Cheers To The Next 5,000 Years!

People have loved drinking beer for 5,000+ years since it was invented 3,500 BCE in Persia (now Iran), making it 5,000 years that people are enjoying and drinking beer! I believe people will not change, and keep on enjoying and drinking beer for many more thousands of years.

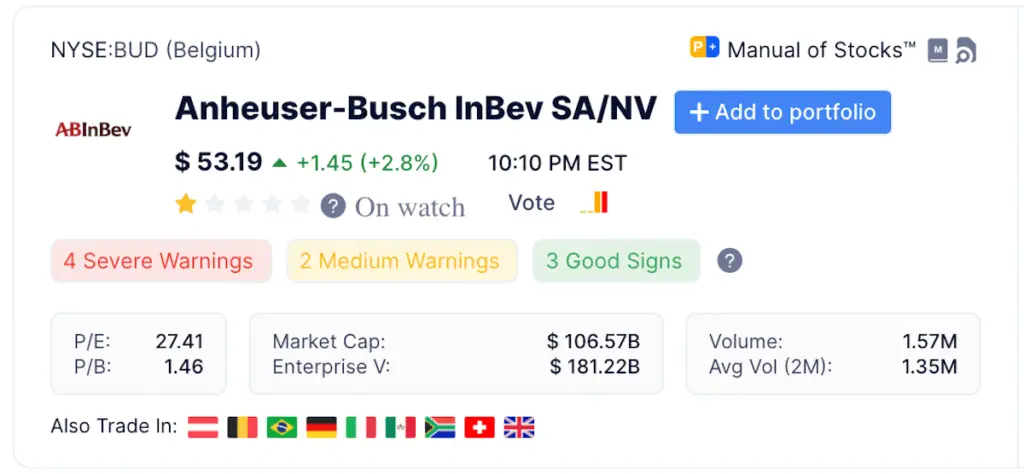

In this post, I review the beer stock Anheuser-Busch. In my opinion, the world’s best company and beer stock to put in your portfolio, and say ‘cheers’ to!

At A Glance

Anheuser Busch ($BUD, $FRA:1NBA) is the world’s largest beer company. Its history goes back hundreds of years, but to keep it short, in 2004, an American company called Ambev merged with the Belgian beer company Interbrew to form InBev.

And in 2016, InBev merged with another American company Anheuser-Busch to form Anheuser-Busch InBev. For the remainder of this article, I refer to Anheuser-Busch InBev simply as Anheuser Busch, or in short, $BUD.

Anheuser’s Brand Portfolio

Ask 10 beer lovers about their favorite beer and you get 12 different answers. Beer lovers are a tribal bunch, passionately arguing for and defending their favorite brand. Personally, although I am from Germany, I love Stella Artois the most, a beer from Belgium.

| Global Brands | Local Brands | German Brands |

| Budweiser | Julius | Beck’s |

| Corona | Jupiler | Diebels |

| Stella Artois (my favorite) | Leffe | Franziskaner |

| Beck’s | Piedboeuf | Haake-Beck |

| Leffe | Safir | Hasseröder |

| Hoegaarden | Vieux Temps | Löwenbräu |

When comparing $BUD with other ‘peer’/beer stocks, you can see that it is twice the size of its next competitor, Heineken. The business of all of those great beer companies has been significantly impacted by the global pandemic between 2020 till now (2022/08). Most bars, restaurants, pubs, clubs, festivals, and other venues had to close due to the lockdowns, driving a wedge into Anheuser Busch’s dividend compounding machine.

