Most investors in the world name American companies like Johnson & Johnson (JNJ), PepsiCo (PEP), or Procter & Gamble (PG) when thinking of good consumer goods stocks. But what about European consumer goods stocks? Can we find interesting investment opportunities? And what is my personal top pick?

Let’s first look at the largest European consumer goods stocks by market cap, including their Price-to-Sales Ratio.

Largest European Consumer Goods Companies

| M.Cap, in Bio $ | PS* | |

| 🇨🇭 Nestlé | $320 | 3.2 |

| 🇫🇷 L’Oréal | $232 | 5.6 |

| 🇬🇧 Unilever (in my portfolio) | $131 | 2.1 |

| 🇬🇧 Diageo | $99 | 4.8 |

| 🇳🇱 Heineken | $60 | 2.0 |

| 🇬🇧 Reckitt Benckiser (in my portfolio) | $55 | 3.1 |

| 🇫🇷 Danone | $39 | 1.3 |

| 🇩🇪 Henkel | $30 | 1.1 |

| 🇩🇪 Beiersdorf | $29 | 3.1 |

| 🇨🇭 Lindt & Spruengli | $28 | 5.0 |

*low price-to-earnings ratios are better, e.g. if a hot dog stand has sales of 100 in a year, and its market cap is 500, it would have a PS of 5

The stocks have price-to-sales ratios ranging between 1.1 and 5.6 (whereby lower ratios mean the shares are attractively priced).

From a pure PS ratio, companies like 🇩🇪 Henkel (HENKY) and 🇫🇷 Danone (DANOY) appear to be on the cheap side, but this is just one first ratio to consider.

Let’s look at how the companies are doing in terms of their price-to-earnings ratio, and dividend yield.

European Consumer Goods Stocks, by PE & Dividend

| PE | Yield | |

| 🇬🇧 Unilever (in my portfolio) | 16 | 3.4% |

| 🇫🇷 Danone | 39 | 3.3% |

| 🇬🇧 Reckitt Benckiser (in my portfolio) | 19 | 2.8% |

| 🇩🇪 Henkel | 23 | 2.8% |

| 🇨🇭 Nestlé | 33 | 2.6% |

| 🇬🇧 Diageo | 23 | 2.0% |

| 🇳🇱 Heineken | 21 | 1.5% |

| 🇫🇷 L’Oréal | 38 | 1.2% |

| 🇨🇭 Lindt & Spruengli | 44 | 1.1% |

| 🇩🇪 Beiersdorf | 35 | 0.6% |

Unilever (UL) stands out with the lowest PE while having the highest relative dividend yield.

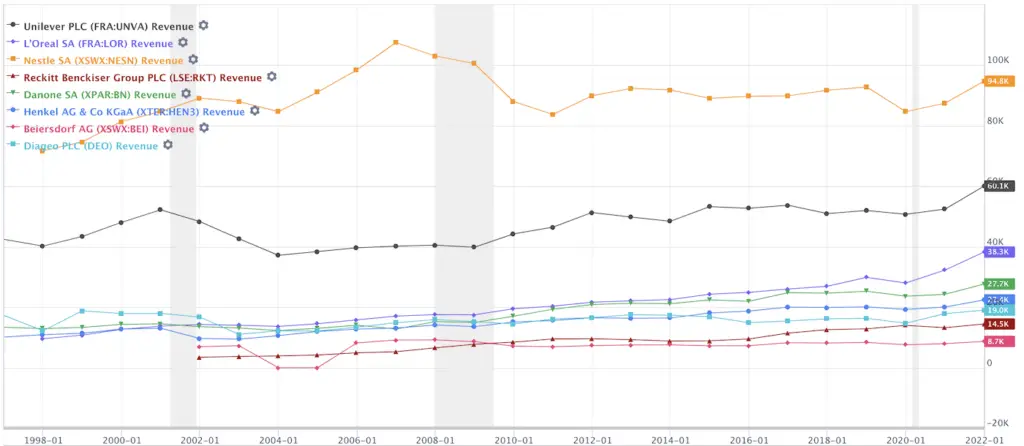

Revenues of European Consumer Goods Companies (25 years)

When looking at the company’s sales over the past 25 years, Nestlé (NSRGY) is ahead of the pack, and Unilever (UL) is in the second spot, followed by L’Oréal (LRLCY).

We easily can see that essentially all European consumer goods stocks show a positive trend in the last two years, and all of them have higher sales as compared to before the pandemic.

Seems that all the leading companies in the consumer goods sector in Europe have stable revenue growth, which is key to know once we look at their respective share prices (which fluctuate a lot).

Let’s review the chart of their respective dividend yields over the course of 10 years.

Dividend Yield Of Top Consumer Goods Stocks in Europe (10 years)

Unilever’s (UL) dividend yield is the highest, at 3.4%, and the lowest is L’Oréal’s (LRLCF) at 1.2%.

