We are sailing in uncharted territories!

The U.S., arguably the most powerful country in the world, adds $1 Trillion debt, every 100 days.

This path is unsustainable, hence the prudent and wise investor should allocate the majority of his/her portfolio to things that the central banks can not print!

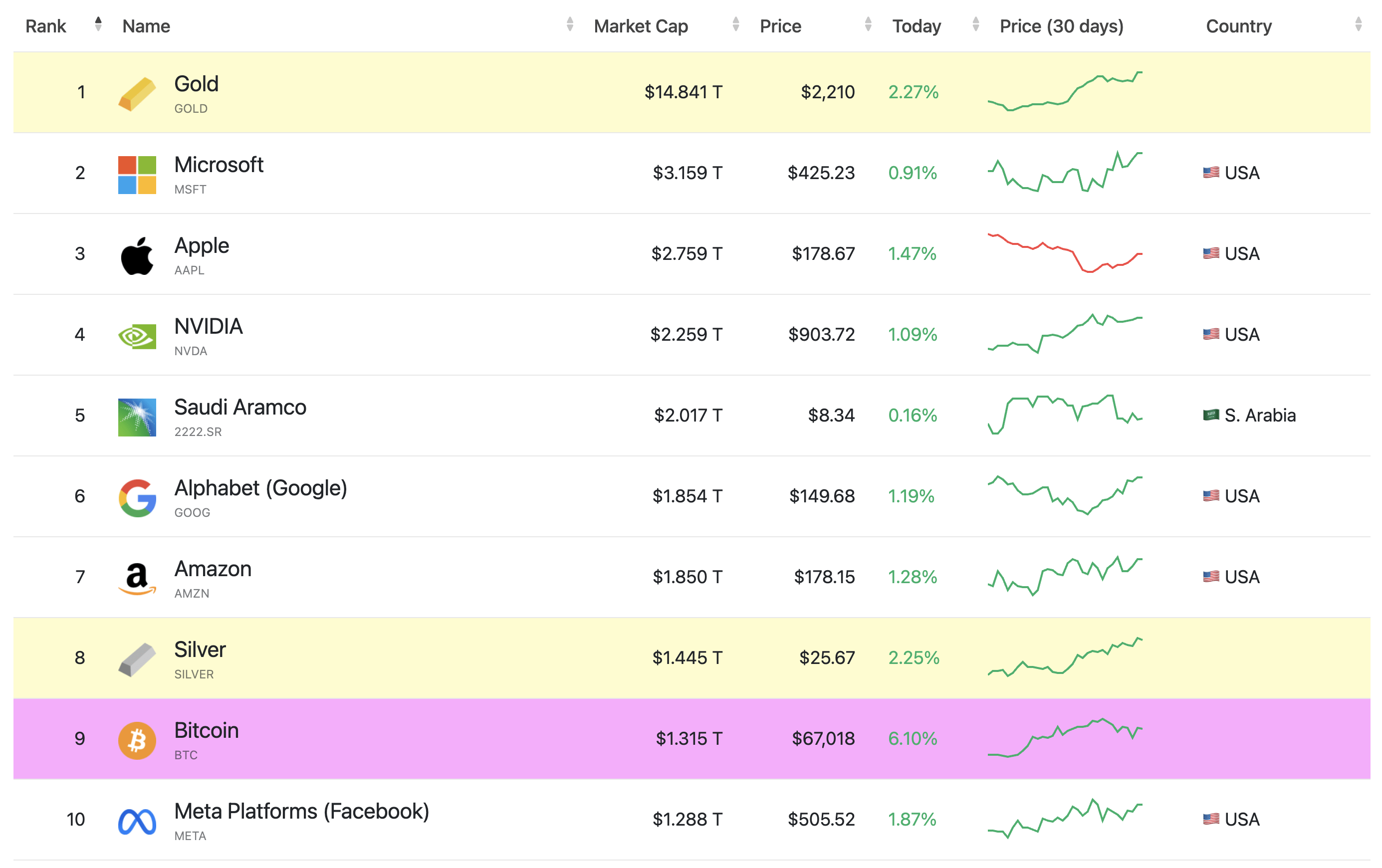

Overview of All Assets

Let’s first take a look at the market cap of **all asset classes**:

Hard Asset Overview

Here are the six largest hard assets.

| Hard Asset | Market Cap | |

| 1 | Gold | $14.8 T |

| 2 | Silver | $1.5 T |

| 3 | Bitcoin | $1.3T |

| 4 | Ethereum | $416 B |

| 5 | Platinum | $254 B |

| 6 | Palladium | $95 B |

I am not considering the following assets:

- Rare Earth Elements

- Diamonds

- Fine Wine incl. Whiskey

- Art and Collectibles

- Land

- Real Estate

Most of these can also be called ‘hard assets‘ but there are too many variables and it is difficult to quantify the value of each category due to wide variations in market prices.

