FEATURED IMAGE by Kanchanara on Unsplash

3 Best Ways to Earn Yield on Bitcoin in 2025

If you’re wondering how to make your Bitcoin work for you, you’re not alone.

A reader of my blog recently asked me how to earn yield on Bitcoin, so I’m sharing my top three methods that I’ve used successfully for over two years, earning roughly 0.25 BTC in passive income.

These strategies are beginner-friendly, but I’ll also highlight risks to keep you informed. Let’s dive into how you can earn passive income with Bitcoin, mainly through lending and borrowing strategies.

To Get Started – Buying Bitcoin (If You Don’t Own Any Yet)

- Sign up on a trusted exchange: I use Kraken for its low fees or Coinbase for its reliability.

- Deposit funds: Add USD, EUR, or another currency via bank transfer or card.

- Buy Bitcoin: Swap your funds for BTC or set a limit order (which I always do).

- Withdraw your Bitcoin: Withdraw your BTC to a non-custodial wallet like Phantom (create a SegWit bitcoin address eg. bc1xxx…)

Pro Tip: Never leave large amounts of crypto on exchanges to avoid risks like hacks.

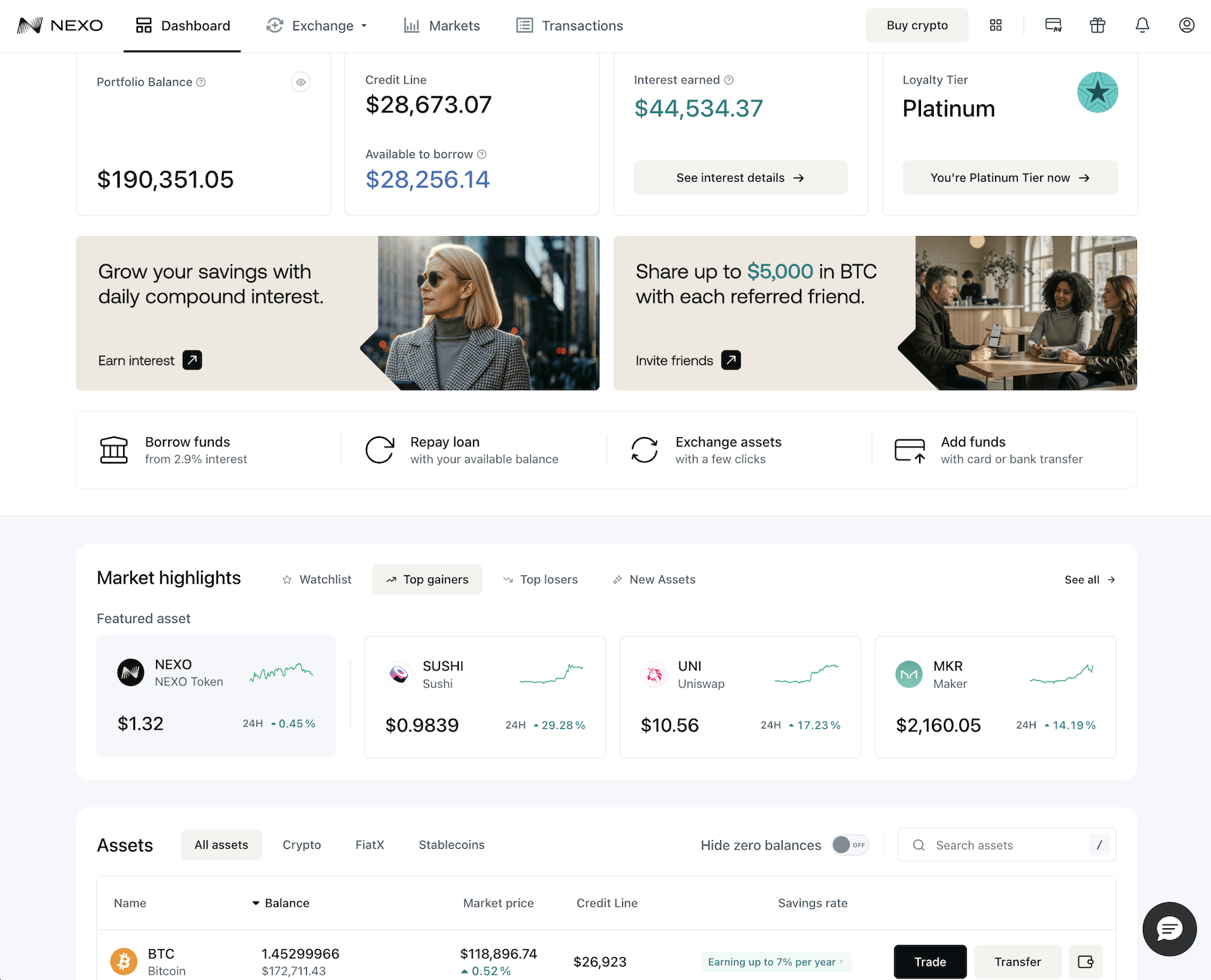

Option 1: Earn Yield on Bitcoin with Nexo

Here’s how it works

- Deposit Bitcoin: Transfer BTC from your wallet to Nexo.

- Choose your yield: Earn in BTC or Nexo’s native token, NEXO, for a 2% higher yield (I chose to earn in Nexo tokens)

- Maximize perks with Platinum status: Hold at least 10% of your portfolio in NEXO tokens to unlock the highest yields (up to 7% APY as of 2025) and benefits like free withdrawals, 2% cashback with the Nexo credit card, etc.

I prefer earning in NEXO tokens to keep my Platinum status, which boosts returns and perks. However, be aware that Nexo is a centralized platform, so there’s counterparty risk if the platform faces issues.

