I’m a DIY Investor, Managing my own crypto Portfolio since 2017. in This Article, I Openly Share how I earn interest on crypto, and the Platforms I’m Using.

How To Earn Interest On Crypto.

Earn Passive Income With Your Crypto

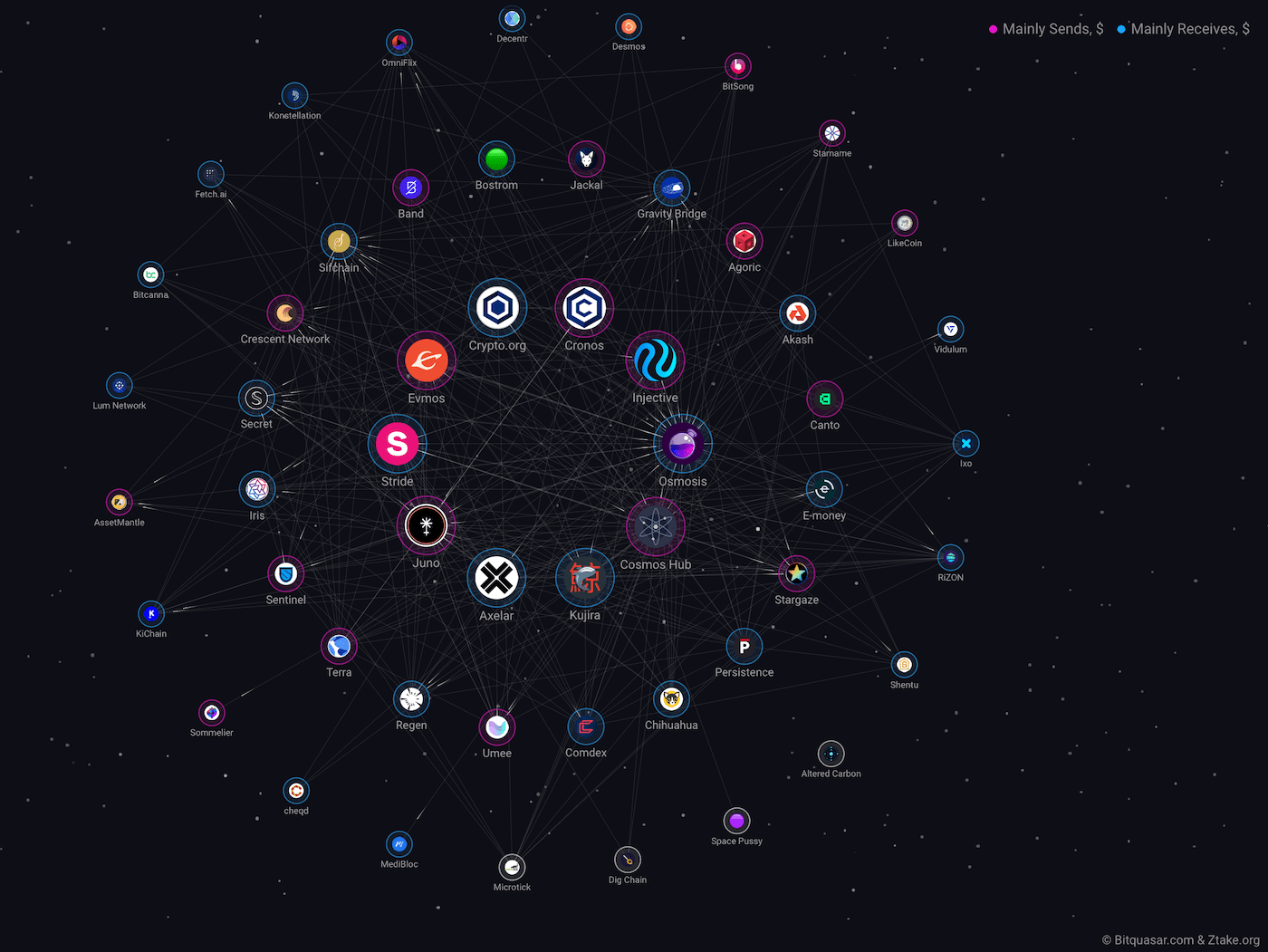

Osmosis

Osmosis is a battle-tested DeFi protocol built on the Cosmos SDK. It has a modern DEX & AMM, offering cross-chain P2P trading in a trustless manner. I’m currently earning $20/day with a $10,000 principal.

