Crypto Gains of 2M USD – What Should I Do?

The recent bull run in the digital asset space has left me sitting on crypto gains of over $2 million, and I’m debating what my next steps should be.

Below, I’ll walk you through the details of my portfolio, why I believe it’s “dangerous” when feeling like a genius, the lessons I’ve learned from past bull markets, and why securing some profits now might be a counter-cyclical wise move.

My Crypto Portfolio Breakdown

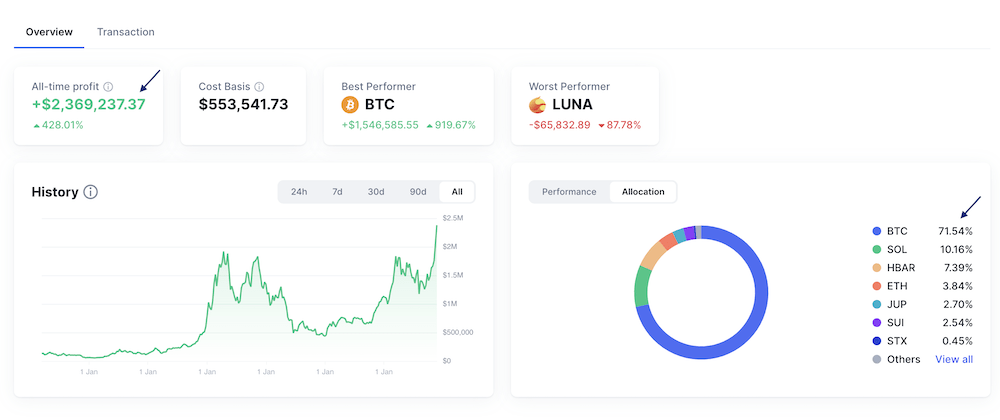

My crypto holdings have grown to $2.8 million, representing 35% of my total net worth. However, if I exclude illiquid assets like real estate and company shares, crypto accounts for a staggering 40% of my current assets.

Keep good track of your entire portfolio with Coinmarketcap.com!

Here’s a quick recap:

- Invested a total of $481k into my Digital Asset Portfolio (most of it during 2019-2022)

- During the 2021 bull market, my portfolio peaked at $1.8M

- By 2022, it dropped to $300K—a sharp reminder of how inhumanly volatile this market can be

- I vowed then that if my portfolio ever returned to $1.8M, I’d cash out $1M to secure profits and rebalance my portfolio.

Now, with my portfolio sitting at $2.8M (at the time of writing this post), I find myself tempted to hold on, convinced that “the bull market is just getting started.”

The Emotional Trap of Crypto Gains

I’ve noticed something: Because of my gains, I feel like a “genius” at this very moment.

Historically, these moments of overconfidence typically coincide with peak opportunities to sell.

In hindsight, selling during euphoric highs has proven to be a wise move. Yet, I’m battling the FOMO (fear of missing out) that tells me to keep holding.

Learnings From ‘Via Negativa’

In my previous post on the Via Negativa concept, I discussed how avoiding losses can be more important than chasing gains. With my current crypto gains, I feel like I’ve pretty much “won this round”, and my goal now is not to lose what I’ve gained.

Taking a lesson from this mindset, I’ve started acting cautiously. See further below for what I did.

Why Securing Profits Matters

The temptation to let my portfolio ride is strong, especially when optimism about the market is so high. However, history has shown me that euphoria can quickly turn into regret. By taking profits strategically, I reduce the risk of losing what I’ve gained while positioning myself for steady, long-term growth.

That’s why this week, I sold some first positions:

- 61 SOL at $259 for $16,000

- 3,345 SUI at $3.55 for $12,000

- 80,000 HBAR at $0.15 for $12,000

- 3.5 ETH at $3,400 each, securing $12,000

- Total: $52,000 USD

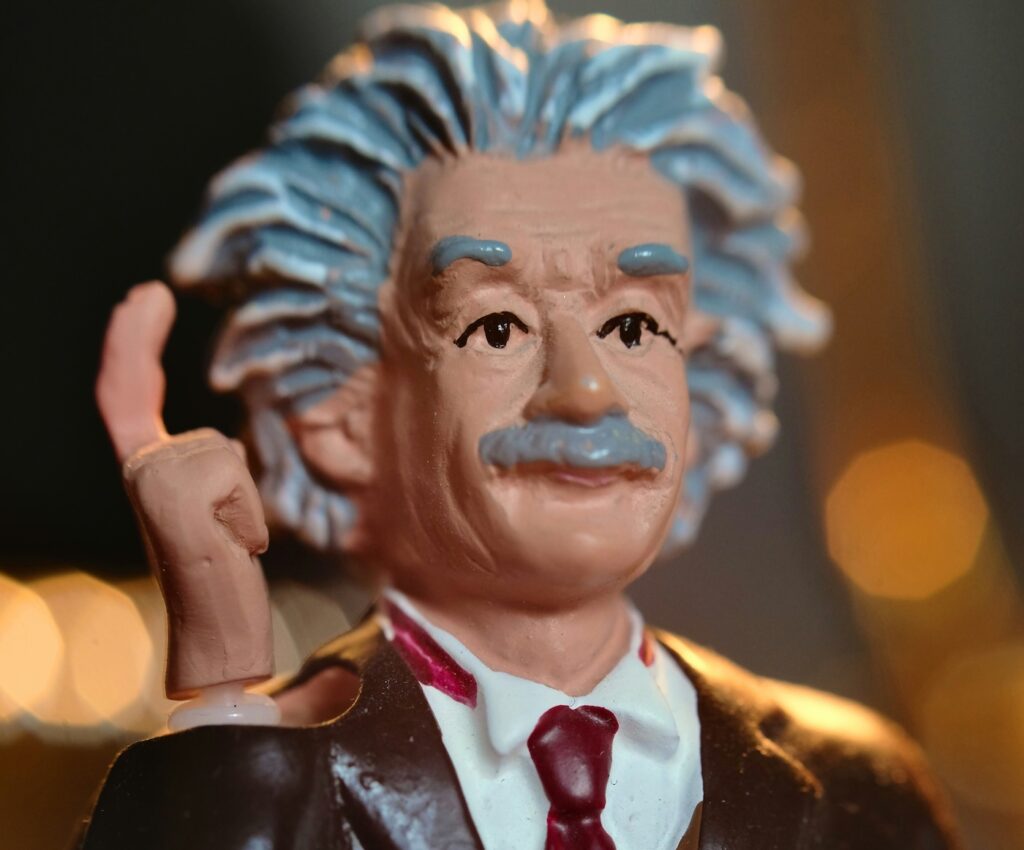

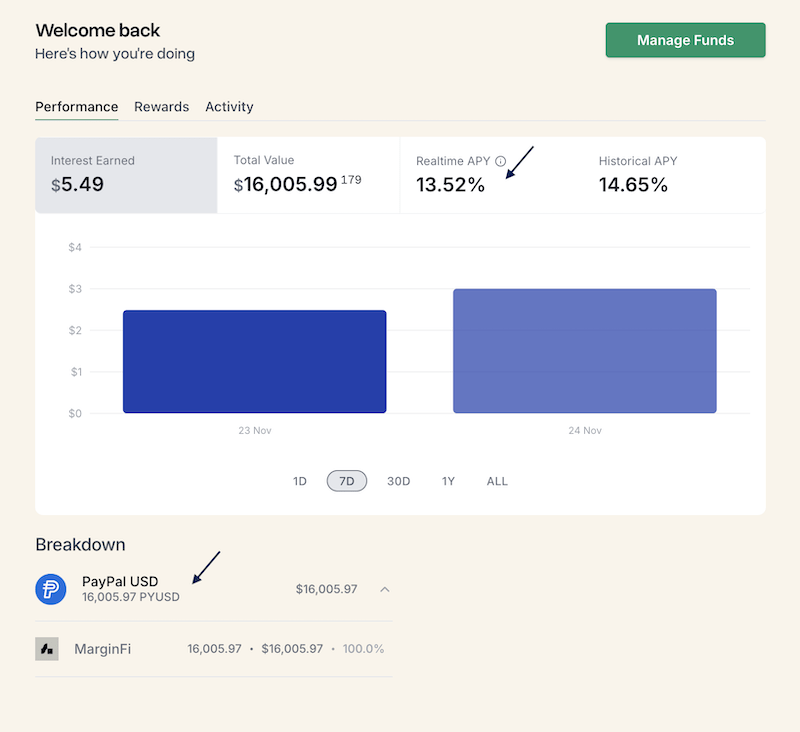

In total, I sold $52,000 of which I will invest $6,000 in my All-Weather Portfolio, and with $46,000 USD I just started farming stablecoins on various chains.

My Plan – Turning Crypto Gains Into A Stablecoin Farm

When it comes to deploying my money, I’m a relentless, drill-sergeant-style boss who accepts nothing less than peak performance. Every dollar under my command has a mission, and there’s no room for laziness or excuses.

The moment I got the $46k, I put it to work. Below, I break down the protocols that now have the job to deliver good returns on my stablecoins.

Some are liquidity pools, some a yield aggregator or lending positions. Combined I refer to them as my stablecoin farm:

The above table shows I am using four different blockchains and four different Dapps.

Let’s take a quick look at what I am earning on each platform.

On Solana, I am using the yield-managing Dapp Lulo, making finding the best yield opportunities easy. I love such apps that work hard (and smart) for you 24/7 after you make a simple, single deposit. You put in $16k, and Lulo does the rest. 💚 Luving it!

