Two fellow readers of my blog asked me to provide feedback on their current wealth allocation, consisting of the 8 pillars I talked about in my How To Structure An Investment Portfolio blog post, which are

- Cash

- Bonds

- Stocks

- Metals

- Real Estate

- Crypto

- Art

- Venture Capital

Reader E.’s Wealth Allocation Pillars

The first reader is E., who lives in the Netherlands and has the following quick bio:

- Age: 28

- Married, no children yet

- Industrial Engineer

- Basic Monthly Expenses: 1,955€

- Monthly Income After Tax: 3,500€

- Able to invest/month: ~1,500€

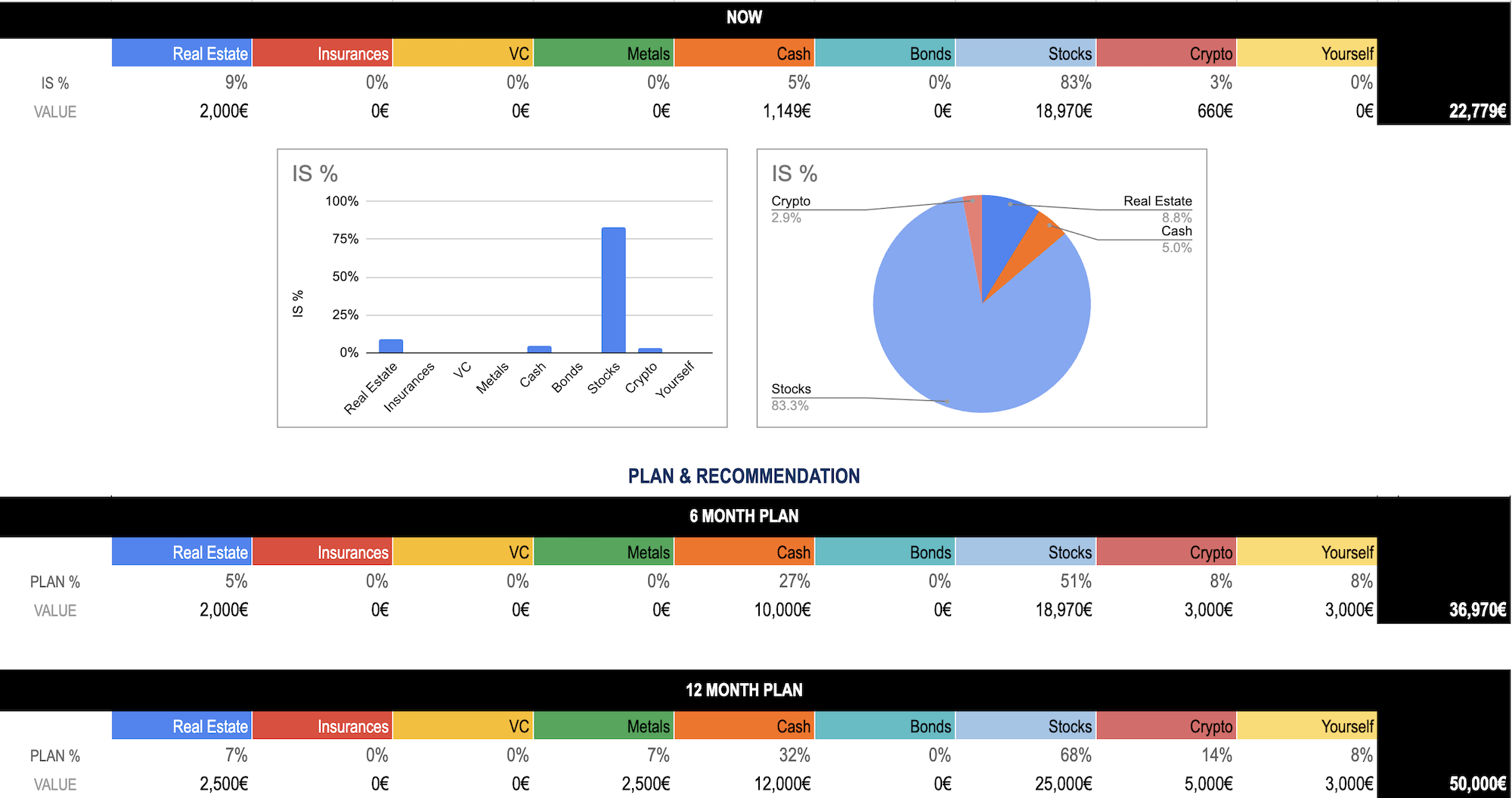

E. currently has the following wealth allocation pillars (see my suggested allocation further below):

My Recommendations For E.

