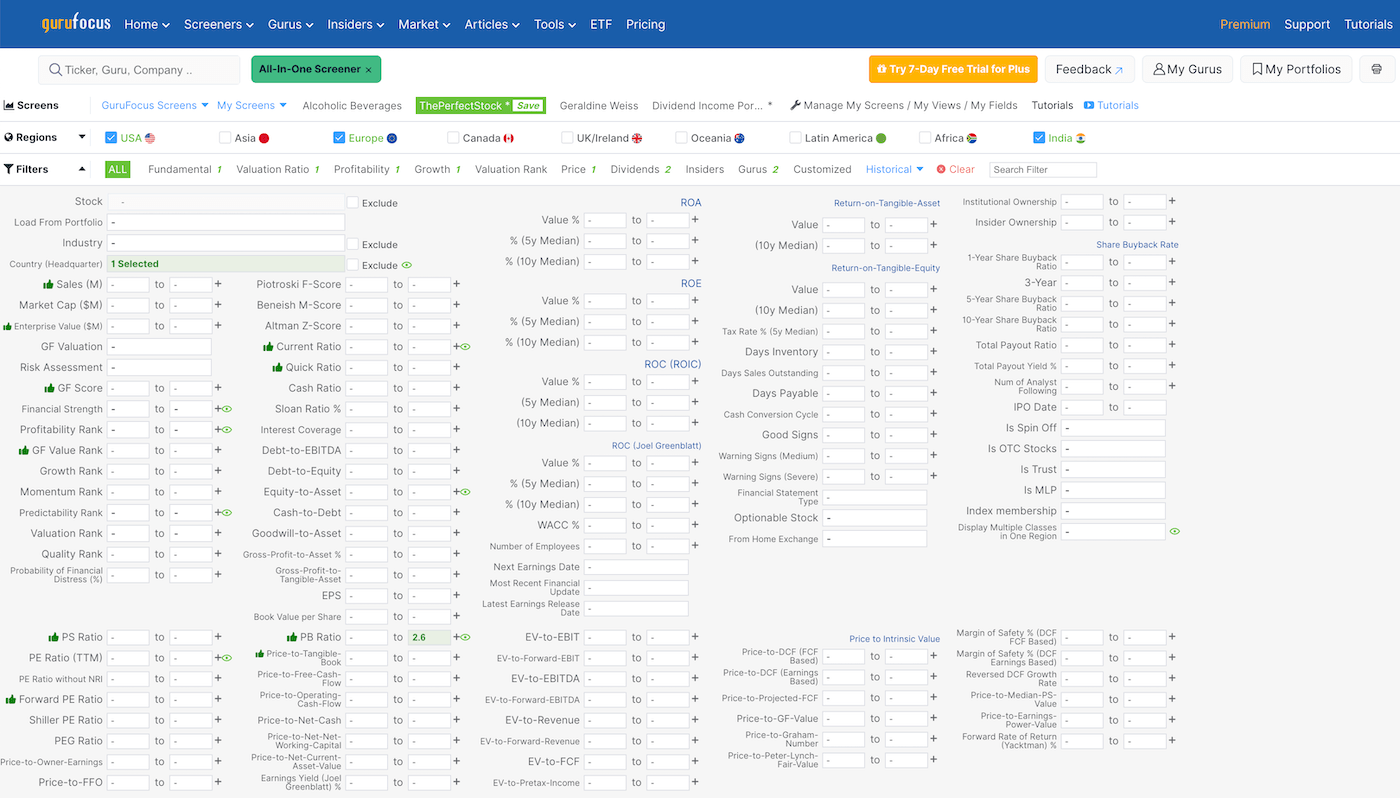

Gurufocus’s Stock Screener

By far the most detailed stock screener is the one on Gurufocus.com. The search filters at your disposal are endless, allowing you to comb and find the most suitable dividend stocks. I have been using it for years and more features and filters get added frequently. The annual Premium membership is 499 USD, but the value you get out of the platform is well worth it, in my opinion.

