How to Invest in Asia – The 5 Best Asian Stocks To Buy

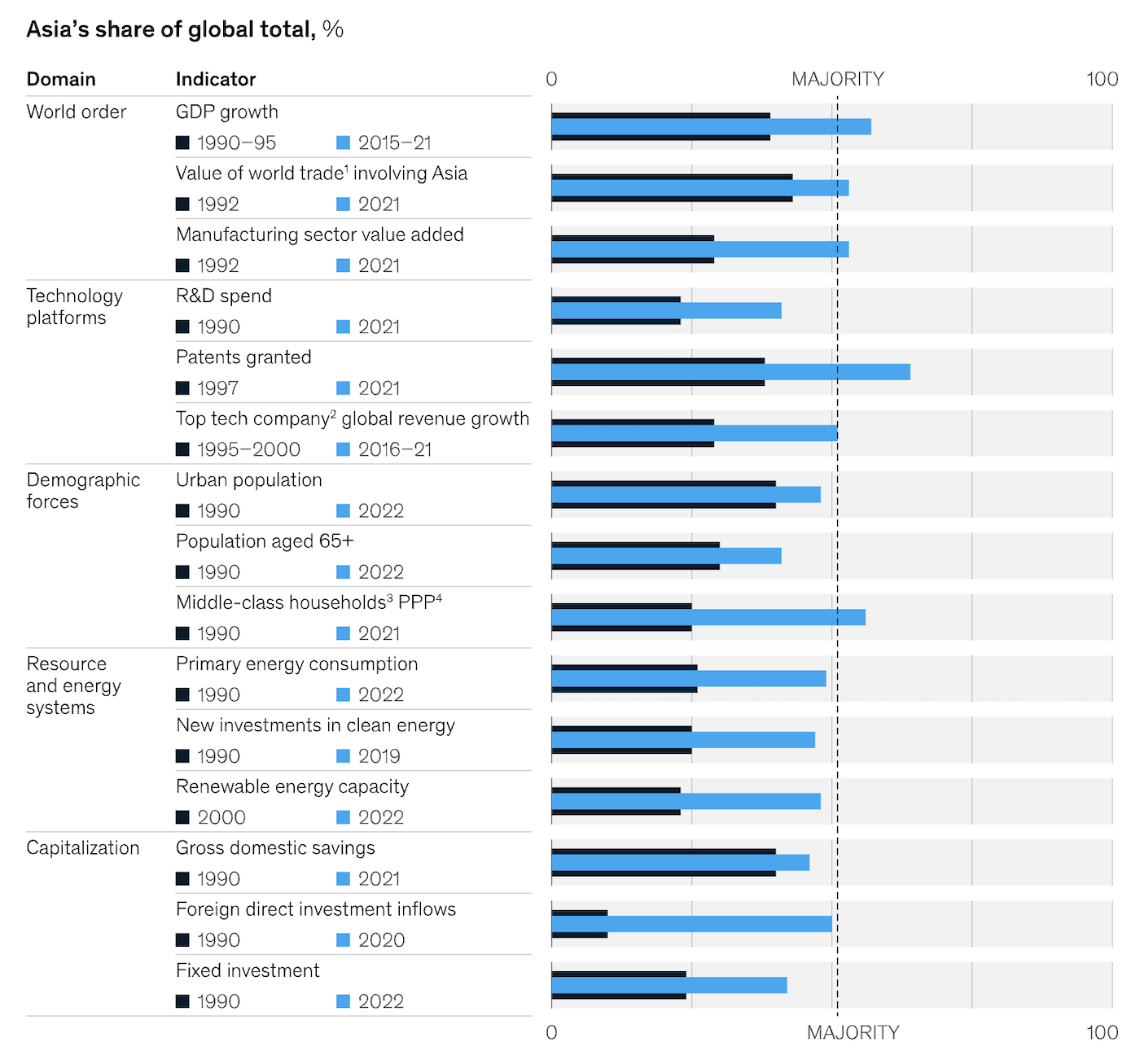

While Europe has a beautiful and rich history, I firmly believe the future of global economic growth lies in Asia.

History shows that power shifts across continents:

- The 18th century belonged to the British Empire.

- The 19th century was Europe’s.

- The 20th century saw the United States rise to prominence.

Now, the 21st century is shaping up to be Asia’s.

Asia’s, in particular, China’s global lead extends to 37 out of 44 technologies, according to The Australian Strategic Policy Institute (ASPI in short).

The ASPI covers a range of crucial technology fields spanning defense, space, robotics, energy, the environment, biotechnology, artificial intelligence (AI), advanced materials, and key quantum technology areas.