Why Are Precious Metals Still Important?

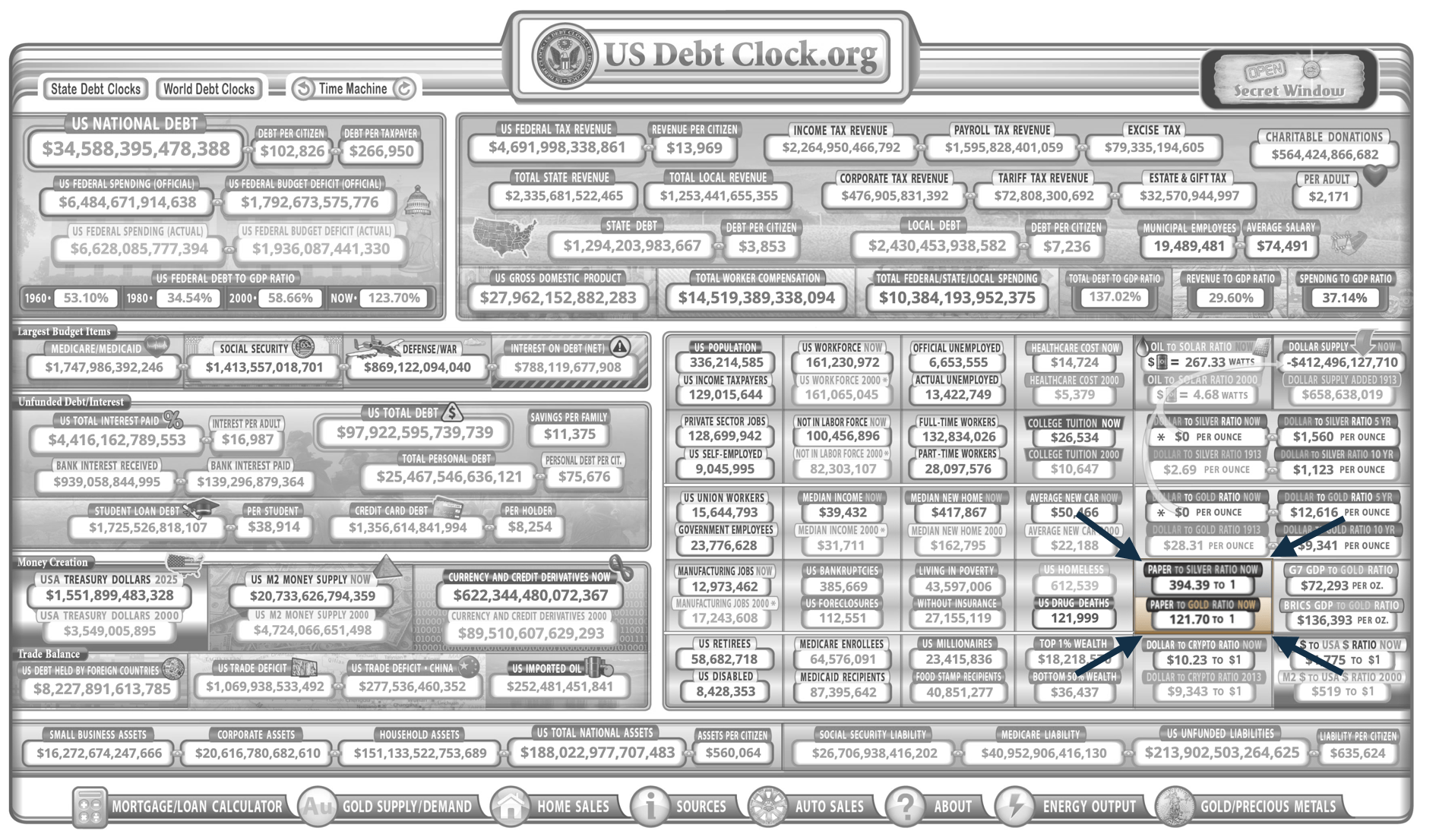

I like to draw your attention to the excellent U.S. Debt Clock website.