| Company Name |

Market Cap ($M) |

Revenue ($M) |

Rev Growth (5yr) |

EBITDA % |

Net Margin % |

| Anheuser-Busch (owned) |

$106,567 |

56,499 | -1.20 | 21.63 | 6.91 |

| Heineken NV |

$55,729 |

27,736 | -0.10 | 28.43 | 13.99 |

| China Resources Beer |

$22,419 |

5,215 | 2.30 | 18.54 | 13.67 |

| Carlsberg A/S |

$18,258 |

10,444 | 2.00 | 23.24 | 10.27 |

| Asahi Group |

$17,460 |

20,165 | 1.90 | 13.70 | 5.48 |

| Tsingtao Brewery |

$17,269 |

4,755 | 2.60 | 15.20 | 10.71 |

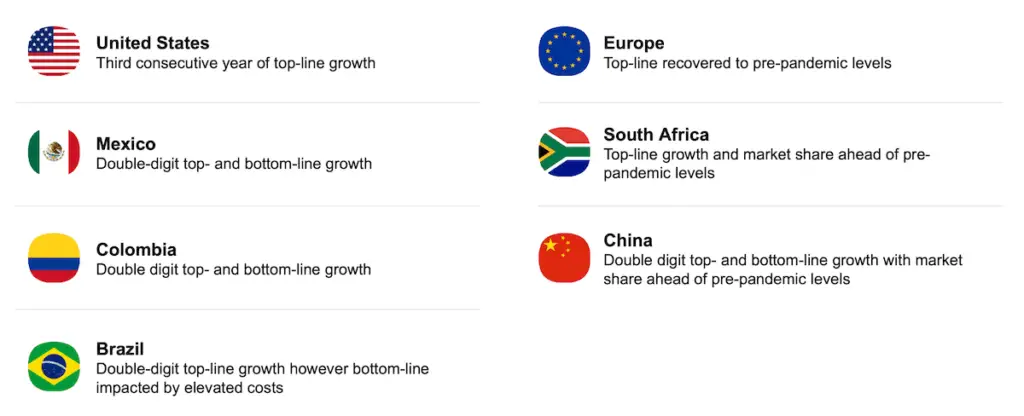

Although 2020 and 2021 were challenging years for any beer company, there are already signs that things got better in 2021, as shown from Anheuser Busch’s Investor Presentation below:

The regular reader of this blog knows that I gravitate towards the category leaders of each industry I am investing in. Be it Kraft-Heinz as the number #1 in Ketchup or PepsiCo as the number #1 in soft drinks, most of these category leaders have multiple characteristics in common, which I also see for $BUD, outlined below.

Did You Know?

The founder of Budweiser, one of Anheuser Busch’s flagship brands, was a German called ‘Adolphus Busch’, who left Germany in 1857 and settled in the U.S. in 1857.

5 Reasons Why I Believe BUD Is The #1 Beer Stock

1/ Economies of Scale

$BUD is a juggernaut of a company. With a market cap that is double of the 2nd largest competitor, Heineken (HEINY), Anheuser Busch is the 800-pound gorilla in the room. This always brings unique advantages with it, be it financial resources, required size to make large acquisitions, attractiveness to attract (and retain) the best employees, etc. The resulting market power enables $BUD to have profit margins of 30%, generating $15 BIO USD in operating income (pre-pandemic). Insane!

$BUD" width="700" height="210" />

$BUD" width="700" height="210" />

2/ Global Footprint & Local Expertise

Anheuser Busch’s products are basically available in any country in the world. And not only that, but in some key markets, like in Latin America, it owns a subsidiary called Ambev (also stock listed $ABEV), manufacturing beer and carbonated soft drinks. By owning dozens of breweries across Europe, $BUD has the know-how, connections, resources, and staying power required to survive in this competitive but humongous market.

3/ Wide & Deep Brand Portfolio

With a global market share of 27%, $BUD is the clear leader in the beer business and the leading beer stock in the world. It owns 8 of the 10 largest beer brands in the world (!).

4/ Beer – Loved By People All Around The World

As I wrote in the opening of this article, people drink beer for more than 5,000 years, and although there are some concerns about people preferring more healthy drinks in the future, I can tell you out of experience that wherever you go in the ‘New World’, e.g. be it emerging Southeast Asian countries, South America or the Middle East, you see people having a great timing drinking and enjoying beer. It is so deeply rooted in us humans that I can not imagine a world without beer, and by buying $BUD, essentially you are betting on this trend to continue by owning the best beer stock in the world.

5/ Deep Pockets To Finance Interesting Acquisitions

According to Tracxn.com, Anheuser made 3x acquisitions since 2019, acquiring companies that are fast and agile, creating new types of beer resonating with their target consumer segment. With its strong balance sheet and large cashflows, it can easily keep on buying smaller competitors.

