A fellow reader from Sweden asked me over the weekend what my 3 highest conviction investments would be for the coming 10 years.

Put differently, what would I invest in if I could only pick three separate investment vehicles? A great question, that’s why I sat down to write this post!

General Thoughts on High Conviction Investments

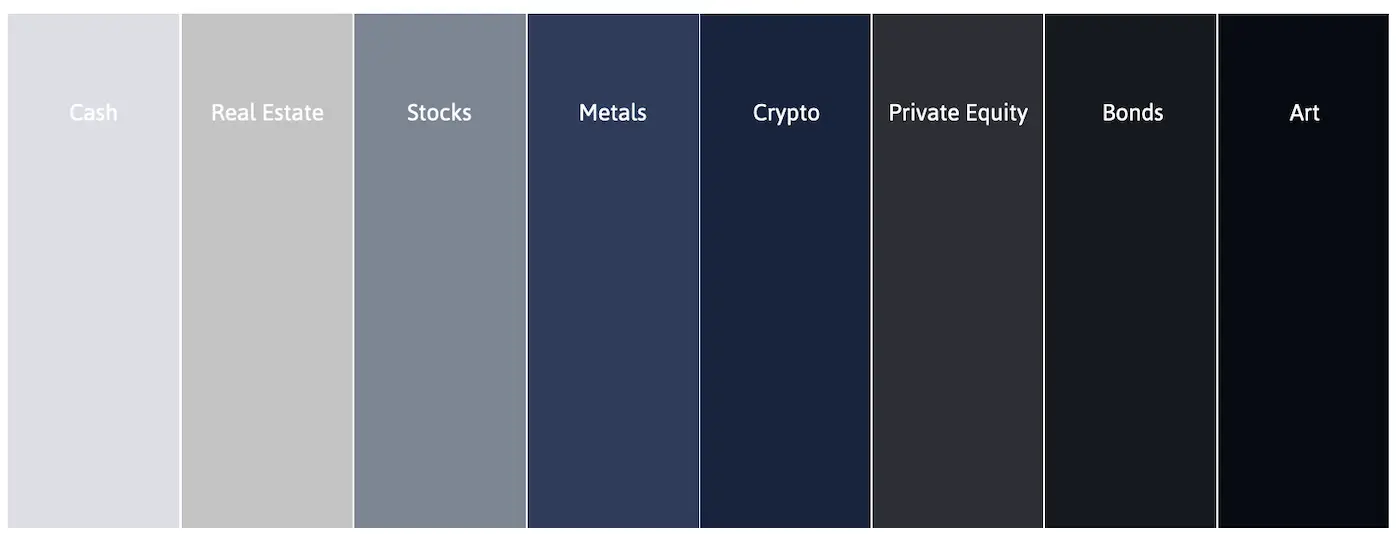

In a recent article, I shared How To Structure An Investment Portfolio (with 8 strong pillars). As a quick refresher, here they are again:

- Stocks

- Metals

- Cash

- Crypto

- Bonds

- Real Estate

- Private Equity

- Art

Highest Conviction Investment #1 – Scottish Mortgage Trust

I am convinced the coming ten years will bring more innovation, change, and therefore disruption than the last 250 years combined.

RealVision’s CEO, Raoul Pal, does an excellent job explaining this in this YouTube video.

As tech changes so breathtakingly fast, I don’t believe investing in a single stock is the right way. The chance you’ll end up investing in the next Kodak, BlackBerry

or Polaroid is too high.

