I get asked at least once a week how I manage my crypto asset portfolio, with a current value of US$1.5 Mio.

That’s why I thought it’d be good to write a quick post about it.

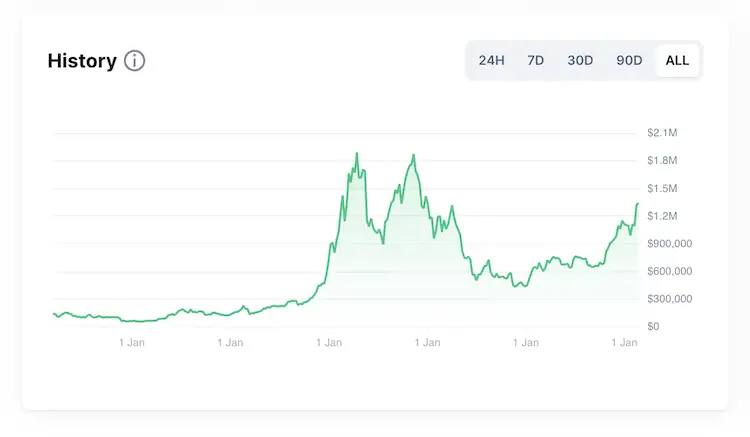

Crypto Asset Portfolio Chart

Not considering my crypto fund investment, this is what my long-term crypto asset portfolio chart looks like.

Back in 2021, my all-time high was at $1.8 Mio US. Back then my crypto fund at briefly valued at $1.2 Mio US.

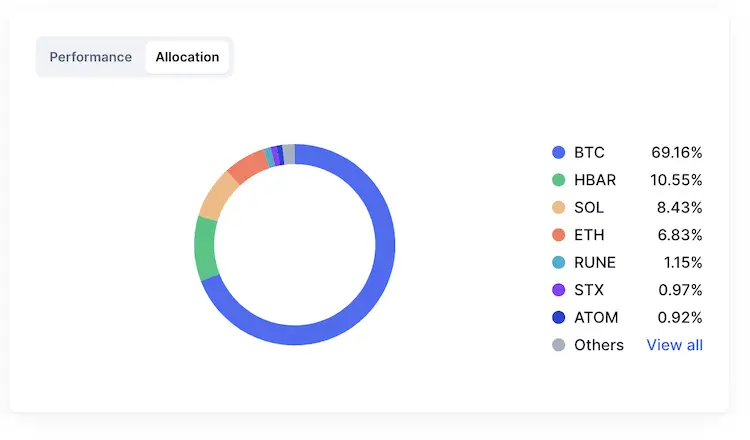

Current Crypto Asset Portfolio Chart

Bitcoin is my largest position, representing 69% of my total digital assets.

Charts are from Coinmarketcap.com, where I track my portfolio performance.

Crypto Asset Portfolio Management

Let’s get to how I manage my crypto asset portfolio.

The table above shows you at one glance which coins I hold on which wallet, and how I generate interest on my crypto assets.

Crypto Asset Portfolio – Deep Dive

I like to highlight a few important ones:

