Stablecoin Farming 101: How I Earn 15%+ Returns

Stablecoins on various blockchains are offering very attractive yields right now, particularly on Solana and various Ethereum L2.

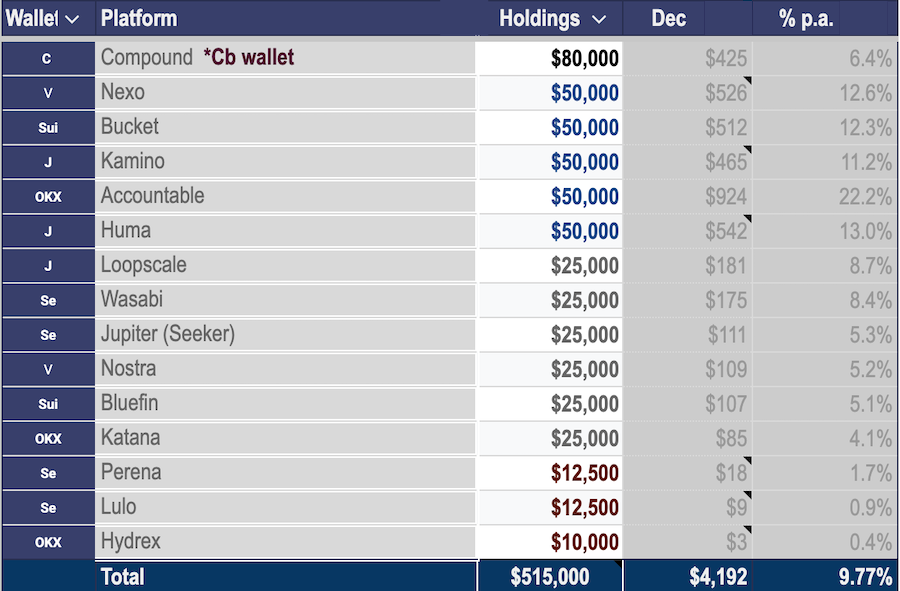

In this post, I’ll share insights into my $525,000 stablecoin farming portfolio (originally I started with $300k), which I started building in late 2024. Let’s explore the best yields, why they’re so high, and which platforms I use and trust the most.

My Current Stablecoin Farms

As of January 2026, I have a total of 515,000 USD invested in various Dapps and chains. My largest position at the moment is on Compound with $80k.

Farming The Best Stablecoin Yields

Yields on stablecoins move fast—sometimes changing by the hour.

They’re driven purely by supply and demand, with lending and borrowing platforms adjusting rates in real time. It’s not uncommon to see several percentage points swing in a single day.

As a lender, I like knowing my money is working around the clock—no weekends, no holidays, just quiet, relentless compounding.

To get a real-time snapshot of the best yields, I recommend checking the stablecoin comparison page on DeFiLlama. Sorting by APY (Annual Percentage Yield), you’ll see rates climbing as high as 25%.

Why Are Stablecoin Yields So High?

The crypto market goes through dynamic and boring phases. Investors are leveraging their positions by typically borrowing more stablecoins against their collateral, often in the form of Bitcoin, Ethereum or Solana. This demand then drives up borrowing rates, allowing lenders to profit.

However, these high yields are very cyclical. During the 2022-2023 crypto winter, stablecoin farming was less exciting.

Typically, stablecoin lending yields range between 4% and 6% in the slow season and between 6-25% in the hot season.

Which Stablecoin Is Best?

I primarily use three stablecoins: USDC, USDT, and PYUSD. Here’s a quick breakdown:

- USDC: Issued by Circle, a U.S.-based company planning a 2025 Nasdaq IPO.

- USDT: The largest stablecoin, issued by an offshore company. While retail users widely trust it, institutional investors may hesitate.

- PYUSD: Issued by PayPal and fully backed by USD in their treasury. The new player in the stablecoin arena.

