Dividend Reinvestment Report – September 2024

I do not follow a strict Dividend ReInvestment Plan, called DRIP, because I prefer to allocate available funds to stocks that offer the best risk/reward at the specific moment.

Dividends Received

September was a good month with $2,591 US received.

In September 2023 I received $2,144 – an increase of about $450 – nice.

Largest dividends were paid by consumer giant Reckitt Benckiser and Rio Tinto, one of the four largest mining companies in the world, producing those materials we need to transition to a sustainable future!

| Dividends | Shares | Value |

| Reckitt Benckiser | 675 | $524 |

| Rio Tinto | 320 | $424 |

| Enbridge | 510 | $292 |

| Unilever | 800 | $289 |

| Shell | 350 | $241 |

| Pfizer | 600 | $176 |

| Public Storage | 45 | $115 |

| Kraft-Heinz | 400 | $112 |

| Realty | 470 | $105 |

| BlackRock | 26 | $99 |

| J&J | 80 | $89 |

| Union Pacific | 75 | $85 |

| Franco Nevada | 127 | $39 |

| Total | $2,591 |

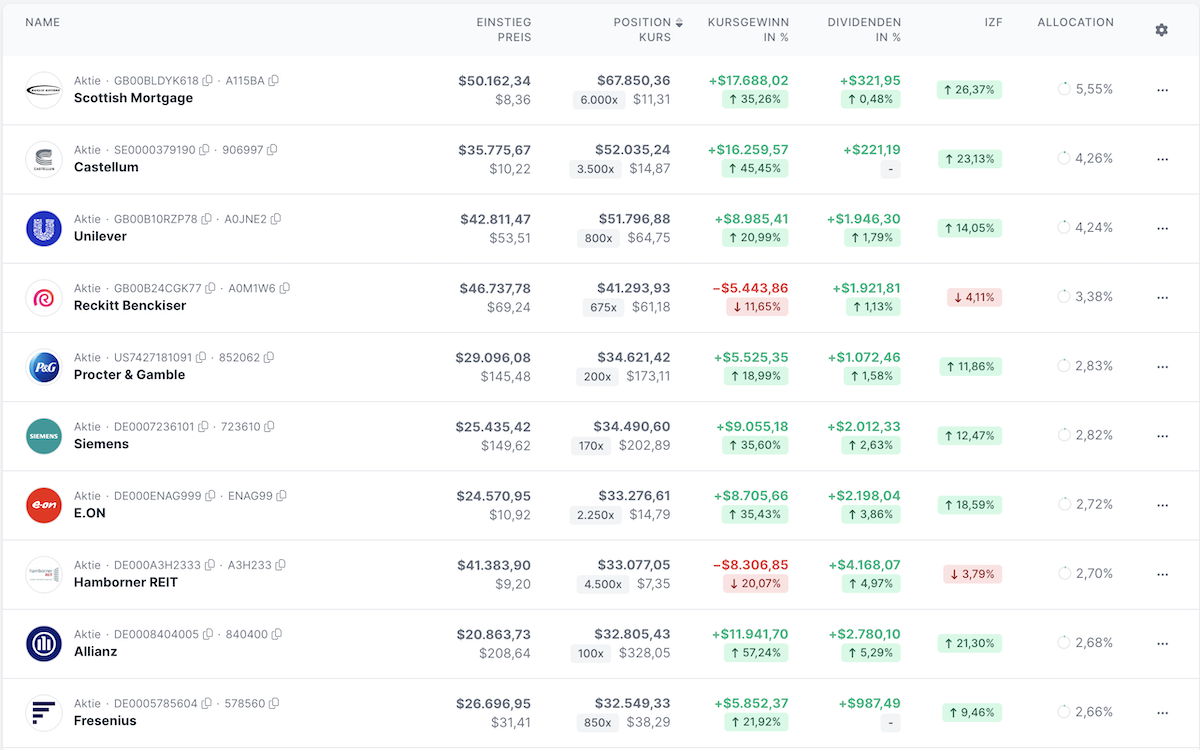

10 Largest Portfolio Positions

See below my current 10x largest positions in my All-Weather Portfolio.

This dashboard is from the fantastic free version of Parqet – love what those guys are building.