We can see that all consumer goods stocks in Europe we look at were able to pay at least some dividend, meaning they had the net profit to enable them to distribute profits back to their shareholders.

I like what I see with Unilever – it has a high/stable dividend, the lowest PE, and the 2nd highest sales.

Let’s check which of these European consumer goods stocks has their best return on equity, return on assets, and, most importantly, return on invested capital.

| ROE % | ROA % | ROIC % | |

| 🇬🇧 Diageo | 45.5 | 9.9 | 13.3 |

| 🇬🇧 Unilever (in my portfolio) | 41.0 | 9.7 | 11.0 |

| 🇬🇧 Reckitt Benckiser (in my portfolio) | 27.1 | 8.3 | 9.6 |

| 🇫🇷 L’Oréal | 22.3 | 12.5 | 14.2 |

| 🇨🇭 Nestlé | 19.9 | 6.8 | 10.2 |

| 🇳🇱 Heineken | 14.4 | 5.2 | 6.6 |

| 🇨🇭 Lindt & Spruengli | 12.2 | 7.0 | 8.6 |

| 🇩🇪 Beiersdorf | 10.1 | 6.3 | 10.4 |

| 🇩🇪 Henkel | 6.3 | 3.8 | 4.8 |

| 🇫🇷 Danone | 5.4 | 2.1 | 4.9 |

Unilever does not take the top spot, but it’s basically in the top quintile of each category.

Warren Buffett loves companies with ROICs of +10%. He thinks that if a company can achieve higher-than-average returns on invested capital, then it should be able to generate above-average returns for its shareholders, over time.

An ROIC of +10% easily covers inflation, and even small missteps or management mistakes can more easily be ‘forgiven’.

The World’s Best Consumer Goods Stocks (By ROI)

Let’s quickly compare the best consumer goods companies in the U.S. with those from Europe, here’s what we get:

| ROE % | ROA % | ROIC % | |

|---|---|---|---|

| 🇺🇸 Johnson & Johnson (in my portfolio) | 23.83 | 9.96 | 15.31 |

| 🇪🇺 L’Oréal | 22.32 | 12.49 | 14.20 |

| 🇪🇺 Diageo | 45.51 | 9.91 | 13.28 |

| 🇺🇸 Coca-Cola | 40.51 | 10.22 | 13.13 |

| 🇺🇸 Procter & Gamble (in my portfolio) | 31.70 | 12.04 | 13.11 |

| 🇺🇸 PepsiCo (in my portfolio) | 50.10 | 9.58 | 11.94 |

| 🇪🇺 Unilever (in my portfolio) | 41.02 | 9.71 | 11.01 |

| 🇪🇺 Beiersdorf | 10.13 | 6.28 | 10.41 |

| 🇪🇺 Nestlé | 19.93 | 6.75 | 10.24 |

My 🏆 Top Pick

My personal consumer goods stock in Europe is without a doubt Unilever (UL). I will explain why below.

My 2nd favorite European consumer goods stock is L’Oréal (LRLCF)- a company I am planning to add to my All-Weather Portfolio once it comes back down to 325€.

Why Unilever Is My Top Pick

14x Flagship Products With 1 Bio USd In Sales

Our family of four makes use of products from Unilever in virtually every room in the house.

From the kitchen to the bedroom, we regularly utilize Unilever’s food and drink, beauty, personal care, and home care items. Here are some of the Unilever products that we use most often:

- my wife uses Rexona personal care

- we all use Dove shower gels

- we all love Magnum ice creme (almonds!)

- the kids use shampoo from Lux

- we use Persil and Omo as washing powder

Well Diversified

Historically, the Beauty & Personal Care and Food & Drinks segments of $UL have been major drivers of profit.

However, the Food & Drinks segment has recently been growing at a faster rate than the Beauty & Personal Care segment.

This makes the company’s focus on R&D and innovation all the more important, as it seeks to build upon its success in the Food & Drinks segment and capitalize on its growth potential.

Unilever generates more than 50% of its revenues from Emerging Markets.

Multiple Flagship Brands

$UL has 14 brands with over $1 billion in sales. Operating in England since the 1880s, he has made a name for himself with his innovative Sunlight Soap products.

Check out all the Unilever Brands.

Many people don’t know that brands such as Magnum, Ben & Jerry’s, Dove, Knorr, or AXE are all owned by the same company.

Worldwide Footprint

$UL currently employs 6,000 employees in research and development. Unilever invests around €1 billion in research and development each year and has a portfolio of over 20,000 patents and patent applications.

Massive Research & Development

$UL has 6 of his R&D labs focused on delivering breakthrough innovations and 31 large R&D labs focused on developing and implementing product innovations.

As a long-term investor, I live in the companies I am invested in and invest a lot in innovation and R&D.

