Dividend Analysis

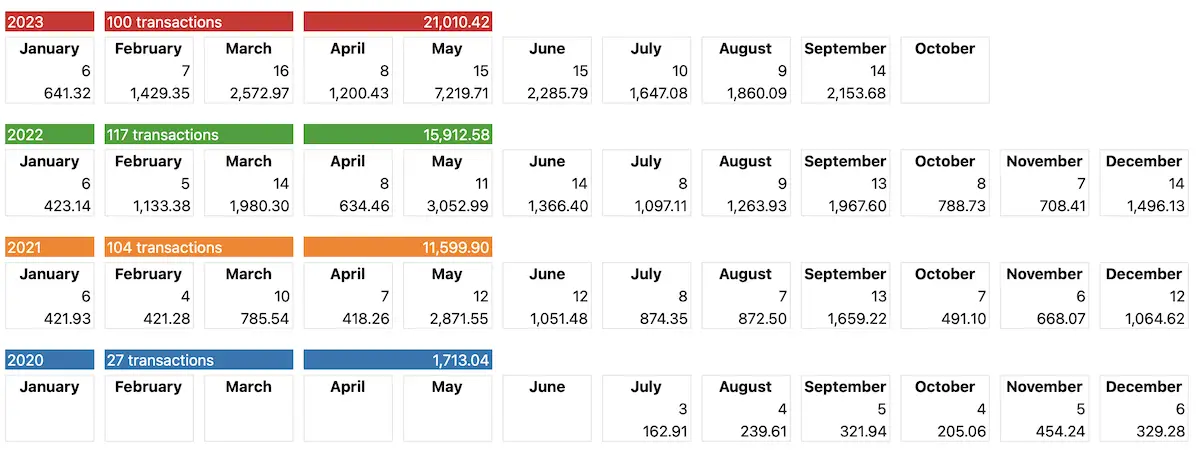

In the last month, I received a total of $2,144 US, an increase of $235 from the $1,909 generated last year.