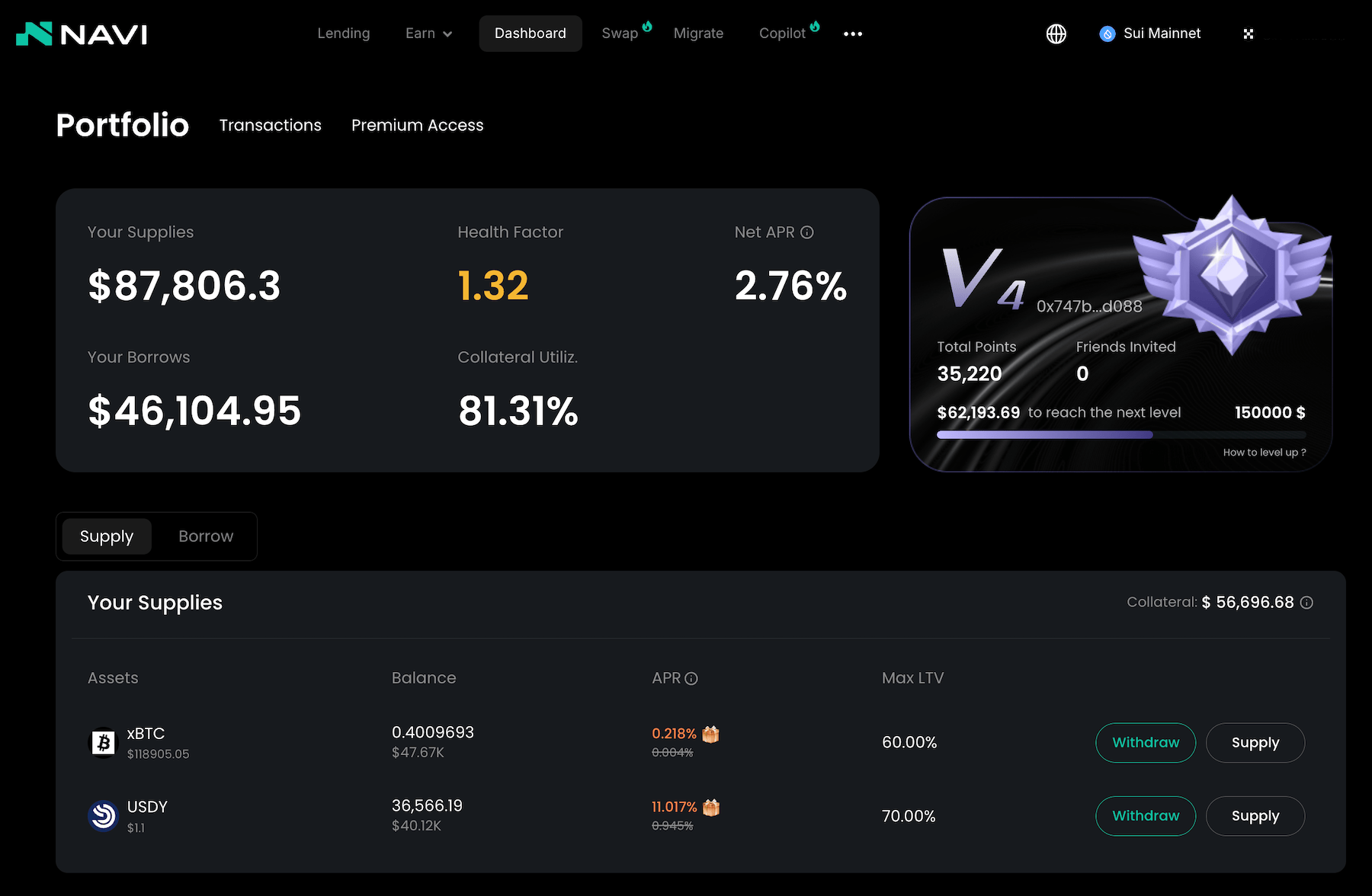

Option 2: Earn Bitcoin Yield on Sui with Navi Protocol

Best for: Intermediate investors comfortable with DeFi and on-chain wallets.

This method involves yield farming on the Sui blockchain using Navi Protocol. It’s a bit more technical but offers higher potential returns.

How to earn interest on Bitcoin on Navi (Sui Chain)

- Set up a Sui wallet: Install the Slush Wallet Chrome extension and create a SegWit Bitcoin address (starts with “bc1”).

- Transfer Bitcoin: Withdraw BTC from Kraken to your new Slush wallet.

- Get SUI tokens: Buy $2 worth of SUI on Kraken and send it to your Sui wallet for transaction fees as well.

- Convert to LBTC: Visit Lombard Finance to wrap your BTC into LBTC (takes 15–30 minutes).

- Deposit on Navi Protocol: Go to Navi Protocol, deposit your LBTC, and start earning yield (typically 4–8% APY).

Advanced Bonus Strategy

- Take out a loan against your LBTC (30–50% of your LBTC value, e.g., 10,000 USDC) on Navi.

- Deposit the USDC on AlphaLend to earn additional yield (e.g., 5–7% APY).

- Use the interest to buy more LBTC, compounding your returns.

- Bonus: You also earn points for future Navi or AlphaLend airdrops.

Risk Note: DeFi platforms carry smart contract risks, and liquidation is possible if LBTC’s value drops significantly. Monitor your loan-to-value ratio closely.

Option 3: Earn Yield on Bitcoin with zBTC on Solana

Best for: Investors interested in Solana’s ecosystem and higher yields.

This strategy uses Solana’s Kamino Finance to earn yield on zBTC, a wrapped Bitcoin token.

Here’s how to earn BTC yield on Solana

