Featured image created with Limewire’s A.I. Studio, using the prompt A futuristic pyramid, with different steps and ultra-modern surface thrones over a modern clean city.

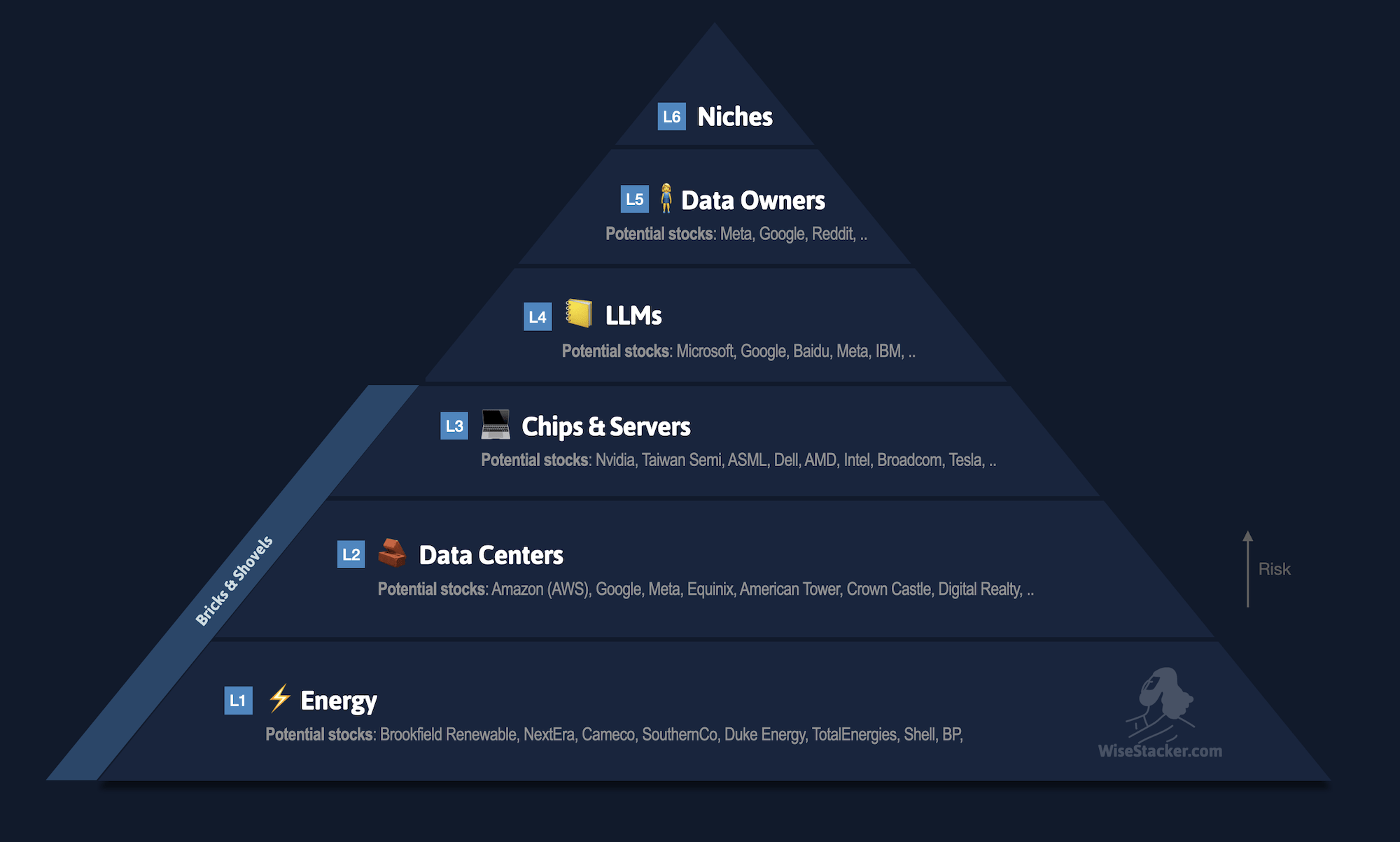

The AI Investment Pyramid

I like using ‘investment pyramids’ as mental models to think through certain investment themes.

