Passive Income Growth Nov/2023 – Invested $26,000

In terms of dividends, November was a relatively quiet month for me. I received $1,014 US before and $857 after tax in dividends, from seven companies:

| Shares | Amount | ||

| 2023/11/27 | 🇸🇬 DBS | 700 | $245 |

| 2023/11/24 | 🇺🇸 AbbVie | 145 | $215 |

| 2023/11/16 | 🇺🇸 AT&T | 625 | $173 |

| 2023/11/15 | 🇺🇸 Welltower | 200 | $122 |

| 2023/11/15 | 🇺🇸 Procter & Gamble | 125 | $121 |

| 2023/11/08 | 🇺🇸 Realty Income | 445 | $114 |

| 2023/11/01 | 🇺🇸 Deere | 18 | $24 |

| Total | $1,014 |

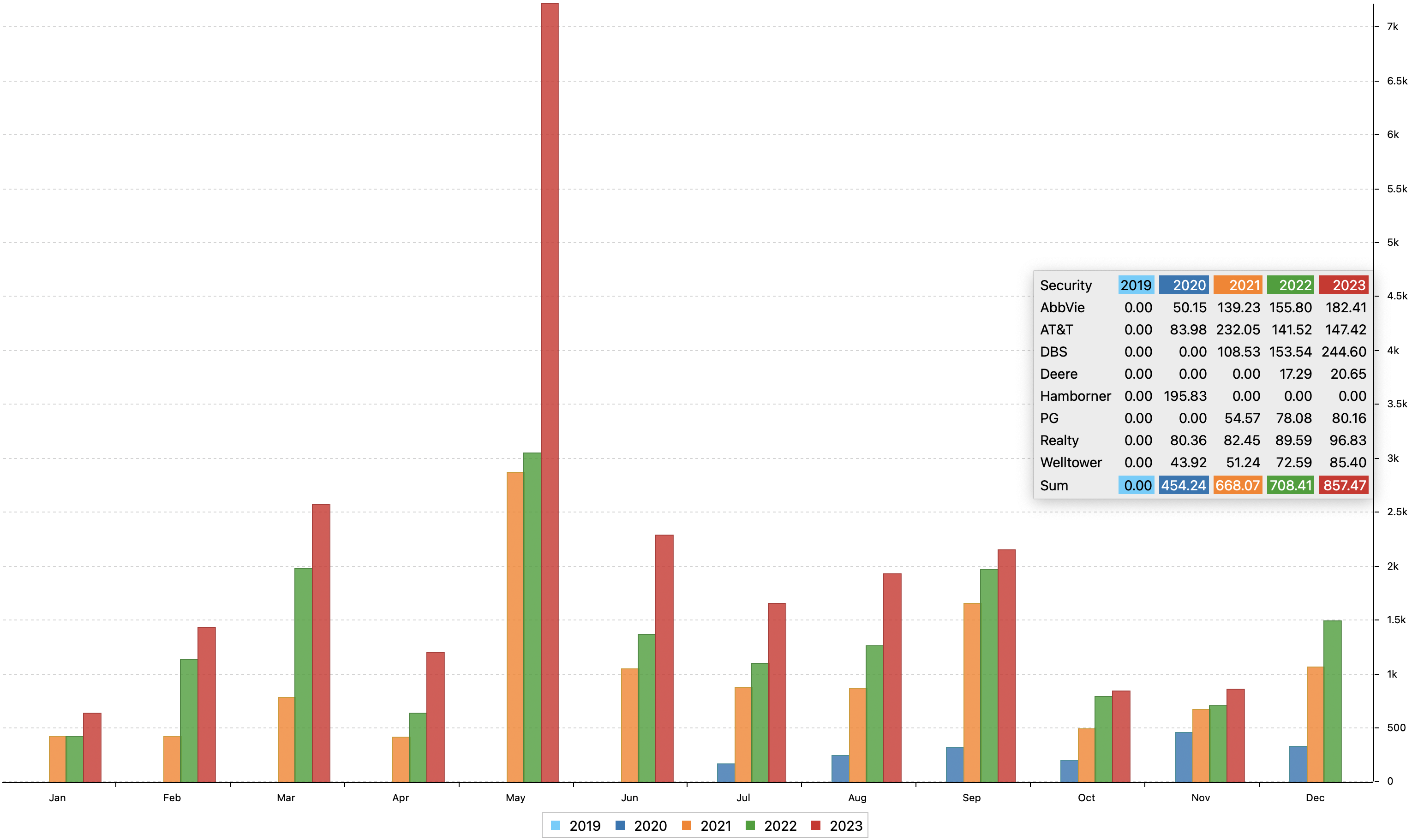

Every single dividend stock paid more than the previous year (see the year-on-year comparison on the following chart) – the kind of dividend-snowballing income growth action dividend investors like myself enjoy seeing.

