The 5 Best European Insurance Stocks To Buy

Key Takeaways

✅ Insurance companies have solid fundamentals

✅ Many legendary investors like Warren Buffett are heavily invested

✅ Insurance companies in the E.U. pay solid dividends

✅ I present Europe’s 5 best dividend stocks & my top pick

Many investment gurus like Warren Buffett allocate significant portions of their portfolios to insurance stocks. Why is that, which ones are the best European insurance stocks, and what’s the best one of them all?

Let’s take a look and find out!

Why are insurance companies good businesses?

Imagine I tell 10 of my friends to give me 2,000 USD each, per year (!), which I’ll invest on their behalf.

If something bad happens to e.g. friend nr 10, I then use the money of friends 1-9 to pay for number 10’s expenses.

Many would ask if I am crazy, but that is in a nutshell what insurance companies do.

Why do investment gurus love insurance stocks?

Insurance companies can invest their “float” (unclaimed premiums) in the asset class of their choosing.

And it is these huge piles of cash that attracted successful investors like Warren Buffett when he started acquiring insurance companies.

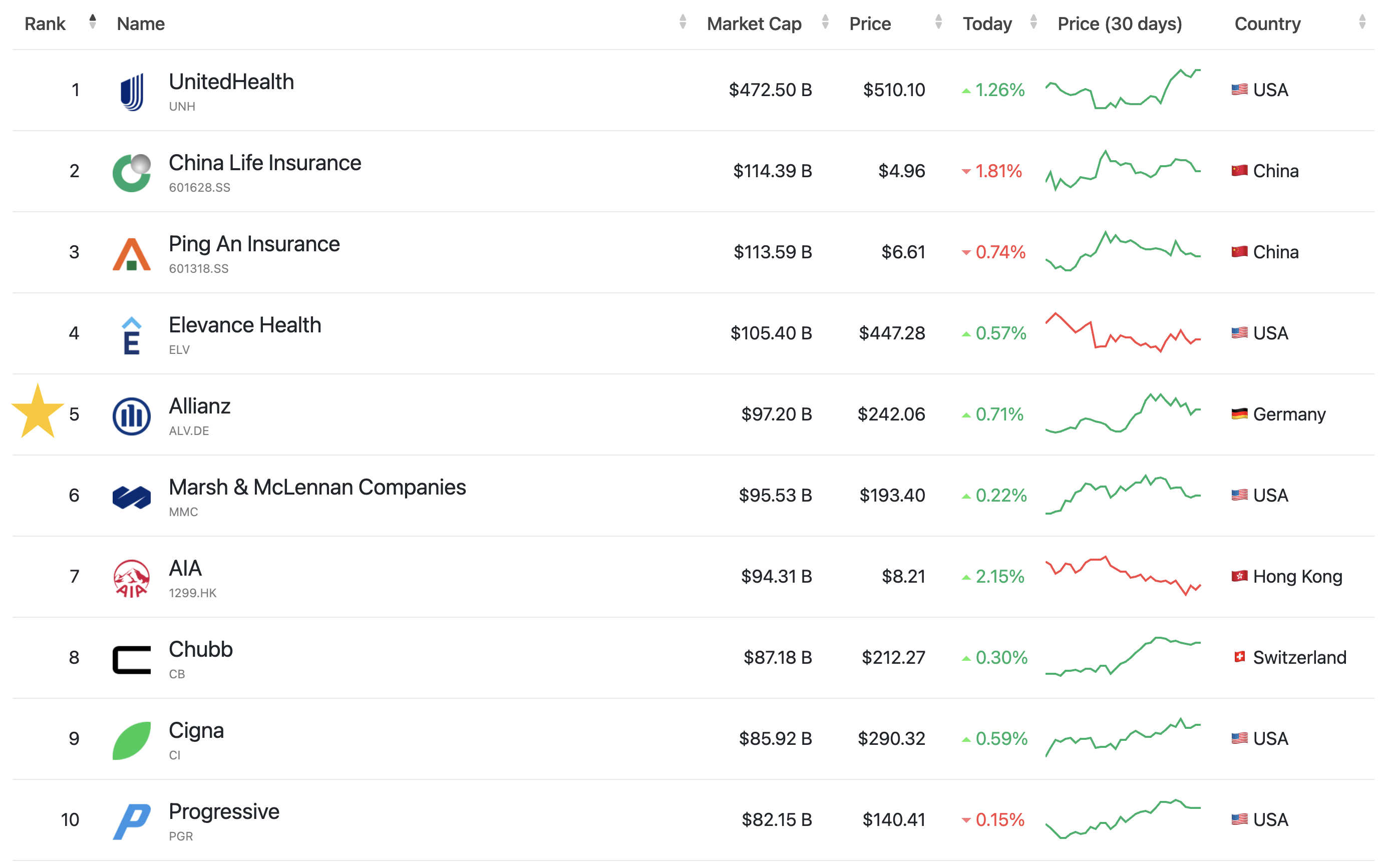

The Largest Insurance Companies In The World

Of the 10 largest insurance companies in the world, only one from the E.U. makes it into the top 10: Allianz.

Chubb, headquartered in Switzerland, but arguably a company from the U.S., is on spot 8, however, technically, it’s not part of the E.U.

The Largest Insurance Companies In Europe

| Market Cap in Mio | Sales, in Mio | PS | ||

| XTER:ALV | Allianz | $124,049 | $97,074 | 0.77 |

| XTER:AXA | AXA | $111,767 | $67,607 | 0.62 |

| MIL:G | Generali | $103,182 | $32,392 | 0.32 |

| FRA:MUV2 | Munich Re | $71,022 | $53,894 | 0.76 |

| FRA:ZFI1 | Zurich Insurance | $65,757 | $66,561 | 1.03 |

| XSWX:SREN | Swiss Re | $47,998 | $30,041 | 0.65 |

| XTER:TLX | Talanx | $39,285 | $16,401 | 0.4 |

| XTER:PRU | Prudential | $22,867 | $29,664 | 1.3 |

| FRA:4VK | Aon | $12,930 | $67,275 | 5.37 |

| OHEL:SAMPO | Sampo Oyj | $10,740 | $21,898 | 2.08 |

The Most Profitable Insurance Companies In The E.U.

Which insurance company in Europe has the highest net income? Also, check out the highest return-on-assets (ROA %) and return-on-equity (ROE %).

