The 5 Best Animal Health Stocks For Pets Megatrend

Introduction

In an era of relentless change—AI reshaping jobs, economic uncertainty lingering, and the world feeling more complex and unpredictable by the day—people are retreating inward.

We’re cocooning ourselves in our homes, seeking comfort and stability in the one place that still feels safe and predictable.

And right there with us, often curled up on the couch or waiting at the door, are our pets. They became a part of our family, emotional anchors, quiet companions that provide unconditional presence when everything else feels shaky.

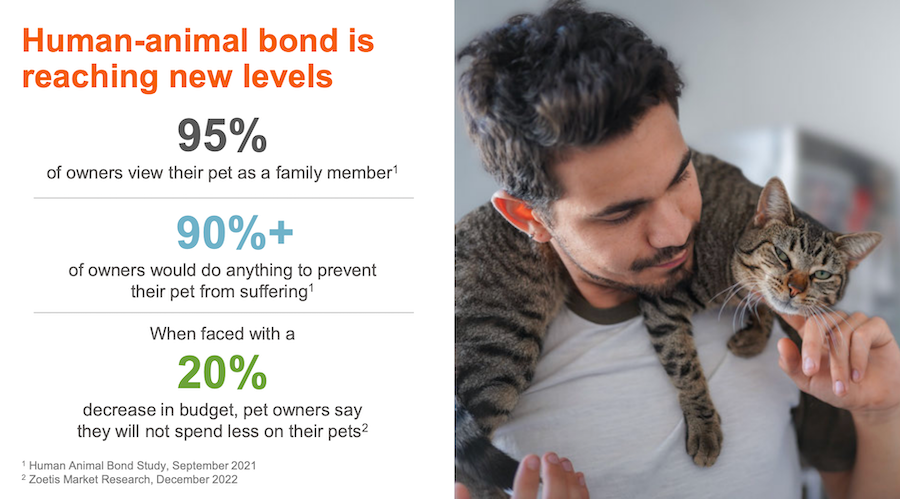

The humanization of pets has accelerated in recent years, with owners treating dogs, cats, and other animals as full members of the household—spending more on their health, wellness, and longevity than ever before.

Photo by Krista Mangulsone on Unsplash

This isn’t a fleeting trend; it’s a deep response to modern life, where a loyal furry friend can make the difference between isolation and connection.

At the same time, the global population is on track to approach 10 billion by mid-century. Feeding everyone sustainably will require more efficient, healthier animal protein systems—from cattle and poultry to pigs and beyond.

These two forces—rising emotional reliance on companion animals and the practical need for resilient livestock production—are converging into what many call the Pets Megatrend.

It’s a long-term shift that’s quietly reshaping entire industries, with animal health companies at the center.

In this post, I’ll look at the five best stocks positioned to benefit from this megatrend and will reveal the one I like the most, and have already bought.

Why Animal Health Stocks Make Sense for Long-Term Investors?

When I look for dividend investments, I’m drawn to sectors with predictable, recurring revenue—and animal health fits that profile perfectly. Pet owners don’t skip veterinary care when the economy dips; they treat their animals’ health as non-negotiable.

The business model is equally compelling. Animal health companies benefit from high switching costs and pricing power that translates into consistent cash flows—the foundation of reliable dividends.

What sets this sector apart is the dual tailwind: companion animal spending is surging as pets become family members, while global protein demand drives growth in livestock health. This rewards patient, long-term investors who prioritize stability and income.

The 5 Leading Companies in This Animal Health Stock Sector

| Metric | Zoetis $ZTS | Elanco $ELAN | IDEXX $IDXX | Phibro $AHC | Neogen $NEOG |