And according to a recent report from McKinsey, Asia accounts for over 50% of the world’s growth in key areas, such as:

- GDP

- Middle-class households (on a purchasing power basis)

- Manufacturing sector value

- Global revenue from tech giants

- Patents granted

- Global trade value

Since moving to Asia in 2002, I’ve witnessed firsthand the rapid transformation of cities like Singapore, Shanghai, and Bangkok into dynamic economic hubs.

Asia has lifted more people out of poverty in the last 20 years than any region has in history, and countries like Vietnam, with its robust demographics and strategic position, are set to continue this trend over the next 20-30 years.

If you’re looking to invest in Asian stocks, the region’s sheer scale and diversity can feel overwhelming.

That’s why, with the help of some seasoned Asia-based investors, I’ve curated a list of sectors and Asian stocks that reflect the long-term potential of this region.

Key Sectors to Invest in Asian Stocks

To build a balanced portfolio that captures Asia’s growth, I recommend focusing on five key sectors:

- Real Estate

- Tech

- Financials

- Industrial

- Consumer

My Top Picks For Top 5 Asian Stocks

Here are five stocks that I believe represent the best opportunities to invest in Asian stocks and capitalize on the region’s future across these critical sectors.

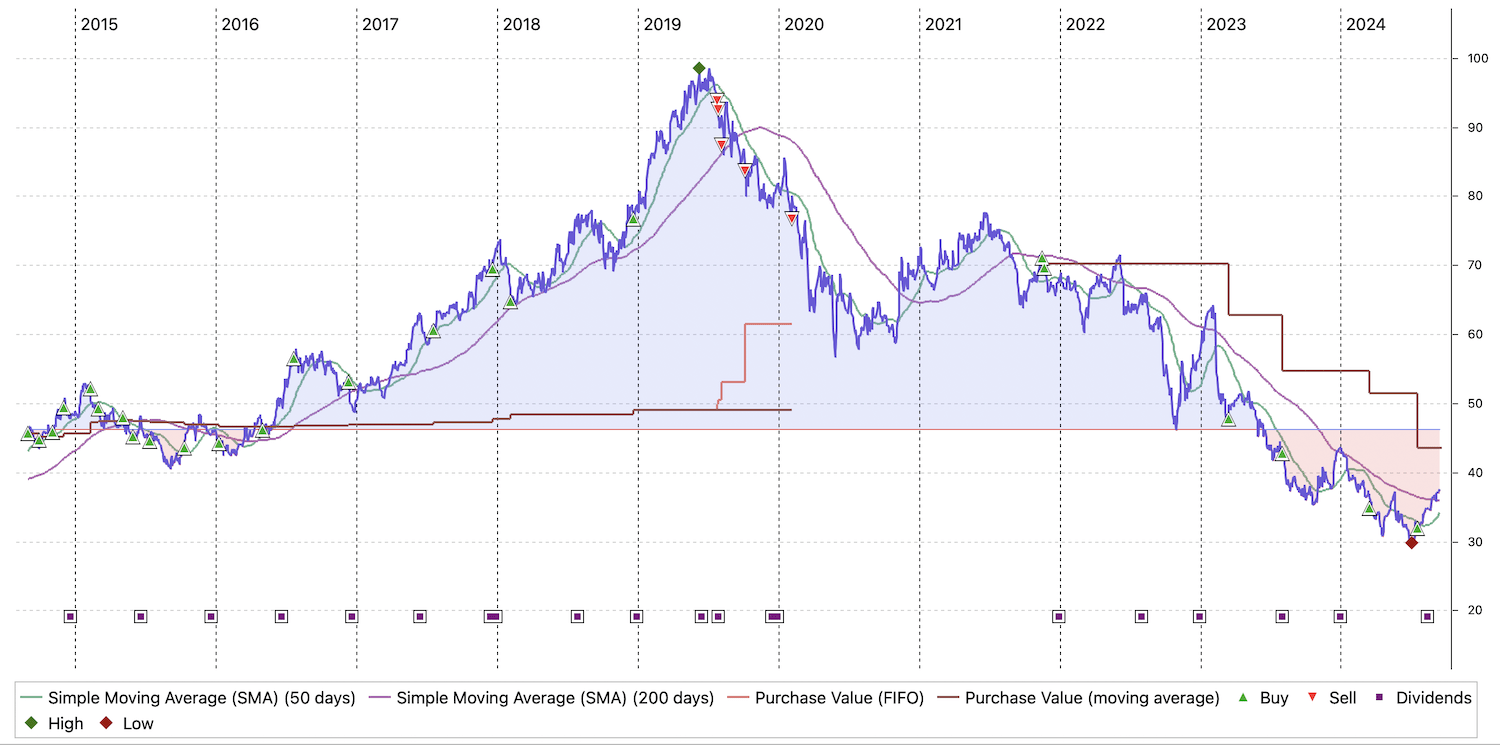

5/ Top Asian Real Estate Pick – Link REIT – Hong Kong

The Link REIT, $HKSE:00823, $OTCPK:LKREF, is Asia’s largest real estate investment trust, a giant in property holdings across office parks, malls, and car parks.

