Key Takeaways

✅ CK Hutchison is one of the world’s most well-managed global conglomerates

✅ Undervalued Assets: Assets are worth more than their market cap

✅ Offers a sustainable 5% dividend yield while the PE is at 10

✅ Potential 19B USD port sale could drive buybacks or special dividends

Why I See A Lot of Value In This Global Conglomerate

Investing in international markets can uncover hidden gems, and CK Hutchison, OTC ticker: $OTCPK:CKHUY, in Germany, listed as $FRA:2CK or WKN A14QAZ, stands out as a global conglomerate with a compelling value proposition.

Led by Victor Li, the older son of one of Asia’s richest men, Li Ka-shing, CKH operates a vast portfolio of assets across multiple sectors and geographies, focusing on long-term value creation and a consistent dividend.

CK Hutchison offers a strong case for inclusion in a long-term portfolio for investors comfortable with owning a diversified set of global businesses and seeking a stable dividend yield.

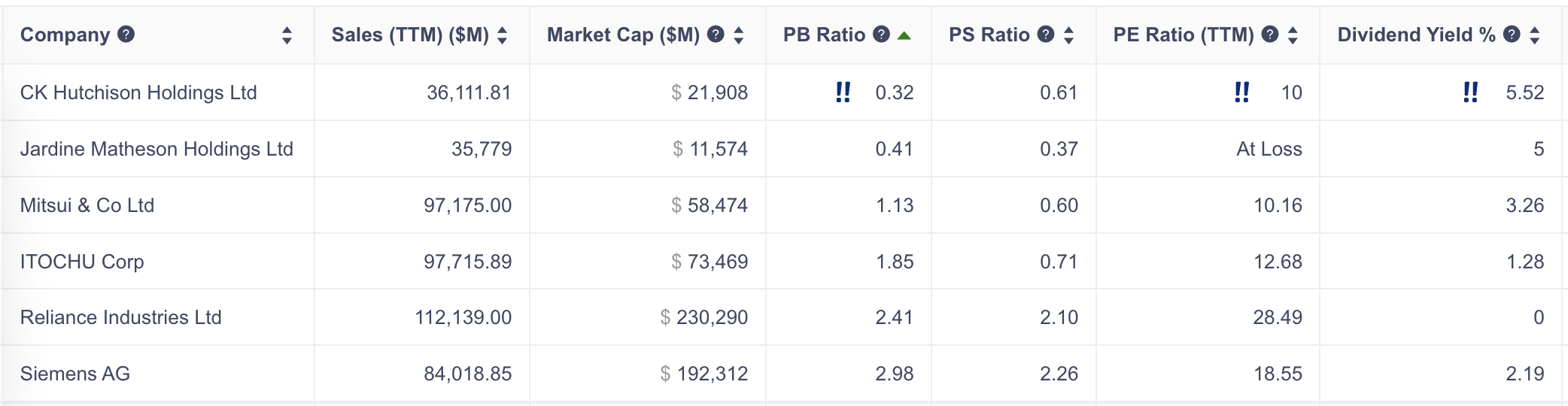

A quick overview of the largest global conglomerates reveals that CKH has the lowest price-to-book ratio, the lowest PE and the highest dividend yield.

What Does CK Hutchison Do And Own?

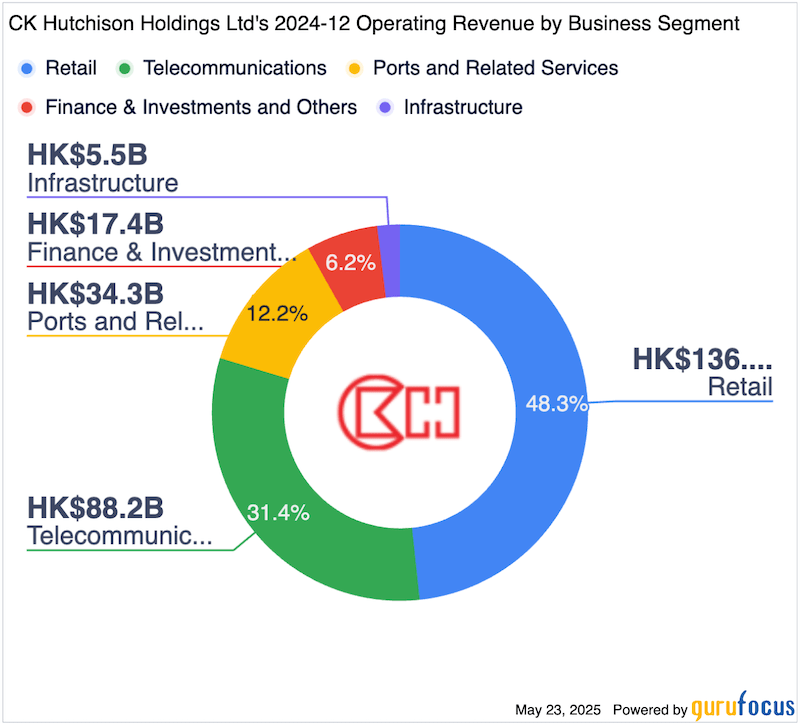

CK Hutchison’s strength lies in its diversified portfolio, which spans several industries and continents. Here’s a breakdown of its key holdings:

Global Ports: CKH operates one of the world’s leading port networks, with operations in numerous countries. Ports are a stable business tied to global trade, providing reliable cash flows despite economic cycles.

