Key Takeaways

✅ The world’s top industrial conglomerate dividend stocks are reviewed

✅ The three best ones are Danaher, Honeywell, and Siemens

✅ All three of them offer excellent performance ratios

✅ My top pick is Siemens

I believe industrial conglomerates represent a unique and attractive way to build wealth over the long term.

My German grandpa was an engineer and a big believer in solid European industrial manufacturing companies. He owned their shares for decades.

I also believe that industrial conglomerate dividend stocks offer compelling opportunities for investors looking to maximize their returns as they most of the time have robust balance sheets, are innovators, and offer attractive dividends.

Investing in industrial conglomerates is also an excellent way to benefit from the global trends toward increased technological advancement.

These companies are well-positioned to capitalize on new opportunities from developments such as the growth of the Internet of Things (IoT), electrification, and digital transformation.

Moreover, their often vast financial resources enable them to deliver lasting returns to shareholders.

As such, this article will explore the 8x top industrial conglomerate dividend stocks and discuss why they represent an appealing investment opportunity for long-term investors.

World’s Leading Industrial Conglomerate Dividend Stocks

As always, let’s start by checking what the largest companies are in this space, by market cap and sales.

| Market Cap | Sales | Yield | P/S | |

| 🇺🇸 Danaher | $170,049 | $30,950 | 0.5% | 5.5 |

| 🇩🇪 Siemens | $131,245 | $79,185 | 2.8% | 1.6 |

| 🇺🇸 Honeywell | $127,990 | $35,954 | 2.1% | 3.6 |

| 🇺🇸 General Electric | $110,551 | $72,190 | 0.3% | 1.5 |

| 🇯🇵 Mitsubishi * | $57,572 | $151,453 | 3.2% | 0.4 |

| 🇯🇵 Hitachi * | $54,022 | $78,856 | 1.8% | 0.7 |

| 🇺🇸 3M | $53,540 | $33,431 | 6.2% | 1.6 |

| 🇯🇵 Itochu * | $49,817 | $103,752 | 1.4% | 0.5 |

*Berkshire Hathaway is owning shares since 2020

The first interesting fact is that we only see companies from three countries: the U.S., Germany, and Japan.

Mitsubishi is clearly leading the pack by revenues ($151 bio US), while Danaher is the largest by market cap ($170b US).

| Operating Margin % | FCF Margin % | |

| Danaher | 26.85 | 23.65 |

| 3M | 11.86 | 12.13 |

| Siemens | 11.18 | 10.66 |

| Honeywell | 19.05 | 10.23 |

| Mitsubishi | 4.91 | 6.73 |

| General Electric | 2.85 | 6.14 |

| ITOCHU | 5.1 | 5.08 |

| Hitachi | 7.09 | 3.75 |

We can quickly see why Danaher is more valuable than the others: Danaher’s operating margin and Free Cash Flow margin are fantastic. Twice as good as the second-best, 3M.

| ROE % | ROA % | ROIC % | |

|---|---|---|---|

| Honeywell | 29.96 | 8.48 | 12.14 |

| Danaher | 14.36 | 8.34 | 10.10 |

| 3M | 37.47 | 11.80 | 9.44 |

| ITOCHU | 18.49 | 6.42 | 5.65 |

| Siemens | 12.98 | 4.12 | 5.02 |

| Mitsubishi | 17.13 | 5.61 | 4.85 |

| Hitachi | 9.53 | 3.09 | 4.79 |

| General Electric | 0.36 | 0.07 | 0.85 |

Honeywell boasts the best Return on Invested Capital with 12% (a good number!), meaning it generates an average return of 12% on all the investments it makes.

Let’s do a quick shortlist and only continue with the top 3 industrial conglomerate dividend stocks:

- Honeywell

- Danaher

- Siemens

I like Danaher and Honeywell because of their high excellent ROE, ROA, and ROIC. And I like Siemens because of its relative size (higher sales as Honeywell and Danaher combined), its good dividend, and its high operating margin.

Let’s look at their current valuation:

| Price-to-FCF | PE | PB | PS | |

| Siemens | 15.3 | 21.8 | 2.7 | 1.6 |

| Danaher | 23.4 | 25.0 | 3.4 | 5.5 |

| Honeywell | 35.9 | 25.2 | 7.6 | 3.6 |

The current valuation ratios paint a different picture. Siemens starts to look a lot more reasonably priced.

It has

- the lowest price-to-FCF

- lowest PE

- lowest PB

- lowest PS

I believe all these three companies are excellent choices, but my clear favorite one is Siemens.

Of course, as from Germany myself I might be biased, but I am looking to find stocks that I can buy and hold forever, and Siemens fits that bill.

🏆 My Top Pick – Siemens

Siemens is a household name in most countries.

Most people know Siemens as a retail consumer brand, producing washing machines, dryers, or dishwashers.

