Key Takeaways

✅ The Hedera network is unlike any other crypto project

✅ It offers cutting-edge tech and speed while being ABFT

✅ Its governing council comprises 39 world-class enterprises

✅ Hundreds of projects from many verticals are building on Hedera

✅ It offers a great risk/reward ratio & is the best crypto to invest in

Many crypto investors try to diversify their digital assets portfolios by looking for undervalued crypto projects. I believe Hedera, with its native token HBAR, stands out due to its unique tech, performance, security, fairness, and sustainability.

In this post, I share my personal and high-level reasons why I believe Hedera is the best crypto to invest in in 2023, and why I own 1 Mio HBAR myself in my Digital Asset Portfolio.

What is Hedera?

Hedera is a distributed ledger. It does not use blockchain technology used by Bitcoin, Ethereum, or alike, but a DAG, a Directed Acyclic Graph.

It uses the ‘Hashgraph’, a consensus algorithm that was invented by Hedera’s founder, Dr. Leemon Baird.

With the help of its innovative “gossip about gossip” protocol and “virtual voting”, Hedera achieves high-throughput performance with +10,000 transactions per second, while ensuring the security of the network.

Utilizing a Hashgraph as opposed to a traditional blockchain brings significant improvements in terms of

- security,

- performance,

- sustainability, and,

- fairness.

Hedera had its initial coin offering in 2018, with a superb launch event. Check it out here. In total, approx. $110 Mio USD was raised.

Who Are Hedera’s Founders?

Dr. Leemon Baird is a computer scientist and inventor who is the co-founder and Chief Scientist at Hedera. He is credited with inventing the Hashgraph distributed consensus algorithm, which is the foundation of the Hedera network.

Mance Harmon is a serial entrepreneur and the co-founder and CEO of Hedera. He is a leading expert in distributed ledger technology and has been instrumental in helping to develop the Hedera network and its governing.

What is Hedera’s Native Token?

Hedera’s native cryptocurrency is called ‘HBAR‘ (check out the HBAR price on Lunarcrush). Put simply, HBAR is a utility token users of the network need to have to pay for transactions, fees, crypto assets, non-fungible tokens, interactions with smart contracts, etc.

Within the crypto industry, Hedera follows a unique approach: It lets dApps being built on Hedera choose to set prices in USD, and not its own native currency, ie. a smart contract execution can be set as 0,02 USD, instead of 1 HBAR, etc.

Does Hedera Pay Staking Rewards?

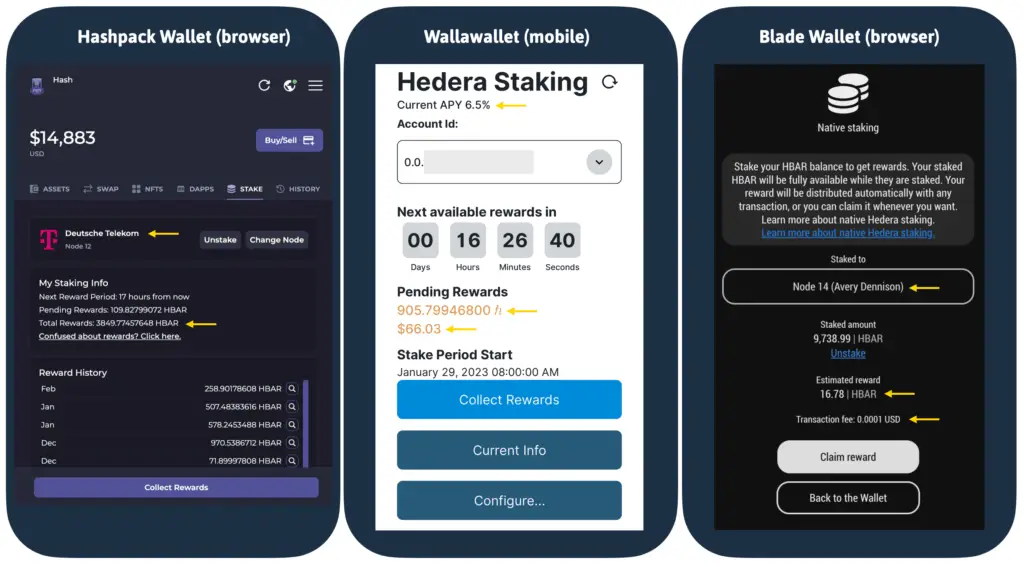

Yes. You can natively stake directly in all major hedera wallets. The staking APY is approx. 6.5%, paid out daily.