Please take a close look at the highlighted section below:

It tells us the

- the Paper To Silver Ratio is 394 to 1, and,

- the Paper to Gold Ratio is 121 to 1.

These ratios represent the ratio of paper contracts or derivatives (ie. futures and options) to physical metal in the market.

In simple terms, what this means is that for every ounce of physical silver available in the market, there are 394 paper contracts or derivatives representing silver. Therefore, the amount of paper claims on silver far exceeds the actual physical supply.

Similarly, this ratio indicates that for every ounce of physical gold, there are 121 paper contracts or derivatives linked to gold.

This raises the question about the general market integrity and price discovery. We all know gold and silver prices are manipulated, hence, we need to prioritize physical ownership! I for example buy and store gold with Goldbroker.com.

My Top Pick For Each Hard Asset

If I could only pick one single vehicle to invest in each of the hard assets, here’s what I would do.

Top Pick To Invest In Gold

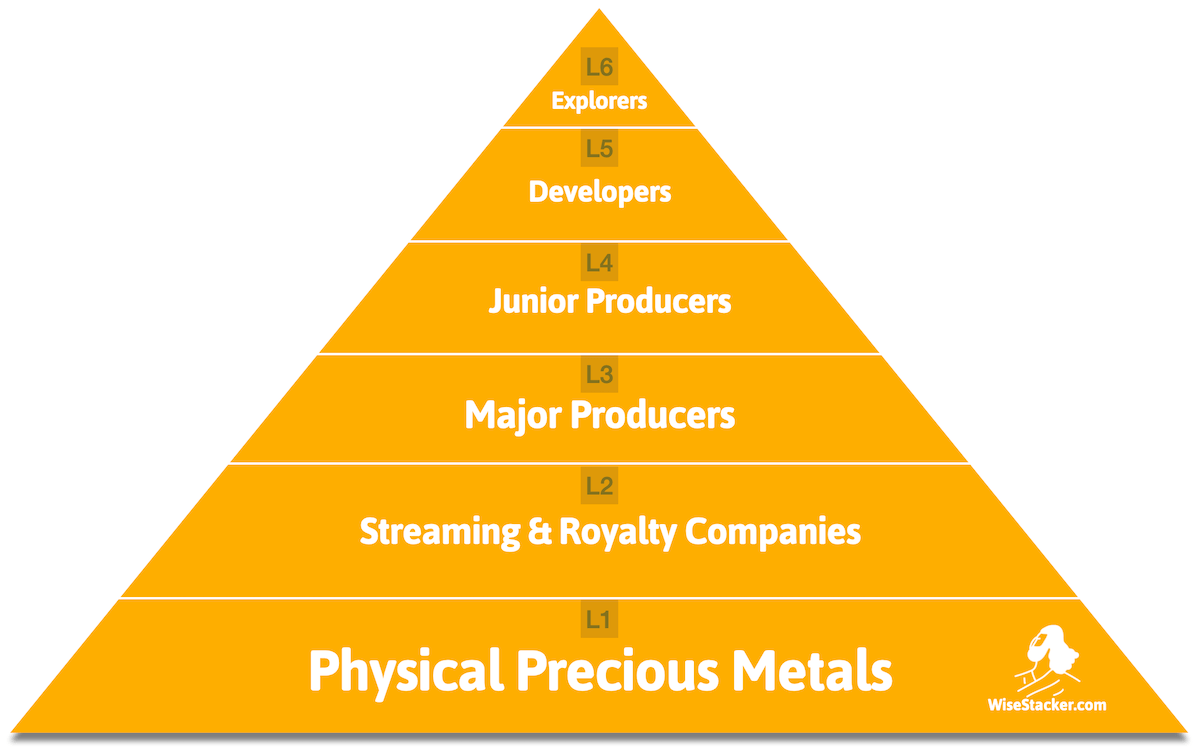

Always start with physical Gold as your foundation. Only once you have like 3-5% of your total liquid net worth in physical metals, move up the gold investment pyramid and buy shares of major gold producers, etc.

See below a chart I did for a post called How To Build A Portfolio Of Gold Mining Companies.