My Favorite Stablecoin Lending Platforms

I’ve tested many lending platforms, but here are my current top picks:

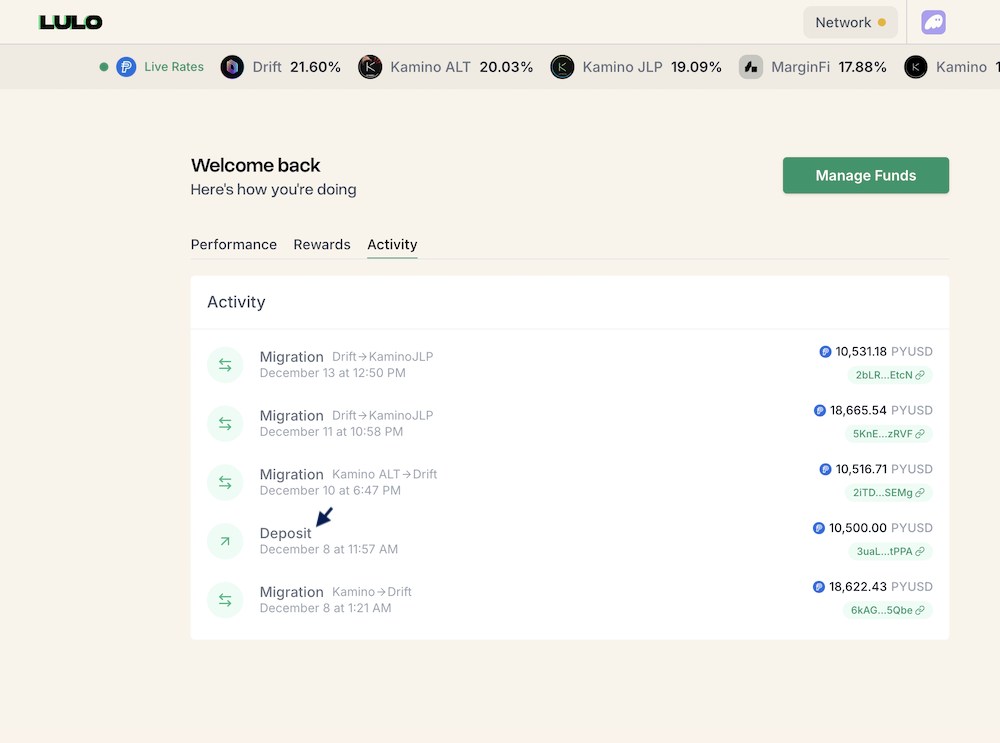

1. Lulo on Solana

Lulo.fi, backed by Circle, is one of my go-to lending platform. It offers:

- A clean, intuitive interface

- Easy-to-use features

- Significant time savings

- Automatic allocation to the best lending rates on Solana

It makes it super easy to check out your daily earnings and see how your money works for you!

I deposited $29,000 and earn about $10 daily on Lulo and plan to grow this over time.

What I love most about Lulo is how it automatically deploys my capital on Solana, offering the highest stablecoin yield at any moment. Here’s a look at everything Lulo did autonomously:

After I made another deposit of $10,500 on Dec 8th, Lulo instantly got to work and kept shifting my capital to whatever platform offers the highest lending interest rate.

Stablecoin farming on autopilot!

