It’s been a while since my last update, so I thought I’d share a simple recap of how 2025 went for me financially and share a full portfolio review.

I hope posts like this one offer some ideas or encouragement for anyone on a similar path—nothing more than that.

My Net Worth Progress

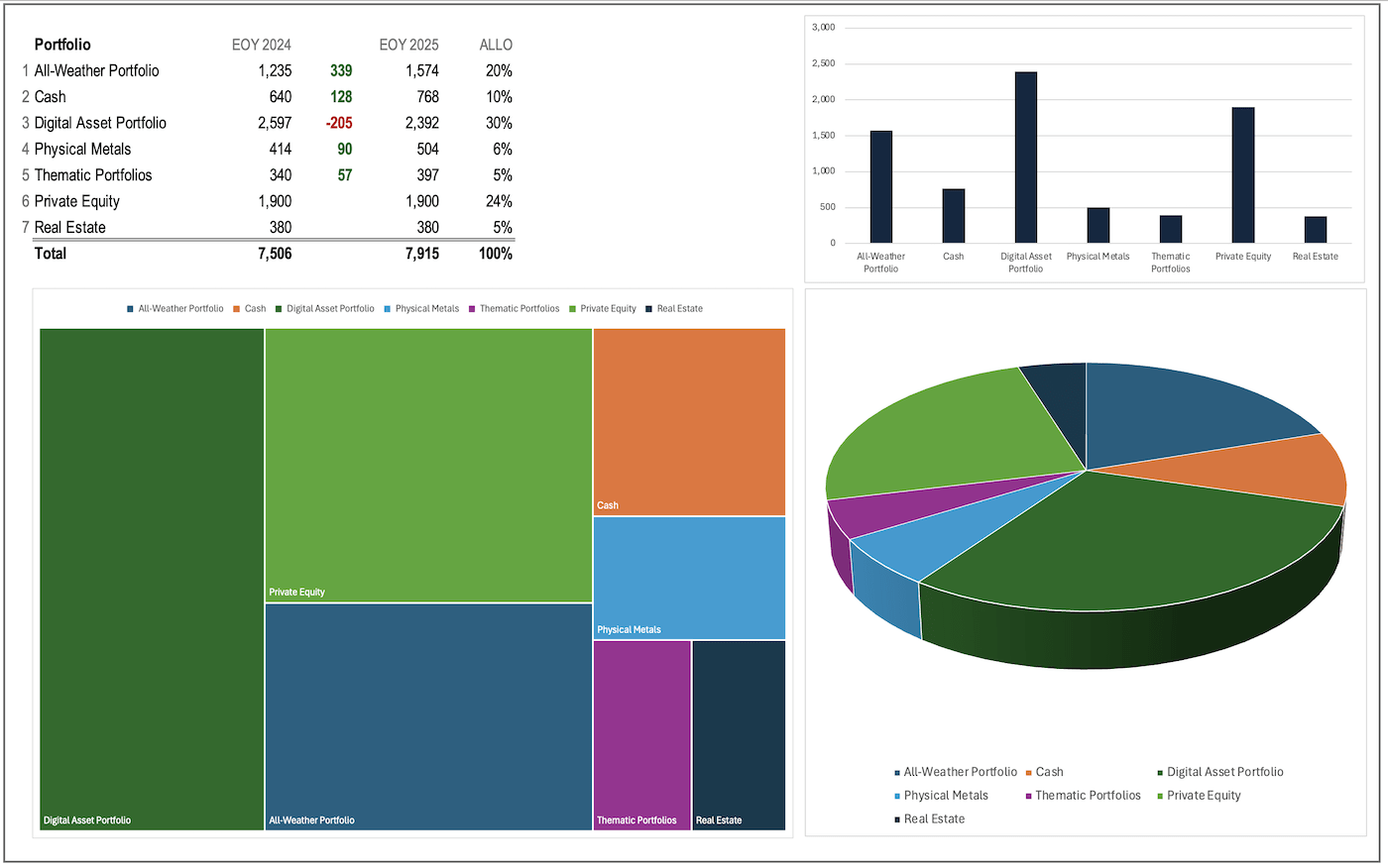

I started the year with $7.5 million and ended it with $7.9 million. See the dashboard below for anyone curious about the breakdown.

The modest growth came mostly from my precious metals holdings and my All-Weather Portfolio. It’s been a steady, quiet year—no big surprises.

