Key Takeaways

☑️ There are only a handful of listed car rental stocks

☑️ It’s a competitive market with few dominant players

☑️ The largest car rental company is privately-owned

☑️ Avis and Hertz are drowning in debt

☑️ I like Sixt the most

We all rent cars at airports and train stations all the time – but have you ever wondered what actually the largest car rental companies are?

Who’s behind those companies, and what are the 5 best car rental stocks? Do some of them even have attractive valuations, and pay interesting dividends?

Let’s take a look.

The World’s Largest Car Rental Companies

| Symbol | Revenues | Fleet Size | |

| 🇺🇸 Enterprise Group | private | 17.4 Bio | 1.9 Mio |

| 🇺🇸 Hertz | HTZ | 9.8 Bio | 0.57 Mio |

| 🇺🇸 Avis | CAR | 9.1 Bio | 0.55 Mio |

| 🇫🇷 Europcar | private | 3.5 Bio | 0.34 Mio |

| 🇩🇪 Sixt | SIX3 | 2.8 Bio | 0.30 Mio |

| 🇨🇳 China Auto Rental. | private | 2.2 Bio | 0.18 Mio |

| 🇧🇷 Localiza | LZRFY | 0.6 Bio | 0.27 Mio |

Surprising to learn that the world’s largest car rental company, Enterprise Group, with brands such as Enterprise, Alamo, or National, is a private company and is not traded on the public markets.

It’s owned company by the Taylor family, according to Forbes the 48th richest family, which maintains majority ownership and control of the company.

The largest publicly-listed car rental firm by revenue is Avis, which also owns the famous Budget brand.

5 Largest Publicly-Listed Car Rental Stocks

The largest, The Enterprise Group, 4th-largest, Europar, and 6th-largest, China Auto Rental, car companies are private enterprises.

Let’s look at the five largest publicly-listed car rental stocks, by market cap, PE, PS, and their respective net margins in %:

| M Cap (B $) | PE | PS | Net Margin % | |

| 🇺🇸 Avis | $9,429 | 4 | 0.8 | 19.5% |

| 🇺🇸 Hertz | $5,958 | 6 | 0.5 | 20.5% |

| 🇧🇷 Localiza | $15,467 | 38 | 3.0 | 8.4% |

| 🇩🇪 Sixt | $5,113 | 15 | 1.6 | 10.7% |

| 🇰🇷 Lotte Rental | $769 | 10 | 0.3 | 3.5% |

Let’s look at the sales, EBITDA, and debt growth of these companies.

