Key Takeaways

☑️ The 8 best railroad stocks are compared

☑️ Transportation stocks in general are slow and steady growers

☑️ Investment gurus like Buffett love railway businesses

☑️ Check out my 🏆 ‘Railroad Stock Top Pick’

The Investment Case For Railroad Stocks

Railroad companies provide essential services that are vital for the transportation of goods and people. They are like the main arteries of a country, state, or region.

Subsequently, the demand for their services is stable and not much impacted by sudden changes in the economy.

Railroad companies benefit from significant barriers to entry, as they usually own the land on which the railway tracks are located.

This means that once the railway operator connected city A with city B, there is no economic incentive to buy the expensive land required to build another track. This greatly protects market share and limits competition.

Transportation stocks in general, and railroad stocks in particular, are known to generate steady, predictable revenues and profits, over long periods of time, rewarding patient investors with stable and growing dividends.

“I felt it was an opportunity to buy a business that is going to be around for 100 or 200 years, that’s interwoven with the American economy in a way that if the American economy prospers, the business will prosper. It is the most efficient way of moving goods in the country. It is the most environmentally friendly way of moving goods, and both those things are going to be very important.”

Warren Buffett

My Personal Story With Locomotives

My great-grandfather, born in 1884, was one of Germany’s first locomotive drivers for a railway company in a city about an hour outside of Munich.

He passed away a few years before I was born, but I have vivid memories of visiting the transport museum in Nuremberg, where the locomotives he was driving are on display.

Further, Railroad Tycoon is one of my Top 10 Games of All Time, an absolute classic strategy game I played for years and years.

So, railway companies, locomotives, and their stocks are right in my ‘wheelhouse’, and I love analyzing railway stocks!

The World’s Largest Railroad Stocks

The most valuable railway stock in the world, by market cap, is Union Pacific $UNP.

| Company Name | Market Cap (in B) | Revenue (in B) |

| 🇺🇸 Union Pacific Corp $UNP | $124 | $169 |

| 🇨🇦 Canadian National Railway $CNI | $79 | $89 |

| 🇺🇸 CSX Corp $CSX | $63 | $101 |

| 🇺🇸 Norfolk Southern $NSC | $54 | $86 |

| 🇭🇰 MTR (Hong Kong) $MTRJF | $33 | $43 |

| 🇯🇵 Central Japan Railway $CJPRY | $24 | $63 |

| 🇯🇵 East Japan Railway $EJPRY | $21 | $119 |

| 🇨🇳 China Railway Group $CRWOF | $20 | $1,281 |

China’s number one railway stock, China Railway Group $CRWOF, has a 7.5x larger revenue compared $UNP, while its market cap is 6x lower. Quite a dramatic difference. So is China Railway Group my top pick?

Let’s dig a bit deeper.

First-Hand Experience With China Railway

Living in Asia for +20 years, and having traveled to China numerous times, I can attest that China’s locomotives, trains, train stations, and its entire infrastructure are extremely modern, well-managed, and reliable. Everything is digitalized, the trains are clean, it’s easy to book and buy tickets via your mobile phone, etc.

The perception in other countries is often that China’s train system must be old and unreliable, but simply put the exact opposite is the case. It’s often the trains in the U.S. or Europe that feel dated.

Railroad Stocks List

| Company Name | PE | PB | PS |

| 🇺🇸 Union Pacific Corp $UNP | 18 | 10 | 5 |

| 🇨🇦 Canadian National Railway $CNI | 21 | 5 | 6 |

| 🇺🇸 CSX Corp $CSX | 16 | 5 | 4 |

| 🇺🇸 Norfolk Southern $NSC | 17 | 4 | 4 |

| 🇭🇰 MTR (Hong Kong) $MTRJF | 23 | 1 | 5 |

| 🇯🇵 Central Japan Railway $CJPRY | 37 | 1 | 3 |

| 🇯🇵 East Japan Railway $EJPRY | 33 | 1 | 1 |

| 🇨🇳 China Railway Group $CRWOF | 7 | 0.5 | 0.1 |

$UNP generates 169 US Bio in revenues and has a price-to-sales ratio of 5. What this means is that you’d need to pay approx. 5x the total revenue to buy all shares of the entire company.

