Why I Believe In & Invest In CRISPR Stocks

Understanding and mastering our DNA is not just a scientific endeavor—it’s about securing our future as individuals and species.

Our DNA holds the blueprint for who we are, from our health to our traits and potential. If we don’t take control of this knowledge, we risk letting others do it for us.

To avoid this, we must be the ones to unlock the secrets of our biology, ensuring that this incredible power is used to enhance our lives, not manipulate them.

What is CRISPR?

The field of gene editing has taken a major leap forward with CRISPR, a revolutionary technology that allows scientists to precisely edit DNA.

While the potential applications of CRISPR—from curing genetic diseases and advancing personalized medicine to even revolutionizing non-biologic fields—are staggering, the journey to fully realize these breakthroughs will take time.

CRISPR is not only reshaping healthcare but also opening doors to innovations like smart materials and genetically modified crops, affecting industries far beyond biology.

For investors like me, with a multi-decade perspective, this represents a rare opportunity.

In this post, I’ll share why I believe in CRISPR tech and the three best CRISPR stocks I chose to participate in this believe in this multi-decade investment theme.

What Are CRISPR Use Cases?

1. Healthcare: Gene Therapy for Genetic Diseases

CRISPR has revolutionized gene therapy by enabling precise editing of faulty genes. One major use case is in treating inherited disorders like sickle cell anemia and beta-thalassemia. By directly targeting and correcting the defective genes, CRISPR offers potential cures for conditions that were once considered incurable.

2. Agriculture: Genetically Modified Crops

In agriculture, CRISPR is being used to develop crops that are more resistant to diseases, pests, and harsh climates. For example, gene-edited rice has been engineered to withstand flooding and drought, improving food security in regions most vulnerable to climate change.

3. Environmental Conservation: Reviving Endangered Species

CRISPR is being applied in efforts to help endangered species by correcting genetic issues that lead to population decline. In a project focused on reviving the American chestnut tree, CRISPR is used to introduce resistance to blight, potentially bringing back a species vital to forest ecosystems.

4. Industrial Biotechnology: Biofuel Production

In the energy sector, CRISPR is enhancing the production of biofuels by genetically modifying microorganisms like yeast and algae. This increases their efficiency in converting biomass into fuel, making biofuels a more viable alternative to fossil fuels.

5. Non-Biologic: Smart Materials

Beyond biology, CRISPR is being used to create smart materials like DNA hydrogels. These materials can change shape or dissolve on command, potentially leading to innovations in fields such as targeted drug delivery, tissue engineering, and even robotics.

The Leading CRISPR Companies

There are not that many public CRISPR companies out there yet. Here are the leading ones:

The 3 Best CRISPRS Stocks

After many hours of research, I short-listed four pure CRISPR stocks, and then decided to invest $10,000 in total into the following three companies:

This is what my current CRISPR portfolio looks like (you can also follow it on my Thematics Portfolio page).

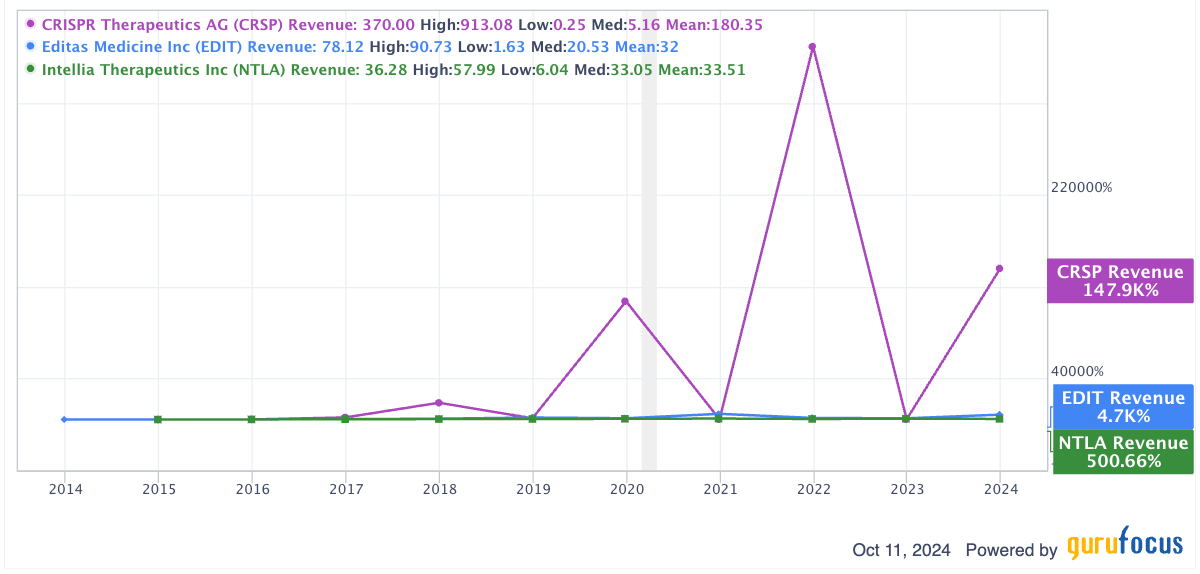

Let’s first look at the revenues over the past three years of the chosen three companies:

CRISPR Therapeutics ($CRSP) has the highest, yet choppy revenues, due to irregular milestone payments from partnerships and the absence of consistent product sales. All of these CRISPR companies are still in the clinical trial phases for many of its therapies, leading to highly fluctuating income.