| Net Income, in Mio | ROA % | ROE % | |

| Allianz | $8,840 | 0.9 | 16.3 |

| AXA | $6,656 | 1.0 | 13.9 |

| MunichRe | $4,482 | 1.6 | 18.5 |

| Zurich Insurance | $4,433 | 1.3 | 17.8 |

| Generali | $4,291 | 0.8 | 20.8 |

| Prudential | $3,237 | 2.1 | 20.7 |

| Aon | $2,530 | 7.9 | – |

| Swiss Re | $1,596 | 1.0 | 12.7 |

| Talanx | $1,439 | 0.8 | 16.8 |

| Sampo Oyj | $1,136 | 2.5 | 12.5 |

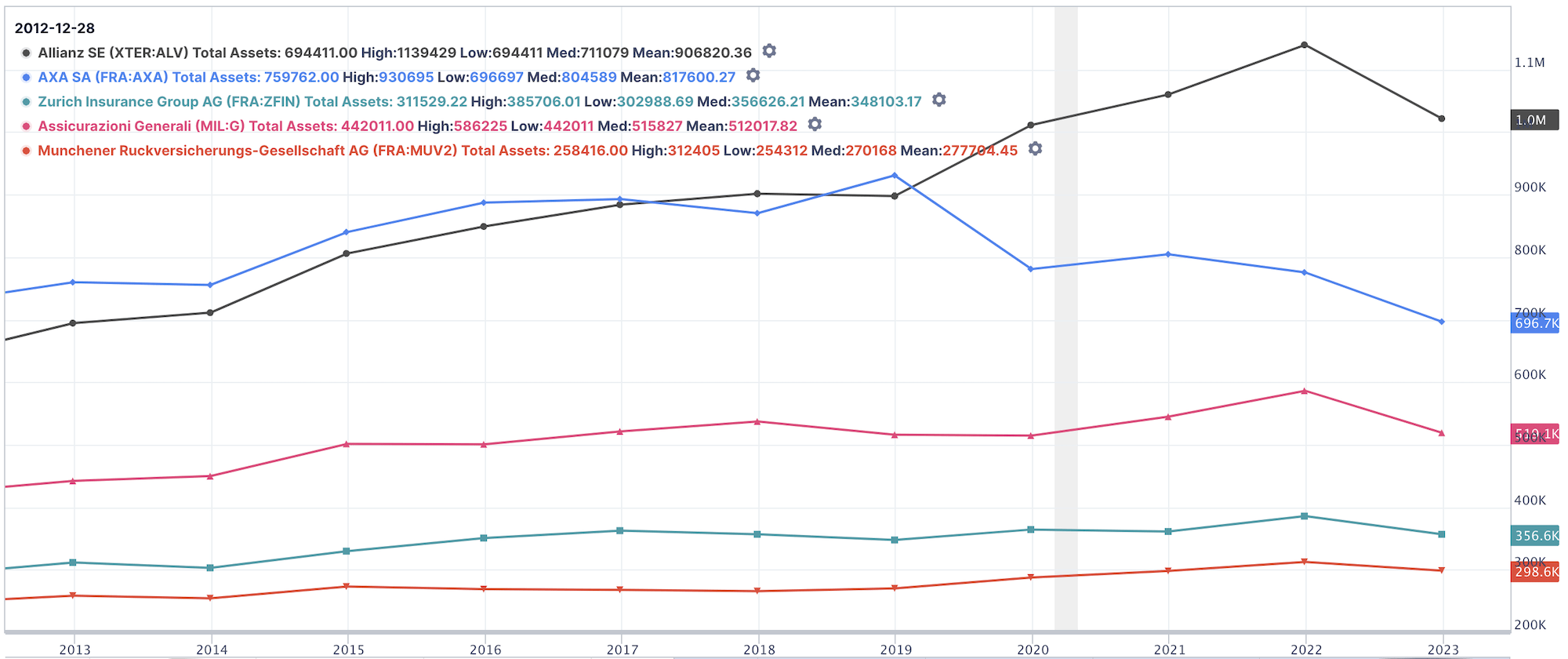

Total AUM of Largest European Insurance Companies

A quick look at the last 10 years of the assets under management of each of the largest 5 European insurance companies shows that 🇩🇪 Allianz comes in first, followed by 🇫🇷 AXA and 🇮🇹 Generali.

All of them saw a dip in 2022. Some of them saw declining AUMs post-pandemic (see AXA), while others did quite well (see Generali, MunichRe, and Allianz).

