Passive Income Breakdown – July 2023

My total dividend income in July 2023 was $1,647 US:

|

Date |

Shares |

Value |

|

|

2023-07-05 |

🇩🇪 Porsche |

300 |

$615 |

|

2023-07-27 |

🇬🇧 Ecora Resources |

11,280 |

$240 |

|

2023-07-03 |

🇨🇦 Brookfield |

550 |

$158 |

|

2023-07-28 |

🇺🇸 Cisco |

350 |

$123 |

|

2023-07-17 |

🇺🇸 Avalon Bay |

70 |

$94 |

|

2023-07-15 |

🇺🇸 Realty |

429 |

$93 |

|

2023-07-04 |

🇩🇪 ProSiebenSat1 |

2,500 |

$92 |

|

2023-07-01 |

🇺🇸 Pepsico |

72 |

$82 |

|

2023-07-05 |

🏴 Scottish Mortgage Trust |

3,500 |

$75 |

|

2023-07-17 |

🇺🇸 Mondelez |

225 |

$61 |

|

|

Total |

|

$1,647 |

The biggest dividend I received was from Porsche Holding (FRA:PAH3), the parent company controlling 53% of the entire Volkswagen Group, including brands such as Volkswagen, ŠKODA, SEAT, Audi, Lamborghini, Bentley, Porsche, and Ducati. I purchased 300 shares between late 2022 and mid-2023, which paid 2.56€/share.

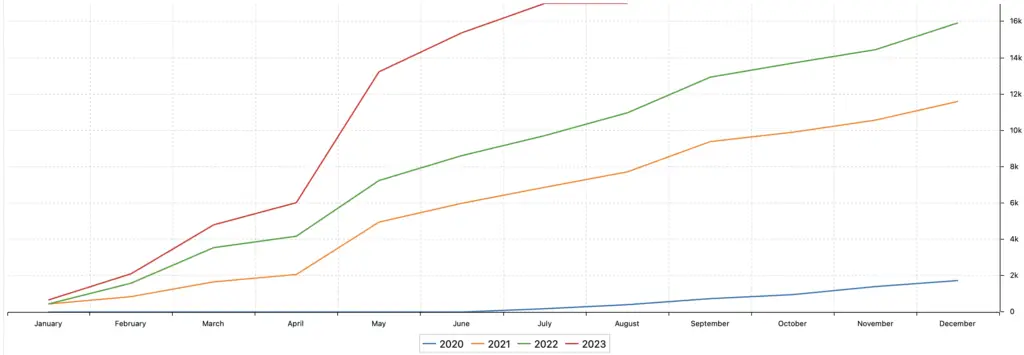

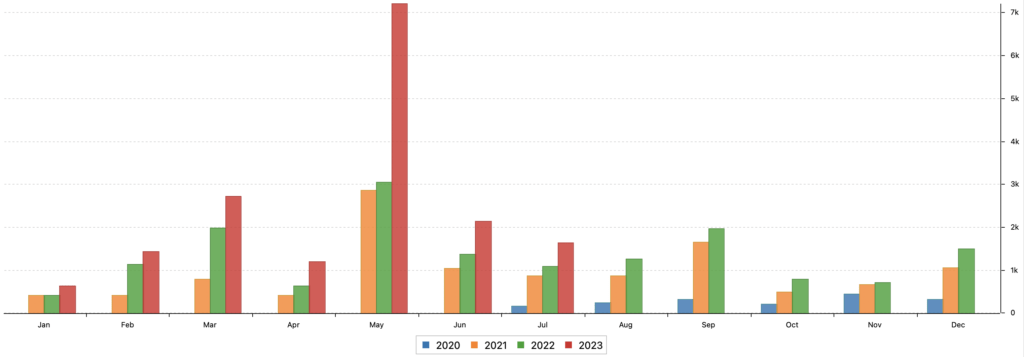

Passive Income Breakdown Charts Jul 2023

The below chart shows the dividends I received each month since I started building my All-Weather Portfolio.

The first dividends I received were in July of 2020, and since then basically every single month was better compare to the month of the previous year.

Dividend Stock Purchases In July 2023

Another part of my passive income breakdown is the purchases I made throughout the previous month:

|

Date |

Shares |

Value |

|

|

2023-07-28 |

🇺🇸 Public Storage |

45 |

$12,691 |

|

2023-07-30 |

🏴 Scottish Mortgage Trust |

750 |

$7,085 |

|

2023-07-13 |

🇺🇸 Disney |

35 |

$3,146 |

|

2023-07-19 |

🇮🇳 CapitaLand India |

2,300 |

$1,877 |

|

Total |

$24,799 |

I participated in a capital raise of CapitaLand India, my preferred way to be invested in India. This is a commercial REIT, owning dozens of newly built and modern commercial parks throughout India.

I added to my Scottish Mortgage Trust position, which I like to build out to 6,250 shares, equaling $50,000 US.

I sold my 3M shares and replaced them with Public Storage (PSA), in my opinion, the world’s best self-storage stock.

Check out this 30 sec Public Storage TV commercial:

My current dividend portfolio value currently sits at roughly $850,000 US, with the aim to reach $900,000 US by the end of 2023.

If no major crash occurs, I believe I’ll make additional purchases of approx. $50k in the coming five months.

Conclusion

Not a very eventful month, but I am happy with my new Public Storage position.

I know the company for years and believe it is a good long-term hold. It has one of the best fundamentals of ALL businesses, and I believe it will be a reliable dividend payer for years to come.

📘 Read Also

- The 10 Best Water Stocks With Dividends

- The 5 Best Car Rental Stocks With Dividends

- My 7-Figure Portfolio Allocation – Back Above $5 Mio!

FAQ

What passive income means?

Passive income is income you generate without actively working for it, be it

– income from dividend stocks you own,

– interest income,

– staking rewards from cryptocurrencies,

– rental income,

– royalty income,

etc.

How does passive income work?

Passive income comes to you without you having to actively work for it, this can include rental income from properties, dividends paid from shares you own, interest income, staking rewards from cryptocurrencies like Ethereum, etc.

Which passive income is best?

There is no right answer to this question. It depends on numerous variables. One good rule of thumb is usually to not rely on one source of passive income but to have a good passive income breakdown of several streams, such as rental income from properties, dividends from stocks you own, staking rewards from cryptocurrencies, etc.

What is a good passive income breakdown?

A good passive income breakdown is to try and have four different buckets of passive income, such as

– rental income,

– income from dividend stocks you own,

– staking rewards from cryptocurrencies,

– interest income,

– royalty income.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love