Selling My Sixt Stocks After An Awful Experience

Today I’d like to share a personal tale that intertwines my investment strategy with a not-so-pleasant customer experience.

Back in 2020, when I started my journey into dividend investing, I was all about finding those ‘buy-and-hold-forever’ stocks. Sixt, Europe’s largest car rental company, was one of them. I’d rented from them for years and thought they were a reasonable company that offered a reliable service.

The Shift in Perception

In August 2024, I rented a BMW X5 for +30 days for a family trip, and everything seemed fine when I returned the car. But come September, I got a letter claiming there were ‘scratches on two wheels’, demanding €1,600, or $1,700.

That’s the maximum they could legally charge, by the way.

Navigating the Legal Maze

Thankfully, for the first time, I could make use of the legal protection insurance from Allianz (another stock in my portfolio) came to the rescue. The appointed lawyer (paid by Allianz) told Sixt they needed to prove the damage occurred during my rental. We sent letters, emails, and even registered mail, but Sixt remained silent. Frustrating!

A Pattern Emerges

I then spoke with a German friend in Hong Kong, who had an identical run-in with Sixt. He ended up settling for €500 after a long back-and-forth. A former employee on Reddit confirmed what I suspected; ‘branches have quotas‘ for charging customers for damages just to meet internal KPIs.

Seriously! How likely is it that one random friend I asked (also living overseas) has the same thing happening to him?

This is something the press should pick up because it is not right what Sixt is doing.

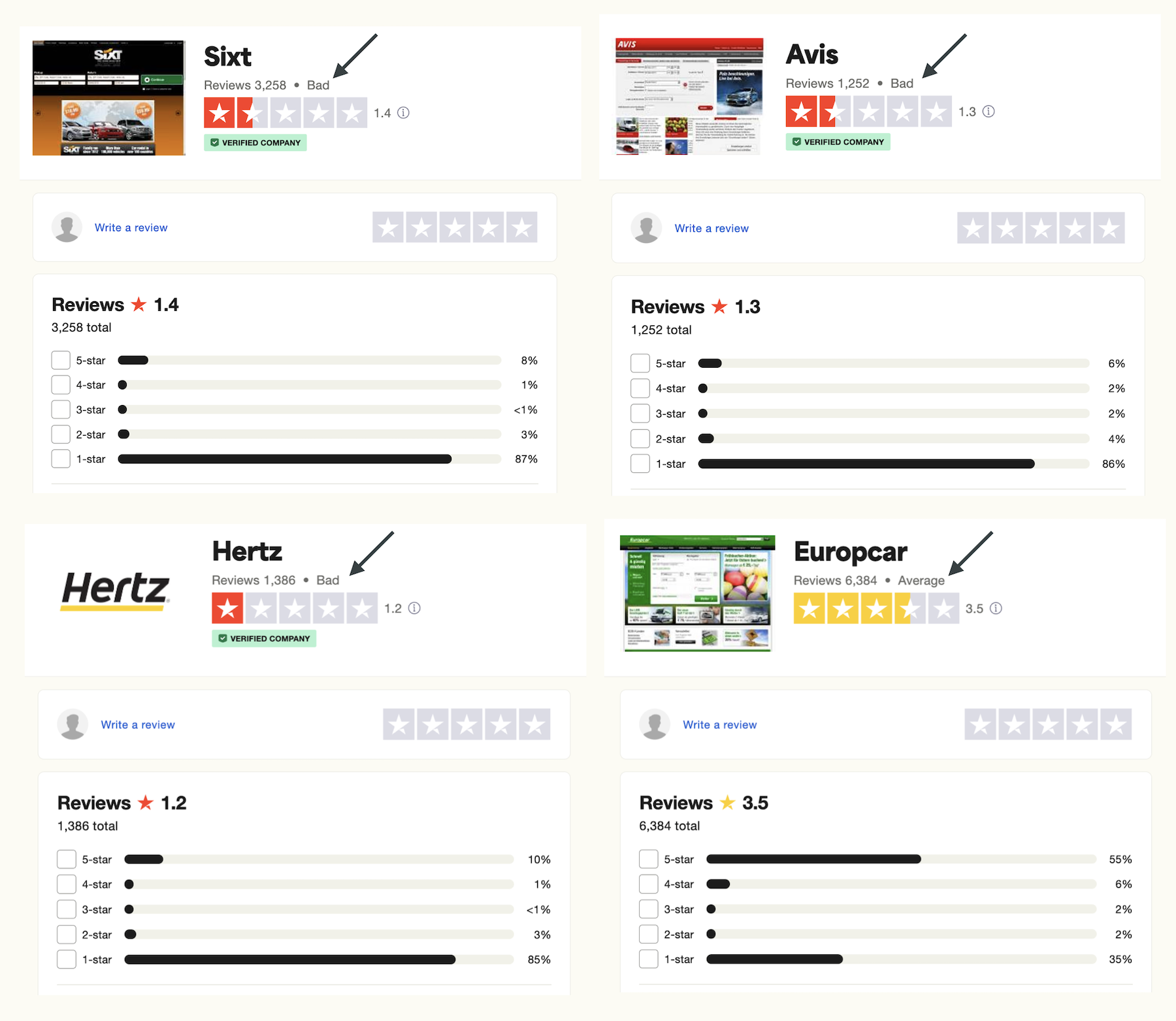

Dismall Ratings of Car Rental Companies

This experience might explain the poor ratings Sixt gets on Trustpilot and why similar complaints are echoed across other rental companies, too. The price of the Sixt stock is a reflection of its customer’s rating as well.

The Impact on My Investment

Initially, I was attracted to the Sixt stock owner perks (like access to the Diamond Lounge and discounts), as well as its low valuation and attractive dividend.

But my enthusiasm waned after holding the stock for 557 days, with a 16% drop in share price and this experience.

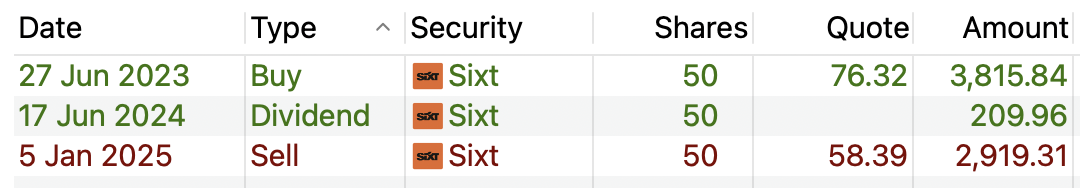

My first Sixt test stock purchase (to see if I can then use the Diamond Lounge and get a “shareholder discount”, was in June 2023.

See all transactions below.

Conclusion

I’ve sold my Sixt stocks and decided to take my business elsewhere, hoping for better customer service from competitors like Europcar, Hertz or Avis.

I also came to understand that although I initially liked car rental stocks, it might be better to use them, but not good businesses to own a part of.

For example, I believe investing in one of the best self-storage REITs has much superior risk/reward ratios.. and better customer ratings as well, see below.

Question For You

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love