Read Review –>

No Trustpilot Reviews

Nexo

Nexo is the world’s most advanced & regulated crypto company, offering instant crypto loans, daily earnings on assets, and instant swaps for 40+ fiat currencies in more than 200+ jurisdictions.

Binance

Binance, the most popular cryptocurrency exchange in the world, has established a vast eco-system. It’s the crypto exchange with the volume & one of the fastest growing firms on the globe.

Disclaimer: I’m not a financial advisor. No content is meant to be a recommendation. Please do your own research. Pages might contain affiliate links. Please read my Disclaimer page.

Table of Contents

Compound Interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

Albert Einstein

Links To All Dapps I Am Using

Osmosis Review

Key Features

- Battle-tested DeFi protocol

- Provide liquidity and passively earn LP rewards

- Get LP rewards paid directly to your wallet - daily!

- No middlemen, only on-chain interactions

My Quick Take

I use Oxmosis since early 2022 and have come to really love it. Once a day I receive OSMO directly in my Kepler wallet. No complicated liquidity pool IL calculations. I get paid straight into my wallet. This is how DeFi should be!

Osmosis is an advanced automated market maker (AMM) protocol allowing you to swap any Cosmos IBC connected chain (e.g. ATOM, JUNO, OSMO, LUNA, CRO, SCRT, etc.) in a decentralized, trustless manner.

If you provide liquidity in ie. USDT and OSMO, you earn a percentage of the swap fees the pool generates.

I am currently in the DAI/OSMO pool, earning 18 OSMO per day.

OSMO is currently at 1,10 USD, meaning I earn 20 USD per day, paid out directly to my wallet, with a principal of 10,000 USD.

Risk comes from not knowing what you're doing.

Warren Buffett

Nexo Review

Key Features

- Super easy to use

- Wise variety of coins

- Very good interest rates

- Transparent Leadership

My Quick Take

If you like to earn interest on crypto, I can wholeheartedly recommend Nexo, as I have come to fully trust and love their platform and service.