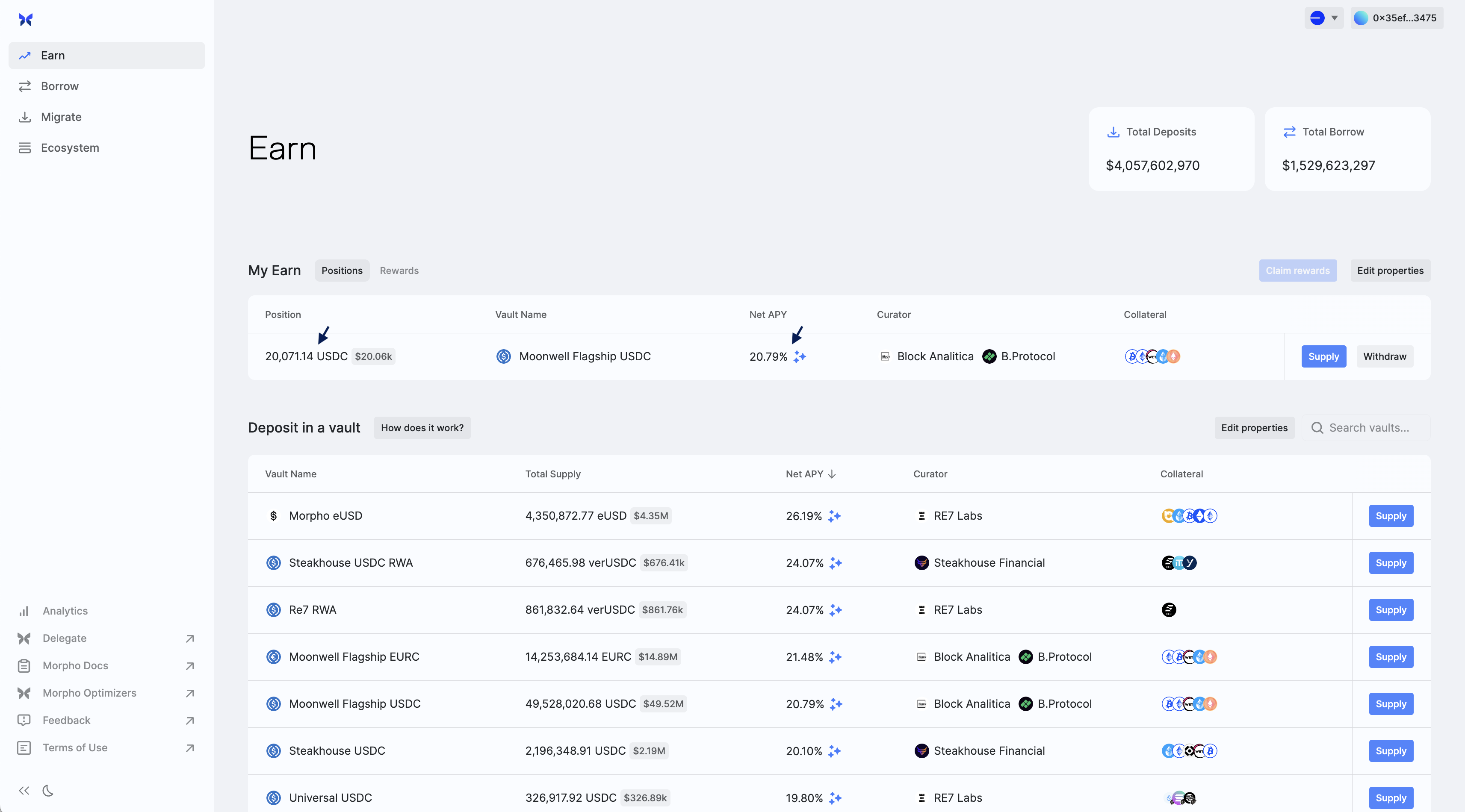

2. Morpho on Base

At the moment, I earn a 20% APY on USDC on Base, the L2 Coinbase launched in 2023.

I deposited $20,000 so far.

Once a week, I claim extra rewards that Morpho helped me to collect – giving me the feeling I “harvest” and “get something” extra, which is cool.