Bitcoin

- I keep the majority of my Bitcoin on my Ledger

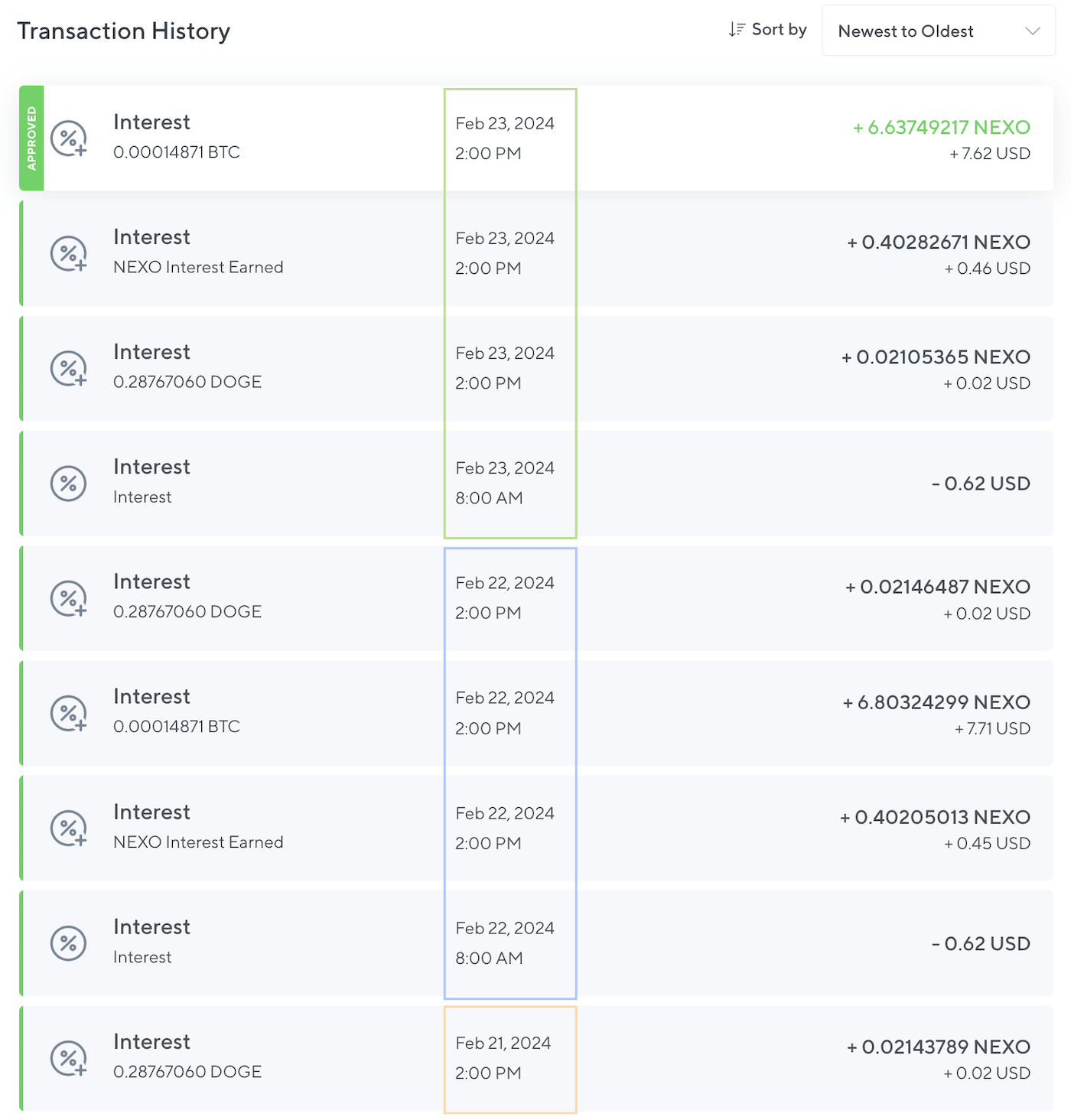

- I put 2.5 BTC on Nexo to earn passive income

- These generate enough interest to cover 100% of monthly credit card bill

- I use the Nexo credit card for everything, and I am super happy with it

- Below is an image of how the transaction page looks like showing all the daily interest

Hedera

- As I wrote before, I am convinced Hedera will become a top 10 coin by 2025

- The team, tech, speed, security (ABFT!), use cases, and ‘carbon negativeness’ (!) are just some of the reasons

- one of the main reasons is Hedera’s unique government council, with companies like Google, Hitachi, Mondelez, Dt. Telekom, etc.

- maybe not appealing to the typical crypto ethos, Hedera positions itself as an enterprise network, which corporations sooner or later will trust and gravitate to

- I am a big fan of the Hedera-native wallet, Hashpack, as well as the two Hedera DeFi projects: SaucerSwap and Heliswap

Solana

- I have owned Solana for years and held it when it was in the single digits, as well as when it was above $200 US

- I love its Phantom wallet and currently am using two DeFi projects with upcoming airdrops