- Set up a Bitcoin wallet: Use Phantom, Solana’s most popular wallet to create a Bitcoin address.

- Transfer Bitcoin: Send BTC from Kraken or Nexo to your Phantom wallet.

- Convert to zBTC: Visit Apollo by Zeus to swap BTC for zBTC.

- Deposit on Kamino: Go to Kamino, deposit zBTC, and start earning yield (typically 5–9% APY).

Advanced Bonus Strategy

- Borrow USDC or FDUSD against your zBTC (e.g., at 3.5% APR).

- Lend the borrowed funds on another platform (like Drift Protocol) for 6–8% APR.

- At month-end, repay the loan and convert profits into more zBTC.

Risk Note: Solana’s network can experience outages, and wrapped tokens like zBTC rely on bridge security. Ensure you understand these risks before proceeding.

Alternative Options for Yield on Other Chains

- Starknet: Deposit wBTC on Nostra, borrow ETH, and lend on Vesu

- Arbitrum: Deposit wBTC on Aave, borrow wstETH, and lend it out on Folks.Finance

- Base: Deposit cbBTC on Morpho, borrow, and lend it out on ExtraFi

Each chain has unique risks and rewards, so research platforms and gas fees before diving in, but all methods are good ways to earn yield on Bitcoin.

Conclusion

For many investors, Bitcoin forms a significant portion of their portfolio. Yet, it often sits unused in a wallet, missing out on potential growth.

By applying any of the methods outlined above, you can earn a yield on Bitcoin, around the clock, every day.

📘 Read Also

- Why I Bought $30,000 Worth Of This Global Conglomerate Stock

- The 3 Best Australian REITs To Buy

- Stablecoin Farming 101: How I Generate 15%+ Returns

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love