China Railway Group has a PS of 0.1, meaning it would only need to spend 10% of its annual revenue to buy the entire company. Such drastic differences are quite uncommon when analyzing the largest 5-10 stocks in any given industry.

Which Railway Company Has The Best ROIs?

Until now, China Railway Group $CRWOF looks like a screaming buy.

But there is more to it. Let’s look at what sort of return on equity, return on assets, and return invested capital the management teams of the best railroad stocks are generating:

| Company Name | ROE% | ROA% | ROIC% |

| 🇺🇸 Union Pacific Corp $UNP | 56 | 11 | 12 |

| 🇨🇦 Canadian National Railway $CNI | 23 | 10 | 4 |

| 🇺🇸 CSX Corp $CSX | 32 | 10 | 12 |

| 🇺🇸 Norfolk Southern $NSC | 25 | 8 | 10 |

| 🇭🇰 MTR (Hong Kong) $MTRJF | 7 | 4 | 1 |

| 🇯🇵 Central Japan Railway $CJPRY | 2 | 1 | 2 |

| 🇯🇵 East Japan Railway $EJPRY | 3 | 1 | -5 |

| 🇨🇳 China Railway Group $CRWOF | 11 | 2 | 5 |

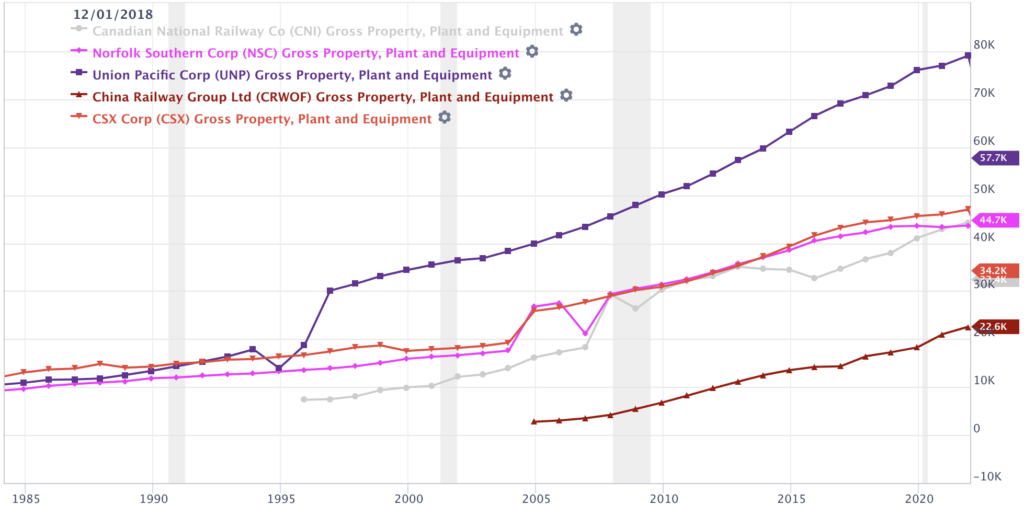

Chart Of GPPE Assets Of Largest Railway Stocks

The above chart shows the Gross Property Asset Charts of the largest railway stocks. Easy to spot that almost all of those five show a steady positive trendline, meaning they keep adding to their existing base of property, plant, and equipment ownership.

Do Railroad Companies Own The Land Of The Tracks?

In most cases, railroad companies do need to buy the land on which their railway tracks are located.

In the U.S. for example, each railway company is typically granted a “rights-of-way” for each of their tracks, through a very bureaucratic process called “eminent domain”, allowing state governments to grant railway companies and operators the right to purchase the required land.

In other cases, for example in Canada, railroad companies may purchase the required land directly from the government.

Owning the land of the railway tracks creates of course a very strong moat, making it very difficult for new competitors to enter.

What Are The Warren Buffett Railroad Stocks?

It is no secret that Warren Buffett likes railroad businesses. Via his Berkshire Hathaway, he actually bought several railroad companies over the years. The largest acquisition was Burlington Northern Santa Fe.

Over the years Berkshire also owned Union Pacific (UNP). When Buffett bought Burlington, he sold his other railroad shares. Besides, he has also invested in railroad-related companies, such as railcar leasing and manufacturers.

