Check Out My Thematic Portfolios, Each With Exposures To Specific Investment Themes. Each Folio Has A Different Investment Time Horizon And Tactical Allocation.

Thematic Portfolios

Disclaimer: I’m not a financial advisor. No content is meant to be a recommendation. Please do your own research. Pages might contain affiliate links. Please read my Disclaimer page.

Thematic Portfolio Overview

I am not good at market timing.

I learned rather quickly that short-term momentum trading is not for me. When staring at charts, I get quickly inpatient. What works for me are mid-to-longterm invest horizons, like 6 to 24 months, or even longer.

In my All-Weather Portfolio, my time horizon is ‘forever’, for the thematic portfolios I am showing on this page my time horizons vary, but typically are around one to three years.

You can check out my Digital Asset Portfolio – I bought my first Bitcoin in 2017, and some more in 2019 (my average buying price is around 10,000 USD).

Trading Portfolio

I keep a separate trading portfolio with which I aim to generate additional cashflow. I am not a day or swing trader, but usually hold shares for about three to twelve months.

Natural Resource Portfolio

If you are interested in gold and precious metals in general, check out my Top 10 Reason To Invest In Gold article here.

Plan Your Trade. Trade Your Plan.

Unknown

Uranium Portfolio

Check out my full Uranium investment thesis in this article. My article explaining why and how I invest in commodities might also be interesting.

Metaverse Portfolio

The Metaverse Portfolio is my latest and so far smallest thematic portfolio. I believe this investment theme will play out nicely in the many years to come. I am down quite a bit, but I don’t mind that at all, as volatility is to be expected in this space!

- Perion (a Web3.0 gaming community and guild of pro players, governed via a DAO, aiming to attract the economic champions of tomorrow)

- Sweat Coin – an app that pays you to walk.

- Stepn – a NFT app allowing you to purchase virtual sneakers that you can then level UP and make actual money with. I am currently making about 45 USDC per day with it.

CRISPR Portfolio

I started building this portfolio in 2019, after reading a lot about CRISPR and having probably watched 25 hours our interviews with industry experts. Decided to allocate 10,000 USD to this portfolio, and aim to not trade it, but keep the stocks for many years.

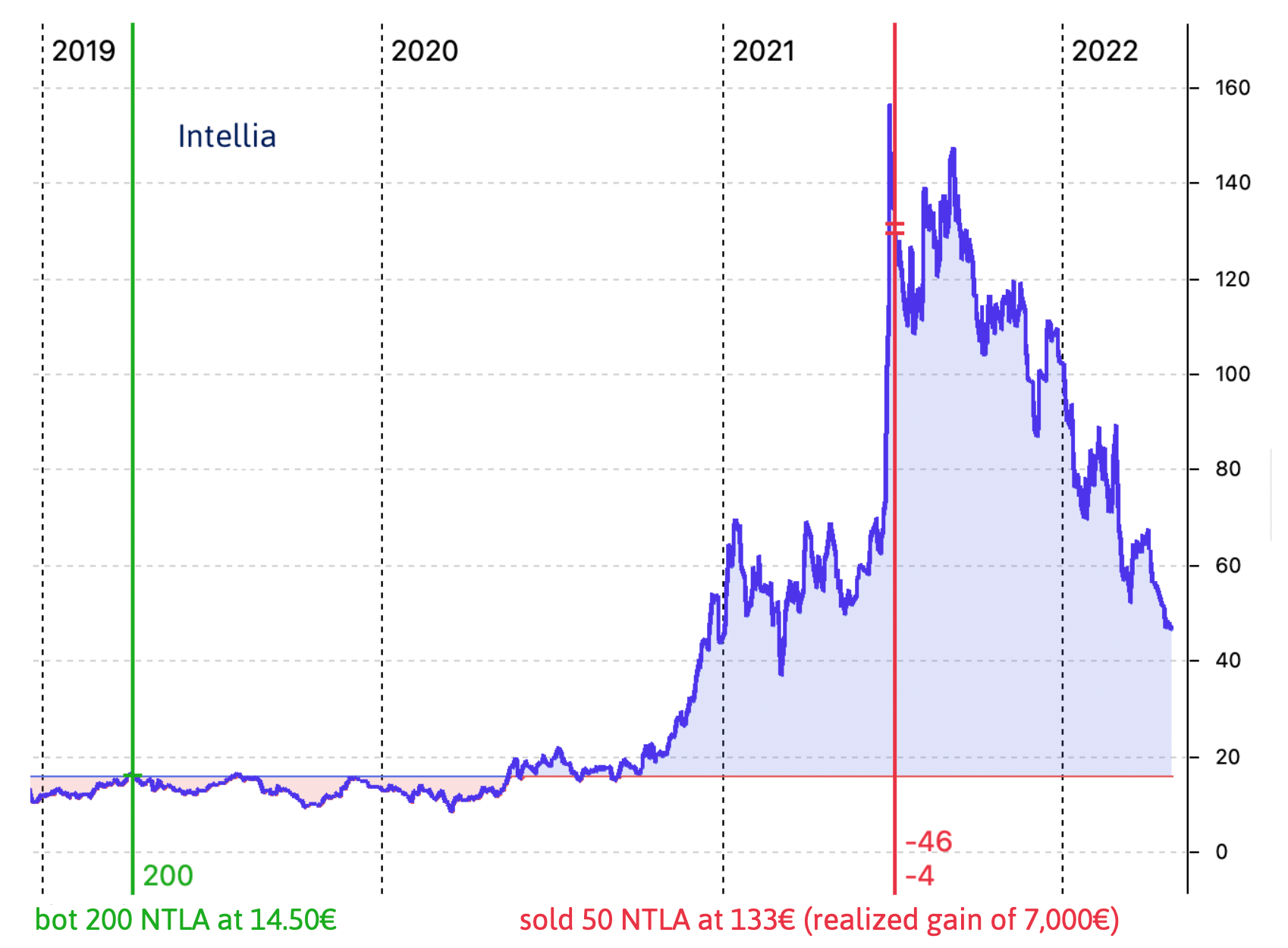

Decided to go with the three leading companies: Crispr, Editas and Intellia ($NTLA). They had a phenomenal run in 2020 (after the CEOs of two of them won the Nobel Prize), and luckily I took some profit on Intellia, see the trade below.

With the 7,000€ of profits, I then bought Fulgent and Bionano. Not directly CRISPR companies, but two of the most exciting genomic testing and sequencing companies. Since then I held on to Fulgent, but sold Bionano with a loss.

Recent Posts

Comments

Subscribe

Connect withD

Login

I allow to create an account

When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you'll be logged-in to this account.

DisagreeAgree

Connect withD

I allow to create an account

When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you'll be logged-in to this account.

DisagreeAgree

0 Comments

Inline Feedbacks

View all comments