|---|---|---|---|---|---|

| Founded | 2013 (form. Pfizer) | 2019 (form. Eli Lilly) | 1983 | 1947 | 1981 |

| Country | USA | USA | USA | USA | USA |

| Employees | 13,800 | 9,300 | 10,000 | 2,300 | 2,900 |

| Sales’24 in Bio | $9.3 | $4.4 | $3.9 | $1.1 | $0.9 |

| Net Profit in Bio | $1.2 | Loss | 0.8 | $~0.02 | Loss |

| Yield (%) | 1.6% | 0% | 0% | 1.2% | 0% |

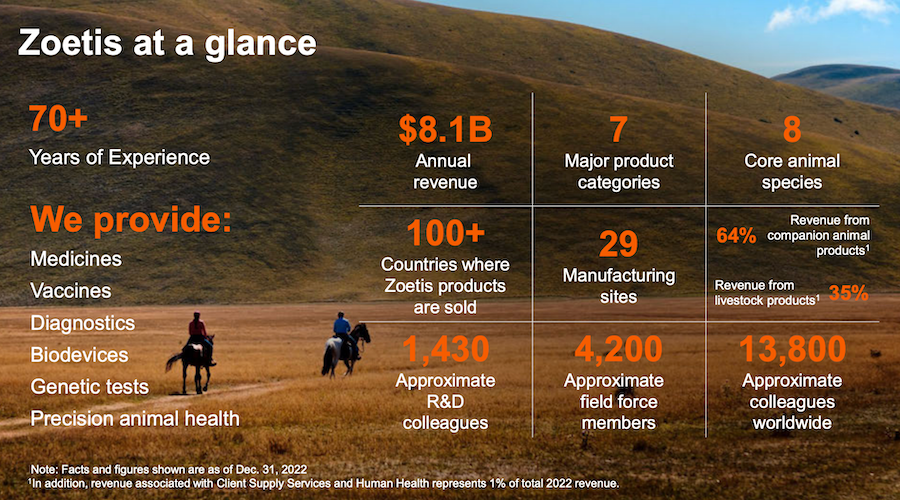

Zoetis – The global leader in animal health with the broadest product portfolio spanning both companion animals and livestock across nearly every major market worldwide.

Elanco – A major competitor focused on farm animal health and pet therapeutics, though it carries more debt and has faced integration challenges from past acquisitions.

IDEXX Laboratories – Dominates the veterinary diagnostics market with proprietary testing equipment and software that creates recurring revenue from consumables and lab services.

Dechra Pharmaceuticals – A UK-based specialist in veterinary pharmaceuticals for companion animals, known for niche products and a strong presence in European markets.

Boehringer Ingelheim Animal Health – Part of a larger privately-held pharmaceutical company, offering a deep pipeline in vaccines and parasiticides with particular strength in European livestock markets.

What Makes Investing in Pet Stocks a Smart Long-Term Play

Pet companies enjoy rare pricing power because owners rarely skimp on their animals’ health and nutrition.

The industry benefits from high regulatory barriers that keep competition limited, especially in veterinary pharmaceuticals and specialized foods. These aren’t discretionary purchases—pet care products are essential, which gives these businesses stable demand even during economic downturns.

The pet ownership megatrend continues strengthening as more households treat animals like family members and spend accordingly on premium foods, advanced medical care, and wellness products.

This shift toward “humanization” of pets drives consistent revenue growth across the sector. Meanwhile, the livestock and production animal segment adds diversification, serving commercial farming operations that need reliable animal health solutions regardless of consumer sentiment.

My Favorite Animal Health Stock & Why I’m Invested

I’ve put my money into Zoetis, the largest pure-play animal health company in the world. They dominate both the companion animal and livestock markets with a portfolio of products that veterinarians rely on daily.

