My Favorite Dividend ETFs

Key Takeaways

- Dividend ETFs work better for 99% of investors

- Single stock dividends work great for 1% of investors

- Important is to DCA (dollar-cost average) over time

- It is key to choose a low-cost broker

Are Dividend ETFs A Good Idea?

My wife, having ZERO interest in stocks or investing, recently asked me what she should do if I wouldn’t be around anymore to manage the money of the family? A really good question! I don’t like to leave a mess behind, that’s why I created a simple plan that I like to share in this post. In short, I’d recommend my wife use three dividend ETFs to keep things simple and generate passive monthly income.

Step 1 – Sell All Single Stocks & Crypto

As my wife has no interest in stocks, divided ETFs or mutual funds, I first would advise her to sell ALL stocks. Yep, all 40x stocks of my All Weather Portfolio, Thematic Portfolios, and also all my crypto from my Digital Asset Portfolio.

Step 2 – Transfer The Money To A Neo Broker

After selling all single stocks, I’d recommend transferring all proceeds to one neo broker such as TradeRepublic in Germany, or Betterment in the U.S., allowing you to manage everything from the comfort of your mobile phone, and in a simple and low-cost manner.

Step 3 – Buy A Combination Of 3 Great Dividend ETFs

Most neo brokers offer a wide variety of thousands of ETFs and mutual funds. I know my wife would not have the interest, patience, and frankly, know-how, to pick and choose the right dividend ETFs. That’s why I went ahead and chose three complimentary dividend ETFs that pay dividends in different months, and focus on different geographies, industries, and investment approaches.

Dividend ETF 1 – iShares MSCI World Quality Dividend

The first dividend ETF I chose is the iShares MSCI World Quality Dividend ($WQDV, ISIN: IE00BYYHSQ67), focusing on companies with higher dividend yield and quality characteristics within the MSCI World Index, while also seeking to achieve a carbon-reduction and environmental, social and governance (ESG) score improvement. I believe this will be a mega trend for decades to come.

TOP HOLDINGS (%)

- MICROSOFT CORP 3.10%

- APPLE INC 2.81%

- CISCO SYSTEMS INC 2.54%

- QUALCOMM INC 2.54%

- ROCHE HOLDING PAR AG 2.48%

- TEXAS INSTRUMENT INC 2.46%

- UNILEVER PLC 2.44%

- ABBVIE INC 2.39%

- MERCK & CO INC 2.38%

- NOVARTIS AG 2.31%

As you can quickly see, those are the dividend-heavy hitters. Companies everyone knows, and should have in your long-term dividend portfolio. The fund pays dividends in May and November and currently yields about 2,9%.

Dividends ETF 2 – iShares STOXX Global Select Dividend 100

The second dividend ETF I chose is the iShares STOXX Global Select Dividend 100 ($ISPA, ISIN: DE000A0F5UH1), investing in a broad range of companies from developed countries globally that are high dividend payers.

This dividend ETF pays a dividend of 4,65% (!) and pays dividends in the months of January, April, July and October. It has a total expense ratio (TER) of 0,46%, making it significantly cheaper than most actively-manged mutual funds.

Dividend ETF 3 – iShares EM Dividend

The third dividend ETF I chose to buy is the iShares EM Dividend ($SEDY, ISIN: IE00B652H904), investing in emerging markets companies with the highest dividend yields. Investing in EM (emerging markets) comes with more risk, more volatility, and therefore also more potential.

TOP HOLDINGS (%)

- COLBUN MACHICURA SA 2.25%

- RIVERSTONE HOLDINGS LTD 2.00%

- EXXARO RESOURCES LTD 1.84%

- UNIPAR CARBOCLORO SA PREF B 1.77%

- STAR BULK CARRIERS CORP 1.76%

- CPFL ENERGIA SA 1.69%

- METALURGICA GERDAU PREF SA 1.69%

- EMPRESAS CMPC SA 1.62%

- SRI TRANG-AGRO INDUSTRY 1.61%

- PETROLEO BRASILEIRO PREF SA 1.59%

This dividend ETF currently pays a massive dividend of 10,5% (!), and has a TER of 0,65% (still relatively cheap compared with other emerging market ETFs). This fund pays dividends in March, June, September and December, complimenting the other two funds.