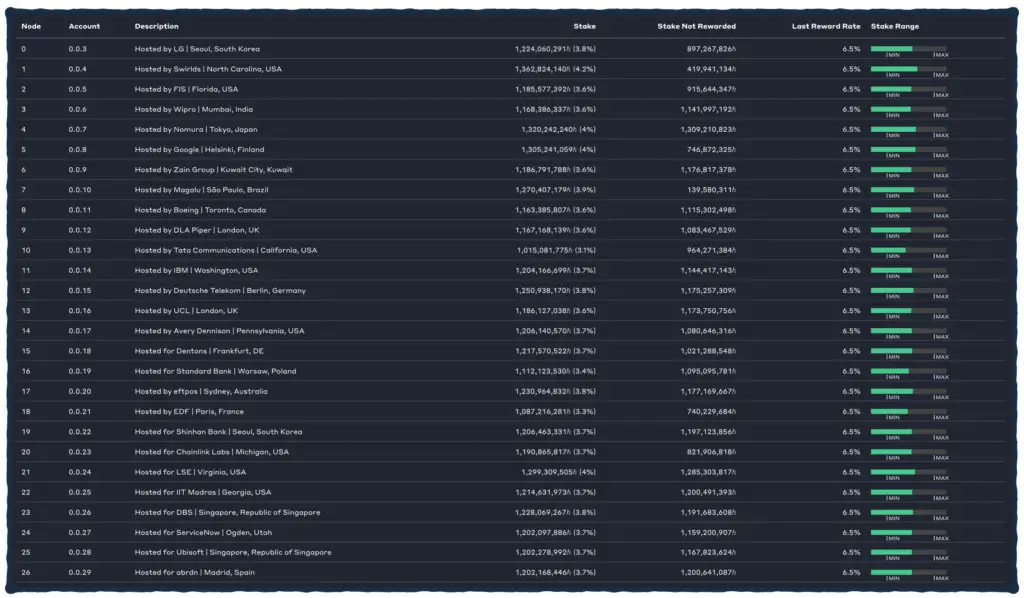

Staking on Hedera could not be easier. Simply deposit some HBAR into your wallet of choice, and choose one of the node operators (I stake with Avery Dennison, Dt. Telekom, and DBS).

See below how the staking page looks on each page (showing my actual staking rewards for the past 9 days).

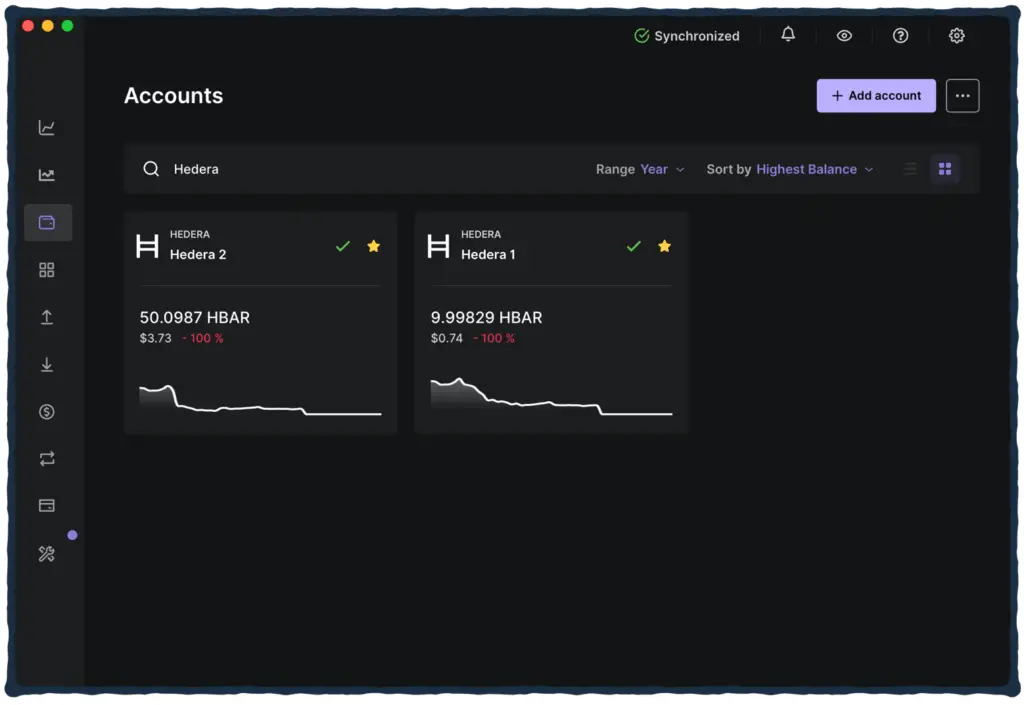

What Are The Best Hedera Crypto Wallets?

Hedera has several good crypto wallets, of which I like three different ones in particular:

- Hashpack Wallet (browser & mobile)

- Blade Wallet (browser extension)

- WallaWallet (mobile)

- Ledger Wallet (so far without staking)

Note re. Hedera and Ledger: You can natively store HBARs on your Ledger, but so far in-app staking is not activated yet. That’s why I am currently using the other three wallets. See the below image of how HBAR appears on Ledger.

Hedera’s Tokenomics

There are currently 26 Bio HBARs in circulation (circulating supply), that’s 52% of the max supply of 50 Bio.

Hedera opted for a very slow supply schedule, meaning a pre-fixed amount of HBAR will be released over the coming 10-15 years.

If there is one point I am not thrilled about it is the relatively high inflation (tokens released to the public) – but this can sort of be countered with the 6.5% staking rewards (see below).

Although Hedera’s tokenomics are not great, it is still one of the best cryptocurrencies to invest in.

Hedera’s Network Security

Did Hedera Solve The Blockchain Trilemma?

Every distributed ledger faces the challenge of the Blockchain Trilemma of decentralization, scalability, and security.

For the longest time, it was believed that decentralized networks can only meet two of three criteria, but not all three at the same time.

That’s the challenge Dr. Baird began to work on trying to solve back in 2015. And solve he did. He found a way to make a permissionless network not only decentralized and scalable but also secure.

