Key Takeaways

☑️ Stock prices of European REITs have been hit hard

☑️ Compelling risk/reward ratios can be found

☑️ Three interesting European REITs are presented

☑️ Investors need to allow 2-3 years to reap rewards

Three Best European REITs

- 🇬🇧 Headquartered in the UK

- Revenues $0,8 Bio

- Market Cap $11,6 Bio

- Enterprise Value $18,1 Bio

- Dividend Yield 3.6%

- FCF Margin 32.2%

- Gross Margin 63%

- 🇱🇺 Headquartered in Luxembourg

- Revenues $1,7 Bio

- Market Cap $2,4 Bio

- Enterprise Value $14,9 Bio

- Dividend Yield paused

- FCF Margin 45.1%

- Gross Margin 45%

- 🇩🇪 Headquartered in Germany

- Revenues $6,8 Bio

- Market Cap $20,2 Bio

- Enterprise Value $66,4 Bio

- Dividend Yield 3.7%

- FCF Margin 29.9%

- Gross Margin 54%

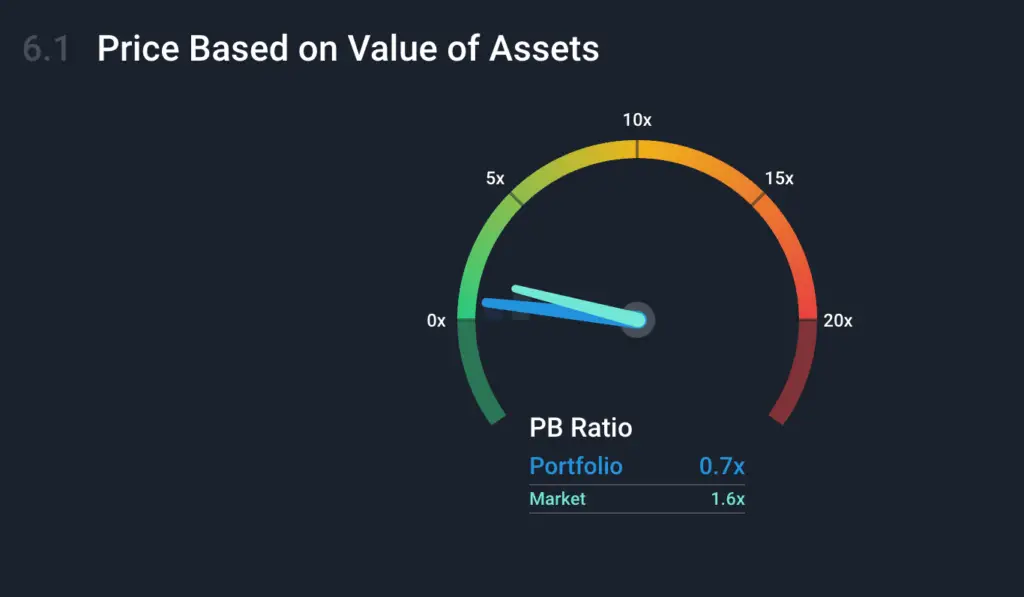

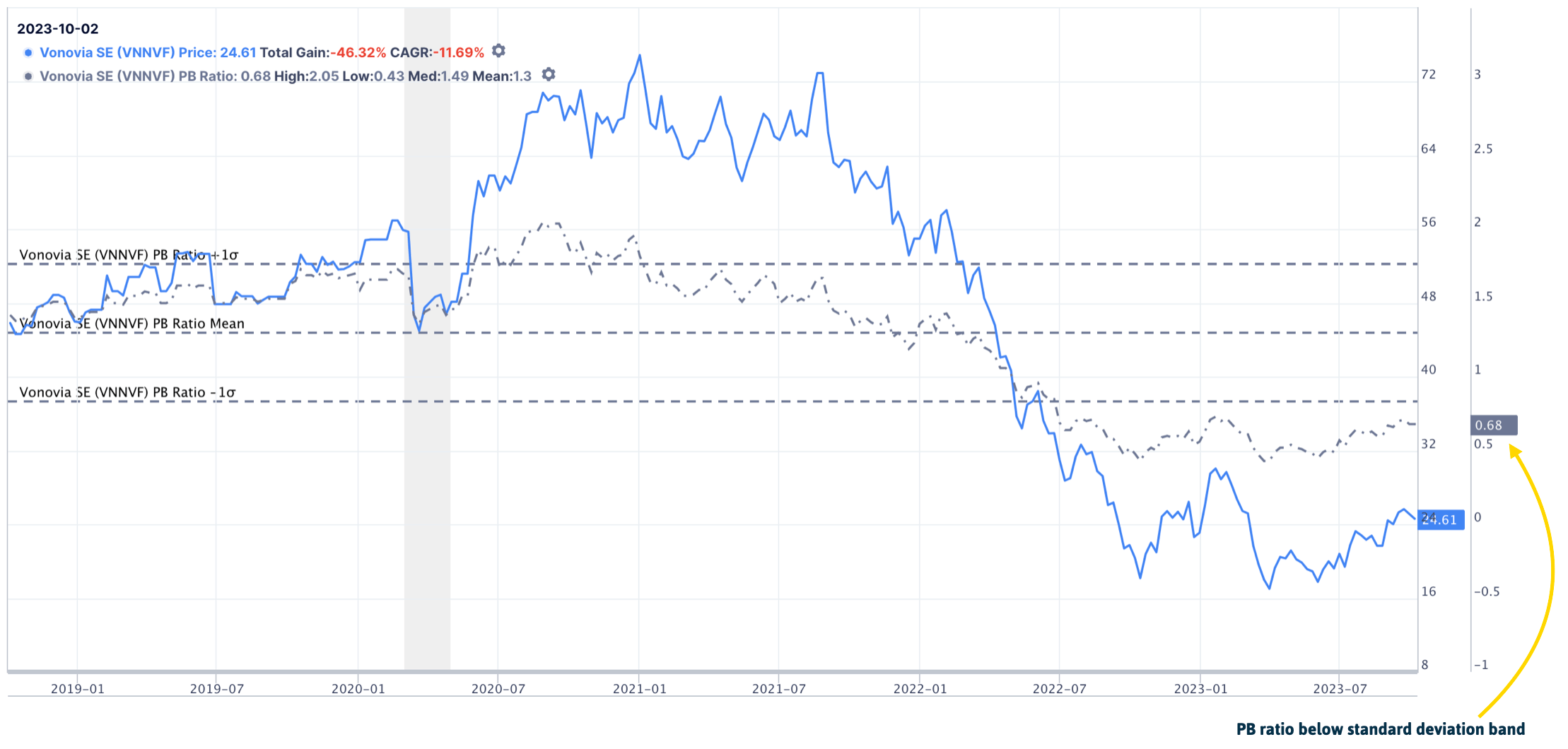

When comparing further ratios, we can see that the PB ratios are really at a depressed level. PBs like 0.2 in the case of Aroudntown, or 0.6 for Vonovia, for real-estate owning companies, are either great buying opportunities, or the companies are in severe financial distress.