It works like this: at the base, at the foundation of the pyramid, are the types of assets that make all other investments possible. These are usually low-risk investments. As you advance to the top, investment options become riskier, with the most speculative ones at the very top.

Pyramids As Mental Models

I don’t only use investment pyramids as mental models; I often structure my day with them as well.

Simply draw a quick pyramid on a piece of paper, add 3-4 levels, and ask yourself: What is the one single thing today that can make this day a good day? Put this item at your foundation.

Then, the second level is the second most important thing, and so on. By limiting the space, pyramids help me prioritize the essential 1-3 things that are relevant for today.

The Artificial Intelligence Investment Pyramid

Layer 1 – Energy

I believe the amount of energy required to power AI is grossly underestimated. In other words, I believe the baseload energy required to power all data centers to enable proper artificial intelligence will dwarf any expectation.

Besides AI, the accelerating trend towards electrification of everything, in particular the entire transport, requires insane amounts of energy. That’s why at the base of my AI investment pyramid are stocks of companies making it all possible.

List of energy stocks I like and that are suitable as foundational stocks for your pyramid:

- Brookfield Renewable $BEP (I own this)

- NextEra $NEE

- Cameco $CCJ (I own this)

- SouthernCo $SO

- Duke Energy $DUK

- TotalEnergies $TTE

- Shell $SHEL (I own this)

- BP $BP

I believe we will see more and more exclusive renewable energy off-take contracts like this one between Microsoft and Brookfield Renewable.

Level 2 – Data Centers

The second level of our AI investment pyramid is infrastructure plays: Data Centers and companies producing products that make AI possible in the first place.

The FAANNG stocks all own and run their own data centers, but there are also multiple digital REITs that we can consider.

These are your typical bricks & shovel

List of Data Center stocks suitable as your second level:

- Equinix $EQIX

- American Tower $AMT

- Crown Castle $CCI

- Digital Realty $DLR

- Amazon $AMZN

- Google $GOOG

- Meta $META

Level 3 – Chips & Servers

Besides energy and data centers, chips and servers make up the rest of the bricks & shovels part of our AI investment theme.

Without energy, data centers, and semiconductors, artificial intelligence would not exist.

This sector is ultra-competitive and requires extensive technical expertise to be able to choose the winners. An expertise I clearly do not have.

Chips & Server stocks you can consider:

- Nvidia $NVDA

- Taiwan Semiconductors $TSM

- ASML $ASML

- Dell $DELL

- AMD $AMD

- Intel $INTC

- Broadcom $AVGO

- Tesla $TSLA

Level 4 – Large Language Model Companies

Now we have all the infrastructure to start talking about actual first AI companies.

I am referring to companies that developed Large Language Models, or LLMs, that now serve as the basis for essentially all AI applications we know and use.

At level 4, we already ventured out on the risk curve, and the potential of all of these players is enormous, but so is the inherent risk coming with it.

Picking a winner in this space with dozens of contenders moving and breaking things at breath-neck speed, is close to impossible.

LLM stocks to consider:

- Microsoft with OpenAI $MSFT

- Google, with Bard $GOOG

- Meta, with Llama $META

- IBM, with Watson (formerly Deep Blue) – $IBM

- Baidu – $BIDU

- Amazon, with Alexa and AI initiatives – $AMZN

- NVIDIA, supporting AI and LLM development – $NVDA

- Alibaba, with DAMO Academy and AI projects – $BABA

Level 5 – Data Owners

LLMs only work when fed with enormous amounts of data, be it text, images, music, videos, numbers, or any sort of data.

To start, LLMs need to devour, analyze, study, and synthesize huge amounts of data.

Companies giving LLMs access to large data pools will be able to monetize this access or use startups like GetGrass’ suite of services.

Data owner investments to consider:

- Reddit $RDDT

- Youtube $GOOG

- Facebook & Instagram $META

- Office365 $MSFT

- GetGrass, a service letting you earn effortless passive income by letting it use unused bandwidth

- Uprock is a platform rewarding you for contributing data to power AI discoveries

Level 6 – Niche Verticals

We reached the top of our investment pyramid!