This is a breakthrough innovation I believe is not understood well enough yet, and sooner or later will be recognized to a greater extent.

And while solving the blockchain trilemma, Dr. Baird took it even one step further and achieved what’s called the industry’s gold standard of security: aBFT.

What Is Hedera’s aBFT?

aBFT stands for asynchronous Byzantine Fault Tolerance, a security characteristic that means a network will still work properly even if 50% of its participants are maliciously attacked.

Most modern blockchains these days are BFT but are not aBFT.

In order to become aBFT, the consensus algorithm needs to solve what’s called the Byzantine General’s Problem.

The Byzantine General’s Problem – Explained

Mike Maloney does a great job explaining the Byzantine General’s Problem. The video also explains how Dr. Baird solved this challenge, which then became the basis for the Hashgraph algorithm that the Hedera network is built on.

Is Hedera Resilient to Distributed Denial of Service Attacks?

Yes, by being aBFT (see above), Hedera uses a leaderless algorithm, meaning it essentially is making distributed denial of service attacks (DDOS) impossible. There simply is no leader to attack!

As one of the only DLTs, Hedera is Peer Reviewed by a Carnegie Mellon’s Professor, confirming that its Hashgraph consensus algorithm Is asynchronous byzantine fault tolerant. He checked this using the Coq system, a formal proof verification system.

Additionally, Hedera is also post-quantum secure.

What Are The Benefits Of Using The Hashgraph Algorithm?

If a crypto exchange for example is built on Hedera’s Hashgraph, all transactions of crypto coins are registered, recorded on, and written to the DAG. If you ie. sell, transfer, or trade a digital currency or NFT, every transaction is recorded and sorted in the actual order, down to the millisecond.

Cheating, front-running, or just being dishonest, becomes impossible, as the entire history of digital currency transactions, regardless if these happened on decentralized exchanges or crypto wallets, are traceable, and sorted in the order as they actually happened.

Conclusion #1: The Hedera network is as secure as it gets.

Performance Of Hedera Hashgraph

How Fast Is Hedera?

While regular blockchains such as Bitcoin, Ethereum, or Cardano are structured as a “block” or “chain” of transactions, Hedera’s Hashgraph is a “graph” of transactions, that can process transactions in parallel.

Therefore, it takes a completely different approach to share information within its network, and, most importantly, find consensus among the node operators.

–> HederaTXNS

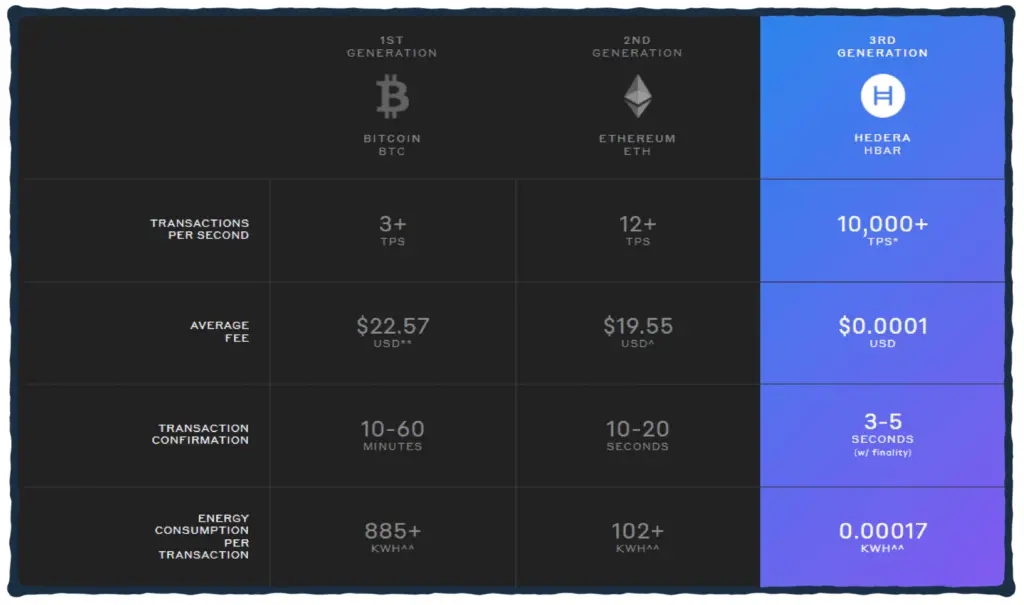

How Many TPS Can Hedera Process?

At the time of writing this post, Hedera already processes hundreds of transactions per second or TPS.

According to Hedera itself, it currently throttled the network to 10,000+ TPS on the mainnet but can go up to 1,000,000 TPS with sharding and using Graphics Processing Units (GPU).

If we compare the number of transactions that the popular Layer-1 blockchains can process on the native layer, we can see how well Hedera does.

How Many Seconds To Full Finality?

Hedera’s consensus algorithm currently requires less than 35 seconds to full finality. In these three seconds, you get verifiable proof that your transaction, no matter if it is buying a coffee at a Starbucks or a 1 Mio USD property acquisition, is checked by all nodes and written to the ledger.

You can check the time to finality on Metrika.

Conclusion #2: Hedera is an ultra-high-performance layer 1 network.

