The First Step In My Financial Independence Story

To get to know me better, I thought it would be interesting to share my story how I went from zero to $5 Mio in 40 years.

Thanks for checking it out and following me along.

Key Takeaways

☑️ It took me roughly 40 years to reach $1 Mio in net worth

☑️ Adding another $4 Mio then only took 4 years

☑️ Owning cashflow-producing & dividend-paying assets is key

☑️ Having a well-diversified portfolio is important too

Growing up in Germany (1978-1996)

I grew up in the suburbs of Munich. When I was around 14, I discovered that I was quite entrepreneurial.

Together with my best friend from school, we

- mowed the lawns of neighbors and made some money,

- we offered a car washing service in front of the best restaurant in town,

- we did any sort of summer job we could.

Our Big Dream

Our big dream was, and I kid you not, to have enough money at 18 to permanently live in Disneyworld.

We both earned about 6,000 DM (Deutsche Mark, approx. $3,000), a massive amount of cash, and we both felt great.

My First Stock Purchase (1992)

With 14, with the money I earned from the above-mentioned jobs, I bought my first stock (Microsoft!).

My parents had to sign a certain paper at my local bank (Sparkasse!) to allow me to do so. Unfortunately, I sold the few stocks a few months later for approx. 30% profit. Stupid me. But a seed was planted.

Net Worth At The End Of 1995: $5,000

Financial Advise To Friends & Family (1996-2000)

During the .com bubble, I did not realize that it wasn’t me that was smart, rather, the stock market was so bubbly that almost everything you bought went up.

Some of my friends and family members asked me for financial advice and good stock picks, that’s why I set up a small LTD for myself and started offering “consulting” services to them. Simply put, they set up a new and separate account, gave me the login credentials and I started buying and selling stocks on their behalf!

This went well till early 2000 when the bubble slowly started to unravel.

Noticeable trades during that time:

- buying Yahoo! with $3,000, selling it at $15,000, netting a profit of $12,000

- buying $CSCO with $2,500, selling it at $8,000, netting a profit of $5,500

- buying AOL call options (via a dubious call center), netting a profit of $9,000 (naive+lucky)

- buying $MSFT with $4,000, selling it at $11,000, netting a profit of $7,000

I was incredibly fortunate to have had 2-3 good trades right at the beginning of the bull market, giving me some extra funds I could then invest again.

At the height, I crossed $100,000, but because I did not sell early enough, my net worth dropped to $40,000.

Reflecting on this, upon graduation as a student, I had about $40,000 to my name, which is pretty good, but I sort of felt terrible.

I felt terrible because I did not see the $40,000 I had, but the $60,000 of paper gains I “lost”.

Net Worth At The End Of 2000: $40,000

My First Job

In 2000 I landed my first job in the marketing department at an online bank (like Charles Schwab). I was a ‘Project Manager’ working on all sorts of marketing-related projects.

The building of the first company I worked at.

The two years were great, as it gave me a good overview of how a marketing department works, and how it cooperates with other departments.

I was not involved in stock trading per se, but the whole team and company was non-stop talking about stocks and investment, so I learned quite a bit.

In regard to my financial independence journey, those two years did not do much for me. I made about $3,250 US in salary, but as I had to pay for my own flat, car, groceries, tax, etc., I was not able to save much, and at that time I switched to long-term ETF investing (MSCI World).

Net Worth At The End Of 2002: $45,000

Moving To Singapore

During my first two years in Singapore, I worked as a Marketing Director at a local IT solution company. A friend of mine, already living in Singapore for a while, landed me a job interview with the GM of the company. As I felt things were moving too slowly in Munich, I wanted a change, so I jumped on the opportunity.

I stayed two years with the company and made about $3,500 in salary per month, but the big difference was that the company paid for my housing, telecommunication, and one flight per year (economy class).

I was able to save about $15,000 per year, which I instantly invested back into the MSCI World.

Net Worth At The End Of 2004: $75,000

Starting My Own Business

I took $50,000 of my saved $75,000 and set up a marketing agency in 2004. I worked my ass off and after a few first two tough years, business started to be pretty good. It was never a big business, but we soon made about $1 Mio US in sales, with an approx. profit of $50,000 to sometimes $100,000.

I only paid myself a rather minimal salary of approx. $4,000 US, but as I did not have any kids yet and lived in a small apartment, that was fine.

2009 was a tough year when the GFA hit. Our customers were all hiding below their desks, and revenues tanked by about 50-60%. But in hindsight, that was just a temporary blip, the next year things already started to look better again.

