Key Takeaways

☑️ The first 6 months were good throughout the board

☑️ I still sit on a large cash position

☑️ I am okay with my current portfolio allocation

☑️ The goal is to further increase my dividend income

Back Above $5 Mio

Today I do a detailed review of my current portfolio allocation, and see how it developed over the course of the past 2-3 years.

Let’s jump right in – here’s my current portfolio allocation:

| (in ‘000 USD) | 2023/07 | Allocation |

| Cash | $459 | 12% |

| All-Weather Portfolio | $857 | 17% |

| Digital Asset Portfolio | $971 | 16% |

| Thematic Portfolios | $323 | 5% |

| Physical Metals | $312 | 6% |

| Private Equity | $1,810 | 37% |

| Real Estate | $380 | 8% |

| Total | $5,112 | 100% |

My biggest position is private equity. Those are the shares I own in five private companies.

I value these positions ‘conservatively’, meaning I discount the real value by approx. 50%. These companies currently distribute dividends of $200k US per year.

My All-Weather Portfolio, a dividend income portfolio consisting of my favorite dividend stocks you can buy and hold forever, slowly keeps increasing in size.

Now sitting at $857k, my plan is to get it to $1 Mio at the end of the year.

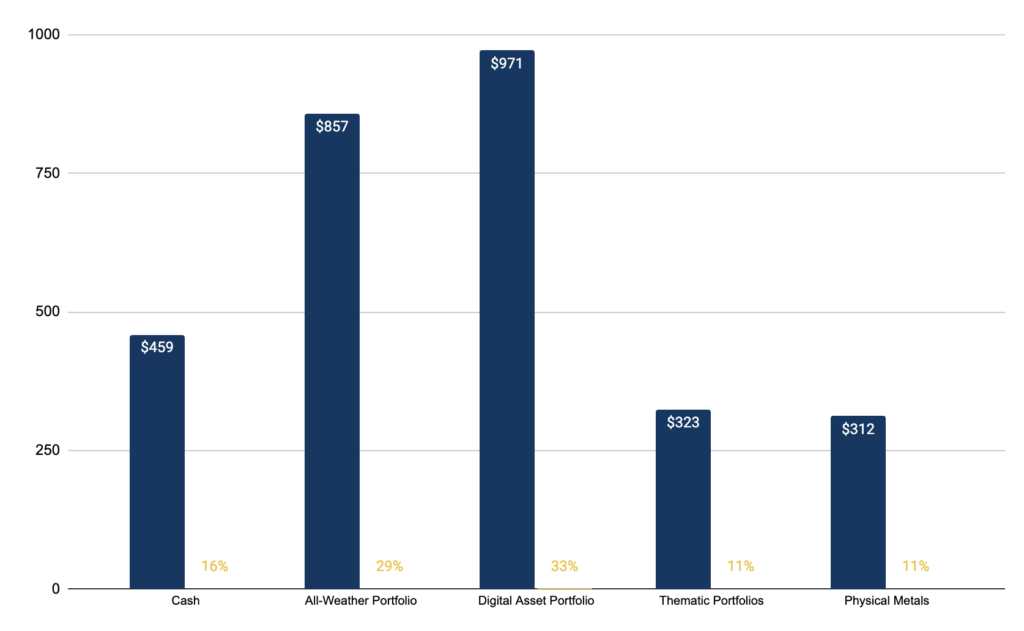

Portfolio Allocation – Liquid Assets Only

If we remove illiquid assets such as private equity and real estate, the allocation looks like this:

| (in ‘000 USD) | 2023/06 | Allocation |

| Cash | $459 | 16% |

| All-Weather Portfolio | $857 | 29% |

| Digital Asset Portfolio | $971 | 33% |

| Thematic Portfolios | $323 | 11% |

| Physical Metals | $312 | 11% |

| Private Equity | – | – |

| Real Estate | – | – |

| Total | 2,922 | 100% |

Under liquid assets, I understand assets that I could liquidate within one business day or so.

This also includes cryptocurrencies of my Digital Asset Portfolio that are generating income from staking and providing liquidity (check out how to earn interest on crypto).

Visual Portfolio Allocation – Liquid Assets Only

Now here’s a chart showing a visual portfolio allocation of my liquid assets:

I see my cash position is quite high, considering how well the markets performed in the last couple of months.

However, similar to many, I also have been waiting for a significant pullback to be able to buy shares more cheaply.

Net Worth Development 2020-2023

The table below shows the development of my total net worth from 2020 (the year I started writing my financial blog):

As the past three weeks were pretty good, my net worth increased from $5,055 to $5,112 US.