Hedera’s Sustainability

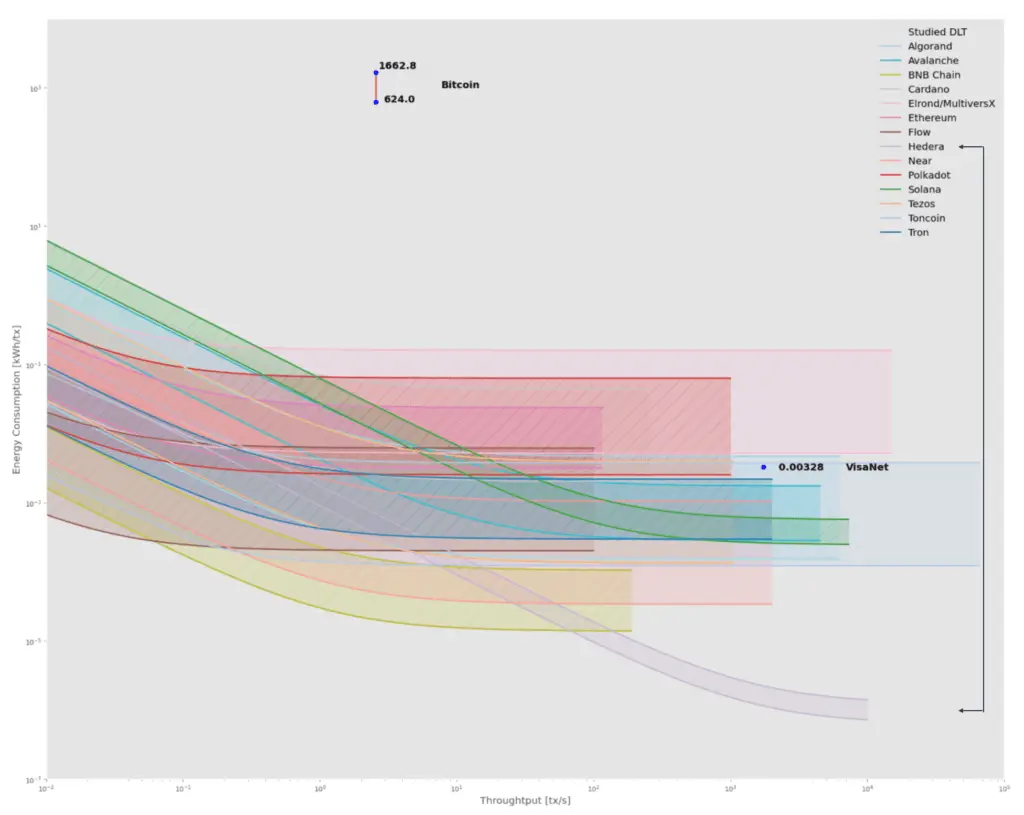

The University College London (UCL) did an empirical study and looked across the entire crypto market which cryptocurrency projects fair the best in sustainability, measured in how many watt-hours it takes to process one transaction.

Check out the chart below.

Because Hedera is a DAG, it relies, as Dr. Baird put it “on pure math and not on proof of stake (ie. like Ethereum) or proof of work (ie. like Bitcoin).

This math-heavy yet energy-light approach makes Hedera use about 1 billion times less energy than Bitcoin.

Even compared to Binance Chain, according to the study an alternative coin on the 2nd spot, Hedera still uses 19x less energy to process one transaction.

Is Hedera Carbon-Neutral?

No, it is even better than carbon-neutral. Hedera is carbon-negative, meaning that it is actively removing carbon dioxide from the atmosphere!

Bitcoin can process about 6 transactions per second, requiring hundreds of thousands of energy-eating mining rigs for its proof-of-work algorithm. This requires the same energy as an entire country as Ireland requires.

In contrast, Hedera achieves tens of thousands of transactions, with 1 billion times less energy (!).

Even Visa, the credit card behemoth with massive volumes of scale requires 1,000 more energy to process the same amount of transactions as Hedera.

Conclusion #3: By being the “greenest network”, Hedera has the potential to become the go-to Distributed Ledger Technology network for projects that prioritize sustainability. I believe one of the key requirements for any candidate with the aim to become the best crypto to invest in.

How Does The Hedera Network Ensure Fairness?

If the points mentioned above are not already enough to make Hedera stand out from other popular cryptocurrencies, it is, I believe, its Global Governing Council where Hedera really shines

From the onset, Hedera asked itself what the most trusted governing body would look like to ensure the highest possible amount of fairness, and trust.

It opted to set up a global council of world-class companies. These are the highest-caliber multinationals, interested in governing the network, having a say in the direction it is heading, and helping develop as well as operating a node to support the network.