From 2009 to 2018, I kept my head down and kept on working on my little business.

Getting Married

In 2012 I got married and we had our daughter. In 2014 we had our son. The agency was doing reasonably well, nothing spectacular, but I could sleep well.

A few years earlier I realized that my business would most likely never help me reach financial independence, as it simply wasn’t a highly cash-generative business.

In 2017, we did $1,5 Mio in sales and had a profit of $150,000 (which often had to instantly be re-invested in new servers, equipment, office fit-outs, etc.)

That’s why I started quizzing people who sold their companies before and started to implement all their recommendations into my own business.

My best trade during these years was buying $10,000 worth of Take-Two Interactive (TTWO) at $12 in 2013, and selling it at $125 for a total of $104,000. This was my first ten-bagger.

Net Worth At The End Of 2017: $250,000

Selling My Agency

In 2018, I received a phone call from the CEO of a relatively large creative agency from the U.S., with the question if I would be willing to meet with him.

He explained that his largest customer is pushing him to set up shop in “Asia”, as otherwise, he’d risk losing the account altogether.

He asked if I could imagine selling an initial 30% to him. He said I could instantly “have” his large account, and we’d join forces.

As my goal was to make as much buck as possible, we ended up agreeing on me selling 100% of the company for cash and shares.

Ultimately, I sold the agency for shares (valued at the discretion of the seller) of $1,5 Mio, and $500,000 in cash.

Taking A Creative Break

After six months of post-merger integration work, I left the company for good and walked away with essentially $500,000 in cash.

The shares, with a nice sounding value of $1,5 Mio US are great, but they are entirely illiquid, as the acquiring company is a private Ltd.

I took it easy and decided I would fully focus on managing this money now as well as possible.

Net Worth At The End Of 2019: $2,250,000

Focus On Investing

In 2017 I bought my first Bitcoin and was lucky enough to benefit from the year-end bull run. I sold a lot in December and then invested $200,000 in a long-only crypto fund in early 2018.

Four years later, in 2021, this fund paid out $770,000. I rolled over $200,000 in one of their follow-up funds and cashed out $500,000. My goal was to use those $500,000 as the basis for my dividend portfolio (see below).