Passive Income This Year

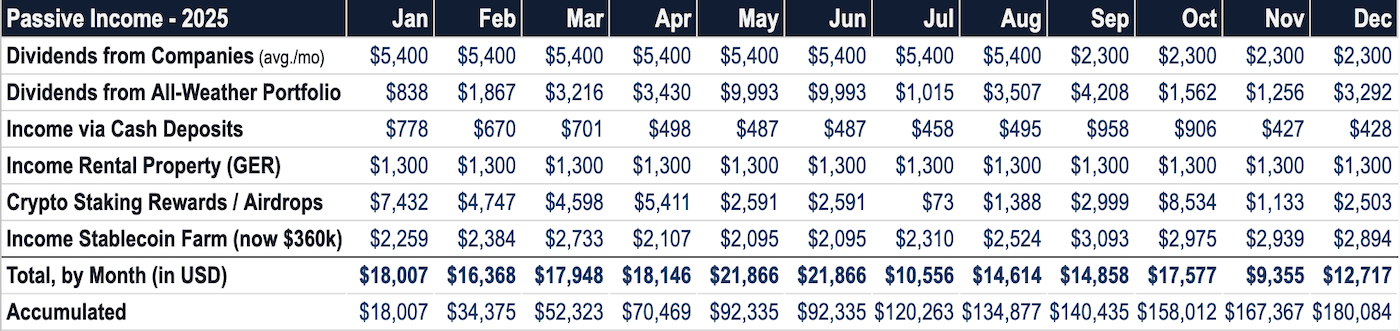

I received about $180,000 in passive income throughout 2025, from a few different sources:

- $52,000 from dividends in private companies

- $41,000 from my All-Weather dividend portfolio

- $30,000 from my stable coin yield farming

- $44,000 from staking rewards and airdrops

These streams have built up slowly over time, and I’m grateful they’re there. It’s taken consistent effort to set them up, but now they provide a nice buffer.