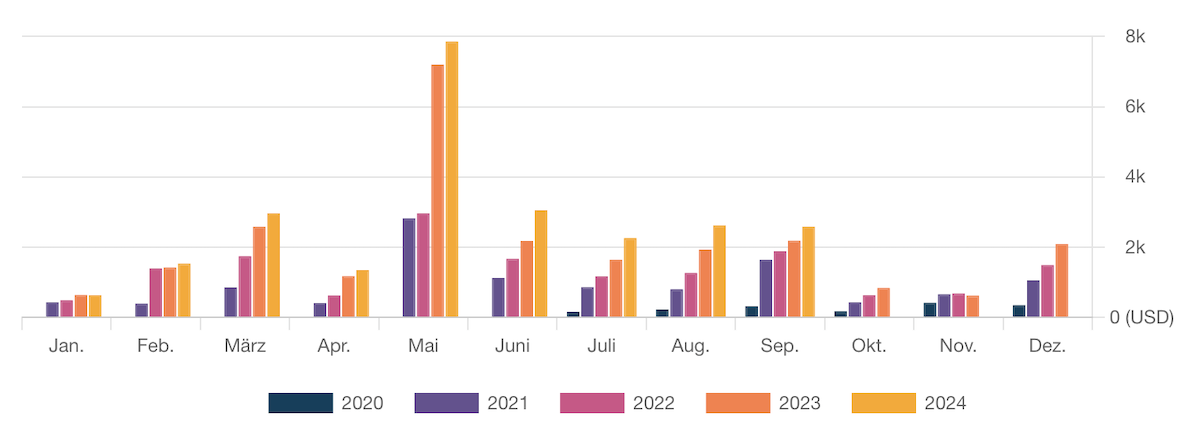

When looking at how my dividends have developed over the years, it looks like this (2024 is yellow, 2023 is orange, etc.).

Dividends Reinvested in September

In September, I only made 3x purchases:

| Purchases | Shares | Value |

| LVMH | 10 | $7,672 |

| ProSiebenSat1 | 100 | $655 |

| Realty | 10 | $609 |

| Total | $8,937 |

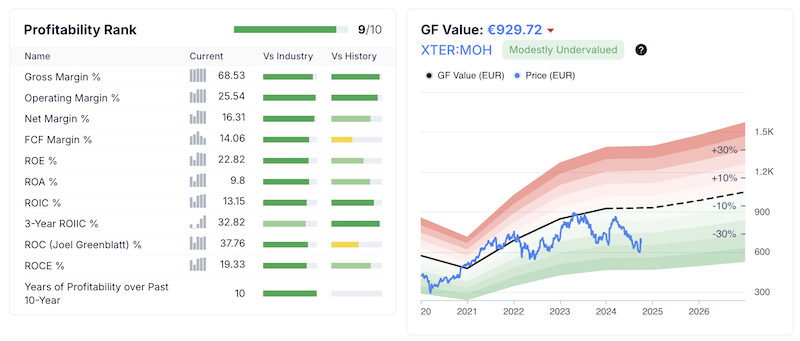

I finally bought more shares of LVMH after it was back in Gurufocus’ undervalued range.

My Realty Income position keeps creeping up towards my long-term goal of having 500x $O. It’s currently paying me $105 every single month, and knowing that they own +13,000 properties in the U.S. and the U.K. gives me the feeling that these distributions will keep coming for a while.

I believe $O is an excellent dividend reinvestment stock because you instantly get more the next month if you buy just a few shares.

I also bought more ProSiebenSat1, one of the largest German media companies, after it kept showing positive results towards making various bold changes. Sooner or later this will pop to 8-10€ per share.

Conclusion

September was a solid month for my dividend income, with a notable increase compared to the same time last year.

While I don’t follow a traditional DRIP approach, my strategy of selectively reinvesting dividends has allowed me to take advantage of undervalued opportunities like LVMH. I am convinced this approach continues to build long-term wealth while steadily increasing my passive income stream.

Looking ahead, I will try to remain focused on balancing growth and stability in my portfolio, ensuring that I maximize both dividend income and capital appreciation. September’s reinvestments reflect this goal, and I’m excited to see how these positions evolve in the coming months.

📘 Read Also

- Business Broker Tips: How I Earned $15,000 in One Day

- How to Invest in Asia – The 5 Best Asian Stocks To Buy

- My Next Big Crypto Bet: Jupiter Exchange

- ETF Investment Guide for A New $1.5 Mio Portfolio

FAQ

Are dividend reinvestment plans worth it?

Dividend reinvestment plans (DRIPs) can be worth it if you’re focused on long-term growth. They allow you to automatically reinvest dividends into more shares, helping you compound returns over time without needing extra cash.

What is a dividend reinvestment program?

A dividend reinvestment program (DRIP) allows you to automatically use the dividends from your investments to purchase more shares of the same stock, helping to grow your investment over time.

What is the dividend reinvestment type?

Dividend reinvestment type refers to how dividends are reinvested, whether through an automatic plan (DRIP) or manually choosing to reinvest dividends into stocks you prefer.

Which dividend reinvestment plan is best?

The best dividend reinvestment plan depends on your goals. If you want automatic compounding, a company-sponsored DRIP is convenient. However, manually reinvesting may give more flexibility in choosing stocks based on current market opportunities.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love