Passive Income Overview – June 2024

Last month, June 2024, marked my second-best month in my four-year dividend investing journey.

Here’s a breakdown of the 17 dividends I received from the stocks in my All-Weather Portfolio.

| Shares | Amount | |

| Vonovia | 800 | $792 |

| Ecora Resources | 14,000 | $303 |

| Enbridge | 510 | $290 |

| Shell | 350 | $241 |

| Unilever | 650 | $227 |

| Pfizer | 600 | $176 |

| Anheuser | 275 | $169 |

| Sixt | 50 | $154 |

| Tencent | 400 | $126 |

| Public Storage | 45 | $115 |

| Kraft-Heinz | 400 | $112 |

| Realty | 460 | $103 |

| BlackRock | 26 | $101 |

| J&J | 80 | $89 |

| Union Pacific | 75 | $83 |

| Franco Nevada | 123 | $38 |

| Total | $3,106 |

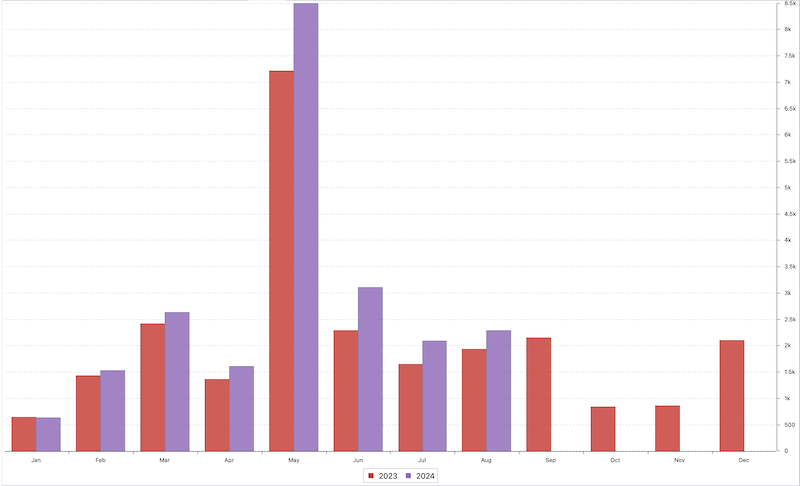

Last year, I received $2,135 (see report here), and the year before that, $1,232.

This June, I earned $3,106—an increase of $971 from last year. Unsure though how much of this if because of the dividend snowball or how much is due to the fact that I just invested quite a bit more cash since then.