| Symbol | Company Name | Market Cap ($M) | PS Ratio | PB Ratio | Price-to-Free-Cash-Flow |

| SEGXF | Segro PLC | $14,715 | 13.66 | 0.94 | 25.48 |

| AANNF | Aroundtown SA | $3,558 | 2.37 | 0.26 | 4.33 |

| VNNVF | Vonovia SE | $28,647 | 5.52 | 1.1 | 12.62 |

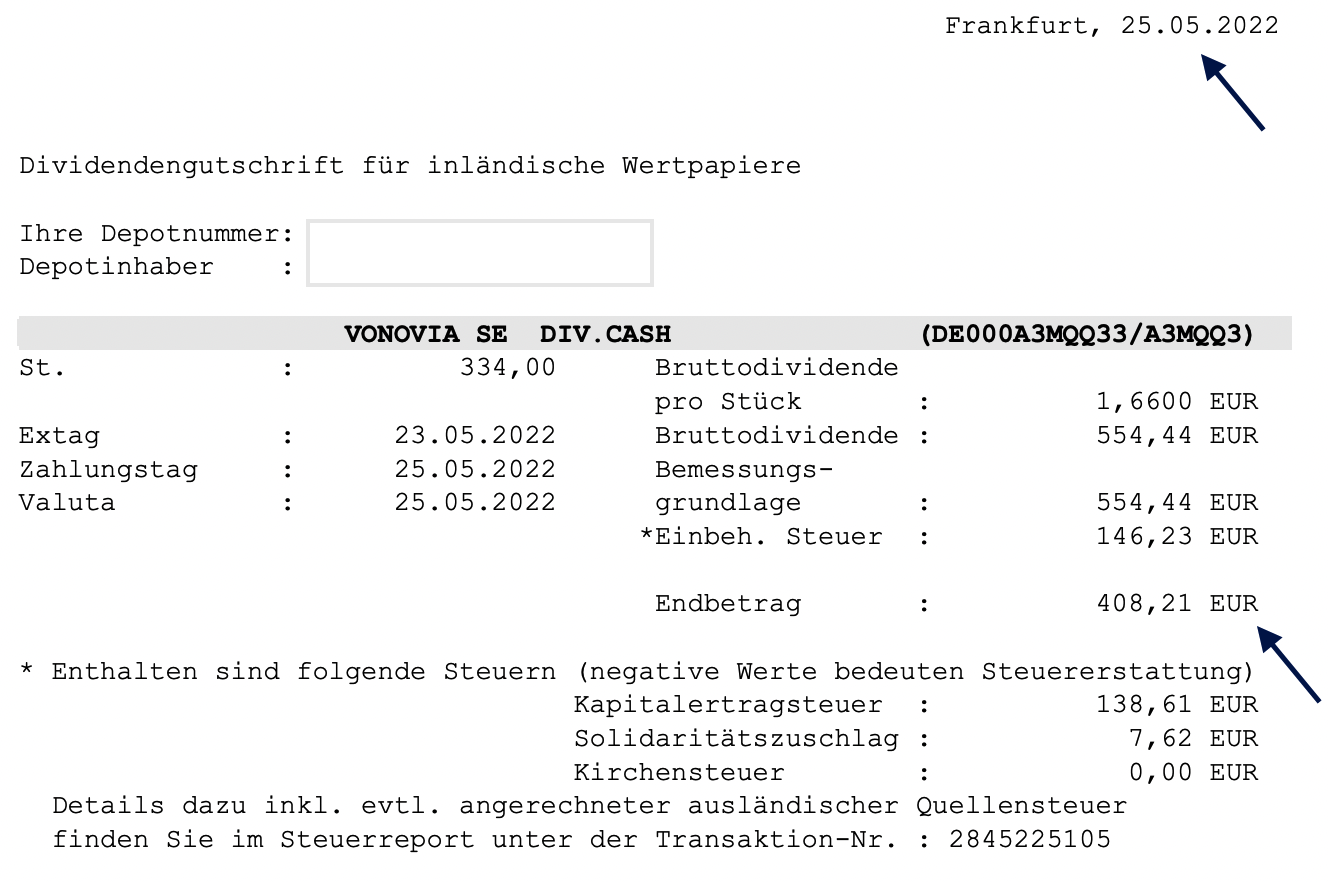

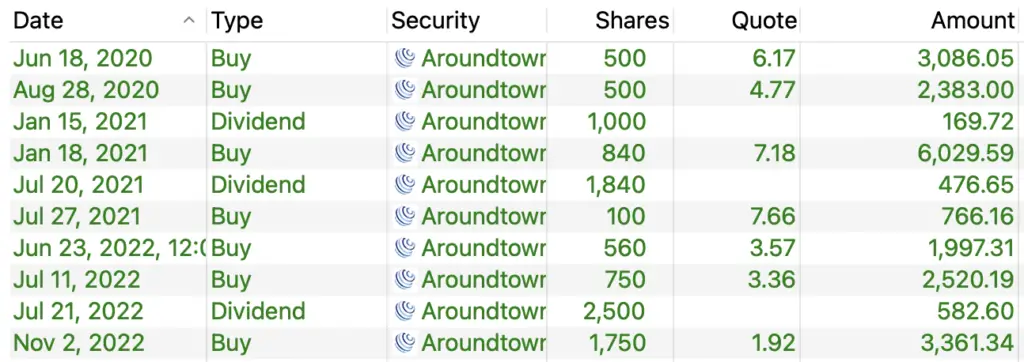

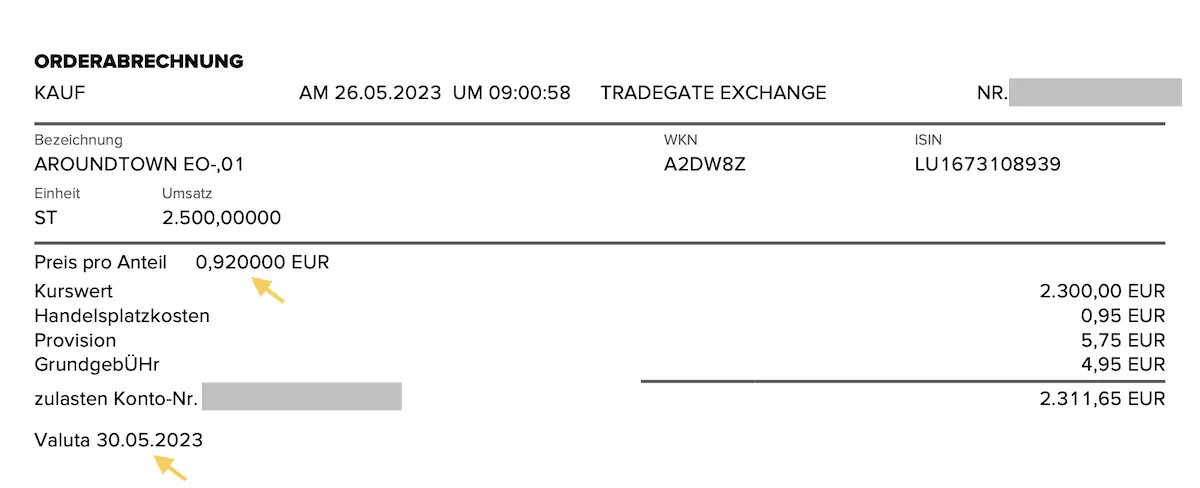

I believe these prices represent buying opportunities, hence I bought both Vonovia and Aroundtown this year, see below for the transaction slip for the Aroundtown purchase (at the time of writing this post, in May 2023 at 0.92€).

