Key Takeaways

✅ AI is like water – it represents danger & opportunity

✅ Investors can choose from 3x investment buckets

✅ 3 best options how to invest in AI are presented

✅ I share my 🏆 Top Pick at the end

My Personal Experience With AI

Personally, although I am sort of a tech nerd and love to try new things, I stopped using Siri, Apple’s AI, out of pure frustration.

Put simply, I feel Siri is so dumb that she often could not even follow the most basic tasks such as setting up a reminder and taking notes.

Artificial Intelligence’s iPhone Moment

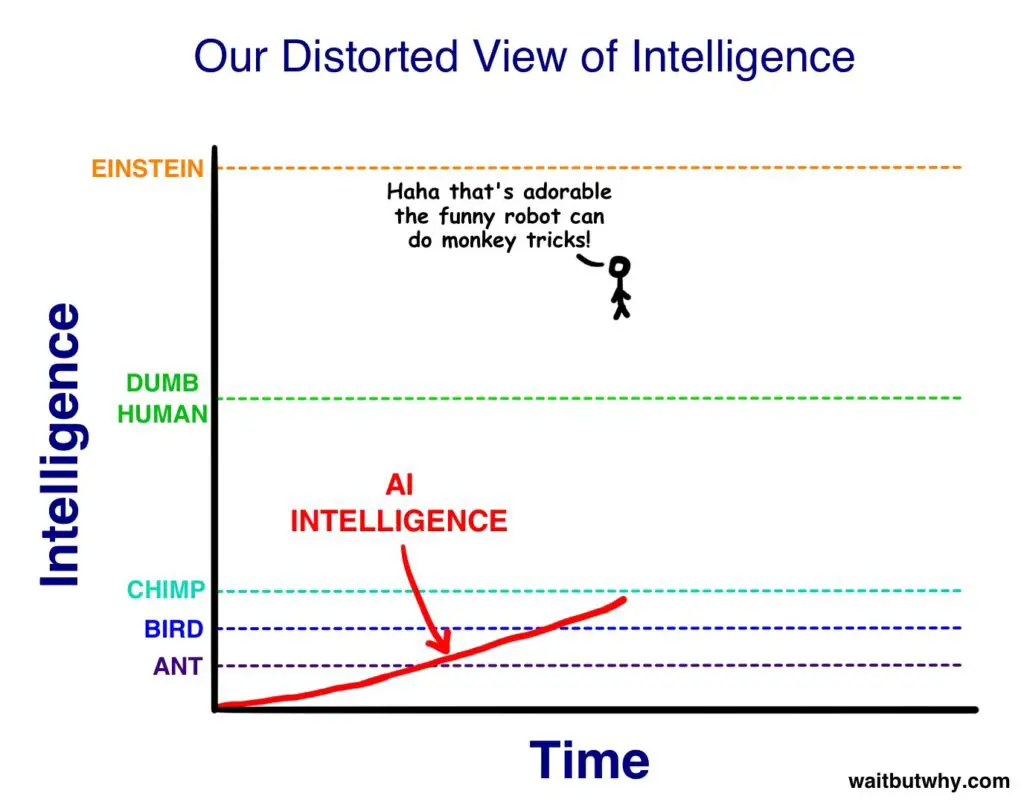

When I tried ChatGBT for the first time, I instantly was reminded of two pictures I saw back in 2015 (!), when reading the excellent WaitButWhy.com’s Artificial Intelligence post.