But these days Siemens makes a lot more money with non-consumer products.

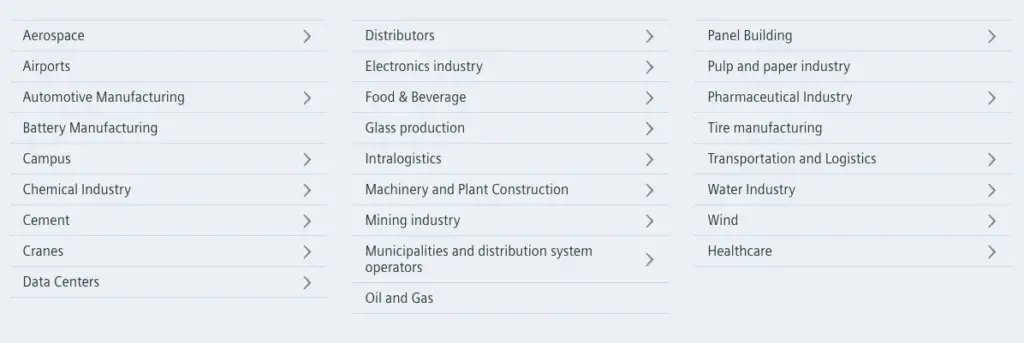

Siemens is currently a global leader in key technology areas including electrification, automation, and digitalization. This makes it well-positioned to capitalize on the upsurge in digital transformation and customers’ increased focus on Industry 4.0-related projects.

It primarily serves among many others the automotive industry, smart city energy & infrastructure (mobility), and healthcare.

It is also exploring opportunities to expand into new areas, such as artificial intelligence and data analytics.

Siemens’ Businesses

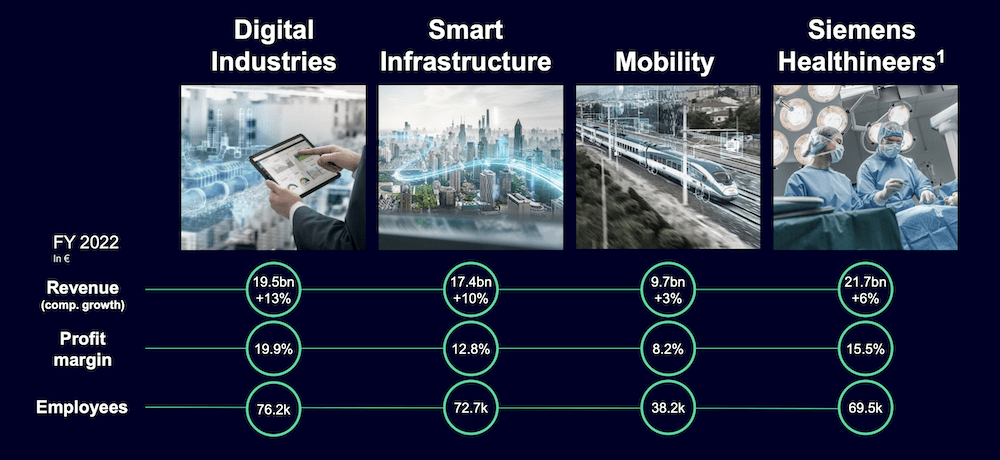

Siemens Healthineers is the largest business segment, with 21.7b Euro in sales, followed by Digital Industries with 19.5b Euro.

The Siemens holding (the share I like) owns about 72% of Siemens Healthineers and 35% of Siemens Energy, both stock-listed as well.

I like the fact that Siemens has a very healthy industrial diversity.

Siemens Geographic Footprint

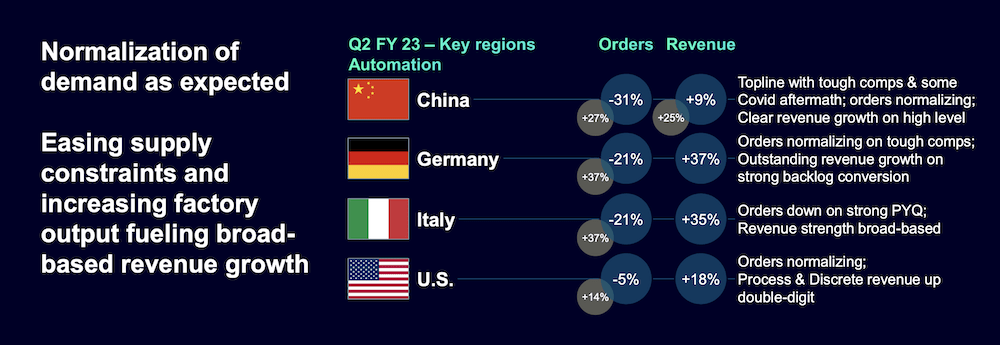

Like most industrial conglomerates, Siemens also is active on all continents, seeing a good increase in revenues comparing this and last year’s quarters.