Are European REITs A Good Investment?

First off, I am not a professional analyst, just a passionate DIY investor, always looking for the world’s best dividend stocks (I explain my process here).

In general, I like the high predictability, yields, and stability of real estate investment trusts (REITs). These are the three reasons why my All-Weather Portfolio consists of approx. 25% of the highest-quality REITs.

The U.S. has thousands of REITs to choose from, but when it comes to European REITs, it’s a different story. Each of the major countries in the E.U. has a handful of large blue-chip REITs, but they don’t come in the dozens.

In this article, I am presenting the three European REITs I like (disclaimer: I own two of the three). In particular, after the recent steep drop in price, I like all of them at these low price levels.

Vonovia – EU’s Largest Residential REIT

Vonovia ($VNA, $VNNVF, ISIN: DE000A1ML7J1), is Europe’s leading private real estate company.

Technically, it is not a REIT, but simply put can be seen as one, because it focuses solely on real estate. It specializes in residential properties, of which it owns +560,000 apartments in the most attractive cities of Germany, Sweden, and Austria.

It also is the property manager of +72,500 apartments. The current value of all the real estate Vonovia owns is currently approx. 102 Bio USD.

Vonovia Fun Fact #1:

Vonovia is the title sponsor of the German soccer club VfL Bochum 1848, whereas the other European REIT I like, Aroundtown, is a title sponsor of another Bundesliga soccer club, see below!

Vonovia Fun Fact #2:

It is the property manager of my two-bedroom rental apartment that I bought in 2013 for 280,000€ (80 sqm).

Vonovia invests a lot in ESG, in particular in maintenance, modernization, and senior-friendly property conversions. The company is increasingly building new apartments through post-compaction and additions.

It was one of the first European REITs to list on the STOXX50, originally, it was called Deutsche Annington, and later, when it merged with Terra Firma, it became the largest German property company in 2006, when it also took over Viterra AG. It has been called Vonovia since 2015.

I believe Vonovia below 25€ or less, offers a very good risk/reward ratio here.

How Big Is Vonovia?

Well, Vonovia is massive. It’s a real juggernaut.

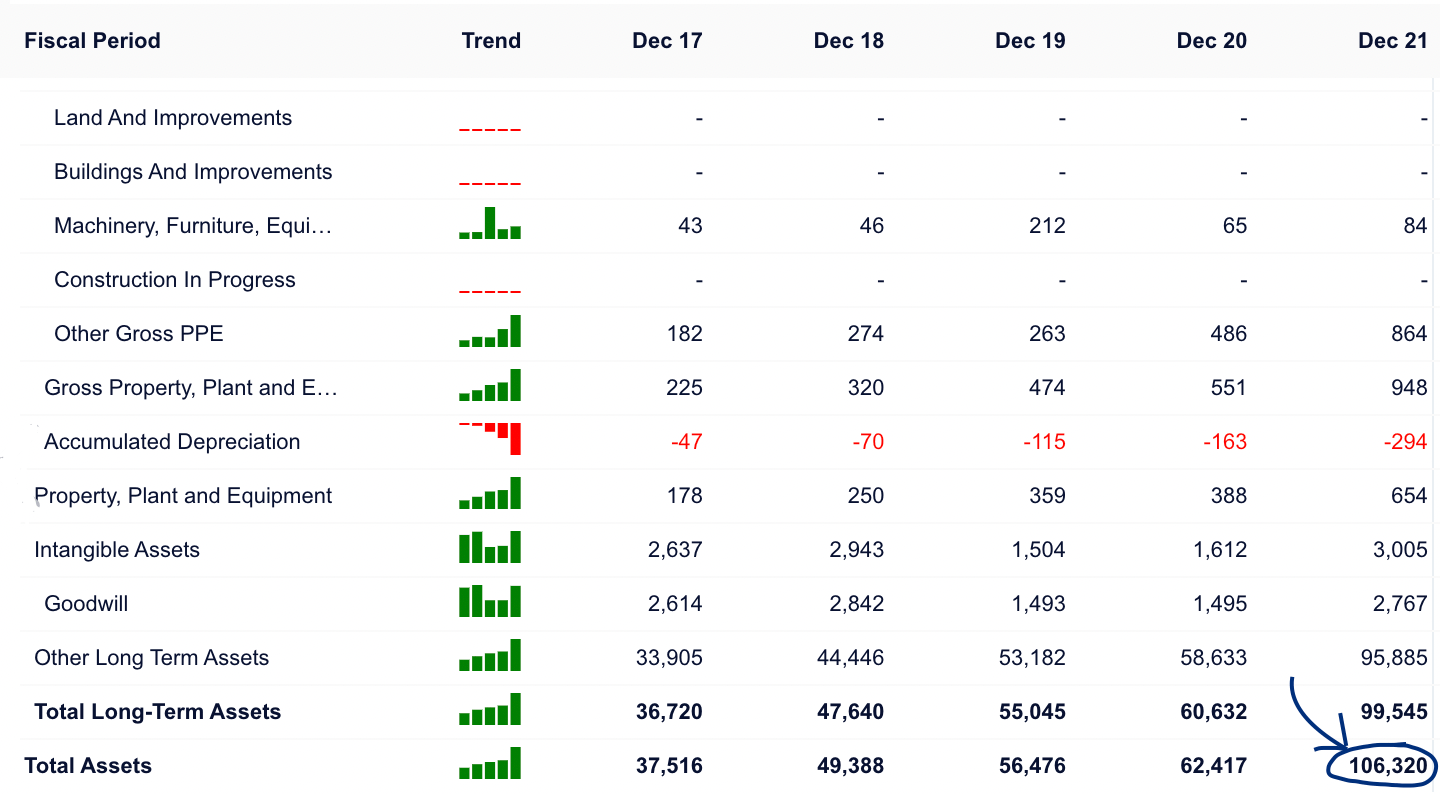

Let’s take a look at the balance sheet:

That’s 106 Bio Euros in Total Assets or 113 Bio USD. Not small indeed.

