Dividend Snowball Report 2024 Jul + Aug

In this monthly report, let’s see if we can find any evidence of a dividend snowball effect during the past vacation months.

I spent the last 1.5 months with family in Europe and took some much-needed time off, away from computers, charts, and the stock market.

Now, back home, my batteries are fully charged, and I have gained a fresh perspective on things.

First off, here is a high-level overview of my current holdings:

| in ‘000 US | ||

| Cash | $249 | 4% |

| Thematic Portfolios | $347 | 5% |

| Physical Metals | $458 | 7% |

| Real Estate | $510 | 8% |

| All-Weather Portfolio | $1,162 | 18% |

| Digital Asset Portfolio | $1,646 | 26% |

| Private Equity | $2,010 | 31% |

| Total | $6,382 | 100% |

Check out my progress of my total net worth.

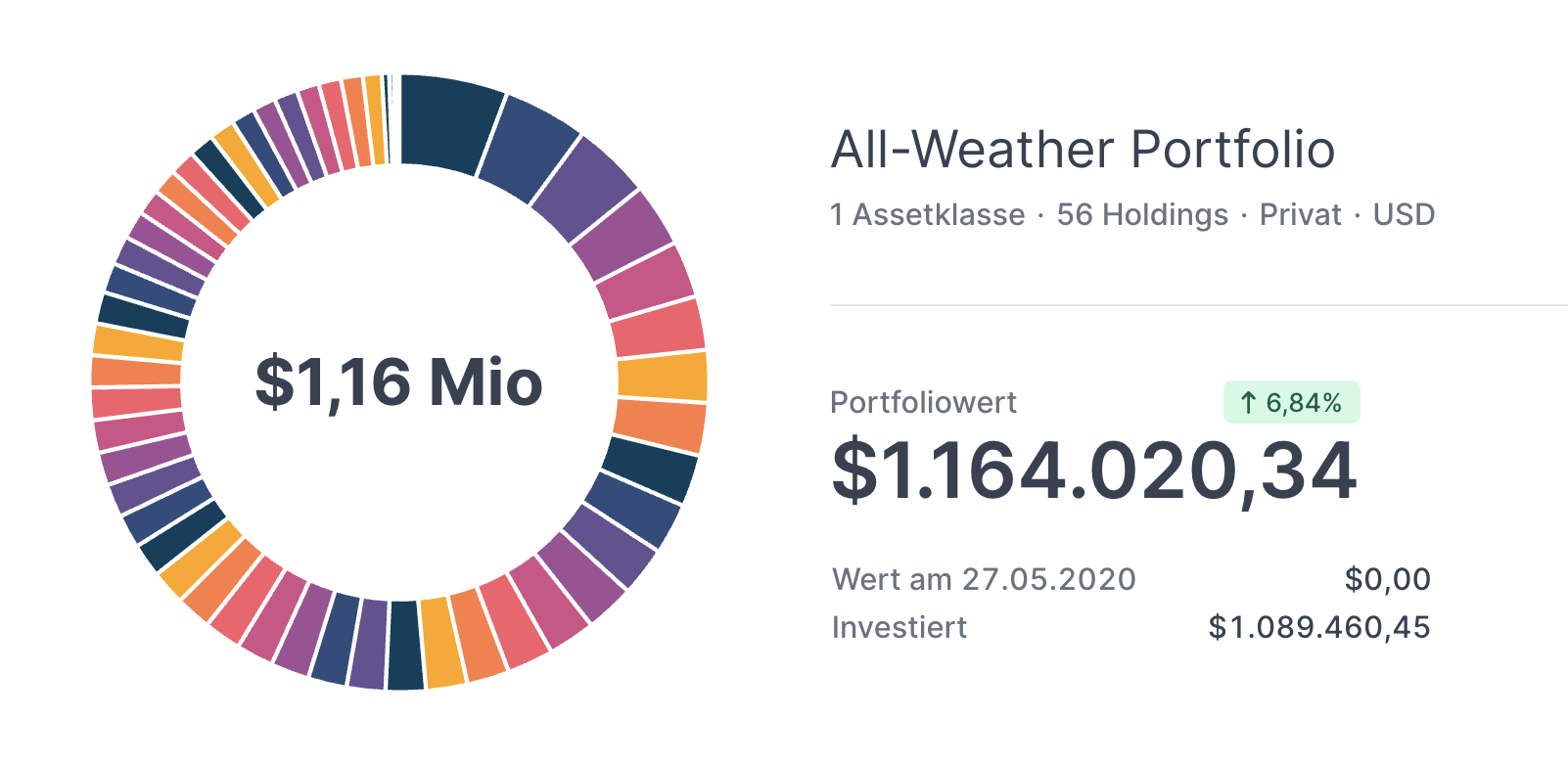

My All-Weather Portfolio is now at roughly $1.16 Mio US. I so far invested $1.08 Mio US in it, meaning gains from stock price increases contribute to about $76k.

