Key Takeaways

☑️ The 10 best car stocks with dividends are compared

☑️ Some car stocks have attractive valuations at the moment

☑️ European automakers are historically undervalued

☑️ I share and review my top pick

The Best Dividend-Paying Car Stocks

Automakers are currently facing a multitude of challenges, such as

- the transition from ICE to EVs,

- autonomous driving,

- energy crises and war in Europe,

- chip shortages,

- supply chain interruptions,

- a looming recession,

- and among others!

But a crisis typically also brings opportunities, and that’s why I feel it is time to see if we can find some dividend-paying car stock gems.

Let’s begin by looking at the largest automotive companies, ranked by market cap (not sales!).

Car Stocks by Market Cap

| Car Stocks, by Market Cap | Market Cap | Yield | PE |

| 🇺🇸 Tesla | $375 B | 0.0% | 37 |

| 🇯🇵 Toyota | $189 B | 2.9% | 10 |

| 🇨🇳 BYD | $114 B | 0.1% | 183 |

| 🇩🇪 VW | $79 B | 4.7% | 4 |

| 🇩🇪 Mercedes-Benz | $77 B | 7.4% | 3 |

| 🇩🇪 BMW | $64 B | 6.5% | 3 |

| 🇺🇸 GM | $53 B | 0.5% | 6 |

| 🇺🇸 Ford | $52 B | 3.9% | 6 |

| 🇯🇵 Honda | $40 B | 4.0% | 8 |

| 🇩🇪 Porsche* | $18 B | 4.6% | 3 |

*Please note that I am referring here to the Porsche Automobil Holding SE here, owning the majority (53%) of the ordinary shares and 31% of the subscribed capital of the entire Volkswagen AG (OTCPK:VLKAF), and also 25% of the actual Porsche AG, the manufacturing entity producing the Porsche cars.

Market cap wise, Tesla (TSLA) is in a league of its own. However, it actually should not be on this list in the first place, as it is not a dividend-paying car stock! But any review of the automotive industry would be incomplete with its chief category disrupter!

Now let’s rank the stocks of the automakers by PE. We can quickly see that the German car stocks all have profit to earning ratios (PE) of below 5 (!), see the following table.

Car Stocks with Dividends by PE

| Car Stocks, ranked by PE | Market Cap | Yield | PE |

| 🇩🇪 Mercedes-Benz | $77 B | 7.43% | 3 |

| 🇩🇪 Porsche Holding | $18 B | 4.58% | 3 |

| 🇩🇪 BMW | $64 B | 6.45% | 3 |

| 🇩🇪 VW | $79 B | 4.65% | 4 |

| 🇺🇸 Ford | $52 B | 3.89% | 6 |

| 🇺🇸 GM | $53 B | 0.49% | 6 |

| 🇯🇵 Honda | $40 B | 4.00% | 8 |

| 🇯🇵 Toyota | $189 B | 2.90% | 10 |

| 🇺🇸 Tesla | $375 B | 0.00% | 37 |

| 🇨🇳 BYD | $114 B | 0.04% | 183 |

When we rank them by dividend yield, we get the following.

Car Stocks by Dividend Yield

| Car Stocks, ranked by Yield | Market Cap | Yield | PE |

| 🇩🇪 Mercedes-Benz | $77 B | 7.4% | 3 |

| 🇩🇪 BMW | $64 B | 6.5% | 3 |

| 🇩🇪 VW | $79 B | 4.7% | 4 |

| 🇩🇪 Porsche Holding | $18 B | 4.6% | 3 |

| 🇯🇵 Honda | $40 B | 4.0% | 8 |

| 🇺🇸 Ford | $52 B | 3.9% | 6 |

| 🇯🇵 Toyota | $189 B | 2.9% | 10 |

| 🇺🇸 GM | $53 B | 0.5% | 6 |

| 🇨🇳 BYD | $114 B | 0.0% | 183 |

| 🇺🇸 Tesla | $375 B | 0.0% | 37 |

The car stocks with the lowest PEs have the highest dividend yields. That is because their share prices are currently depressed, due to the massive uncertainty in the market.