Noteworthy Trades

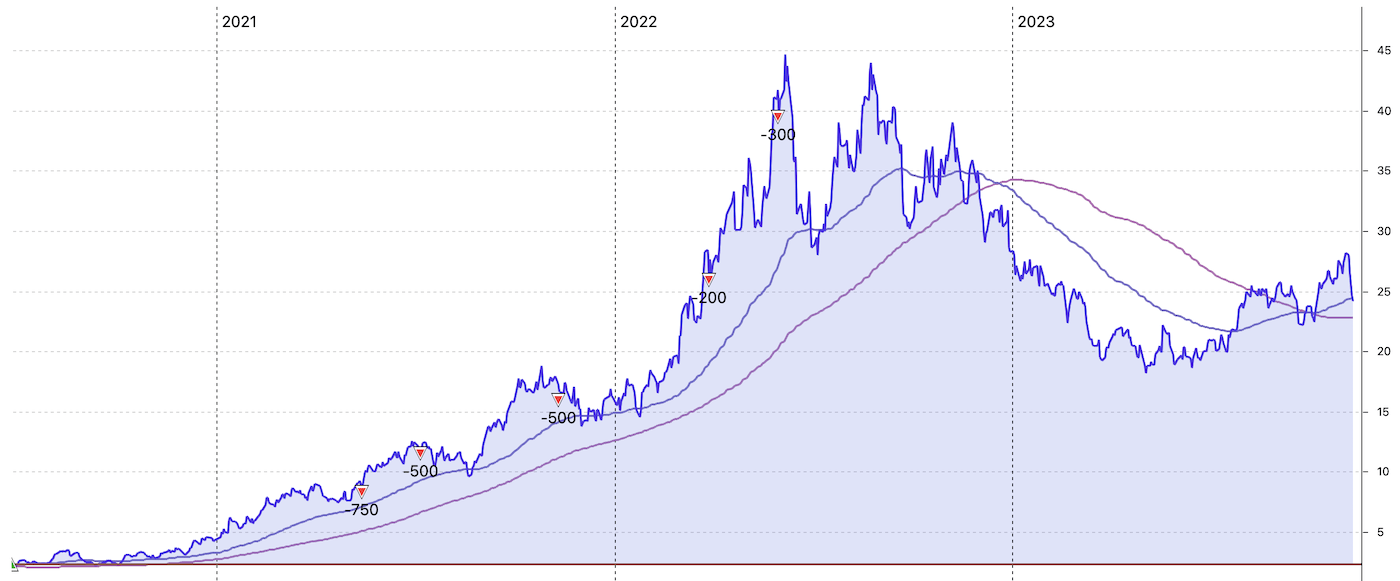

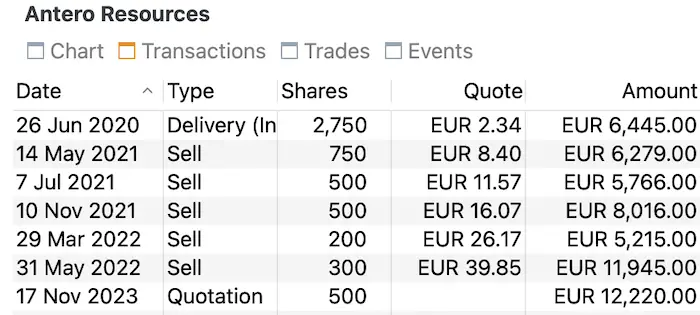

I did multiple trades like this one, Antero Resources.

I originally bought 2,750 shares of $AR at 2.34€ for 6,445€ in total.

Since then I realized profits of 36,000€, while I still hold 500 shares worth 12,000€.

(AR) buying and selling" width="1400" height="581" />

(AR) buying and selling" width="1400" height="581" />

the tiny green dot in the left corner represents a buy order, and the red arrows are sales orders.

It’s multiple trades like with $AR that quickly brought my total net worth above $3 Mio.