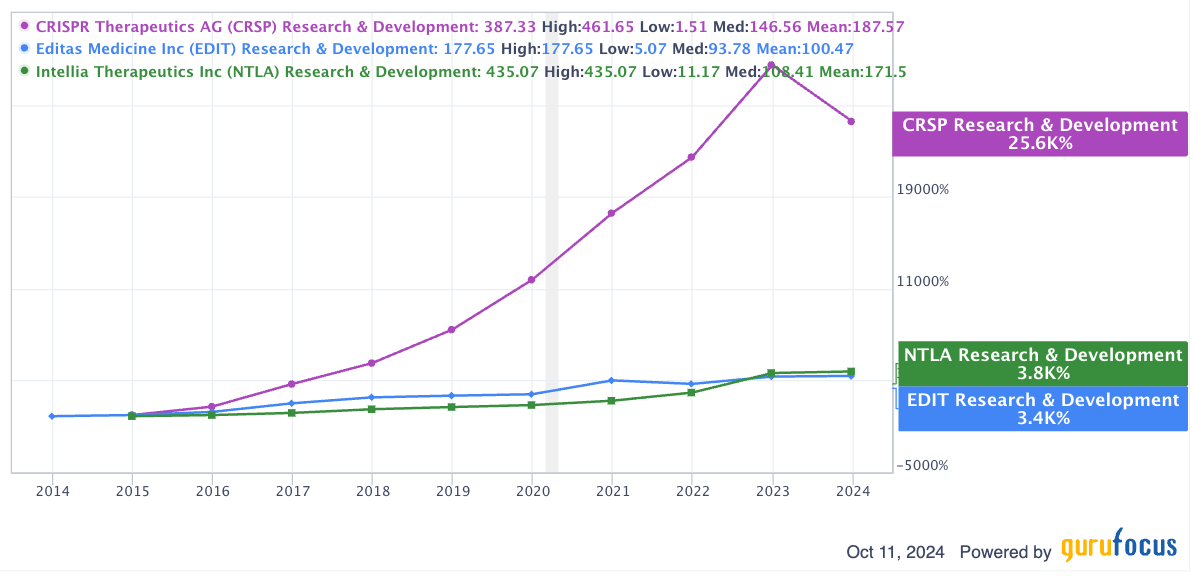

Let’s take a look at how much each of the companies spends on R&D.

In comparison, $CRSP spends the most. If it will lead to a successful ROI needs to be seen, but all three companies spend heavily on research & development.