Retail: Through AS Watson Group, CKH owns the world’s largest international health and beauty retailer, operating over 16,950 stores across Europe and Asia. With a massive loyalty member base, this segment delivers steady, if unspectacular, cash flows.

CK Infrastructure: CKH holds a 75.67% stake in CK Infrastructure, a listed subsidiary that owns critical global infrastructure assets, including power, electricity distribution, and utilities. These regulated assets often generate stable, inflation-linked cash flows.

Telecom: CKH’s telecom operations, primarily in Europe (notably the UK and Italy), are known for generating strong free cash flow. Despite recent market challenges in the European telecom sector, these assets carry minimal debt, enhancing their financial stability.

Finance & Investments: This segment includes a diverse range of assets, such as a 17% stake in Canadian oil company Cenovus Energy, adding further diversification.

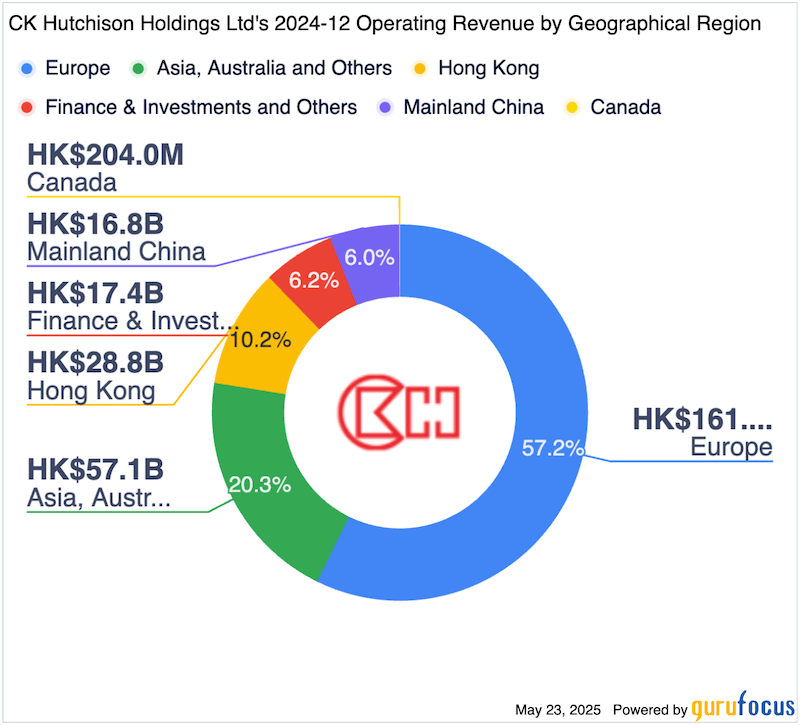

With over 57% of its operating revenues coming from Europe, CK Hutchison’s global footprint reduces exposure to any single market, making it a resilient investment in an uncertain world.

Why CK Hutchison Is a Compelling Investment

My primary argument for investing in CK Hutchison is the significant discrepancy between its market capitalization and the underlying value of this global conglomerate’s assets.

Many analysts believe the market undervalues CKH’s portfolio, particularly its infrastructure holdings. For example, CK Infrastructure’s assets alone are estimated to be worth nearly twice CKH’s total market cap from a private equity perspective, suggesting a substantial margin of safety for investors.

Additionally, CKH offers a reliable dividend, with a 2024 payout of HKD $2.2 per share, translating to a yield of approximately 5% at recent prices. This dividend is considered sustainable, providing investors with a steady income stream while awaiting market recognition of the company’s intrinsic value.

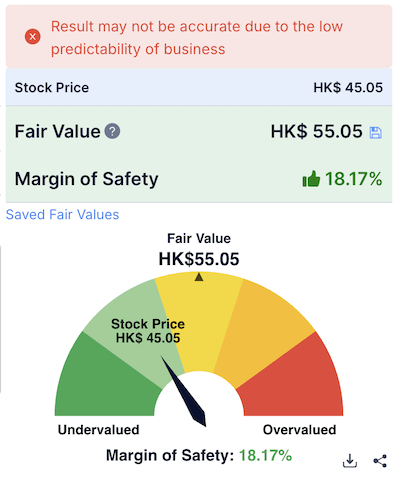

According to Gurufocus, CKH’s margin of safety (the difference between its intrinsic value and the current market cap) is roughly 18% – a good sign!