Let’s compare Vonovia’s numbers with the largest REITs worldwide:

| Worldwide Largest REITs | M. Cap | Total Assets | PB | PS | Yield % |

| Prologis | $116 B | $61 B | 2.7 | 17.6 | 2.5% |

| AMT | $100 B | $66 B | 16.0 | 9.5 | 2.7% |

| Equinix | $66 B | $29 B | 6.0 | 9.3 | 1.7% |

| Crown Castle | $63 B | $38 B | 8.2 | 9.2 | 4.1% |

| Realty Income | $44 B | $46 B | 1.6 | 12.5 | 4.4% |

| Vonovia | $16 B | $113 B | 0.5 | 4.9 | 4.6% |

It’s pretty obvious that although Vonovia owns most assets ($113 B), it has the lowest market cap of all five. All of this while the price-to-book value sits at 0.6 (best and lowest), the price-to-sales at 4.9 (best and lowest), and the dividend yield at 6.32% (best and the highest).

Comparing Vonovia To Large U.S. Residential REITs

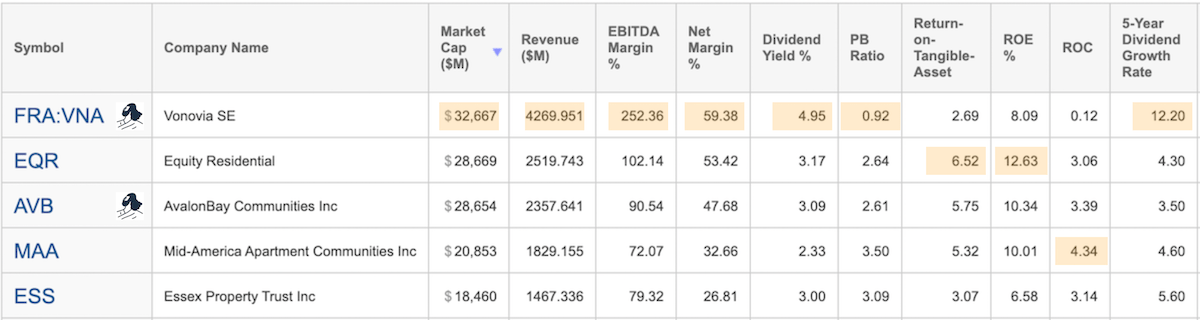

What if we compare Vonovia with the largest residential REITs in the U.S.? Well, I did and was quite surprised. It’d be the largest residential property owner, with the best financial ratios. I am highlighting the best values for each REIT. Disclosure: I also own Avalon Bay ($AVB) in my All-Weather Portfolio.

The below chart was created in Q4 of 2022 – since then, Vonovia’s price has come down substantially, making the bull case for Vonovia even stronger.

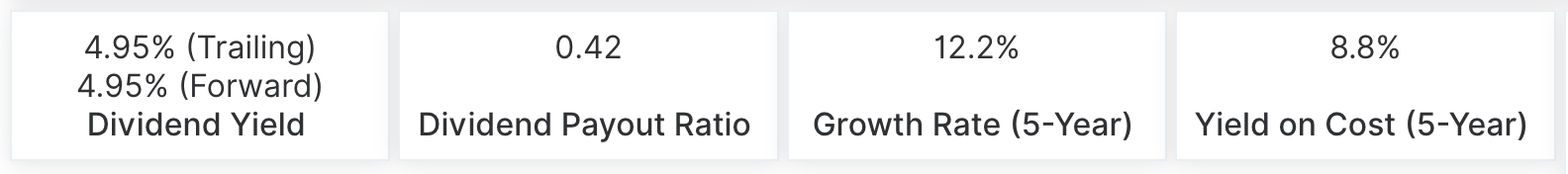

Is Vonovia’s Dividend Safe?

Measured by the relatively low payout ratio of 42%, I deem Vonovia’s dividend as safe. At the end of the day, it is the largest European REIT, something that people gravitate to in times of uncertainty.

I see room for a potential increase. However, one word of caution: A large part of the profits is achieved through the yearly revaluation of the properties. Measured against the funds from operations from 2021 of EUR 2.15 per share, however, there could also be room for improvement.

The equity ratio of 34 percent is not very high, but for a capital-intensive business model – like Vonovia’s – there could be more leeway. In summary, I think the dividend is safe, with realistic room to grow over the years.

Is Vonovia Reasonably Priced?

Some quick back-of-napkin math: Vonovia owns 565,000 apartments, with 770 million shares = 1,370 shares per apartment (approx. €45K(apartment). The average size of all apartments is 62 sqm. With a market cap of 16,4 Bio €, that’s 29,000€ per apartment (used to be 45,000€ when I originally published this post in May 2022).

Well, I can tell you, you have to search for a long time if you like to find an apartment for 29,000€ and 62 sqm. This shows how grossly undervalued the Vonovia stock has become.

When looking at Vonovia’s price-to-book ratio, PB, we can see it currently sits at 0.48 (Oct 10th, 2022), which is the lowest it has ever been (light blue line).

Vonovia’s Dividend

As income investors, the dividend section is of great interest to us. Let’s take a look:

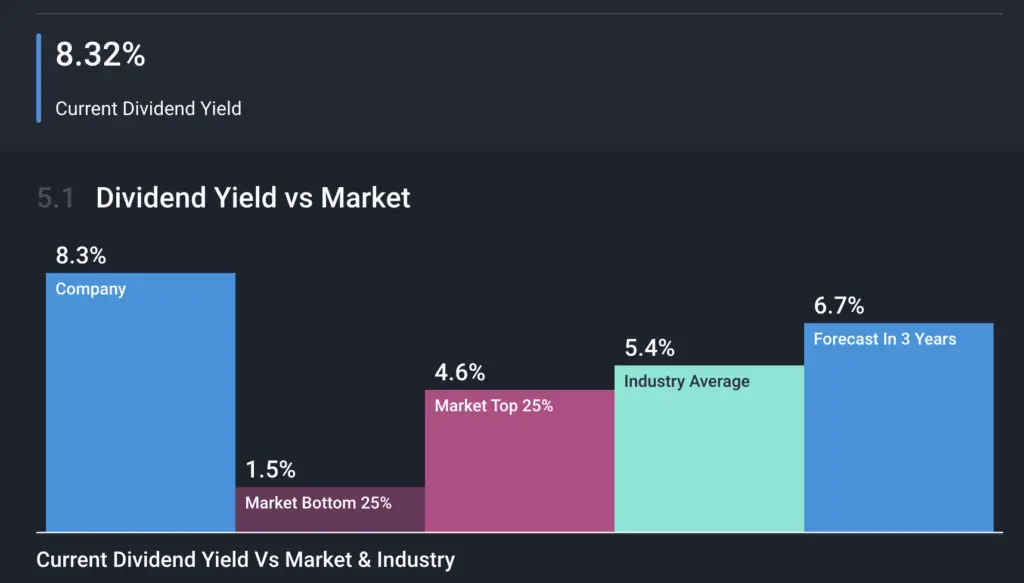

What I like here, in particular, is the high growth rate of 12.2%. That, paired with a 4.95% dividend yield gives us a chowder CAGR of 17,15% (not sure what the Chowder Dividend Rule is? –> watch this 5-min Youtube video), clearly above the recommended 12% for high-dividend payers. Not bad.