| Shares |

Dividend |

|

| 🇦🇺 BHP | 210 | $333 |

| 🇬🇧 Rio Tinto | 250 | $305 |

| 🇨🇦 Enbridge | 500 | $275 |

| 🇬🇧 Reckitt Benckiser | 350 | $244 |

| 🇬🇧 Shell | 250 | $166 |

| 🇬🇧 Unilever | 350 | $120 |

| 🇺🇸 Pfizer | 400 | $115 |

| 🇺🇸 Public Storage | 45 | $115 |

| 🇺🇸 Realty Income | 435 | $94 |

| 🇺🇸 BlackRock | 25 | $90 |

| 🇺🇸 Johnson & Johnson | 80 | $86 |

| 🇺🇸 Kraft-Heinz | 300 | $84 |

| 🇺🇸 Union Pacific | 75 | $83 |

| 🇨🇦 Franco Nevada | 123 | $36 |

| Total | $2,144 |

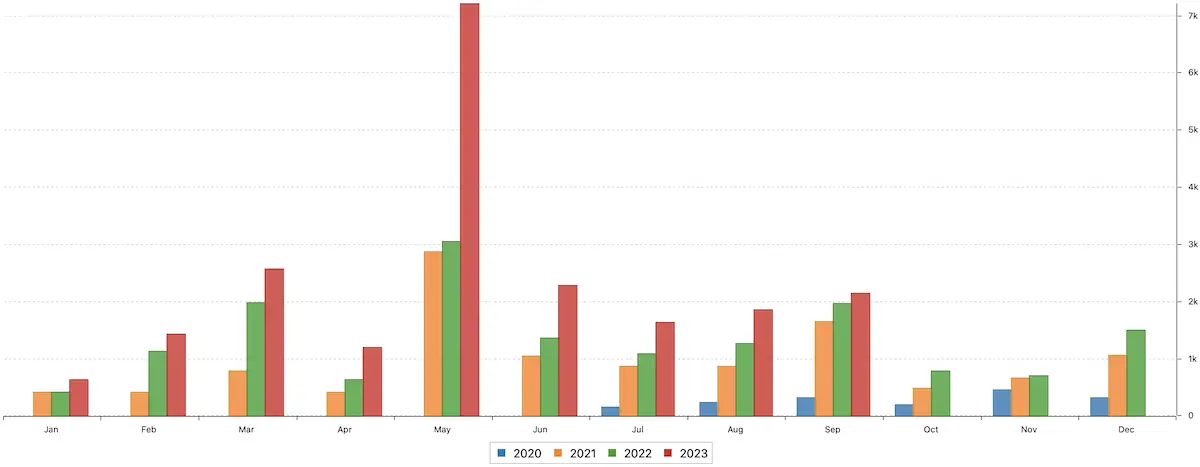

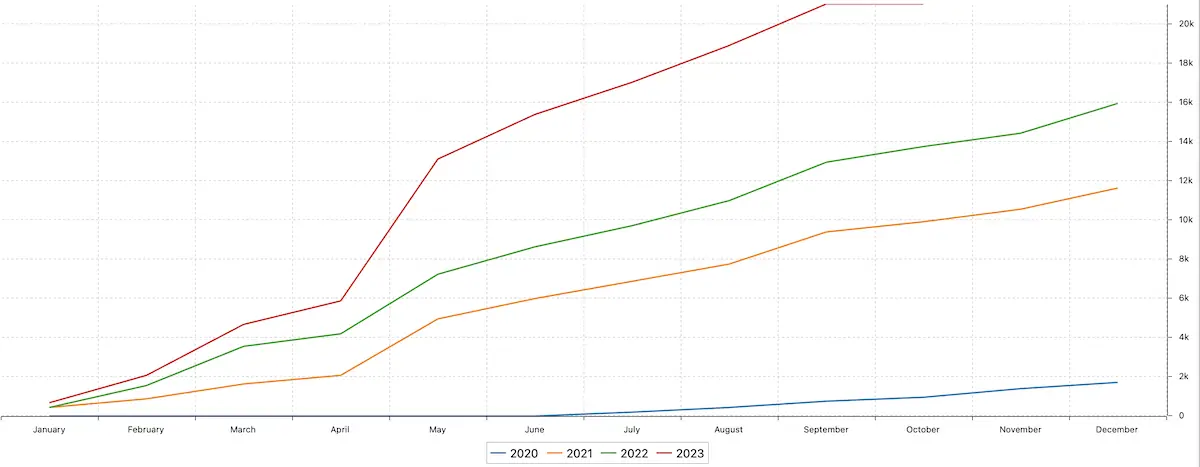

Dividend Analysis Charts

Buying $15,357 Worth Of Dividend Stocks

On the purchase side of things, I invested $15,357 in four of my holdings:

| Shares | Purchases | |

| 🇨🇦 Brookfield Renewable | 160 | $4,001 |

| 🏴 Scottish Mortgage | 500 | $4,000 |

| 🇺🇸 Kraft-Heinz | 100 | $3,268 |

| 🇦🇺 BHP | 40 | $2,245 |

| 🇩🇪 ProSiebenSat1 | 250 | $1,843 |

| Total | $15,357 |

Brookfield Renewable – Dividend Analysis

Brookfield Renewable $BEP, is one of my 12 Never Sell Stocks in my All-Weather Portfolio, a global renewable giant with massive investments in solar, wind, hydro, and geothermal projects.

With rising interest rates, its share price decreased a lot, and the financing of many low-yield projects needs to be re-evaluated, I see the current prices as an opportunity to add to my ultra-long position.

Purchase of 500x Scottish Mortgage Trust

Similar to all the previous five months, I again DCA’ed into one of the best tech funds, the Scottish Mortgage Trust. I now invested a total of 50,000 Euro, own 5,500 units, and have a full position.