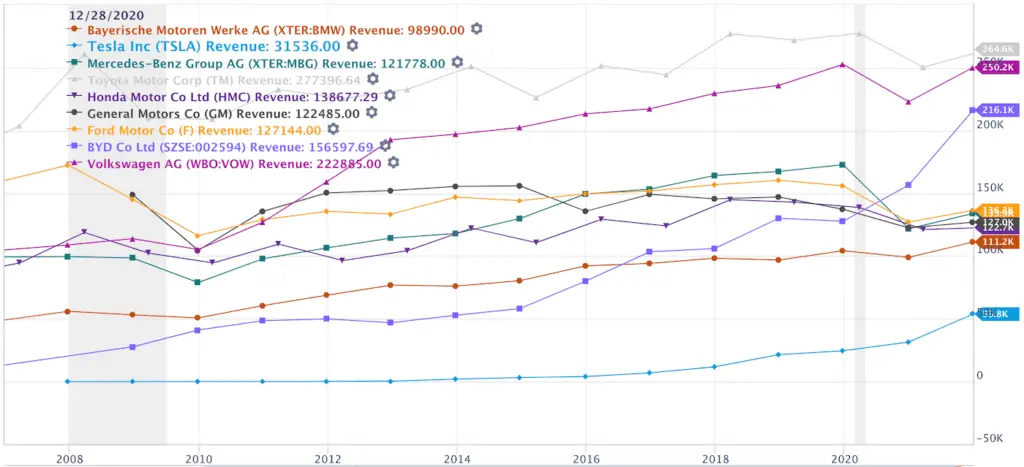

Looking at the revenues of the largest car stocks in the past 10 years, we see the following:

Chart of Car Stocks By Revenues

A big surprise here on 3rd spot is BYD, the Chinese Tesla challenger. It even grew in the difficult pandemic years. It generates about 30% with its battery-related business.

Revenues of Largest Automakers, in Bio US Dollar

- 🇩🇪 VW $287

- 🇯🇵 Toyota $265

- 🇩🇪 Mercedes-Benz $155

- 🇺🇸 Ford $152

- 🇺🇸 GM $147

- 🇩🇪 BMW $141

- 🇯🇵 Honda $118

- 🇺🇸 Tesla $75

- 🇨🇳 BYD $50

- 🇩🇪 Porsche* $3

*Porsche Holding

What are the fastest growing car companies?

Looking at the 3 year average growth rates, we can see Tesla and BYD killing it with +20% of sales growth.

It’s interesting to me to see that all leading car companies were able to grow their EBITDA in the last three (challenging!) years.

| Car Stocks – 3 Year Growth Rates | Sales Growth | EBITDA Growth Rate |

| 🇺🇸 Tesla | 24% | 67% |

| 🇨🇳 BYD | 20% | 8% |

| 🇩🇪 BMW | 5% | 15% |

| 🇯🇵 Toyota | 3% | 14% |

| 🇩🇪 VW | 2% | 8% |

| 🇯🇵 Honda | -2% | 1% |

| 🇺🇸 Ford | -6% | 9% |

| 🇺🇸 GM | -6% | 3% |

| 🇩🇪 Mercedes-Benz | -7% | 10% |

The Future Of The Automotive Industry

Watching an interesting interview with VW’s Innovation Executive Director, Nikolai Ardey, on Real Vision, changed my view on the automotive industry in general.

Yes, the millennials and Gen-Zs for sure will buy fewer cars compared to previous gens, however, the way we’ll use cars will fundamentally change, and someone still needs to own cars in order to provide them via ride-sharing. Once autonomous driving is really reliable, the “car”, and the time in the car, will be re-defined.

You will be able to do things that were never possible in cars before. You will be able to work, eat, sleep, read, play, learn, and communicate – all from the comfort of a beautiful, safe environment. Will everyone own a car? Maybe not. But with cars ‘re-defined’, it will be a very pleasant and completely different experience.

“Alexa/Siri/OpenAI, get me a 6 seater car at 8 am tomorrow, and drive me to my weekend cottage!”.

My Car Stock With Dividends Top Pick

My current favorite German car stock with a good dividend and at an attractive valuation is BMW.

About Automaker BMW

Headquartered in Munich, Germany, BMW is not only one of the world’s leading manufacturers of luxury light vehicles, but it also manufactures some of the most loved motorcycles, and makes substantial revenues with financial services as well.

Besides the BMW brand, it also owns the Mini brand, and the luxury car brand Rolls-Royce. The business includes 31 production sites in 15 countries and a distribution network in over 140 countries.