He outlines his railroad stock investment thesis very clearly in this (short) video of 2007:

Are Railway Stocks Future-Proof? Risk Of Driverless Trucks?

That’s a great question. I believe the ‘not well-run railway companies‘ might not be future-proof, as they will face more and more competition from driverless trucks in the (near!) future.

This will reduce the demand for railroad freight services, as trucking companies may be able to offer more competitive rates. However, railroads may still be able to remain competitive for certain routes, and by providing value-added services that are not easily replicated by driverless trucks, such as transporting hazardous materials or carrying larger loads.

Also, although driverless trucks will increase the competition, freight by rail is still significantly cheaper compared to by truck. This allows railroad operators to be flexible in terms of pricing.

🏆 My Railroad Stock Top Pick

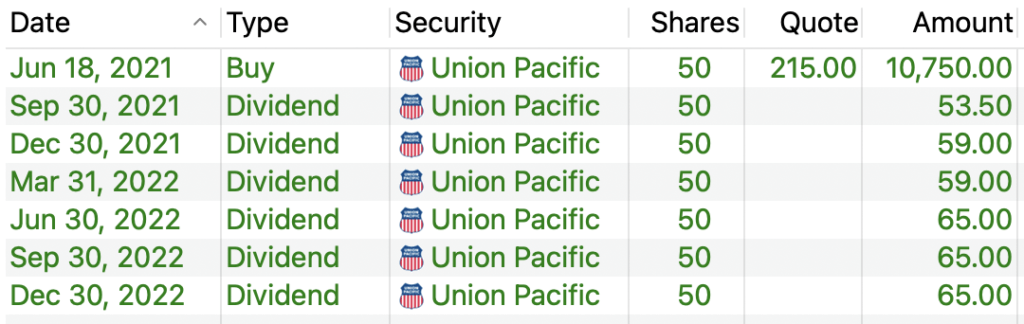

My current favorite railroad stock is clearly Union Pacific (UNP). Full disclosure: I own $UNP since 2020, and plan to literally own it forever in my All-Weather Portfolio. Below show all of my transactions so far:

About Union Pacific

Union Pacific (UNP) was founded in 1862 as part of the Pacific Railroad Act in the United States. It was the driving force behind the construction of the Transcontinental Railroad in the United States, enabling millions of people to travel, and transport all sorts of goods across the country.

In 1969, Union Pacific merged with the Missouri Pacific Railroad, forming the largest freight railroad network in the US.

$UNP’s network is also well-connected to other railroads, ports, and intermodal facilities, providing the company with access to a broad range of transportation options.

Massive Moat

$UNP currently operates the largest network of rail tracks in North America, with 32,000 miles across a total of 23 states. In order to compete with this giant, a competitor would first need to acquire the required land with the difficulty to get zoning rights and build out an equally large network.

On the company’s balance sheet, we see $80 Bio US worth of Gross Property, representing a wide deep moat.

