Key takeaways

✅ Most football clubs are not listed companies

✅ We can find about 12 football stocks in Europe

✅ The smallest clubs surprisingly have the best financial ratios

✅ None of them pay any dividends, and their returns are bad

The 10 Best European Football Stocks

Football, or soccer as it is called in the U.S., is The World’s Game.

Europe alone has hundreds of millions of fans, and dozens of thousands of football clubs.

The vast majority of those clubs are either private companies, organizations, or associations.

But some of the most prominent clubs are actually publicly listed companies, of which any fan or investor can become a co-owner!

As a big football fan and FC Bayern Munich supporter myself, I absolutely loved putting this article together and was surprised by what I found.

Let us first look at the biggest and best European football stocks, and see if we can find anything worthwhile to invest in.

List of All Publicly-Listed Football Stocks In Europe

The below shows all the publicly-listed football stocks in Europe I could find:

Of those 12, some of them, 8 in fact, can easily be bought in the U.S. (over the counter or as a pink sheet), and 4 of them can only be bought if you have access to a European stock broker account such as TradeRepublic.

10 Largest Football Stocks In Europe

| Football Club | Sales in Mio | M.Cap in Mio | PS | |

| 1 | Manchester United | $719 | $3,117 | 4.3 |

| 2 | Juventus Turin | $484 | $749 | 1.3 |

| 3 | Borussia Dortmund | $415 | $441 | 1.0 |

| 4 | A.S. Rome | $200 | $286 | 0.0 |

| 5 | Ajax Amsterdam | $197 | $196 | 1.0 |

| 6 | Olympique Lyon | $187 | $180 | 0.7 |

| 7 | FC Porto | $162 | $27 | 0.2 |

| 8 | Lazio Rome | $160 | $68 | 0.5 |

| 9 | Celtic Glasgow | $148 | $150 | 1.0 |

| 10 | Benfica Lisboa | $77 | $79 | 1.1 |

| 11 | Sporting Lisboa | $37 | $140 | 1.7 |

| 12 | Galatasaray Istanbul | $35 | $319 | 8.2 |

This gives us a good frame of reference. The largest football or soccer club by market cap in Europe is Manchester United.

It generates sales of $719 Mio per year. The smallest on the list is Turkish Galatasaray Istanbul.

The Most Profitable European Football Clubs

The following numbers blew me away, I had no idea:

| Football Club | Sales in Mio | Net Income in Mio | Net Margin % |

| Celtic Glasgow | $148 | $41 | 27.8% |

| Ajax Amsterdam | $197 | $52 | 26.4% |

| FC Porto | $162 | $21 | 13.8% |

| A.S. Rome | $200 | -$262 | 0.00% |

| Sporting Lisboa | $77 | -$3 | -4.5% |

| Borussia Dortmund | $415 | -$25 | -5.3% |

| Manchester United | $719 | -$116 | -16.1% |

| Lazio Rome | $160 | -$31 | -19.8% |

| Olympique Lyon | $187 | -$92 | -49.3% |

| Juventus Turin | $484 | -$278 | -57.4% |

Simply put, the smallest of the 10 largest European soccer clubs are profitable, and the largest ones all lose money with negative net margins.

Only three clubs of the top 10 turn a profit, the others lose money.