Pricing Power

In inflationary times as we live in, it’s vital that companies have pricing power. A Ben & Jerry’s ice creme easily costs $10 USD, and people are happy to pay for it as the ‘total experience’ is great. Axe and Rexona have much higher price tags than no-name brands, but people still buy them because if you pay $4 or $7 USD, it does not impact people’s lives too much.

Conclusion

To me, Unilever (UL) is the best European consumer goods stock you can buy and hold forever.

📘 Read Also

- My Favorite Consumer Staples Dividend Stock

- The 3x Best German Stocks To Buy

- The 5 Best Dividend-Paying Entertainment Stocks

- A Quick Southeast Asian Business Trip to Hong Kong & Hanoi

FAQ

What are consumer goods stocks?

Consumer goods stocks refer to businesses producing items that are purchased for immediate use or enjoyment, such as packaged food, household, personal care, clothing, appliances, spirits, cars, etc. These stocks are usually slow but reliable growers, as they are less dependent on the state of the economy and consumer spending habits. Some of the most known consumer goods companies are Pepsico, Kraft-Heinz, Unilever, L’Oréal, Nestle, and Diageo.

What are Europe’s top consumer goods stocks?

The consumer goods stocks in Europe, ranked by return on invested capital, one of Warren Buffett’s favorite criteria when evaluating companies:

🇫🇷 L’Oreal with an ROIC of 14.2%

🇬🇧 Diageo with an ROIC of 13.3%

🇬🇧 Unilever with an ROIC of 11.0% (my top pick)

🇩🇪 Beiersdorf with an ROIC of 10.4%

🇨🇭 Nestle with an ROIC of 10.2%

🇬🇧 Reckitt Benckiser with an ROIC of 9.6% (I own this)

🇨🇭 Lindt & Spruengli with an ROIC of 8.6%

🇳🇱 Heineken with an ROIC of 6.6%

🇫🇷 Danone with an ROIC of 4.9%

🇩🇪 Henkel with an ROIC of 4.8%

What’s the difference between consumer goods and consumer staples?

Consumer goods are items we buy for immediate use, or for our ‘enjoyment’, such as food, clothing, appliances, cars, etc. Consumer staples are items that we regularly buy to meet such basic needs as washing powder, shower gels, shampoos, toiletries, and basic household items. They are considered essential items and are usually more affordable than consumer goods.

List of consumer goods stocks in Europe?

Largest consumer goods stocks in Europe, by Market Cap, in Bio $

🇨🇭 Nestle | $320

🇫🇷 L’Oreal | $232

🇬🇧 Unilever | $131 (my favorite)

🇬🇧 Diageo | $99

🇳🇱 Heineken | $60

🇬🇧 Reckitt Benckiser | $55 (I own this)

🇫🇷 Danone | $39

🇩🇪 Henkel | $30

🇩🇪 Beiersdorf | $29

🇨🇭 Lindt & Spruengli | $28

When do consumer discretionary stocks do well?

Consumer discretionary stocks do generally well when the economy is doing well. When employment rates are high and people feel good, they tend to spend more on things like entertainment (a trip to Disney), travel (cruises and hotel stocks), luxury (Tiffany’s), or cars (BMW, GM, etc.).

What are the largest consumer goods companies?

By market cap:

1/ Johnson & Johnson, $473,654

2/ Procter & Gamble Co, $345,284

3/ Nestle SA, $319,526

4/ Coca-Cola Co, $265,722

5/ PepsiCo Inc, $247,132

6/ L’Oreal SA, $230,883

7/ Unilever PLC, $131,245

8/ Anheuser-Busch, $125,325

9/ Diageo PLC, $99,756

10/ Mondelez International, $94,873

11/ Reckitt Benckiser, $55,060

12/ The Kraft Heinz, $47,104

13/ Henkel AG & Co, $30,708

How are consumer discretionary and consumer goods stocks different?

Consumer discretionary stocks are referring to companies that sell products that are considered to be optional or luxuries, such as luxury goods (Swarovski, Tiffany’s) or entertainment (a trip to Disney, a cruise in the Caribbean), or a new car (automotive stocks like BMW or GM).

Consumer goods stocks. Such stocks are often more volatile than consumer goods stocks because they depend on the state of the economy. Stocks of the consumer goods sector fulfill more basic needs, such as household goods, personal care, or packaged food (e.g. Knorr from Unilever, Ben & Jerry’s, etc.)

My 'European Consumer Goods Stock' Top Pick

To me, Unilever (UL) is the best European consumer goods stock you can buy-and-hold-forever.

PROS

- 14x Flagship Products With $1b In Sales

- Well Diversified

- Multiple Flagship Brands

- Worldwide Footprint

- Massive Research & Development

- Pricing Power

CONS

- Slow Grower

- Many Products Use Plastic Packaging

- Global Supply Chain Complexities

- Impacted By High Inflation

- Threat from cheap own-brands from retailers

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love