In my blog post The 5 Best Asian REITs, I explain in detail why I’ve held The Link REIT for years.

Notable recent acquisitions include:

- 2019: Sydney’s 100 Market Street

- 2020: The Cabot, London (occupied by Morgan Stanley)

- 2021: 100% of Happy Valley Shopping Mall, Guangzhou

- 2022: Jurong Point, Singapore

As one of the most significant real estate entities in Asia, The Link REIT is well-positioned to benefit from the region’s continued urbanization and development.

The first time I purchased shares of Link was in 2014 when the price was approx. 40 HKD. At the height, I held 24,500 units. The all-time high was 99 HKD or 2.45 Mio HKD (approx. $310,000 US). I sold all of these in early/mid 2019 when the yellow umbrella protests started.

I started buying shares again in late 2021 (too early), and have been dollar cost averaging in regularly since then. See below for my purchases and sales.

I believe at these levels Link Reit represents excellent value for money. That’s why I keep DCAing into it and own it in my All-Weather Portfolio.

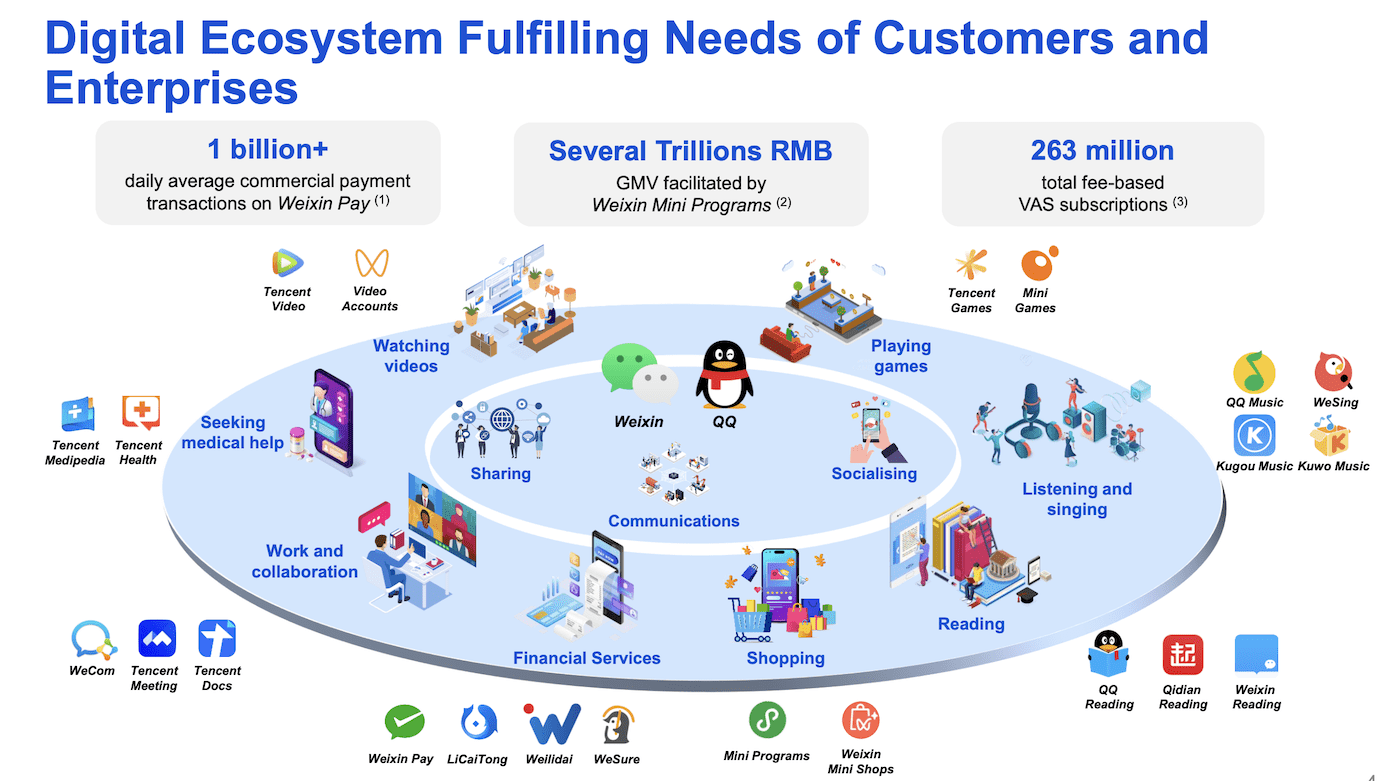

4/ Top Asian Tech Stock Pick – Tencent – China

Tencent, $OTCPK:TCEHY, is a cornerstone of China’s tech ecosystem, owning WeChat, China’s “super app,” with over 1 billion users.

Additionally, Tencent holds stakes in over 600 companies (!!), including:

- Epic Games (Unreal Engine, Fortnite)

- NIO (EVs)

- Spotify

- Sea Ltd (Southeast Asia)

- JD.com

- Meituan

- Tencent’s gaming, retail, and tech infrastructure are all profitable, and the company’s extensive investments alone are worth far more than its market cap.

With a strong dividend yield, Tencent is a solid long-term hold for anyone looking to invest in Asian stocks and Asia’s tech future.

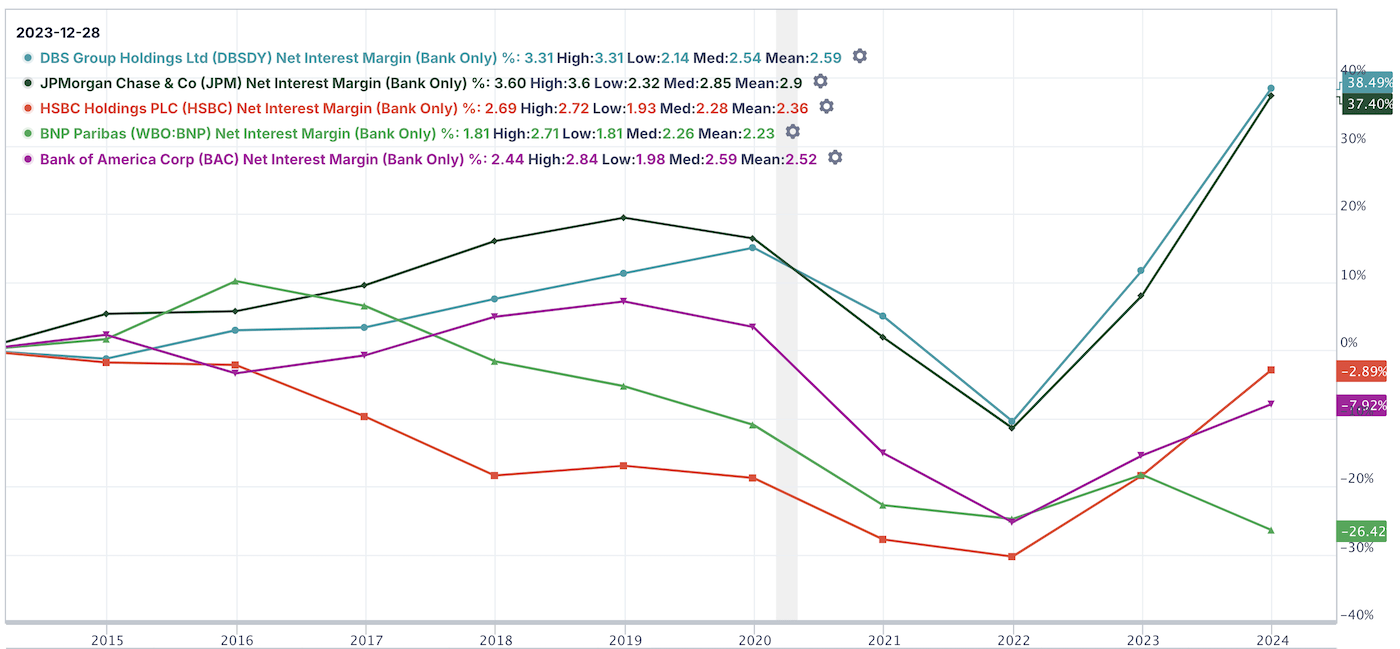

3/ Top Asian Financial Pick – DBS Bank – Singapore

DBS Bank, $OTCPK:DBSDY, named “Best Bank in the World” in 2022 by Global Finance, is a major player in Asia’s financial landscape, serving 4 million customers in Singapore. Its focus on high-value clients and well-capitalized SMEs makes DBS an agile yet powerful force.