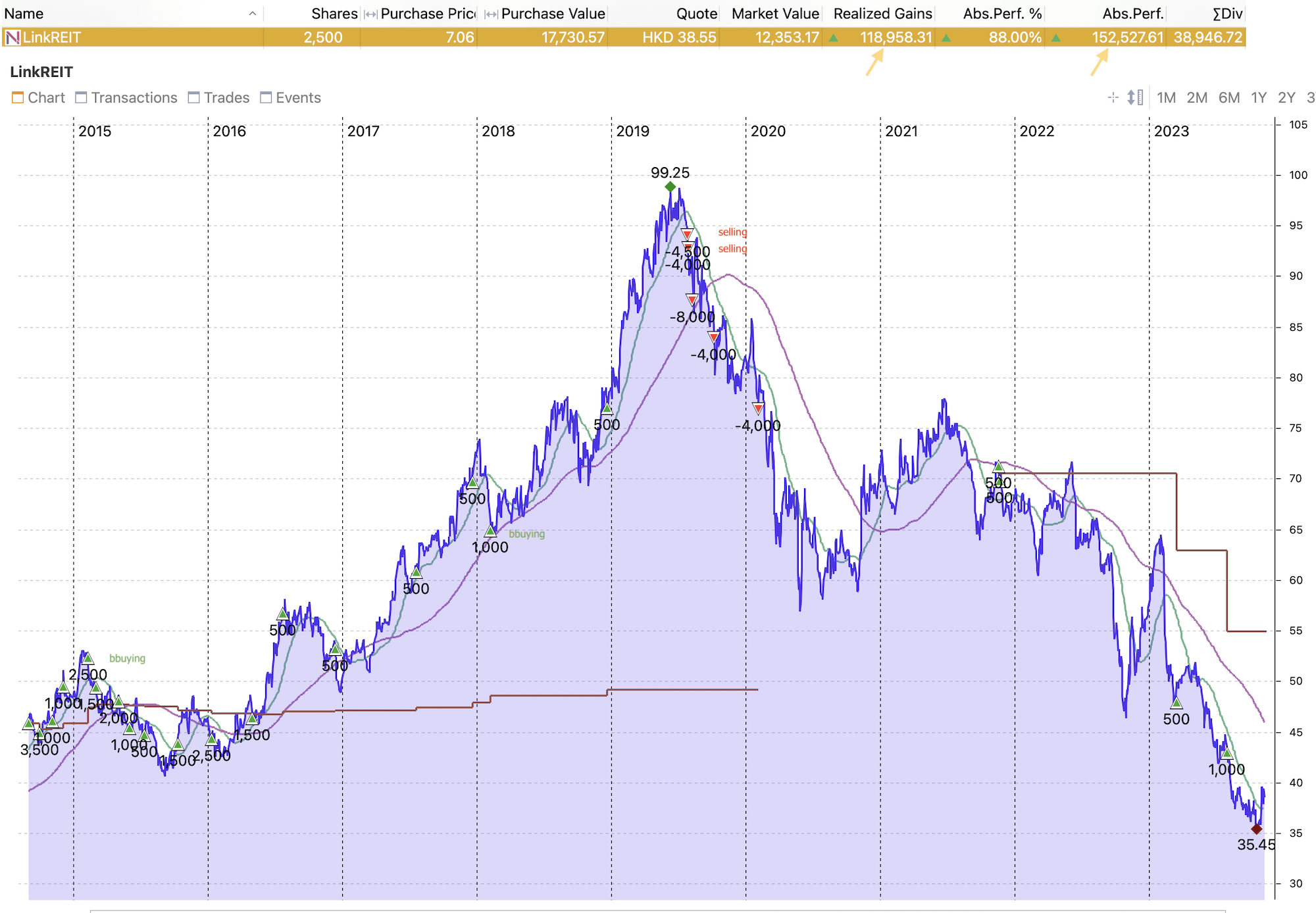

Another noteworthy buy was Link REIT (LKREF), in my opinion, Asia’s best REIT.

The image below shows my total buys and sales.

When the protests started in Hong Kong, I started to sell and sell all of my $LKREF in early 2020.

The total realized gain was close to $119,000. As you can see on the chart, I again started buying shares in late 2022 and again in 2023, but so far my timing seems to be completely off.

Having said that, there was a whole series of trades like this that brought my total net worth up to $3,7 Mio.

Net Worth At The End Of 2020: $3,771,000

My First Dividend From My “New” Company

In 2019, I received the first dividend from the company that just had acquired mine. I own roughly 1.5% of that company. The 2018 profit was $8 Mio US, and the amount to be distributed was $7,5 Mio, resulting in a dividend payment of $112,000.

It was a fantastic feeling to receive that amount of money and be able to have it available to invest.

Starting A Dividend Portfolio

In May 2020, I got inspired by a YouTube video of the GenXDividendInvestor, talking a lot about how to reach financial independence. This was the video I watched.

It inspired me to build a portfolio of the best buy-and-hold-forever dividend stocks I could find, and am committed to holding for the very long term.

It all felt right to me. I knew I only now would possess the experience, the patience, and the right temperament, to build and manage a long-term portfolio of single stocks.

Here are the first purchases I made:

| Shares | Price | Amount | ||

| 2020-05-05 | Kraft-Heinz | 135 | $31 | $4,181 |

| 2020-05-27 | Store REIT | 200 | $20 | $4,000 |

| 2020-05-27 | BHP | 100 | $46 | $4,600 |

| 2020-05-29 | Welltower | 80 | $50 | $4,000 |

| 2020-06-02 | Realty | 400 | $57 | $22,800 |

| 2020-06-09 | Dexus | 650 | $7 | $4,513 |

| 2020-06-09 | E.ON | 500 | $11 | $5,647 |

| 2020-06-13 | Mondelez | 80 | $51 | $4,080 |

| 2020-06-15 | Allianz | 25 | $218 | $5,449 |

| 2020-06-18 | Aroundtown | 500 | $6 | $3,086 |

| 2020-06-24 | BASF | 100 | $59 | $5,900 |

| 2020-06-27 | AbbVie | 50 | $95 | $4,750 |

| 2020-07-11 | Shell | 150 | $33 | $4,950 |

| 2020-07-15 | Hamborner | 500 | $10 | $4,864 |

| 2020-07-24 | Brookfield Renewables | 37 | $29 | $1,056 |

| 2020-07-26 | Pfizer | 125 | $39 | $4,896 |

| 2020-08-27 | Anheuser Busch | 100 | $59 | $5,900 |

| Total | $95,000 |

This portfolio now grew to approx. $900,000 (see here for my latest passive income report).