| 3yr Sales Growth | 3yr EBITDA Growth | 3yr Debt Growth | |

| 🇺🇸 Avis | 30% | 43% | 7% |

| 🇩🇪 Sixt | 24% | 11% | -10% |

| 🇧🇷 Localiza | 15% | 38% | 51% |

| 🇺🇸 Hertz | -13% | -10% | -6% |

| 🇰🇷 Lotte Rental | -25% | -25% | 5% |

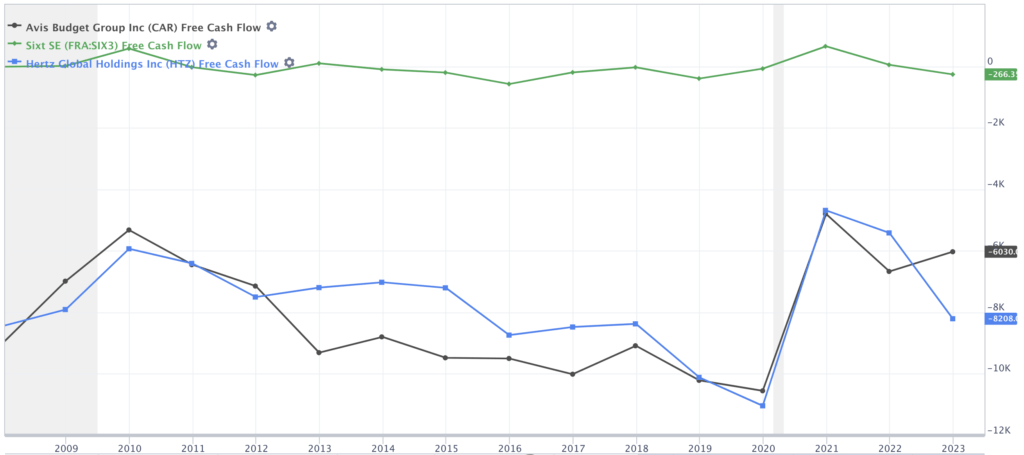

At first glance, Avis, with clearly the best ticker symbol, $CAR, looks like a clear winner, but when we dig deeper and check out the free cash flows each of the car rental stocks generate, we conclude something differently:

The above chart goes back 15 years (!) and shows that both $CAR and $HTZ did not have one year with positive free cash flow. Major ouch. Only $SIX3 is close to having positive free cash flow.

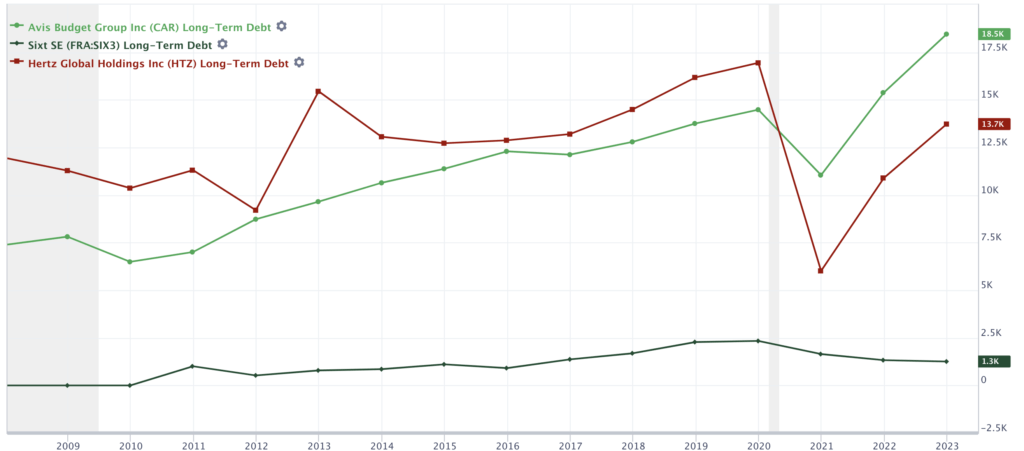

Next, let’s check out the 15-year long-term debt:

We see that $CAR and $HTZ are drowning in debt. $SIX3 has been able to not take on too much debt and has been reducing it since 2020.

Let’s now look at the operating margins:

As the market is extremely competitive, no surprise that all three leading car rental companies have similar operating margins, ranging between 23-35%

In my point of view, $CAR and $HTZ have too much debt – and without one year of free cash flow in the past 15 years, I can not consider them.

Last but not least, let’s look at the dividends of all car rental stocks:

| Company Name | Yield % | Payout Ratio | Next | Frequency |

| 🇩🇪 Sixt | 5.9% | 51% | 2023-05-26 | 1 |

| 🇰🇷 Lotte Rental | 3.4% | 33% | 2023-04-21 | 1 |

| 🇧🇷 Localiza | 1.9% | 80% | 2023-08-24 | 4 |

| 🇺🇸 Hertz | – | – | 0 | |

| 🇺🇸 Avis | – | – | 0 |

So Avis and Hertz don’t pay any dividends (no surprise without any free cash-flow!).

This seals the deal for me and leaves us with one clear winner.

🏆 My Favorite Car Rental Stock – Sixt

My personal experience when renting cars (mainly at the Munich airport) was the following:

- Europcar was lousy

- Avis was okay

- Sixt was excellent

Others I haven’t tried yet.

So, yes, I am biased, but you can also call it relevant first-hand experience!

Why Do I Like Sixt?

Sixt (SIX3), the preferred shares (“Vorzugsaktien” in German), have enjoyed steady growth over the years, making it an attractive stock to own for investors looking for potentially rewarding long-term gains.