–> Link

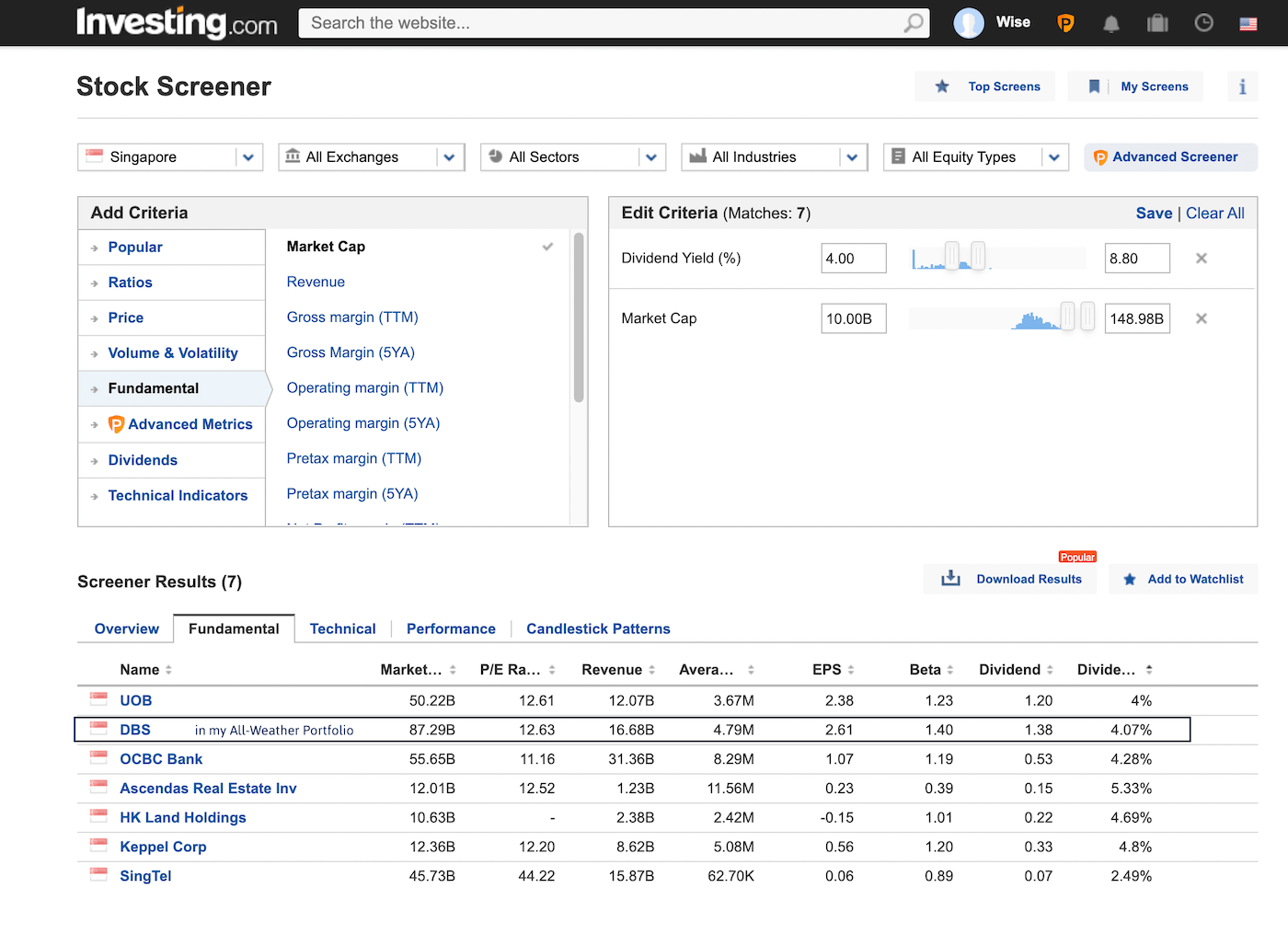

Investing.com

One of my most frequently visited sites, Investing.com, has an excellent free dividend screener. First off, I love the “scrollable visual bar”, which instantly shows you how many e.g. dividend stocks are there. It covers all the major markets. For example, see below for a quick screen of high yield dividend stocks in