About Hedera’s Governing Council

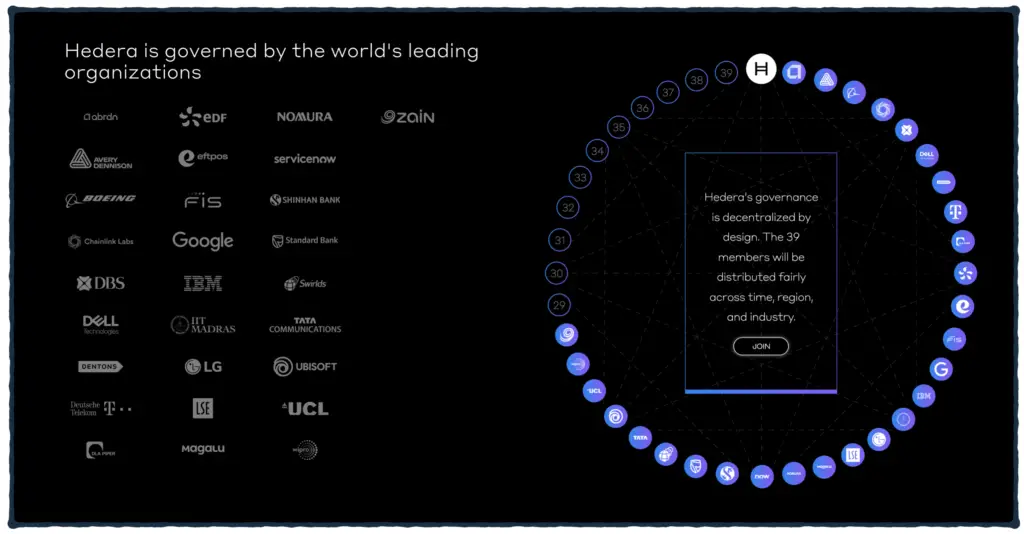

In total, Hedera’s Governing Council may have a max of 39 council members.

At the time of writing this post, 28 spots are filled, with Dell just being announced as the latest multinational to join the council.

The members show a wide variety in terms of

- geography,

- industry,

- expertise, and,

- preferences.

Who Makes Up Hedera’s Global Council?

The total list of members includes companies such as

- Ubisoft (2nd largest gaming company in the world)

- Dt. Telekom

- Dell

- IBM

- EDF (one of France’s largest utility companies)

- Boeing

- LG

- Standard Bank (Africa’s largest bank)

- Shinhan Bank (South Korea’s largest bank)

- University College of London

- Zain (one of the largest TelCos in the Middle East)

- etc.

See the image below showing the current nodes run by each of the council members.

Check the live status of the nodes here.

Each of these council members runs a full node, helping to empower the entire network. It also participates in the quarterly Global Council Meetings.

The 39 members are publicly identified and are legally bound to act in the best interest of the network.

The Council is also subject to regular independent audits, and each member must adhere to a strict code of conduct.

Additionally, the Council must approve any major changes to the protocol, so that the entire process is open and transparent.

This whole structure and the world-class enterprises making up the council are one of the key reasons why I believe Hedera is the best crypto to invest in.

Is Hedera Transparent?

Yes. Even the minutes of each global council meeting are shared after the meeting, ensuring that every stakeholder is in the know of what is happening and more importantly, what will happen and be done on the network.

–> Hedera’s Council Minutes

For companies like Dt. Telekom or Boeing, it surely is not money that incentivizes them to join. They join because they want to hear and see what other council members do, have a say in how the network develops, and exchange ideas among like-minded executives.

There are loads of projects in the crypto industry where it is not really clear who actually governs the network and has the final say.

With Hedera, it’s all in the wide open, and decisions are made by world-renown companies of different industries, regions, and expertise.

Conclusion #4: Hedera took a very smart approach by letting world-class enterprises become its own governance body, encouraging them to build their own use cases on the network. Releasing the minutes of every single council meeting makes it also one of the most transparent crypto projects.

Hedera Services

At the current stage, besides being a high-performance, secure, and fair Layer 1, Hedera offers a series of additional modular services:

HTS – Hedera Token Service

Network users are able to create, mint, and manage fungible and non-fungible tokens, aka NFTs. They can manage all aspects of the tokens they like to create, be it internal tokens for their DAPP, or publicly-available tokens for.

HCS – Hedera Consensus Service

Other crypto projects can decide to only use Hedera’s Consensus Service, aka HCS. Using Hedera’s HCS, any transaction can be recorded in a verifiable way, ordered in an immutable event log for other applications, or other permissionless blockchains, to check.

Hedera Smart Contracts

Developers and other crypto projects such as Ethereum are used to code with the programming language Solidity. Hedera created a way for Solidity Devs to deploy Solidity smart contracts directly on Hedera, making transactions go through faster with substantially lower fees.

–> Learn more about Hedera’s service on the How It Works page

Hedera DeFi

Besides earning staking rewards by simply holding HBAR in your wallet, Hedera also offers interesting DeFi and yield farming opportunities. The best crypto to invest in needs a strong DeFi ecosystem, and although DeFi on Hedera is still young and not even one year old, it’s growing steadily.