A Bit More on My All-Weather Dividend Portfolio

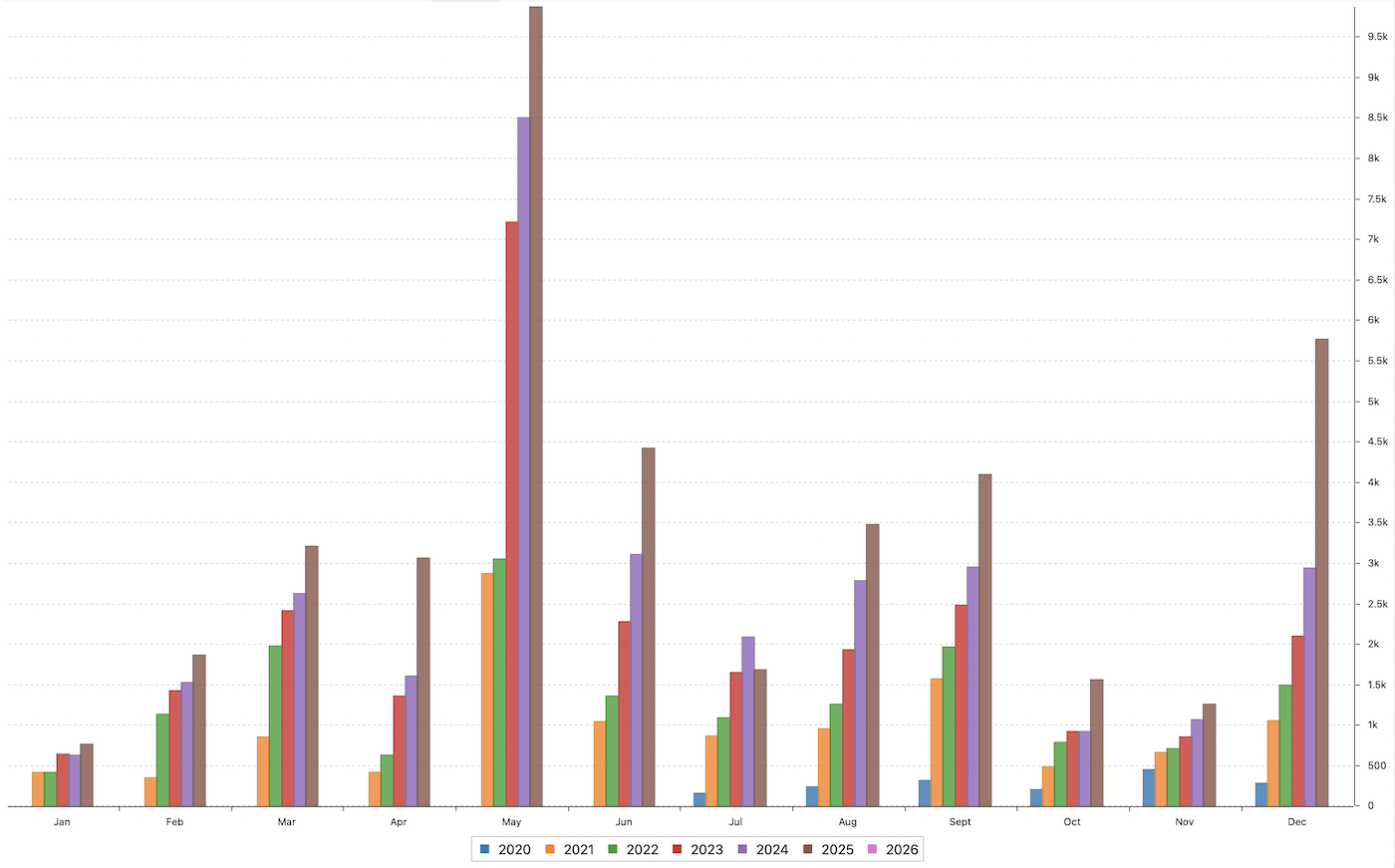

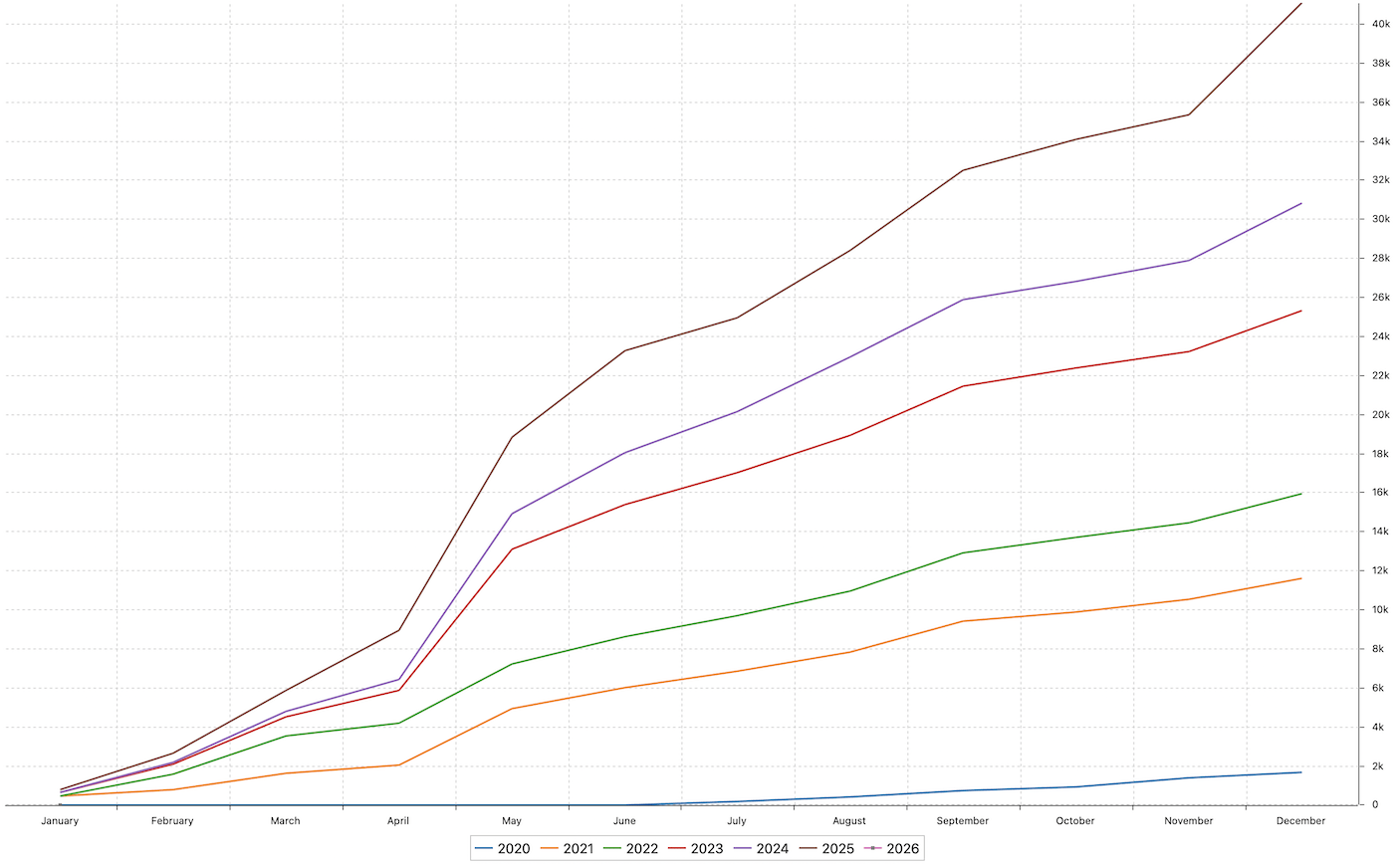

I began seriously building this dividend-focused portfolio back in May 2020.