- Singapore

- with a market cap of at least 10 Bio USD

- and a dividend yield between 4% to 8%

–> Link

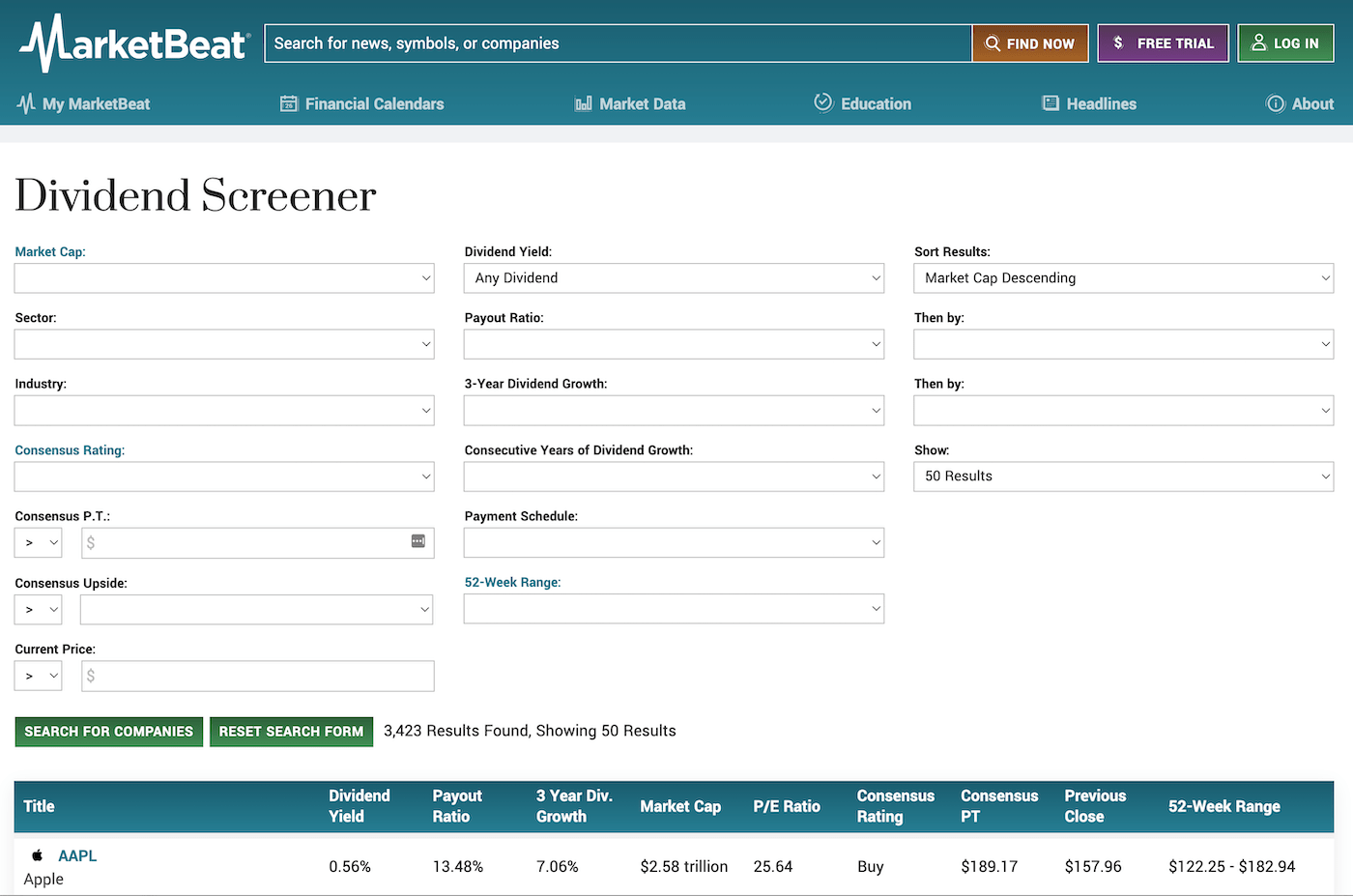

Marketbeat

A simple yet good screener, allowing you to however screen the U.S. markets only. As an international DIY investor, I prefer screeners that also have at least European and Asia-Pacific stocks as well, because I want to simply find the world’s best high yield dividend stocks to buy and hold.