Yearly Revenues Of Large European Football Clubs

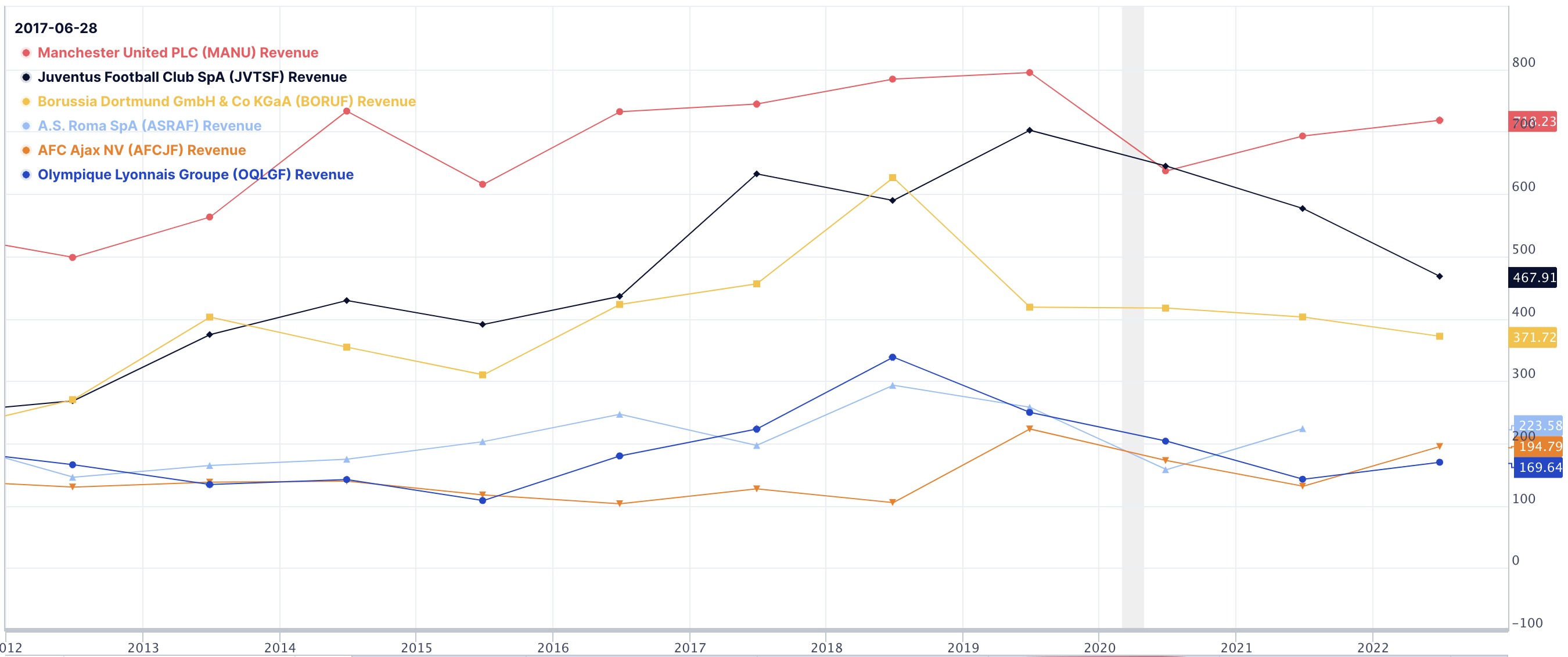

If we look at the generated revenues of the six largest clubs, we see the following:

We need to note that none of the shown football clubs won the European Champions League in the past 12 years (Manu won in 2009).

I guess that is one of the reasons why no major jumps in sales can be recorded.

Recent Winners Of the European Champions League

2013 🇩🇪 Bayern Munich

2014 🇪🇸 Real Madrid

2015 🇪🇸 Barcelona

2016 🇪🇸 Real Madrid

2017 🇪🇸 Real Madrid

2018 🇪🇸 Real Madrid

2019 🏴 Liverpool

2020 🇩🇪 Bayern Munich

2021 🏴 Chelsea

2022 🇪🇸 Real Madrid

2023 🏴 Manchester City

Unfortunately, none of the above champions are publicly listed soccer stocks.

Return To Shareholders Of European Football Clubs

In my opinion, one of the most important ratios to look at, is the return of assets, or ROA, meaning what return a club generates with the assets it owns.

