I’m a DIY Investor Investing in commodities & Natural Resources for 25 years. In this article, I share the investment thesis for commodities, And The 15 Companies i Chose To Benefit From The Coming Commodity Supercycle.

I’m a DIY Investor Investing in commodities & Natural Resources for 25 years. In this article, I share the investment thesis for commodities, And The 15 Companies i Chose To Benefit From The Coming Commodity Supercycle.

Disclaimer: I’m not a financial advisor. No content is meant to be a recommendation. Please do your own research. Pages might contain affiliate links. Please read my Disclaimer page.

I have been investing in natural resources and commodities since the mid 80s. One of my first stocks I purchased was M.I.M. in 1990, an Australian mining giant (now part of Glencore). Since then, I have always been fascinated by the commodity sector, and am following it closely ever since.

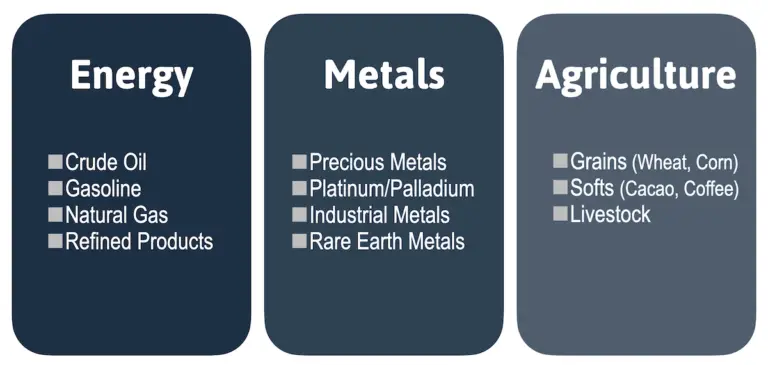

First, let’s first look at what the commodity sector consists of:

In simple terms, you can dissect the overall commodity sector into three buckets:

Each respective bucket represents a huge part of the economy, and we could spend weeks just talking about each one of them.

For this article, I’ll share why I believe it’s important to build a commodity portfolio and invest in commodities, and which company I am putting my money on.

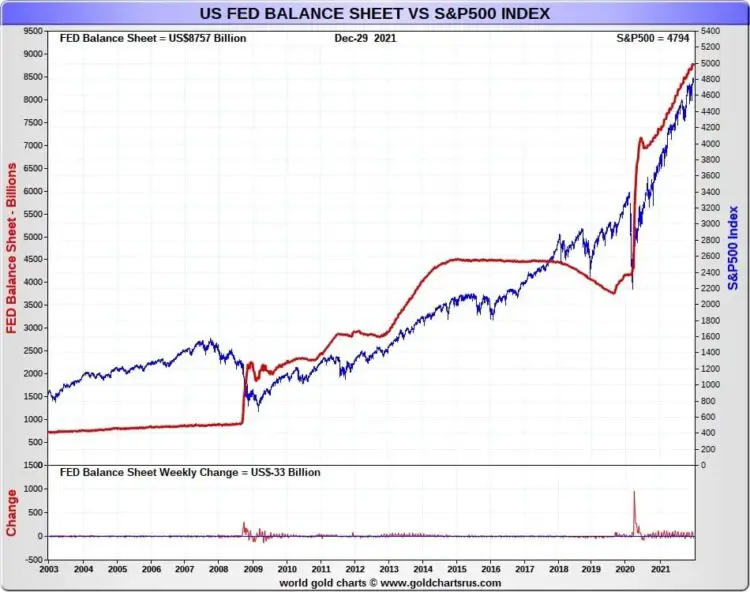

Since the Global Financial Crisis (2008/2009), central banks all over the world crank their printing presses into overdrive, creating money like crazy.

40% of all U.S. Dollars in existence were created in 2020 and 2021 alone. Mind-boggling!

The newly created dollars primarily resulted in asset price inflation, benefiting those owning assets such as stocks, digital currencies, and real estate.

Look at the chart below showing the correlation (and causation) between increasing money supply, and gains in stock prices.

Most central banks announced QT, quantitative tightening, meaning they are planning to unwind their assets. They tried this at the end of 2018, resulting in them pivoting back to quantitative easing (money printing).

Many macro-economic experts believe this time will not be any different, and it’s just a matter of time before the money printing continues.