So start by buying physical metals, the vendors I like and trust:

- Goldbroker.com – A good place to buy and store gold in Zurich, Singapore, New York or Toronto

- Directbullion.com – No. 1 UK Gold Store

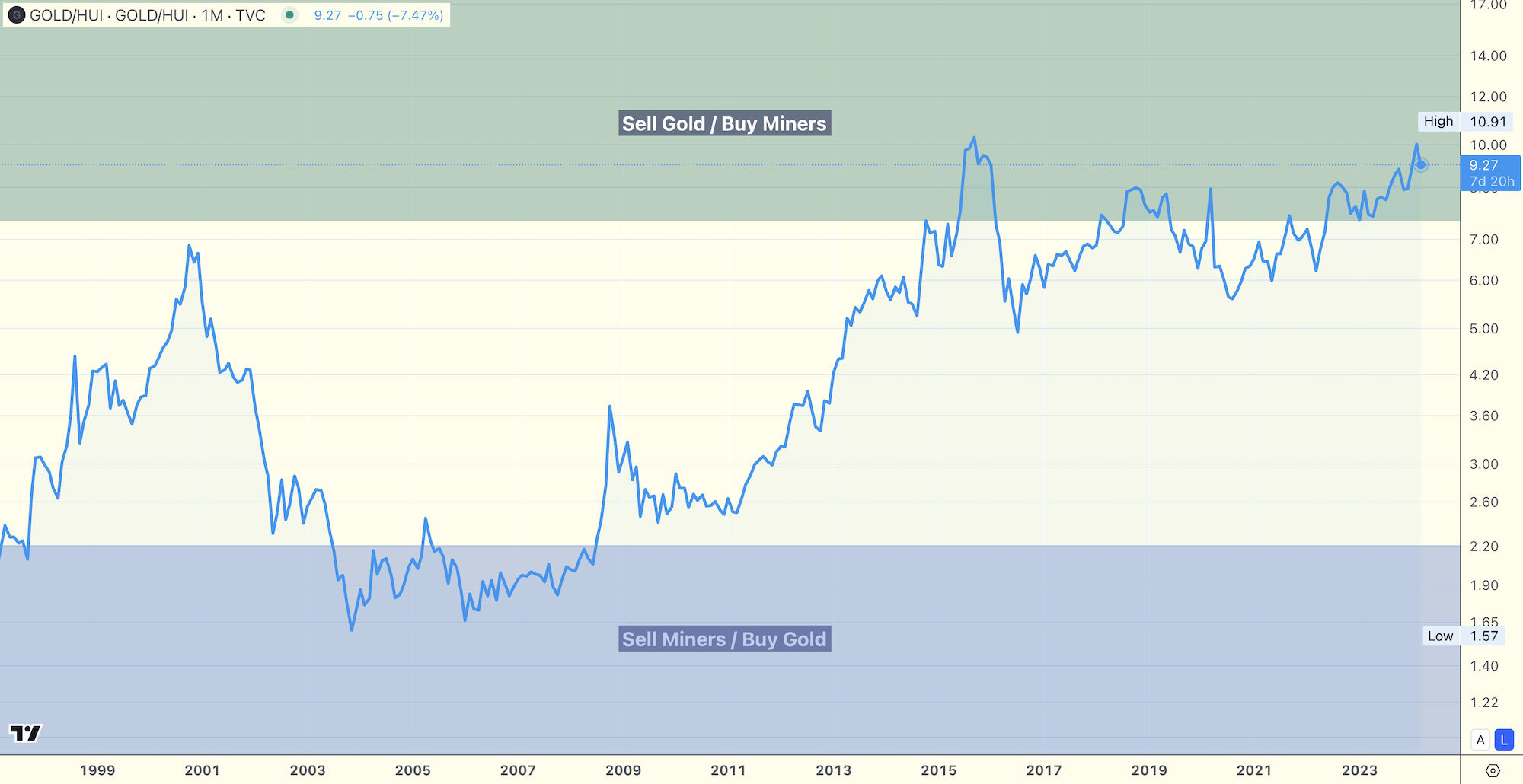

Use the Gold-to-Gold-mining-ratio chart to know when to consider buying Gold mining stocks.

For example, at the moment it’s not a bad time to consider buying gold miners as well. Check out a post for my all-time favorite gold mining stock.

Top Pick To Invest In Silver

Similar to Gold, start by building a core physical Silver holding.

