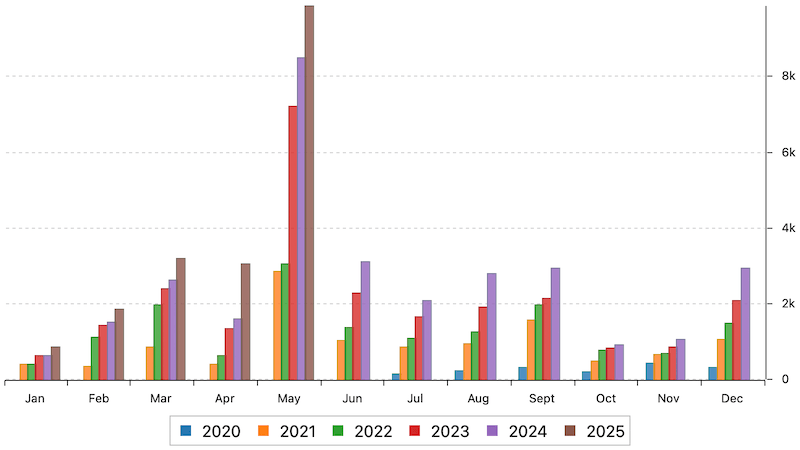

Best Dividend Month So Far | 2025-05 | Got 9k + Invested 60k

May 2025 turned out to be my best dividend month yet, just like in previous years. I collected a total of $9,877, which is up $1,377 from last year’s $8,500.

That steady climb feels like a pat on the back after years of building this portfolio.

Below is a breakdown of the dividends that made my best dividend month.

All Divvies Received In May – My Best Dividend Month

As in past years, most of the increase comes from growing my position sizes rather than the companies hiking their dividends.

Either way, in my fifth year of dividend investing, I’m seeing what most long-term investors experience: a slow, steady improvement compared to the previous year.

It’s pretty exciting to watch those numbers creep up—proof that consistency pays off.

I’m especially happy about Ecopetrol (Wikipedia), one of the newest additions to my All-Weather Portfolio, and in my opinion, one of the two best Latin American energy stocks to buy.

It’s been a solid dividend payer, and I’m glad I took the leap.

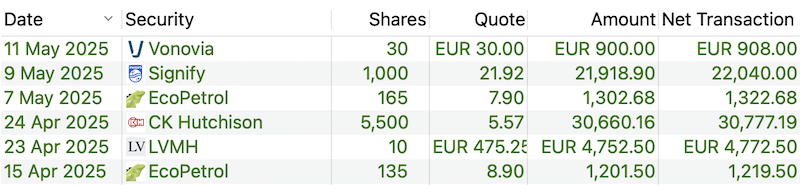

Recent Dividend Stock Purchases

Since my last post, I’ve continued rebalancing my Digital Asset Portfolio, investing a total of approx. $60,000 in my dividend portfolio.

Basically, I made two big purchases this time:

Dividend Stock #1: CK Hutchison

As I mentioned in my previous post, I think CK Hutchison (GuruFocus profile) is an exceptional global conglomerate.

It’s got an attractive valuation, a high dividend, and a solid margin of safety at current levels. I’m happy to be back in this position—I believe this will be good for the long haul.

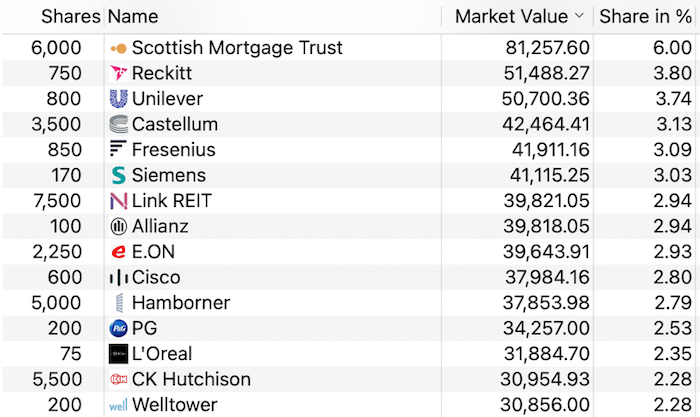

I am convinced of the investment rationale here. That’s why I made CKH one of my 15 largest holdings:

Dividend Stock #2: Signify

The other stock I picked up is Signify (GuruFocus profile), the world’s largest lamp and lighting solutions company. It’s the rebranded lighting division of the Dutch industrial giant Philips, and I’ve got a bit of a personal connection here.