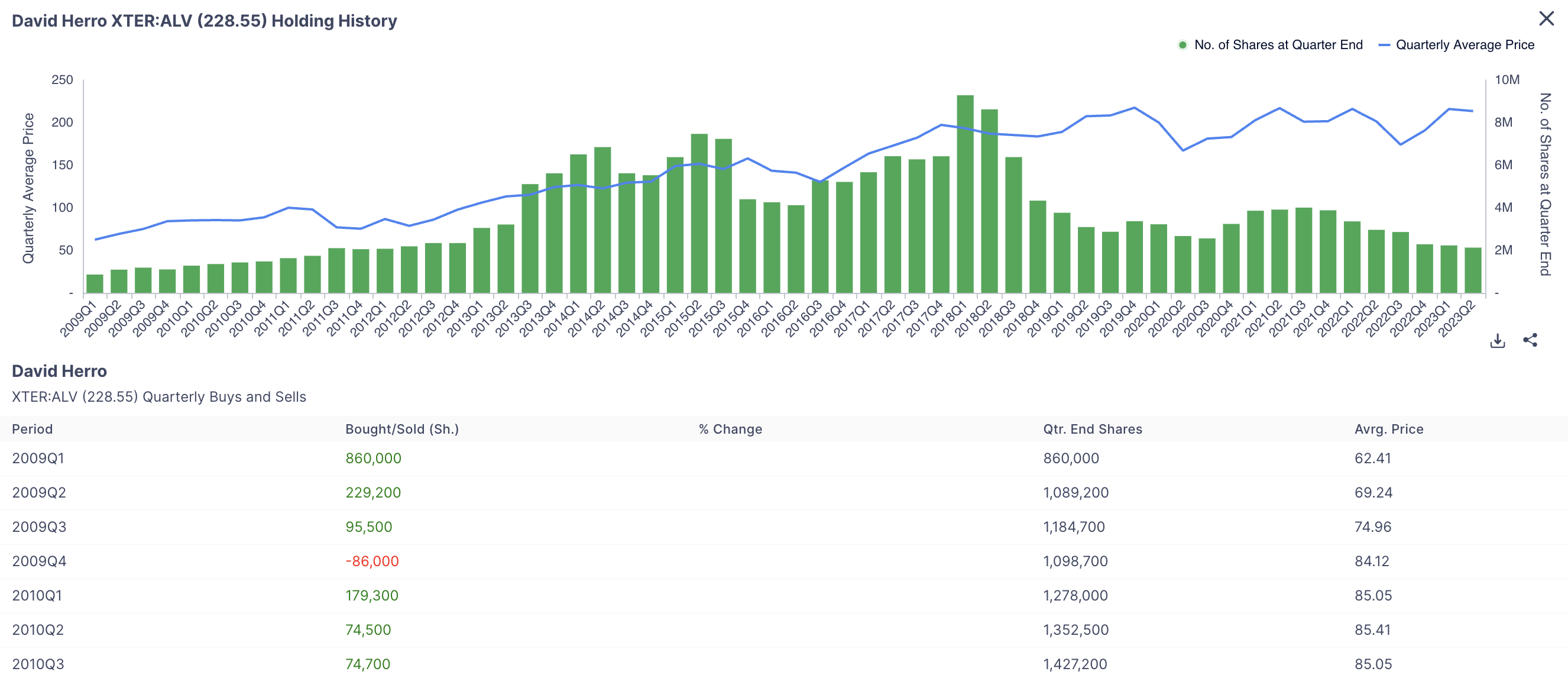

Which European Insurance Stocks Are Held By Legendary Investors?

What I love about Gurufocus.com is that it allows DIY investors like me to really dig into a lot of data.

For example, we can find out that legendary investor David Herro made the following purchases of Allianz, including the respective ownership and the average price of the quarter the purchases happened. His 2 Mio shares will pay Mr. Herro a yearly dividend of approx. 21 Mio Euro, not bad.

The 5 Best European Insurance Stocks

Below are the five European insurance stocks I like the most. This is certainly a subjective list, but with it, we can make some further comparisons.

| Price-to-GF-Value | PE Ratio | Yield | PB | |

| Allianz | 0.9 | 10 | 5.2% | 1.7 |

| Aon | 1.0 | 26 | 0.7% | 1029.3 |

| AXA | 1.2 | 10 | 6.0% | 1.4 |

| Zurich Insurance | 1.2 | 14 | 5.8% | 2.9 |

| Generali | 1.2 | 7 | 6.0% | 1.2 |

The Price-to-GF Value reflects the present intrinsic value of a stock determined through Gurufocus’ unique methodology, computed considering three main factors:

1. Historical multiples

2. An adjustment factor taking into account the company’s past returns and growth

3. Estimations of the future performance of the business.

When researching a sector, this ratio has proven to work quite well.

🏆 My European Insurance Stock Top Pick

My personal favorite European insurance stock and 🏆 top pick is 🇩🇪 Allianz, with the ticker symbol $XTER:ALV.

Full disclaimer: I own and hold Allianz in my All-Weather Dividend Portfolio.

