At The Dawn Of A New Era

In the past 12 years, we have seen historically low-interest rates. This enabled high-growth companies almost unlimited access to funding. In an era with monumental money printing, hard assets such as gold seemed less important. My thesis is that this is about to change, in a very big way. You can refer to this article in which I explain my top 10 reasons to invest in gold.

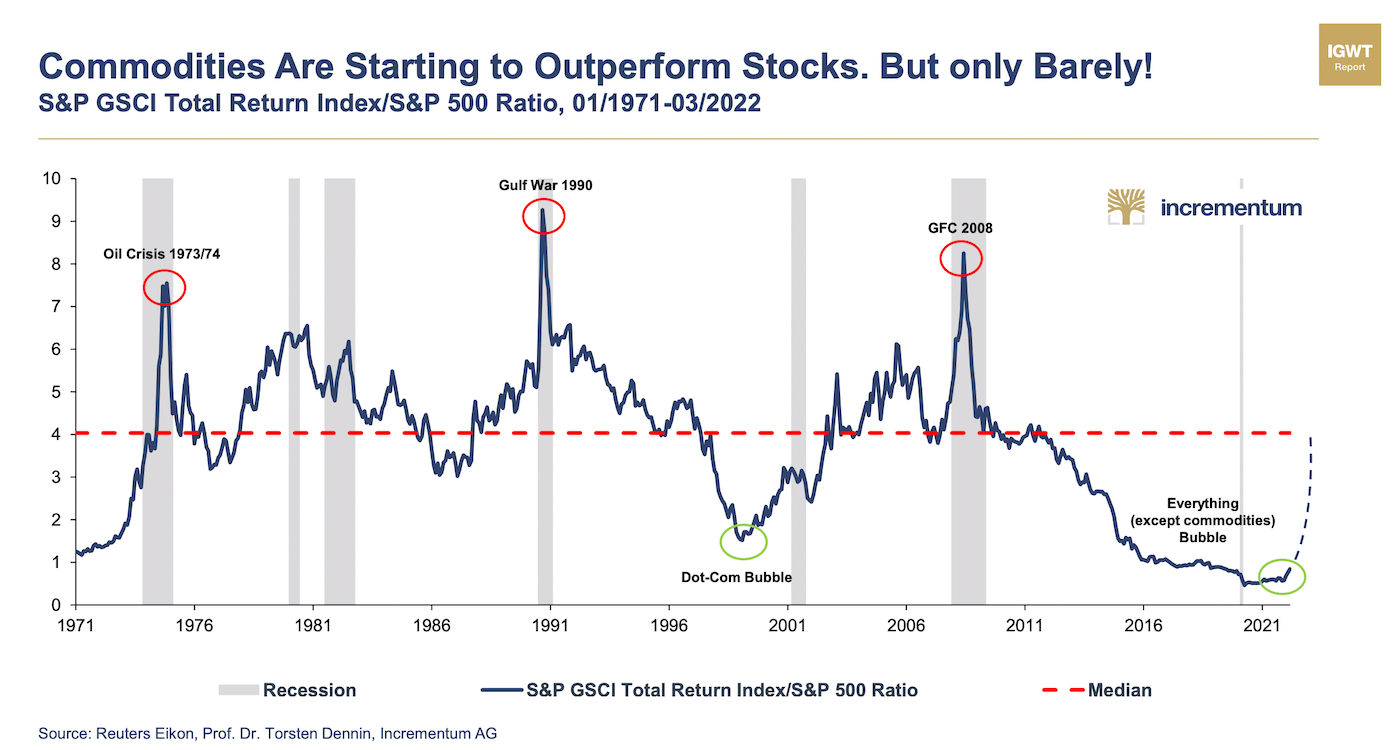

One Chart Says It All

When looking at the long-term S&P index/commodities ratio, you can see that stocks are very expensive. Commodities in general are out of favor. The average investor does not even think of allocating a part of this portfolio to producers of commodities. Not even mentioning gold mining companies!

The New FAANG

The original term ‘FAANG‘ stood for Facebook, Amazon, Apple, Netflix, and Google. The New FAANG, or FAANG 2.0, will consist of a

- Fuels

- Aerospace & defense

- Agriculture

- Nuclear

- Gold mining companies & precious metals in general

In the coming decade, the New FAANG will reflect a world of geopolitical risks, repricing anything that can not be printed out of thin air –> hard assets.

The Return To The Historic Mean

As Rick Rule keeps explaining: We don’t need any sort of crazy over-valuation of commodities. All we need is to go back to the average mean.