Healthy Margins

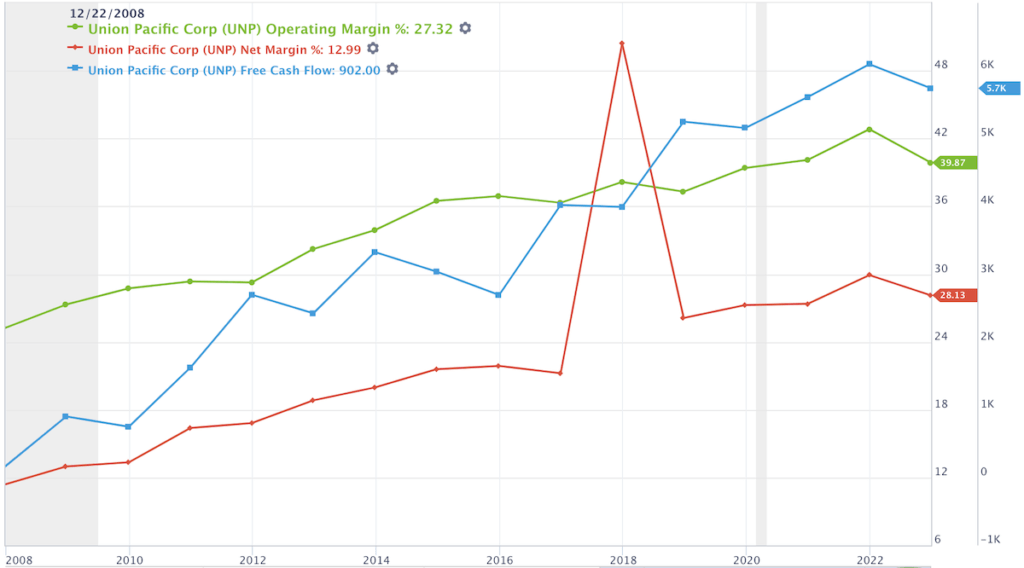

Let’s take a quick look at whether $UNP‘s Gross Margin & Operating Margin increased or decrease over a period of 15 years.

Same here, we can see a nice stable trend. Any business that is able to do so deserves the attention of long-term-oriented dividend investors.

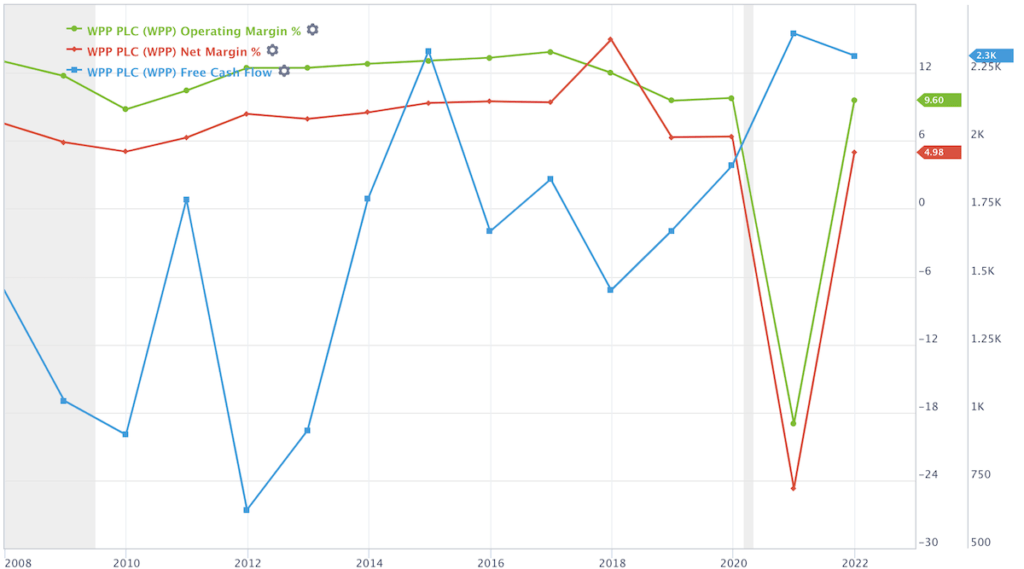

Let’s quickly compare this with a completely different type of business, advertising. Below is the chart showing the same three items for $WPP, one of the world’s largest advertising networks.

Which stock would you rather be a long-term owner of?

Cash Flow Machine

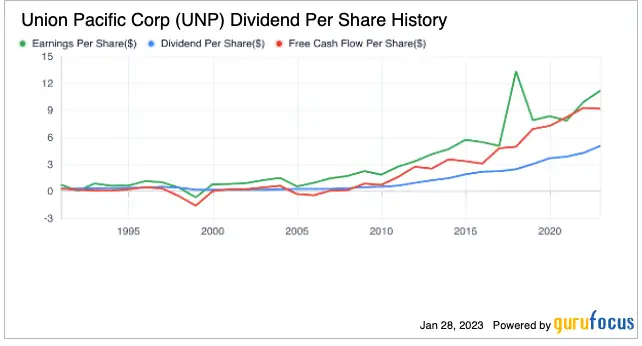

With its healthy margins, it is no surprise $UNP generates very healthy cash flow. In 2012, $UNP generated $2.6 Bio US in free cash flow. In 2022, it generated $6 Bio US. When looking at the development of its free cash flow, you see a healthy and steady uptrend (see the chart above).