Good things are easy. And the investment thesis for commodities is exactly that – it’s easy. Really easy to understand.

‘Invest in anything that the world needs that can not be printed or created out of thin air.’

And this primarily includes energy, metals, and agricultural commodities. Whatever happens to the debt-wreck of a global financial system we have at the moment, its clear as day to me that we will still need energy, metals, and agricultural commodities, hence my strategy is simply to invest in

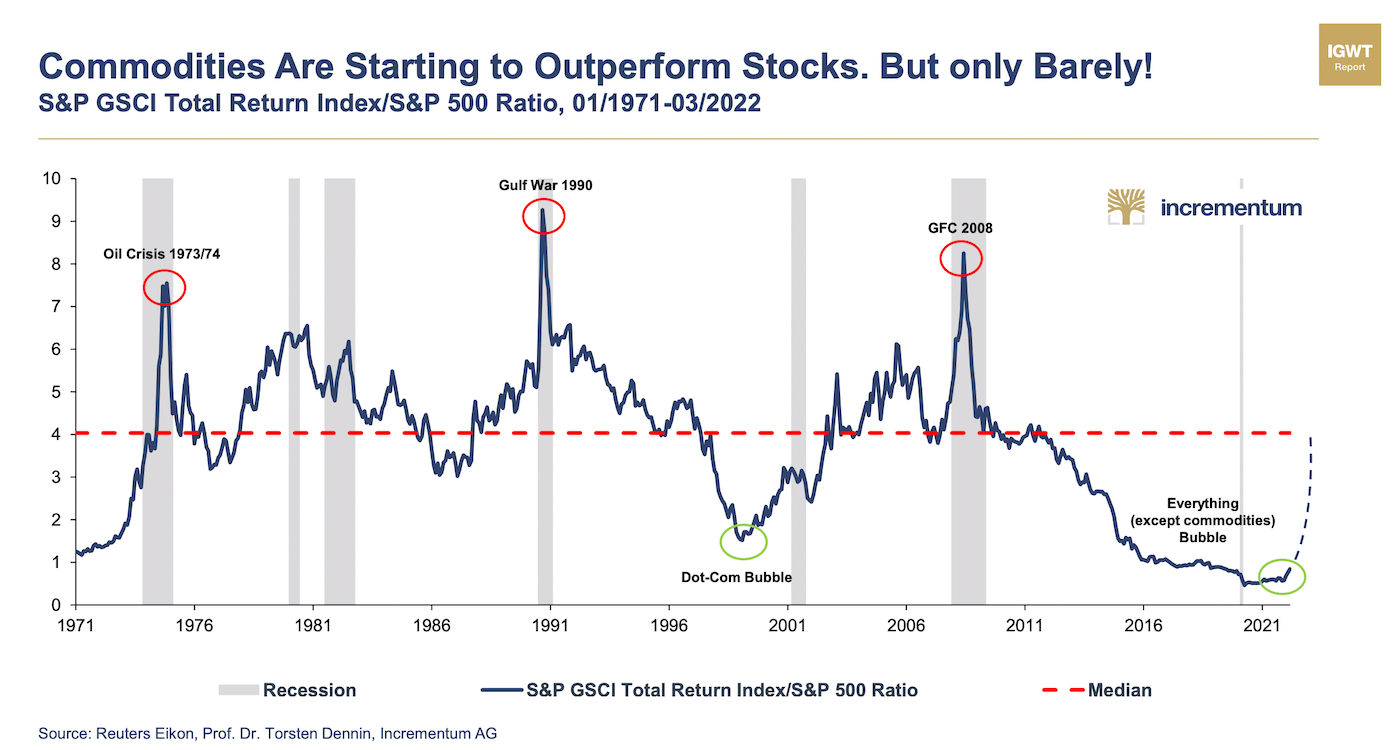

Looking at the chart below makes things eye-catching and obvious:

We are at the very bottom right corner. Once we reach levels 5 to 6, I will start to sell into market strength and lock in profits.

For those of you enjoying researching and picking the best single stocks, I will propose 15x great stocks you can consider for your personal account. This is, again, not financial advice. I am simply sharing what I am doing.

And for those preferring just one ETF to invest in commodities, I will also share 5x possible options.