Only 0,5% of investible assets are in gold. The long-term mean is 1,5%. Imagine what would happen if 1% of the world’s investible money goes into a sector that Apple could buy purely with its cash reserves

Precious Metals are historically under-owned. To give you a comparison: In the 80s, after the world recovered from very high inflation in the 70s, the average portfolio allocation to gold-related securities was 7%. Now, in 2022, it only is 0,25%. Imagine we’d simply go back to this average!

Now that we know that gold is historically under-owned and that it makes sense to have a part of your portfolio in gold mining companies, we can ask ourselves: How to build a portfolio of gold mining companies?

The Two Best Books On Gold (in 2022)

If I’d have to recommend just two books that give you great insights, I’d suggest the following two:

Why Gold? Why Now?, by E.B. Tucker

Gold! Madness, Murder, And Mayahen In The Colorado Rockies, by Ian Neligh

You can find both of them on Amazon.

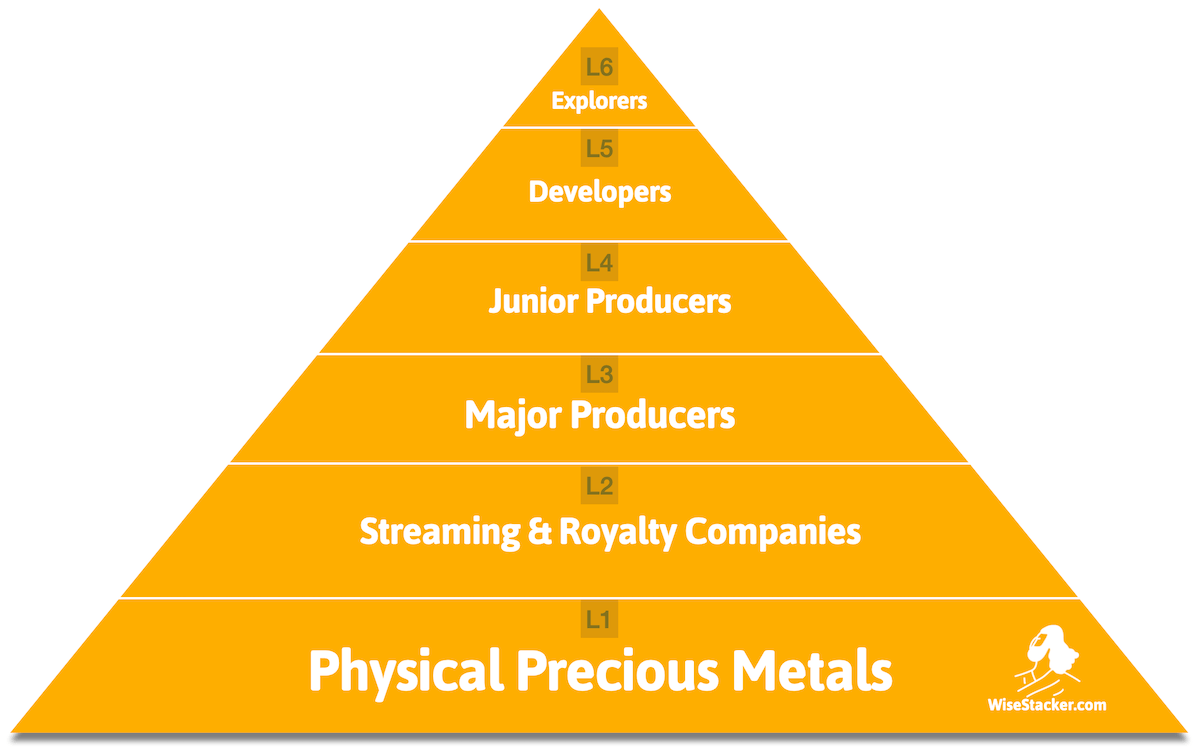

The Golden Pyramid of Portfolio Allocation

Picture a pyramid. How do you build one? We of course need to start by laying a strong foundation.

The 1st Layer – Physical Gold – Your Foundation

Any pyramid is built on a strong foundation. That’s why before thinking of building a precious metal mining portfolio, it is highly recommended to first build up a core position of physical precious metals. There are tons of good online stores that deliver the precious metals straight to your door. You can also choose to store them at a trusted vaulting operator. For example, I use and trust Goldbroker.com for years. They got vaults in the U.S., Europe, and Asia. Alternatively, you can store precious metals at home (check out my article here).

How much of my portfolio should be allocated to precious metals miners?