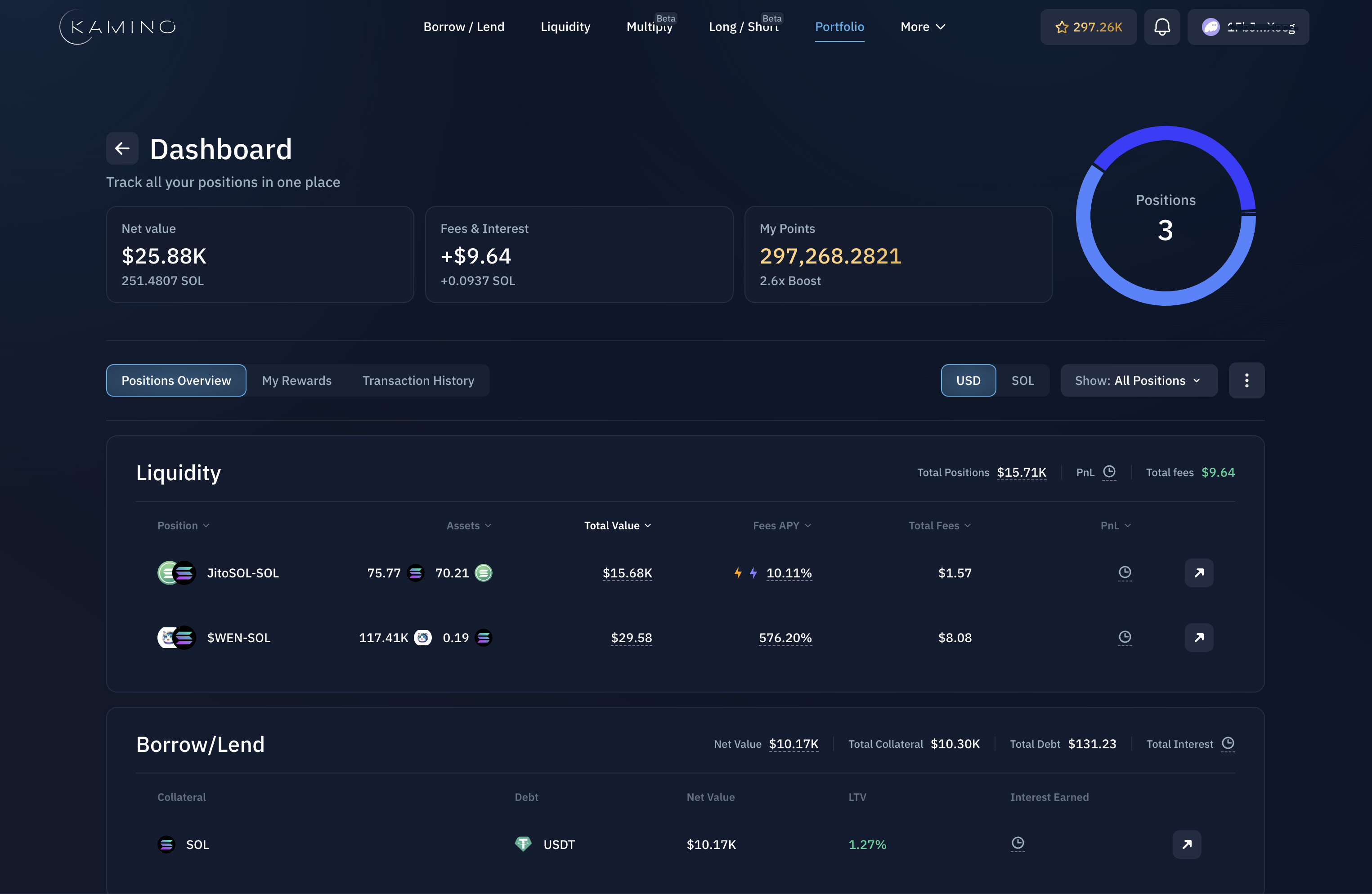

- Kamino Finance – I am liquidity farming with approx. 250 SOL, see my dashboard below

- For example, you can convert SOL into jitoSOL, then put these into an LP on Kamino or MarginFi

