Key Takeaways

☑️ The best luxury stocks are good portfolio diversifiers

☑️ They are cyclical stocks that do very well in good times

☑️ The ten largest luxury goods companies are compared

☑️ I share my luxury stock 🏆 Top Pick

Are Luxury Stocks A Good Investment?

Luxury goods are universally seen as status symbols and are typically more dependent on how the economy is currently doing than, for example, household or consumer goods.

In the last 10-15 years, the luxury goods industry has benefited primarily from stronger sales in Asia. In particular, the fast-growing upper class in China was one of the world’s largest buyers of jewelry, designer fashion, and other luxury items.

As the pandemic is now behind us, consumer discretionary stocks in general, and stocks of luxury goods companies in particular have been performing well!

But are luxury brand companies a good investment? What are the best luxury stocks out there?

Disclaimer: I currently do not own any luxury brand stocks, yet thought it would be a good time to look into this space.

Let’s start by defending what luxury actually is. I think this quote puts it best.

Largest Luxury Stocks – by Market Cap & PS

| Symbol | Company Name | Market Cap in bio | PS Ratio |

| LVMHF | 🇫🇷 LVMH | $492 | 5.59 |

| HESAF | 🇫🇷 Hermès | $234 | 17.82 |

| CHDRF | 🇫🇷 Christian Dior | $169 | 2.02 |

| CFRHF | 🇨🇭Richemont | $97 | 4.05 |

| PPRUF | 🇫🇷 Kering | $77 | 3.33 |

| MONRF | 🇮🇹 Moncler | $20 | 6.94 |

| PRDSF | 🇮🇹 Prada | $19 | 4.13 |

| BBRYF | 🇬🇧 Burberry | $12 | 3.43 |

| RL | 🇺🇸 Ralph Lauren | $7 | 1.24 |

| BOSSY | 🇩🇪 Hugo Boss | $5 | 1.31 |

As someone who was lucky enough to sell his business (in 2017) for 2.3x sales, I always look at the price-to-sales ratios of the stocks I research.

The luxury goods company with the highest PS is Hermès, with a whopping 17.8x its sales.

The one with the lowest one is Ralph Lauren at 1.25x. In other words, you’d need to give the shareholders of Ralph Lauren 1.25x of the revenues to buy the whole company, but it’d take you 17.8x to buy Hermès.

The luxury industry is very competitive and the trends change all the time. It is therefore vital for any luxury brand to be in touch with the upcoming consumers.