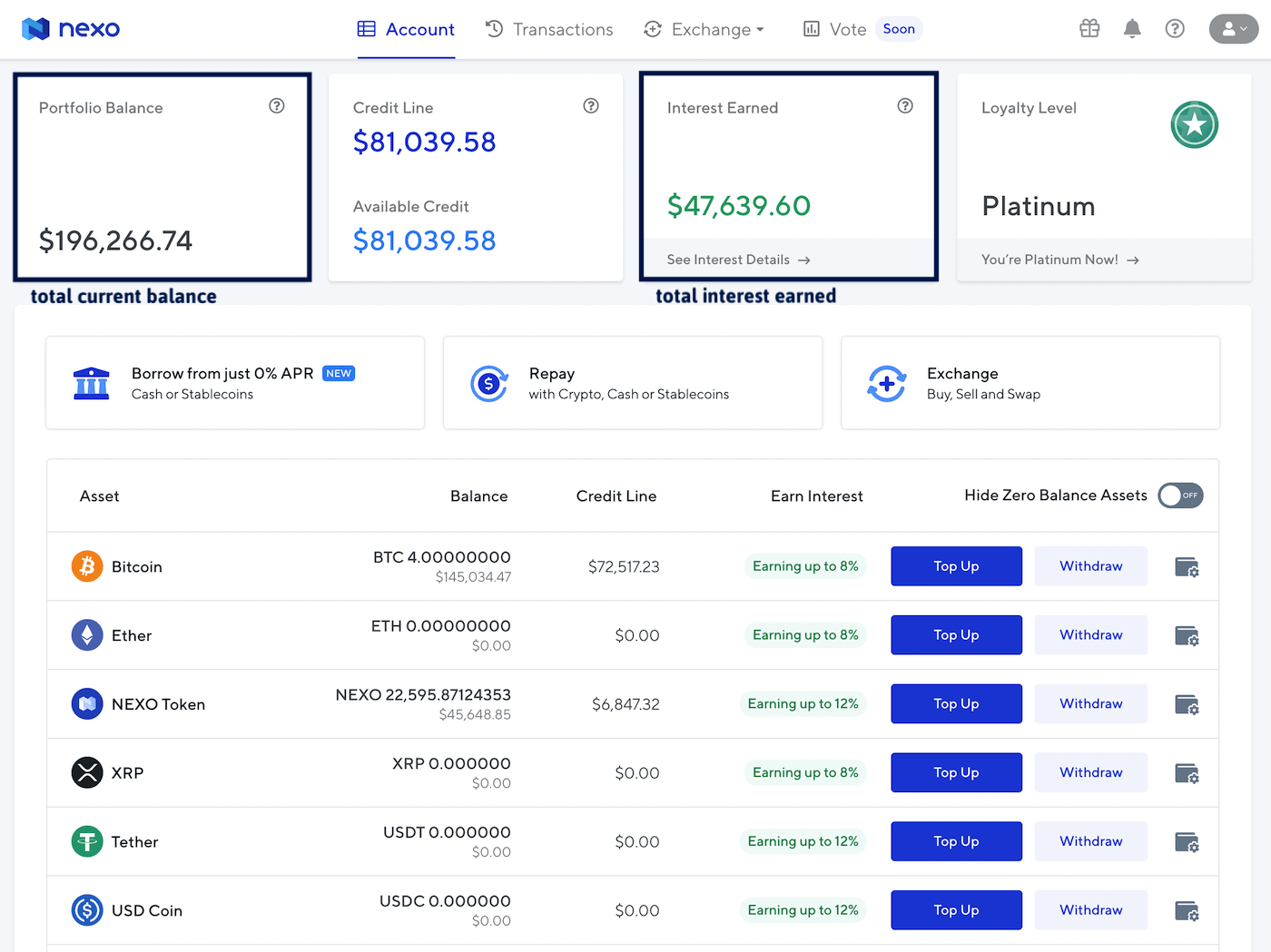

I am a Nexo customer since 2019. At the moment, as of May 2022, I have a total balance of 196,000 USD on the platform (see image below), earning me approx. 35 USD per day. Check out some of the screenshots below to check out the great design of Nexo’s web app. Absolutely love the simplicity and cleanliness. At the moment I have about 195k USD on Nexo, but I recently moved quite a bit of money around, and will soon add more on Nexo again.