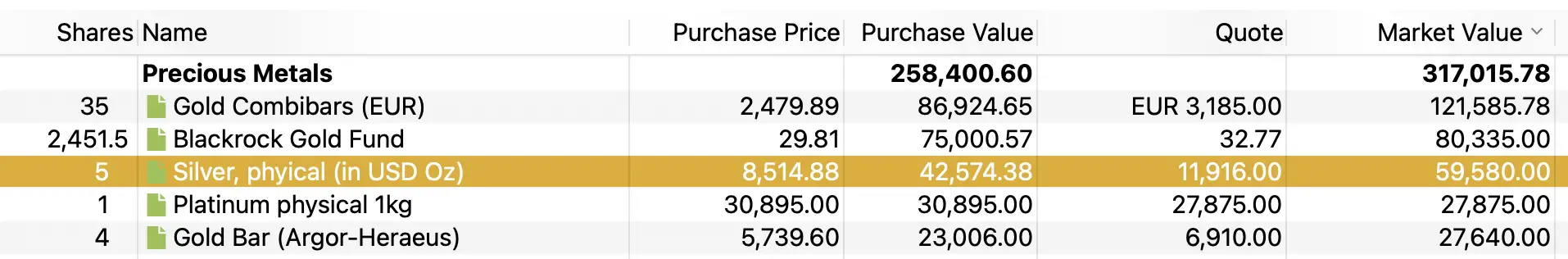

Here’s a quick overview of my precious metals holdings:

Other than the Blackrock Gold Fund, the other positions are all held as physical assets. The Gold combibars are at my home, all others are stored with GoldBroker.com.

With Silver, stick to and simply stack physical metal. If you like a good Silver mining stock, I would go with $PAAS Pan American Silver, a solid dividend payer.

Top Pick To Invest In Bitcoin

The HUGE difference between Bitcoin and precious metals is the fact that any transaction or allocation is 100% visible and readable directly “on-chain”.

