Steady Dividend Growth: November Report

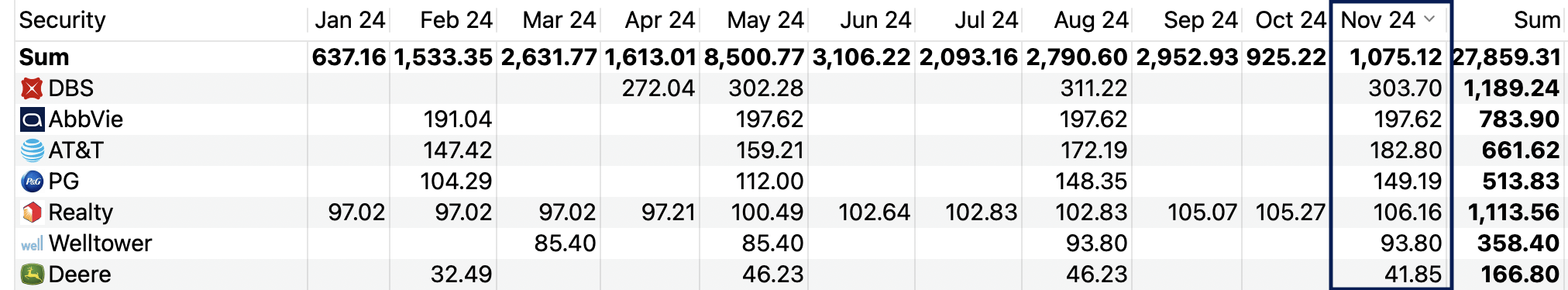

In November, I received $1,075 in dividend income from seven companies.

The largest contributor was DBS (FRA:DEVL), Singapore’s leading bank, which paid me $303 this month, adding up to $1,189 in dividends for 2024. Its strong balance sheet and consistent payouts highlight the value of steady dividend payers in my portfolio.

Another notable contributor was $DE, a position I built entirely with profits from crypto investments. This blue-chip stock now generates an annual dividend of $166.

I love converting high-risk gains into reliable, steady dividend streams, and building these cross-populating pairs: transitioning profits from volatile assets far out on the risk curve into traditional, old-world, blue-chip dividend stocks in my All-Weather Portfolio.