Now, when looking at the chart, you can see an extremely low RSI. It is at a bombed-out level. I think the area marked as ‘floor’ is a good buying area (update Jan 25th, 2023: Vonovia’s stock price sits now at around 25€, providing an even better risk/reward).

Update Sep 21: Vonovia now sits at 23€, representing an even more interesting price level to start building a position.

On May 25th, 2022, I received the latest Vonovia dividend, see below. For the 334 shares I own (total holding value approx. 11,000€), I received 408€, roughly 440 USD. I can sleep well at night owning a part of the largest European REIT.

Vonovia’s Dividend Record

To check out Vonovia’s dividend record, let’s hop over to SimplyWall.st, see the image below. The blue line shows the dividend yield, and the green how much has been paid out in Euro. The pink line shows the earnings per share.

I believe that all the negatives (e.g. lower earnings per share, the war in Ukraine, the increasing interest rates, etc.), are now all priced in, that’s why the stock tanked by more than 50%!

Is European REIT Vonovia A Buy Here?

In short, yes for me. Comparing it with many of its peers, Vonovia is a rock-solid company with a fortress-like balance sheet, high dividend, good international diversification, and very experienced and prudent management I trust will steer this mega-ship steadily through any storms to come.

Update May 2023: At the current levels, I think Vonovia is a buy here but you need to be patient (three or five years plus).

Aroundtown – Europe’s #1 Office REIT.

Aroundtown ($AANNF, $AT1, LU1673108939) was founded in 2004 and has been listed on the German stock exchange since 2015. It was included in the S-Dax in 2017, in the MDAX in 2018, and it is now even included in the DAX 50 ESG Index since it took over another large REIT called TLG-Immobilien. It is now the largest European office REIT, holding real estate worth 25 Bio Euros.

Aroundtown Fun Fact:

Aroundtown is the title sponsor of the German Bundesliga soccer club, 1. FC Union Berlin, playing in the highest league.

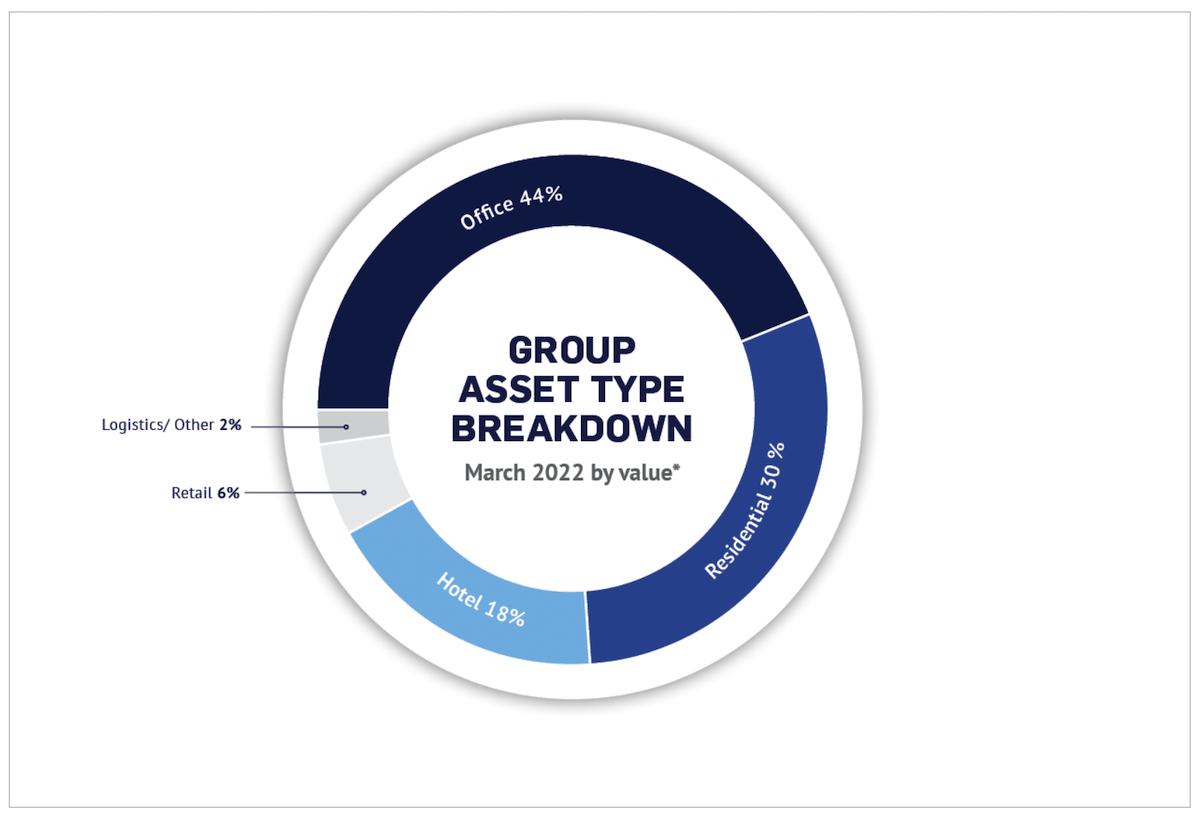

The main business model of the Luxembourg-based company is to acquire, develop, and lease income-generating quality properties in Tier 1 European cities in Germany, the Netherlands, and the UK (basically London). It buys and leases out office, hotel, and commercial real estate, below is a quick breakdown:

It also owns a subsidiary that specializes in residential real estate, Grand City Properties ($GCP), also a publicly traded real estate company.