My Largest Income Growth Providing Dividend Stocks

The following table lists my biggest dividend payers of 2023:

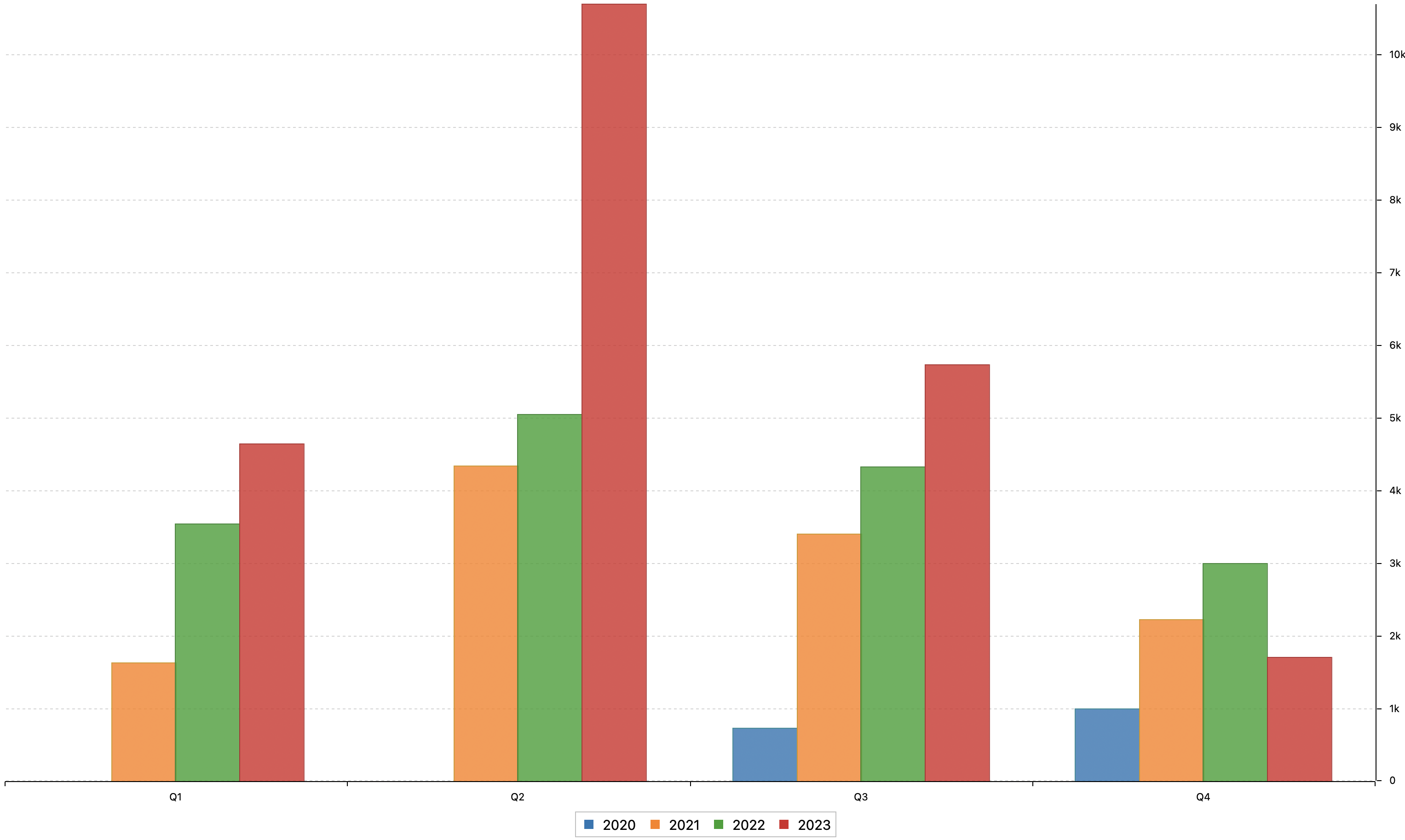

Quarterly Portfolio Income Growth

When looking at the quarterly income growth of my portfolio, we see that Q4 is my weakest one in terms of dividend income.

