What Is My Net Worth?

Disclaimer: I’m not a financial advisor. No content is meant to be a recommendation. Please do your own research. Pages might contain affiliate links. Please read my Disclaimer page.

Table of Contents

My Current Net Worth

Update Feb 29, 2024: Crypto bull market is in full swing. New all time highs for gold. Dividend stocks still not moving much. Planning to trimm crypto and re-balance to the All-Weather portfolio.

Update Dec 31, 2023: Seems we made it through crypto winter. Guess the ETFs are coming soon, hopefully in Q1. My dividend stocks are not doing much. My Uranium stocks do very well.

Update Dec 31, 2022: The year 2022 was a pretty shitty year. Lost about 1,5 Mio USD in “paper gains”. Made 135,000 USD in passive income, also quite a bit down from 153,000 USD in 2021.

The main reason was that I first got punched in the face by the Terra Luna collapse, and then got a kick in my balls by the Celsius bankruptcy. Luckily cashed out 700,000 USD from a crypto long-only fund I invested 200,000 USD in in 2018 (and kept 200,000 USD in a new crypto fund).

I still have quite a bit of cash, and generally believe I am diversified enough.

You will see one item in the above table that says investments in private companies.

The current breakdown is that about 67% of my total net worth is liquid, meaning I could close and liquidate all positions within 24 hours. The non-liquid assets are mainly company investments (see below) and one small rental property I own.

When you get to know me you will see that I’m a a combination of a builder & entrepreneur at heart, and a long-term oriented income investor.

I love building companies and have done so since a young age. But I also love researching stocks, hunting for good passive income opportunities, with the aim to have more time with my family. I always loved this quote: “There is a season to saw, there is a season to reap. You don’t do both in the same season”.

That’s why the fast-paced company building paired with patient long-term investing in dividend stocks and other forms of passive income really works well for me.

See below for a simple overview of my current investments in private companies:

How I Got Here

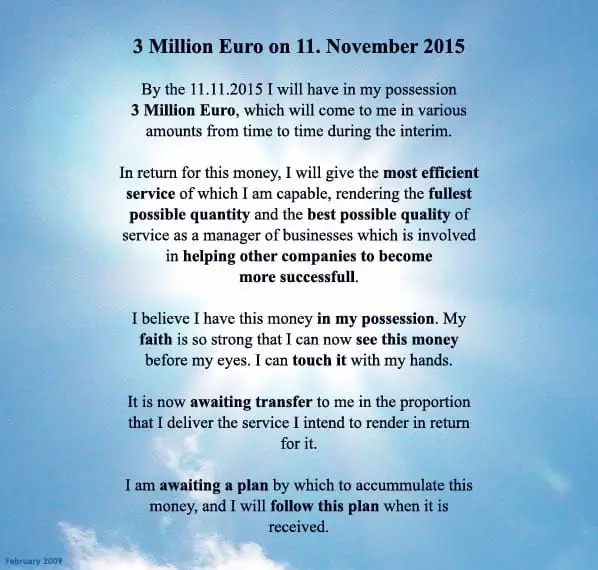

In February 2009, when I was in my early 30s, inspired by Napoleon Hill’s Think & Grow Rich, I wrote the following affirmation and hung it in my wardrobe.

I saw it every single day when putting on clothes. Although I knew about the law of attraction, to be honest, deep down, I had no clue how I’d ever get to 3 Mio € (3,5 Mio USD).

Why 3,5 Mio USD?

I figured if I could get 5% interest on 3,5 Mio USD, that would come down to 175,000 USD, or 14,500 USD per month. That should clearly be enough to feel safe and not have to worry too much.

For many years the goal seemed too far and too high, as the business I was building didn’t go that well for me. But then things slowly changed (I sold my business, made some good investments, got some sweat equity,..). I sort of ‘overshot my original target’ and am currently well above my original goal.

Most people overestimate what they can do in one year and underestimate what they can do in ten years.

Bill Gates

This above quote had a big impact on my life, as it supported me and gave me conviction that I just need to get on hustling and working hard.

Another quote I love is from Robin Sharma:

‘Daily ripples of excellence over time become a tsunami of success.’

Investment in Private Companies

Recent Posts