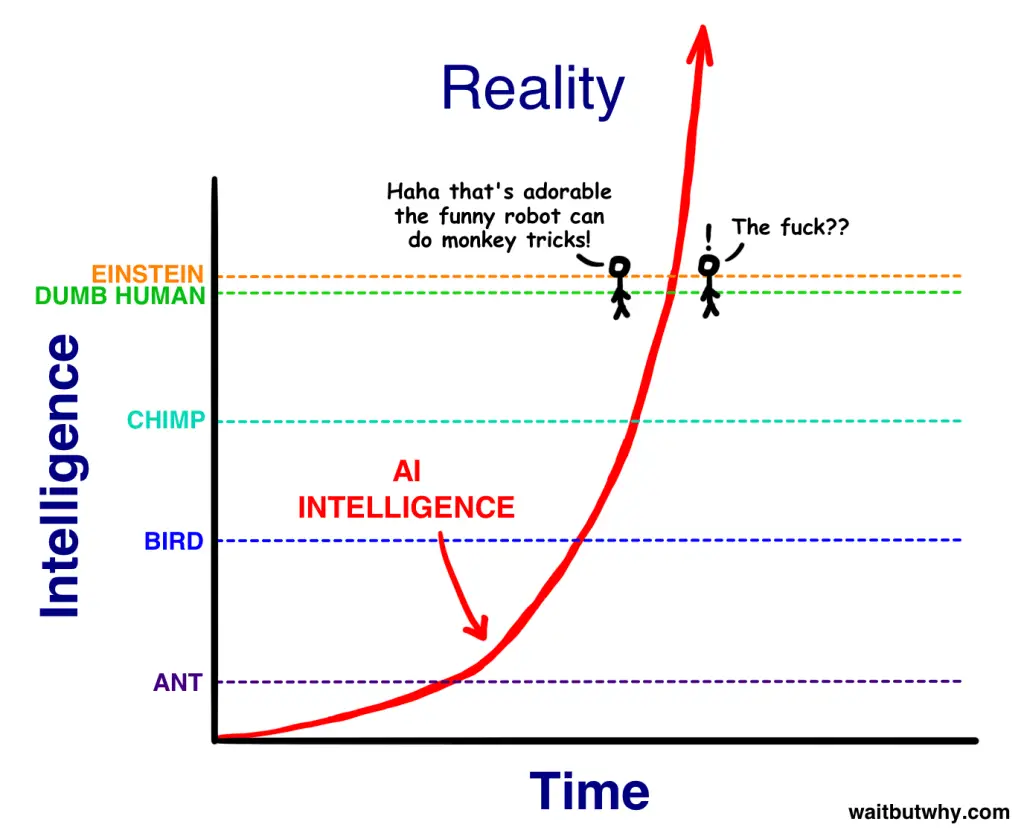

As we are really bad at understanding exponential trends, it’s difficult for us to fathom how quickly especially technical things can accelerate. Just a couple of years later, I feel like the little stickman on the right:

My hunch back in 2016, when I read Tim Urban’s piece, was that he was actually correct.

But to be frank, I could not imagine that we would go from “tell me what you want to be reminded about” to an application like ChatGBT that passes top college-level medical and law exams within a few weeks after it was launched.

Is AI dangerous?

No one answers this question better than David Holz, the CEO of Midjourney, a leading generative AI company:

“AI is like water.. and there’s danger in the water, too — you can drown in it.. but you can also swim in it, you can make boats, you can dam it, and make electricity. Water is dangerous, but it’s also a driver of civilization, and we are better off as humans who know how to live with and work with water.

It’s an opportunity. It has no will, it has no spite, and yes, you can drown in it, but that doesn’t mean we should ban water. And when you discover a new source of water, it’s really good.“

David Holz, Midjourney’s CEO

Nuf’ said. Yes, there are dangers, but the rewards outweigh the risks. We just need to learn how to use AI to our advantage.

3 Ways How To Invest In AI

Now let’s look at ways we can express our bullish view on AI. I see three different buckets to play this:

A.I. ETFs

The simple basket approach

- First Trust AI ETF

- Xtrackers AI ETF

- Scottish Mortgage

A.I. Stocks

Pick the best A.I. stocks

There is actually a fourth one: Angel/direct investments in AI startups.

But as such investments are not easily investible to the public, I didn’t want to go into detail in this post.

The Best AI ETFs & Mutual Funds

The First Trust AI & Robotics ETF, with approx. 250 Mio USD of AUM, has good exposure to rather smaller and less-known AI companies.