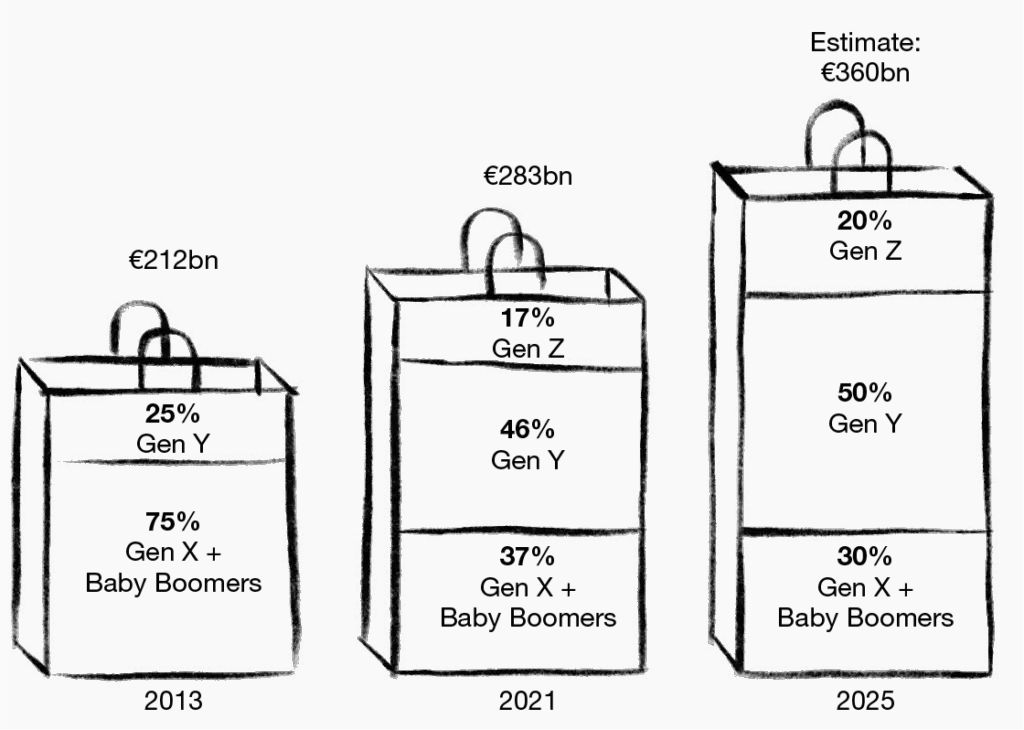

If we look at which “generation” is currently buying the most luxury products, we can see the following:

Spending on Luxury Goods By Generation

The chart above shows that the GenX (my generation) and the baby boomers are already not the biggest spenders on luxury goods anymore (surprising!). That’s why it’s key for all those luxury brands to create products that appeal to the Millenials (=Gen Y) and GenZs!

🇫🇷 Domination

The four French luxury companies LVMH, Hermès, Dior, and Kering (incl. EssilorLuxottica, not listed above), have a combined market cap of over $1 Trio US!

This represents about 80% of the world’s top 20 largest public luxury companies’ total value (!).

This even makes the Paris stock exchange the one with the highest total value in Europe (the London Stock Exchange is in place 2). And of the 270 top high-end luxury brands in the world, a stunning 130 are French.

The 10 Best Luxury Stocks

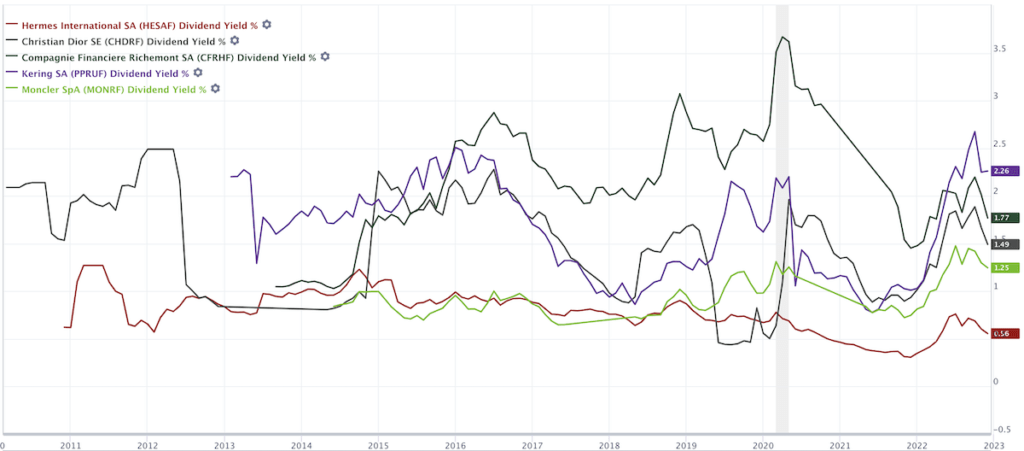

Let’s now take a look at the dividends the luxury companies are paying.

First off, we can see that all of the 10 best luxury stocks pay a dividend. Not really high ones, but at least they all pay one.

Best Luxury Stocks – By Dividend Yield

| Company | Yield % | Payout Ratio | Dividend p.a. |

| 🇺🇸 Ralph Lauren | 2.7 | 0.39 | 4 |

| 🇫🇷 Kering | 2.49 | 0.41 | 2 |

| 🇬🇧 Burberry | 1.92 | 0.42 | 2 |

| 🇮🇹 Prada | 1.67 | 0.38 | 1 |

| 🇨🇭Richemont | 1.37 | 0.5 | 1 |

| 🇫🇷 Christian Dior | 1.35 | 0.37 | 2 |

| 🇫🇷 LVMH | 1.33 | 0.43 | 2 |

| 🇩🇪 Hugo Boss | 1.01 | 0.23 | 1 |

| 🇮🇹 Moncler | 0.87 | 0.27 | 1 |

| 🇫🇷 Hermès | 0.66 | 0.25 | 2 |

The luxury stock with the highest dividend yield is U.S.-listed Ralph Lauren (2.7%), followed by the French luxury conglomerate Kering.

