Buy Defense Stocks In These Uncertain Times?

We are living through an uncertain and fragile time. There are not just one, but several, hot kinetic wars, and many more are boiling below the surface.

Russia vs. Ukraine. Israel vs. Hamas. These are hot wars.

Then there are geopolitical hotbeds like Armenia vs. Azerbaijan and inner-political conflicts in Sudan and Niger.

No one wants wars, but most likely you’d agree that the chance of not having any in the coming decades is slim.

That’s why today I like to look at the best defense stocks and see if they are suitable additions to my All-Weather Portfolio.

I’ll also explore whether it is morally okay to invest in shares of aerospace and defense contractors

Overview of Types of Aerospace & Defense Contractors

- Major Defense Contractors e.g., Lockheed Martin, Raytheon

- Weapon Manufacturers e.g., Northrop Grumman, General Dynamics, BAE Systems

- Electronics Defense Companies e.g., Harris Corporation, L3Harris Technologies, Thales Group

- Military Services Providers e.g., Booz Allen Hamilton, ICF International, SAIC

- Aerospace Manufacturers e.g. Boeing, and Airbus, also have defense divisions

The World’s Largest Aerospace & Defense Companies

| Sales in Mio $ | M.Cap in Mio $ | PS | |

| 🇺🇸 RTX (former Raytheon) (RTX) | $70,573 | $107,548 | 1.5 |

| 🇺🇸 Lockheed Martin (LMT) | $67,393 | $111,090 | 1.7 |

| 🇩🇪 Thyssen Krupp (TKAMY) | $41,235 | $4,488 | 0.1 |

| 🇺🇸 General Dynamics (GD) | $40,859 | $65,877 | 1.6 |

| 🇺🇸 Northrop Grumman (NOC) | $37,881 | $73,986 | 2.0 |

| 🇺🇸 L3Harris (LHX) | $17,988 | $33,722 | 1.9 |

| 🇫🇷 Dassault Systemes (DASTY) | $6,036 | $49,261 | 8.2 |

| 🇩🇪 Rheinmetall (RNMBY) | $3,082 | $12,262 | 4.1 |

$RTX, formerly known as Raytheon, is the defense contractor with the highest revenues: $70 Bio US.

The most valuable defense company is $LMT Lockheed Martin, with a market cap of $111 Bio US.

Check out the price-to-sales ratios of these defense stocks. Germany-based $TKAMY Thyssen Krupp, the third largest in terms of sales, has a PS ratio of 0.1!

Valuation Of The Largest Defense Stocks

| PE | PB | Yield | Debt-to-Rev | ROIC % | |

| 🇺🇸 Lockheed Martin (LMT) | 16 | 12.0 | 2.8% | 0.26 | 16.3% |

| 🇺🇸 General Dynamics (GD) | 20 | 3.4 | 2.1% | 0.28 | 7.8% |

| 🇺🇸 Northrop Grumman (NOC) | 16 | 4.8 | 1.5% | 0.41 | 7.8% |

| 🇫🇷 Dassault Systemes (DASTY) | 53 | 6.3 | 0.6% | 0.52 | 7.4% |

| 🇺🇸 L3Harris (LHX) | 43 | 1.8 | 2.5% | 0.53 | 5.1% |

| 🇺🇸 RTX (former Raytheon) (RTX) | 20 | 1.5 | 3.1% | 0.52 | 3.8% |

| 🇩🇪 Rheinmetall (RNMBY) | 104 | 4.1 | 1.6% | 0.00 | 2.2% |

| 🇩🇪 Thyssen Krupp (TKAMY) | 15 | 0.3 | 2.2% | 0.08 | 0.9% |

Ratios are all over the place!

- PEs range from 15 to 104

- Price-to-book ratios range from 0.3 (!!) to 12 (huh?)

- Dividend yields are sort of in a similar range from 0.6% to 3.1%

- Highest debt-to-revenue is 0.52

- Return on invested capital ranges widely, from poor 0.9% to excellent 16.3%

The ROIC is one of the financial ratios I look at the most when comparing companies within one industry. Read this excellent article on Investopedia.

