For 99% of all investors, the best approach is to dollar-cost-average into the Vanguard Total Stock Market Index Fund ($VTSAX). A sweet and simple strategy.

However, it’s also a very boring strategy, and I don’t want to be part of the boring ‘99%’. I am a self-taught DIY Investor, trying to do things differently.

Besides having worked effing hard, I also avoid money managers, because no one will care for my money better than I do. So I take matters into my own hands and am a DIY-investor.

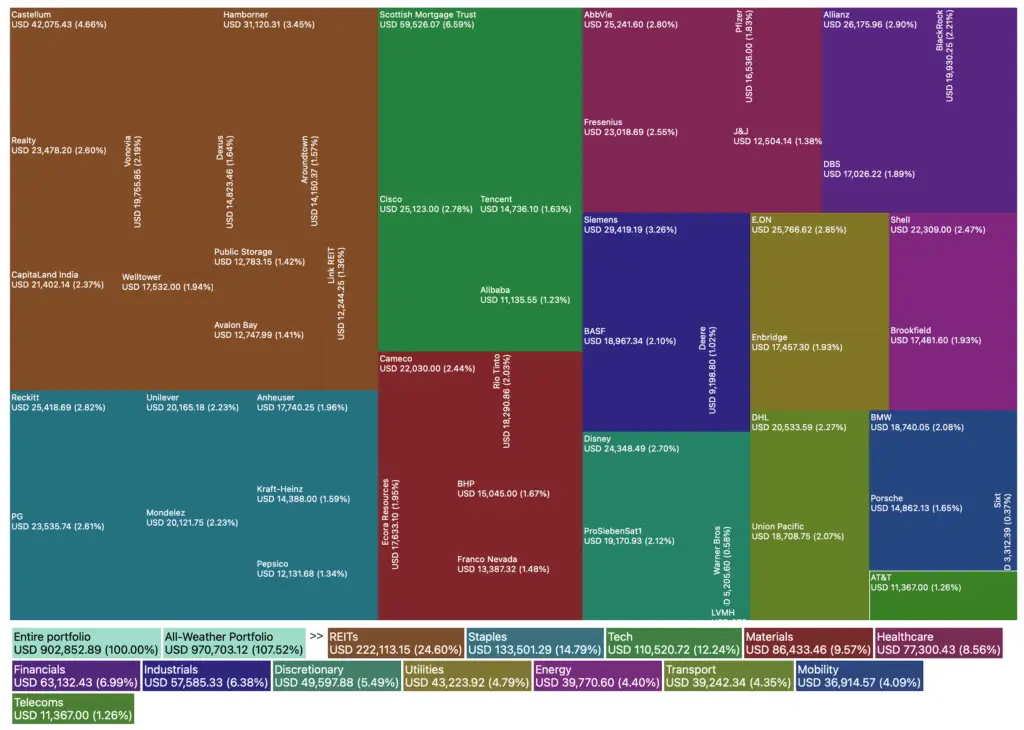

I build a quite extensive portfolio of commodity stocks, as well as uranium stocks. I find great joy in researching the best companies in the best regions and industries, and allocating the amount of money I like to.

At the moment, my All-Weather Portfolio only represents 6% of my total Net Worth, however, I aim to increase that to 50% by 2025.

My Digital Asset Portfolio represents 21% of my total assets. I plan to bring this down to 15%, freeing up 600k USD All-Weather Portfolio.

1 My strategy is dividend-centric. My goal is to receive dividends from fortress-like dividend machines. I stick to companies that will still be around in 50 years. That means no tech, banks, retailers, or cars. All Too Hard! I like businesses that I pay to not change their product every week. Think Lays Potato Chips. Heinz Ketchup. Milka Chocolate.

2 I invest internationally, in particular in developed countries. I only consider companies I have a very high conviction in that they will outlive me. Therefore, I stay away from tech stocks (Nokia, Kodak, etc.). I invest in companies creating products that don’t have to be changed all the time.

3 I only invest in companies that do good and have great management teams with proper values. No weapons. No tobacco. No sin stocks.

4 I understand that the human side is the greatest enemy of the average investor. Fidelity’s best-performing accounts are those people literally forgot their passwords or died.

5 I plan to ‘never sell’ any of my all-weather dividend machines and ride through any market weaknesses. I may allocate free funds from dividends as I see fit.