My Story How I Got Started To Invest In Gold.

Gold is personal to me. My grandfather gifted me one ounce of gold on each of my birthdays till I was 18. I believe I must have been 4 or 5 years old when I at least remember getting the first one. My grandfather had just returned from a long vacation in South Africa, and he kneeled in front of me and said, that he brought me something, something special.

Thankfully, and wise as my grandfather was, he always bought the same type of coin, a 1 oz Krugerrand, one of the most known gold coins in the world. It’s easy to trade, sell or exchange in basically every country.

So when I was turning 18 in 1996, the price for one ounce was 380 USD, and my 18 ounces were worth 6,840 USD.

As a teenager, I remember I often felt ‘unexcited’ already knowing what I’d get for my birthday, but my grandfather did not just gift me coins, but with gold prices now at 1,900 USD, he instilled in me the understanding of the power of ‘wise stacking’. I realized that with consistent stacking, I can build wealth, and although it takes time, everyone can do it.

Where Does Gold Come From?

Gold can not be produced by men. Every piece of gold you ever held in your hand, was forged and created when massive stars in the universe exploded in a supernova and shot out heavy elements throughout space.

It then found its way to our tiny blue planet and landed scattered around the earth.

That’s why gold is called the ‘Sweat of The Sun’, and silver is referred to as ‘The Tears Of The Moon‘. For the Incas, gold was considered to be sacred.

Pause for a second, and really think about it. When you hold a piece of gold in your hand, you quite literally hold the remnants of an unimaginable distant star in your hand, that collapsed under its own gravity, exploded millions of years ago, and traveled on top of an Asteroid to earth.

Nowadays, most gold can only be found deep in the layers of the earth. It gets increasingly difficult to get it out of the ground, giving more rationale to the idea to invest in gold!

The Monetary History Of Gold

For more than 5,000 years, gold has been the best store of wealth. You do not invest in gold to speculate and become rich. In other words, you don’t buy it out of greed, but out of fear. It is similar to insurance. You buy it in the hope that you don’t need it. As Rick Rule put it so eloquently: ‘I rather live in a world with the gold price at 1,900 USD than in a world where the gold price is at 10,000 USD’!

So in history, gold acted as an excellent way to maintain your purchasing power over long stretches of time.

Since then, all the gold that has ever been mined represents a cube of approx. 20x20x20 meters, or 60x60x60ft, a bit like an Olympic swimming pool. That’s it. That’s all the gold that has ever been mined.

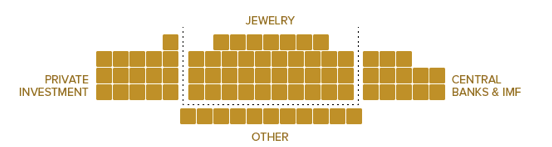

The below image shows you who currently owns all the gold that is still in existence. A large part became jewelry, many private households own it, and many central banks have gold on their balance sheets (smart to create “currency” out of thin air and then buy “money” aka gold with it!). Click here if you like to know how much gold and other precious metals I own. I stack and invest in gold regularly, roughly 3-4 times a year.

The ‘Gold 2,000 Years Ago’ Example

Let’s go back two thousand years and consider you are a successful merchant in Egypt, and you own one ounce of gold. It’s well documented that, back then, you were able to buy

- A custom men’s suit or Toga from a top-tier tailor

- A nice stay at a top hotel with your partner

- A fine-dining dinner

- You’d still have some money left after paying for all of the above

So in summary, an ounce of gold back then could afford you a very good time with your partner.

Now, if you’d still have the specific currency of that particular era, it might still have some historic ‘antique’ value, but as the currency is not in existence anymore, the monetary value would have entirely collapsed.

However, if you would have kept this one ounce of gold, this ounce of gold would be worth approx. 1,900 USD (April 2022). And with 1,900 USD at your disposal, you would easily be able to afford and pay for a night at a five-star hotel, get a nice suit, have a nice dinner and potentially still have some spare cash left!

I love this example because it illustrates that gold won’t make you rich, but simply maintains your buying power. You can basically go back to any other point in time, e.g. to the 1920s. Back then, an ounce of gold was 20 USD an ounce! One ounce of gold back then is still one ounce today. But I guess today you won’t get far with 20 USD! You can maybe buy your partner a Big Mac Menu.

So let’s look at all the reasons why I believe you should invest in gold and own at least 3-5% of your portfolio in gold and other precious metals.