- Over 90% of net assets are invested in common stocks and depositary receipts

- It aims to track the performance of companies engaged in AI and robotics

- It pays a small dividend with a yield of Yield 0.31%

- It focuses on rather smaller AI companies

| Name | Exposure |

| AMBA | 2.3% |

| ANSS | 2.2% |

| ATO | 2.5% |

| AUTO | 2.1% |

| AI | 3.2% |

| LAZR | 2.1% |

| PEGA | 2.3% |

| 3993 | 2.1% |

| PATH | 2.2% |

| FR | 2.1% |

💁🏻♂️ My Two Cents: I like what the First Trust AI ETF is holding, but am not buying it at the moment.

Best AI Fund #2: Xtrackers AI & Big Data ETF

The 2nd AI ETF I like is the Xtrackers AI & Big Data ETF.

- it invests in international artificial intelligence companies in the sectors

- It uses ESG criteria to filter our stocks

- +80% of this AI ETF’s funds are allocated to U.S.-based companies

- it is an accumulating fund, meaning it does not pay a dividend

- focuses on the AI-industry heavyweights like Nvidia, Meta, Amazon, etc.

| Name | Exposure |

| Nvidia | 5.3% |

| Meta | 5.0% |

| Amazon | 4.9% |

| Samsung | 4.8% |

| Apple | 4.5% |

| Alphabet | 4.5% |

| Bank of America | 4.3% |

| Salesforce | 4.3% |

| Accenture | 4.2% |

| Cisco | 4.1% |

💁🏻♂️ My Two Cents: I like what the Xtrackers AI ETF is holding, but am not buying it at the moment.