Fun fact: My favorite tech fund, investing in disruptive tech companies, and in which I just started building a position in, interestingly owns a big position in Kering.

Looking at the long-term development of the dividends of the best luxury stocks, we can see the following:

Seems even the best luxury stocks are not big dividend payers. The highest dividend yield ever is 3.6%, quite low compared to other industries!

Best Luxury Stocks – By Return on Equity

| Company | ROIC % | ROE % | ROA % |

| 🇫🇷 Hermès | 55.82 | 31.47 | 21.78 |

| 🇬🇧 Burberry | 20.65 | 28.52 | 12.1 |

| 🇮🇹 Moncler | 19.69 | 23.06 | 14.23 |

| 🇫🇷 Kering | 15.54 | 26.56 | 11.04 |

| 🇨🇭Richemont | 14.52 | 0.67 | 0.33 |

| 🇫🇷 Christian Dior | 13.87 | 33.74 | 4.54 |

| 🇺🇸 Ralph Lauren | 13.71 | 20.85 | 7.04 |

| 🇫🇷 LVMH | 13.57 | 27.62 | 10.8 |

| 🇩🇪 Hugo Boss | 12.61 | 20.72 | 7.3 |

| 🇮🇹 Prada | 8.89 | 13.91 | 6.41 |

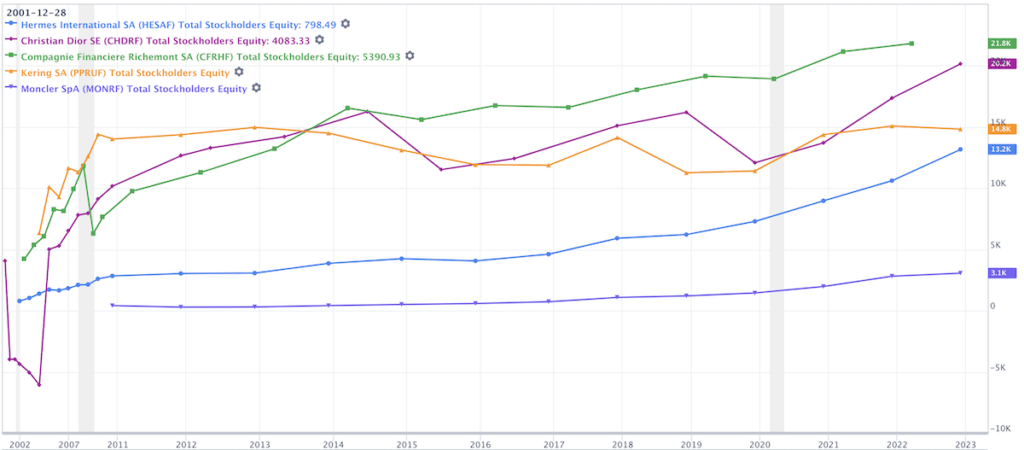

One key metric I look at is whether the companies I invest in are able to build up stockholder equity over time. The chart below shows 25 years of history of the leading luxury goods stocks:

My 🏆 Top Pick Of The Best Luxury Stock

Kering is my personal top pick as the best luxury stock.

Its brand portfolio is world-class, it is led by an experienced and well-respected CEO (2nd generation), is geographically well diversified, and most importantly, knows how to appeal to the young consumer!

Why I like Kering

1/ Fantastic brand portfolio including Gucci, Saint Laurent, Bottega Veneta, Alexander McQueen

2/ Exciting growth prospects over the next decade

3/ Underpinned by innovative projects in new fabrics and manufacturing processes, online sales

4/ International expansion of the group’s smallest brands

5/ Exciting experiments in digital luxury (virtual Gucci bags sell for more than their physical counterparts!)

6/ Experiments with clothing for metaverse avatars etc.

7/ Worldclass CEO with Pinault (since 2005)

8/ Knows like no other to appeal to the young consumer

Interview with Kering CEO Pinault

I believe Kering’s CEO, Mr. Pinault, is doing a fantastic job and leads the company extremely well. Here’s a brief interview:

💄Luxury Stocks & The Lipstick Effect

The lipstick effect, a phenomenon in which your average consumer keeps on spending money on affordable indulgences during economic downturns or recessions, is one of the factors that luxury stocks fare well and are therefore more resilient even during such economic downturns.