Kraft Heinz – Dividend Analysis

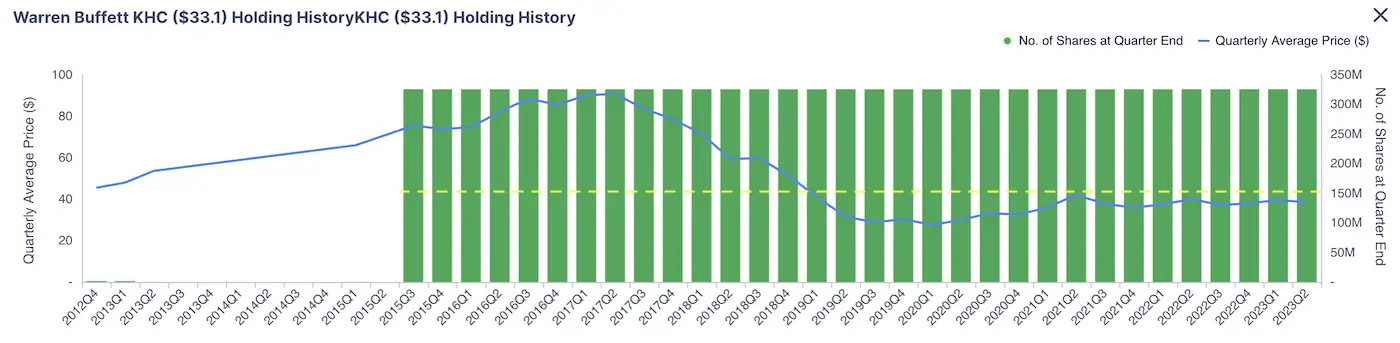

You can currently buy shares of Kraft-Heinz $KHC for less than half of the price that Warren Buffett paid.

Check out the excellent chart of Gurufocus.com, showing Berkshire Hathaway’s holding history.

Buffett purchased a large junk of the company in the third quarter of 2015 when $KHC‘s share price was approx. $75.

My family just bought another two large cans of Heinz tomato ketchup, and we won’t stop doing so anytime soon. That’s why I believe Kraft Heinz’s dividend is safe.

Dividend Analysis of BHP

While the mad money printing continues or accelerates, I happily add to $BHP, in my opinion, one of the best natural resource stocks!

To decarbonize the world, the world will need millions of truckloads of ‘stuff’. And BHP mines and produces this ‘stuff’.

Regardless of what currencies we use in the future, countries and companies will need and therefore buy all the minerals, commodities, and natural resources BHP produces, and that’s why I see it as a great buy-and-hold stock, as explained in one of my most read posts: How To Invest In Commodities – 15 Great Stock Ideas.