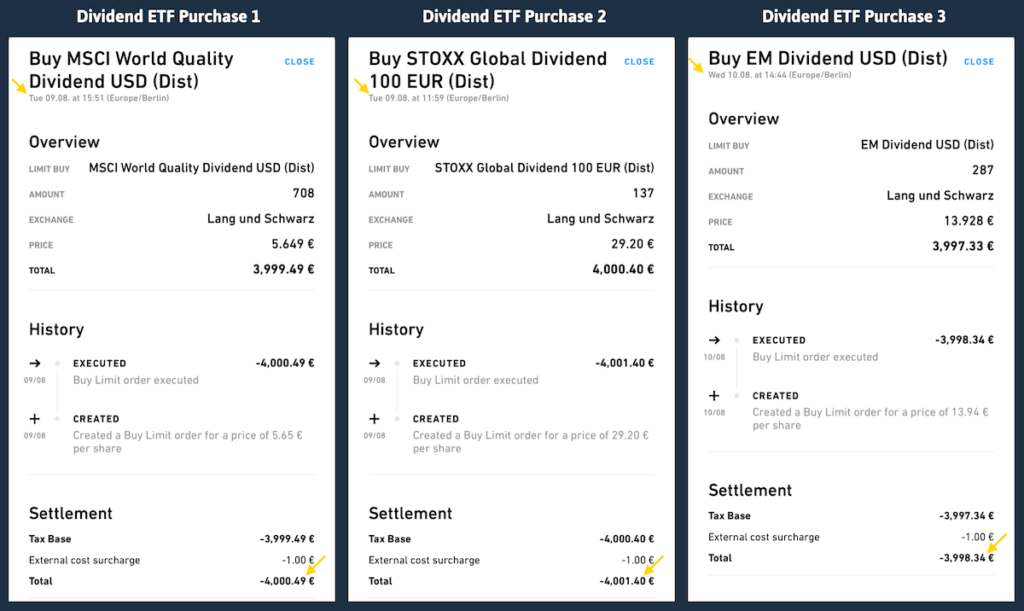

Recent Dividend ETF Purchases

See below for the trade confirmations of the dividend ETFs I just bought for my family on TradeRepublic. Those trades represent real, actual money. I transferred 12,500€ into my wife’s account, then made those purchases. Later on, should I not be around anymore, she can just add to those dividend ETFs, without having to select or choose any on her own.

Dividend ETF Income Calendar

With just three dividend ETFs, my family would receive monthly passive income in the following months:

| Month | Dividend ETF |

| Jan | STOXX Global Select Dividend 100 |

| Feb | |

| Mar | EM Dividend |

| Apr | STOXX Global Select Dividend 100 |

| May | MSCI World Quality Dividend |

| Jun | EM Dividend |

| Jul | STOXX Global Select Dividend 100 |

| Aug | |

| Sep | EM Dividend |

| Oct | STOXX Global Select Dividend 100 |

| Nov | MSCI World Quality Dividend |

| Dec | EM Dividend |

I am only using dividend ETFs from Blackrock, the largest asset manager in the world, and soon to be another stock in my All-Weather Portfolio. I intend to buy 10,000 USD with of $BLK in the coming few weeks.

My Top Pick & Conclusion

If I could only choose one dividend ETF, I would go with the iShares MSCI World Quality Dividend. It consists of world-class companies such as $MSFT, $JNJ, or $CSCO, companies you simply like to have in your long-term dividend portfolio.

But with the above three dividend ETFs as a combo, it’s easy to generate constant, passive, and monthly income. You’d be invested in a wide range of successful, high-paying companies with just three separate ETFs, giving you exposure to all relevant geographies of the investment world.

📘 Read Also

- My favorite senior living REIT that I will buy and hold forever

- Three interesting European REITs you can consider

- The three best German dividend stocks to buy

- The five best REITs in Asia to consider

FAQ

What is a good dividend-paying ETF?

What is the largest dividend ETF?

The largest dividend ETF, by respective Assets Under Management (AUM):

$VIG Vanguard Dividend Appreciation ETF with $63b AUM

$VYM Vanguard High Dividend Yield ETF with $49b AUM

$SCHD Schwab U.S. Dividend Equity ETF with $40b AUM

$SDY SPDR S&P Dividend ETF with $24b AUM

$DGRO iShares Core Dividend Growth ETF with $23b AUM

$DVY iShares Select Dividend ETF with $21b AUM

$FVD First Trust Value Line Dividend Index Fund with $12b AUM

$HDV iShares Core High Dividend ETF with $12b AUM

$NOBL ProShares S&P 500 Dividend Aristocrats ETF with $10b AUM

$RDVY First Trust Rising Dividend Achievers ETF with $8b AUM

How do ETFs make money?

Each ETF has an expense ratio showing the fees the fund sponsor deducts automatically. Low-cost ETFs have expense ratios (TER) of below 0,05%, expensive ETFs have TERs of 1% or more.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love