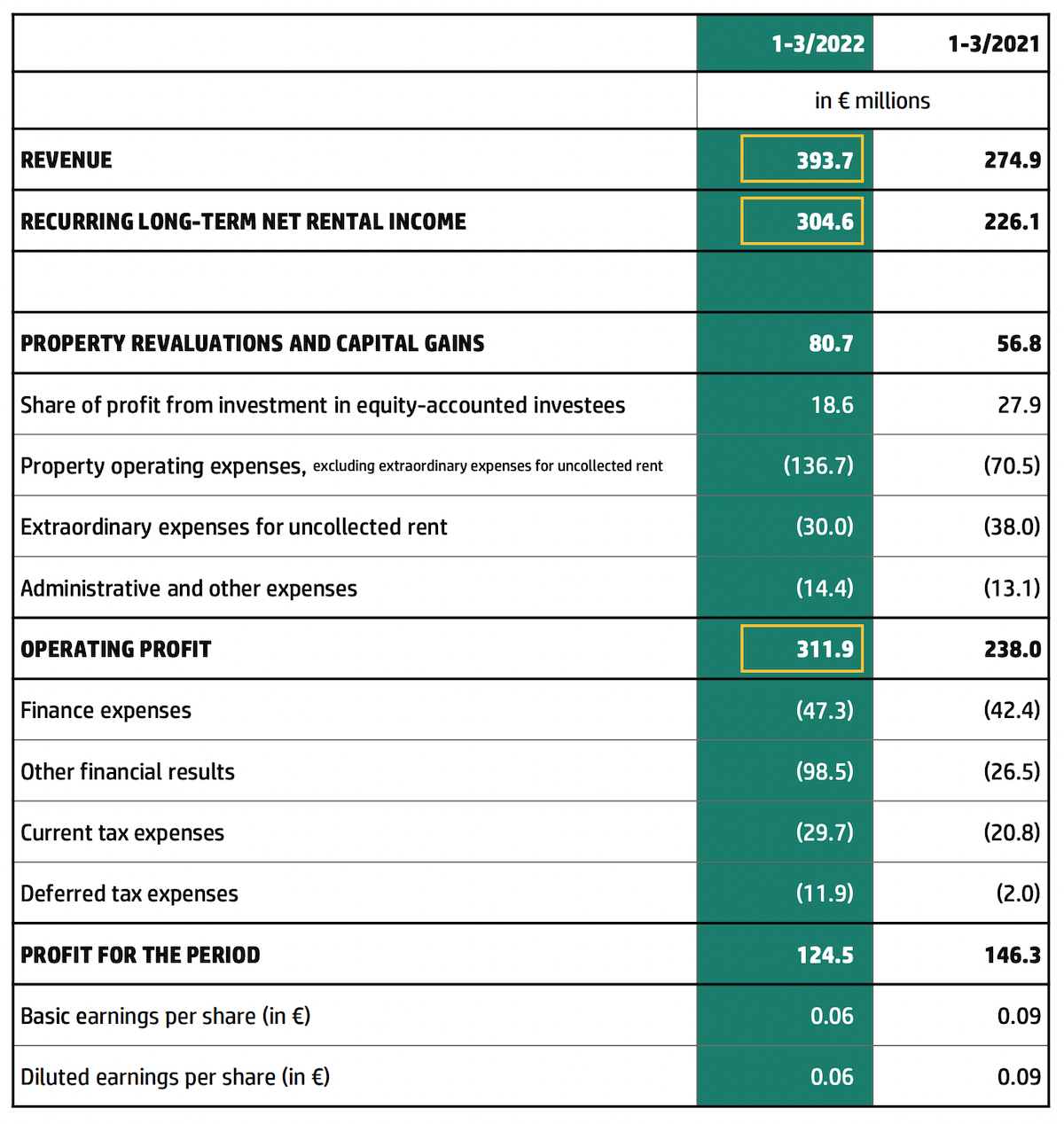

How About Aroundtowns Profit & Loss?

As you know, I am not a professional analyst, more like your neighbor who’s passionate about dividend investing. But I like to study annual reports, balance sheets, and income statements, and here’s a glance:

Revenue is up, a recurring long-term rental is up, operating profit is up, and the share price is down. Way down, more than 41% in fact.

Recent Aroundtown Purchases & Updates

Update Oct 10, 2022: Aroundtown’s stock price tanked further, to 2.2€, providing a very compelling risk/reward ratio at this level.

Update Nov 2, 2022: Bought 1,750 x 1,93€, now own 5,000 shares, all transactions below

Update Feb 4, 2023: The stock price seem to have found a bottom at 1.70€ (see the chart below). It’s now back at 2.70€. I now own 5,000 stocks and will keep adding if it drops again below 2.25€.

Update May 26, 2023: After listening to the quarter-end earnings call, I took the following notes:

- Net rental income increased 13% to €1.2 billion

- like-for-like rental growth of 3.5%

- disposals in the amount of €1.6 billion in 2022

- with a further €150 million so far in 2023

- conservative financial profile with a low LTV ratio of 40%

- comfortable ICR of 5.2x (interest coverage ratio = NOI / interest)

I bought 2,500 Aroundtown shares at 0,92€.

Update Sep 21, 2023: Aroundtown is back above 1,80€, and I believe it is still okay to buy at these levels.

Aroundtown’s stock price took a brutal nose-dive from the peak, that’s obvious. All of this while the business performance is up. This smells like Mr. Market provides us with an opportunity.

Now, I know there are several major uncertainties, in particular around the potentially rising interest rates (historically bad for property developers and owners), but I believe the central banks put themselves in a corner, and won’t be able to keep interest rates elevated for long.

They’d bankrupt one community, city, region, country, or even region (e.g. PIGS) after the other.

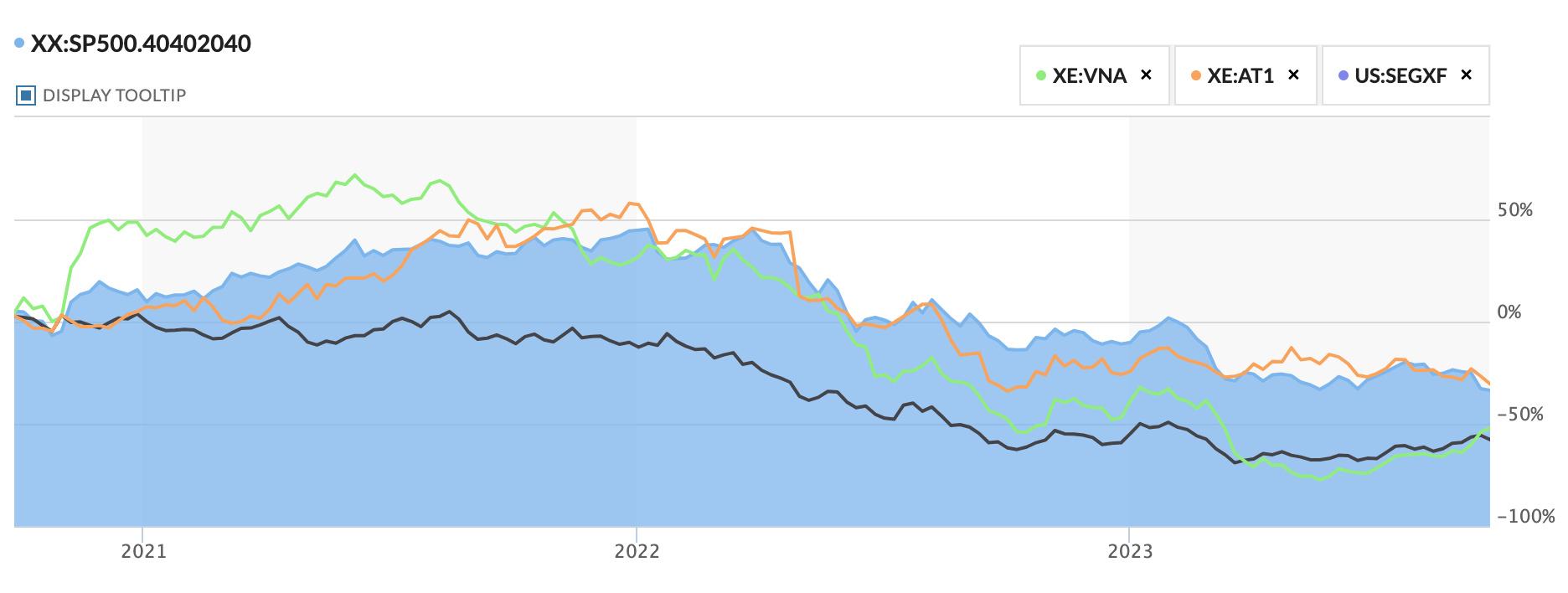

Let’s briefly check how office REITs in the U.S. did, by comparing its chart to the three European REITs presented here.