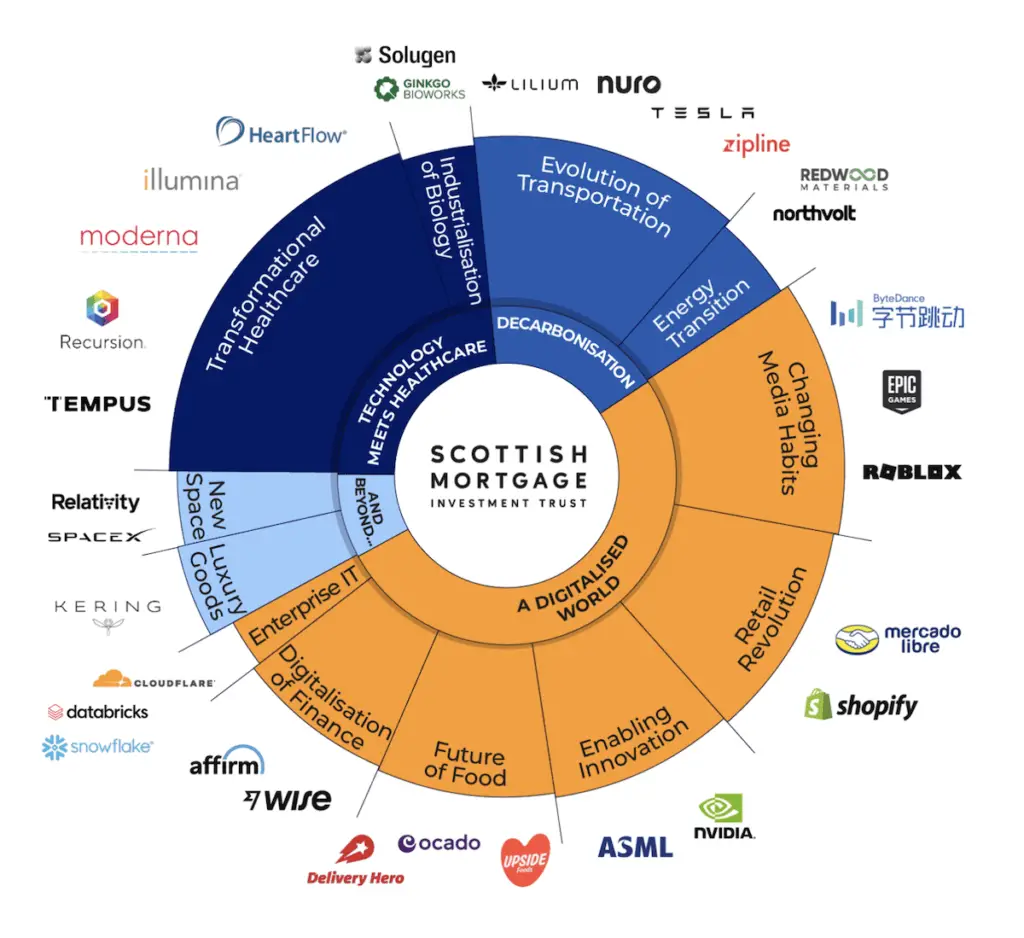

Best AI Fund #3: Scottish Mortgage Trust

A fund founded in 1905 in Edinburg by two lawyers with £50,000 of capital, is most likely a surprising pick for the best way to invest in AI.

But the Scottish Mortgage Trust is a trust like no other. It focuses solely on

- it is not a pure AI fund but invests in companies set to change the world

- it considers the long-term investment horizon

- it aligns with the philosophies of the companies it invests in

- all of the trust’s holdings utilize, advance, or use AI

- has interesting illiquid investments such as SpaceX

The Scottish Mortgage Trust’s Portfolio

Source: https://www.scottishmortgage.com/en/uk/individual-investors/holdings

|

Name |

Exposure |

| Moderna | 7.9% |

| ASML | 7.4% |

| Tesla | 5.2% |

| Mercadolibre | 4.2% |

| SpaceX (!) | 3.5% |

| Northvolt | 3.5% |

| Illumina | 3.2% |

| Kering | 3.1% |

| Meituan | 2.7% |

| Bytedance | 2.6% |

| Nvidia | 2.6% |

| Pinduoduo | 2.5% |

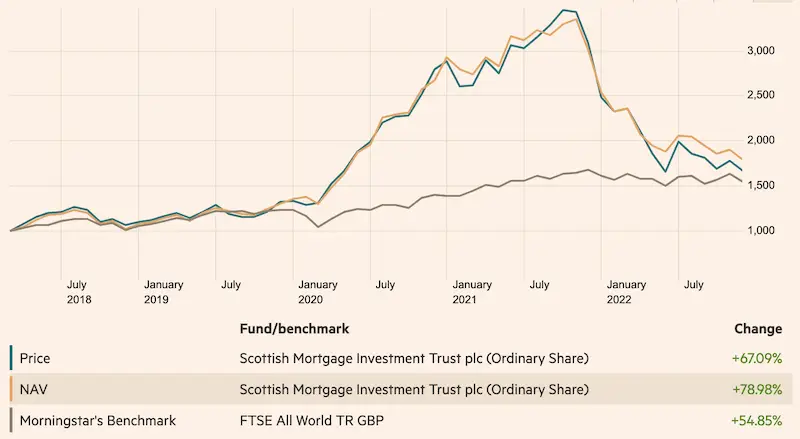

Performance-wise, the Scottish Mortgage Trust does well and beats its benchmark indices. However, most recent years have been extremely tough, and the Trust was hit hard, similar to all risk-on/tech-related stocks.

The chart below quickly illustrates this:

Once the FED started to hike interest rates, the tech sector, in general, was hit hard, as investors sold ‘risk assets’ and piled into ‘risk-off assets’.

That’s why I believe now is an opportune time to slowly start building a position. From its high in November 2021, prices came down by exactly 60%.

Now, the companies the Trust holds remain to change the world, however, you can buy these companies at a 40% discount compared to just 1,5 years ago.

Scottish Mortgage Trust ticker symbols:

| U.S. | $STMZEF |

| UK | SMT |

| ISIN | GB00BLDYK618 |

| Germany | A115BA |

💁🏻♂️ My Two Cents: I like what the Scottish Mortgage Trust is doing, and will start building a position!

Buy Scottish Mortgage Trust on Trade Republic.

The 3 Best A.I. Stocks

If you like to invest in AI and choose single stocks, I list my personal favorites below. Those are the companies that I believe are the best AI companies stock.

Best A.I. Stock #1: Microsoft

The Seattle-based company has proven over and over that it does not rest on its laurels, and keeps re-investing its huge cash flows into the sectors of the future.