Let’s start by looking at the energy commodity stocks I like and own:

Shell is one of the world’s largest oil & natural gas companies. Its 89,000-strong workforce is active in more than 140 countries. It is now also one of the largest investors in renewable energy in the world.

Antero Resources, with its headquarters in Denver, is a major producer of natural gas. It has a worldclass asset with proven reserves of 17 Trio cubic feet, located in the Appalachian Basin (CAN).

Brookfield Renewable owns and operates renewable power assets including hydro dams, solar and wind parks all over the world. It produces 20+ GW of renewable energy, with 60+ GW in the pipeline.

Enbridge is a leading utility company in the U.S., moving energy around the country. Its infrastructure transports 25% of all oil and supplies, and 20% of nat gas in North America, making it key infrastructure.

Siemens’ water division offers complete waterworks, pump systems, disinfection and desalination plant technology primarily for public utilities. It builds and operates plants all around the world.

I love the fact that Shell invests heavily in renewable energy. The company sees another 30 years of strong oil demand. It has a fortress-like balance sheet. It pays a stable & high dividend. I believe Shell is a buy-and-hold forever stock, that deserves a spot in anyone’s long-term dividend portfolio.

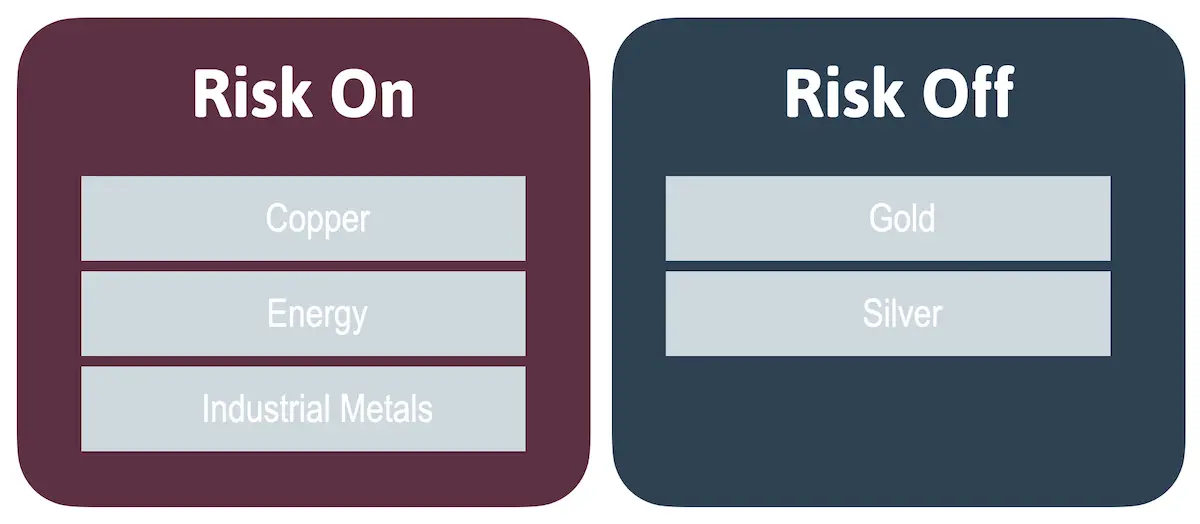

Energy commodities are the most inelastic, while metals are the most elastic commodities.

Simply put, in times the economy expands, the energy commodities tend to fare well, while when things get tougher, the metals, in particular the precious metals, do well.

In line with my commodities super cycle investment thesis, I think basically all energy commodities will do well in the decades to come. I believe in the long-term potential for natural gas, and NGL, and see Antero Resources as one of the best plays in the commodities sector.

Revenues 2021 (Bio USD)

Price To Book

Employees

Founding Year

Although many fossil energy opponents don’t like to hear it, but the reality is that oil and natural gas consumption will be with us for at least two to three more decades.

That’s why my aim is to find the best of the best oil and natural gas company. With Shell and Antero Resources, I feel well-positioned to benefit from this ongoing consumption trend in the years and decades to come.

I believe the transition to renewable energy is one of the most powerful trends in the coming decades. I plan to invest in commodities via multiple vehicles, whereby Brookfield Renewable will be one of my pillar ‘power houses’.

Brookfield Renewable already is but will grow into a real powerhouse of a renewable company. Below is a chart showing the locations and current production capacities:

I find it particularly interesting that Brookfield Renewable recently signed power off-take agreements with Amazon or Bank of Nova Scotia.