A Car Stock At A Very Attractive Valuation

BMW currently has an ultra-low PE of 3 and a price-to-book (PB) of 0,68!

| Car Stocks, ranked by PB | ROE % | ROIC % | ROA % | PB Ratio |

| 🇩🇪 Porsche Holding | 11.56 | 0.3 | 11 | 0.35 |

| 🇩🇪 VW | 10.74 | 2.96 | 3.1 | 0.36 |

| 🇯🇵 Honda | 6.24 | 3.14 | 2.76 | 0.47 |

| 🇩🇪 BMW | 22.4 | 4.78 | 7.36 | 0.68 |

| 🇺🇸 GM | 15.85 | 3.92 | 3.87 | 0.8 |

| 🇯🇵 Toyota | 9.51 | 2.73 | 3.68 | 0.89 |

| 🇩🇪 Mercedes-Benz | 30.35 | 4.94 | 8.73 | 0.89 |

| 🇺🇸 Ford | 20.82 | 6.71 | 3.59 | 1.26 |

| 🇨🇳 BYD | 10.49 | 6.31 | 3.03 | 7.69 |

| 🇺🇸 Tesla | 33.39 | 27.38 | 17.01 | 9.42 |

“Never let a good crisis go to waste”! I believe BMW at these levels represents a good buying opportunity if you can be patient and hold it for years.

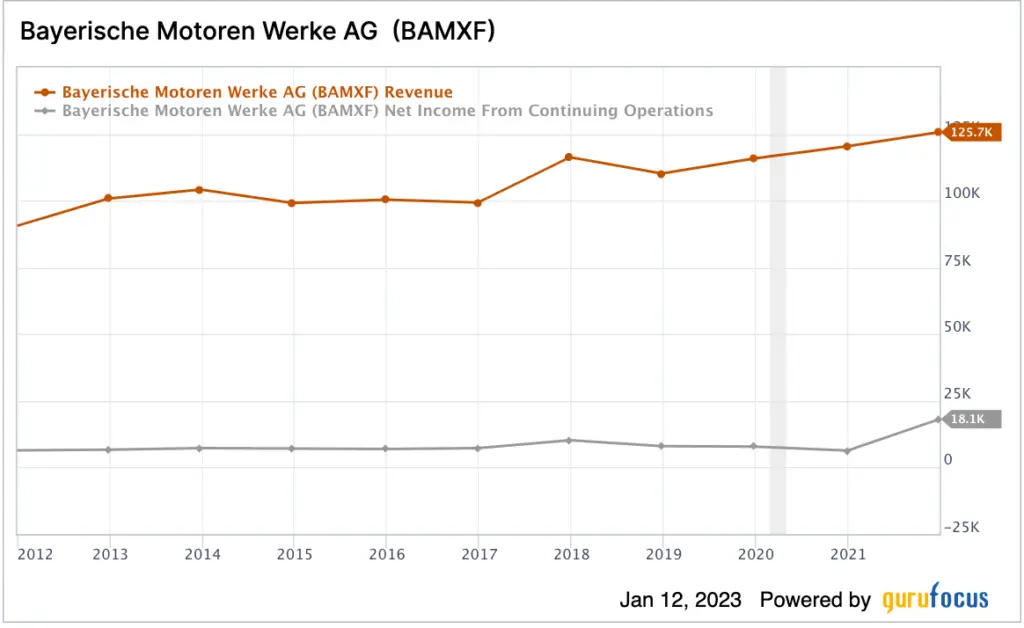

Generating Top-Notch Cash Flows

Although BMW faces a whole series of tough challenges, it still is able to generate significant cash flow from its operations, see the chart below. $18 bio in cash flow from operations is nothing to sneeze at, especially during such difficult years!

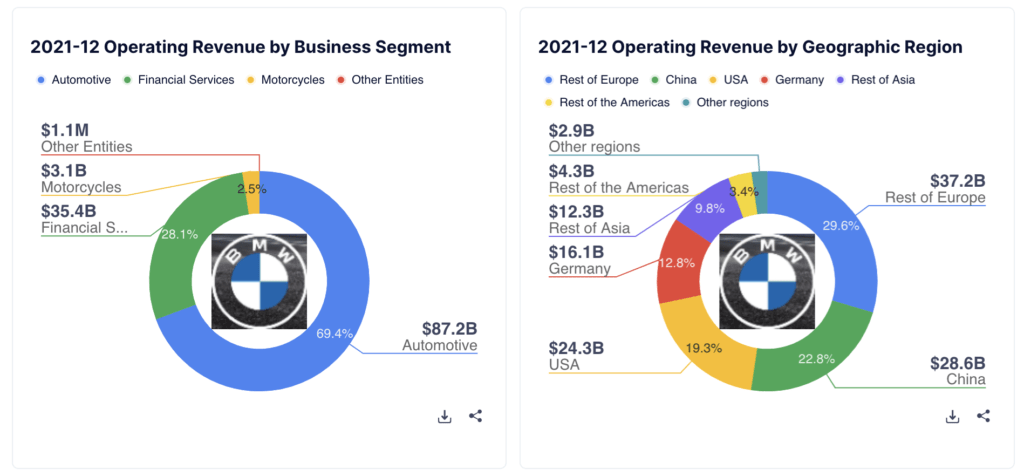

Diverse Revenue Portfolio & Geographic Mix

Besides its core business, the automotive segment, BMW also generates 35 Bio USD with financial services and 3 Bio USD with motorcycles.