Top Reasons To Invest In Gold

1/ Worldwide Debasing of Currencies

Central banks around the world are printing money like there is no tomorrow. Labeled as ‘Quantitative Easing’, central banks basically create money out of thin air. This is akin to counterfeiting. If ordinary people would do it, they’d be sent to jail. Look at what happened between 2020 and 2022: 40% of all USD in existence was created in those two years! This banana-republic-like ‘conFEDdy’ money creation is severely debasing the fiat you own, resulting in high inflation and prices going up.

2/ Unsustainable Debt Levels

The U.S., similar to most other Western countries, is literally suffocating in debt. The U.S. has 29 Trio USD on-balance-liabilities debt (that’s 29 thousand billion or a 29 with 12 zeros). But the off-balance liabilities, those things that are promised to be paid, but not captured in the above-mentioned 20 Trio USD, exceed 120 Trio USD! So put simply, we are talking about 140 Trio USD that the “richest nation on earth” owes to its debtors. How in god’s name will it ever be able to service and extinguish this debt? Especially considering it runs a yearly deficit of 2 Trio USD! This is just insane, and a house of cards.

3/Promises Handed From The Older To The Younger Generation

All this unsustainable debt will not be paid back by the older generation that made all these promises. It will be the younger generation that needs to settle the bill. This again is completely not understood by the younger generation, making the entire worldwide financial system unsustainable.

4/ Negative Real Interest Rates

The sheer concept of having negative interest rates is simply crazy. Would you loan money to me when I’d guarantee to you to give you back less than you gave me? Of course not! But this is what most first-world nations do among each other. Germany loans money to Greece when Greece said we will only give you back 98% of what you loaned us? Sounds great, let’s do it!

5/ Gold Is Completely Under-Owned

The current market cap of all gold miners is approx. 100 bio USD. Apple alone could acquire all gold miners with their pure cash on hand! And about 30 years ago, the long-term mean of gold in investors’ portfolios was 1,5%, meaning that 1,5% of people’s money was in physical gold, paper gold, and gold-related mining companies. Currently, in 2022, we are at one-half of 1% (=0,5%), so all we are looking for is to go back to the long-term mean (=1,5%). The gold price or related investments would need to triple from here.