–> Link

Tradingview

When it comes to technical analysis and charting solutions, Tradingview is, in my opinion, a must-have in every investor’s toolbox. But if you are looking for an excellent high yield stock screener, then you won’t find it here. Even after I worked with it for a couple of hours, it still can not compete with the more comprehensive solutions out there. I for example could not search for high yield monthly dividend stocks, only by quarter or year.

–> Link

Noteworthy Runner-Ups

Following stock screener are solid and good, but did not make it into my top five recommended stock screeners.

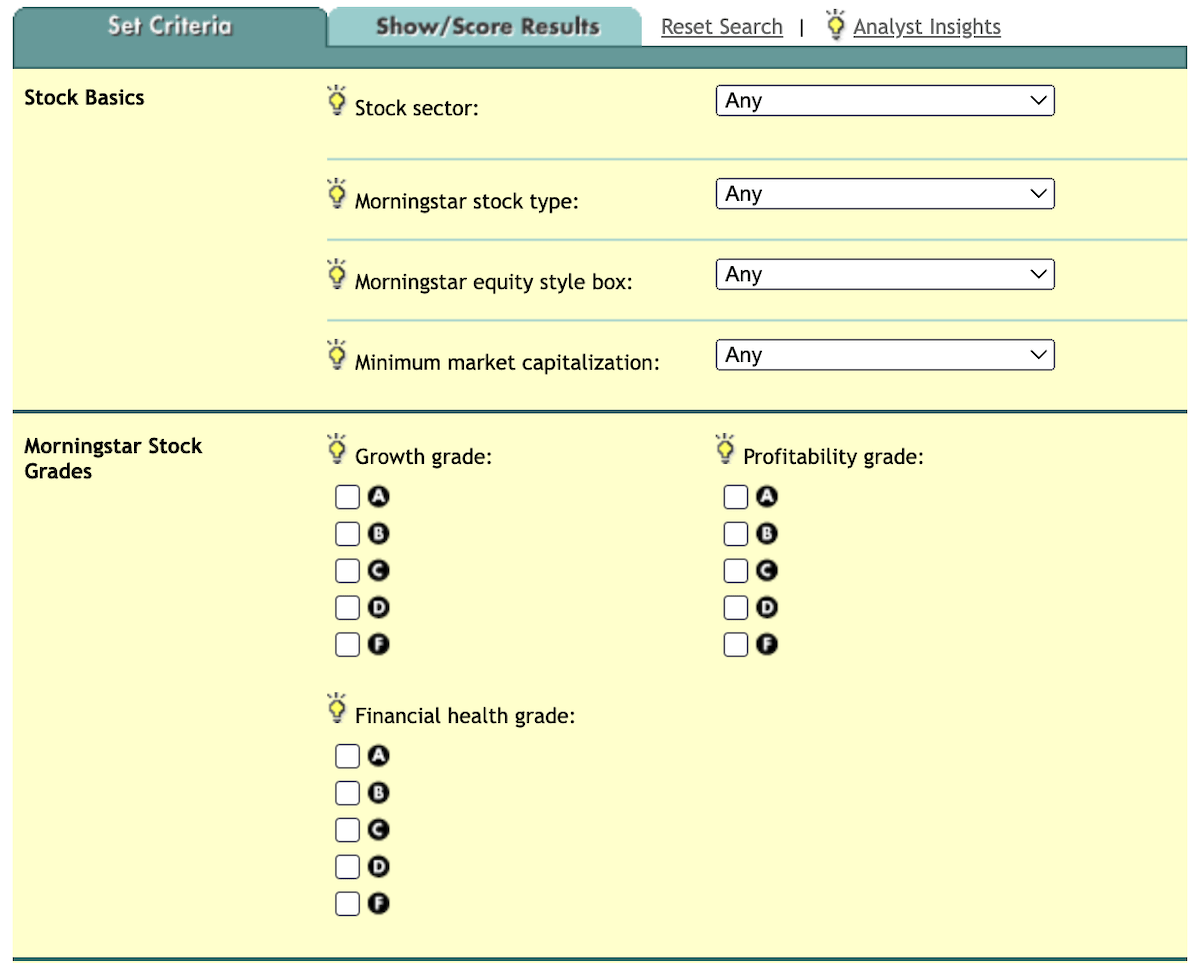

MorningStar

One of the juggernauts of the investing industry, but their stock screener is under-whelming. You also need to set up an account, it’s for free, but it forces you to sign up to test-drive it. Visually anything else than convincing, and the search and filter functions are also not that extensive. If you are looking for high yield dividend stocks in the world, you won’t get far with this screener, that’s for sure.