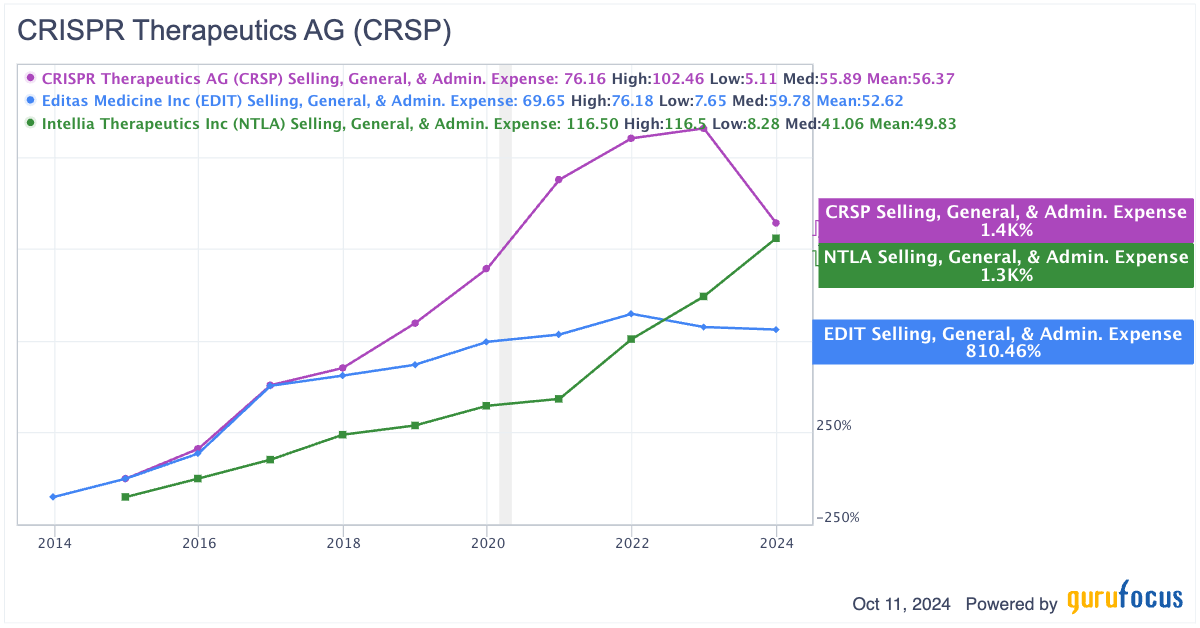

Finally, let’s look at the overall SGA (Selling, General & Admin Expenses).

Looking at the fundamentals of CRISPR stocks does not make much sense, because they don’t have actual products on the market yet.

But I believe now is an opportune time to get positioned, because each of the companies is aiming to become revenue-generating by next year.

- CRISPR: Expected to begin generating revenue from its lead therapeutic, CTX001, possibly in 2025 as it advances its clinical trials and potentially gains FDA approval.

- Intellia: Anticipates revenue from its lead product, NTLA-2001, potentially by 2025 if it achieves successful clinical trial results and regulatory approval.

- Editas Medicine: While Editas has promising gene-editing therapies in the pipeline, it may take until the late 2020s to see substantial revenue from its clinical assets.

(source: ARK Invest)