Regardless if it is big data, cloud computing, cybersecurity, blockchain, gaming, AR/VR, or in this case artificial intelligence, Microsoft is ‘always involved’.

With the recent major investment in OpenAI, the company behind ChatGPT, Microsoft has a strong foot in the door for whatever is to come.

Microsoft (MSFT) also pays a dividend, appealing to long-term and dividend-growth investors.

$MSFT is a solid and good pick if you like to invest in AI.

💁🏻♂️ My Two Cents: I like what Microsoft (MSFT) is doing, but am not buying it at the moment.

Best A.I. Stock #2: Alphabet

Alphabet (GOOGL), the ParentCo of Google, seems to have lost a battle when it comes to ChatGPT, however, I believe Alphabet has a lot of cards up its sleeve.

Let me list out a few of those:

- it has a massive research and development budget and has invested heavily in AI

- Google Cloud AI and its TensorFlow machine learning platform are widely used

- AI is used in essentially all services: Google Assistant, Photos, Maps, Translate, etc.

- Google Duplex, a voice-based assistant, is becoming better by the day

- It made many AI-driven acquisitions: DeepMind, Kaggle, Lighthouse AI, Cyara, X.ai, etc.

- Google’s Bard AI bot is quickly catching up with ChatGBT

I use Google’s products on a daily basis: Google sheets, Gmail, Google Translate, Google Drive, Google Maps, and Google Ads.

In summary, I believe it has built such a wide moat around its business that it is very difficult for any incumbents to steal customers from it.

💁🏻♂️ My Two Cents: I like what Alphabet (GOOGL) is doing, but am not buying it at the moment.

Best A.I. Stock #3: Baidu (BIDU)

With 1,4 Bio people and +1 Bio mobile phone users, China has an almost unfair advantage when it comes to big data and subsequently artificial intelligence applications.

Baidu (BIDU) is the leader in the AI space not only in China but Asia. I know first-hand that it’s working on a multitude of exciting and moon-shot-like ideas, that will come to market in the coming 1-2 years.

I believe it would be wise for investors to consider one non-U.S.-based company that is strong in A.I., and Baidu fits this bill:

- has been a leader in the AI space for years, with its ‘Brain platform’ and its AI-driven products and services.

- similar to Alphabet, it has a wide range of AI-powered products: Maps, Search, Translate, Cloud, Autonomous Driving, etc.

- It has invested heavily in AI-related start-ups, such as

- KITT.AI: a speech recognition and natural language processing start-up, in 2017

- Raven Technologies: an AI-driven customer service platform, in 2017

- DeepScribe: an AI-driven medical transcription platform, in 2018

- Facemoji: an AI-powered facial recognition start-up, in 2019

- Mobvoi: a speech recognition and natural language processing start-up

- Syntiant: Ban AI-driven chipmaker, in 2020

- Baidu was less active in 2021-2023 due to the pandemic, but I believe this will change soon

💁🏻♂️ My Two Cents: I like what Baidu (BIDU) is doing, but am not buying it at the moment.

AI Cryptocurrencies

As of writing this post in early 2023, there are a couple of interesting AI cryptocurrencies you can consider investing in.

I’ll briefly share the basics of each of those three, if they are good options if you like to invest in ai, and share my 2 cents for each.

Best AI Cryptocurrency #1: SingularityNET

Put simply, SingularityNET.io is a decentralized marketplace for AI services.

What this means is that it enables others such as developers or companies, to create, share, and monetize AI services at scale.

- It enables the development of AI models, that can then be used to solve specific problems

- It uses a decentralized blockchain to ensure transparency and security of all transactions

- It already has impressive partnerships with AI companies such as Google, Microsoft, and IBM

- It has a very strong team of AI engineers

SingularityNET’s native token is called AGIX, which you can buy on Coinbase.

💁🏻♂️ My Two Cents: I like what SingularityNET is doing, but am not buying it at the moment.

Best AI Cryptocurrency #2: Fetch.ai

Fetch.AI was founded in 2017 via an IEO on Binance in 2019.