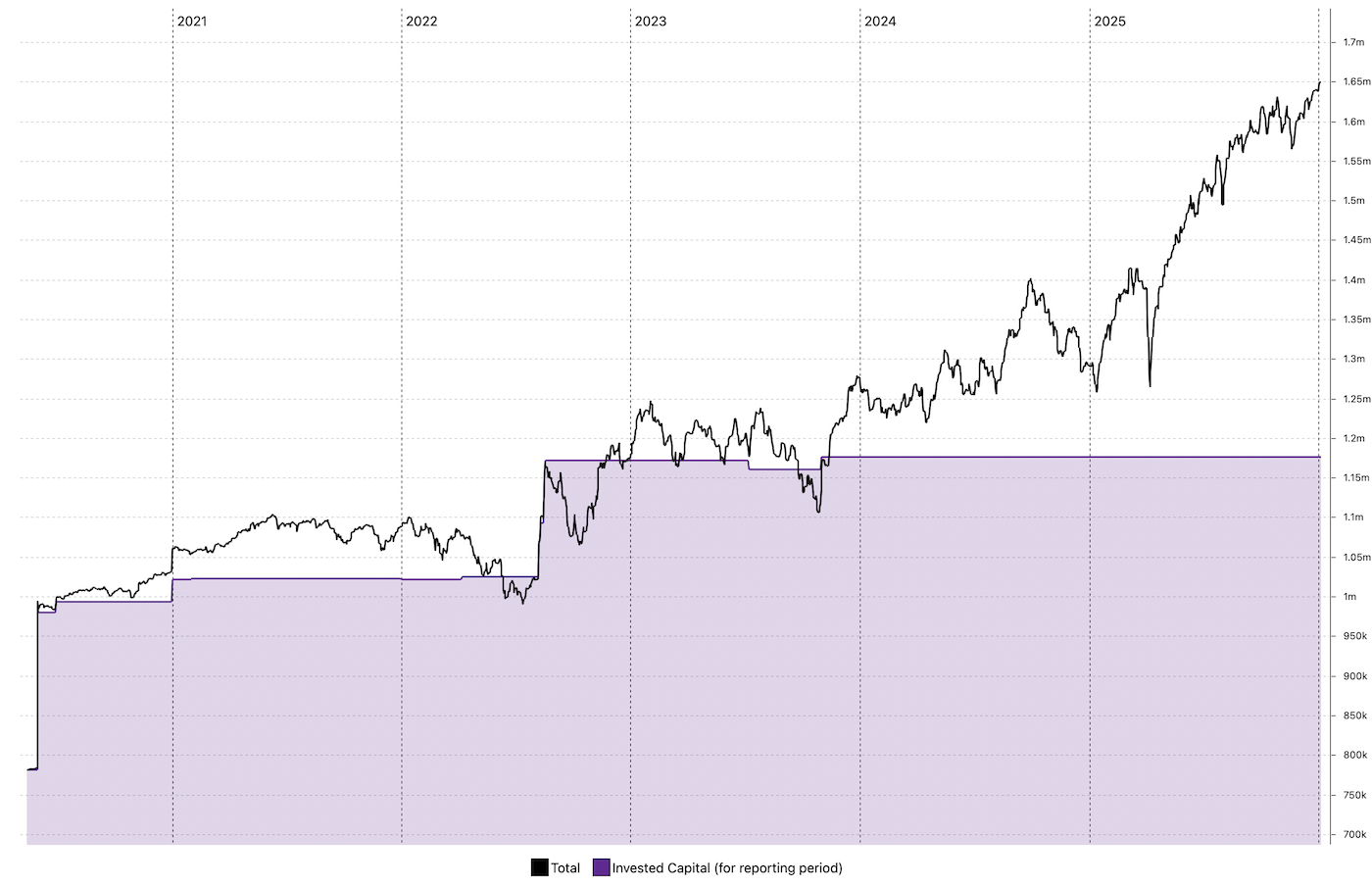

Over the years, I’ve invested approximately $1.3 million, and it has now grown to $1.65 million (see the chart below if you’re interested).

The dividend growth feels like a slow snowball—partly from adding new money when I can, and partly because about 75% of my main holdings raised their payouts this year.

I use a free tool called Portfolio Performance to track everything; it’s straightforward and helps me see trends clearly, like the month-by-month dividend changes (another chart below). I have grown to love PP, and it’s essential for portfolio reviews, which I do frequently.