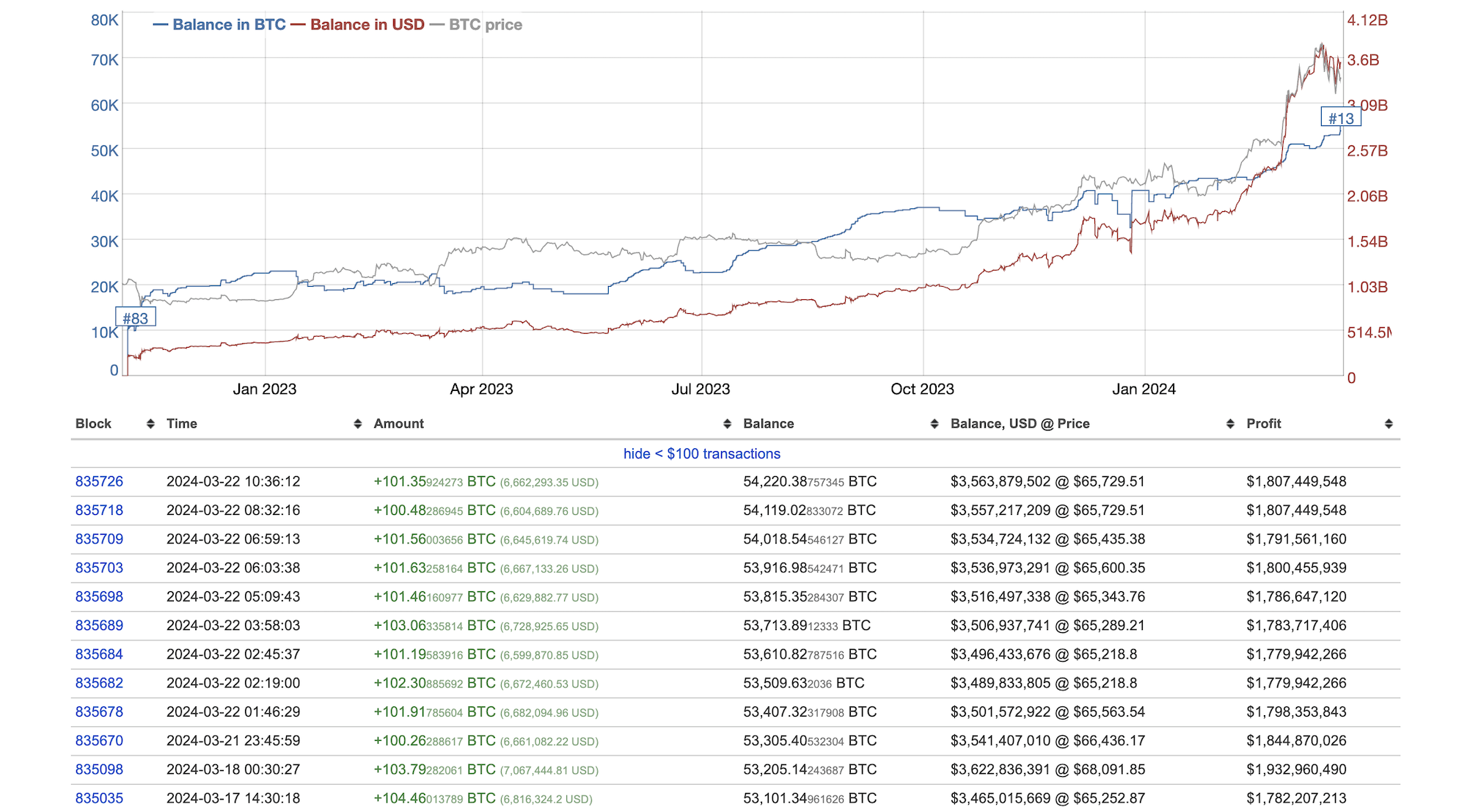

For example, let’s take a look at this interesting wallet:

This investor buys 100x BTC every day, sometimes multiple times per day.

He/She/it now amassed 54,220 BTC, representing a total value of $3.5 billion US.

When it comes to Bitcoin, keep things simple: Buy Bitcoin on the exchange of your choice, I like for example Nexo, and then store it on a cold wallet like e.g. Ledger).

That’s it.

Although the Bitcoin ETFs are convenient (my favorite tracking site is this one from RationalRoot’s excellent Twitter account , you will only support the Paper To Bitcoin Ratio to go up – not good.

So, buy BTC and store it in your cold wallet!

Top Pick To Invest In Ethereum

Other than Bitcoin, Ethereum is not a proof-of-work protocol anymore, but a proof-of-stake.