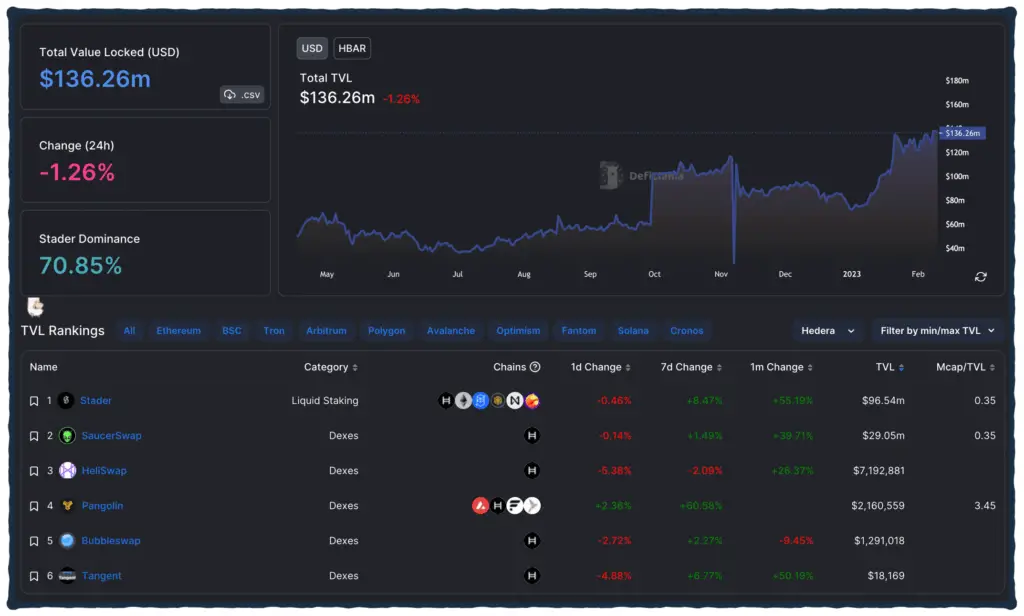

According to DeFilama.com, Hedera’s TVL (total value locked) is at 139 Mio USD, see the dashboard below.

The dashboard shows the 2-3 major DeFi platforms on Hedera:

- Stader Labs (liquid staking)

- SaucerSwap

- Heliswap

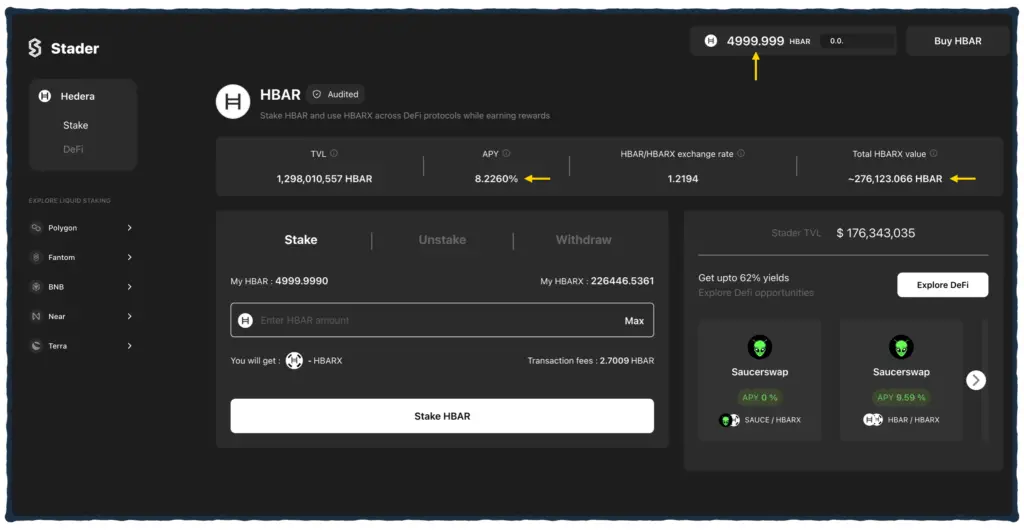

Liquid Staking on Hedera via Stader Labs

You can use Stader Labs to use its liquid staking solution to lock up your HBAR. In return, you will get HBARX that you again can use to yield farm on other DeFi platforms (see ie. below). As you can see in the following image, I currently have 276,000 HBARX, and it’s completely up to me what I want to do with it.

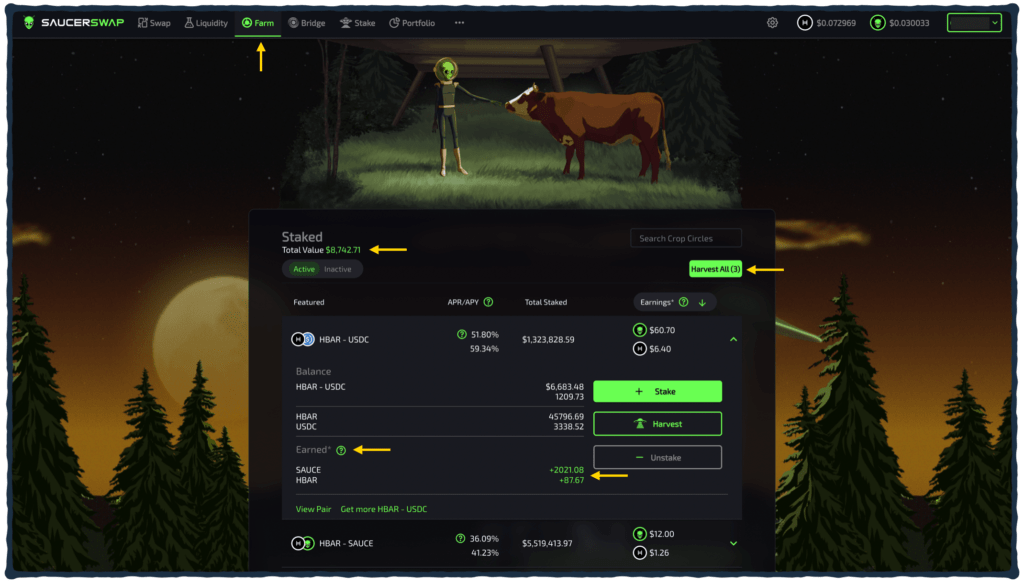

Yield Farming on Hedera With SaucerSwap

SaucerSwap was Hedera’s first decentralized exchange, offering a full range of DeFi services, such as liquidity pools, native SAUCE staking, and yield farming. I have been a SaucerSwap user literally from day one and currently am in the HBAR/USDC liquidity pool (and farm), and HBAR/SAUCE LP (and farm).