I keep my physical metal allocation at around 5% of my total liquid net worth. Whenever I have an influx of cash, e.g. I’ll receive about 60,000 USD in August 2022 in form of a dividend, I’ll simply purchase 3,000 USD worth of gold coins at Goldbroker.com, my go-to online precious metals store & vault.

What is the best allocation for gold, silver, and platinum?

Personally, I recommend keeping 60% of your physical precious metals in gold. You can divide the remaining 40% into physical silver and physical platinum. Once you have up this portfolio position, we can talk about the 2nd layer of the pyramid.

Your 2nd Layer – Streaming And Royalty Companies

Gold streaming companies, also called royalty companies, help precious miners like e.g. gold mining companies by providing them with capital in exchange for a % of future sales. By this, the mining company gets direct access to smart money, while the royalty company gets a cut of the future sales, including an option for all future discoveries.

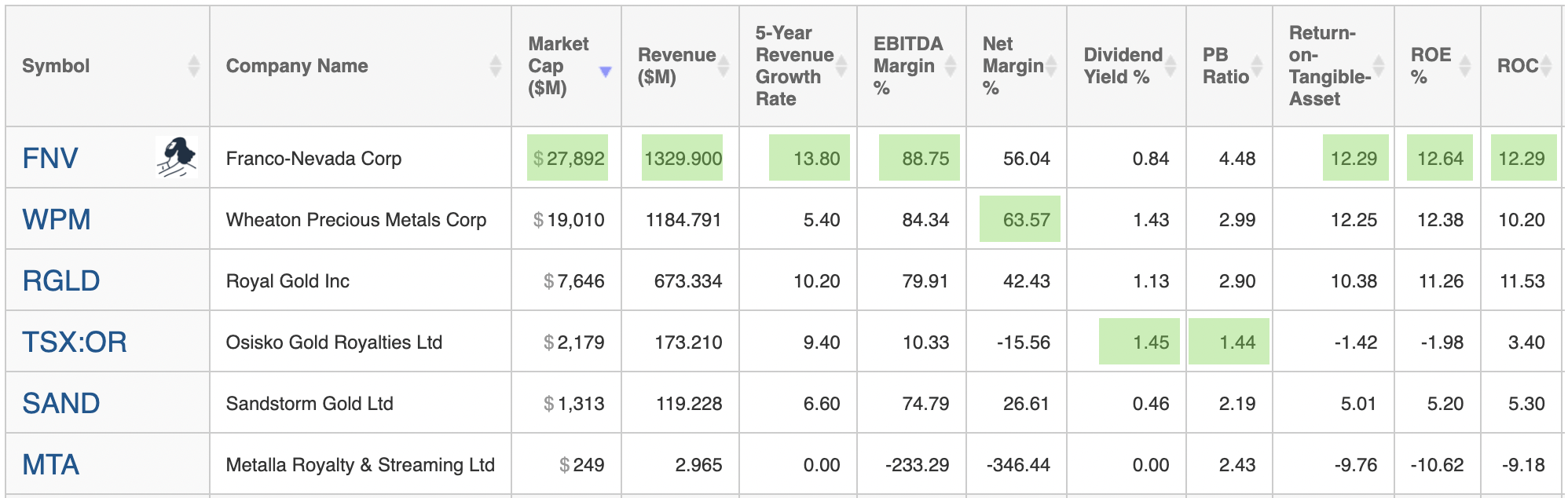

What are the best gold streaming companies?

Let’s first look at the six largest ones (by market cap).

- Franco Nevada – The best of the best

- Wheaton Precious Metals – 2nd largest royalty company

- Royal Gold

- Osisko

- Sandstorm

- Metalla

Disclosure: I own $FNV in my Resource Portfolio.

Franco, Wheaton, and Royal account for +90% of the combined streaming company market cap. Osisko, Sandstorm, and Metalla are sort of the New Kids on the Block, but also worth a look.