Here, we find startups focusing on specific niches in a wide variety of sectors, such as

- Finance

- Generative AI

- Healthcare

- Gaming

- Education

- Legal

- Creative

- Media

- etc.

See below for an overview from CBInsights:

I feel I have zero chance of picking a winner here. The space is simply moving too quickly.

Hence I don’t even try.

How Do I Invest?

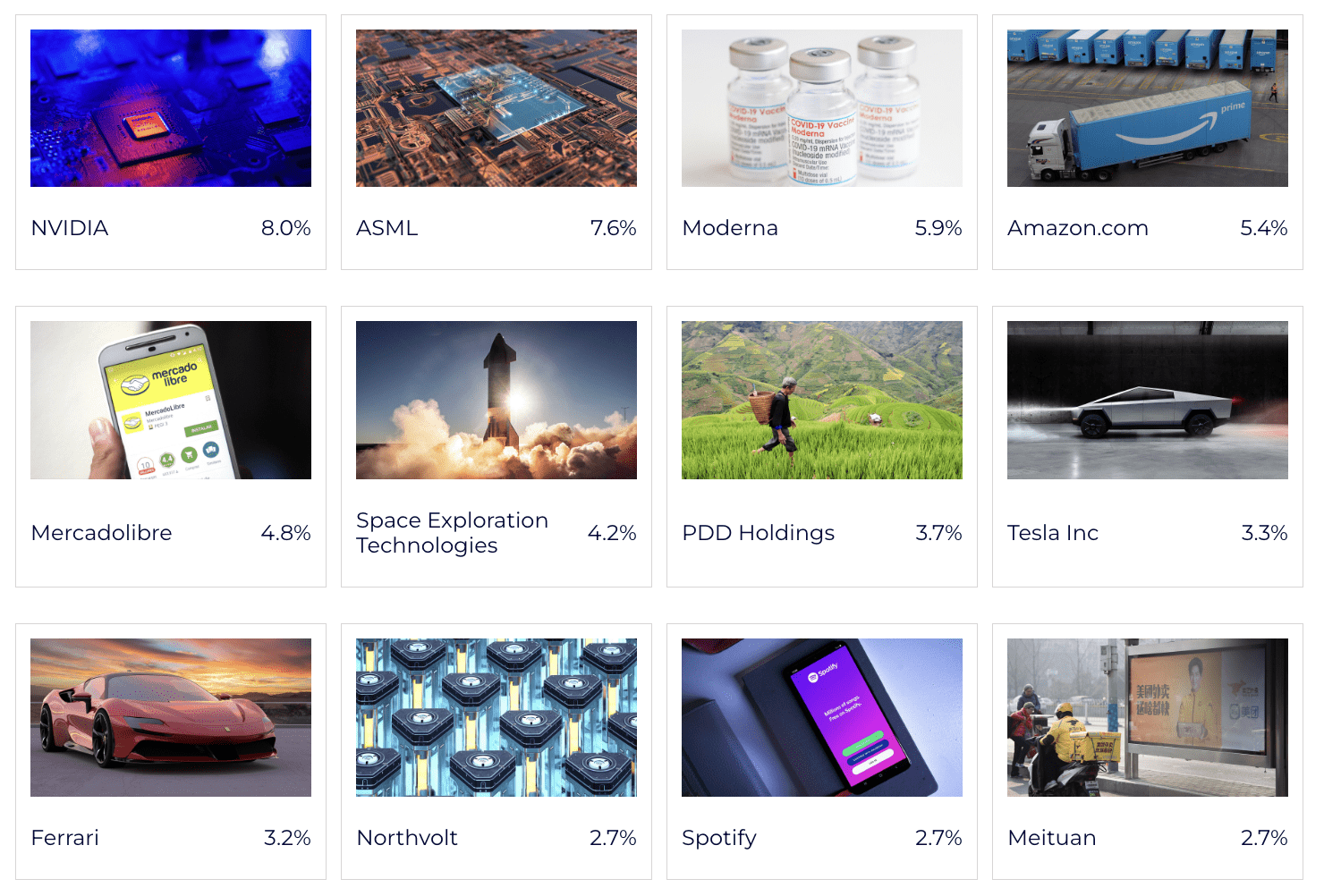

I decided to invest in the A.I. theme via the Scottish Mortgage Trust, in my opinion, the best disruptive tech fund and the largest holding in my All-Weather Portfolio.