In order to make it easy to track the performance of the liquidity pools I am in, I usually deposit round numbers. In this case, I originally deposited 6,000 USDC on the platform, swapped 3,000 USDC into HBAR, put those USDC/HBAR into the liquidity pool, received the LPs, and staked those LPS in the yield farm.

I did this in late August 2022. Since then, whenever I collected the rewards in form of HBAR and SAUCE, I put those two in the HBAR/SAUCE LP and farm.

My balance is now 8,742 USD, an increase of 46% in 5 months. Nice. I also staked 10,000 SAUCE in SaucerSwap’s native staking pool, earning an approximate APR of 15%.

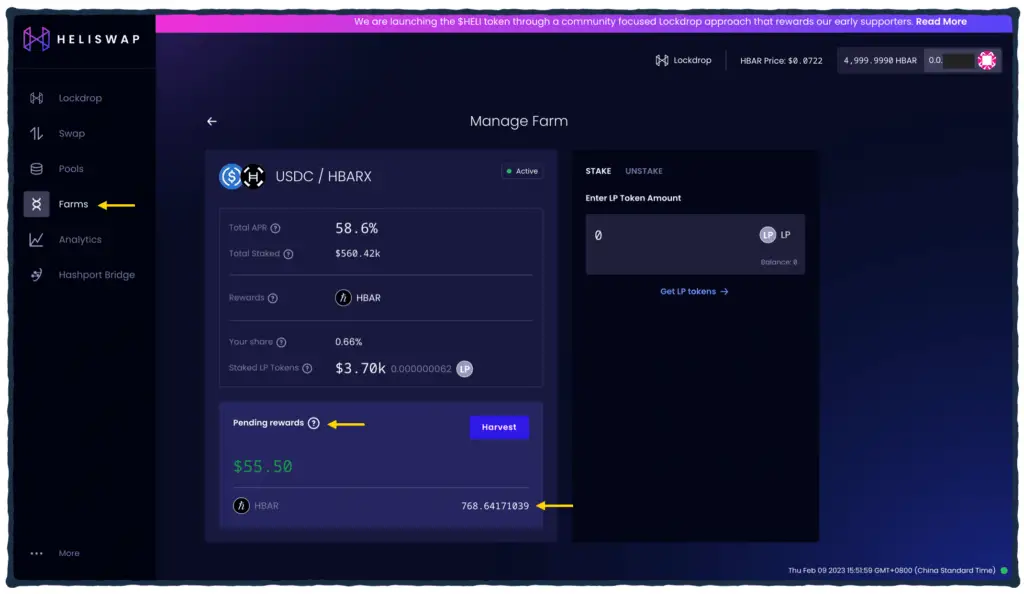

Earing Fees Via Heliswap’s Liquidity Pools

Besides SaucerSwap and StaderLabs, you can also use Heliswap, Hedera’s first DEX to not only support native Hedera tokens but also enable participants in the Hedera ecosystem to swap between HTS (Hedera Token Service) and ERC-20 tokens in a cost-efficient manner.

In early October 2022, I started liquidity mining with 1,644 USDC + 23,500 HBARX (see above /StaderLab’s liquid staking). The average APR since then has been approx. 41%.

For the last 9 days, I earned 55 USD, or 768 HBAR, which I collect once a month and either deploy or use elsewhere.

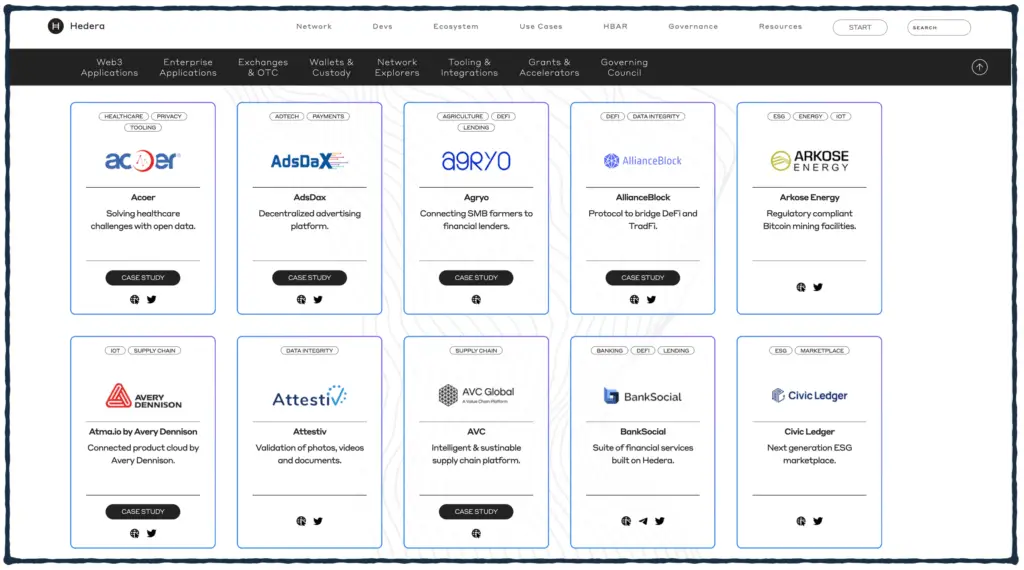

What Use Cases Are Built On Hedera?