Ethereum

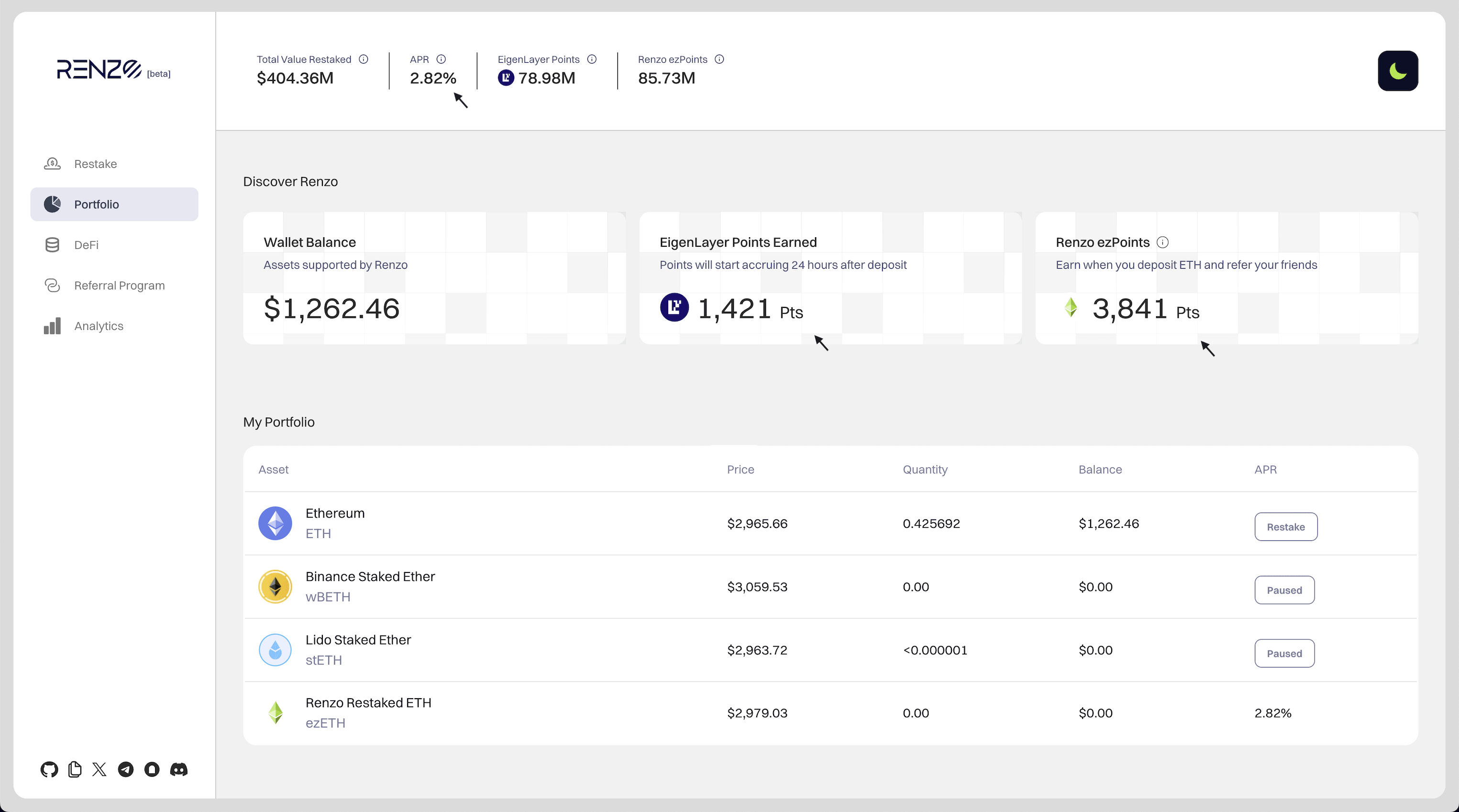

- Like many others, I believe the Eigenlayer airdrop will be massive

- That’s why I am staking natively with Eigenlayer (with virgin ETH and swETH from Swell)

- but also through some of those liquid restaking platforms that build on top of Eigenlayer

- All you need to get started is some ETH on a Metamask or my favorite Rabby Wallet

- go to one of the projects listed above, convert your ETH into the staked version, and you will be collecting points

Below is what this looks like, for example, on Renzo.

For anyone interested in staking and liquid restaking Ethereum I recommend watching this Bankless video:

Thorchain

I would only recommend Thorchain for experienced crypto users. LPing comes with a whole series of risks and is not for everyone. The best Thorchain wallet is Xdefi.

In the past, I provide liquidity to the BTC/RUNE, ETH/RUNE, and USDT/RUNE pools, all on Thorswap. Use Thoryield to get good analytics of your LP positions.