The bank is backed by Singapore’s wealth fund, Temasek, and pays attractive dividends. I’ve been using DBS for years and continue to hold it in my dividend portfolio.

It simply is a well-run bank! For example, let’s quickly compare the net interest margin with those of other major banks (chart from Gurufocus.com).

2/ Top Asian Industrial Stock Pick – Reliance Industries (India)

Among Asia’s industrial powerhouses, Reliance Industries, $OTCPK:RLNIY, stands out as a leading choice.

With diversified operations across

- petrochemicals,

- telecommunications,

- retail (with 18,836 total stores!), and,

- energy,

Reliance plays a central role in India’s economic growth.

Its telecommunications arm, Jio, has revolutionized India’s digital landscape, while its retail segment is rapidly expanding across the country.

Reliance is also heavily investing in green energy, aiming to be a leader in the global energy transition.

The company consistently delivers strong revenue growth and pays regular dividends, making it a compelling choice for long-term investors.

While I don’t currently hold Reliance shares, I believe its multi-sector approach positions it for significant future gains.

1/ Top Asian Consumer Stock Pick – Samsung (South Korea)

When it comes to home-grown consumer products in Asia, Samsung Electronics, $OTCPK:SSNGY, is my go-to stock.

From smartphones to semiconductors, Samsung’s diversified business model makes it a leader in global electronics manufacturing.

Its dominance in memory chips and displays, along with its status as the largest smartphone maker, provides a strong foundation for future growth.

It also invests a lot in AI, which is currently being rolled out across its entire platform.

Samsung also pays a quarterly dividend, further enhancing its appeal as a long-term investment.

Personally I don’t own Samsung shares, but I believe they will do well in the years to come.

Dividend Months Overview

Here’s a quick overview of the dividend payouts from the suggested stock picks:

April: DBS, Samsung

May: DBS, Samsung

June: Tencent

August: DBS, Samsung, The Link REIT

September: Reliance Industries

November: DBS, Samsung

December: The Link REIT

Final Thoughts on How to Invest in Asian Stocks

By investing in these five stocks, you’ll gain exposure to the diverse and rapidly growing markets of Asia.

Whether it’s the tech innovations of China, the sheer market size potential of India, or the design skills of South Korean consumer electronics, these Asian stocks provide a comprehensive approach to capitalizing on Asia’s rise in the 21st century.

Though Japan remains a significant player, I believe its long-term potential is limited by poor demographics and high debt. In contrast, emerging markets like Vietnam offer more compelling growth stories for investors looking to invest in Asia.

Conclusion

Asia represents the most exciting investment frontier of the 21st century.

By focusing on key sectors like real estate, tech, and finance, you can position your portfolio for the dynamic growth this region offers.

If you’re serious about long-term wealth creation, consider some of these Asian stocks to successfully build your portfolio.

📘 Read Also

- My Next Big Crypto Bet: Jupiter Exchange

- The AI Investment Pyramid – Building A Balanced Portfolio

- The Via Negativa Concept – 5 Tips on How to Win by Not Losing

FAQ

What are the best Asian stocks?

Some of the best Asian stocks to consider include:

– The Link REIT– The largest real estate investment trust in Asia.

– Tencent – A tech giant behind WeChat and stakes in hundreds of companies.

– DBS Bank – One of Asia’s top banks with strong dividends.

– Samsung Electronics – A leader in smartphones and semiconductors.

– Reliance Industries – A massive company with diverse businesses like energy, retail, and telecom.

Why are Asian stocks falling?

Asian stocks can fall for several reasons, including global economic factors like inflation, interest rate hikes, political tensions, or a slowdown in China’s economy. Market volatility often impacts Asia’s stock markets just like anywhere else.

How to buy Asian stocks?

To buy Asian stocks, you can use online brokers like Charles Schwab, Ameritrade, or Trade Republic, which makes it easy to access and trade Asian stocks from your phone or computer. Just open an account, deposit funds, and start buying!

What are Asian stocks doing today?

Asian stocks can move up or down depending on market conditions. You can check real-time stock updates on financial news websites or stock-tracking apps like Bloomberg or Yahoo Finance.

What is the best Asian ETF?

A popular Asian ETF is the iShares MSCI All Country Asia ex Japan ETF (AAXJ), which gives you exposure to a wide range of stocks across Asia, excluding Japan.

Best Southeast Asia ETF?

The iShares MSCI Emerging Markets Asia ETF (EEMA) is a good option for Southeast Asia. It includes stocks from fast-growing countries like Indonesia, Thailand, and Malaysia.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love