Increase Cash: Maintain a cash buffer of at least 6x your average monthly expenses, with 12x being even better. This ensures you have enough time to recover from unforeseen events. Only invest excess cash beyond this buffer. Focus on lowering or eliminating unnecessary expenses, especially those that do not benefit you like going out too much, alcohol, drugs, tobacco, expensive dinners, etc.

Forget About Real Estate: For now, I recommend avoiding real estate due to high prices and interest rates. Only consider purchasing if you find your dream property and can see yourself living there long-term.

Increase Crypto To 10%: Allocating 10% to crypto could generate significant returns over the next 12-18 months. With the total crypto market cap around $2.5 Trio, experts like Raoul Pal predict substantial growth towards $100 Trio over the next decade. Watch this short video.

Pause Stock Investing: Stocks typically yield around 7% per year. Focus on saving up 6-12x your monthly expenses and achieving a 10% crypto allocation before continuing with dollar-cost averaging into quality stock ETFs.

Invest in Yourself: This is the most impactful recommendation. Take classes, learn new skills, pursue an MBA, or acquire programming skills. Increasing your monthly income will provide the foundation to maximize ROI on your portfolio. Set a fixed budget you have available. I set $3k per year, that’s $250 per month. For example, Udemy has some excellent courses on investing in general.

What Would Zeno Do?

As a practitioner of stoicism, I find inspiration in Marcus Aurelius’s question, “What would Zeno do?” Modify this to fit someone relevant to you, such as a friend or co-worker, and ask yourself: If X did Y, would I feel left behind? This adds urgency to the question.

Consider what actions Mr./Mrs. X could take to advance effectively and make you feel motivated to keep up. Additionally, ask yourself: What needs to happen in the next three years to give you the best chance at career advancement?

Identify 1-3 concrete actions that would significantly impact your life.

Reader P.’s Wealth Allocation Pillars

The second reader is called P., living in Portugal.