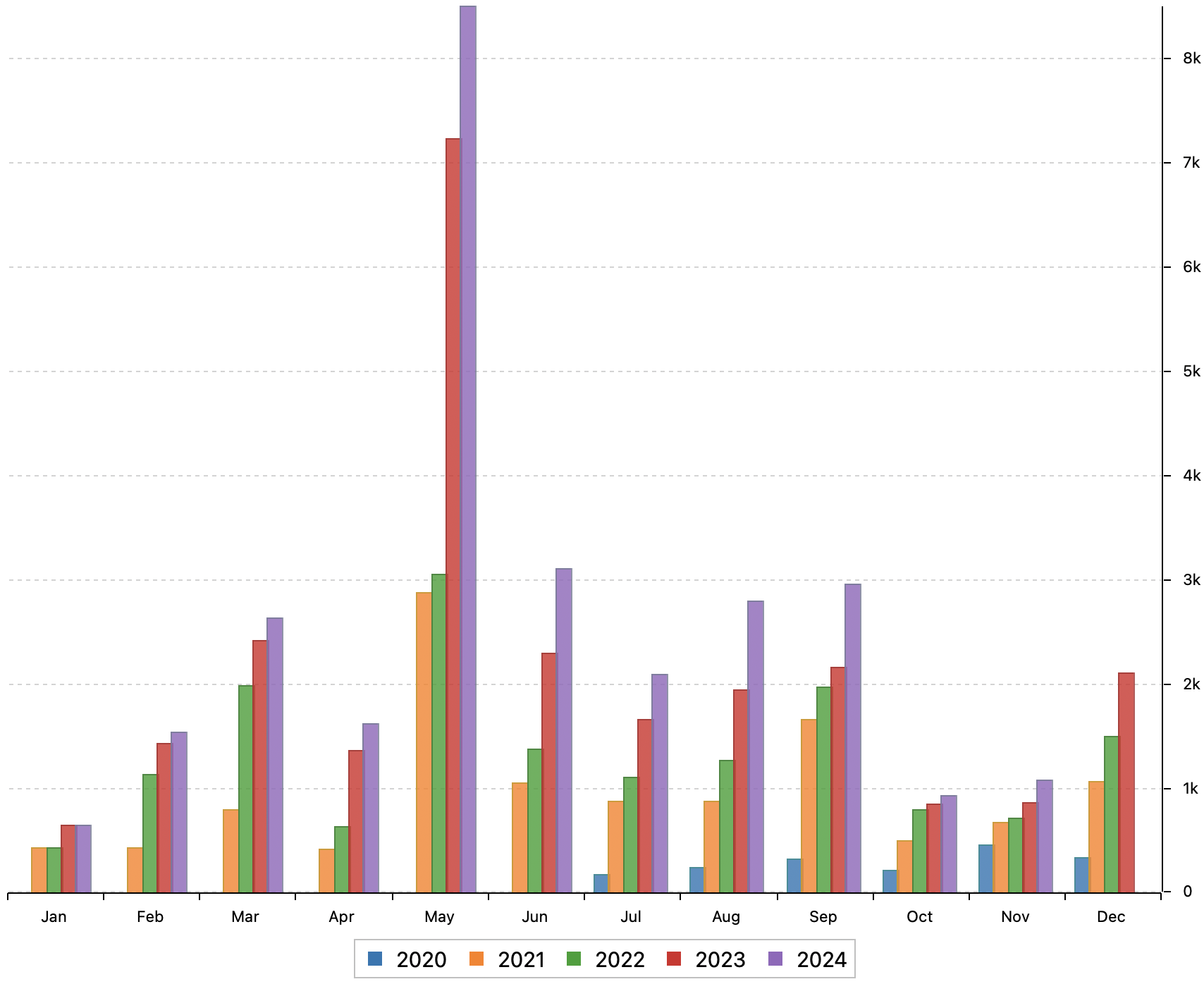

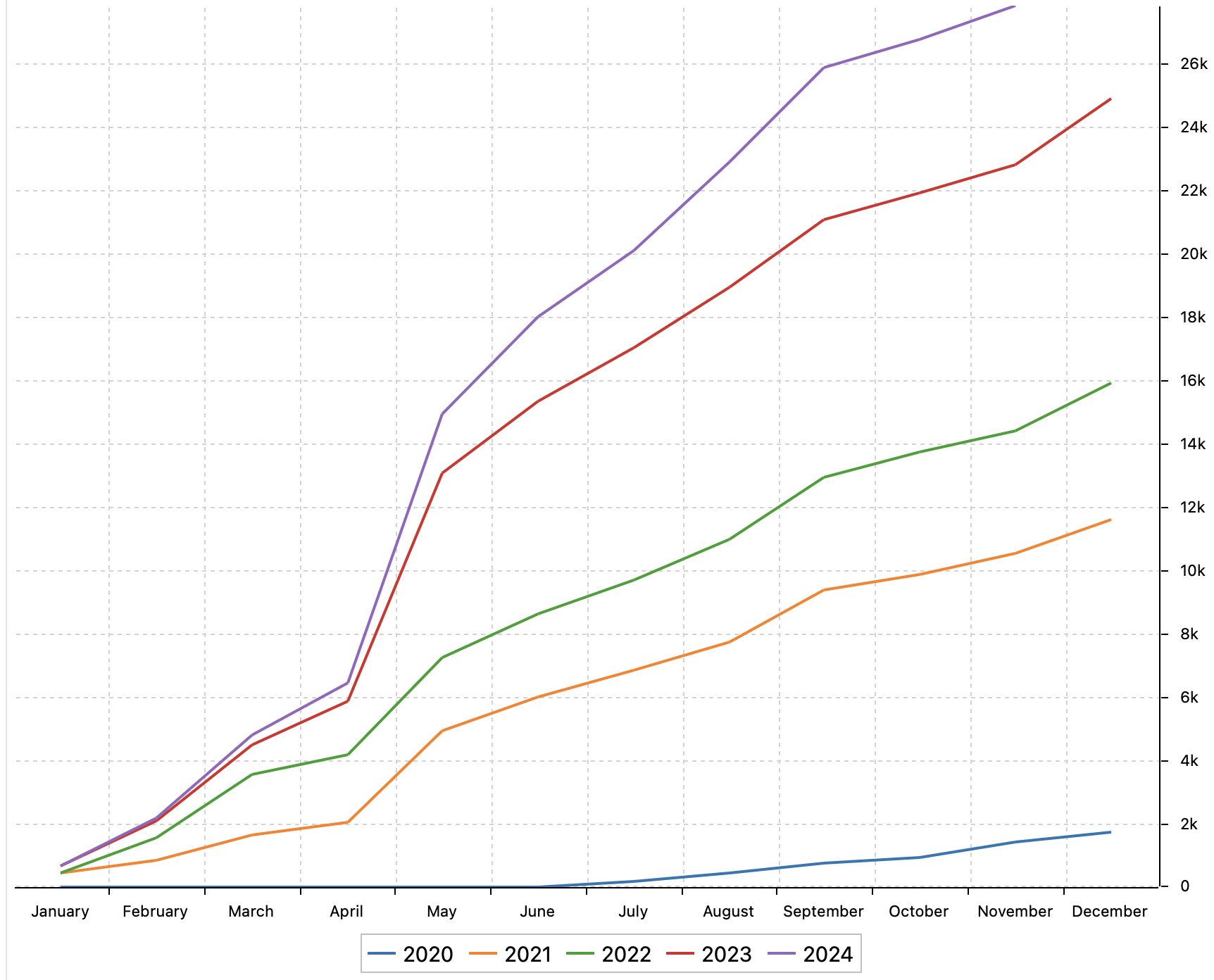

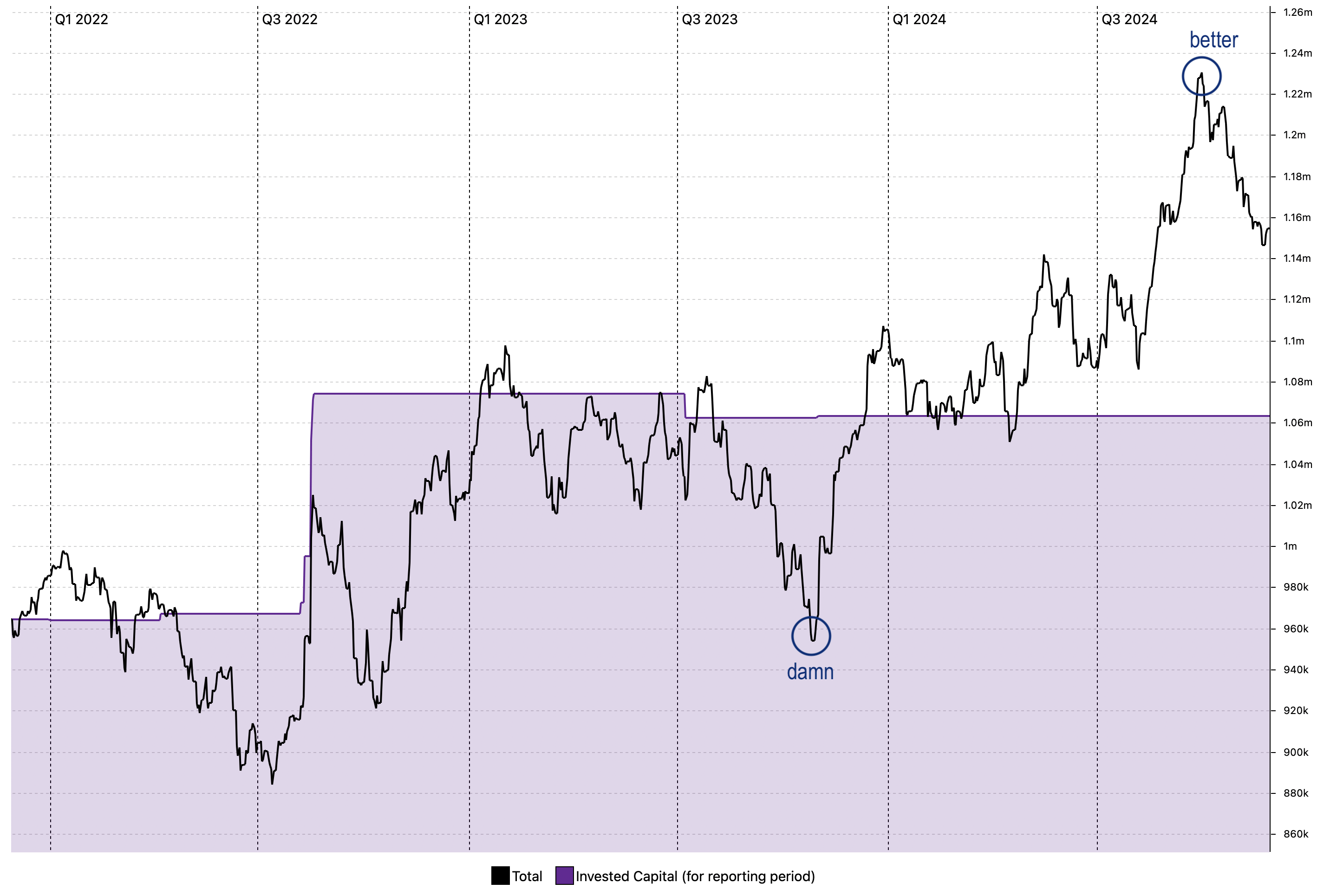

Dividend Progress

Below are charts showcasing the steady progress of my dividend income over time.

Watching this growth is a motivating reminder of the power of compounding and strategic reinvestment.

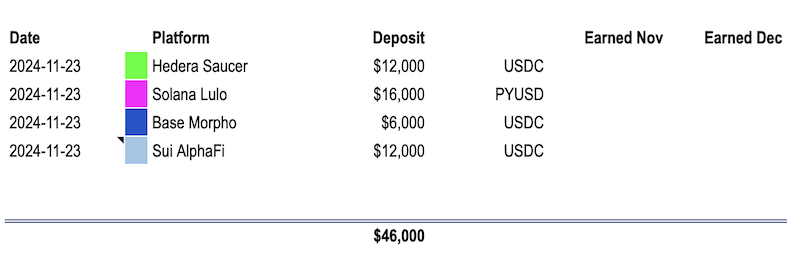

In my recent post, Crypto Gains of $2M, I shared how I began selling some of my positions and building a stablecoin farming portfolio. So far, I’ve allocated $46,000 across four platforms. Here’s a detailed overview.

At the end of each month, I’ll track my earnings, “harvest” the yields from each farm, and decide whether to reinvest for compounding or transfer the interest to Nexo. I can easily spend these crypto profits using my Nexo credit card as needed.

Dividend Stocks Purchased in November

This month, I invested a total of $10,700 into 2x high-quality companies, further building my portfolio’s capacity for generating steady dividends:

Steady Dividend Stock #1 – Reckitt Benckiser

-

- Added 75 shares to my position in $RBGLY, one of the world’s largest consumer goods companies, known for brands like Calgon, Durex or Dettol

- Despite recent challenges, the current valuation offers a compelling buying opportunity for this steady dividend payer