| Date | Company | Amount | Location |

| 2019 | Craft Brew Alliance | Undisclosed |

Portland, United States

|

| 2019 | Platform beer | Undisclosed |

Cleveland, United States

|

| 2019 | BABE | Undisclosed |

New York City, United States

|

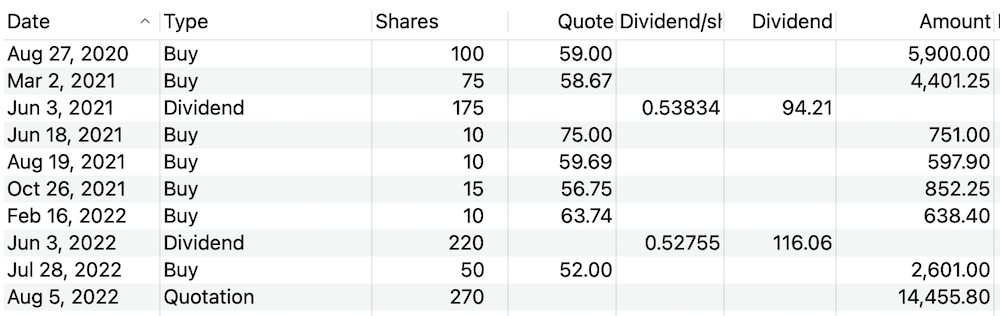

Purchase & Dividend History

I purchased my first stocks of $BUD in August 2020, and received two dividends so far.

$BUD used to pay a semi-annual dividend, but in the pandemic years of 2020 and 2021, it changed it to annual dividends.

| Reported Dividend | Pay Date | Type | Frequency |

|---|---|---|---|

| 0.543 | 2022-06-02 | Cash Div. | annually |

| 0.601 | 2021-06-03 | Cash Div. | annually |

| 0.567 | 2020-07-09 | Cash Div. | semi-annually |

| 0.886 | 2019-12-18 | Cash Div. | semi-annually |

| 1.122 | 2019-06-06 | Cash Div. | semi-annually |

| 0.909 | 2018-12-21 | Cash Div. | semi-annually |

| 2.390 | 2018-05-30 | Cash Div. | semi-annually |

Conclusion

There are not many products that I enjoy as much as those of Anheuser Busch. I am not a heavy beer drinker. I drink about 2-3 Stella a week, usually when watching sports, especially soccer. My investment thesis to buy this beer stock is that sooner or later $BUD will reach its former glory and payout substantially larger dividends than now. While I wait for this to happen, I remain calm, enjoying drinking an ice-cold Stella!

📘 Read Also

- Beer goes well with Chips from another buy and hold forever stock I love

- Read how I make money with solar panels

- Which video game stock do I love and like to add to my All Weather Portfolio

FAQ

What beer brands does Anheuser Busch own?

Too many to list, but the most essential ones are Budweiser Julius Beck’s, Corona, Stella Artois (my favorite Pilsner), Leffe, Franziskaner, Leffe, Hasseröder, Hoegaarden, and Löwenbräu.

Who owns the Anheuser-Busch beer company?

The company is the result of multiple larger mergers (Interbrew, InBev, Anheuser Busch, etc.), and the largest family owner used to be the Busch family. Nowadays, most of the shares are held by Institutions and mutual funds.

Is Anheuser Busch the biggest beer company?

Yes, measured by revenues and market cap, $BUD is the largest beer company in the world.

Why is Budweiser just called ‘Bud’ in some countries?

Due to a legal fight with another brand, Anheuser-Busch may not use its Budweiser trademark in some countries. The simple solution was to just call it ‘Bud’.

What beer is sold the most in Germany?

On the German market, the Radeberger Group (owned by the Oetker Group), with a range of different beer brands such as Jever, DAB, and Berliner Pilsner, is the brewery group with the highest sales. 2nd highest revenues are generated by Anheuser Busch, my favorite beer stock.

Which countries drink the most beer?

The country with the highest per capita consumption of beer is the Czech Republic 🇨🇿. The average per capita consumption totaled around 182 liters. Austria, Poland, and Romania follow in the ranking. Namibia, the first country outside of Europe, is in seventh place. What happened to Germany, UK, and Ireland!? 😉

WiseStacker's Take

I love getting a dividend from a beer stock that is higher than the money I spend on its booze! More booze --> higher dividend! Well, sort of.

PROS

- Economies of Scale

- Global Footprint & Local Expertise

- Wide & Deep Brand Portfolio

- Beer - Loved By People All Around The World

- Deep Pockets To Finance Interesting Acquisitions

CONS

- Shrinking Beer Consumption

- Health Conscious Consumer

- Closed Venues Due To Pandemic

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love