Will My Crypto Gains Change My Lifestyle?

I am sitting on quite some gains and a fellow reader just asked me “Do you drive a 20-year-old Corolla? How much does frugality contribute to your financial equilibrium, and from which point on do you allow some spoiling to your and your family?“.

Frugal Lifestyle or fatFIRE?

Here are just some quick first definitions:

A frugal lifestyle revolves around the philosophy of

- conscious and mindful spending,

- prioritizing essential needs,

- avoid unnecessary wants.

- minimizing expenses,

- avoiding unnecessary debt,

- and live within their means.

Many practitioners of the frugal lifestyle movement, also called leanFIRE, share tips, tricks, and thoughts on this group on Reddit.

In the fatFIRE movement, short of Financial Independence, Retire Early, practitioners..

- emphasize a more affluent and lavish lifestyle

- aim to accumulate a substantial nest egg,

- allowing them to have a higher level of spending and indulgence post-retirement

- typically pursue aggressive wealth-building strategies,

- often through high-income careers, entrepreneurship, or strategic investments.

You can find one of the best fatFIRE communities on Reddit, here.

What Do I Practice?

I am not a practitioner of frugal lifestyle, nor fatFIRE. I generally practice stealth wealth, living in a pretty nice compound, in a 170m2 apartment.

Most people around me don’t know that I have

It’s not a penthouse or villa, but it works super well for us four (wife and two kids, 11 and 9).

It’s very close to our kid’s school, making the mornings less stressful.

Will My $1.5m Gains In Crypto Change My Lifestyle?