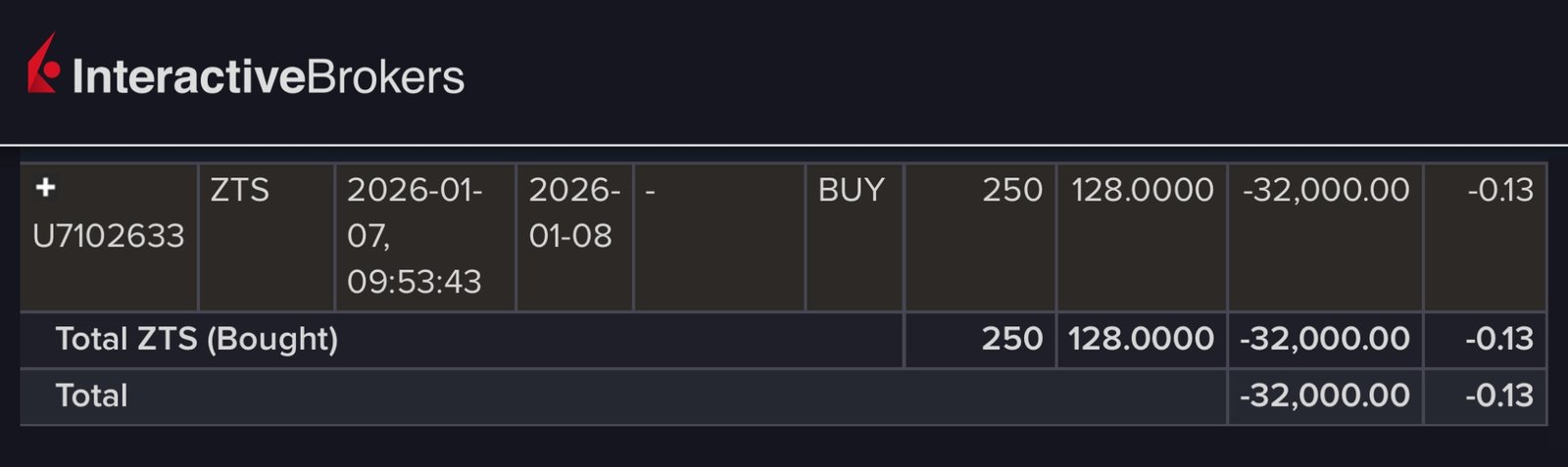

On Jan 7th, I bought 250 $ZTS at $28 in my All-Weather Dividend Portfolio, see my Interactive Broker’s trade confirmation below.

Zoetis fits my dividend strategy for three key reasons:

1/ they generate exceptional cash flow from recurring revenue products like vaccines and parasiticides,

2/ they have a track record of consistent dividend growth since spinning off from Pfizer in 2013, and,

3/ their global scale creates pricing power that protects margins over time.

The current yield sits around 1-1.5%, which isn’t high, but the dividend growth rate has been strong, typically in the high single digits to low double digits annually.

I’m prioritizing growth over current income here because the company’s earnings should compound steadily as pet spending increases and their livestock business expands in emerging markets.

Final Thoughts

Animal health stocks offer a rare combination of defensive characteristics and long-term growth potential, anchored by the unstoppable trend of increased pet spending and essential livestock care.

Zoetis stands out as the category leader with the pricing power, scale, and dividend growth profile that aligns with a patient, income-focused strategy.

If you’re looking to add more stability to your dividend portfolio, consider allocating a small position to this sector—start by researching Zoetis and comparing its valuation to its historical averages before making your move.

FAQs

What exactly is an animal health stock?

An animal health stock is a company that develops, manufactures, and sells products for animal wellness—including pharmaceuticals, vaccines, diagnostics, and nutritional supplements. These businesses serve both the companion animal market (pets) and the production animal market (livestock and poultry used in agriculture).

Why is the pet megatrend important for investors?

The pet megatrend reflects a fundamental shift in how people view and spend on their animals, treating them increasingly like family members. This drives higher spending on premium food, advanced veterinary care, and preventive health products—creating predictable, growing revenue streams for companies positioned in this space.

Are animal health stocks different from pet stocks?

Yes, there’s an important distinction. Animal health stocks focus specifically on medical and health-related products like vaccines and treatments, while pet stocks can include retailers, food manufacturers, and service providers. Animal health companies typically have stronger pricing power and regulatory moats due to the specialized nature of veterinary medicine.

Is Zoetis the only animal health stock worth considering?

Zoetis is the largest pure-play option, but it’s not the only one. Other animal health stocks include Elanco, Dechra Pharmaceuticals, and IDEXX Laboratories, plus large pharma companies like Merck and Boehringer Ingelheim have significant animal health divisions. Each offers different exposure to companion animals versus livestock, along with varying dividend profiles and growth rates.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love