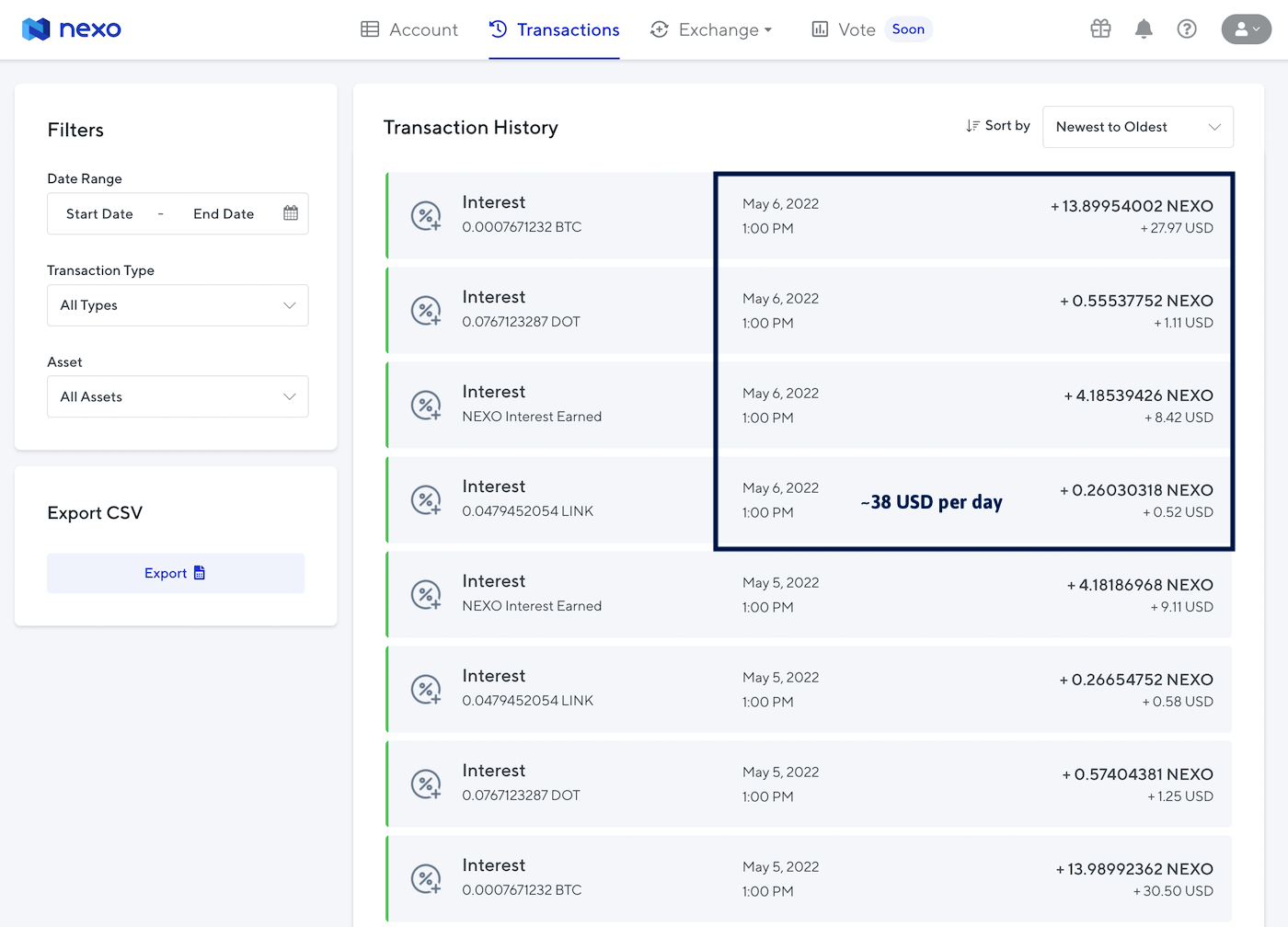

Below image shows the transaction page – every single interest payment is tracked and can be easily downloaded via a .csv file.