I like the preferred shares more than the ordinary shares (SIX2) for several reasons:

- The Sixt family controls +50% anyways, making the right to vote pointless

- The preferreds are also substantially cheaper

- They also pay a slightly higher dividend

Edgy Advertising

Sixt’s advertising is edgy and fun. We have seen in almost every airport in the world its eye-catching, orange billboards.

The Sixt Shareholder Discount

As a Sixt shareholder, you are entitled to get a special shareholder discount (“Aktionärstarif” in German), regardless of how many shares you own!

This offer aims to reward shareholders with up to 20% off their car rental bill (!).

To me, this dividend in kind is HUGE, because I spend about $2,500 per year with Sixt anyways, when renting the car for our summer holidays.

Sixt Shareholder Discount Back-Of-The-Envelope Calculation:

- Bought 50 Sixt shares for $3,832

- My rented car in Aug’2023: $2,750 (2,515€, see below)

- Sixt shareholder discount: 15% or $415

- regular Sixt stock dividend: $4,50 per share (5.8% yield!)

- so, on top of the already high dividend, I further get a discount of $415

- $415/50 shares equal $8,30 US per share

- total dividends: $4,50 + $8,30 = $12,80 representing a yield of 18% (!)

- This makes me an even more loyal customer!

How cool is that?!

Here’s my upcoming Sixt booking of an Audi A4 Combi, for my upcoming family trip in Europe (34 days!):

Sixt Is A Family Business

At the same time, they can be more flexible and agile, as they essentially can do whatever they think is right for the business.

Strong Global Presence

Sixt has established itself as a leading player in the global car rental industry with a presence in dozens of countries. Its eye-catching corporate design can be found in almost every major airport. This global reach positions Sixt advantageously compared to competitors, especially in terms of capturing international travel demand and benefiting from diverse revenue streams.

Sixt Embraces Innovation and Technology

Sixt has been proactively adopting new tech and embracing digitalization, for example, its apps are great and the reservation systems are fast and work great.

They also experiment with integrating innovative solutions such as keyless car rentals, digital vehicle management, and tailored loyalty programs, making me confident that they will be on top of things for years to come.

Beneficiary of Autonomous Vehicles

Conclusion

As a happy Sixt customer myself, I appreciate getting the shareholder discount of 5-20% on cars I would rent anyways from them. The high yield of currently 5.9% per year, in combination with an attractive valuation makes it easy for me to add Sixt to my All-Weather Portfolio.

📘 Read Also

- The 5 Best Car Companies With Dividends

- The 10 Best Luxury Stocks In The World

- How To Invest In Battery Metal Stocks

- What Is My Current Net Worth?

FAQ

How do car rental companies make money?

Car rental companies mainly make money through the rental fees they charge you for using their vehicles. Here’s a total overview of what ways car rental generate revenue:

1/ Rental Fees

2/ Additional Services such often optional insurance coverage, GPS navigation systems, roadside assistance, etc.

3/ Corporate Accounts: special agreements with corporations, government agencies, and other organizations.

4/ Vehicle Sales: periodically car rental companies sell off used vehicles which can lead to margins

What is the best car rental stocks to buy?

What are the largest car rental companies?

The largest car rental company is The Enterprise Group, a privately held company. The next largest are Avis, Hertz and Germany-based Sixt (the author’s favorite car rental stock).

Which car rental company is publicly listed?

Hertz or Avis – which one is bigger?

Avis used to be the number 2 (with the slogan “We try harder”), but recently it overtook Hertz as the largest listed car rental company. The largest car rental company in the world is The Enterprise Group, a privately held company, owner by the Taylor family.

Best Car Rental Stock - Sixt

After reviewing all car rental stocks, Sixt is my clear winner!

PROS

- Edgy Advertising

- Shareholder Discount

- A Family Business

- Strong Global Presence

- Embraces Innovation and Technology

- Beneficiary of Autonomous Vehicles

CONS

- Competitive saturated market

- Bad reviews on Trustpilot

- Cyclical business

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love