The number of decentralized applications (DAPPS) being built on Hedera is very difficult to follow, as there are now simply too many!

Check out the excellent dashboard giving you a sense of the amount and quality of DAPPS being built and deployed on Hedera.

There are a couple of DAPPs I like to however highlight:

-

- Toko.network

TOKO is a digital asset creation engine created by DLA Piper, a Hedera Governing Council member, that couples the compliance and regulatory rigor of one of the world’s largest law firms. - AdsDax

AdsDax reduces the costs associated with fraud and intermediaries and creates trust between advertisers and publishers using Hedera. - DOVU.earth

DOVU, partially owned by Jaguar Land Rover, is a tokenized data economy for DeFi carbon offsetting. - Atma.io

atma.io is a connected product cloud by Avery Dennison, unlocking the power of connected products by assigning unique digital IDs to everyday items, and providing unparalleled end-to-end transparency by tracking, storing, and managing all the events associated with each product. - Zuse.market

Zuse Market is the leading NFT marketplace built on Hedera with the mission is to making NFTs simple.

- Toko.network

Conclusion

So, Is Hedera The Best Crypto To Invest In? A completely biased and resounding yes!

I believe Hedera deserves a spot in any cryptocurrency investor’s portfolio due to the reasons I am sharing above. It is a superior network not only in terms of tech, performance, and security but also due to its highest-standard governing council, ensuring fair and transparent decision-making.

Please bear in mind that I’m approaching this with the mindset of a long-term investor. I am not a software dev or technical engineer, claiming to understand every small nuance of the tech involved.

📘 Read Also

- Check out Digital Asset Portfolio

- The 7 Best Video Game Stocks To Buy In 2022

- The 3 Best Ways To Invest In The Metaverse

- How To Invest In AI (9 Concrete Ideas)

FAQ

Where to check the Hedera Hashgraph chart?

The best way to check the Hedera Hashgraph chart is on Tradingview.com.

What is the Hedera Hashgraph token?

Hedera’s native utility token is called the HBAR. One transaction on the Hedera network costs about thousands of a dollar or a tenth of a cent = 0,001 USD.

Can I buy Hedera Hashgraph on Coinbase?

Yes, you can buy HBAR, the native token of the Hedera network, on Coinbase.

Does Ledger support Hedera Hashgraph?

Yes, the Ledger cold wallet supports Hedera and its native token, HBAR, natively, however, as of Feb 2023, staking is not activated yet.

What is the best crypto to invest in today?

There are many candidates, but the top spot takes Hedera Hashgraph with its token HBAR. It uses next-generation distributed ledger tech with the best governance, throughput, security, and sustainability in the cryptocurrency industry, and should do well in the years to come.

What are the top 5 crypto investments?

1. Bitcoin

2. Ethereum

3. Hedera

4. Cosmos

5. Solana

Which crypto has the most potential?

The three crypto projects with the most potential, relative to where their token price is now, are

1. Hedera Hashgraph with its HBAR token

2. Cosmos with its ATOM token

3. Solana, with its SOL token

Why is Bitcoin still the most important cryptocurrency?

Bitcoin is still the most important cryptocurrency because it is apolitical incorruptible money, giving every individual, regardless of race, color, gender, age, or location, the ability to hold their own wealth without any intermediary, it is digitally scarce, secure, censorship-resistant, seizure-ship resistant, permissionless, very hard to create, global and borderless, non-sovereign, easily portable, and, disinflationary.

Which crypto has the most potential?

Considering the risk/reward ratio of all cryptocurrencies, the crypto project with the most potential is Hedera Hashgraph, with its native token HBAR. It is considered to be the next big cryptocurrency and the best crypto to buy in 2023.

What are some other important cryptocurrencies?

Besides Hedera, other important cryptocurrencies are

– Thorchain, with its native token RUNE,

– Cosmos, with its native token ATOM,

– Solana, with its native token SOL,

– Polkadot, with its native token DOT, and,

– Cardano, with its native token ADA.

Follow Me On Twitter

Learn why I bought 1 Mio $HBAR.

— WiseStacker (@WiseStacker) February 14, 2023

How I earn passive income.

What yield farms and wallets do I use.

And why Hedera will be a Top 10 coin before year-end.

👉 https://t.co/pxTTH47Lev

The Best Crypto To Invest In - Hedera Hashgraph

I believe Hedera deserves a spot in any cryptocurrency investor's portfolio due to the reasons I am sharing above. It is a superior network not only in terms of tech, performance, and security but also due to its highest-standard governing council, ensuring fair and transparent decision-making.

PROS

- High-Performance Network

- Highly Diversified Governance

- 10,000 TPS

- No Fork Guarantee

- High Security (aBFT, Coq Proof)

- Quantum Computing Resistant

- No Mining Or Proof Of Work

- Open Source

- Carbon Negative

CONS

- Currently Only 28 Validators

- Enterprise-Focused

- Inflationary Tokenomics

Review Breakdown

-

Speed & Throughput

-

Governance

-

Decentralization

-

Sustainability

-

Security

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love