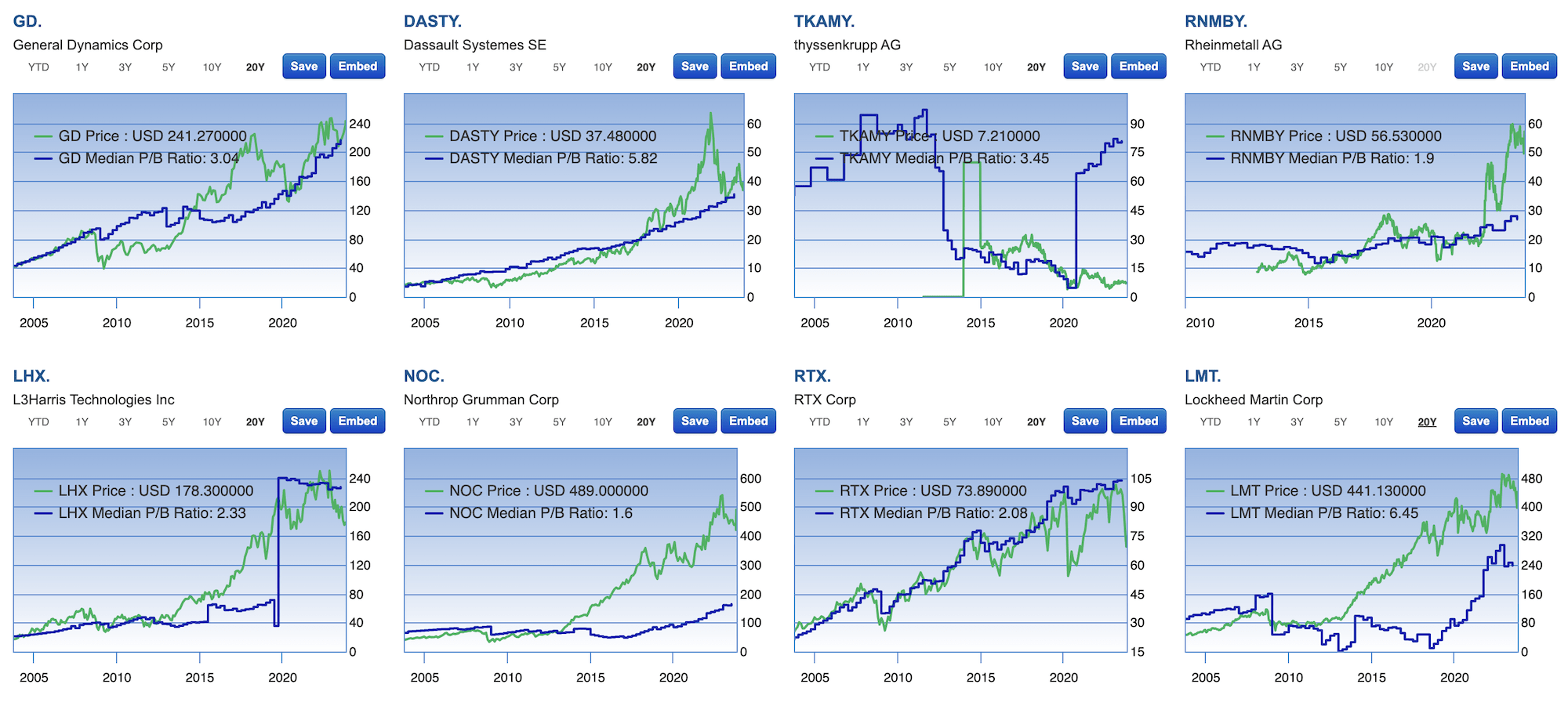

Let’s head over to Gurufocus and see what the median price-to-book ratios look like of these defense stocks.

Median PB Ratios Of Top Defense Stocks

Put simply, you want the blue line (the median PB ratio) above the green line. This indicates that the current market cap per share is higher than the book value per share.

It indicates whether a stock is overvalued or undervalued relative to its balance sheet.

From a quick glance, $TKAMY and $RTX jump out.