I’m sharing this just in case it’s useful for anyone thinking about dividend investing. It’s worked well for me as one piece of a broader approach, but everyone’s situation is different.

My Current All-Weather Portfolio

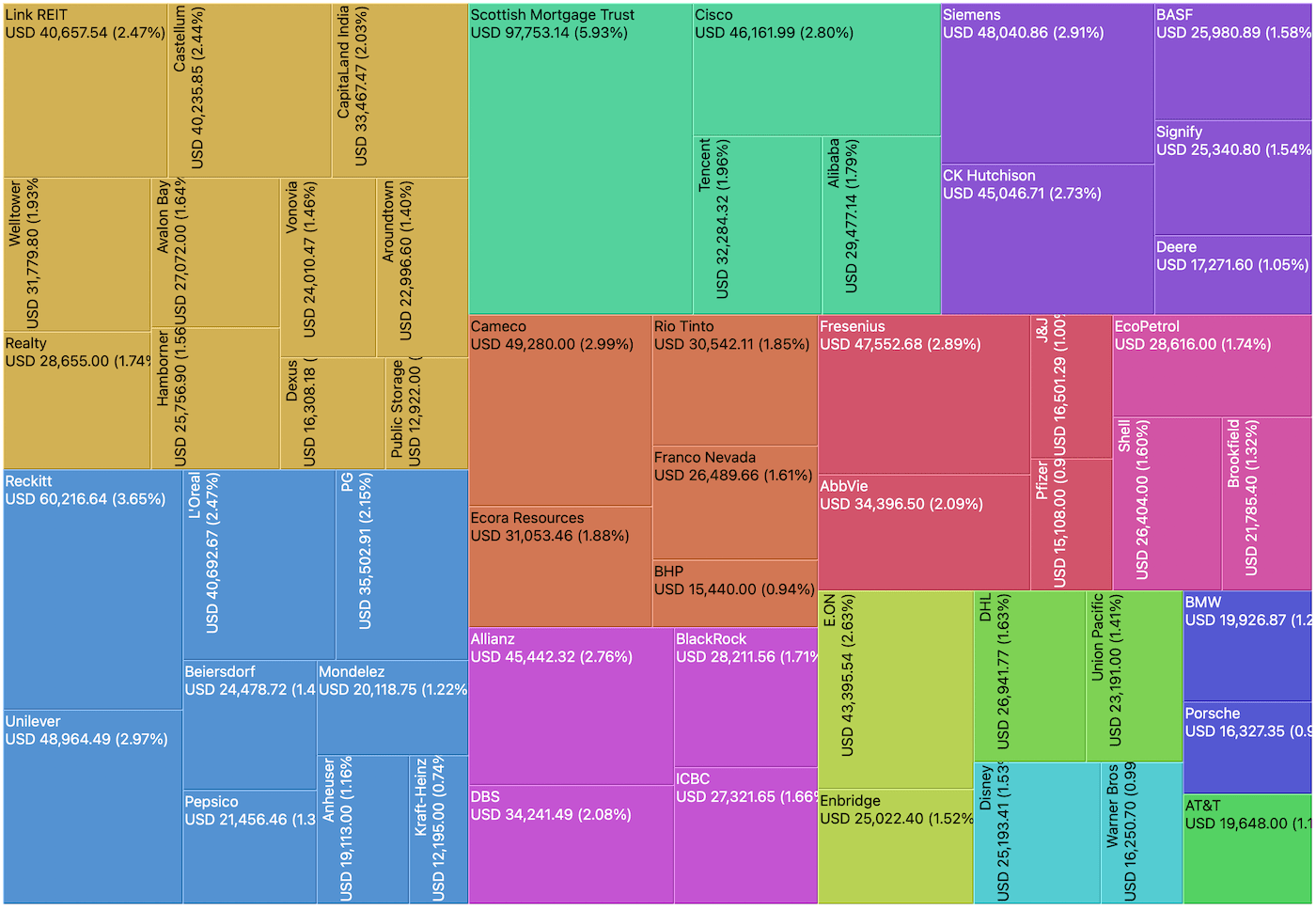

Here’s a quick look at the full breakdown of my long-term dividend portfolio (I’ll share the details below). This is the part of my investments I think of as the core—the one I plan to hold steadily through good times and bad.

See my entire portfolio breakdown below. You can see every single position, color-coded by industry.