Fortress-Like Balance Sheet

Siemens is a well-respected firm, with substantial financial resources: It has a strong balance sheet and financial resources to support its projects and investments, enabling it to deliver long-term returns to shareholders.

Industry Leading Dividend Yield

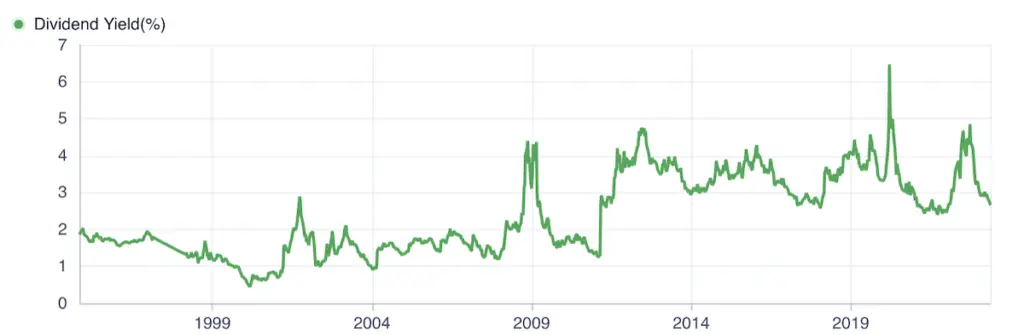

Although it has the lowest PE, PB, and PS of the top 3 industrial conglomerate dividend stocks, Siemens boasts the highest dividend yield, with 2.8%, making it a very appealing stock for dividend investors.

Great Innovator

Siemens is one of the most innovative companies on the planet, as it constantly invests in R&D, positioning itself well to capitalize on new opportunities arising from technological advancements, such as the growth of the Internet of Things (IoT), artificial intelligence, or smart infrastructure.

Futuristic Industries

I appreciate the fact that Siemens also has its fingers in many important and futuristic industrial applications, such as

- renewable energy, providing wind turbines for many European countries,

- software tools for the James Webb telescope,

- automation technology for the world’s largest space telescope (in Chile),

- water filter solutions for pharmaceutical and petrochemical industries,

- developing cutting-edge 5G network solutions

- digital health solutions that enable personalized patient care and improved outcomes,

- modern high-speed trains (maybe at some point in California!)

Conclusion

In my point of view, Siemens is the world’s top industrial conglomerate dividend stock, providing income investors like myself with a good night’s sleep.

I am ultra-long and plan to hold Siemens for a very long time.

📘 Read Also

- The 5 Best Container Shipping Stocks With Dividends

- The Best European Consumer Goods Stocks

- My All-Weather Dividend Portfolio

- Ouch – Selling This Dividend King Stock Hurts

FAQ

List of Dividend Stocks of Conglomerates Companies?

🇺🇸 Danaher

🇩🇪 Siemens

🇺🇸 Honeywell

🇺🇸 General Electric

🇯🇵 Mitsubishi *

🇯🇵 Hitachi *

🇺🇸 3M

🇯🇵 Itochu *

🇮🇳 Reliance

*Berkshire Hathaway is owning shares in those companies

What are the best industrial conglomerate dividend stocks?

Are conglomerates good or bad?

In generally, conglomerates are not as profitable as companies only focusing on one single industry, but due to their diversification, they are often more robust and resilient when it comes to market downturns.

What are the 5 largest industrial conglomerates?

🇮🇳 Reliance

🇺🇸 Danaher

🇩🇪 Siemens

🇺🇸 Honeywell

🇯🇵 Mitsubishi

What is the biggest conglomerate in Asia?

The biggest industrial conglomerate in Asia is India-based Reliance Industries Ltd, engaged in hydrocarbon exploration and production, refining and marketing, petrochemicals, financial services, retail, and communications.

What is the biggest conglomerate in Europe?

The largest conglomerate, and one of the world’s top industrial conglomerate dividend stocks, is Germany’s Siemens with businesses selling components and equipment for factory automation, railway equipment, electrical distribution equipment, and medical equipment.

Why do conglomerates exist?

Industrial conglomerates like Siemens, Danaher or Honeywell exist because over time they

– tapped into an array of different markets and capitalize on synergistic effects,

– enjoy and benefit from economies of scale,

– to reduce dependence on any one market or industry, and,

– to increase the overall competitiveness of the company.

Do industrial conglomerate stocks pay dividends?

Yes, some of the best industrial conglomerate dividend stocks such as Siemens, Danaher or Honeywell have dividend yields ranging between 0.5%, e.g. Danaher, to 2.8% like Siemens. The dividend stock 3M (MMM) currently yields more then 6.5%.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love