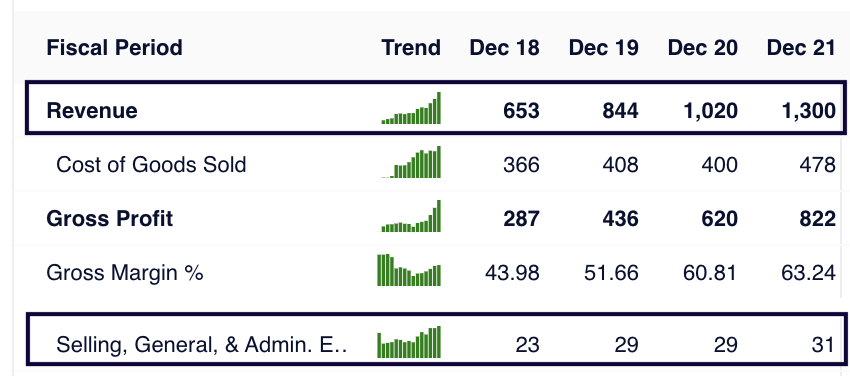

Gold streaming companies have one of the most lucrative business models in the world. Take the income statement of Franco, the royalty company I own, as an example.

1,3 Bio USD in sales, with a Gross Profit of 822 Mio USD, while its total SGA (salaries, office rent, etc.), is a total of 31 Mio USD. Incredible!

It generates a net income after taxes of 734 Mio USD, with a total of 42 employees. Yes, forty-two in total (not 42 thousand). On a Net Income per Employee basis, Apple, arguably one of the most profitable businesses ever created, does not even do 10% of what Franco does, see the side-by-side comparison table:

| Apple | Franco Nevada | |

| Net Income (2021) | 95 Bio USD | 0,73 Bio USD |

| Employees | 154,000 | 42 |

| Net Income/Employee | 0,6 Mio USD | 17,4 Mio USD |

Once you built your first (physical precious metals), the next step is to choose one of the major gold streaming companies. Going with Franco Nevada, Wheaton Precious Metals or Royal Gold is a good start. Besides streaming companies, let’s now look at how to structure a portfolio of gold mining companies?

Your 3rd Layer – Major Producers

Now that you have a solid base consisting of physical precious metals and gold streaming companies, you can consider adding one of the major gold mining companies, also referred to as major gold miners or major producers.

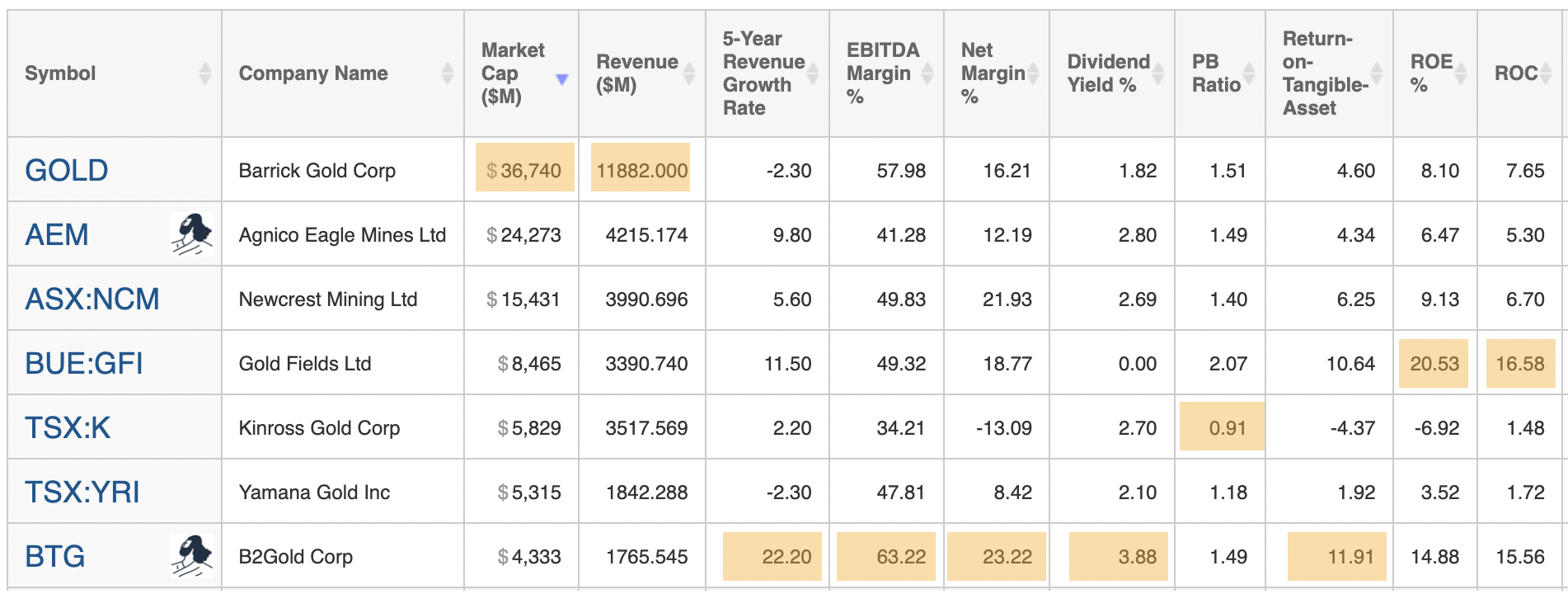

The following tables show the seven largest gold mining companies, ranked by market cap. I excluded those gold mining companies that are not easy to buy (e.g. China’s ZiJin Mining), or are currently not tradeable (e.g. Russia’s Polyus).