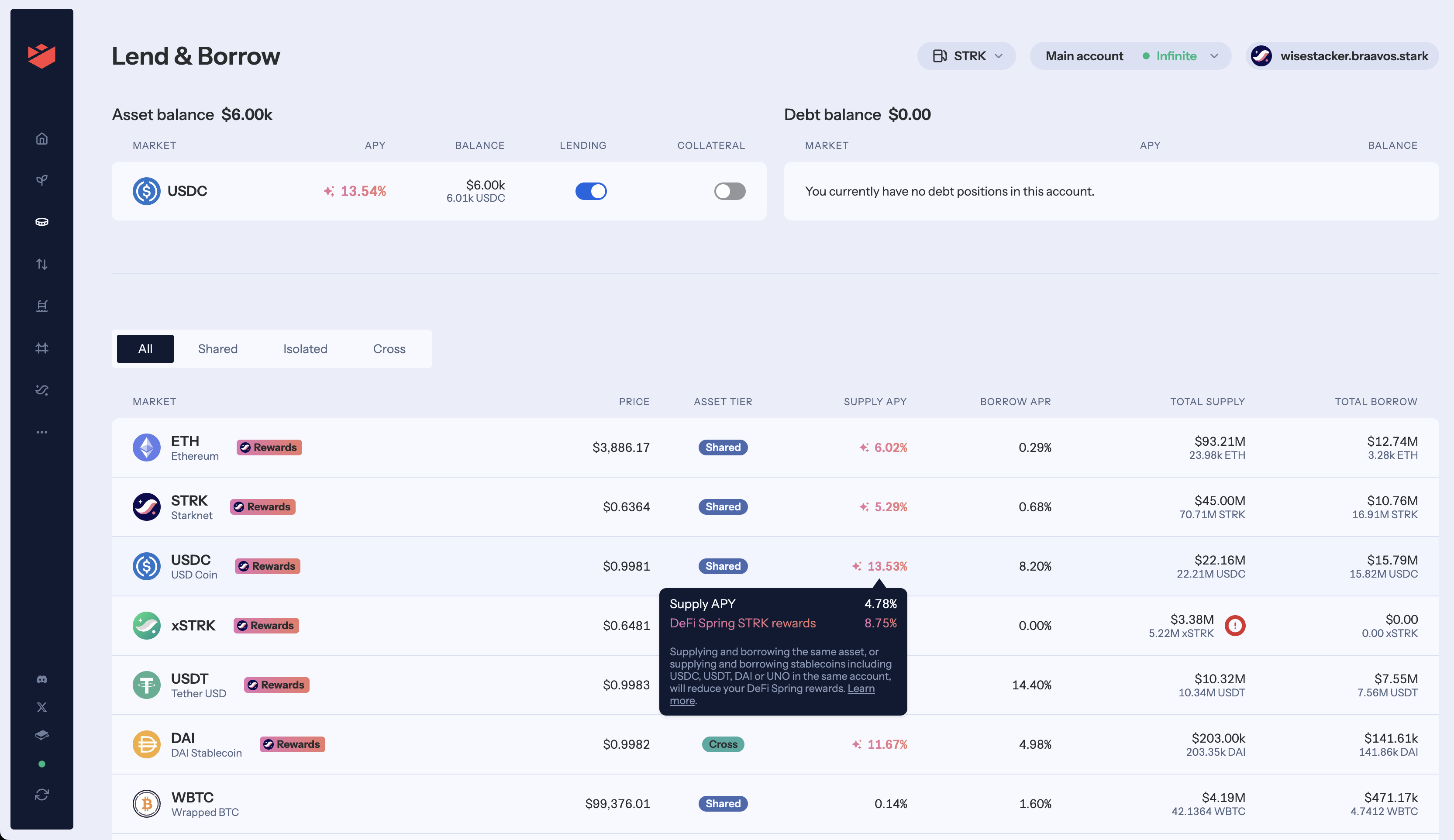

3. Nostra Finance on Starknet

I have been a fan of Nostra Finance since its launch. It’s currently only available on Starknet, an L2 on Ethereum.

Once a week, I harvest the DeFi Spring STRK rewards (8.75%).

Let’s say you have $2,500 USD and like to start earning a good yield on Nostra.