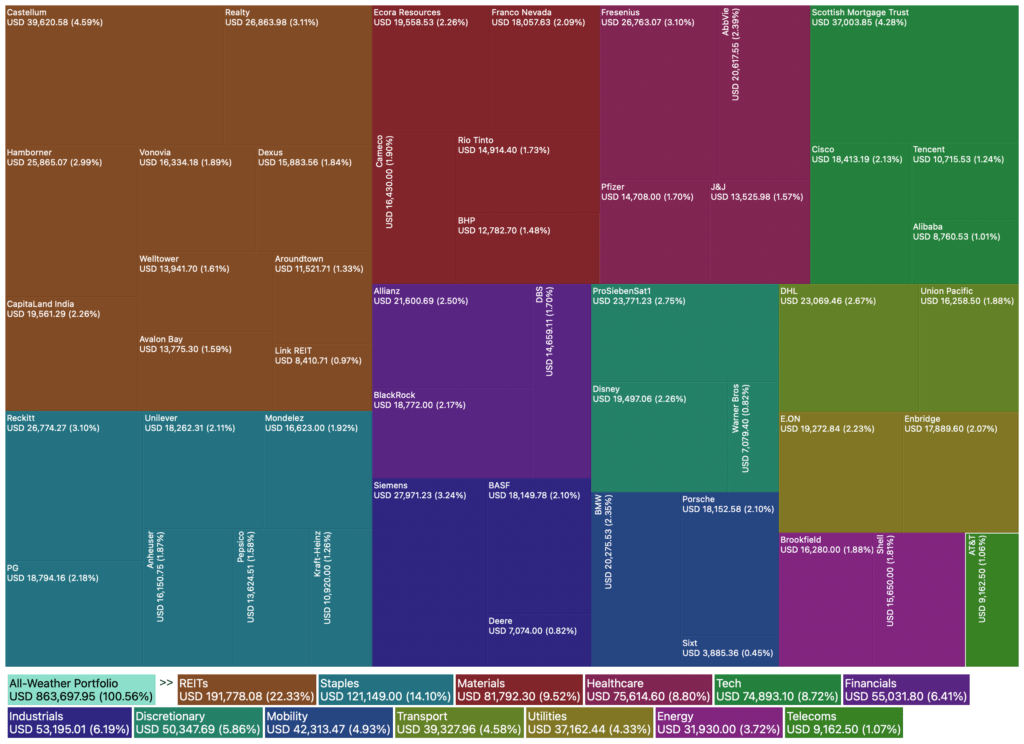

Dividend Portfolio DeepDive

Let’s do a deep dive and check out the specific allocation of my dividend portfolio:

Many people always bug me for having such a small allocation to the Tech space (see all my positions in green/ on the top right).

As my idea is to only buy stocks that will still be around in 50 years, I just think the Tech space is just too damn hard and disruptive.

That’s why I decided to invest in the Scottish Mortage Trust, in my opinion, this fund is managed by the best Tech investors on the planet.

Portfolio Development 2020-2023

Let’s see how my total portfolio, incl. digital currencies, private equity, etc., did in the past three years.

The red line shows how the MSCI World did, and the black one how my portfolio did.

This outperformance is mainly due to my relatively large Bitcoin position. Just last year in mid-2022, I had zero outperformance. Only in 2023 Bitcoin started to perform well.