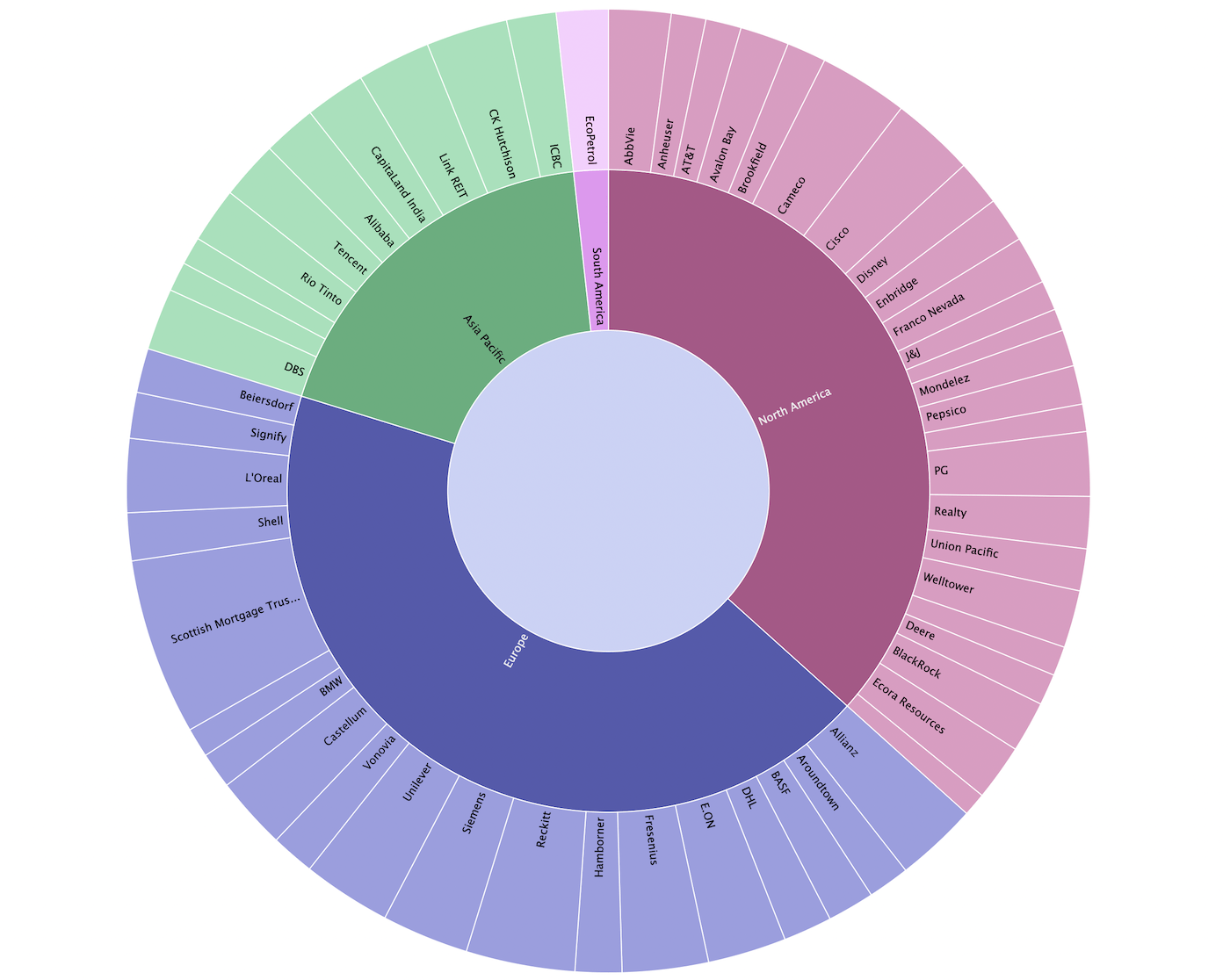

And a separate pie chart view below, separated by region.