Here is how to get started:

1/ Buy $2,500 worth of STRK tokens on Coinbase or Kraken

2/ Create a free Braavos wallet on Chrome

3/ Send some ETH (for fees) and STRK tokens to your Braavos wallet

4/ Convert the STRK into USDC with Nostra

5/ Deposit the USDC into the Nostra Lending

— Done. —

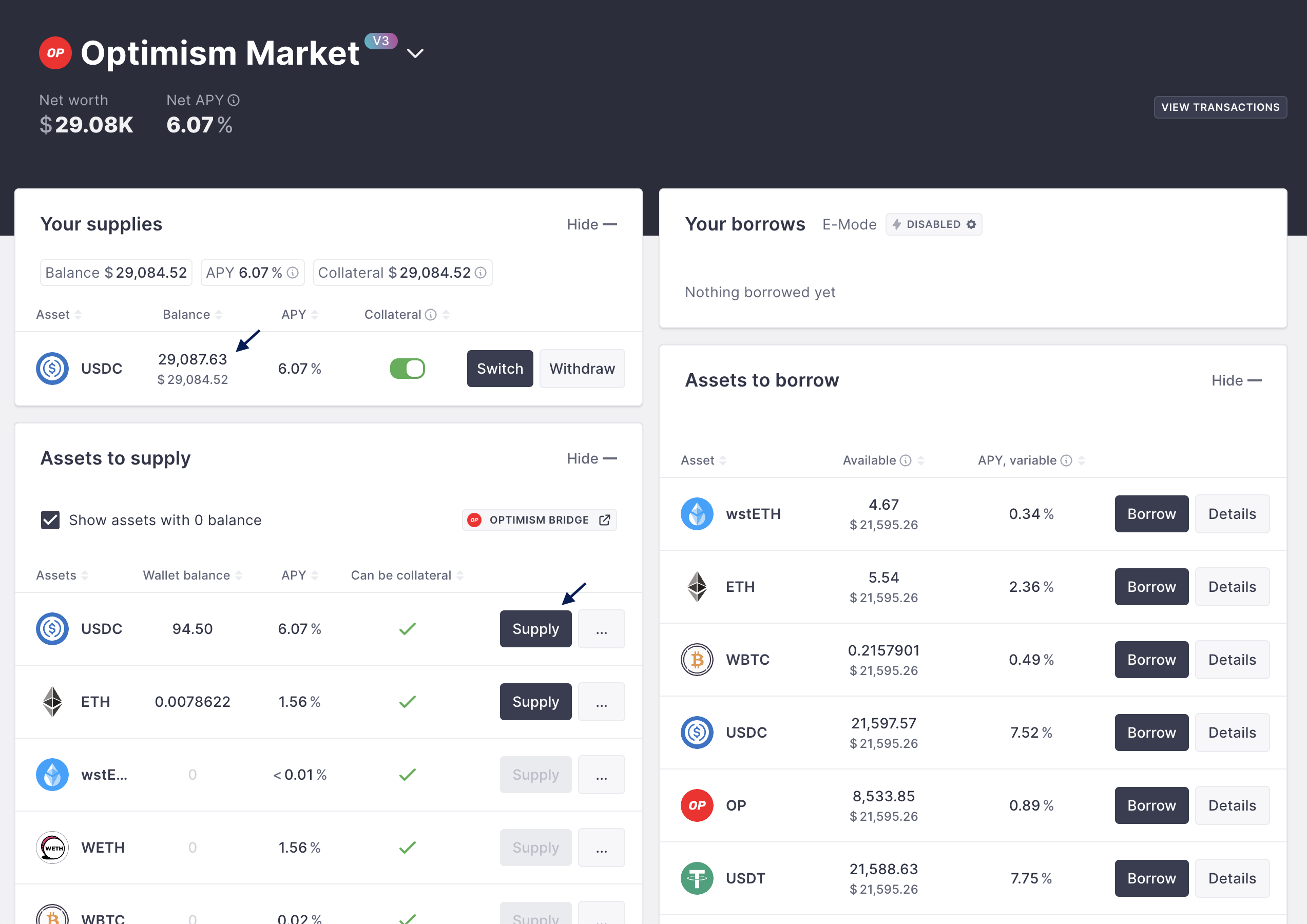

4/ Aave on Optimism

I am a longtime Aave user and have been using it to lend and borrow assets for years.