Since I started dividend investing in May of 2020, my portfolio has paid me $76k in dividends.

Private Equity Update

I own shares in five private companies.

In July, I received $46,935 US in dividends from two of those.

In August, I bought out one shareholder who had an urgent cash need, paying him $200,000 US for his shares.

This transaction makes me now the largest shareholder in a Southeast Asian-based commercial property holding company.

Dividend Snowball Report For Jul/Aug 2024

Let’s check the monthly income for July & August and see if we can find evidence of an accelerating dividend snowball.

In July, I received the following dividends from my long-term All-Weather Portfolio:

| Dividends Jul’24 | ||

| Porsche | 350 | $782 |

| Brookfield | 730 | $259 |

| Alibaba | 1,500 | $229 |

| Cisco | 600 | $178 |

| Scottish Mortgage Trust | 6,000 | $152 |

| Pepsico | 120 | $146 |

| Avalon Bay | 100 | $145 |

| Realty | 460 | $103 |

| Disney | 225 | $91 |

| Mondelez | 275 | $82 |

| Total | $2,166 |

Compared to last year’s $1,651 US, we can see an increase of $515.

Throughout the twelve months, I added to most of the positions, but in general, each company raised its dividends.

Disney (DIS) and Alibaba (BABA) re-instated their distributions!

In August, I received the following:

| Dividends Aug’24 | Shares | Net Amount |

| CapitaLand India | 30,000 | $830 |

| Link REIT | 3,000 | $503 |

| Dexus | 2,900 | $385 |

| DBS | 770 | $311 |

| AbbVie | 150 | $198 |

| AT&T | 730 | $172 |

| PG | 200 | $148 |

| Realty | 460 | $103 |

| Welltower | 200 | $94 |

| Deere | 37 | $46 |

| Total | $2,791 |

Compared to the previous year’s $1,932, another healthy increase of $859.

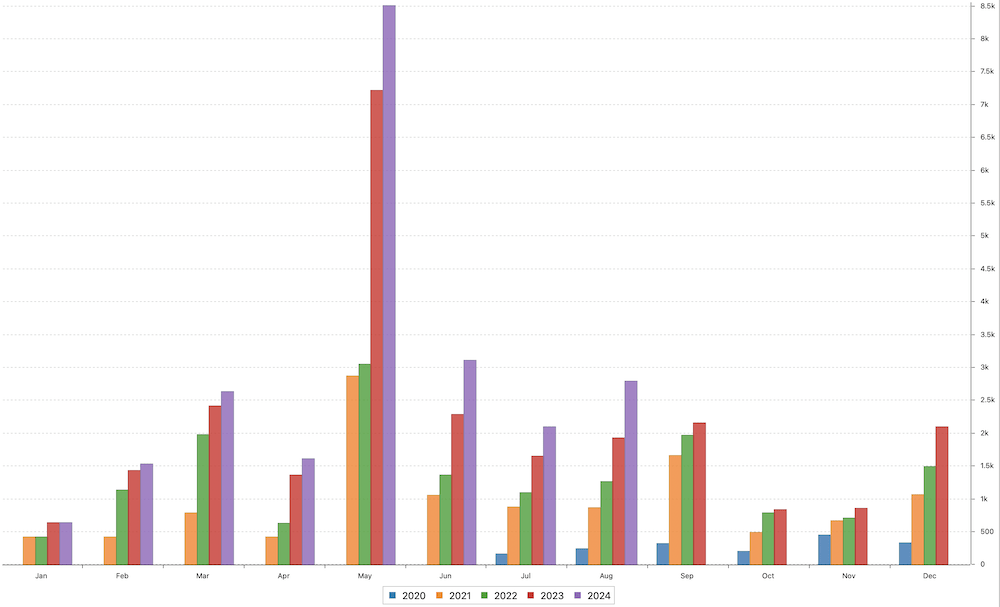

I am not interested in the granular details. But when looking at the purple bars on the following chart, we can see clear signs of the dividend snowball effect.