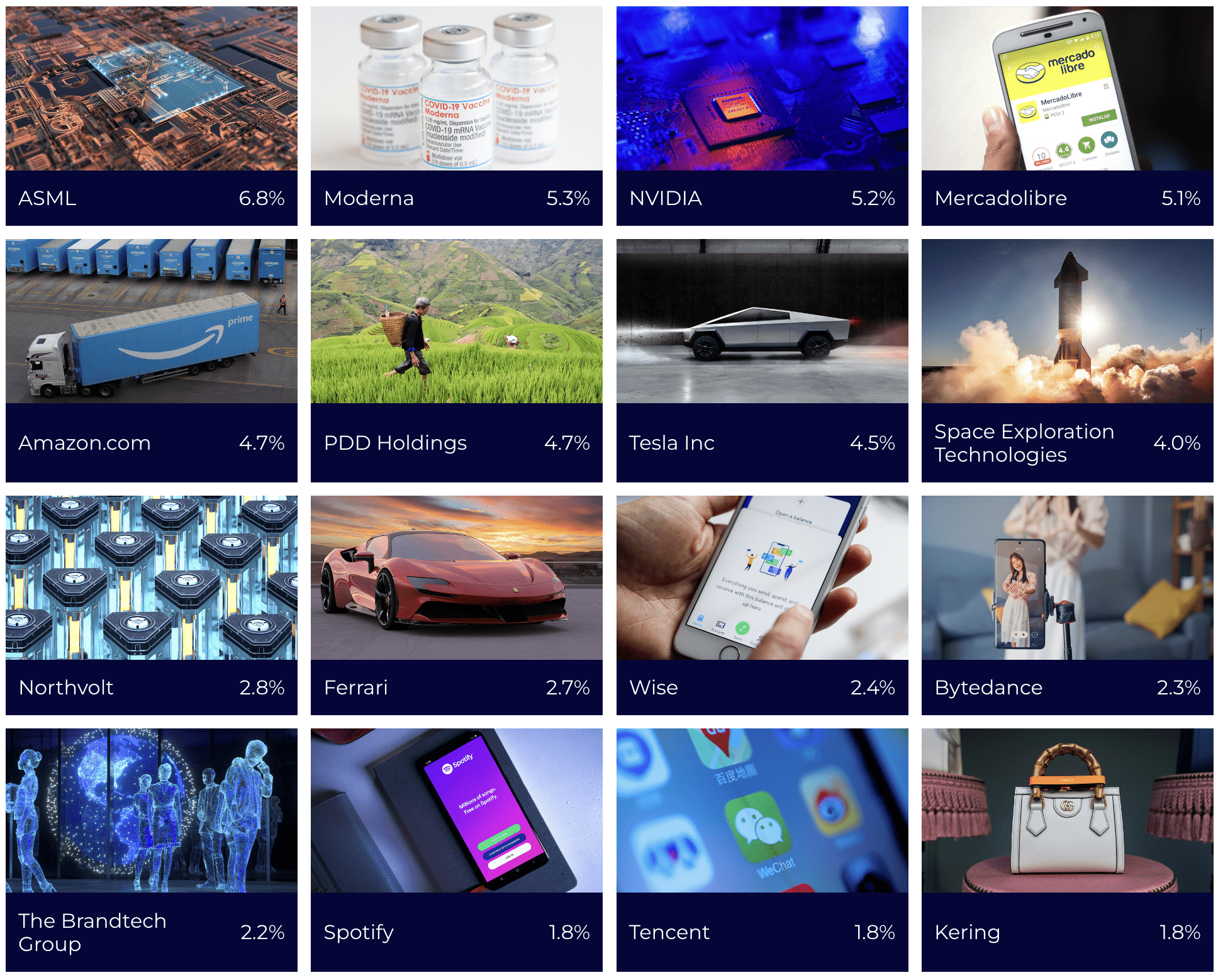

That’s why I tried to find the best disruptive tech fund in the world – and I am convinced I found it – The Scottish Mortgage Investment Trust (LSE:SMT) (which I reviewed in detail here).

Put simply, this trust is NOT investing in mortgages, but in the best tech companies in the world, with a “patient capital allocation approach“.

Here are Scottish’s largest holdings as of the time of writing this article:

Why Do I Own 6,000 x The Scottish Mortgage Trust Shares?

Diverse Exposure to Disruptive Technologies – Invests in a range of disruptive tech sectors, avoiding reliance on single tech stocks.

Experienced Management – Led by seasoned managers with a track record of early stock selection.

Long-Term Commitment* – Focuses on providing patient capital to outstanding growth companies over a 5-10-year horizon.

Geographic Diversification – Holdings span across the globe, including prominent companies from the US, Europe, Asia, and Latin America.

Major Disruptive Sectors – Covers essential disruptive technology areas such as energy transition, retail revolution, digitalization, and space exploration.

Opportune Investment Timing – Considered a favorable time to build a position after a significant price correction.

Untapped Potential* – Is invested in promising unlisted companies such as SpaceX, Epic Games, TikTok, Alipay, etc.)

Support from Industry Experts – Endorsed by influential figures like Raoul Pal, highlighting its credibility and potential.

Low Fees – Charges ultra-low management fees without performance fees, providing cost-effective investment opportunities.

Dividend Payments* – Offers dividends twice a year, enhancing investor returns while enjoying the benefits of the fund’s strategy.

*important to me

You can buy the Scottish Mortgage Trust at stock brokers that list UK stocks, such as TradeRepublic (only $1 per trade).

Highest Conviction Investment #2 – Bitcoin

Bitcoin is surely not for everyone, but in my opinion, at this stage of the game, it is a must-own for every investor.