My Investments So Far

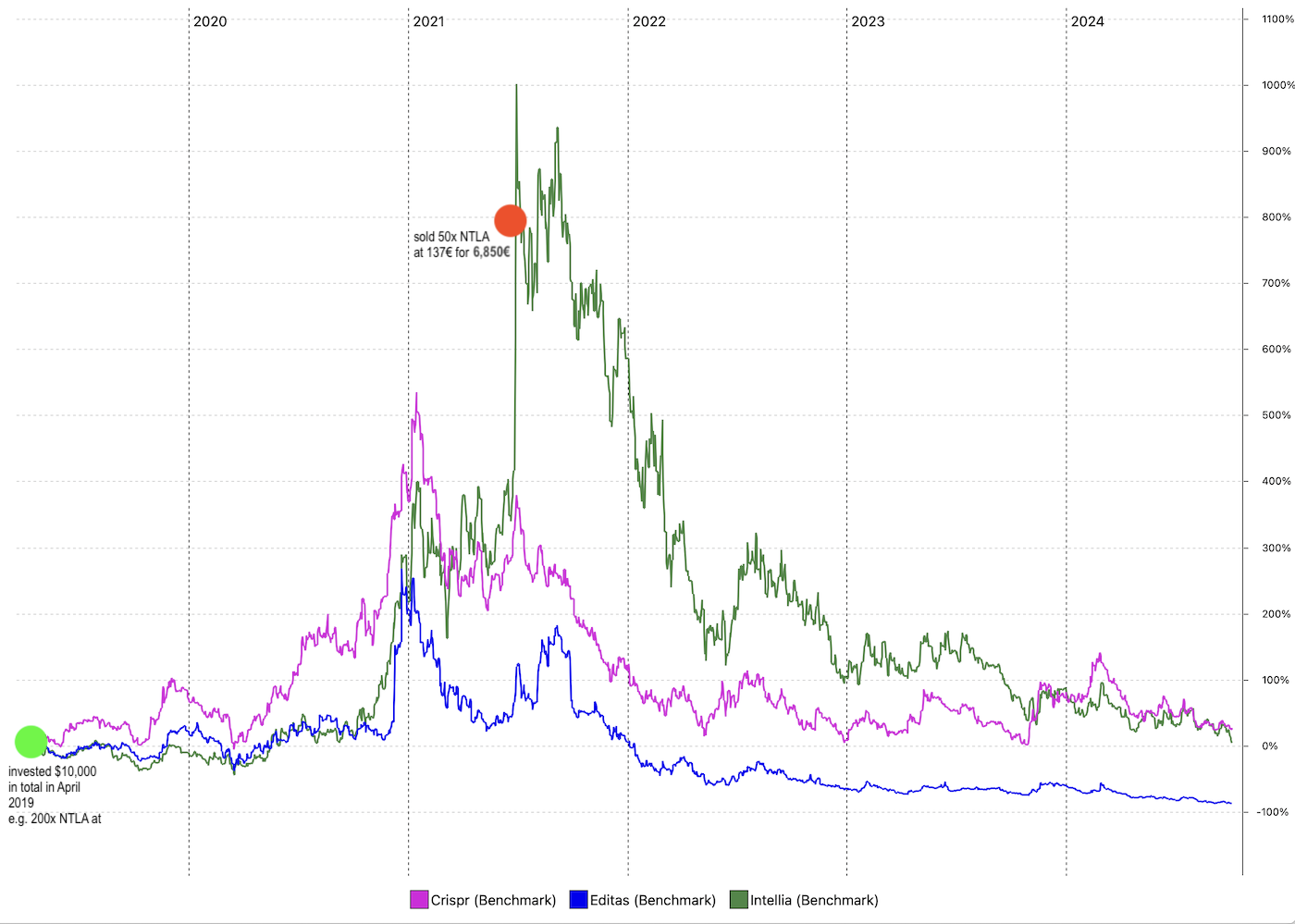

In Apr 2019, I invested a total of $10,000 US in equal amounts into the three mentioned CRISPR stocks.

In mid 2021, I sold a quarter of my $NTLA position after a 8,5X. In other words, I only invested a total of 10k-6,8k= 3,2k, which is now worth $8.2k.

Put differently, if you invest now it’s a better moment than any time in the past 5-6 years before!

Incoming M&A Frenzy?

I believe each of these three companies will sooner or later be acquired by one of the large pharmaceutical companies.

For example, the following Pharma companies already have indirect exposure to CRISPR:

- Amgen (AMGN)

- AstraZeneca (AZN)

- Baxter (BAX)

- Biogen (BIIB)

- DowDuPont (DD)

- Glaxo-Smith Kline (GSK)

- Johnson and Johnson (JNJ) (in my All-Weather Portfolio)

- Monsanto (MON)

- Novartis (NVS)

- Pfizer (PFE) (in my All-Weather Portfolio)

- Regeneron (REGN)

All these companies are involved in biotechnology and genetic research, with CRISPR technology playing a potential role in their future innovations.

Are There Good Genomics ETF?

If investing in single stocks is not your thing, you can take a look at one of the following three ETFs:

-

Kelly CRISPR & Gene Editing Technology ETF (XDNA): This ETF focuses specifically on CRISPR and gene-editing technologies, making it a great choice if you want concentrated exposure. It holds companies that lead the CRISPR and gene-editing revolution, including those developing DNA modification systems and gene-editing tools (Nasdaq).

-

Invesco Nasdaq Biotechnology ETF (IBBQ): While not solely focused on gene-editing, this ETF tracks a broad range of biotechnology companies, including those involved in CRISPR technology. It’s a good option if you’re looking for a wider exposure to the biotech sector (Nasdaq).

-

ARK Genomic Revolution ETF (ARKG): This fund targets innovative genomic companies, including those involved in gene-editing, diagnostics, and gene therapies. It’s an option for those looking for exposure to broader genomic advancements alongside CRISPR (etf.com).

Conclusion

As CRISPR technology continues to evolve, its transformative potential across healthcare, agriculture, and beyond becomes increasingly clear.

For long-term investors like myself, now is an opportune time to get positioned in this revolutionary field.

While the road to profitability may be gradual, the breakthroughs on the horizon could redefine medicine and biotechnology. Patience is essential, but the rewards of supporting these pioneering companies could be substantial as their innovations reshape the future.

I am therefore long $EDIT, $NTLA, and $CRSP.

📘 Read Also

- Business Broker Tips: How I Earned $15,000 in One Day

- How to Invest in Asia – The 5 Best Asian Stocks To Buy

- My Next Big Crypto Bet: Jupiter Exchange

FAQ

What are the best gene-editing stocks?

The best gene-editing stocks are typically those with strong pipelines in CRISPR technology, such as CRISPR Therapeutics, Intellia Therapeutics, and Editas Medicine, which are leading the way in groundbreaking treatments.

Why are CRISPR stocks down?

CRISPR stocks are usually down due to market volatility, regulatory delays, and slow progress in product approvals. Investors are also cautious as gene-editing therapies face high development risks. This space has enormous potential, but investors need to be patience and should not sweat the weekly ups and downs.

Which CRISPR stocks to buy?

Consider buying stocks like CRISPR Therapeutics, Intellia Therapeutics, and Editas Medicine. These companies are at the forefront of gene-editing technology and have promising pipelines. But bring patience and don’t expect anything in weeks, months or even years. Take a longterm investment approach.

How to invest in CRISPR technology?

You can invest in CRISPR technology by purchasing shares in biotech companies that specialize in gene-editing, such as CRISPR Therapeutics, Intellia Therapeutics, or Editas Medicine.

What are the 3 best gene-editing stocks?

The three best gene-editing stocks are CRISPR Therapeutics, Intellia Therapeutics, and Editas Medicine, which are leading the development of gene-editing therapies using CRISPR technology.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love