In 2024, I received a total of $22,900 US in the form of pure passive income.

I love it. No meetings. No employees. No negotiations. No broken pipes or windows. No commute. Just pure sweet passive income.

Making The Dividend Snowball Larger

With the fresh $50k USD ($46k + $2.1k + $2.8k), I used most of it to pay for the shares and also invested some in the following dividend stocks:

| Purchases | ||

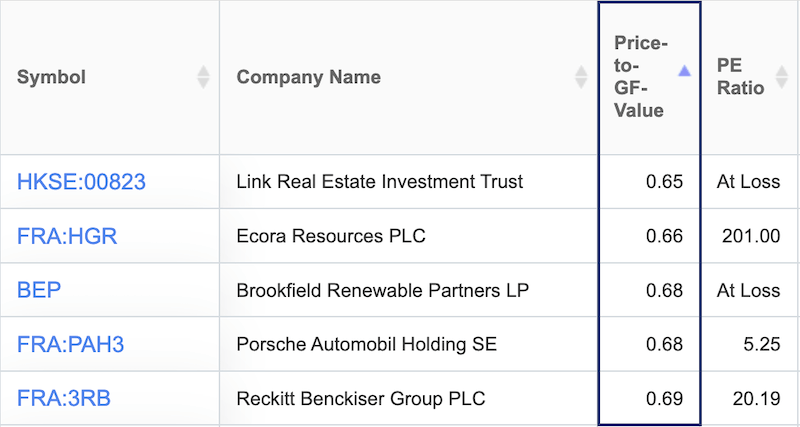

| Link REIT | 2,000 | $8,225 |

| Rio Tinto | 70 | $4,482 |

| Reckitt | 75 | $4,310 |

| Franco Nevada | 4 | $498 |

| Brookfield | 10 | $244 |

| Total | $17,759 |

DCAing Into An ETF vs. Single Stocks

I find dollar-cost averaging into a stock ETF easier than adding to positions of single stocks.

With ETFs, you don’t have to think about which position to add; you blindly allocate, let’s say, $500 per month, and the ETF managers, or better, software, spreads your investment across its various holdings.

When managing a portfolio of single stocks, we need to choose which stock to buy and at what price. And this is where the input/output ratio of how much time you spend on such a task is critical. You don’t want to end up thinking for hours about where to invest your $500, as the opportunity costs are just too great.

What I do is look at the price-to-GF-value, and anything below 1 is usually undervalued. I don’t just buy stocks blindly following this ratio, but it helps me to come up with the first shortlist of candidates.

Income From Airdrops & Current Projects

In 2024, I so far received a little bit more than $19,000 in the form of airdrops, mainly from the following projects:

Plan For September

I am uber-bullish on two projects at the moment:

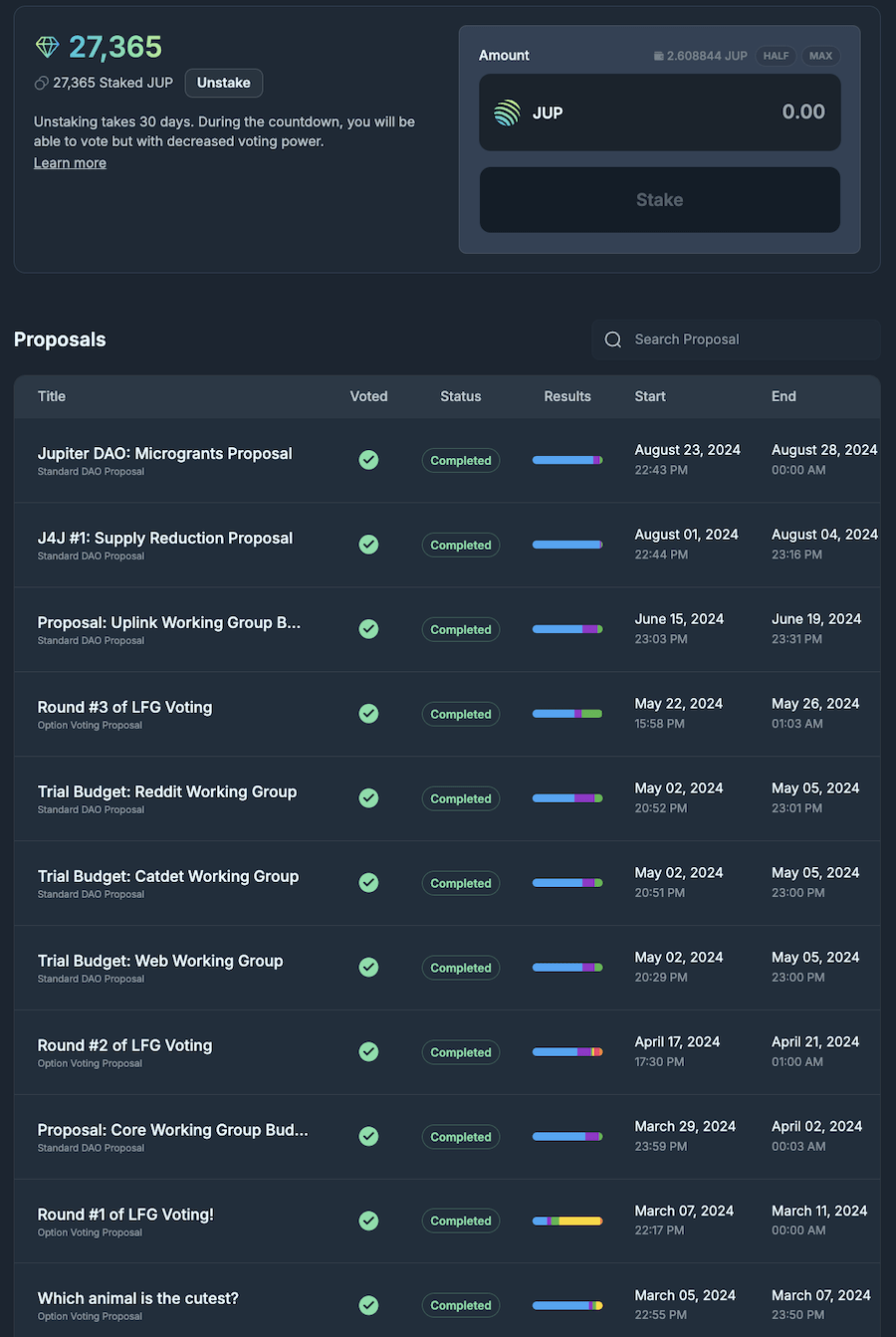

1/ Jupiter Exchange on Solana

My goal is to build a 50,000 JUP position in this decentralized exchange. When staking your JUP tokens, and voting on the various proposals, you get Active Staking Rewards – I believe this can easily be 10-12x from here.

To get started, visit the Jupiter Exchange website, buy some JUP tokens, and stake them (see governance tab).

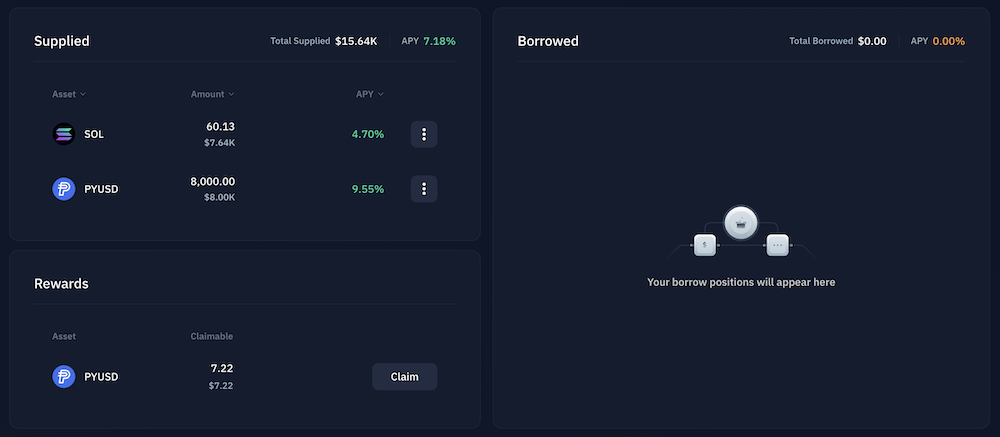

2/ Kamino Lending on Solana

Kamino is primarily a lending/borrowing platform on Solana, but it keeps adding new products every month. In my eyes, it has the next UX in the entire crypto space, and with a market cap of just $50 Mio US, while already having more than $1 Bio US in TVL, I can see this easily 15-20x from here.

I am currently borrowing $8,000 PUSD on MarginFi (PayPal’s stablecoin) for 6%, lending it out on Kamino for +10% (see the claim button).

I expect September to be quite volatile, with a good Q4 for the crypto market!

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love