The blue mountain shows the chart of the U.S. Office REIT index on Marketwatch.com, the green is Vonovia’s, the orange is Aroundtown’s and the dark one is Segro’s.

In summary, Aroundtown is down in line with the U.S. office REIT index.

Aroundtown’s Dividend History

Looking at Aroundtown’s dividend history on SimplyWall.st, we can see the following:

Is European REIT Aroundtown A Buy?

Below 3€, I like Aroundtown, sub 2€, I like the stock a lot. I bought 2,500 at 0,92€, and believe we are through the worst.

Having money in Europe’s largest office REIT to me is an ultra-long position, something I plan to hold for +10 years!

SEGRO – Europe’s #1 Industrial REIT.

SEGRO (ISIN GB00B5ZN1N88, $SEGXF), is a real estate investment trust focused on industrial real estate. Its portfolio includes warehouses, industrial buildings, offices, logistics, and data centers in commercial and industrial areas in Great Britain and Europe.

The target properties are typically in close proximity to important transport hubs such as highways, ports, or airports. The company was founded in 1921 and is headquartered in Slough Berkshire, UK.

Technically SEGRO is not a company of the European Union, but from my point of view, it surely counts as a European REIT, as as of May 2022, it owns properties in multiple countries in Europe, see the breakdown below:

-

-

- UK (70)

- France (51)

- Germany (28)

- Poland (18)

- Italy (12)

- Spain (10)

- Netherlands (8)

- Czech Republic (1)

-

The activities of SEGRO include project management from planning through construction to marketing and administration of the buildings, as well as property management of existing buildings. SEGRO owns and manages real estate with over 6 Mio sqm (roughly 60 Mio sft) of commercial space.

I have been following SEGRO for years but so far have not bought it. I am not yet clear how a UK-based REIT would be treated tax-wise for German investors like myself, living in Singapore.

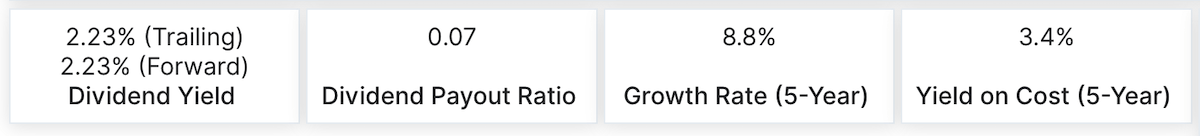

How About SEGRO’s Dividend?

SEGRO pays a solid dividend of 2.2%, growing at a 5-year average rate of 8,8%. The payout ratio is extremely low (only 7%), meaning SEGRO can easily increase its dividend, should the experienced management so want.

Is Industrial REIT SEGRO A Buy?

When looking at SEGRO’s stock chart, we can see it’s about 50% off its high. It came down with the entire market without any particular catalyst or reason. I believe a prudent, long-term income investor can start to nibble on this conservatively managed company at these levels.

Update Oct 10, 2022: Segro’s stock price came down by another 30%, same as for the two other European REITs, offering very interesting risk/reward ratios.

Update Feb 4, 2023: Looks like Segro found a bottom in Q3/Q4 of 2022. Look at how oversold it was, RSI reading of sub-25!

Update Oct 2, 2023: Segro’s chart sees strong support at around 700.

I personally like the company a lot, and it’s on my shopping list should we see any further major decline due to for example geopolitical stress. I appreciate the fact that SEGRO has a focus on the U.K., but is geographically sufficiently diversified. This European REIT has a strong balance sheet to weather any major storms, and its core business, industrial properties, will be in high demand in highly industrialized Europe for decades to come.

What Are The Largest REITs in Europe?

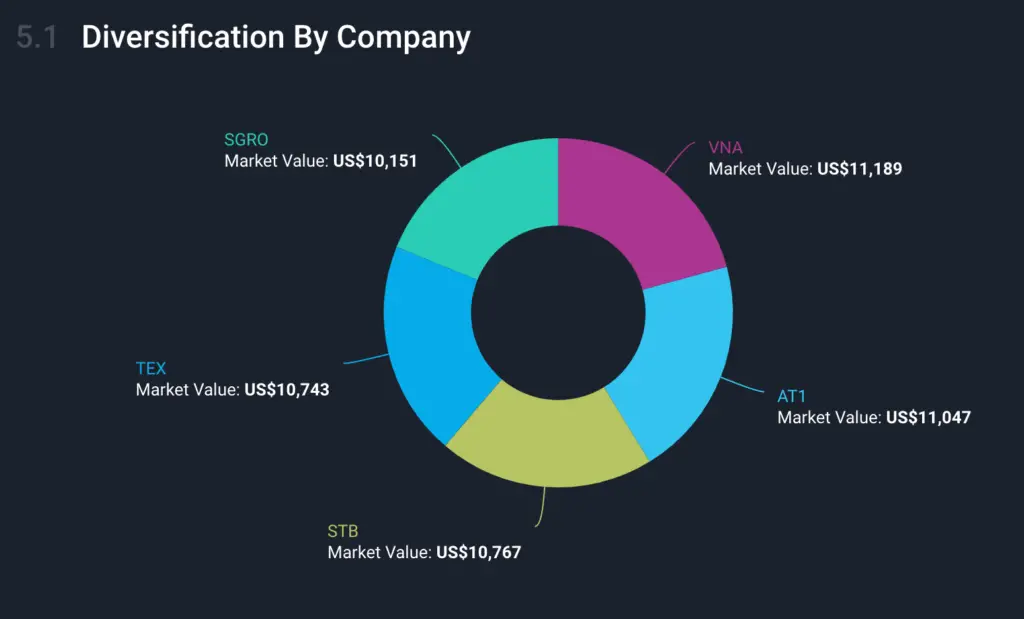

Portfolio of Best European REITs

I created a simple portfolio of the five best REITs in Europe over at SimplyWall.st, a site I really like for how they present complex issues in an easy-to-understand and visual way. This portfolio assumes that we invested an imaginary 10,000 USD in mid last year.

It consists of the following REITs:

- 🇩🇪 Vonovia (Europe’s largest residential property owner)

- 🇩🇪 Aroundtown (one of Europe’s largest office REITs)

- 🇬🇧 Segro (a leading industrial REIT with properties in the UK, GER, FRA, POL, CZ, ITA,..)