Back in the day, my marketing service company was a supplier for Philips, and for several years, they were our biggest client. I got to know the inner workings of the company and met some truly great people.

I always admired their straightforward culture and the respect they showed to partners.

I might be a little biased because of that history, but I think it’s also an advantage—I’ve got some insider perspective on how they operate.

At current levels, Signify offers a solid risk/reward setup: a P/E of 7.8, a 7% dividend yield, and while it’s not growing fast right now, one of its biggest markets is China, which has seen a lot of change over the past five years. I’m optimistic about its future, and I see this as an ultra-long hold.

Other Passive Income

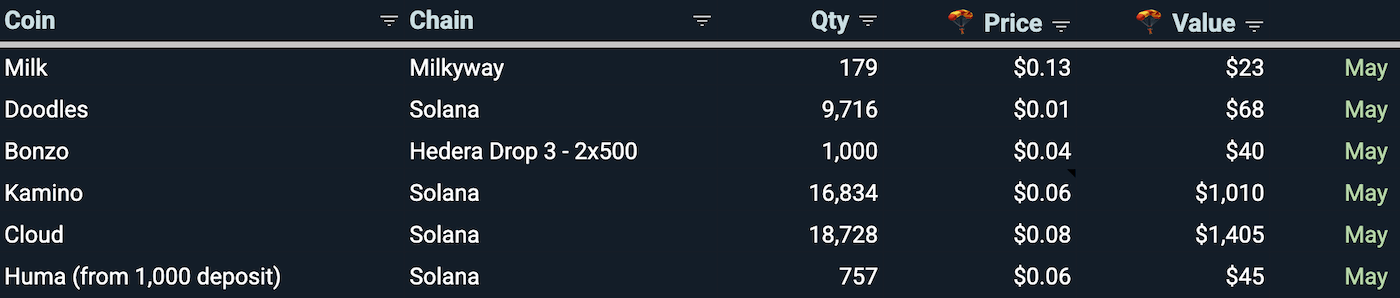

Besides my long-term dividend portfolio, I am also active in crypto. My $300,000 stablecoin farm yielded $2,100.

I got $2,500 in the form of airdrops, see below which projects dropped how much.

In 2025, I have so far received airdrops worth $21,000, and in 2024, it was $29,000.

I earned $748 on Nexo, my main platform on which I earn interest on my crypto.

And with HSBC’s Deposit Plus, I earned $487

In total, I received $21,866 in form of passive income in May.

If you’d like to see an overview of how much I made in total, check out my Passive Income Calendar page.

Wrap Up

I am happy and grateful for the last month becoming my best dividend month so far.

My plan for the coming months is to keep re-balancing my portfolio (shift funds from my thematic and crypto to my longterm dividend portfolio.

📘 Read Also

- Why I Bought $30,000 Worth Of This Global Conglomerate Stock

- The 3 Best Australian REITs To Buy

- Stablecoin Farming 101: How I Generate 15%+ Returns

FAQ

What is usually the best dividend month?

May often stands out as the best dividend month for me because many of my European stocks, like Allianz or E.ON, pay their dividends then. It’s a reliable boost every year, which is why I look forward to spring!

Why do some months bring in more dividend income than others?

Some months have higher dividends because companies often schedule payouts in specific quarters, like May for many European stocks. It really depends on your portfolio’s mix and when those companies decide to share the profits.

How can I pick stocks to boost my passive income in peak dividend seasons?

Look for companies with consistent payouts and attractive yields, like CK Hutchison, and focus on sectors that pay dividends in your high-income months. A bit of research and timing can go a long way!

What role does global market exposure play in maximizing dividend payouts?

Diversifying across regions, like adding Ecopetrol from Colombia, helps catch dividends from different markets that pay on varied schedules. It’s a simple way to keep the cash flowing year-round.

Should I reinvest dividends or take the cash during high-yield months?

Reinvesting dividends, like I did with my $62,000 in May, can help grow your portfolio faster, but taking the cash works if you need the income now. It’s all about balancing your goals and what feels right for you.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love