As the green little chicken keeps saying “energy is life”, and Brookfield Renewable is doing nothing else but creating clean, renewable energy, that is then consequently used to power our homes, factories, offices, EVs, labs, and museums – I sleep like a bear knowing that my investment supports the transition to renewable energy!

🔮

Whether it’s nat gas to heat your home, oil for gasoline, or jet fuel, Enbridge has its hand in transporting a significant amount of it across the entire continent. It’s a dividend aristocrat and in my point of view one of the few retirement dream stocks.

The German industrial giant, Siemens, is not directly involved in producing energy or metal commodities. But its infrastructure solutions are essential for all of them to work. Siemens is therefore an in-direct way to invest in commodities, and a stock I plan to buy-and-hold forever.

Revenues 2021 (Bio USD)

Dividend Yield

PE

Dividends since

Siemens has three major divisions:

Its infrastructure division is highly exposed to energy commodities. Its solution ensure that one of the most important commodities of all, water, gets cleaned, filtered, from A to B, desalinated, etc.

For example, it builds a wide variety of power plants, and its water solutions address the water management needs of the oil and gas production, refining, pharmaceutical, chemical, and petrochemical.

Franco Nevada is the ‘gold standard’ of gold royalty companies. It’s the category-defining pioneer, earning royalties from the world’s best assets. A potential choice for any long-term commodities investor.

Sibanye-Stillwater is the world’s third largest platinum-group metals (PGM) producer. Besides PGM, it is also a major gold, copper & nickel producer, making it an interesting addition to any commodity portfolio.

BHP is the world’s largest mining company, operating iron ore, copper, nickel, uranium, gold, metallurgical coal and potash mines all over the world. It’s one of the top 3 go-to-name in the commodity space.

Ecora Resources is a battery metal royalty company, obtaining streams from a diversified portfolio focusing primarily on battery metals such as Copper, Cobalt, Nickel or Vanadium.

Cameco is the 2nd largest uranium company in the world, creating fuel needed to energize a clean-air world. It also is a leading provider of processing services required to produce fuel for nuclear power plants.

Basically put, metallic commodities can be separated into

Some metals can be found in several buckets, e.g. copper is sometimes seen in the industrial and sometimes in the electronic metals group.

No matter if you use your mobile phone, electricity, an airplane, solar cells or medical equipment, metals can be found everywhere. They are an essential part of our life, and for them to be available, they need to be mined.

The 5x mining companies I chose basically cover the entire metal commodity space, and I feel great buying and holding on to them till I see the commodity to SP500 ratio reach a high level (see above).

Franco Nevada is a one-of-a-kind company in the whole precious metals space. As the Pioneer and inventor of the entire gold streaming industry, Franco Nevada is the company I would choose if I may only choose one gold company.

Of all the gold mining companies, Franco Nevada is the Highlander. There can only be one. The amount and quality of assets it owns is simply world-class. Read why Franco is the best gold stock here.

Its dividend is relatively low, but it’s growing steadily. And if you have some of the world’s best capital allocators at the helm, you let them allocate excess capital and compound capital for you.

If you like to invest in gold, please check out my in-depth article on How To Build A Portfolio Of Gold Mining Companies.

| Company Name | $M)"}">M. Cap | $M)"}">Sales | ROC | EBITDA % | 5Yr)"}">Rev Growth 5Yr |

| Franco-Nevada | 26b | 1,329m | 12.29 | 88% | 14% |

| Royal Gold | 7b | 673m | 11.53 | 80% | 10% |

| Wheaton | 17b | 1,184m | 10.2 | 84% | 5% |

| Sandstorm | 1b | 119m | 5.3 | 75% | 6% |

| Osisko | 2b | 168m | 3.4 | 10% | 9% |

| Metalla | 0,2b | 2.9m | -9.18 | – | 0 |

When choosing a royalty company the main metric I look at is the ROC, the Return on Capital. The respective management teams do not need to be good mine builders themselves, but they need to have a good sense for choosing the right assets, management team and negotiate favorable terms for their shareholders.

🔮

Revenues 2021 (Bio USD)

Dividend Yield

PE

Dividends since

Sibanye Stillwater, based in South Africa, has operating mines in Africa, North America, South America, Europe, and Australia.