–> Link

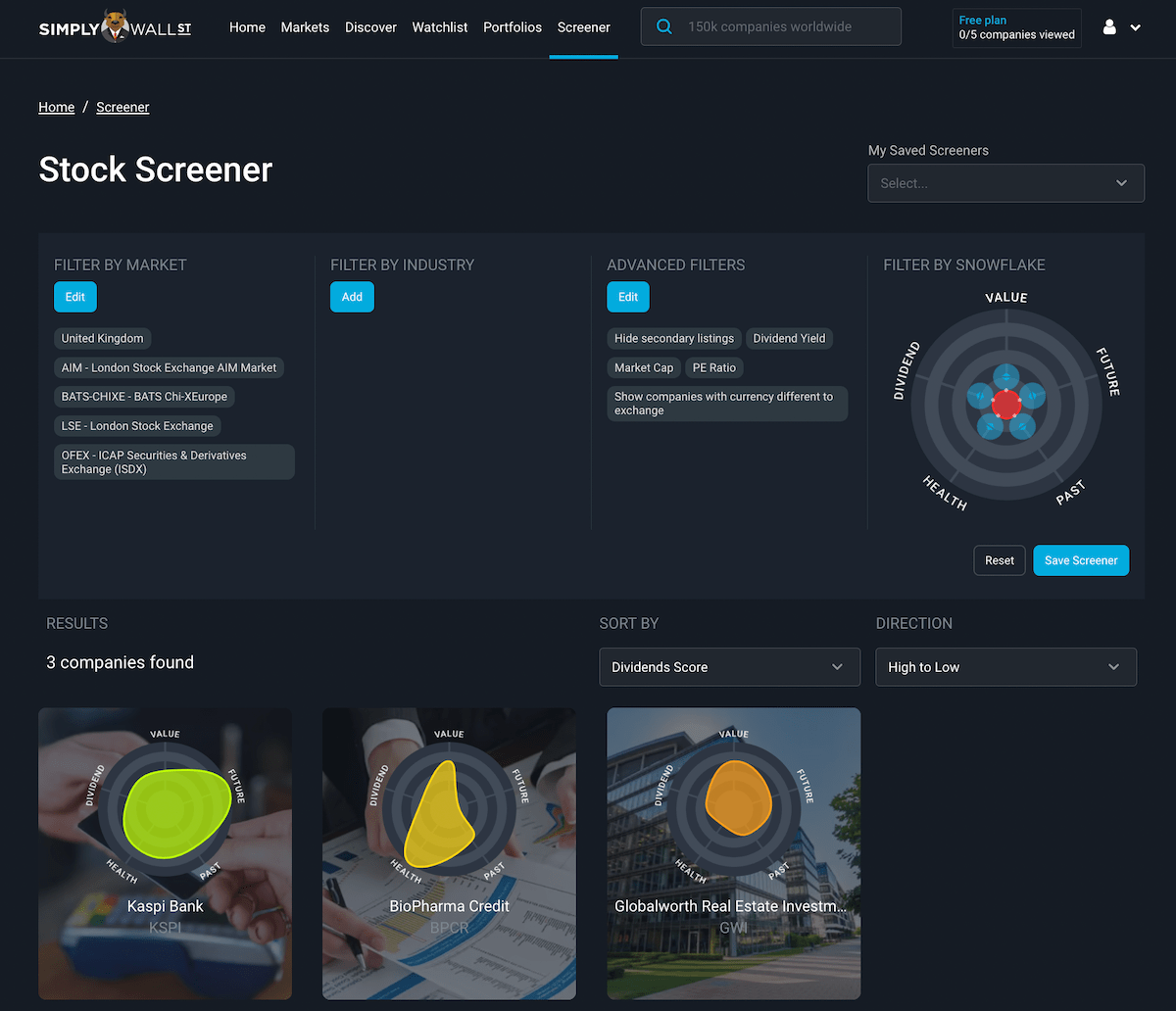

SimplyWall.St

The most likely investing website with the best design has a good and solid screener that covers all the basics: several countries, industries, small-to-mega cap dividend stocks, PE, yield, etc. You get quite far with the free plan, and their premium plan is only 10 USD per month. A solid choice. Their “snowflake” system also makes it easy and possible to find safe high yield dividend stocks.

–> Link

In a second step, we will be looking at how to go about and find the best high-yield dividend stocks. You will see it’s not rocket science, and there is a handful of excellent guides that will help you find real dividend gems!

Best Screening Parameters To Find The Perfect Dividend Stock

There are a handful of excellent methods or dividend screens to help you screen and look for the perfect high yield dividend stock. Let’s look at some of the most popular ones below, and further down I will also share with you the exact filters I am looking for to find the perfect dividend stock.

Geraldine Weiss

Mrs. Weiss, who passed away in April 2022, was one of the most popular female dividend DYI investors of all time.

She was known for keeping things simple. Her excellent book The Dividend Connection: How Dividends Create Value in the Stock Market, is excellent and I can fully recommend it.

She loved blue-chip dividend stocks, and when looking for the best high yield dividend stocks, she had a collection of parameters she was screening for:

1. It must be undervalued as measured by its dividend yield on a historical basis

2. It must be a growth stock that has raised dividends at a compound annual rate of at least 10% over the past 12 years

3. It must be a stock that sells for two times its book value, or less