And this looks pretty dismal. Only 3 out of the top 10 clubs manage to have a positive ROA. When looking at the return on invested capital, the ROIC, only 1 club has a positive ratio. This is really a poor mark, across the whole board.

| Football Club | ROE % | ⬇️ ROA % | ROIC % |

| Celtic Glasgow | 35 | 17 | 15 |

| Ajax Amsterdam | 21 | 9 | -10 |

| FC Porto | 0 | 6 | -10 |

| A.S. Rome | 0 | 0 | 0 |

| Sporting Lisboa | -3 | -1 | -2 |

| Borussia Dortmund | -7 | -4 | -3 |

| Manchester United | -72 | -7 | -4 |

| Lazio Rome | 0 | -11 | -12 |

| Olympique Lyon | -97 | -14 | -20 |

| Juventus Turin | -125 | -27 | -29 |

Valuations Of Top European Football Stocks

So far I don’t like at all what I am seeing. Poor returns across the board! Let’s look at the current valuations and dividends the top European football stocks are delivering:

| European Football Stock | PE | PB | Dividend |

| Celtic Glasgow | 5 | 1.1 | 0 |

| Olympique Lyon | At Loss | 1.7 | 0 |

| FC Porto | 1 | 0.0 | 0 |

| Sporting Lisboa | 19 | 0.7 | 0 |

| Lazio Rome | At Loss | 0.0 | 0 |

| Borussia Dortmund | At Loss | 1.3 | 0 |

| A.S. Roma | At Loss | 0.0 | 0 |

| Ajax Amsterdam | 4 | 0.7 | 0 |

| Juventus Turin | At Loss | 6.0 | 0 |

| Manchester United | At Loss | 24.8 | 0 |

FC Porto is an eye-catcher:

👉 PE of 1

👉 market cap of 25 Mio Euro (ridiculously low)

👉 net profit in 2021: 20 Mio

👉 But, it also has 530 Mio in liabilities

🤦🏻♂️ Hmm, thank you, but no!

How To Invest In Publicly Listed Football Clubs

Investing in publicly listed football clubs is simple. Here’s how:

- Open a free brokerage account on a stock trading platform like TradeRepublic.

- Deposit funds into your account.

- Search for available stocks, like ‘MANU’ for Manchester United.

- Purchase your desired number of shares.

- Monitor your investment’s performance and decide whether to sell or hold onto the shares.

I just checked myself: All top soccer stocks can be purchased on TradeRepublic.

Remember, the risks and rewards are your responsibility.

Key Risks When Investing In Soccer Stocks

Listing just some of the major risks you need to consider when investing in football stocks:

- thousands of variables can make or break the success of a soccer club

- unforeseeable injuries of key players can have a massive impact on share price

- risk of competing clubs luring away some key players

- majority shareholders most of the time still have significant control over listed soccer clubs

- the pressure is immense – players can experience psychological breakdowns or burn-outs

- fans might behave inappropriately (racial slurs, hooligan violence, ..) might cast a bad light on the club

So, Are Football Stocks A Good Investment?

Well, for die-hard fans, I see football stocks are more of a way to show support than a lucrative investment.

The competition on the international club level is immense.

This makes the predicting of soccer matches, and therefore the long-term performance of football stocks, a game of chance. Any injury to key players can have devastating impacts on your football stock.

I will stay far far away from any investment in European soccer stocks and instead just enjoy the matches!

📘 Read Also

- How A Millionaire Invests $20 Mio After A Property Sale

- The 5 Best Dividend-Paying Entertainment Stocks

- Can Europe Become A Dream Destination For Remote Workers?

- Get new investment ideas on my updated 🏆 Stock Picks page

FAQ

Can you buy stock in a football team?

Of the thousands of football teams in Europe, only about 12 are public companies! By buying shares of the club, it’s like owning a piece of the action without having to lace up your boots. But are investments in football stocks a solid bet? I don’t think so.

How to buy stock in a football team?

1/ Open an account with a stock broker like TradeRepublic.

2/ Deposit some funds.

3/ Search for your team’s stocks.

4/ Buy as many shares as you desire.

5/ Pray for your team to do well.

Not financial advice – please read the risks when investing in football stocks!

What football clubs have stocks?

Not many! About 12 football clubs in Europe are publicly listed companies. From the formerly mighty Manchester United to the legendary Juventus, there are however some reputable listed football clubs to choose from. Take your pick!

What are the best soccers stocks?

Ah, the million-dollar question. Do your research and take your shots! None of the listed football clubs won the European Champions League in the past 15 years. Most major listed soccer clubs are not profitable and pay no dividends. Caution is advised!

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love