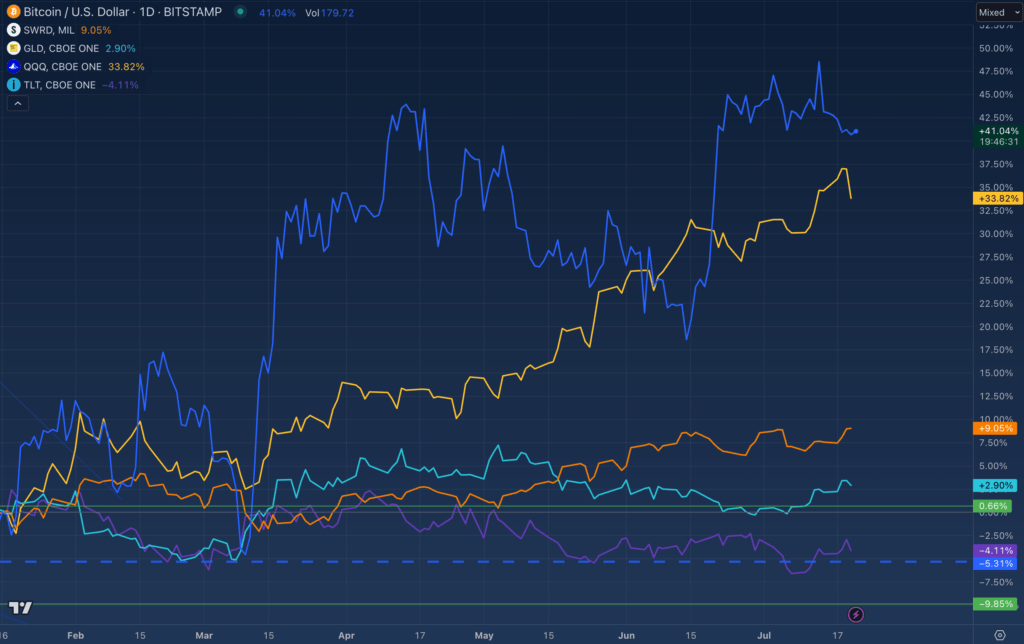

Check out the chart below showing the year-to-date performance of the most important assets:

$QQQ, the 100 biggest Nasdaq stocks is ahead with 41%, followed closely by Bitcoin with 33%.

The MSCI World (SWRD) “only” increased by 9%, the rest is for the dumpster.

Recommended Portfolio Allocation

General, if you are debt-free and between 25-50 years old, I recommend the following simple portfolio allocation:

| Recommended Allocation | |

| Stocks | 55% |

| Real Estate | 25% |

| Cash | 10% |

| Physical Metals | 5% |

| Cryptocurrencies | 5% |

| Bonds | 0% |

| Total | 100% |

The 10% allocation to physical metals and cryptocurrencies is important to have a life raft should the current financial system implode.

My Basic Recommendations

Stocks – Check out how to find high-yield stocks – regular dollar-cost averaging into a dividend ETF as $SCHD works best for most

Real Estate – If you don’t own any property, maybe consider good commercial REITs like Realty Income or residential REITs like Avalon Bay

Physical Metals – Start with actual physical metal (I buy everything here), then consider building a portfolio of good gold mining companies

Cryptocurrencies – giving any individual, regardless of race, color, gender, or age the ability to hold incorruptible money without any intermediary, that is apolitical, digitally scarce, secure, censorship and seizure-ship resistant, is extremely important in the world we live in. I buy everything on Bitstamp and then I earn interest on it on Nexo (get $25 US in BTC via this link).

Bonds – Personally, I don’t own or like bonds. Even if you get 5% you still won’t beat inflation. Why then even bother!?

Conclusion

I hope this deep dive into my portfolio and my basic recommendations in terms of portfolio allocation helps.

I’d be super interested in what other people’s portfolio allocations look like – would be awesome if you could share yours!

📘 Read Also

- How A Millionaire Invests $20 Mio After A Property Sale

- The 6 Best Dividend-Paying Fertilizer Stocks

- How To Invest $50,000 Right Now

FAQ

What asset allocation should I have?

There is no single asset allocation you should have. This depends on dozens of variables and is different to each investor. Generally, I believe it is best to keep things simple. For example, I have the following five asset buckets:

– real estate

– stocks

– physical metals

– crypto currencies

– private equity (shares you hold in companies)

How to determine portfolio allocation?

1/ Add the value of all your assets and figure out the total portfolio value

2/ Group your assets into asset buckets, such as stocks, real estate, physical metals, bonds, cryptocurrencies, art, etc.

3/ Sum up the value of each bucket and compare it to your total portfolio value (step 1)

This is your portfolio allocation.

Can a portfolio be too diversified?

Yes, if you hold too many positions without proper portfolio construction. I have seen portfolios with 100s of single stocks, making it overwhelming to keep track of dividends and performance. It’s important to construct a portfolio from the ground up, defining e.g. the 4-5 asset buckets you will invest in, and what the portfolio allocation should be for each. Keep it simple, so that it is fun to check your portfolio regularly!

What is the best portfolio allocation?

This is different for each investor. One old rule of thumb is 30%/30%/30%:

– 30% in real estate

– 30% in stocks

– 30% in bonds

But nowadays, I believe it should be more like this:

– Stocks 55%

– Real Estate 25%

– Cash 10%

– Physical Metals 5%

– Cryptocurrencies 5%

– Bonds 0%

What allocation is good for a seven-figure portfolio?

This depends on many factors and is different for every investor. Personally, managing a seven-figure portfolio myself, I recommend the following allocation if you are debt-free:

– Stocks 55%

– Real Estate 25%

– Cash 10%

– Physical Metals 5%

– Cryptocurrencies 5%

– Bonds 0%

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love