Over the past few years, CKH, as a global conglomerate, has created value at an estimated annual rate of 14% (relative to market cap) through disciplined debt reduction and consistent dividends. While the timing of value realization remains uncertain, the combination of asset quality and dividend yield makes CKH a patient investor’s dream.

Management’s Conservative Approach

Under Victor Li’s leadership (his younger brother, Richard Li, manages PCCW, a major information technology and telecommunications company in Asia), CK Hutchison adopts a conservative management style reminiscent of Warren Buffett’s disciplined approach.

The Li family prioritizes maintaining a strong balance sheet over aggressive moves like share buybacks, even when such actions might seem financially attractive.

This cautious strategy, while requiring patience from investors, ensures long-term stability and resilience. The Li family’s track record suggests they are not in a rush to unlock value, focusing instead on steady compounding through asset ownership.

I appreciate this mindset and approach!

Potential Catalysts for Value Unlocking

While CKH’s core investment case rests on its asset value and dividend, several catalysts could accelerate value realization:

Sale of Ports Business: CKH is exploring a potential $19 billion sale of its global ports operations, a deal that could significantly boost its cash reserves (compared to its $21.7 billion market cap). If approved, despite ongoing regulatory reviews in China, the proceeds could fund substantial share buybacks, debt reduction, or a large special dividend.

European Telecom Spin-Off or Sale: CKH’s European telecom assets, which carry minimal debt, could fetch $15–$20 billion if sold or spun off. Such a move could further enhance shareholder value.

Increased Buybacks or Special Dividends: Strong free cash flow or proceeds from asset sales could support aggressive share repurchasing or special dividends, providing a direct boost to shareholders.

While these catalysts introduce some near-term volatility, particularly if the ports deal faces delays, the underlying investment thesis remains robust, grounded in CKH’s diverse assets and consistent dividend.

Risks to Consider

No investment is without risks, and CK Hutchison is no exception.

The conglomerate’s worldwide operations expose it to geopolitical and economic uncertainties, particularly in Europe, where over half of its EBITDA originates.

Additionally, the telecom sector faces competitive pressures and regulatory challenges, which could impact profitability.

The potential ports sale, while a catalyst, introduces uncertainty; if the deal falls through, the stock could face temporary downward pressure.

However, CKH’s diversified portfolio and strong balance sheet mitigate these risks, making it a relatively stable choice for long-term investors.

Did You Know?

- CKH owns 40% of the German drug store Rossmann

- It all began with a small loan to manufacture plastic flowers

- AS Watson’s 16,300+ stores outnumber Starbucks globally

- “Superman” Li: Nicknamed for his deal-making prowess

- Its ports handle containers that could circle the Earth 2X

- The Li Foundation has donated $3.8 billion to global causes

- Victor Li manages CKH, Richard Li PCCW

My First Purchase

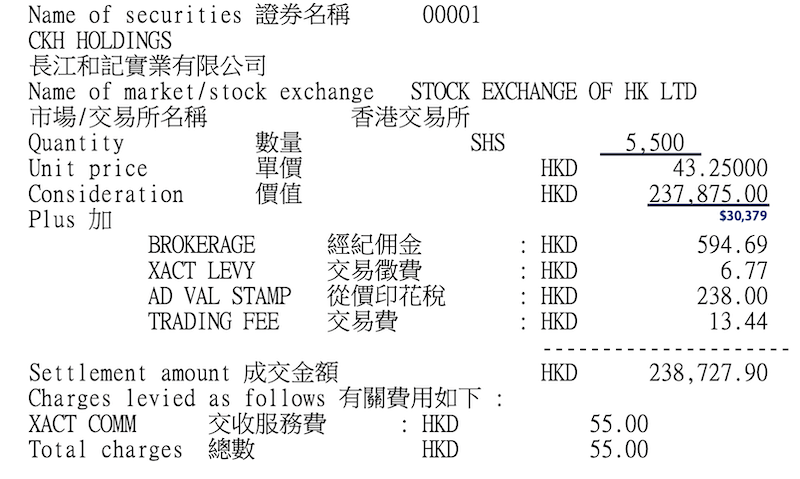

On Apr 24, I acquired 5,500 shares of CHK on the Hong Kong stock exchange for a total of $30,379 USD. See the order confirmation below.

Conclusion

CKH is a well-managed global conglomerate.

offers a unique opportunity to own a diversified portfolio of high-quality global assets at a potentially undervalued price, led by a solid management team with a fantastic track record of making wise investment decisions.

Its combination of stable cash flows, a 5% dividend yield, and potential catalysts for value unlocking makes it an attractive option for patient investors.

While the conservative management approach may delay value realization, the company’s focus on asset ownership and financial discipline provides a solid foundation for long-term growth.

For those seeking exposure to global infrastructure, retail, and telecom, coupled with a reliable income stream, CKH is a stock worth considering.

📘 Read Also

- The 3Fs You Need, The 3Fs You Want For A Great Life Balance

- The 3 Best Australian REITs To Buy

- Selling My Sixt Stocks After An Awful Experience

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love