It refers to itself as an AI lab with a big mission: to build a permissionless, decentralized machine learning network with a crypto economy.

- it aims to make AI technology easily accessible to anyone

- autonomous agents will help people connect to secure datasets and execute complex tasks

- with potential use cases: optimizing DeFi trading services, optimizing transportation networks, smart energy grids, etc.

- AI applications typically rely on large datasets, which Fetch.AI is helping to make accessible

Fetch.AI’s native token is called FET, which you can buy on Coinbase.

💁🏻♂️ My Two Cents: I like what Fetch is doing, but am not buying it at the moment.

Best AI Cryptocurrency #3: Oasis Network

Oasis Network might not be a fully-dedicated AI cryptocurrency, but it is a decentralized blockchain designed for privacy-preserving computation and data management that attracts many AI-powered applications to build on its platform.

- It is powered by a secure, scalable, and private network of computers, called “collators”

- It is a decentralized blockchain platform designed for privacy-preserving computation and data management

- It provides a secure, efficient, and privacy-preserving environment for artificial intelligence applications.

- It has a strong team of AI experts and engineers.

Oasis Network’s native token is called ROSE, which you can buy on Coinbase.

💁🏻♂️ My Two Cents: I like what Oasis is doing, but if you like to invest in ai, I think there are more suitable options out there.

Conclusion

Personally, I picked the Scottish Mortgage Trust to get long-term exposure to Artificial Intelligence.

Choosing a single AI stock or AI cryptocurrencies has unattractive risk/reward ratios.

I don’t want to be on the next Kodak, Blockbuster, or Sony-Ericcson, but rather, invest in the best Tech stock-picking team in the world.

📘 Read Also

- The Best IT Dividend Stocks To Buy

- The 3 Best Way To Invest In The Metaverse

- Check out my All-Weather Dividend Portfolio

FAQ

How to invest in AI?

If you like to invest in AI, you can simply put choose either

1/ AI ETFs

2/ AI Stock

3/ AI cryptocurrencies

You can also invest in AI startups, but that is usually only possible via private investments.

Wha is a good AI stock?

What are the AI companies to invest in?

How to invest in AI technology?

You can choose to invest in single artificial intelligence stocks such as Meta (META), Alphabet (GOOGL), Apple (APPL), or Baidu (BIDU), or you choose AI-mutual funds or AI ETFs such as the First Trust AI ETF, XTrackers AI ETF or my personal favorite, the Scottish Mortgage Trust (SMT in London, or $STMZEF in the U.S.

What AI cryptocurrencies are trading?

– Singularitynet.io, with its platform token called AGIX

– Fetch.ai, with its blockchain token called FET

– Oasis Network, with its native utility token called ROSE

– TheGraph, with its native token called GRT

What are the best artificial intelligence stocks under $10?

When investing in artificial intelligence stocks with lower market caps, beware of the ultra-high risk. These companies run the danger of not making it, but if you dare anyways, here are 5 interesting small cap ai stocks:

– Luminar Technologies (LAZR)

– Duos Technologies (DUOT)

– Innodata (INOD)

– Alithya (ALYA)

– Opera (OPRA)

Can you invest in AI?

Yes, you can choose to either buy an artificial intelligence ETF or mutual fund, single artificial intelligence stocks, or AI cryptocurrencies.

Best Way To Invest In AI - Scottish Mortgage Trust

Investing in Tech is hard, in particular in Artificial Intelligence. Things move at a break-neck pace, and I find choosing a single company is simply too risky. That's why I decided to buy the Scottish Mortgage Trust, entrusting the best tech stock pickers in the world to manage my 5% allocation in Tech.

PROS

- Best tech stock pickers

- Exposure to illiquid investments such as SpaceX

- Longterm time horizon resonates with me

- Covers all regions and sectors, incl. Asia

- Hands-off approach to disruptive tech sector

- Pays a bi-annual dividend

- Dividend comes without withholding tax

- ultra-low management fees

CONS

- Risk that managers pick wrong stocks

- Need to be patient

- Quite cyclical (bad performance since 2021)

- Risk of not beating the index

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love