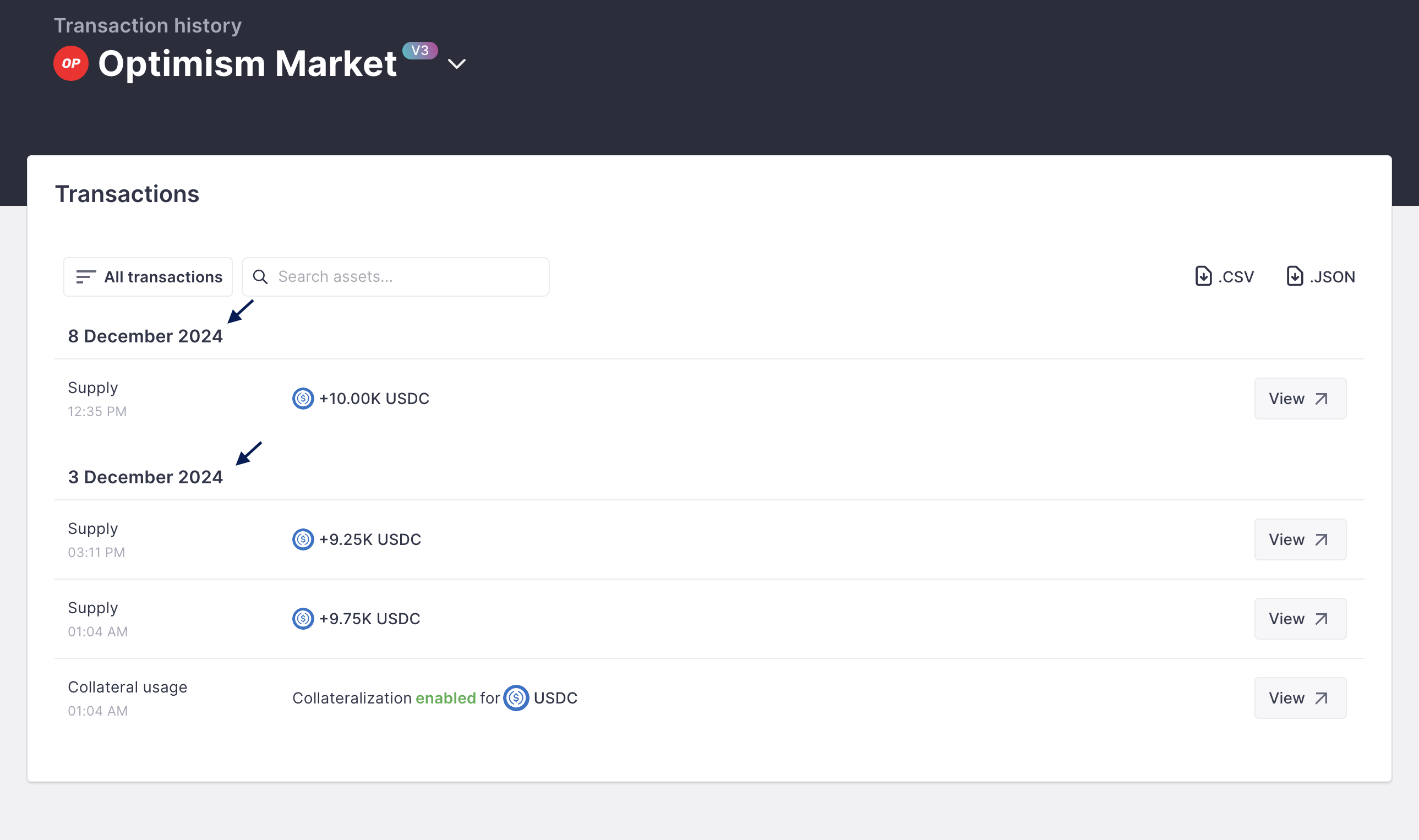

At the moment, I deposited $29,000, and in the past few days, I earned +9%, which just dipped back down to 6% as we speak. But this changes on an hourly basis and I am sure it will go up again once sentiment becomes better again.