- Age: 43

- Married, one child

- Lawyer at a mid-sized law firm

- Basic Monthly Expenses: 2,515€

- Monthly Income After Tax: 4,550€

- Able to invest/month: ~2,000€

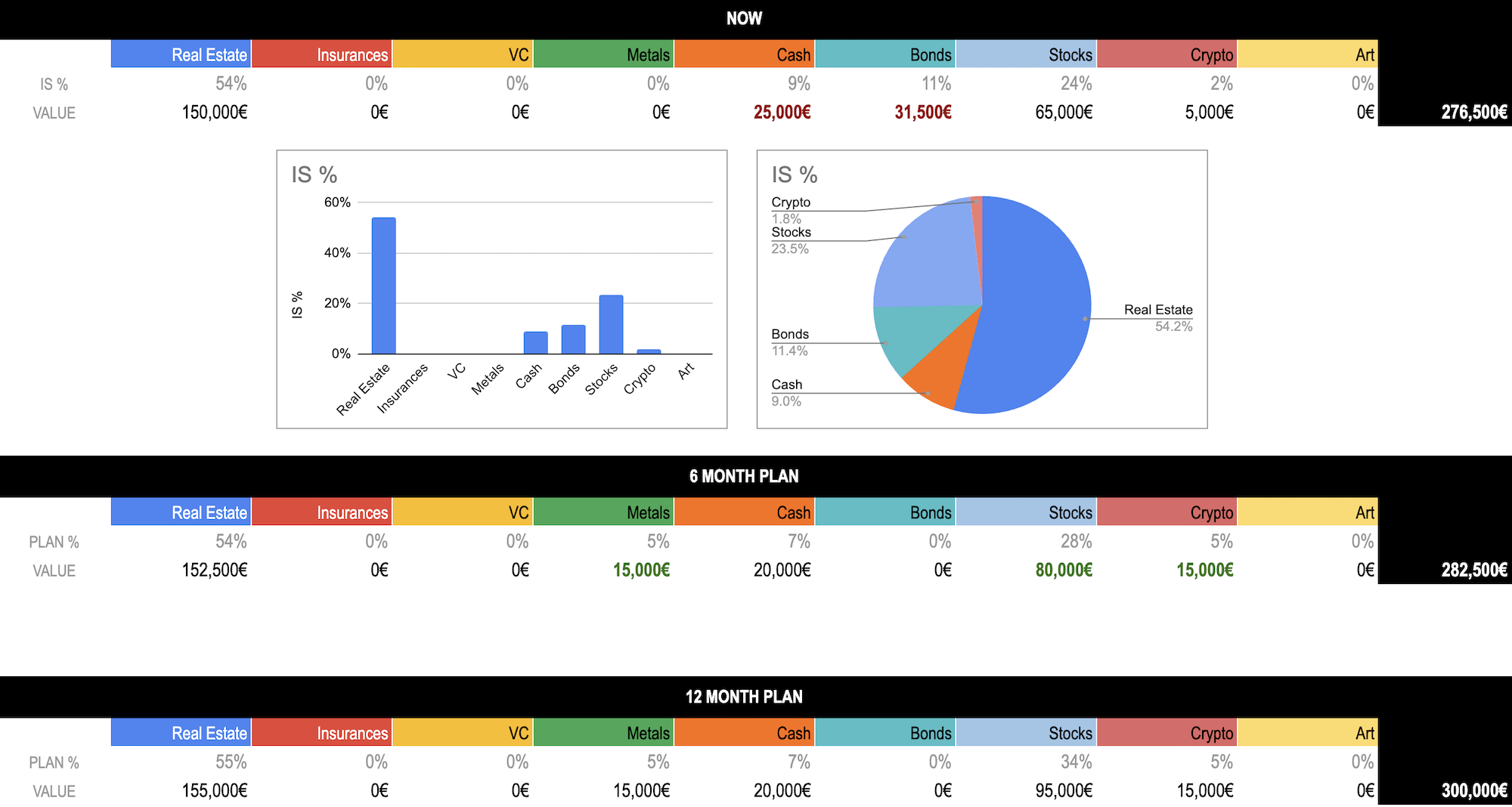

P. currently has the following wealth allocation:

Real Estate: P. lives in an apartment purchased 15 years ago. The net value is approximately 120k after accounting for the remaining mortgage (property worth around 500k with a 350k loan balance).

Stocks: A solid foundation has been established. Continue adding to this on a monthly basis.

Bonds: I am not a fan of bonds, especially for someone with another 20 years until retirement. The low returns from government bonds, coupled with their ability to print more money, make them unappealing to me. Instead, consider the best dividend stocks, invest in yourself, or opt for good dividend ETFs.

Crypto: I would increase the crypto allocation to 5%

Metal: I would increase the crypto allocation to 5% as well.

By incorporating these wealth allocation strategies and ensuring a balanced asset allocation breakdown, you can achieve a well-rounded investment portfolio allocation. This approach to wealth segmentation helps ensure long-term financial stability and growth.