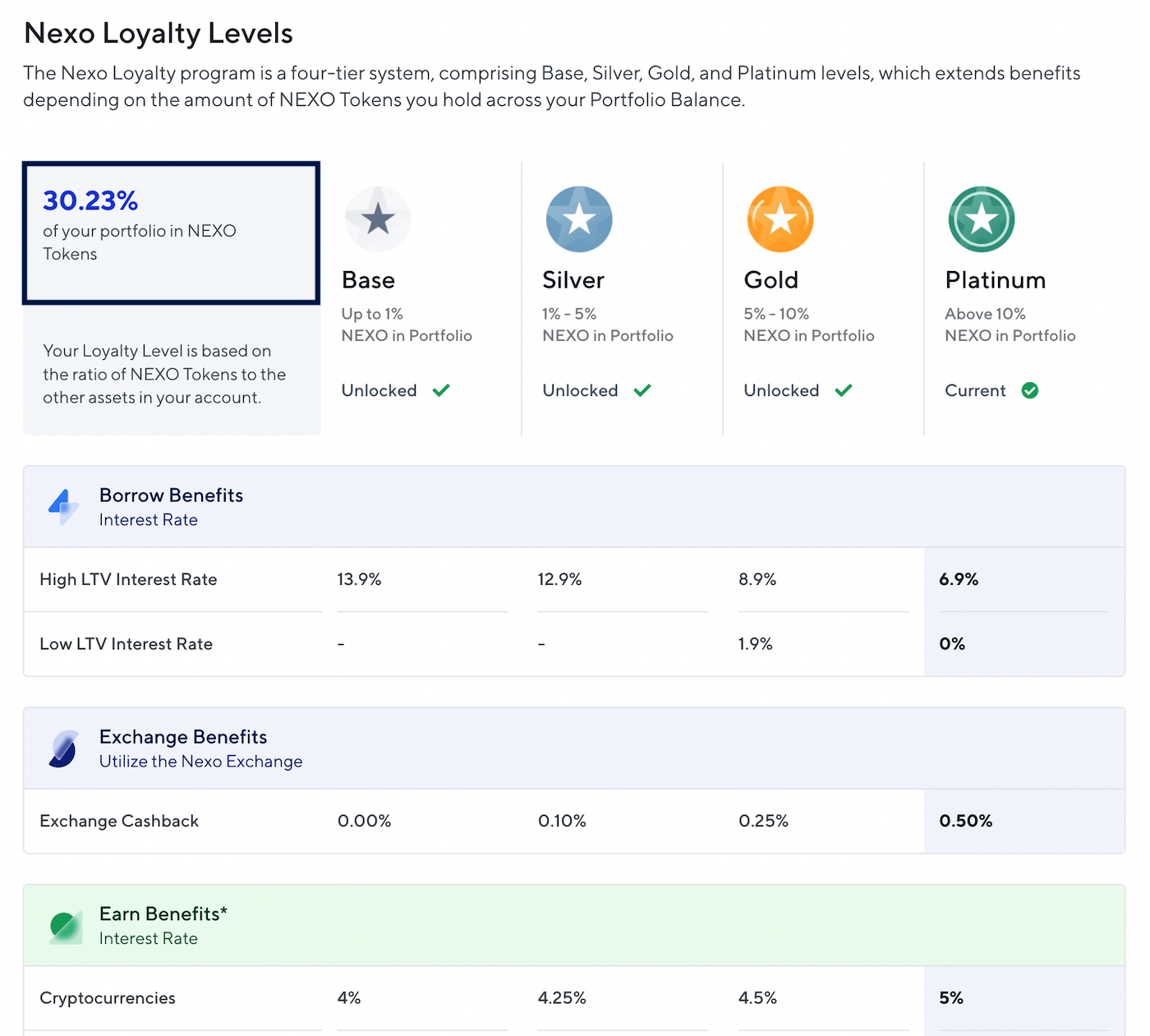

Below shows my loyalty level. As my Nexo tokens represent more than 10% of my assets, I am a Platinum user, getting a multitude of useful perks. (e.g. earning higher interest rates, free withdrawals, cheaper loans, etc.) .

Nexo just announced that the Nexo Credit Card is finally available. This is a game changer, making it finally possible to buy my caramel macchiato at Starbucks with the interest Nexo pays out –every-single -day–,

The most important quality for an investor is temperament, not intellect.

Warren Buffett

Binance Review

Key Features

- Unbeatable volume depth & width

- Largest exchange by volume

- Many value-added services

- Hands-off staking solutions

My Quick Take

Nexo is an excellent platform for long-term HODLing and earning interest on your crypto, but when it comes to trading, Binance is the 800-pound gorilla

0

Revenues in bio USD

0

Customers

0

Crypto Currencies

0

Trustpilot Reviews

(poor reviews)

The Binance Exchange, founded in 2017, is the world’s leading cryptocurrency exchange in terms of daily traded volume.

It has a strong focus on crypto-to-crypto trading in more than 500 cryptocurrencies and virtual tokens, including Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Dogecoin (DOGE), and its own token Binance Coin (BNB).

In response to China’s strict rules on cryptocurrency exchange businesses not allowing you to earn interest on crypto, it relocated its corporate headquarters to Malta, EU, in 2018.

What is a good interest rate for crypto?

Nexo pays between 6-12% for various coins. The more Nexo you hold in your account, the higher the interest rates are.

On Osmosis, the DAI/OSMO liquidity pool yields 60% in form of liquidity mining rewards, paid out in OSMO once a day.

Conclusion

FAQ

Yes, there are plenty of different ways to make your coins and tokens work for you. The most simple and secure way is using platforms such as Nexo.com. This is in my opinion the most trusted and transparent platform.

However, every solution comes with certain risks that you should carefully assess.

This depends on many factors, such as current liquidity, transaction volume, chosen protocol (Ethereum, Solana, Osmosis, ..), etc. The higher the interest rate the more careful you should get. If something sounds too good to be true, look twice and study the underlying tokenomics of the token you will earn.

The is regulatory risk, risk from impermanent loss, smart contract risk, volatility in terms of cryptocurrency prices, and good old simple fraud. Only invest what you can afford to loose.

Choose a provider that is around for a while, that can prove to weather a long and dark crypto winter. Don’t select a provider offering “too good to be true” rewards. Something in the 5-8% range is still considered to be okay. Platforms like Nexo.com have weathered tough storms between 2019-2023 and have earned the trust of many investors.

Yes, either via CeFi platforms like Nexo.com, or DeFi protocols like Aave, Compound or Osmosis. For the beginner, CeFi platforms are always easier to use and recommended. Only invest what you can afford to loose. And spread your eggs across several basket. Expect 5-8% in rewards p.a.

Yes. You can compound interest on crypto by providing assets to liquidity pools on for example aave.com, compound.finance or osmosis.zone, and frequently claiming the rewards and re-allocating them. You can also use vaults and yield aggregators to auto-compound rewards. Popular options are convexfinance.com or sommelier.finance.

Comments

Subscribe

Connect withD

Login

I allow to create an account

When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you'll be logged-in to this account.

DisagreeAgree

Connect withD

I allow to create an account

When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you'll be logged-in to this account.

DisagreeAgree

0 Comments

Inline Feedbacks

View all comments