My Largest Positions

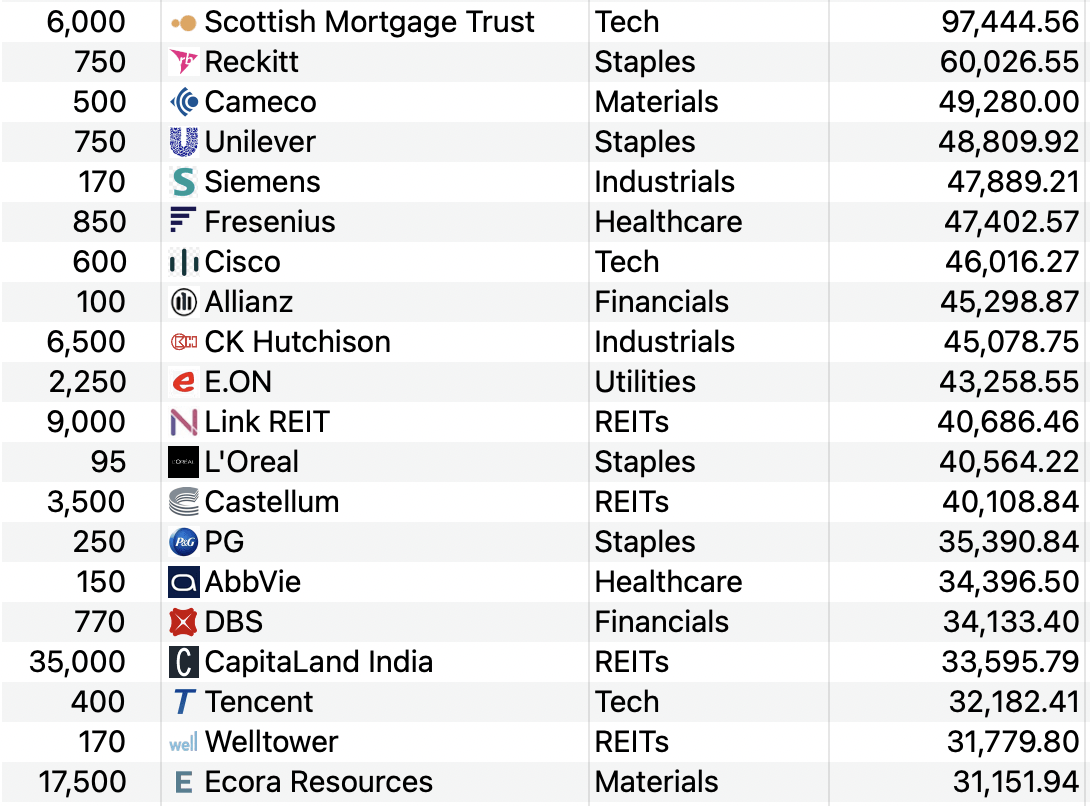

My largest single holding right now isn’t a single stock, but the Scottish Mortgage Investment Trust.

It’s a well-managed ‘fund’ that gives exposure to some of the most innovative growth companies around the world. (I wrote a separate post about why I like it if anyone’s curious.)

Investing directly in individual tech stocks has always felt tricky and risky to me—companies like Kodak, Nokia, or Sony Ericsson come to mind as reminders of how fast things can change.

So I’m very comfortable leaving that area

to a team I respect and believe does it better than I ever could.

Here are my current 20 largest positions.

Largest New Buys in 2025

As part of wrapping up the year, I also looked at my bigger purchases. Overall, I aimed for fewer trades but more meaningful ones when the opportunity felt right.

In total, I put about $121,000 into three new positions and added to four existing ones.

|

Security |

Invested |

|

CK Hutchison – new position |

$37,350 |

|

EcoPetrol – new position |

$22,541 |

|

Signify – new position |

$22,040 |

|

Link REIT |

$17,872 |

|

Avalon Bay |

$9,001 |

|

PG |

$7,393 |

|

Mondelez |

$5,754 |

|

Total |

$121,950 |

I truly enjoy the process of quietly searching for solid, dividend-paying companies that appear undervalued and possess strong competitive advantages—what some refer to as wide moats.

There’s something satisfying about finding these lesser-known names around the world.

For instance, my three largest new buys were CK Hutchison (Hong Kong), Ecopetrol (Colombia), and Signify (Netherlands). They’re from different corners of the globe, but each fits the kind of steady, income-focused approach I lean toward.