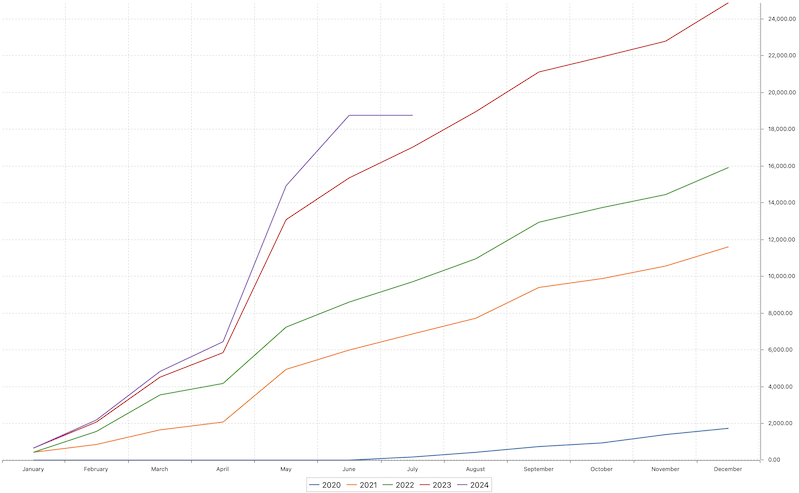

Income Overview Chart – Year On Year

Income Overview Chart – Accumulated

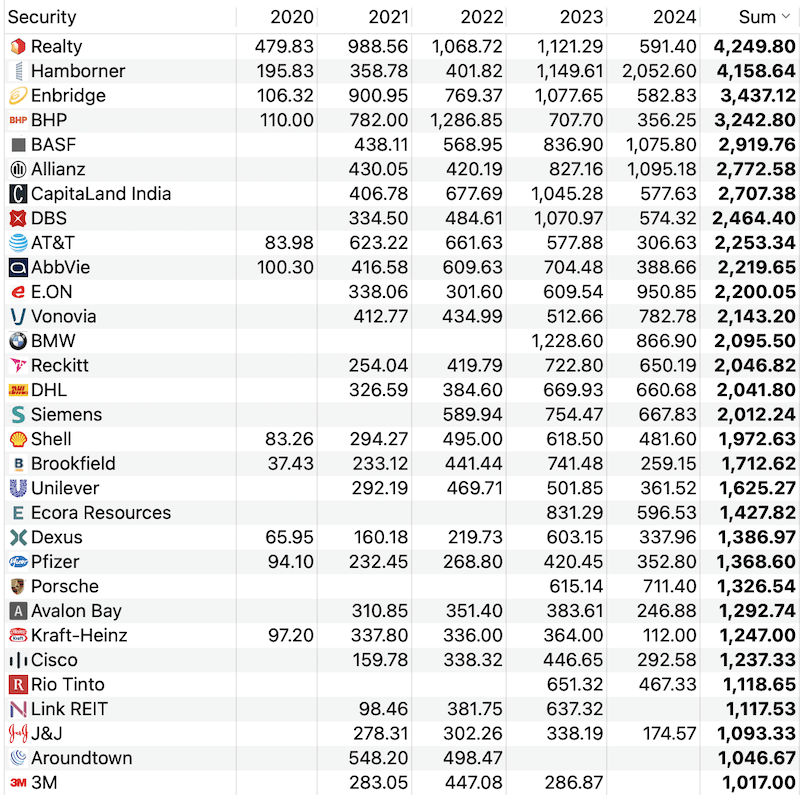

Here are all the dividend stocks that have paid me more than $1,000 since I started investing in May 2020.

Since then the only position I sold was $MMM.

Income Overview – Purchases In June

To ensure this growth continues, I purchased the following stocks worth $24,800:

| Purchases | Shares | Amount |

| Unilever | 150 | $8,477 |

| Cisco | 100 | $4,749 |

| CapitaLand India | 4,500 | $3,323 |

| Procter & Gamble | 50 | $8,256 |

| Total | $24,804 |

Why I Bought These Shares

- Unilever (UL): I invested in Unilever due to its bold decision to spin off its ice cream business with targeted cost-cutting measures & a productivity program, and a new focus on core flagship brands. All of this will unfortunately result in about 7,500 job losses, but at the current level, I believe it is undervalued and poised to benefit from these initiatives.

- Cisco (CSCO) & Procter & Gamble (PG): Both companies have shown strong recent numbers, and I am confident in their long-term potential.

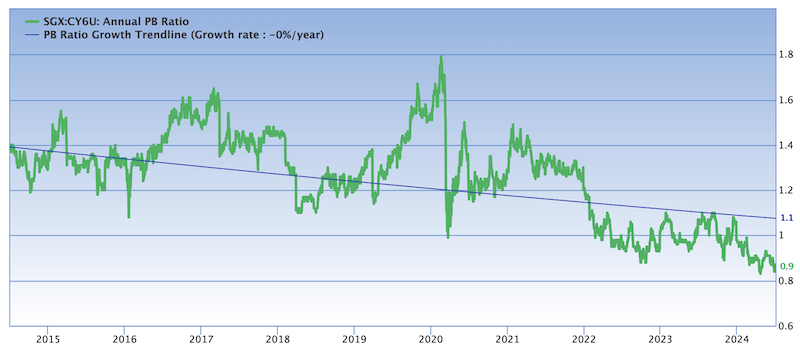

- CapitaLand India (ACNDF): This was the most challenging purchase. The stock price is at a historic low, with its price-to-book (PB) ratio at an all-time low, reflecting extreme pessimism. Historically, my best buys have been when I felt almost ‘sick’ purchasing the stock. Recent insider buying gives me confidence that we are through the worst.

Trading Account Orders

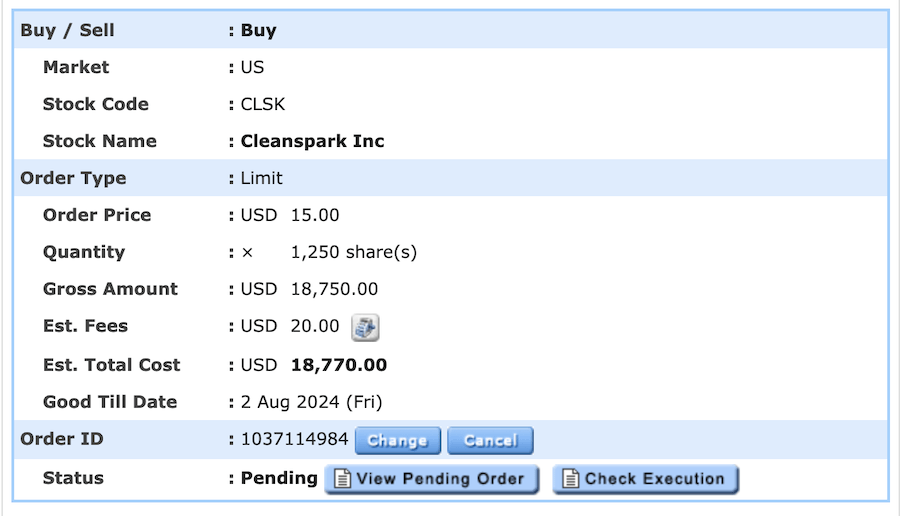

I am patiently waiting for the following two orders to be filled

- 450 x Paypal (PYPL) at $55, closing a gap that has been open for a long time

- 1,250 x Cleanspark (CLSK) at $15, expecting it to be filled today, below is the order ticket

I want to use the recently high volatility to snipe some of the stocks I believe will do well in the coming 6-12 monhts.

Conclusion

I am wrapping up my 2nd best month and the journey of dividend investing continues to be rewarding.

I am excited about the future potential of my portfolio, and I look forward to seeing how it will further develop.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love