October, November, and January are my weakest month.

That’s also one of the reason why I invested $26,000 in the specific stocks this month that are currently undervalued and pay dividends either in Oct or Nov.

Dividend Stock Purchases Of The Month

Here is what I bought, hoping to accelerate my passive income growth in those months:

| Shares | Amount | ||

| 2023/11/30 | 🇺🇸 Mondelez | 50 | $3,560 |

| 2023/11/20 | 🇺🇸 Cisco | 150 | $7,131 |

| 2023/11/20 | 🇺🇸 Procter & Gamble | 25 | $3,777 |

| 2023/11/17 | 🇺🇸 Deere | 8 | $3,008 |

| 2023/11/15 | 🇬🇧 Ecora Resources | 2,720 | $2,975 |

| 2023/11/09 | 🇺🇸 Welltower | 30 | $2,550 |

| 2023/11/09 | 🇸🇬 DBS | 100 | $2,458 |

| 2023/11/08 | 🇫🇷 LVMH 🆕 | 1 | $775 |

| 2023/11/07 | 🇺🇸 Avalon Bay | 3 | $510 |

| Total | $26,743 |

My First Luxury Stock

So I dripped (Dividend Re-Investing Plan) into eight of my existing holdings, and bought one stock of LVMH (LVMUY), the world’s largest luxury company.

I might write one article about LVMH at some point, but, in short, I like it because it produces high-end products that are both scarce in the physical and digital world and have proven to be extremely desired by people all over the world.

The company can almost be seen as a luxury ETF with the hundreds of leading brands it owns in its portfolio.

I only bought one LVHM stock to see how much withholding tax would be deducted. Sometimes, depending on your broker, the French withholding tax can be substantial (about 35%), and if the German WHT of 26% is also deducted, then this would slow my income growth and I might not want to own this stock in my All-Weather Portfolio.

November’s Trade Idea

Earlier in November, I sent out a Trade Idea to my email list to buy Coinbase (COIN).

I bought 200 x $86 and 100 x $92, for a total purchase value of roughly $34,500.

I shared that I think $COIN is a buy under $105. Hope some of you joined and followed this trade idea.

If you didn’t buy $COIN yet, do not buy it at the current levels of $125-135, and wait for a pullback to the $105-110 level, which would be a normal and healthy correction within a positive upward trend.

With my trading account, which I keep completely separate from my other accounts, I aim to generate additional cash flow and enter short-to-mid-term trades (often a couple of weeks to multiple months).

Conclusion

A quiet month, with steady income growth.

I expect next year’s November will be much better (dividend-wise) for all the shares I purchased with November as the dividend month!

📘 Read Also

- The 10 Best Football Stocks In Europe

- My Story Of How I Reached Financial Independence With $5M In Net Worth

- The Best Crypto Stocks To Buy

FAQ

How to achieve income growth?

You can realize income growth by buying dividend-paying assets like stocks, e.g. $JNJ, $PEP, or $MSFT, that increase their yearly distribution. For example, you can take a look at the dividend kings, a list of companies that consecutively raised their dividends for 50+ years. You can also own and use rental properties. To achieve income growth, you need to be able to frequently raise the rent.

What are ways to grow your income?

There are multiple ways to grow your income. Let’s look at the most popular options:

1/ Get a raise

2/ Buy shares of publicly listed companies that pay dividends

3/ Acquire shares of private Ltds that distribute yearly profits

4/ Purchase some cryptocurrencies that can earn you interest

5/ Do side hustle jobs like Amazon dropshipping

6/ Offer your skills via freelance platforms like Upwork

7/ Setup a blog to generate affiliate income e.g. on Hostinger

Which dividend stocks to buy for income growth?

If you are looking for dividend stocks that will provide you with solid income growth, try to find companies that can prove to you that they have been able to do so for many years. For example, look at Dividend Kings, those are companies that raised their dividends every single year, for 50+ years! Not an easy feat, and only approx. 65 companies can call themselves Dividend Kings. I own several of them in my dividend portfolio, such as $JNJ, $PG, or $PEP.

How long does it see dividend income growth?

You should only buy dividend stocks that reliably increase their dividend every year. You gain nothing from a large one-off dividend payment when the share prices fall rapidly thereafter, and the dividends get cut due to weaker operational results. At the end of the day, you are buying a part of a company, and the most important factor is how well the company will be doing, operationally and financially, in the years to come.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love