4. It must have a price-to-earnings ratio of 20 or less

5. It must have a dividend payout ratio of around 50% to ensure dividend

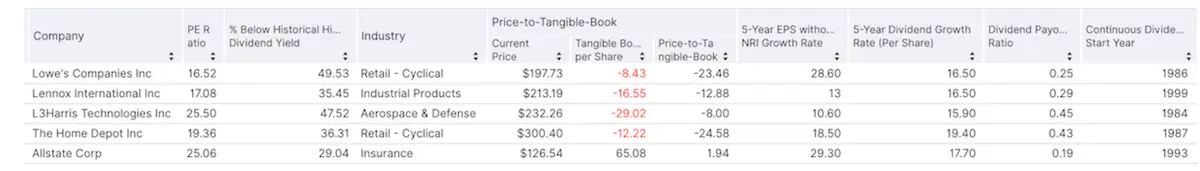

Now, screening for those parameters can be a very time-consuming task. But if we use the excellent stock screener on Gurufocus.com, within a matter of minutes you would get the following results when searching just in the U.S. (one aspect I love about Gurufocus is that it lets you save dozens of different screeners; once you saved one, it’s easy to run it for other countries or even entire regions like Asia-Pacific, etc.):

Let’s take the above screening result as an example. As I don’t consider any stocks from the Defense sector, L3Harris would not be considered. The others already look interesting. As I further don’t consider Retailers for my All-Weather Portfolio (think “Retail Apocalypse“), I am down to two stocks out of all American companies!

It’s of course not as easy as simply choosing Lennox ($LII)and Allstate ($ALL) and calling it a day, but it’s an excellent way to start your research and get to know these companies better. With a PE of 17, a 5-Year Dividend Growth CAGR of 15, and a low Dividend Payout Ratio of 29%, Lennox International indeed looks appealing!

The PYAD Dividend Screener

Another DIY investor’s favorite is the PYAD screener. This screener was created by a British investor called Stephen Bland. We basically look for stocks with a PE ratio that is two-thirds of that of the market. Further, we screen for stocks with a yield that is 50% above market average. This minimizes the downside before considering the upside. It surely does not work in every case but overall it should perform well. The PYAD screener has become very popular among Motley Fool readers.