Its current largest position is currently NVIDIA. It owns a large private stake in Epic Games and Elon Musk’s SpaceX.

And it even pays a dividend!

My Holdings

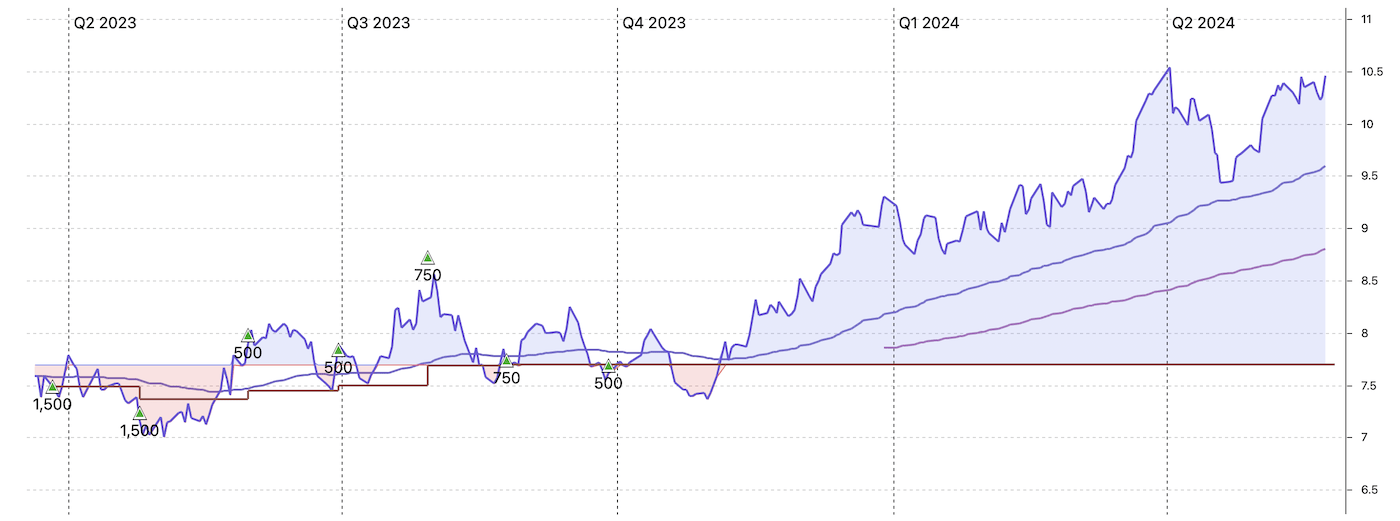

The below chart shows all my Buys – I own 6,000x units and invested a total of $50,000 US (currently worth approx. $68,000).

I buy and hold these in my 🇩🇪 Trade Republic account.

Conclusion

The AI investment pyramid is an effective mental model for structuring and navigating the entire artificial intelligence space.

It helps investors position themselves well by balancing multiple investments across different risk levels.

Alternatively, a simpler approach is to invest in a single ETF, such as the Scottish Mortgage Trust, which offers excellent exposure to the AI sector.

FAQ

What does the investment pyramid mean?

‘Investment pyramids’ can be used as mental models to think through certain investment themes, whereby the foundation of the pyramid represents these types of assets that make all other investments possible. These are usually the lowest-risk investments. As you advance further to the top, investments become riskier, with the most speculative ones at the very top.

How to make an investment pyramid?

1. Draw a simple pyramid on a piece of paper.

2. Add 3-4 horizontal levels.

3. At the lowest level, your foundation, place foundational assets, such as energy and infrastructure.

4. On the next level, add the second most important investments, and continue upwards.

5. At the top, place your most niche and risky investments.

How do investment pyramids relate to daily planning?

The investment pyramid concept can be applied to daily planning by prioritizing tasks in order of importance, ensuring that the most critical tasks form the foundation of your day.

What are the benefits of using investment pyramids?

Using the investment pyramid as a mental model aids in strategic planning, decision-making, and prioritizing investments, ensuring a balanced approach to risk and reward.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love