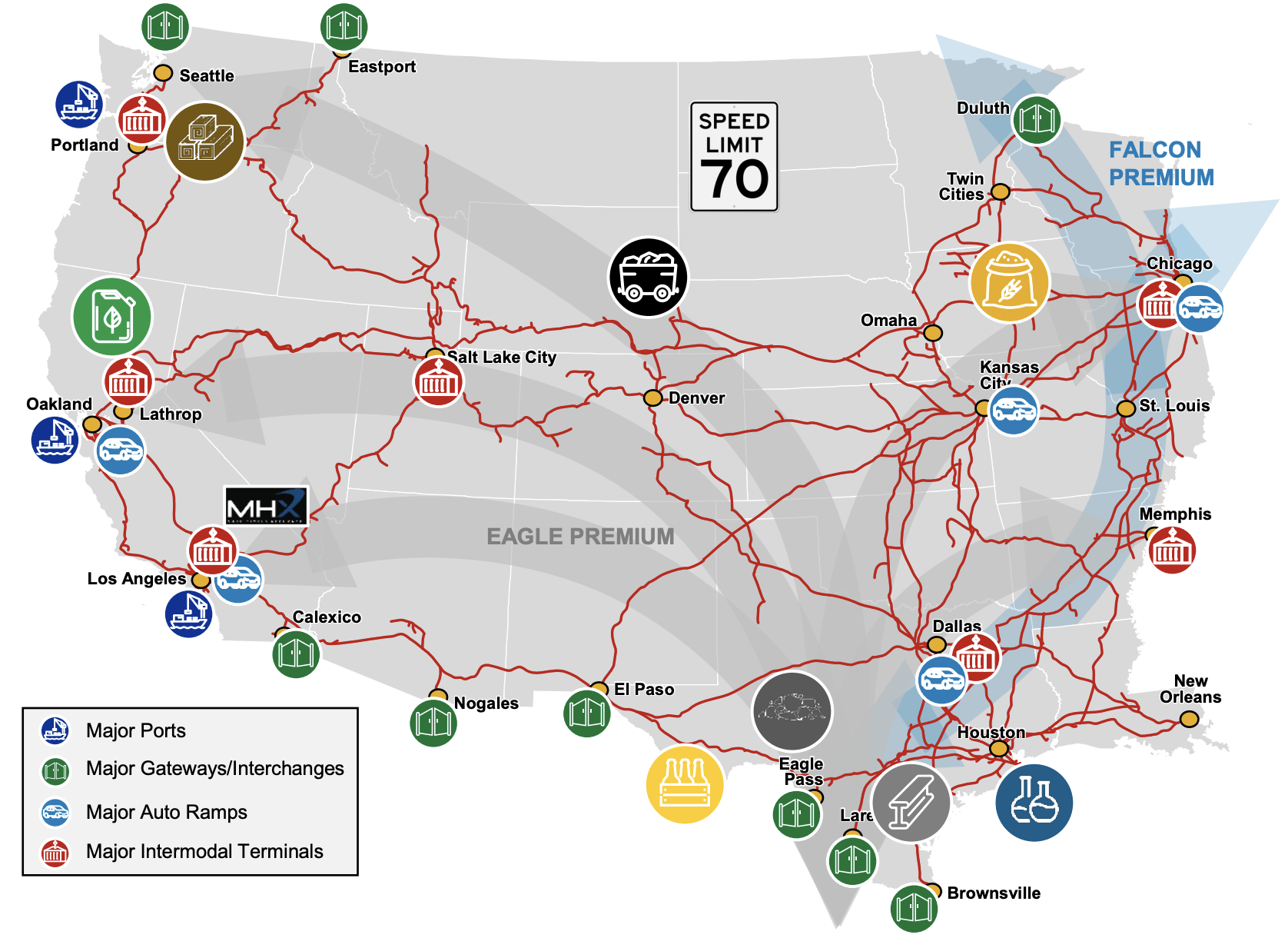

Steady Dividend Stock #2 – Union Pacific

-

- I purchased 25 shares of the U.S.’s premier railway operator, $UNP, which I believe is the best railroad stock in the U.S., playing a critical role in sustainable bulk transportation. They also own key infrastructure, including access to the country’s two largest ports.

- With 100 shares now in my portfolio, I’ve unlocked the ability to sell covered calls on $UNP, providing an additional income stream.

- $UNP is one of the world’s most steady dividend payer – with 125 consecutive years (as of Nov 2024) of yearly distributions! Read more here.