The best Luxury stocks benefit more or less from this effect, as it not only applies to lipsticks but any luxury item that provides some indulgence.

Conclusion

I believe the luxury segment should be part of a well-diversified portfolio.

However, I feel the current valuations are very high, not making me want to buy any luxury stocks at this stage.

Should Kering ever come down to 450€, I will start a position and be a buyer (that’s about 30% off the current price)!

📘 Read Also

- The Best European Consumer Goods Stocks

- Ouch – Selling This Dividend King Stock Hurts

- 5 Best European Stocks With Quarterly Dividends

FAQ

What luxury brands are publicly traded?

The 10 largest luxury brands that are publicly traded (by market cap)

🇫🇷 LVMH

🇫🇷 Hermès

🇫🇷 Christian Dior

🇨🇭Richemont

🇫🇷 Kering

🇮🇹 Moncler

🇮🇹 Prada

🇬🇧 Burberry

🇺🇸 Ralph Lauren

🇩🇪 Hugo Boss

Why invest in luxury stocks?

Luxury goods are bought by people with money, hence the sector is considered to be more recession-resistant than others. A known phenomenon is called the “Lipstick Effect”, describing the fact that during economic downturns, many consumers although they have less money still spend more on items that make them feel good.

What are luxury stocks?

Luxury stocks are the shares of luxury goods brands and companies such as Ralph Lauren, LVMH, Dior, or Kering. These companies sell all sorts of luxury products, such as high-fashion, designer bags, shoes, watches, and jewelry.

What are the best luxury stocks to buy?

The best luxury stock is arguably LVMH, as it is by far the biggest luxury company. The 2nd biggest is Hermes, followed by Kering. All are well-managed and very large corporations with a global presence in all key markets.

How do luxury brands survive recessions?

Typically all luxury brands also get hit by economic downturns and recessions, as in particular, the middle class stops spending on ‘unnecessary’ items. However, the lipstick effect often results in consumers spending money on affordable indulgences, such as lipsticks or designer bags. But in reality, this effect does not make up for the lost sales from the majority of consumers who simply can not afford to spend money on luxury items.

What are the best luxury stocks ETFs?

Consumer Discretionary Select Sector SPDR Fund (XLY)

Three non-US ETFs:

1/ Amundi IS S&P Global Luxury ETF-C EUR (GLUX)

2/ Amundi IS S&P Global Luxury ETF-C USD (LUXU), and the

3/ HANARO Global Luxury S&P (SK: 354350).

An alternative to a luxury stock ETF can be the thematic Global X Millennial Consumer ETF (MILN) which holds luxury-light stocks that are popular with younger generations.

Which companies are on the luxury stocks list?

🇫🇷 Hermès

🇬🇧 Burberry

🇮🇹 Moncler

🇫🇷 Kering

🇨🇭Richemont

🇫🇷 Dior

🇺🇸 Ralph Lauren

🇫🇷 LVMH

🇩🇪 Hugo Boss

🇮🇹 Prada

Is there a luxury brands stock index?

No, luxury stocks are usually part of Discretionary Consumer stock indexes. However, the Consumer Discretionary Select Sector SPDR ETF with the ticker XLY holds most of the best luxury stocks you’d want exposure to and is a good vehicle for many investors.

What are the best luxury retail stocks?

The following companies are popular in that space: LVHM, Dior (Dior owns 41% of LVHM), Kering, Hermes, and Ralph Lauren.

What is the luxury good stock index?

There is no luxury good stock index per se, as luxury brands are typically in the consumer discretionary indices. One way to get exposure to this space is via the Consumer Discretionary Select Sector SPDR ETF (XLY).

Kering - The Best Luxury Stock

Of all luxury stocks, I like Kering the most, however, not at these levels. I placed some buy orders at 475€, that's about 20% off the current levels. I believe current valuations are too high, but in the long-run, this is a great company to own.

PROS

- Fantastic brand portfolio

- Exciting growth prospects

- innovative projects in new fabrics

- International expansion

- Exciting experiments in digital luxury

- Experiments with clothing for metaverse

- Worldclass CEO

- Appealing to the young consumer

CONS

- Fierce competition from LVMH, Hermes, etc.

- Rapidly changing consumer taste

- Impact from recession

- Impact from slowing globalization

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love