(Tip: click on ADJ in the bottom right corner to see the chart with dividends included!)

About Allianz

Allianz is a global insurance and financial services company with a rich history dating back to its founding in Berlin, Germany in 1890.

Over the years, it has grown into one of the world’s largest insurers, expanding its operations globally and adapting to changing market dynamics.

Why Allianz?

Economies of scale – One of the largest global insurance companies with a strong market presence, offering a wide range of insurance products and services.

Geographic footprint -It has a geographically diversified business model, allowing it to capture opportunities in different markets and economies.

Diverse revenue portfolio – Has a diversified portfolio, encompassing both life and non-life insurance segments, reducing its reliance on any single sector.

Financial prowess – The company has a solid financial track record, demonstrating consistent profitability and strong earnings growth over the years.

Stable dividend – History of consistently paying stable dividends, providing a reliable and attractive income stream for investors. Visit Allianz’s dividend page.

Respected brand – The company has a very strong brand reputation, giving it a competitive advantage in attracting and retaining clients and employees.

Digital Transformation – Committed to technological advancements and digital transformation, enabling it to adapt to changing customer preferences and enhance operational efficiency.

Good personal experience – Both myself and my wife have been private health insurance customers for a long time, and only had pleasant and good experiences with the company, sealing the deal for why it is my favorite European insurance stock.

What I don’t like about Allianz

Legal Woes – Has faced legal and regulatory challenges in the past, which can lead to reputational damage and potential financial penalties.

Potential disruption – Operates in a highly competitive industry, facing challenges from both traditional insurers and disruptive InsurTech companies.

Risk Exposure -Exposure to potentially catastrophic events, such as natural disasters or large-scale claims, poses a risk to its profitability and financial stability

Strong technical resistance – Allianz seems not to be able to break out of the 235€ triple top, see the chart above.

Conclusion

I believe all presented European insurance stocks are solid businesses, and choosing a personal favorite one is a subjective decision.

All of them are highly profitable and have deep pockets to weather any storm, and I feel comfortable saying that they most likely will get through any financial turmoil that might be on the horizon.

📘 Read Also

- How To Start With Investing

- The 10 Best Water Stocks – With Dividends!

- How To Invest $50000 Right Now

- 5 Best European Stocks With Quarterly Dividends

-

Get new investment ideas on my updated 🏆 Stock Picks page

FAQ

Are insurance stocks a good investment?

It depends on various factors such as the company’s financial stability, growth prospects, and market conditions. For example, insurance stocks can be a good investment during periods of economic stability and when the company demonstrates strong financial performance. Historically, the best insurance stocks are good performers and pay solid and stable dividends.

When to buy insurance stocks?

The choice of insurance stock to buy depends on individual investment goals and preferences. It can be influenced by factors such as the company’s track record, market position, and future growth potential. Conducting thorough research and seeking professional advice can aid in making an informed decision. Generally speaking, insurance stocks are good performers and are liked by many dividend investors.

Which European insurance stock to buy?

The choice of which European insurance stock to buy depends on individual investment goals, risk tolerance, and analysis of various factors. Some factors to consider include the company’s financial stability, growth prospects, market position, and management team. It is recommended to conduct proper research, analyze financial statements, and compare the stock’s valuation with industry peers before making an investment decision. Seeking advice from financial professionals can also provide valuable guidance in choosing the right insurance stock to buy.

How to analyze insurance stocks?

Analyzing insurance stocks involves evaluating key financial indicators such as revenue, profit margins, underwriting performance, and solvency ratios. Additionally, examining industry trends, competition, and regulatory factors can provide valuable insights for analysis. Utilizing financial ratios and comparing them against industry benchmarks can aid in assessing the company’s financial health. The best European dividend stocks all are solid businesses, having returned money to their shareholders for years.

Where do insurance companies invest their money?

Insurance companies typically invest their money in a diversified portfolio consisting of various assets such as bonds, stocks, real estate, and cash equivalents. This investment strategy aims to generate returns and maintain liquidity to meet insurance obligations.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love