It focuses on the platinum group metals (PGM), however, it also has massive investments in other metal commodities such as rhodium, iridium, ruthenium, copper & nickel. It even owns a top-tier gold-producing mine!

Platinum is heavily used as an industrial metal, e.g. in catalysts and converters, but also as jewelry (my wedding ring is made of platinum).

The current dividend yields and PE ratios of the three large PGM producers are extremely attractive, see the table below.

| Company Name | Market Cap | Revenue | PE | Yield % | EBITDA % |

| Sibanye Stillwater | 7b | 11,640 | 3.61 | 12.59 | 28.64 |

| Impala Platinum | 9b | 8,635 | 3.83 | 10.53 | 46.02 |

| Anglo American Platinum | 23b | 14,464 | 4.68 | 8.98 | 52.85 |

| Eastern Platinum | 0.02b | 69 | 19.35 | – | 20.66 |

| Platinum Group Metals | 0.2b | – | At Loss | – | – |

| Sylvania Platinum Ltd | 0.3b | 190 | 3.97 | 4.73 | 63.42 |

I could not think of any better stock than BHP when it comes to a company benefiting from the coming commodities super cycle in the coming one to two decades. I see BHP as a must-own commodity stock I will hold on to for a long time.

Regardless of the type of commodity we speak about, we need the likes of BHP to keep on producing those commodities needed to transition to renewable energy, electronic vehicles, etc.

If you are serious and like to invest in commodities, BHP offers you a simple way to express your view. The dividend yield of 12% (!), as of June 2022, is nothing to sneeze at, while the PE ratio is in the single digits!

Warren Buffett

Amount of Royalties

Amount of continents

Yearly Dividend

Year Re-Branded

Ecora Resources is a battery metal royalty company, engaged in securing royalties from a wide portfolio focusing on battery metals that support a sustainable future.

With the world transitioning to renewable energy, the need for battery and electronic metals will be immense.

Copper is the third most widely consumed metal in the world. It was one of the first metals we as humans ever extracted from the ground. Over the course of millennia, it had a huge impact on our lives and helped shape civilizations.

An EV car requires 4x more Copper than a traditional internal combustion engine (ICE) car.

The average amount of copper used to build an American home has been 400 pounds. The NEW average American home requires 1,000 pounds of copper.

Because EVERYTHING is electrified, copper is required in any building, appliance, gadget, power plant, phone, wind turbine, solar panel, EV, ship, satellite, power generator, and battery.

👉 $ECRAF Ecora Resources is my favorite battery metal stock.

As the largest uranium miner in the Western hemisphere, Cameco will play a critical role in ensuring North America’s power supply. Uranium is the commodity with the highest energy potency, and is

Revenues 2021 (Bio USD)

Dividend Yield

PE

Dividends since

Deere is the world’s largest agriculture equipment company, manufacturing the iconic green/yellow tractors, as well as harvesters, sprayers, and forestry equipment.

Zoetis is the world’s largest producer of animal medicine and vaccinations for pets and livestock. 11,000+ employees generate more than 6 Bio USD in sales in 100+ countries.

BASF is a the world’s largest chemical company. It operates 238 production sites in 90 countries, generating revenues of 85 Bio USD. A big part of BASF’s business are AgChem products.

Nutrien, headquartered in Canada, is the world’s largest producer of potash fertilizers and the 2nd largest producer of nitrogen fertilizers, essential for growers and farmers all over the world.

Corteva, a company from the U.S., develops end-to-end solutions for farmers that increase crop yields and profitability. It specializes in seeds, crop protection, and digital agriculture.

With ever extreme weather conditions, disrupted supply chains and multiple conflicts all around the world, the need to effective and efficient agricultural output is becoming very important.

The companies I recommend below are those I hope will produce the products and solutions making it possible to feed the entire world population, and ensure sufficient agricultural commodities for everyone (a monumental challenge).

I invest in commodities and the respective companies mining, growing and producing them, because commodities can not be created via a money printer. And as the supply is limited, the value should at least remain, or go up a lot in fiat currency terms.

I believe the John Deere stock is the Tesla of Agriculture. To feed the world, we not only need the best agriculture equipment possible, but also the best farming know-how. And for both of these, we need the engineers of Deere to keep on innovating as they do since over 180 years. To me, the John Deere stock is a buy-and-hold forever stock.