List Of Reasons Why Bitcoin IS Important

- First ever created digitally scarce asset

- Incorruptible money

- Provides financial autonomy for everyone

- Secure and resistant to censorship and seizures

- Permissionless and decentralized

- Hard to create, ensuring scarcity

- Global and borderless

- Non-sovereign and not controlled by any government

- Disinflationary, with a hard capped supply of 21mio

- Easily verifiable and immutable

- Uniformly based on mathematical principles

- First layer asset, not dependent on any other entity like cash or stocks

- Functions as a metric system for money

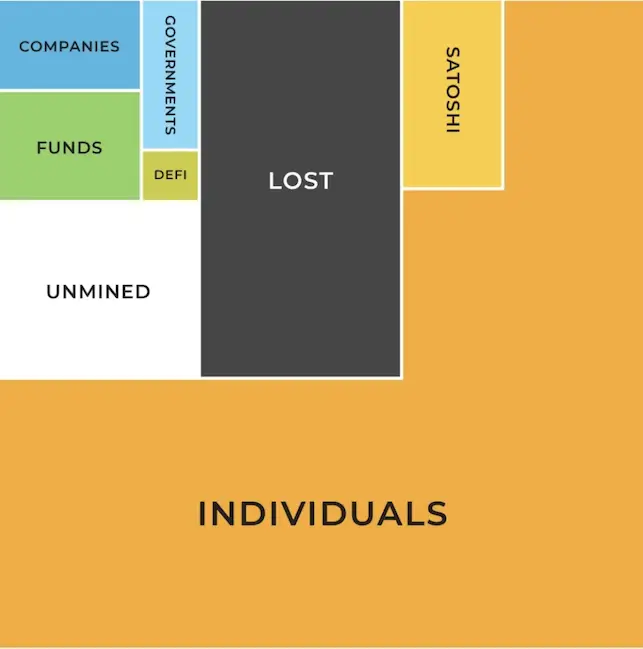

Who Owns All The BitCoin?

How To Invest In Bitcoin

The right way to invest in Bitcoin is to buy it on an exchange and keep it in your cold wallet.

By this, you get the benefits listed above.

The easy way to buy Bitcoin is why the ETFs, but make no mistake, your BTC can be taken from you in no time, and you can’t really see what the ETF manager actually does with your coins. They could lend them out, borrow against them, long/short the market, and so much more.

Not worth it! Buy it on a good exchange like for example, Nexo, then transfer it to a cold wallet like a ledger.

Highest Conviction Investment #3 – ARKG Genomic Revolution

Picturing a pyramid, I believe the Scottish Mortgage Trust provides a solid foundation, and Bitcoin substantial upside and protection.

This means we can go further out on the risk curve, and choose something unrelated to the other two.

I go with the $ARKG – Ark Invest’s Genomic Revolution ETF.

I am fascinated by this space, especially by CRISPR Tech, since watching this video with ARK Invest’s CEO Cattie:

Why Crispr Has The Potential To Change The World?

- Holds promise for curing diseases previously deemed incurable

- Offers precision in genetic modification

- Potential to treat genetic disorders effectively

- Represents a revolutionary medical breakthrough

- Reduces risk of off-target effects compared to traditional methods

- Facilitates advancements in personalized medicine

- Opens avenues for innovative treatments and therapies (can become a platform!)

- Empowers scientists and researchers to tackle complex genetic conditions

- Represents a paradigm shift in healthcare and biotechnology

- Drives progress in agriculture, environmental conservation, and beyond

- Holds transformative potential across diverse industries and applications

ARKG’s Portfolio Composition

| Percentage | |

|---|---|

| Precision Therapies (e.g. CSPR) | 37.4% |

| Multiomic Technologies | 33.9% |

| Programmable Biology | 9.7% |

| Neural Networks | 7.9% |

| Next-Gen Cloud | 6.2% |

| Intelligent Devices | 2.5% |

| Adaptive Robotics | 2.1% |

Personally, I have invested in CRISPR stocks for over five years and plan to keep those for another 10-15 years.

This is my current CRISPR portfolio:

| Qty | Name | Purchase Value | Current Value | Gains |

|---|---|---|---|---|

| 150 | Intellia –NTLA– | $3,000 | $4,127 | $1,127 |

| 100 | Crispr –CRSP– | $4,000 | $6,816 | $2,816 |

| 350 | Editas –EDIT– | $3,000 | $2,597 | -$403 |

| Total | $10,000 | $13,540 | $3,540 |

I allocated $10,000 US to this investment theme and will let it sit for decades.

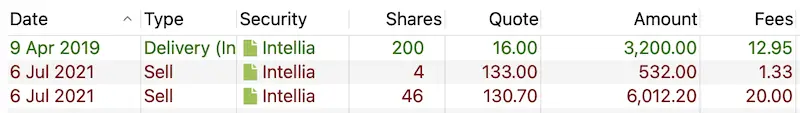

Between 2019 and 2021, I traded in and out of Intellia already. See the tiny green box on the far left side of the chart. That was my buy.

I then sold 25% when it did an 8x in value. Since then I just held tight (which in hindsight was wrong, obviously).

ARKG’s Chart

With prices bottoming for now several years, I believe this is an opportune time to build a first position.

Conclusion

I believe my three highest conviction investments are a good way to get exposure to the three biggest narratives for the coming decade: disruptive tech, blockchain, and life sciences.

Do you like these three themes? What would pick differently?

📘 Read Also

- The 5 Best Hard Assets – A Quick Investment Guide

- Sitting on $1.5M Crypto Gains – Still Frugal Lifestyle Or fatFIRE?

- The 10 Best Emerging Market Stocks To Buy

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love