Stacks

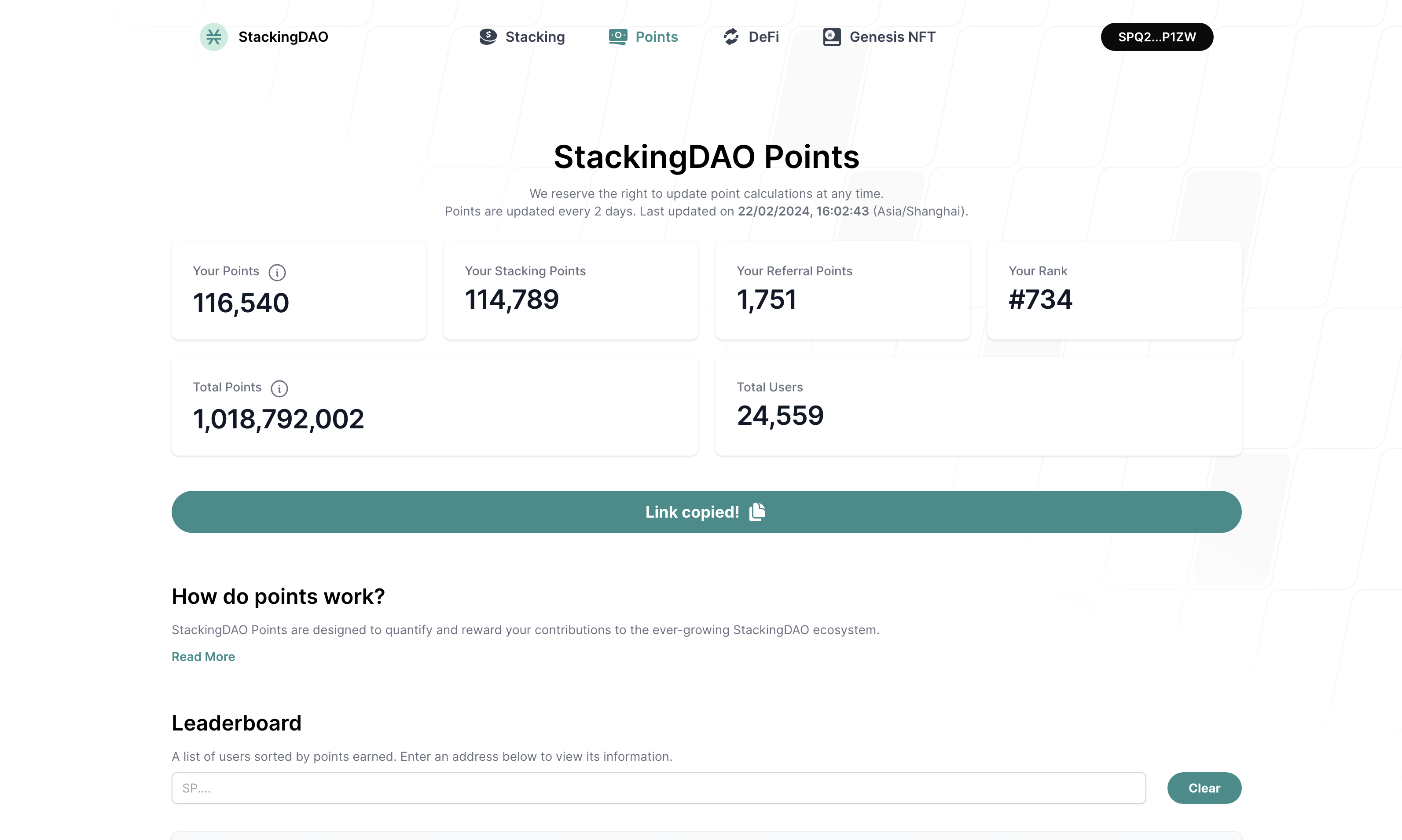

Stacks with its STX tokens is a project I have been following for a long time and invested in January 2024.

Stacks makes smart contracts and decentralized apps possible on the Bitcoin blockchain by using microblocks for speed and a Proof-of-Transfer (PoX) system that links transactions to the Bitcoin blockchain. think of it as an L2 on top of BTC, similar to Arbitrum or Optimism on top of Ethereum.

I am currently one of the top 3% of STX StackingDAO stakers, according to my accumulated points.

Cosmos

I have owned Cosmos’ native ATOM token for over four years. I like what’s getting built on top of Cosmos, but the performance of the ATOM token itself is lackluster.