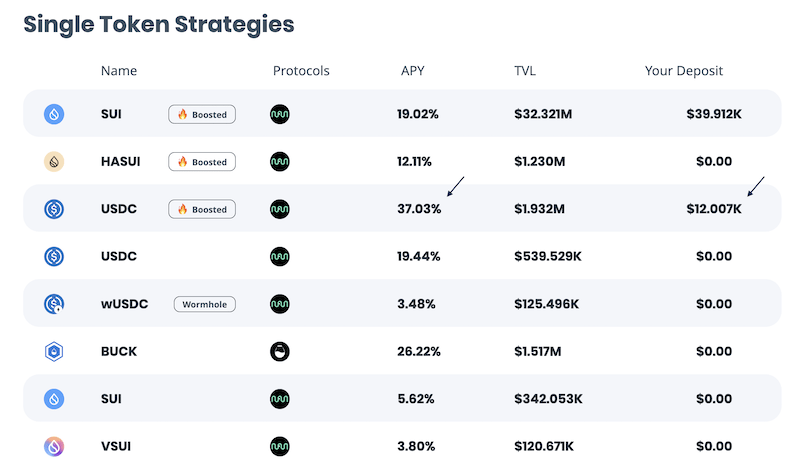

On SUI, I am using a yield aggregator called AlphaFi.xyz to earn 37% on USDC. This platform automates several steps, in short, it

- supplies the USDC into the Navi lending market.

- earned rewards & interest are collected & auto-compounded daily

- users also earn additional ALPHA rewards

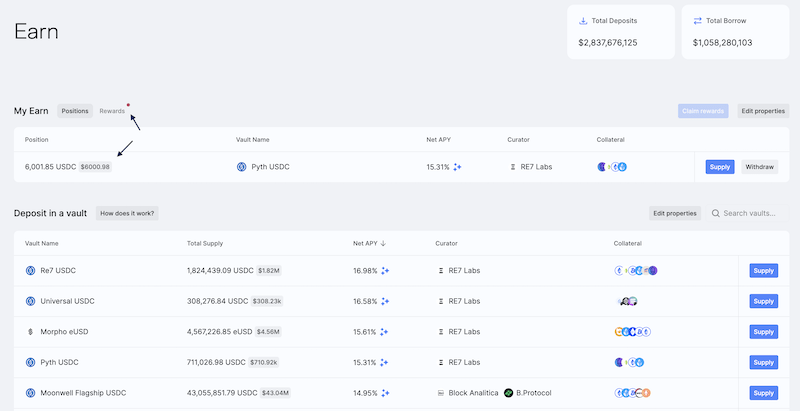

On Base, I am earning about 15% on USDC on Morpho – a lending protocol I really like. I further incentivize users to deposit their coins by rewarding them with MORPHO tokens.

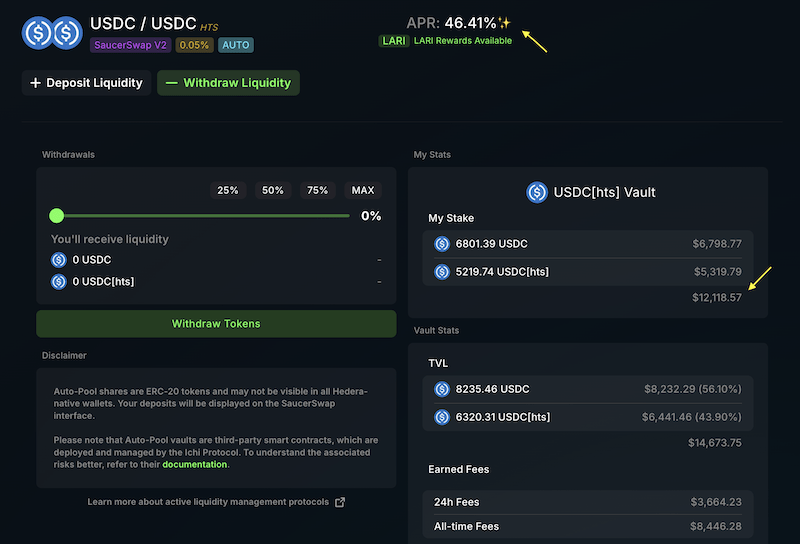

On Hedera, I am using the largest DEX called SaucerSwap to currently earn a whopping 46% on the USDC/USDC-HTS trading paid (bridged USDC from Eth).

I will let each protocol do its thing and take a record at the end of each month.

I’ll then off-ramp some of the earned interest into fiat via my favorite exchange Nexo.

Conclusion

Crypto gains can be thrilling, but managing them wisely is crucial. For me, the focus is now on securing a portion of these profits and ensuring I don’t let market exuberance cloud my judgment.

Have you found yourself in a similar position? Share your thoughts below—I’d love to hear how you approach managing your crypto gains!

Question To You 🫵

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love