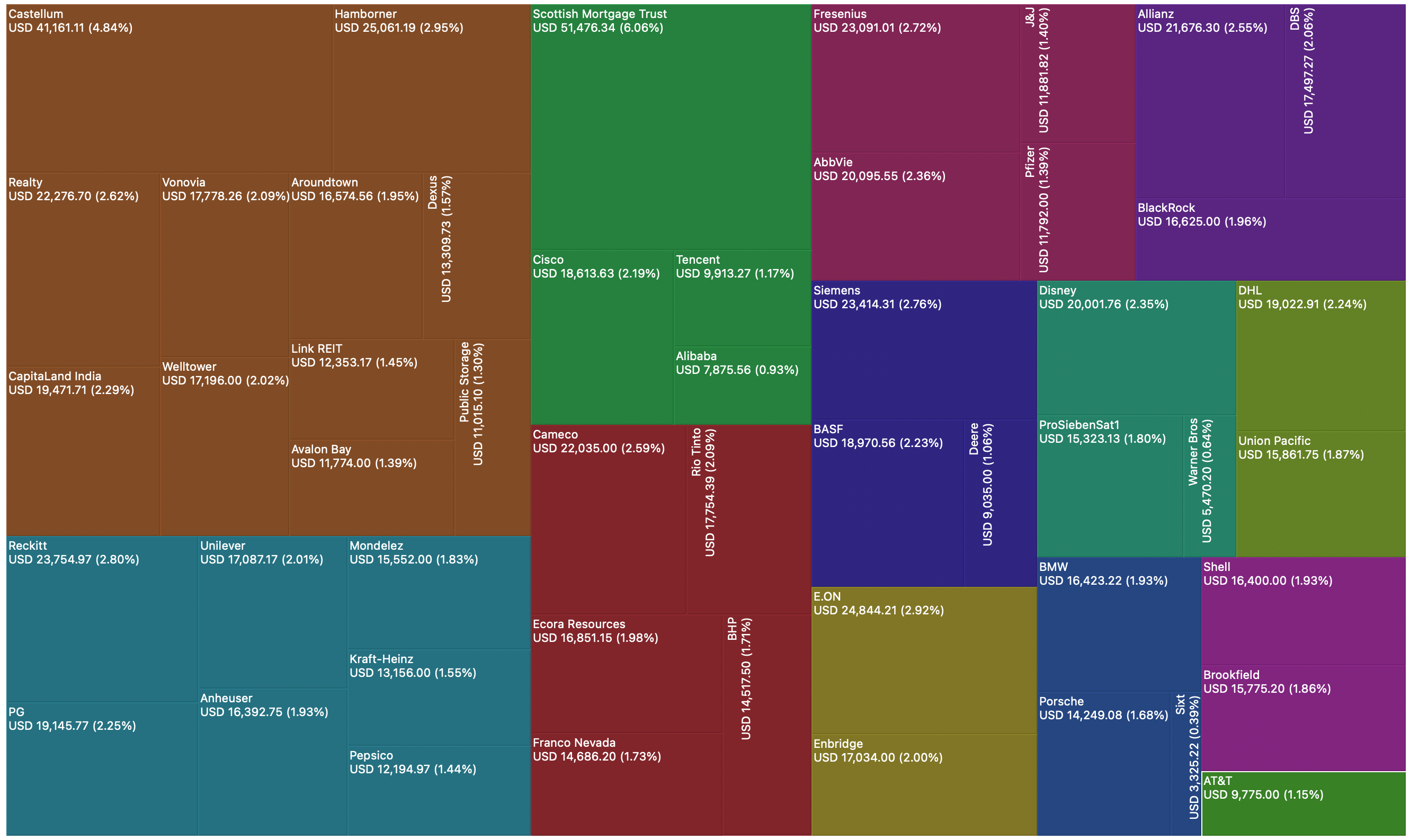

You can check out the full allocation of my All-Weather Portfolio here. Or, here’s a quick chart (dividend stocks only, excl. digital assets, precious metals, ..).