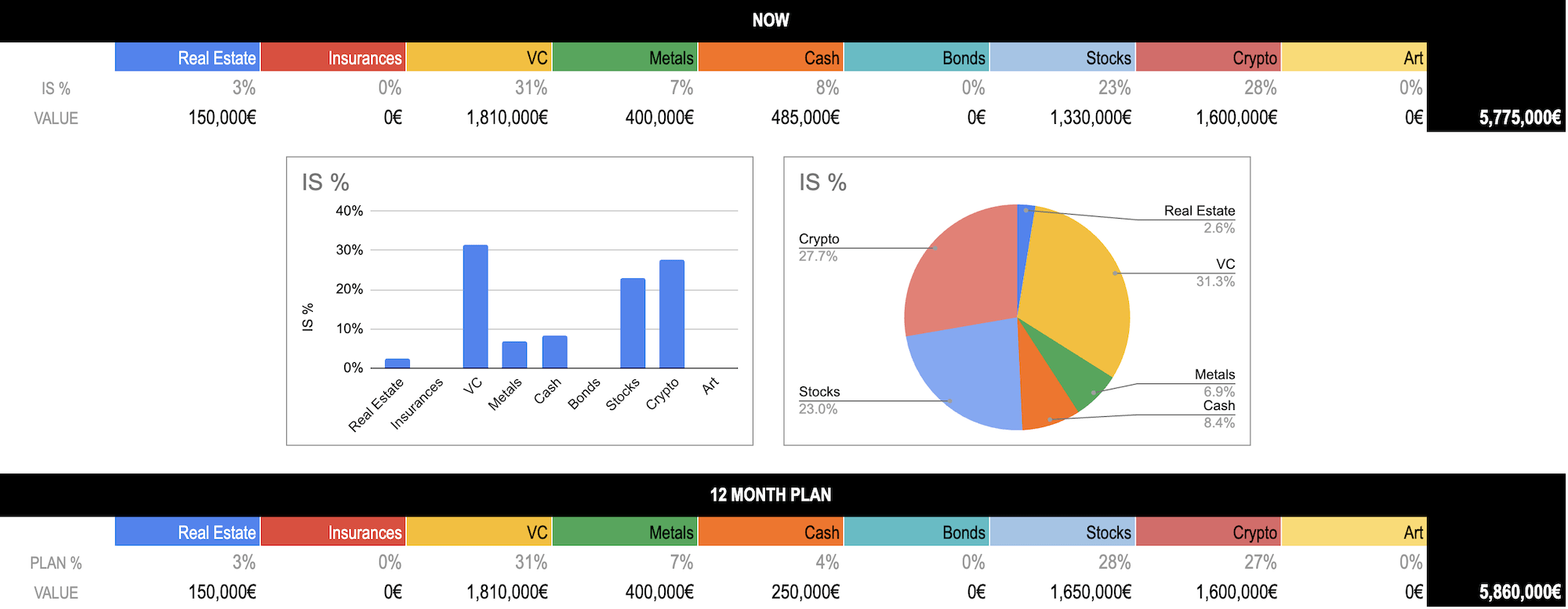

My Current Wealth Allocation

Below, just for reference, is my current wealth allocation (find a full breakdown here).

My basic plan is to focus on growing my All-Weather Portfolio, consisting of the best buy-and-hold forever stocks in the world. Companies with solid balance sheets and wide enough moats to withstand severe financial turmoils, recessions, or even depressions.

Conclusion

In summary, optimizing your wealth allocation pillars is crucial for achieving financial stability and growth.

By carefully balancing cash reserves, strategic investments in stocks, crypto, and other asset classes, and continually investing in yourself, you can create a robust and diversified portfolio.

Like to get my feedback on your wealth allocation?

Leave a comment below and I will share the Google Sheet with you!

📘 Read Also

- ETF Investment Guide for A New $1.5 Mio Portfolio

- The AI Investment Pyramid – Building A Balanced Portfolio

- The Family Bank: Secure Your Family’s Financial Future

FAQ

What is a well-diversified wealth allocation?

A well-diversified wealth allocation helps mitigate risk and maximize returns by spreading investments across various asset classes. This approach ensures that if one asset underperforms, others can compensate, providing a more stable and resilient financial portfolio.

How much cash to keep as part of my wealth allocation buckets?

It’s advisable to maintain a cash buffer equivalent to 6-12 months of your average monthly expenses. This safety net ensures you have enough funds to cover unforeseen expenses or financial emergencies without needing to liquidate long-term investments prematurely.

Why should I consider increasing my allocation to crypto?

Increasing your allocation to crypto can offer the potential for significant returns, as the crypto market has shown substantial growth prospects. However, it’s essential to approach this with caution, only allocating a portion of your portfolio to manage risk effectively.

Should I invest in myself?

Investing in yourself by acquiring new skills, pursuing further education, or enhancing your career prospects can significantly increase your earning potential. Higher income allows you to invest more effectively in various asset classes, ultimately improving your overall wealth allocation and financial security.

What are the main wealth allocation pillars?

The main wealth allocation pillars, or wealth buckets, are:

– Cash

– Bonds

– Stocks

– Metals

– Real Estate

– Crypto

– Private Equity

– Art

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love