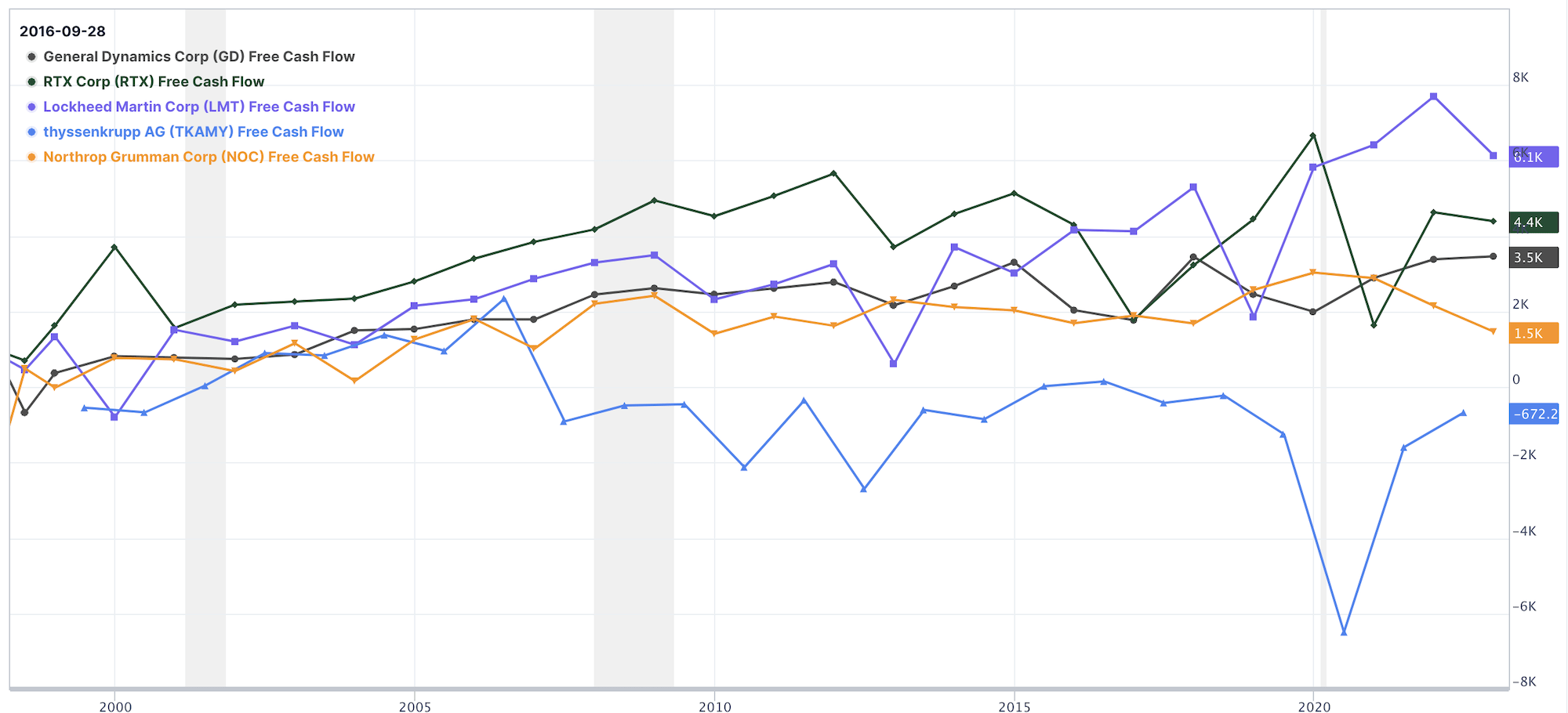

Free Cash Flow Of Best Defense Stocks

Using Gurufocus’ neat interactive chart function, let’s check out what the free cash flow of the best defense stocks looks like:

In the past 13 years, Thyssen Krupp was not able to have one year with a positive free cash flow.

As a long-term shareholder, I like to see money returned to me in the form of dividends, and that is only possible if there is money left at the end of the year.

That’s why I would not consider this particular defense stock for my portfolio.

On the other side, $LMT and $RTX have stable and solid free cash flows!