Profitable Cryptocurrency Trades

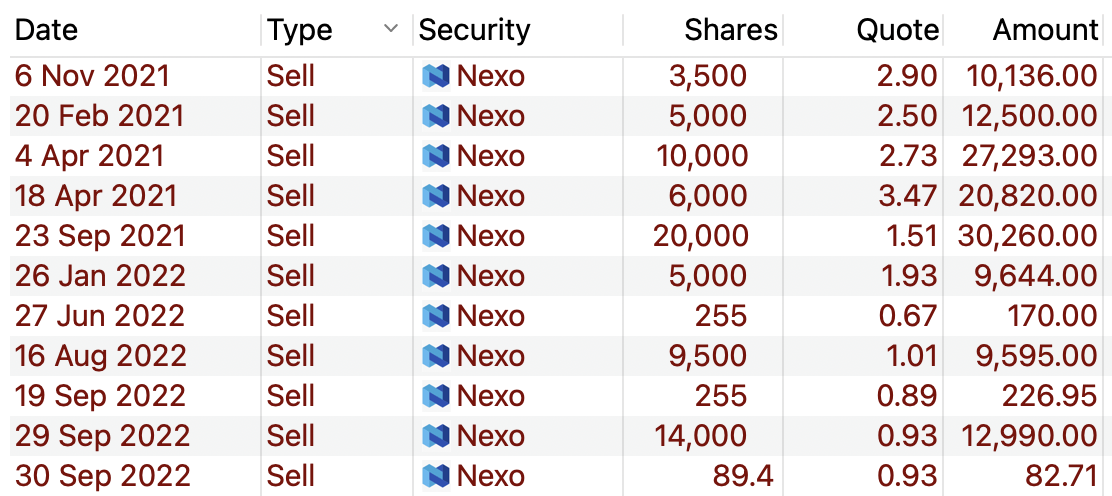

Between 2019-2022, I got very lucky and made good gains on a few cryptocurrencies trades:

- Via Nexo.com, a crypto lending platform, I initially bought 40,000 Nexo tokens for $10,000 to reach the platinum tear

- Then, I earned rewards in return for entrusting the platform with 5x Bitcoin I deposited on their platform

- As the price of the Nexo token was below $0.20, I earned an additional 35,000 Nexo tokens

- When prices started to rise to high levels, I started selling and made $130,000 US

- Till today, I use Nexo and have been a happy customer since day one

You can secure yourself $25 worth of BTC when you open an account and simply deposit $100 US by clicking this link.

At the end of 2021, the height of the last crypto bull run, my network climbs to $5,7 Mio.

Net Worth At The End Of 2021: $5,744,000

2022 – $1.6 Mio US Go Poof

The year 2022 is investing-wise shitty. My total net worth tanked by $1.6 Mio, down to $4.1 Mio.

Mainly because the value of my Digital Asset Portfolio dropped BIG time, and my thematic portfolios as well.

Net Worth At The End Of 2022: $4,120,000

2023 So Far

The year 2023 started also pretty shitty. My REITs are down a lot, some of them up to 60% in the case of Aroundtown or Vonovia. But they bounced back a lot, some of them by 200% since their all-time low.

As of Nov 17, 2023, I am back above $5.0 Mio net worth. My total liquid assets (everything I could liquidate within 24 hours) sits at $2.5 Mio US.

Conclusion

I am 46 years old and reached financial independence after retiring from corporate life in 2018.

My $5.7 Mio US generates a passive income of approx. $150,000.

My pure dividend portfolio only contributes about $25,000 per year so far, the rest is generated via other sources of passive income. If you like to see a breakdown, you can click here to unlock the page.

Private equity (and the resulting dividends I receive) are extremely important to me.

📘 Read Also

- How A Millionaire Invests $20 Mio After A Property Sale

- The 10 Best European Football Stocks

- How To Start With Investing

FAQ

What is financial independence?

Financial independence is FU money. It means you have enough to live till the end of your days without having to work anymore. Either because you have enough money per se, or your current assets generate enough passive income to cover all your expenses and live the kind of lifestyle that works for you. It’s like reaching the “boss level” in the game of life.

How to reach financial independence?

It’s like training for a marathon, but with money. Save diligently, invest wisely, and spend consciously. Make your money work for you so you can sip coconut water on a beach while your bank account does the heavy lifting. Also, financial independence means different things to different people. For some, it’s $1 Mio, or for others, it’s $5 Mio, for others, it’s $100 Mio. Smart people know what they want. Wise people also know what they don’t want!

What counts as financial independence?

It is the moment when your money produces enough passive income that cover all expenses, or when you simply have that much that you don’t even need to rely on any income anymore! Many people who reached financial independence can say, “I choose to work, not because I have to, but because I want to.” Anyone who reaches it MUST do a victory dance.

How much net worth do I need to reach financial independence?

Ask 9 people and you’ll get 10 different answers. For people with frugal lifestyles, it might be less than $1 Mio US, others will need $100 Mio to feel ‘secure’. Figure out how much you need per month, then multiply this by 12. If your assets can reliably generate this amount in pure passive income, then well done!

How to become financially independent?

There are many roads leading to Rome. Some become financially independent by starting and selling a company (like what I did). Others by living frugally for 20 years with a good corporate job. Others by investing wisely. Ideally, you do all of those! The most important is to put away more than you make. By this, you will get closer to your ‘magic number’ every single week! For me, my magic number was $3.5 Mio US, but as my money is invested in assets, I reached $5.7 Mio within 18 months after reaching $3.5 Mio.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love