ProSiebenSat1 – Dividend Analysis

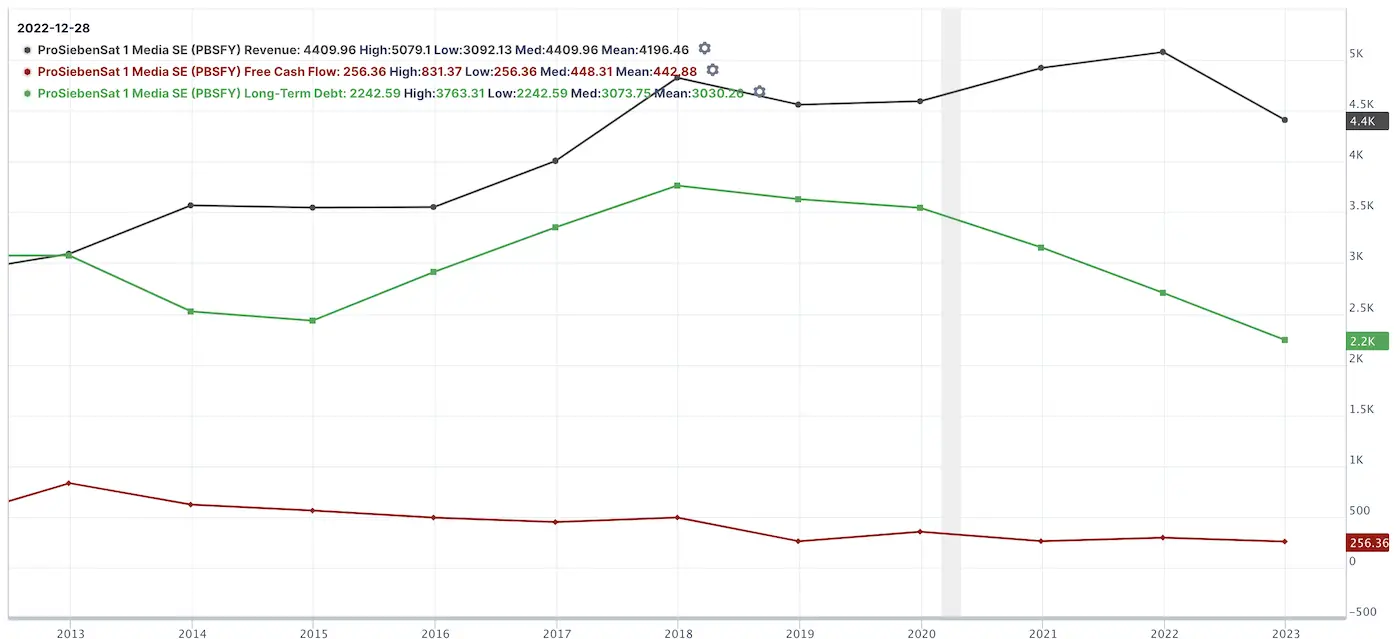

My smallest purchase of the month was ProSiebenSat1 $PBSFY, one of Europe’s largest media companies.

I now own 2,750 shares with an average price of 7.80 euros and believe we will see much higher prices in 2-3 years. Their total market cap as of today is $1.5 Bio US.

In my opinion, seven Ventures, their venture capital unit, contains many aspiring unicorns such as About You, Casper, Helpling, Houzz, etc., and that alone should be more worth than that.

Below are just some of their investments. Most noteworthy is surely Parship, one of Europe’s largest dating sites, aiming to IPO in 2024.

ProSiebenSat1’s revenues came down a bit in the years of the pandemic, but while their massive VC portfolio has time to mature, the company still sees free cash flow of +250 Mio Euros every year.

It also aggressively brings down debt, see the chart below.

Other Passive Income of $10,500

Besides the above-listed dividends, I also earned $10,500 US passive income from a variety of different revenue streams.

For example, $1,660 in staking rewards and liquidity pool fees from my digital assets.

Click here if you like to unlock it & instantly see a full breakdown.

Conclusion

Dividend-wise, a sort of normal and quiet month. Happy to see constant progress.

📘 Read Also

- The 5 Best European Insurance Stocks To Buy

- Unveiling My Uranium Miners Portfolio | My Top 8 Positions

- How To Build A Simple Crypto Portfolio – A Step By Step Guide

FAQ

How to analyze a dividend stock?

To analyze a dividend stock, look for a consistent history of dividend payments, a reasonable dividend yield, and a stable or growing company with sustainable earnings to support future payouts. Use free resources such as dividend.com or Gurufocus.com to see how the dividends of a company developed over time.

Analyzing dividend stocks?

If you like to analyze dividend stocks and the respective dividends they pay out, I usually recommend to look at

A/ dividend growth rate

B/ dividend payout ratio

C/ the average dividend rate of its peers, and,

D/ the company’s ability to generate enough cash flow for dividend payments.

How to do a dividend analysis?

Conduct a dividend analysis by examining the A/ dividend payout ratio, B/ dividend growth rate, and C/ the company’s ability to generate enough cash flow for dividend payments (look for the payout ratio).

How to do a dividend per share analysis?

Perform a dividend per share analysis by dividing the annual dividend payout by the total number of outstanding shares to determine the amount of dividend each shareholder is entitled to receive. Most financial websites like Yahoo or Google Finance already do so, and websites like Gurufocus.com contain much more detailed info for you to do dividend analysis with.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love