The aim is to find high yield dividend stocks offering

- good “value”

- with high comparable yields,

- and most importantly, no debt.

The strategy’s main four filters represent the acronym (PYAD), namely

- Price to Earnings ratio,

- Yield,

- Assets (Price to Book Value), and,

- Debt.

Although simple, I believe this strategy is not bad because it also considers downside risks (with the “no debt” query). You won’t find ultra-high dividend stocks, but that’s usually a fool’s errand anyways. It’s a lot more important to have sustainable yield paired with consistent high dividend growth!

Dividend Aristocrats

Another approach is to start by looking at the components of the S&P 500 Dividend Aristocrats index. Launched in 2005, it consists of companies that all need to have increased their dividends in each of the past 25 consecutive years. As soon as a company fails to raise their annual dividend, or even cuts or doesn’t pay a dividend, the company would be removed from the index!

As a global DIY Investor, I don’t want to limit myself to just the U.S., but I also like to find high-yield dividend stocks in other markets. That’s why I often turn to the SPDR S&P Global Dividend Aristocrats, only containing companies with at least 25 years of consecutive dividend increases.

Top 10 Holdings of the SPDR S&P Global Dividend Aristocrats

| Name | % Assets | |

| 1 | Exxon Mobil | 2.8 % |

| 2 | B&G Foods | 2.0 % |

| 3 | Brandywine Realty Trust | 1.9 % |

| 4 | AT&T | 1.9 % |

| 5 | Japan Tobacco | 1.9 % |

| 6 | Universal Corp | 1.8 % |

| 7 | South Jersey Industries | 1.8 % |

| 8 | Enagas SA | 1.8 % |

| 9 | GlaxoSmithKline | 1.7 % |

| 10 | Seagate Technology Holdings | 1.6 % |

There are currently about 65 companies in this dividend growth club. The next in line to join the club will most likely be the following:

Dividend Kings

You can even take it up a notch and start your research by looking at the Dividend Kings. This super-elite club of high yield dividend stocks consists of only companies with 50 or more consecutive years of dividend increases. It is really the Dividend Hall of Fame. You will know many of these companies, but some are real hidden champions.

50 years of dividend increases. Think about this. Imagine you invest in a little business of a friend of yours, and not only does he pay you a dividend each and every single year. No, he even increases the dividend every single year. This says a LOT about the industry, the instilled work ethic at the company, their long-term strategic thinking, their constant effort, and so on.

Let’s take a quick look at all the Dividend Kings of the U.S.:

| COMPANY | CONSECUTIVE YEARS OF DIVIDEND INCREASES |

|---|---|

| American States Water Co. | 66 |

| Dover Corp. | 66 |

| Genuine Parts Co. | 65 |

| Northwest Natural Holding Co. | 65 |

| P&G (in my All-Weather Portfolio) | 65 |

| Parker-Hannifin Corp. | 65 |

| Emerson Electric Co. | 64 |

| 3M (in my All-Weather Portfolio) | 63 |

| Cincinnati Financial Corp. | 61 |

| Coca-Cola Co | 59 |

| Lowe’s Cos., Inc. | 59 |

| Colgate-Palmolive Co. | 58 |

| J&J (in my All-Weather Portfolio) | 59 |

| Lancaster Colony Corp. | 59 |

| Nordson Corp. | 58 |

| Farmers & Merchants Bancorp | 56 |

| Hormel Foods Corp. | 55 |

| SJW Group | 55 |

| ABM Industries Inc. | 54 |

| Commerce Bancshares, Inc. | 53 |

| California Water Service Group | 54 |

| Federal Realty Investment Trust | 54 |

| Stepan Co. | 54 |

| Stanley Black & Decker Inc | 54 |

| Tootsie Roll Industries, Inc. | 52 |

| H.B. Fuller Company | 52 |

| Altria Group Inc. | 52 |

| Sysco Corp. | 51 |

| National Fuel Gas Co. | 51 |

| Universal Corp. | 50 |

| Black Hills Corporation | 51 |

| Abbott Laboratories | 49 |

| Abbvie (in my All-Weather Portfolio) | 49 |

| Becton, Dickinson And Co. | 66 |

| Kimberly-Clark Corp. | 49 |

| PepsiCo (in my All-Weather Portfolio) | 49 |

| PPG Industries, Inc. | 50 |

Dividend ETFs & Mutual Funds

In a third step, I recommend you seek inspiration from the flagship mutual funds focusing on high yield dividend stocks. There are many, and you can easily get lost in the ocean of data.