Dwight D. Eisenhower

As an animal lover, Zoetis’ products naturally resonate with me. If you like to invest in commodities, in particular livestock, Zoetis is in my point of view a must-own stock.

Revenues 2021 (Bio USD)

Dividend Yield

PE

Dividends since

I am not an expert in this field, but my sense is that animal health is absolutely important for our continued existence.

I see Zoetis and its products playing a vital role in the decades to come, as they will help improve the lives of the pets we love, and the cattle, poultry, pigs, or fish we raise and breed to feed the world.

Knowing Zoetis, with all of its 11,000 employees and 70 years of expertise, focusing entirely on animal health gives me a good feeling for the future.

I believe the world’s largest chemical company and dividend stock BASF deserves a permanent spot in any income oriented dividend portfolio. I am a buyer and long-term holder of this fantastic company.

BASF as a company fascinates me. On any normal day, you most likely are directly or indirectly using products of the company without knowing it.

You can find BASF products everywhere, be it in

BASF is not a commodity company per se, but its products ensure that hundreds of thousands of other companies can produce, grow, store, move, or mine both energy as well as agricultural commodities.

Nutrien, headquartered in Canada, is the world’s largest producer of potash fertilizers & the 2nd largest producer of nitrogen fertilizers, essential for farmers all over the world. If you like to invest in commodities, Nutrien is a company you can buy and hold for decades to come.

Revenues 2021 (Bio USD)

Dividend Yield

PE

Dividends since

Robert Louis Stevenson

The first seed we planted became our foundation. It was the birth of our progress. Corteva specializes in creating the world’s best seeds and crops. To feed 8 or in the future 10 Bio people, this is what we need. I believe Corteva is a super interesting stock investors can buy and hold for a long time.

Revenues 2021 (Bio USD)

Dividend Yield

PE

Dividends since

There you have it, folks.

15x hand-picked companies to ride the wave of the coming mega wave of the commodities super cycle.

If you like to invest in commodities, there is certainly no need to buy all of the presented stocks. To me, as I believe we are entering a decade-long commodity super cycle, I feel great allocating money to a sector creating products that are physically scarce, and can not be printed by any central bank.

An easier way to invest in commodities is to buy a commodity ETF. I know of five good ones that I compare in a separate article.

You ask this question to ten people and you get ten different answers. Energy commodities already did quite well in the past 24 months, metals disappointed me personally quite a bit (as of Jun2 2022), and agricultural commodities are all over the place. I’d begin looking at energy commodities first, then add some EV-related metals such as copper, lithium and nickel.

In general, you can choose between energy, metal and agricultural commodities. See above for 5x specific stocks for each of those categories.

Commodities are critical for a large part of our entire economy to work. Without energy commodities, everything would come to a standstill. Without agricultural commodities, we would run out of food within weeks. Without metal commodities, there wouldn’t be any cars, ships, plans, or trains. Therefore, commodities in general are a very important part of our lives, and a key investment sector.

You can trade actual commodities on specific exchanges like the CME. But even as a beginner you can trade CFDs (Contracts For Difference), a simple option if you like to invest in commodities. There are also thousands of mining companies and ETFs that you can buy in any brokerage account.

Because commodity prices are influenced by many external factors we as investors can not control, including but not limited to weather, natural disasters, conflicts, new discoveries, accidents, etc.

The three major commodity indexes tracked by commodity ETFs are

Each commodity, be it energy, metal or agricultural commodity, goes through different phases. A general answer can not be given. Due to the supply chain disruptions, in particular energy and agricultural commodities are in high demand (as in 2022 June).

The easiest way to invest in commodities is to buy commodity ETFs that hold those type of commodities you are bullish on. If you for example are bullish ‘Agriculture’, you can consider the commodity ETF (MOO), holding the key companies engaged in the agricultural space. Use websites such as justETF.com, EFTdb.com or ETF.com to find the best commodity ETFs.

My total passive income is ~$150,000 US per year. Like to see a full breakdown?

👇

Comments

Ahoy, captain of your own financial destiny! Ready to hoist the sails towards serene financial freedom?

My spam-free, no-cost emails will map the market seas, and steer you towards independence. Unsub anytime! Bonus – Instantly unlock my passive income!