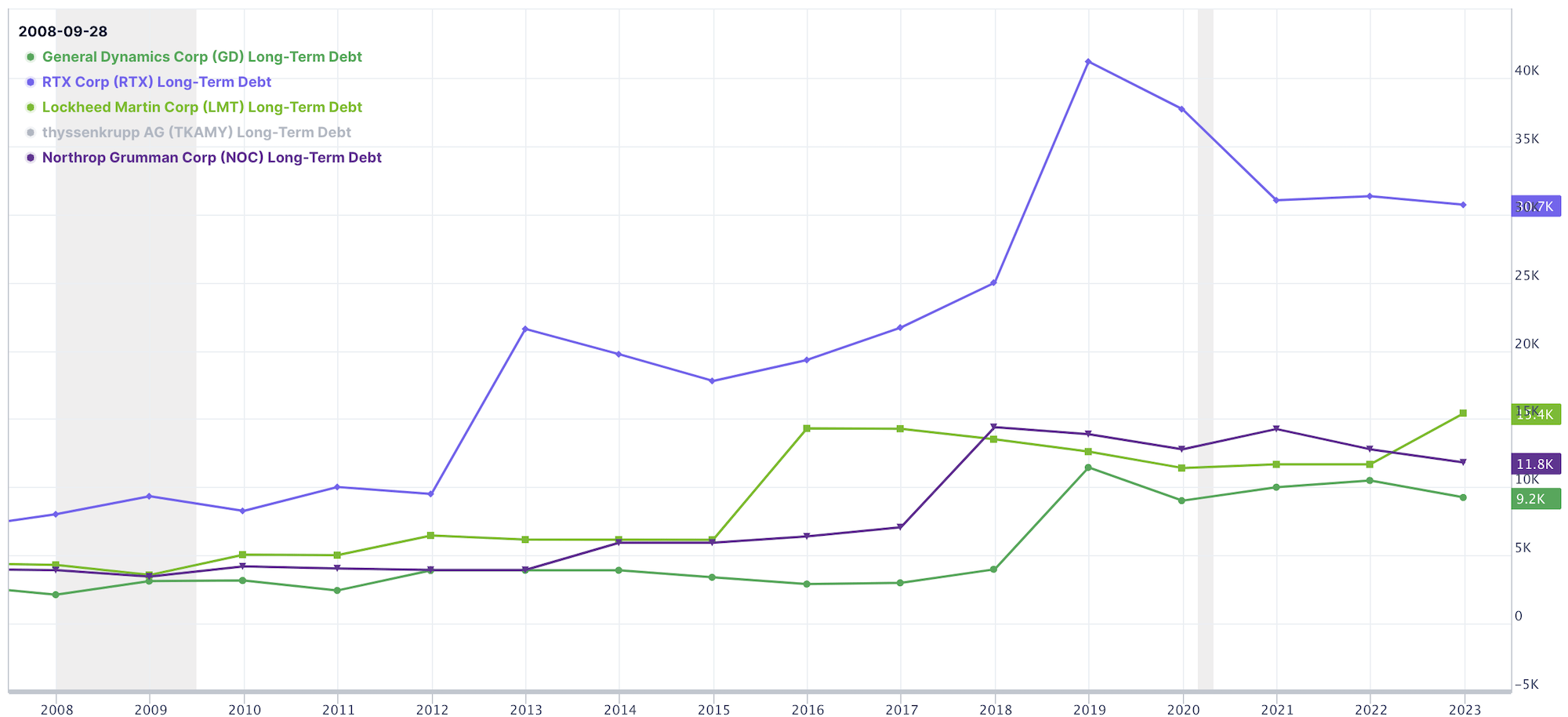

Longterm Debt Of Largest Defense Contractors

We find something interesting when looking into the long-term debt of the largest defense contractors.

$RTX has a whopping $30 Bio US in debt. More than twice than the next largest defense stock: $LMT.

Regardless of the actual interest rates they most likely locked in for years to come, this is a sort of debt level I don’t feel comfortable with.

Therefore, I pass on $RTX.

My Favorite Defense Stocks

This leaves us with three defense stocks we can look at further:

- Lockheed Martin

- General Dynamics

- Northrop Grumman

Lockheed Martin

- P/E: 16

- P/B: 11.9

- Market Cap: $ 111B

- Enterprise V: $ 124B

$LMT Lockheed Martin is a leading global aerospace and defense company known for its advanced technology solutions and innovation in areas such as aircraft manufacturing, missile defense systems, and space technology.

Due to the high price-to-book ratio of $LMT, I will pass on this one as well.