Digital Asset Portfolio Review 2025

My $500k Stablecoin Farm

Stablecoin Drama

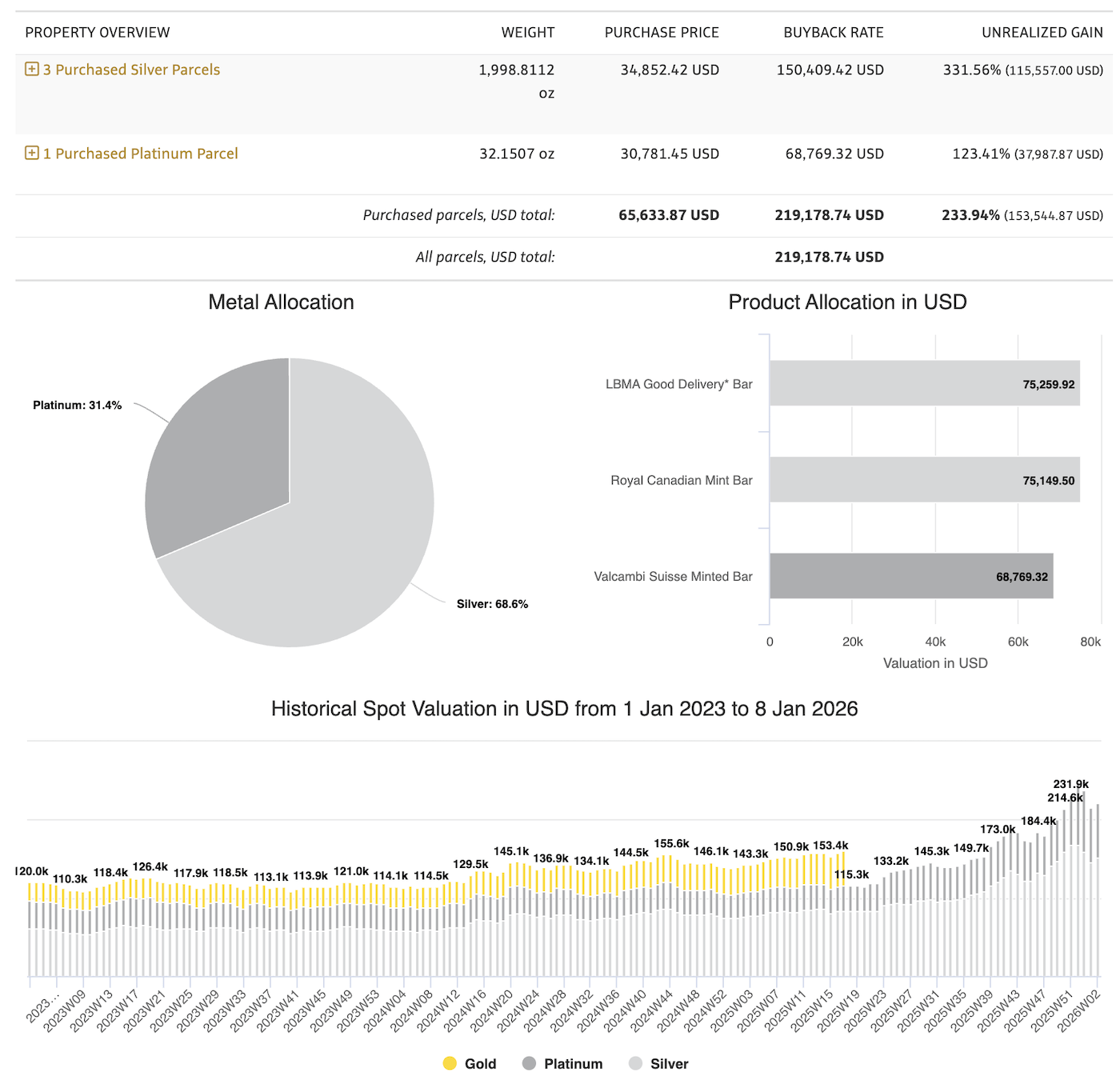

2025 Precious Metals Portfolio Review

For the first time, my precious metals holdings crossed the $500,000 mark by year-end.

To re-balance things a bit, I sold $32,000 worth of silver in late December, and used the proceeds to buy a new dividend stock that I think looks promising—I’ll share more about it in a separate post soon.

I’m quietly optimistic about Gold, Silver, and Platinum heading into 2026 and beyond, but as always, time will tell.

Just part of my broader mix, and I’m sharing in case it’s interesting for anyone else keeping an eye on precious metals as a diversification piece. Everyone’s approach is different, of course.

See below a quick snapshot of my physical precious metal holdings in Singapore (I bought these positions in 2019 and 2020).

Switching To Wealth Preservation

As I will soon be approaching my 50th birthday, I’ve been pausing to reflect on my overall investment approach.

Lately, I’ve noticed a shift: I’m no longer as aggressively chasing the “Next Big Thing.”

Instead, my focus has turned toward preserving and steadily growing what I’ve already built.

As I discussed in my popular blog post on the Via Negativa concept, avoiding losses is often just as important—if not more so—than chasing gains.

This rings especially true when you’re fortunate enough to have accumulated some wealth. That’s why I’ve decided to double down on my long-term dividend portfolio while dialing back on higher-risk bets (such as heavy crypto exposure or penny stocks).

My 2026 Game Plan

For the year ahead, here are my key financial goals:

- Reach $8.25M in total net worth.

- Add $170K to my All-Weather Portfolio (by then I will have totally invested $1.5M)

- Generate $150K in total passive income.

- Earn $42.5K in dividends.

- Get $38K from my stablecoin farm.

This plan keeps things conservative yet ambitious—prioritizing reliable, compounding income streams that can weather any market.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love