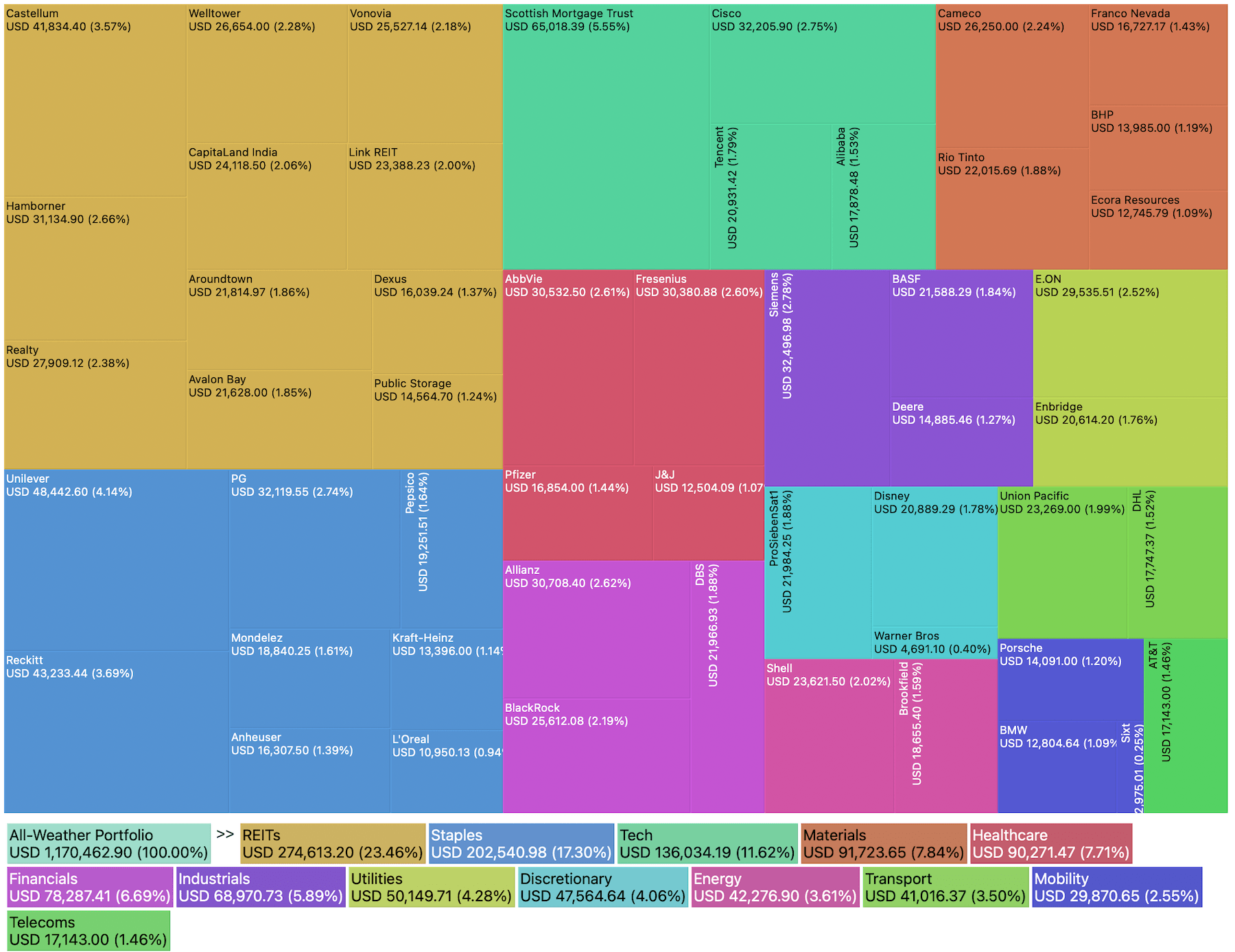

Current Dividend Portfolio

Here are two charts showing all positions of my Dividend Portfolio.

The following chart illustrates my investments alongside their current value. As you can see, there were several months when I was at a loss.

Exploring Covered Calls for Extra Income

November marked a milestone for me as I earned $300 by selling covered calls on stocks I already hold in my portfolio. This strategy complements my dividend income, leveraging existing positions to boost returns. While I’m still learning the nuances, the results so far are promising and align well with my focus on generating a steady income from my investments.

Looking Ahead

November highlighted the power of combining traditional dividend payers with innovative strategies like covered calls to grow both income and portfolio value. The slow but steady dividend growth I’m achieving shows you need to be patient, but it also reflects the strength of a diversified, carefully managed approach.

Let me know your thoughts or share your dividend milestones in the comments!

FAQ

What are the best steady dividend stocks?

Steady dividend stocks are shares of companies known for consistently paying reliable dividends over time. Companies like Union Pacific $UNP for example, have been paying dividends for 125 consecutive years. Dividend Kings (+50 years of consecutive years of dividend increases!) are also popular for providing stable income and are often found in sectors like utilities, consumer staples, and real estate. The best dividend stocks have a combination of consistency, reliability and dividend growth.

How to find good steady dividend-paying stocks?

Look for companies with a proven history of steady dividend payouts, strong financial health, and a stable dividend policy. Research tools like stock screeners and financial analysis platforms can help identify suitable options.

Are there ETFs that focus on steady dividend income?

Benefits of investing in stocks with steady dividend growth?

Stocks with steady dividend growth not only provide regular income but also offer the potential for increasing payouts over time, which helps combat inflation and builds wealth through compounding.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love