- 🇬🇧 Shurgard (Europe’s leading self-storage REIT, owned by Public Stora)

- 🇸🇪 Castellum (Scandinavia’s largest REIT)

Disclaimer: Of the above five REITs, I own Vonovia, Aroundtown, and Castellum.

You can check out the sample portfolio here.

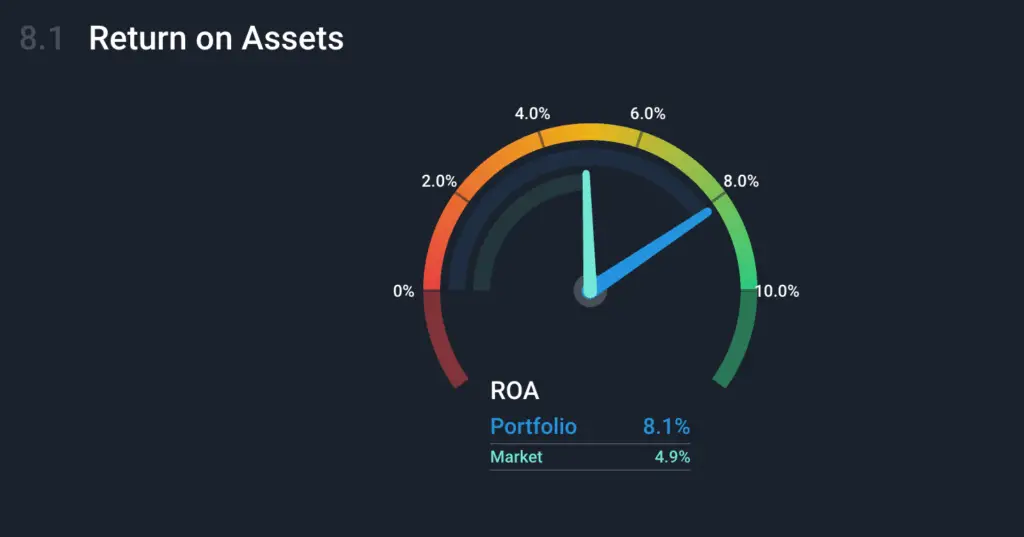

Below are some of those stunning charts of Simplywall.st that I mentioned above.

Conclusion

There you have it, fellow stackers. I present my favorite 3x European REITs I either already own (Vonovia & Aroundtown), or have on my shopping list such as SEGRO.

My favorite Nordic REIT, covering Scandinavia incl. SWE, FIN, NOR and DEK is Castellum. But that’s for another day.

When it comes to investing, it’s easy to lose sight of the forest for the trees, particularly when you’re deep into the woods! When we zoom out, we can see lots and lots of uncertainty. My investment thesis for going heavy on European REITs is that they provide good shelter and stability in the long term.

As long as no war breaks out all over 🇪🇺Europe, these three companies will be around 10, 15, or 25 years from now, and most likely keep paying a healthy dividend.

That’s what I like about them, and that’s why I am a buyer.

📘 Read Also

FAQ

Which European REIT should I buy?

Why did shares of REITs fall so much in 2022?

The stock market is always forward-looking. One additional issue that might already be priced in although it did not make it into mainstream public media is the long-term consequences of “Europe’s Green Deal”, in particular on large property owners such as Vonovia or Aroundtown in Europe. Property owners can expect to see a substantial increase in costs for renovations and building new property types to meet very specific energy and material requirements. They might also have to bear changes in zoning laws, that could significantly limit the development of new properties.

How many REITs are there in Europe?

There are a total of 144 publicly-listed REITs in Europe, with only 15 European REITs having a market cap higher than 2 Bio USD (the U.S. has 74 publicly-listed REITs with a market cap of +2 Bio USD!).

What is the largest European REIT?

The largest REIT in Europe is Cellnex Telecom SA (CLNXF), which owns and operates +100,000 wireless towers in Europe. The second largest is Europe’s largest residential property owner, Vonovia (a European REIT I own in my All-Weather Portfolio).

What are the best real estate stocks in Europe?

Of the 144 listed real estate stocks in Europe, only 15 of those have market caps of +2 Bio USD (the U.S. has 74 publicly-listed REITs with a market cap of +2 Bio USD!). The largest real estate company in Vonovia (VONOY), another interesting one is Aroundtown (AANNF).

What are some good European Residential REITs?

Why are European REITs down in 2022?

The main reason is higher interest rates. The fear is that with higher interest rates, the REITs will have issues getting their debt-financed. If they have to start selling some of their properties, now might not be a good time with everything going on in the world at the moment. Other challenges are rising energy costs and high inflation. The concern is that some rentees might not be able to pay their rent anymore, resulting in bad debt for European REITs like Vonovia, Aroundtown, or LEG.

How does the war impact European REITs?

The war in Ukraine creates a lot of uncertainty for European REITs. Key challenges are the looming energy crisis, high inflation, supply chain disruptions, and on top of all of that, the rapidly rising interest rates. This causes many investors to be concerned about the REITs in Europe to be able to keep their tenants, pay for their often high debt loads, and keep expanding.

What is a good Europe REIT?

As of early 2023, there are not many European REITs yet, but some notable ones are Europe’s largest residential real estate owner Vonovia (VONOY), and Europe’s largest office REIT, Aroundtown (AANNF).

How do the ‘Green Deals’ in the U.S. and Europe impact REITs?

The U.S. New Green Deal, or the ‘Europe Green Deal’, potentially has a significant impact on large property owners such as industrial, retail, residential, or office REITs, in both the U.S. and Europe. These Green Deals demand property developers and owners to adhere to stringent material and energy-efficiency requirements, making it more cumbersome and expensive to build, maintain, or renovate existing buildings. The impact might be substantial. It is estimated that if a property owner owns three multi-family houses, he might have to sell one to have enough money to renovate the other two. And this will in particular have a big impact on those REITs that own thousands, in Vonovia‘s case, hundreds of thousands of apartments all over Europe.

2023 is so far devastating for European REITs – should you sell?

With the rapidly rising interest rates since Q3 of 2022, REITs in general, and European REITs in particular, have been hit very hard, as it becomes increasingly challenging to re-finance their loans. Aroundtown and Vonovia have been hit extra hard. Their share prices tanked by up to 80% in the case of Aroundtown (7.75€ in Feb 2020 and now 1.65€ in Mar 2023). I believe at this stage, most negative drivers have been priced in, and if you still own some Aroundtown shares, I would not sell at this stage, but rather, collect the dividends and ride through this weakness.

Are there European REITs?

Yes, there are. In general, you can find

– residential REITs

– office REITs

– industrial REITs

– self-storage REITs

– logistic REITs

Some companies like Vonovia are not technically REITs, but essentially function as one, because they own over 500,000 residential properties and pay out most of their profits are dividends.

What is the yield of European REITs?

That depends on which category of European REITs you are looking at, such as residential, office, industrial, or

self-storage REITs. When looking at a list of best European REITs, we see the dividend yields are at about 3.2% on average.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love