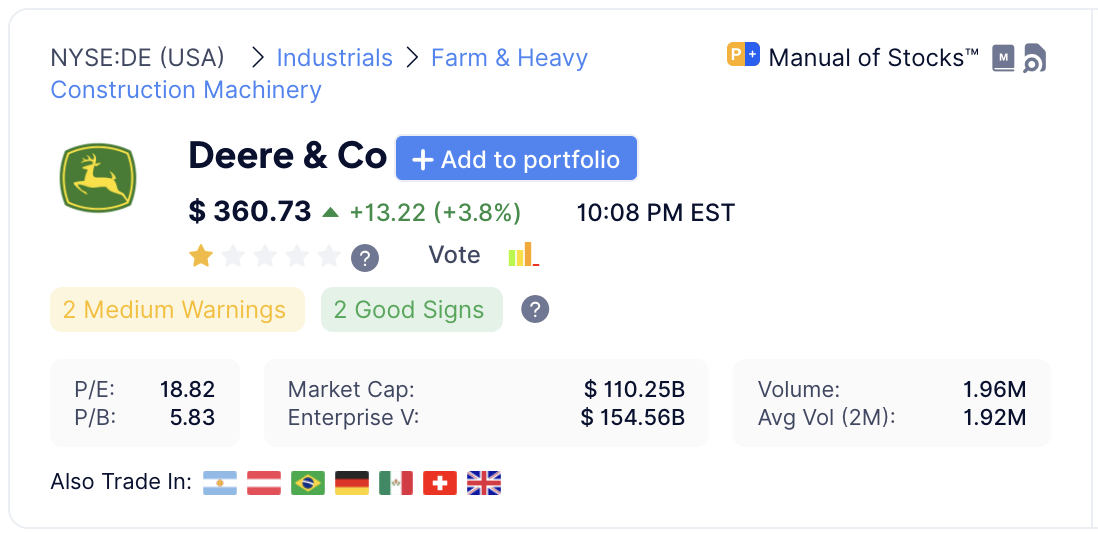

Slow And Steady With The John Deere Stock.

Growing up in a small town in Germany, I spent a lot of time on our neighbor’s farm. His huge tractors and massive harvesters simply amazed me. When he noticed me, he invited me for a ride. I was taken away and felt like a king. I was five years old when going for my first sugar beet harvest.

Pulling sugar beets out of the ground is physical and tiring work. Exposed to direct sunshine for hours, you bend your back the whole day, and it requires a lot of physical strength to pull one beet out after the other. Knowing how tough farming work can help you to get ‘grounded’. It gives you a sense of what it is like to work in the field. But once the work is done, and you find yourself back on the tractor on your way back to the farm, it also gives you a satisfying feeling of achievement.

Sitting on a loud, smelly tractor back then made me feel like a king, and it is since then, that I feel a special resonance with John Deere.

About John Deere

Deere & Company ($DE, ISIN: US2441991054) was founded in 1837 by John Deere in Vermont, making the company 185+ years old. An inspiring entrepreneurial story is captured in the excellent biography The John Deere Story – A Biography of Plowmakers John and Charles Deere. Initially, the company produced plows. Early on, Mr. Deere realized that the soil in Vermont was very different from the soil in Indianapolis. After some adjustments to his plow, the company’s sales started to accelerate rapidly and at this moment, Mr. Deere understood that the trick is to customize and modify his products to the conditions of each respective region.

Now, the company behind the John Deere Stock manufactures a wide range of agricultural products:

- Tractors

- Seed drills

- Excavators

- Loaders

- Field sprayers

- Combine harvesters

- Forage harvesters

- Sugarcane harvesters

- Graders

- Forwarders

(image credits: Deere.com)

My Simple Investment Rationale for The John Deere Stock

1/ Massive Demand for Farming Equipment

To feed a world population of 8.5 billion in 2030 or 9.7 billion in 2050 (as estimated by the U.N.), we firstly will require some profound agricultural know-how, as well as some kick-ass farming equipment – two things John Deere is the undisputed number one in. As for the demand side of things, things look extremely positive for the John Deere stock, as every region in the world will have no other choice but smarten up and use the best tools the world has to offer.

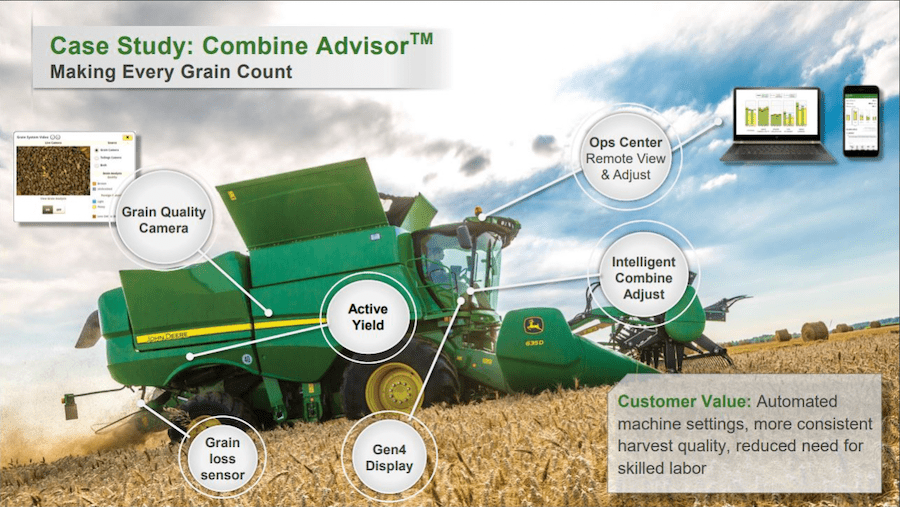

2/ Deere – The Tesla Of Agriculture

When watching the most recent John Deere Stock Press Conference at the CES 2022, I was blown away by the tech and tools the company is using and incorporating into its products. The following terms are not catchwords. Each of those is already used in actual products that are on the market:

- autonomous/driverless farming vehicles

- sensors and high-fidelity cams for precision Ag (e.g. See & Spray)

- AI-powered image recognition and instant recommendation

- value creation through Ag Big Data via the MyJohnDeer Operations Center

- low orbit satellite-powered crop state recognition

- monitoring drones to assess and recommend an optimized farming schedule

- collaborator program supporting and partnering with innovative Agtech startups

- smart glasses technology provides AR-powered support for repairs worldwide

- all John Deere machinery is increasingly getting connected to enable IoT applications

3/ Enormous Climate Challenges

We know that we are looking at some extremely challenging climate changes in the decades to come. Record storms, floods, droughts, changes in the ozone layer, and greenhouse gas emissions all affect agricultural producers significantly. In particular, the intensity and frequency of extreme weather have a strong impact on crop planting dates and yields. Those farmers with access to the best possible know-how and tools (see the previous item), will have a strong advantage over the competition.

4/ Subscription Business

John Deere is increasingly generating subscription income from their various subscription suites like JDLink, MyJohnDeere, etc. It essentially offers Big Data as a service. The company products generate massive amounts of data sets, each day, ideal for machine learning algorithms to analyze, compile and compare all the data, and continuously provide the farmers with actionable advice on when to seed, when to harvest, and so on.

5/ The John Deere Stock in Agribusiness ETFs

Deere is a core holding of essentially all major agricultural ETFs such as $MOO. Such ETFs consists of companies involved in farm/irrigation equipment, farm machinery, agriculture chemicals, animal health and fertilizers, seeds and traits, aquaculture and fishing, livestock, and seed cultivation and plantations.

- MOO VanEck Agribusiness ETF

- SPAG iShares Agribusiness ETF

- FTAG First Trust Index Global Agriculture ETF

Whenever these massive ETFs see inflows, John Deere is one of the companies that benefit the most from fund flows:

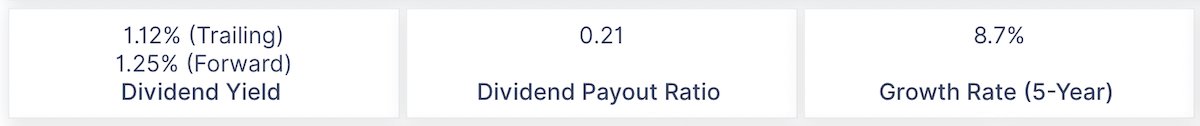

Is John Deere Stock’s Dividend Safe?

DE’s payout ratio is a healthy 21%, meaning it has ample space to maneuver. It has paid its dividend very consistently since 1985, making it a dividend aristocrat. With all the above-mentioned drivers going for the company, I personally deem the dividend safe.

Is The John Deere Stock A Buy?

In my point of view, yes. With all the innovative initiatives and products, the company should do well in the years to come, fueled by very strong demand fundamentals.

What Other AgTech Stocks Do I Own?

Besides the John Deere stock, another large AgTech player I own is the chemical giant BASF (ready my detailed $BASF review here). Although most people don’t know that BASF has a massive AgTech, or better, AgChem division (11% of their total revenue), it has its hands in a variety of segments in that space, such as Seeds & Traits, Crop Protection, and Urban & Rural Pest Control. Besides BASF, the John Deere stock will be my latest addition to my All-Weather Portfolio.

Conclusion – Am I Buying?

I believe the John Deere stock is in an extremely interesting sector and is currently hitting on all cylinders. The market demand will be there for decades to come, and with the recent technological advancements, there is massive potential for the stock to be re-rated. It surely is not a get-quick-rich-stock, but one that I expect to appreciate by 8-10% YOY for years to come, while also paying a healthy quarterly dividend along the way. I believe slow and steady wins the race, and I am a buyer here!

I will be using the monthly cash flow I am generating from my (high-risk) digital assets, approx. 2,500 USD from DeFi Cake, and start buying the John Deere stock. I feel great about this approach because later on, I will know that this relatively conservative position with stable quarterly dividends was purely built by passive income generated from risky assets.

Let’s get stacking!

📘 Read Also

- Why Mondelez is a good dividend stock

- See which European REITs I think are good buys

- Check out my dream REIT stock in the U.S.

- Like to see my total monthly income 👉 Dividend Calendar

WiseStacker's Take

I believe the John Deere stock is like the Tesla of Agriculture. I will dollar-cost-average into this stock and keep it for a very long time.

PROS

- Excellent sector fundamentals

- Massive potential through tech

- Stable dividend since 1985

- Largest AgTech company

- Massive economies of scale

CONS

- Not super high margin industry

- Competition becoming more fierce

- Challenging to keep up with tech

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love