In particular, I appreciate Aave’s transaction summary, see below. It simply lists what you deposited and withdrew on what date. Very useful!

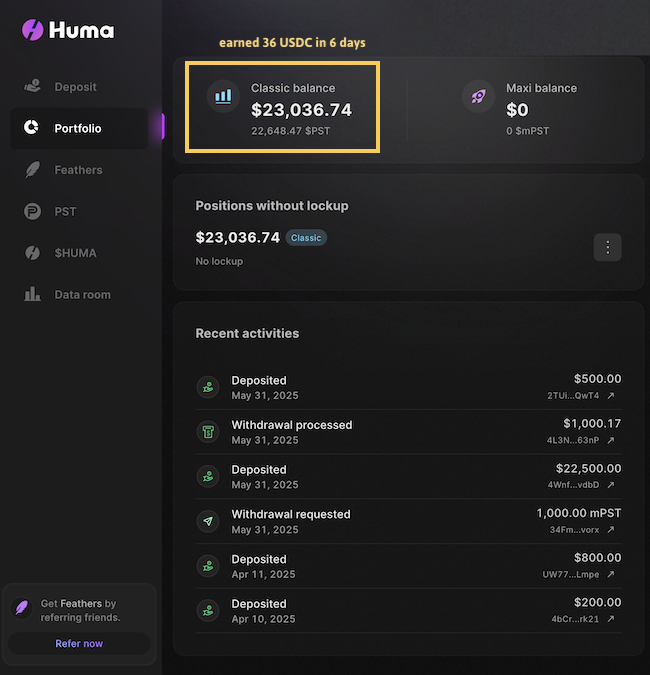

Recent Opportunities (Update June 6, 2025) Here are a couple of airdrop opportunities I am currently farming while earning a high yield:

Huma Finance – a stablecoin yield aggregator on Solana that accelerates global payments with instant access to liquidity anywhere, anytime. Currently earnign 14% on USDC!

Conclusion

Stablecoin farming gives me joy, and the lending yields are good. If my USDCs simply sit on my ledger, I’d feel FOMO with all the cryptocurrency prices going up.

But by earning good yields on my $515k, I feel good knowing that I already cashed out profits from my crypto portfolio, which in turn are put to work.

FAQ

What is stablecoin farming, and how does it work?

Stablecoin farming involves lending stablecoins on decentralized finance (DeFi) platforms to earn interest, often referred to as yield. Platforms facilitate lending and borrowing, allowing you to earn returns while your stablecoins remain relatively stable in value.

How can I find the best stablecoin yields?

You can use platforms like DeFiLlama to get an up-to-date overview of the best stablecoin yields across different chains and protocols. These tools help you identify where your capital can earn the highest returns.

Are stablecoin yields safe and guaranteed?

Stablecoin yields are generally considered lower-risk compared to other crypto investments, but they are not entirely risk-free. Risks include smart contract bugs, platform exploits, or stablecoin de-pegging. Always research the platform and stablecoin you’re using.

Which stablecoins are best for farming?

Popular choices for stablecoin farming include USDC, USDT, and DAI. USDC is issued by Circle and is considered reliable, USDT (Tether) has the highest market cap, and DAI is decentralized. The choice depends on your risk tolerance and preference.

How to get started with stablecoin farming?

To start stablecoin farming, you’ll need to:

1/ Acquire stablecoins (like USDC or USDT) on a centralized exchange or buy it with your credit card.

2/ Transfer them to a compatible wallet (like Phantom for Solana or Rabby for Ethereum).

3/ Connect to a DeFi platform (such as Lulo, Aave, or Nostra) and lend your stablecoins to start earning yield.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love