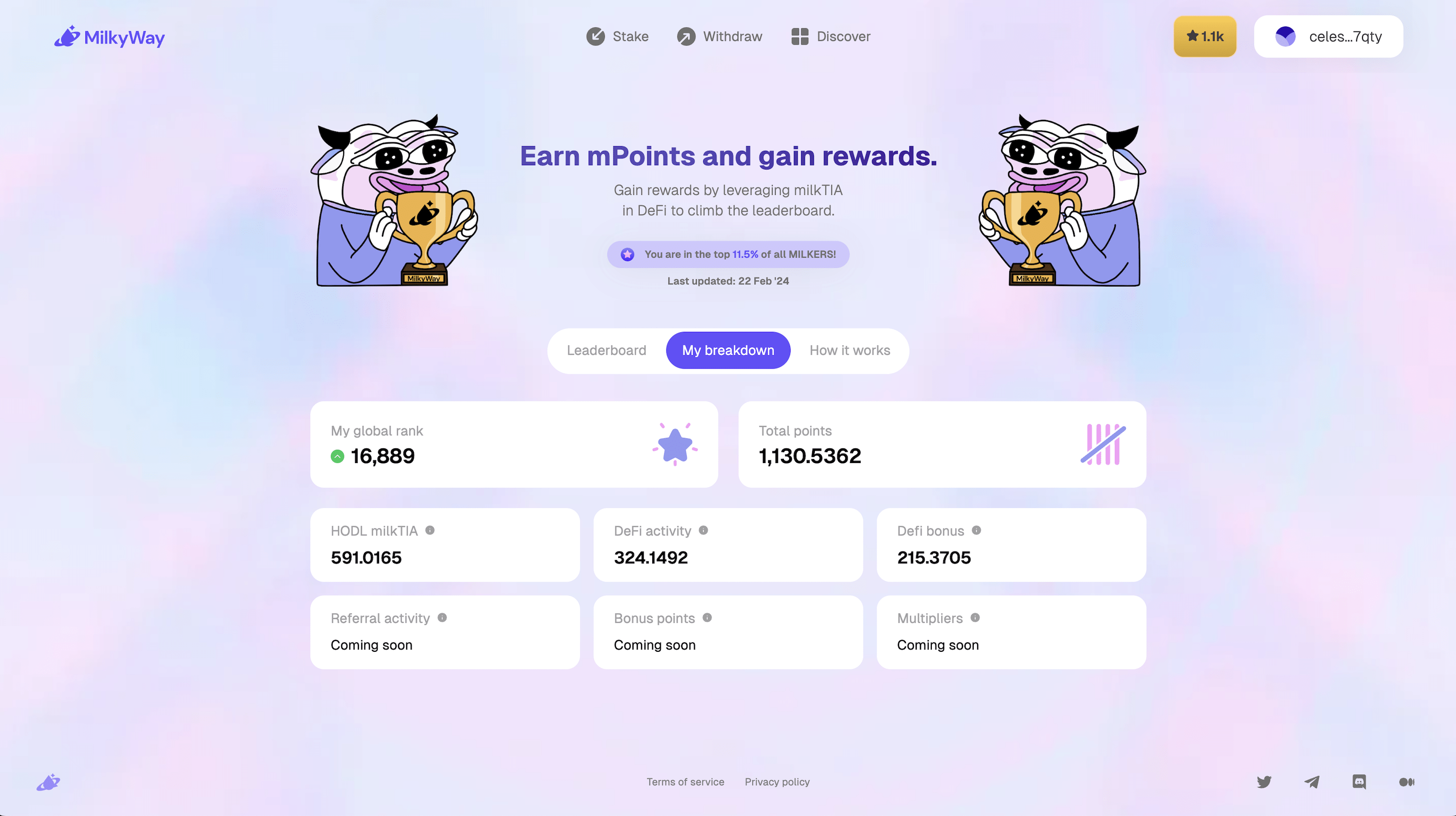

I recently got some of Celestia’s airdropped TIA tokens, which I staked, which made me eligible for a rather sizeable DYM token airdrop (received $1,900 US worth of DYM tokens).

I think it’s worth it to stake ATOM on Stride, as well as stake TIA via Milkyway.

Conclusion

I hope by sharing how I manage my crypto asset portfolio I was able to help you find some inspiration!

FAQ

What is the best crypto asset allocation?

There is no single best crypto asset allocation that fits everyone. Many claim that at least 75% should be in Bitcoin, and 15% in Ethereum, and the rest in other solid L1 like Solana, Hedera, or Cardano, and only the remaining 10% in smaller altcoins.

How to manage a big crypto asset portfolio?

Large funds understand the risk of over-diversification, hence, they typically have a few concentrated bets. Holding more than 50% in Bitcoin alone, followed by 25% Ethereum is not rare, but more like the norm, depending on the respective fund’s mandate.

How do funds manage their crypto asset portfolio?

Most large funds have large concentrated bets on the most promising cryptocurrencies like Bitcoin, Ethereum or Solana. It’s best to be diversified, but not too diversified. You should not hold more than ten cryptocurrencies in your crypto asset portfolio.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love