Only 42% of its revenues are generated in Europe, about 23% in China, and about 19% in the U.S.

Fantastic Design & Brand Portfolio

credits @ bmwgroup.com

BMW arguably creates some of the most beautiful cars in the world. Being from Munich, I naturally grew up in a “BMW family”, meaning we always drove BMW, never Mercedes.

Hence, I’m completely biased, and I don’t care. I can say with confidence that I know BMW cars ‘inside out’, and knowing the product of the company you want to invest in, is always a good start!

The former Head of Design of BMW once said something that stuck with me, he said: “when we launch a new car, it’s better if some customers don’t like certain design elements at first.. it often takes time, and you need to see it repeatedly before you can warm up to it“.

This was the case with the rear of the new Series 3, which in the beginning I did not like at all. But after a couple of years, I started to really like it as we did.

Personally, I believe BMW’s Z8 is the most beautiful car ever built.

No other than James Bond was the first to slip behind the wheel of a pre-production model of the BMW Z8, to chase, or be chased, by the ‘bad guys’ in the 1999 film The World Is Not Enough.

BMW’s Successful Transition to EVs

The visionary BMW i electric car segment is a pioneer in alternative drive, lightweight construction, and aerodynamics.

With 18 Bio US in cash flow from operations, the company can put substantial resources into R&D, constantly innovating and pushing the boundaries.

BMW might be still behind Tesla, but it has recently seen very good progress with its EV cars.

Conclusion

In my opinion, BMW is the best dividend-paying car stock at the moment.

Despite massive challenges, it generates massive positive cash flows, has an ultra-low PE of 3, a PB of 0.68, experienced and resourceful shareholders, a healthy geographic diversity, and a one-of-a-kind brand portfolio.

In my opinion, this car stock is one I plan to hold in my All-Weather Portfolio for decades to come.

📘 Read Also

-

- The 8x Best Railroad Stocks To Buy

- Check out the 5x best REITs in Asia to buy

- The 8 best oil and midstream stocks

- Check out my monthly dividend calendar

FAQ

What is the best car stock?

The best car stocks are those that show good growth, have strong earnings, pay a dividend, and have little debt. Tesla and BYD grow quickly, but don’t pay dividends. Some good car stocks include

1. VW with sales in Bio US Dollar $287

2. Toyota with sales in Bio US Dollar $265

3. Mercedes with sales in Bio US Dollar $155

4. Ford with sales in Bio US Dollar $152

5. GM with sales in Bio US Dollar $147

6. BMW with sales in Bio US Dollar $141

Which car stocks pay dividends?

The best car stocks, ranked by their dividend yield:

Mercedes-Benz 7.4%

BMW 6.5%

VW 4.7%

Porsche Holding 4.6%

Honda 4.0%

Ford 3.9%

Toyota 2.9%

GM 0.5%

Tesla (no dividend)

BYD (no dividend)

What are the best automakers by dividend yield?

The five best automakers by dividend yield ranked from lowest to highest:

5. Honda 4.0%

4. Porsche Holding 4.6%

3. VW 4.7%

2. BMW 6.5%

1. Mercedes-Benz 7.4%

Is the Mullen automotive stock a good buy?

The Mullen automotive stock, a manufacturer of electric vehicles and energy solutions, compared to other leading automakers, is a small company with no sales. Whether it is a good buy or not will only be known a few years from now. But with companies like BMW or Tesla being able to invest billions in R&D, and having decades of a headstart, it is extremely challenging for Mullen or other young companies to really do something that other leading automakers can not do.

What is the best auto dividend stock?

The best auto dividend stock is those with low PEs and high dividend yields, some examples are below:

Mercedes-Benz, with a dividend yield of 7.4% and a PE of 3

BMW, with a dividend yield of 6.5% and a PE of 3

VW, with a dividend yield of 4.7% and a PE of 4

Porsche, with a dividend yield of 4.6% and a PE of 3

Honda, with a dividend yield of 4.0% and a PE of 8

Ford, with a dividend yield of 3.9% and a PE of 6

What are high dividend stocks from car companies?

The three car companies with the highest dividend yield:

3. VW, with a dividend yield of 4.7%

2. BMW, with a dividend yield of 6.5%

1. Mercedes-Benz, with a dividend yield of 7.4%

AbbVie - The Best Pharma Stock

PROS

- Multiple Sources of Growth

- Diverse Product Portfolio

- Reasonable Valuation

- Strong Cashflows

CONS

- Dependence on Humira & Botox

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love