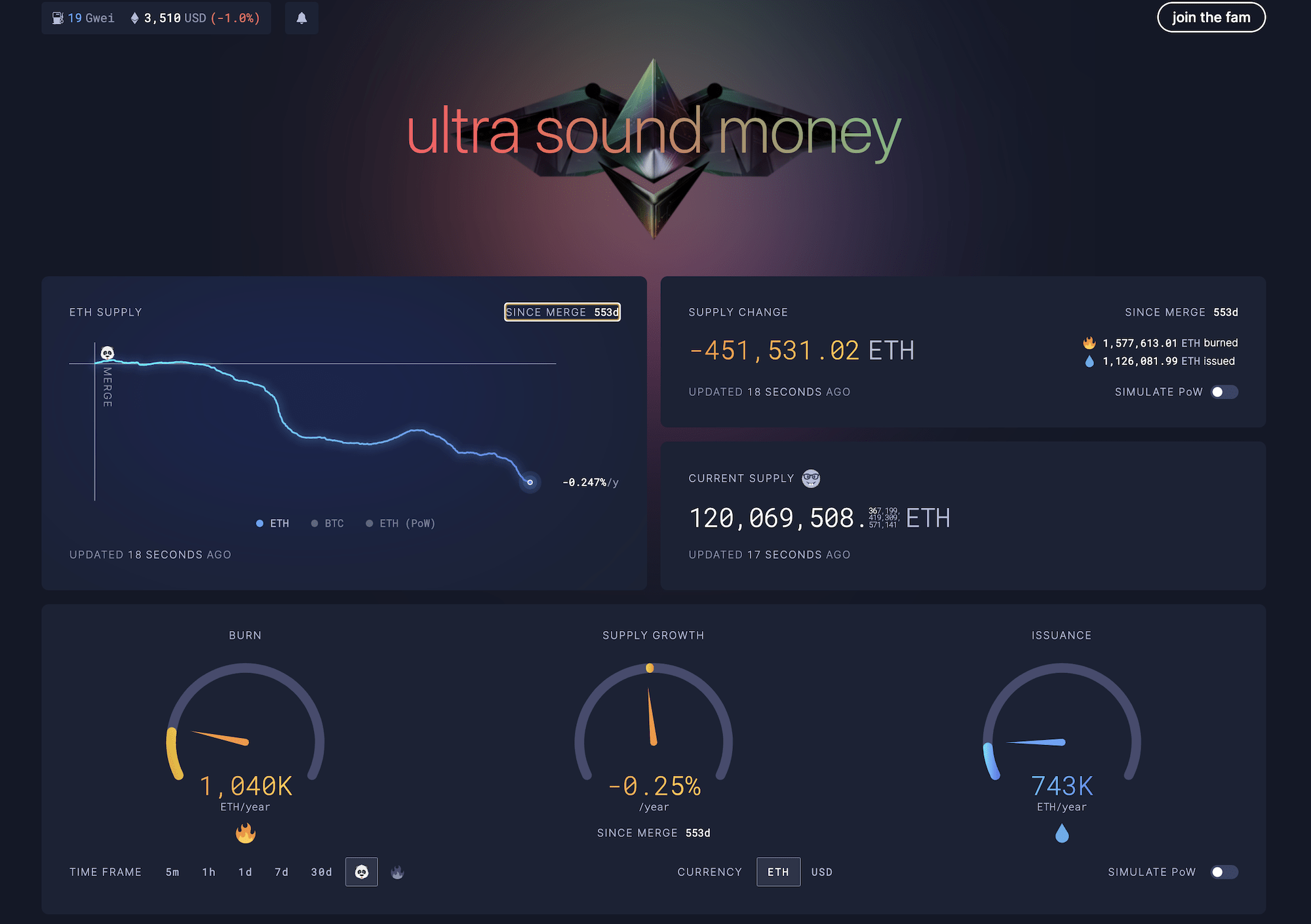

I believe it is not only hard money, but ultra-sound money. Check out the excellent page of ultrasound.money.

As you can see, since the transition to proof-of-stake in Sep 2022, a total of 451,531 ETH were burned, meaning taken out of the system forever.

It would be like a central bank “burning” their fiat currency in order for the circulating currency to gain in value, benefiting all holders!

Bitcoin “inflates” by about 6 BTC every ten minutes (prior to the halving in Apr 2024, 3 BTC/10min thereafter), and Ethereum in fact is deflationary!

When it comes to Ethereum, and other then with Bitcoin, I like to put my ETH to work.

Here is what I do:

After buying some ETH on a Centralized Exchange, I withdraw it to my Ledger.

I then stake these ETH with Lido, and get stETH.

I then head over to one of the liquid re-staking protocols like Renzo or KelpDao, and stake them there (via my preferred Rabby Wallet, connected to my Ledger!).

By this, I help to decentralize Ethereum, get additional yield on my stETH, and collect airdrop points for Renzo, KelpDAO, and EigenLayer (check out this simple airdrop guide)!

Top Pick To Invest In Platinum

Same as with Gold and Silver, I buy physical Platinum with GoldBroker and store it in Singapore.

If you like a good Platinum mining stock, I would go with $SBSW Sibanye Stillwater.

It is one of the major Platinum producers in the world, the share price came down a lot, and I believe this is a good long-term hold.

Conclusion

Given the immense uncertainty we see everywhere, I believe it is wise and prudent to have a substantial, like +50% of your liquid net worth in assets that can not be printed or debased.

We discussed the five best hard assets, and I shared my Top Pick for each.

📘 Read Also

- Sitting on $1.5M Crypto Gains – Still Frugal Lifestyle Or fatFIRE?

- The Best TradingView Chart Settings

- The 10 Best Emerging Market Stocks To Buy

FAQ

What are hard assets?

Hard assets are asset categories that are scarce or rare, and impossible to create out of thin air. This includes Gold, Silver, Platinum, Bitcoin, Ethereum, Fine Art, Agricultural Land, Real Estate, Diamonds, high-quality Wine/Whiskey, and others.

What are soft assets?

Soft assets are intangible assets that cannot be physically touched, yet hold some economic value.

Unlike hard assets, which include tangible items like precious metals, Bitcoin, real estate, or machinery, soft assets derive their value from intellectual or non-physical properties.

How to invest in hard assets?

Keep investing in hard assets simple: buy and own the actual hard asset itself. For example, buy a Gold or Silver coin or bar from a trusted coin dealer. Store it in a safe place, preferably a vault, or a dedicated precious metals storage company for larger stacks.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love