A PB of 12 is simply too high.

General Dynamics

- P/E: 19

- P/B: 3.3

- Market Cap: $ 65B

- Enterprise V: $ 76B

$GD General Dynamics is a prominent defense contractor specializing in designing and manufacturing a range of products including military vehicles, submarines, combat systems, and communication systems, known for its commitment to providing cutting-edge defense solutions.

Northrop Grumman

- P/E: 16

- P/B: 4.7

- Market Cap: $ 73B

- Enterprise V: $ 86B

$NOC Northrop Grumman is a renowned global aerospace and defense technology company recognized for its expertise in areas such as aerospace systems, autonomous systems, cyber solutions, and advanced electronics, playing a significant role in shaping the future of defense technology.

Will I Personally Invest In Defense Stocks?

No, I won’t.

I want to invest in companies creating products that have a positive impact on society, and not help destroy parts of it. That also includes companies producing strong spirits or tobacco.

In times like these, we all need to pause and question the ethics of our investments. For my conscience, this means I will stay away from companies that deal in the machinery of death and destruction.

I want to embrace investments that nurture peace, that uplift humanity, and forge a future of prosperity.

By choosing not to financially support defense contractors, I believe I contribute towards a world that prioritizes peace and non-violence instead.

📘 Read Also

- The 8 Top Industrial Conglomerate Dividend Stocks

- Unveiling My Uranium Miners Portfolio | My Top 8 Positions

- How To Start With Investing

FAQ

Are defense stocks a good buy?

Yes, in general, defense stocks can be a good buy depending on various factors. The defense industry tends to have stable demand, driven by government contracts and ongoing security needs. This stability can provide consistent revenue streams for companies in the sector. Considerable defense stocks to consider are Lockheed Martin (LMT) and General Dynamics (GD), both prominent players in the industry with a history of strong performance and a diverse portfolio of defense products and services.

Are defense stocks recession proof?

While defense stocks can demonstrate resilience during economic downturns, it is important to note that they are not entirely recession-proof. During recessions, governments may experience budget constraints and prioritize spending cuts, which could impact defense budgets and contracts. However, defense stocks tend to have more stability compared to other industries.

Companies with strong fundamentals, diversified portfolios, and long-term government contracts can endure economic uncertainties better.

Examples of such defense stocks include

– Lockheed Martin (LMT) and

– Northrop Grumman (NOC).

Ultimately, the performance of defense stocks during recessions can vary, and conducting thorough research is vital before making investment decisions.

What defense stocks to buy?

The best defense stocks in the U.S. are:

🇺🇸 Lockheed Martin (LMT)

🇺🇸 General Dynamics (GD)

🇺🇸 Northrop Grumman (NOC)

🇺🇸 L3Harris (LHX)

🇺🇸 Raytheon Technologies (RTX).

Additionally, international defense stock top picks include:

🇫🇷 Dassault Systemes (DASTY) from France

🇩🇪 Rheinmetall (RNMBY) from Germany

🇩🇪 Thyssen Krupp (TKAMY)

These companies possess substantial expertise, and diverse product portfolios, and have established themselves as key players in the defense industry.

When to buy defensive stocks?

Consider investing in defensive stocks when:

– Economic uncertainties arise

– Geopolitical tensions increase

– New weapon breakthroughs are achieved (hypersonic weapons, lasers, rail guns, space force, etc.)

Determining the right time to buy defensive stocks can be challenging, but some indicators may help inform your decision.

Which defense stock is best?

Which defense stocks with dividends to buy?

Most U.S. defense stocks pay dividends, but the best defense stocks with dividends are

– $GD General Dynamics with a dividend yield of 2.1%

– $NOC with a dividend yield of 1.3%

– $LMT with a dividend yield of 2.7%

Investors should not simply look at the dividend. $LMT for example has a price-to-book ratio of 12, which is way too high for me to consider adding it to my long-term dividend portfolio.

How do defense stocks perform during war?

The performance of defense stocks during times of war can be influenced by various factors. While it is common to assume that defense stocks would thrive during warfare, the actual performance can vary. Usually, defense stocks perform well in times leading up to wars. It is as if someone would already know in advance that a conflict is about to erupt. Hmm.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love