Buffett’s Chop Of Approval

Berkshire Hathaway used to be an owner of $UNP before it sold all shares after the acquisition of Burlington Northern Santa Fe. Although Buffett does not own $UNP at this stage anymore, we know he loves railroad businesses, providing investors like myself with the added assurance that he liked what he saw before.

Stable & Growing Dividend

$UNP is a stable payer and grower of its dividend. Its payout ratio sits at 45%, and the average Growth Rate over 5 Years at 14.2%. With its improving margins, $UNP should have no problem to keep on increasing its dividend for years or even decades to come.

Conclusion

In my opinion, $UNP is one of the rare businesses that qualify to be a buy-and-hold forever company (check out my 10x favorite buy-and-hold forever companies).

It is the one railway stock I plan to hold in my All-Weather Portfolio for decades to come.

📘 Read Also

-

- The Best Dividend-Paying Entertainment Stocks

- How To Find High Yield Dividend Stocks

- The 8 best oil and midstream stocks

- Check out my monthly dividend calendar

FAQ

What is the best railroad stock to buy now?

What are some railroad stock symbols?

What is Union Pacific railroad stock price?

Listed on the NYSE (New York Stock Exchange), you can check the stock price of Union Pacific (UNP) on Google Finance.

Do railroad stocks pay dividends?

Yes, in fact, railroad stocks are known to be good dividend payers that consistently grow their dividends:

$UNP | Union Pacific | pays a dividend of 2.51%

$NSC | Norfolk Southern | pays a dividend of 2.11%

$CNI | Canadian National Railway | pays a dividend of 1.86%

$EJPRY | East Japan Railway | pays a dividend of 1.33%

$CSX | CSX Corporation | pays a dividend of 1.29%

$CJPRY | Central Japan Railway | pays a dividend of 0.79%

What are the best railroad stocks?

What railroad stock does Warren Buffett own?

Warren Buffett acquired Burlington Northern Santa Fe in 2010. He also owned Union Pacific (UNP) from time time, but sold his entire position after the Burlington Northern Santa Fe acquisition.

What are the best dividend railroad stocks?

Most railroad stocks pay dividends, and paying the highest dividend does not automatically make a railway company the “best dividend railroad stock”. Other things to consider are dividend growth, consistency, and dividend history. Some of the best dividend paying-railroad stocks:

– $UNP | Union Pacific | dividend of 2.51%

– $NSC | Norfolk Southern | dividend of 2.11%

– $CNI | Canadian National Railway | dividend of 1.86%

– $EJPRY | East Japan Railway | dividend of 1.33%

– $CSX | CSX Corporation | dividend of 1.29%

– $CJPRY | Central Japan Railway | dividend of 0.79%

What are the best transportation stocks?

Are there railroad stock ETFs?

No, there is no railroad stock ETF, but you can consider transportation stock ETFs. The five largest ones are:

Symbol | ETF Name | Total Assets

$IYT | iShares US Transportation ETF | with 775 Mio assets under management

$XTN | SPDR S&P Transportation ETF | with 255 Mio assets under management

$AWAY | ETFMG Travel Tech ETF | with 159 Mio assets under management

$HAIL | SPDR S&P Kensho Smart Mobility ETF | with 62 Mio assets under management

$FTXR | First Trust Nasdaq Transportation ETF | with 61 Mio assets under management

Is Amtrak stock listed?

As a company owned by the state, Amtrak is not a listed company. It is a “for-profit company” of which the federal government owns all its shares.

Is the BNSF stock still listed?

The BNSF stock belongs to Burlington Northern Santa Fe, the second largest railway company in the U.S. Its stock is not listed anymore after Warren Buffett’s Berkshire Hathaway acquired the company in 2010.

Union Pacific - The Best Railroad Stock

In my opinion, $UNP is one of the rare businesses that qualify to be a buy-and-hold forever company (check out my 10x favorite buy-and-hold forever companies).

PROS

- Massive Moat

- Healthy Margins

- Cash Flow Machine

- Buffett's Chop Of Approval

- Stable & Growing Dividend

CONS

- Risk From Driverless Trucks

- Issues With Unions

- Maintenance Of Locomotives & Tracks

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love