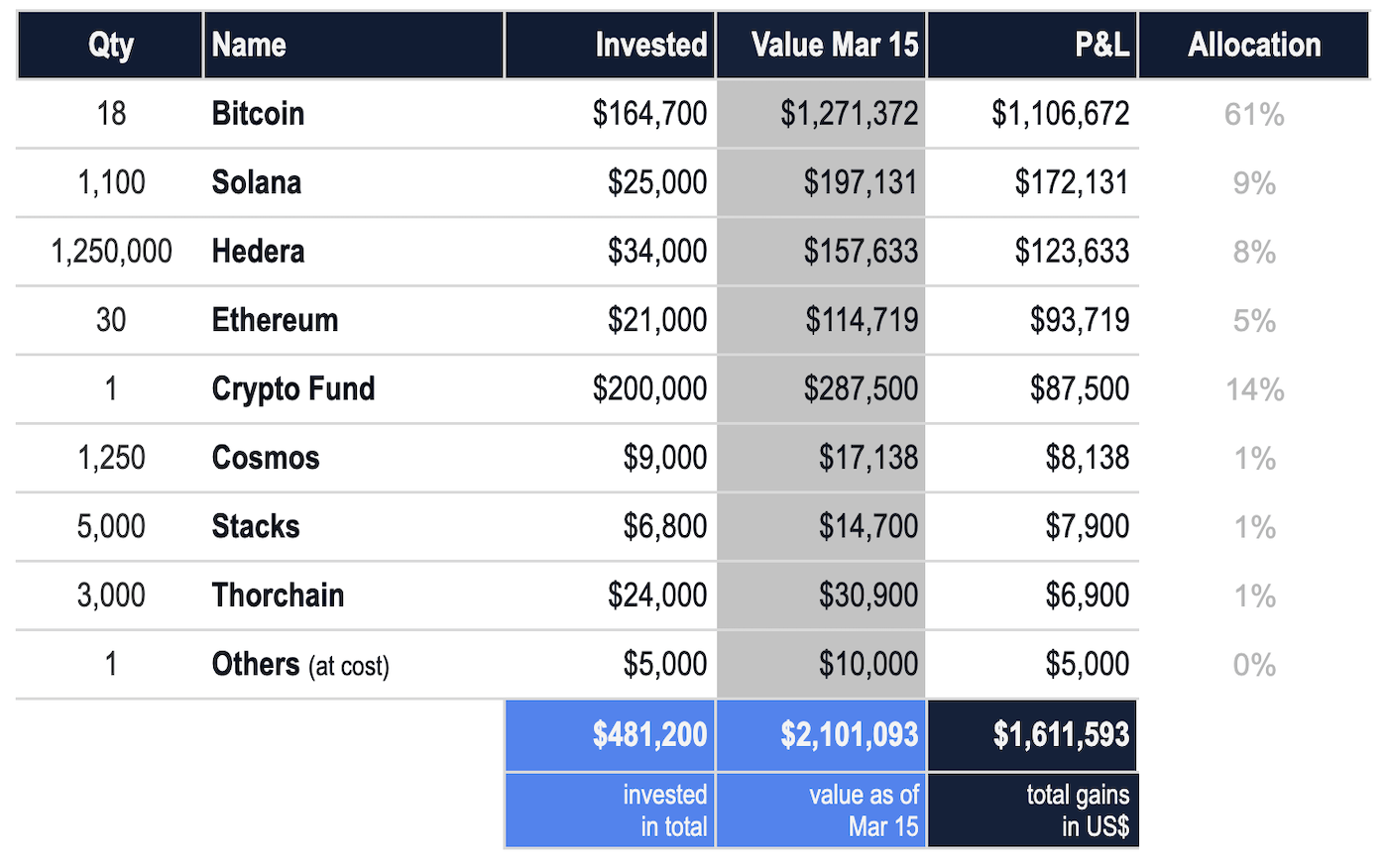

After the recent surge in the crypto market, my initial investment of $481k has grown into $2 million, marking a $1.5 million increase in value.

It’s my first $1 million trade, and all thanks to Bitcoin. All I did was acquire 18 BTC at an average price of $9,150, and hodl.

Below is my entire crypto portfolio, detailing the current prices as of the day of writing this article:

Check out my digital asset portfolio with up-to-date prices here.

What Is Enough?

One of my mentors, a successful businessman, and Chinese baby boomer, now in his late 70s, not practicing a frugal lifestyle, once said to me:

“Am I rich? That depends. If I want to fly in my own plane all the time, then, no! I don’t have enough for that. But do I need my own plane? No, I am happy with what I have“.

This made a big impact on me when I heard that as a teenager.

It felt like I just received some words of wisdom. He was a smart man, but there was more to it. I believe it was back then when I started thinking about wisdom in general and became a lifelong devoted seeker of wisdom.

“Wealth consists not in having great possessions, but in having few wants.“

Epictetus

I started looking for nuggets of wisdom here and there and started finding more and more.

“The smart knows what s/he wants. The wise too, but s/he also knows what s/he doesn’t want.“

Jack Ma, Alibaba

Finding And Spending Time Under A Nice Tree

In 2016, when I knew I’d leave the rat race in mid-2017, I went to Austria to have the space and time to reflect, and think.

I found a spot beneath my favorite tree in Tyrol, grabbed my notepad, and began listing everything I wanted to avoid:

- being told what to do

- being told when to be where

- work with people I don’t like

- overwork or dying young of a heart attack

- miss spending time with my kids when they are young

- spending time commuting to work

- working for others

- etc. you get the point

I also defined all the things I want to do.

- work from home

- help those companies I am invested in

- be free and independent

- have the time and space to reflect

- spend time on the things I love: family, investing, digital assets, companies, ..

- not have anyone giving me shit (other than my wife)

- help entrepreneurs to build great companies

This quote instantly resonated with me – it nails a good day for me on its head:

“The happiest of all lives is a busy solitude.“

Voltaire

So, in summary, I feel it is super important to figure out what is enough for you.. what you want, and what you don’t want.

Once you define that, it becomes possible to be happy without a lot of external, material things.. like ZhuangZi said:

Conclusion

So there you have it.

Besides occasionally choosing nicer hotels, and nicer rental cars (from my favorite car rental stock), I won’t make many changes to my life.

I am fortunate enough to already live in such a way I love.

📘 Read Also

- My Average Week As A Financially Free Investor

- How I Manage My $1.5M Crypto Asset Portfolio

- The Best TradingView Chart Settings

FAQ

What is frugal lifestyle?

A frugal lifestyle, also referred to as leanFIRE, is about mindful spending, prioritizing needs over wants, and living within your means to achieve financial goals. Practitioners of leanFIRE often live in simple homes, don’t spend money on unnecessary things, and adhere to strict dividend investing, making them sufficient income every month to continue to live the way they want to.

How to live a frugal life?

To live frugally, focus on budgeting, minimizing expenses, avoiding unnecessary debt, seeking affordable alternatives, and prioritizing savings and investments.

What is the difference between leanFIRE and fatFIRE?

LeanFIRE aims for early retirement with minimal expenses, while fatFIRE pursues a more luxurious lifestyle post-retirement by accumulating substantial wealth.

Can a frugal lifestyle make you rich?

Over a long period, if you spend less than you make, then yes, adopting a frugal lifestyle can lead to wealth accumulation. It takes a lot of financial discipline. However, as the saying goes “You can not save yourself to riches”, meaning that to become really wealthy, you usually have to work on the offensive rather than the defensive.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love