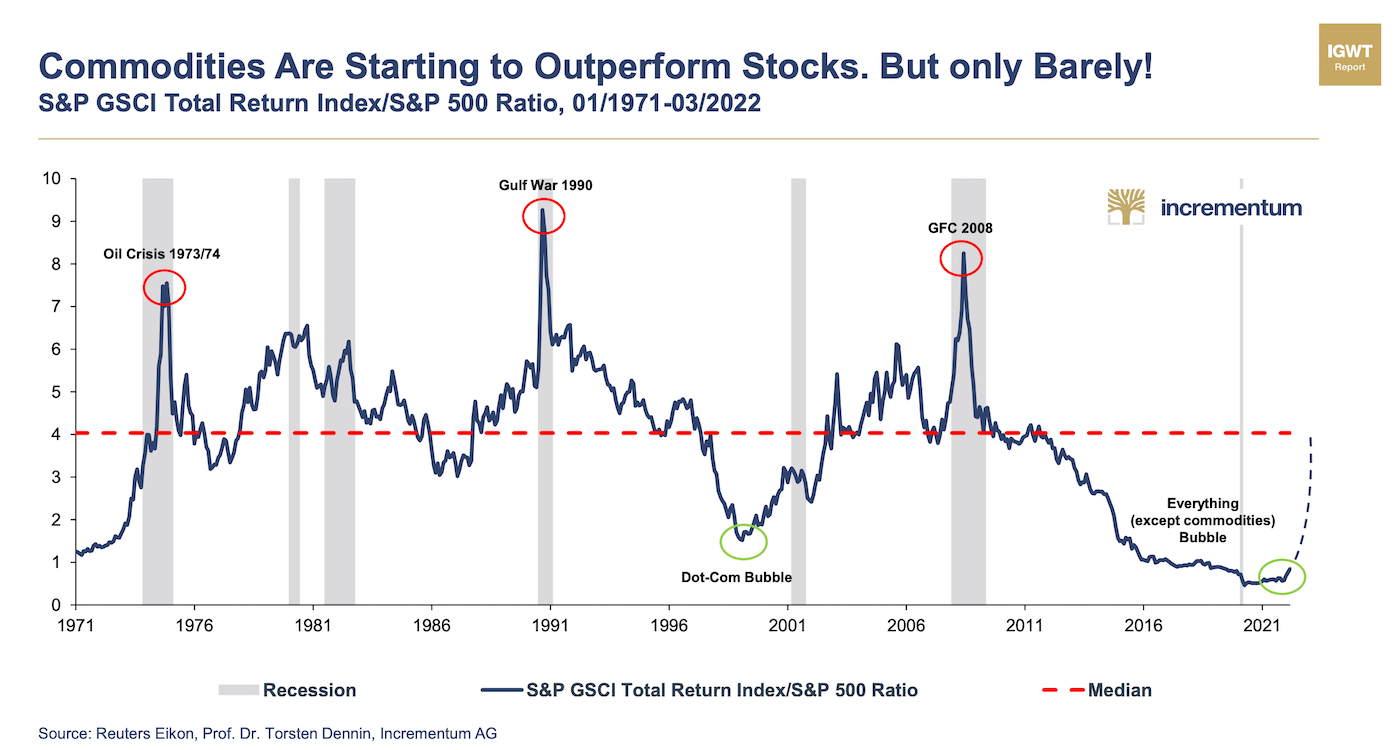

Look at this fantastic chart from Incrementum:

6/ Gold Is An Excellent Performer

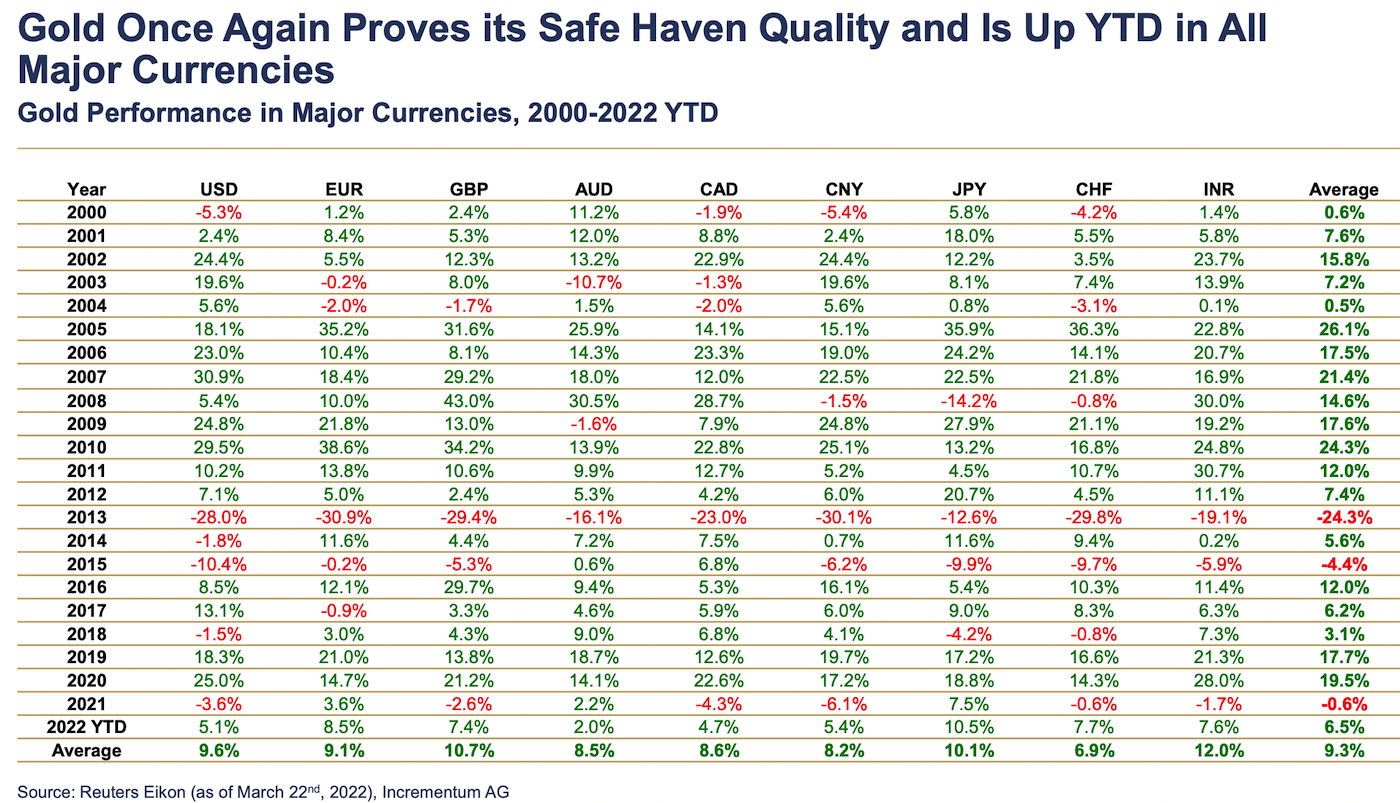

Many people don’t know that, but since 1971, gold on average increased by 7,5% per year, beating the SP500 or Berkshire Hathaway (!). Since 2000, it again performed well, even compared to the most important currencies, as shown on this excellent chart from In Gold We Trust Report:

7/ Gold Is No One Else’s Liability.

Many people sense we are getting closer to a cataclysmic event to reshape the global financial system. The smartest economists like Jim Rickards believe this process started in 2008, and we are actually in the middle of this whole re-set. In such times, it is essential to own something that is no one else’s liability. In this regard, gold is the antithesis of central bank fiat currency regimes – to invest in gold is become a no-brainer!

It is for these reasons that central bankers run in fear of gold and want to disparage gold’s image at every turn and make gold obsolete as a form of savings and investment. Speaking of banks, I suggest keeping your gold far away from banks. You also don’t ask a dog to guard your precious ‘bone’.

Better, do some ‘midnight gardening’, and maybe “sell it” to a John Doe in Antarctica proofing that you don’t have it more should the worst come to worst.

8/ Gold As An Asset Class Is Not Correlated And Is A Great Portfolio Diversifier

The SP500 and Nasdaq are extremely overvalued and need to correct a lot in order to become invisible again. Gold on the other hand is under-owned and under-valued and typically performs well when the broad market does not.

Therefore it’s an idea portfolio diversified that can save your performance in times of distress.

9/ The Gold Market Is Extremely Liquid.

The gold market is an extremely deep and liquid market. Approx. 100 Bio USD are traded every single day. This should represent enough liquidity for you to get out of your position should you so wish! This puts it even ahead of the UK bonds and German bunds!

10/ Gold Has Intrinsic Value And Is Simply Beautiful.

Regardless of what price people put on a bar or ounce of gold, it will always have the intrinsic value of the gold itself, meaning you could always melt it down and the weight of gold would still be valuable (other than antique furniture that can get damaged or digital currencies that can be hacked or replaced by something better/faster/cheaper. besides, gold is also simply beautiful to look at, and some people believe by wearing gold, you also attract more gold to come your way.

Who To Follow?

There are several gold veterans worthwhile following. My favorite one is Rick Rule, former CEO of Sprott. He’s retired since then, but remains very active. Listen to this 10 minute – pure master class, jam-packed with valuable information:

How To Invest In Gold?

Personally, I keep things very simple. I buy physical gold and invest in gold mining companies. I keep some of my gold at home, but most of it is as established bullion dealers in jurisdictions with excellent property rights. Check out my Natural Resource Portfolio on my Thematic Portfolio page and you can see every single position I have (physical and all the mining companies I like and own).

Good Online Shops To Buy & Invest in Gold

I am a long-term customer of Goldbroker.com, and can only recommend them. Fantastic selection, great facilities, and very nice people. From my point of view, it is vital to store wealth in another jurisdiction you live in, with the ultimate goal to preserve wealth! That’s why Goldbroker is great because they operate vault facilities in various international locations such as Zurich, Singapore (Freeport!), New York, and Toronto – one of the best places to start if you like to invest in gold!

I would not recommend buying the largest Gold ETFs like $IAU, because the whole point to buy gold is to exit the financial paper and derivative market, hence buying paper gold defeats the purpose.

If you want to buy an ETF-like product, I would buy the Sprott Physical Gold Trust in Canada. In Germany, if you want to invest in gold, I can recommend Silber-Werte in Hamburg, an excellent gold dealer. They also are always open to chat if you like to invest in gold but don’t know where to start. Buying large gold mining ETFs such as $GLD is okay, but same here, I’d recommend the Sprott Gold Miners ETF ($SGDM).

📘 Read Also

- Another healthcare service provider I like and own is Fresenius

- See which European REITs I think are good buys

- Check out my dream REIT stock in the U.S.

- Like to see my total monthly income 👉 Dividend Calendar

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love