Below are a few I frequently look at. They have quite different assets under management (AUM), are managed by some of the most trusted asset managers in the world, and can be a good choice if you like the lazy approach. I would tend to look more at actively-managed funds, as the passively-managed ETFs tend to own all the same companies.

| Franklin Global Dividend | WisdomTree Intl Dividend | Vanguard High Div.Yield Fund | iShares Global Select Dividend | |

| 1 | Microsoft Corp | Fortescue Metals | JPMorgan Chase | Fortescue Metals |

| 2 | Apple Inc | Naturgy Energy | Johnson & Johnson | GlaxoSmithKline |

| 3 | UnitedHealth | Equinor ASA | The Home Depot | Harvey Norman |

| 4 | AbbVie Inc | Fortum Oyj | Procter & Gamble | Power Assets |

| 5 | J&J | Vodafone | Bank of America | SSE PLC |

| 6 | Walmart Inc | Canon Inc | Exxon Mobil Corp | JB Hi Fi Ltd |

| 7 | Roche | BHP Group PLC | Comcast | Contact Energy Ltd |

| 8 | Bristol-Myers Sq. | SSE PLC | Verizon | Legal & General |

| 9 | Pfizer Inc | BASF SE | Intel Corp | Japan Tobacco Inc |

| 10 | Newmont Corp | BA Tobacco PLC | Cisco Systems | IG Group Holdings |

| AUM | 0.18B (tiny) | 0.14B(tiny) | 57B (massive) | 1.94B |

| Yield | 2.57% | 3.40% | 2.79% | 3.40% |

Note – companies in bold are in my All-Weather Portfolio.

WiseStacker's Recommendation

How To Find High Yield Dividend Stocks

What is the exact screen I am using, and what are the most important parameters in my point of view? I list them below:

1/ 5-Year Avg. Revenue Growth > 5%

2/ Gross Margin > 35%

3/ Net Margin > 10%

4/ LT Debt to Equity < 50%

5/ Current Ratio > 1.5

6/ Return on Equity > 15%

7/ P/E < 20

8/ Dividends Yield > 2%

I would argue that any company that meets the above parameters is worthwhile to be looked into further! Let’s head over to Gurufocus and fire up our All-In-One-Screener, and let’s see which companies pass the test in Germany and the U.S.:

Germany: only one stock, SAP (considering adding it to my All-Weather Portfolio)

United States: only two stocks, Johnson & Johnson, and Cisco Systems (I own both)

Again, just passing my “smell test” does not mean we can blindly add the stock to our long-term portfolios, but it’s a start.

I know that I am not the sharpest tool in the workshop, but I believe I am quite good at ‘triangulating‘. If one stock for example passes my initial smell test, and

- it’s owned by at least one or several Gurus (easy to screen for on Gurufocus),

- a CEO or CFO recently bought more shares,

- some analysts on SeekingAlpha recommend the stocks and publish good articles on them with positive commentary,

- etc.

then I often trust my gut feeling and know that I am onto something, and I might seriously consider it.

This, fellow stacker, is my general advice on how to go about finding, screening, and ultimately choosing the ultimate high yield dividend stocks 2022! My guide is surely not covering everything there is to it, but again, it’s meant to give you an overview and set you up for success!

📘 Read Also

- Check out the 5 Best REITs in Asia

- What are the 5 best inflation stocks?

- Read a post about the 3 best European REITs to buy

- How to invest in commodities – 15 great stock ideas

Full Passive Income

My total passive income is ~$150,000 US per year. Like to see a full breakdown?

👇

Comments

Subscribe

Login

0 Comments

Most Voted

Newest

Oldest

Inline Feedbacks

View all comments