Disclosure: Of this list, I own $AEM and $BTG.

Personally, from this list of major gold mining companies, I own Agnico Eagle and B2G for a long-time in my Resource Portfolio. Both pay good dividends.

Your 4th Layer – Junior Producers

We keep climbing up the pyramid. By now, you have quite the solid base with physical precious metals, at least one gold steaming, and one major gold producer. We can now venture out on the risk curve and add one junior gold producer.

There are many to choose from, and finding companies with good value is not easy. If you are really interested in this space, I would advise against doing it yourself.

Instead, consider signing up with one of the reputable gold mining stock newsletters such as The Morgan Report or SilverChartist.com. Both have a very good reputation, I am or have been a subscriber myself, and they know what they are doing.

Not investment advice, just listing the junior gold mining companies I own:

- Coeur Mining

- Pan American

- SilverCrest

Your 5th Layer – Developers

Now that we built a strong foundation of physical precious metals, streaming, and major and junior gold mining companies, you can consider adding a precious metal mine developer.

A developer already found and has usually permitted a new mine, but it’s not in production yet. It currently is developing the mine. Many things can and typically do go wrong when building a mine. Therefore, I would only touch developers once you have built a solid base in layers 1-4.

Let me quickly share an example of a typical developer story: I bought shares of Aurcana in mid/late 2021 at around 0,60 USD. A few weeks after my first purchase, there was a ‘rock movement event’ at the company’s “Revenue Virginius mine”.

Thankfully, no fatalities or injuries occurred, however, the ongoing operations were severely impacted. It basically made continuing working on the mine impossible for the foreseeable future. The stock, six months later, traded at 0,08 USD, and I had lost about 85% of my investment. Ouch. This is just one of the examples of what can happen when building a mine.

I generally would advise against buying any developer, and if, then it should only represent a very small part of your overall Natural Resource Portfolio. Below are surely not any buying recommendations, just sharing the developers I own:

- MAG Silver

- Discovery Metals

- Aurcana

- Silvercrest

Your 6th Layer – Explorers

We reached the top of the pyramid. This is the most-risky layer, containing gold mining companies primarily engaged in the exploration of assets. This is the furthest out on the risk curve you can go, and this segment should only represent a tiny small portion (from my point of view absolute max. of 2,5%) of your overall natural resource portfolio.

Whether or not an exploration team can end up finding a gold deposit or not, is the first monumental challenge. Even if it does, it then needs usually 3-12 years to do the required feasibility studies and get the required permits! And judging this likelihood from afar is close to impossible (and often not even from up-close).

That’s why this section is not for the average investor. I compare it with gambling and shooting in the dark. If one of the companies should indeed find gold, it could X-in value, but as the chance for it happening is not possible to quantify, please treat this with great caution.

Not financial advice, just listing out those explorers I currently own:

- Fury Gold

- Tier One Metals

- Granada Gold

- Klondike

- Gungnir

- MacDonald

Combined the above represent less than 2,5% of my total Natural Resource Portfolio.

Summary of the Precious Metals Portfolio Pyramid

Following this time-and-tested advice is a prudent approach to building a portfolio of the world’s best gold mining companies. You would have solid exposure to the entire sector, while also generating some quarterly cash flow.

Alternatives To Building Your Own Portfolio Of Gold Mining Companies

If my pyramid approach is too time-consuming or cumbersome, you can choose an ETF or a mutual fund investing in gold mining companies

What Are The Best ETFs Holding Gold Mining Companies?

The easiest way to invest in gold mining companies is to buy one of the largest Gold Mining ETFs. Of these leading Gold ETFs, I like $GDX and $SGDM the most. Sprott is in my opinion one of the most respected companies in this space, and I am following them for 10+ years. The way they choose which gold mining companies to be included in their ETFs ($SGDM and $SGDJ) is superb, and with their in-depth knowledge, you can trust their judgment.

Maybe consider choosing one of the ETFs buying major gold mining companies (like $GDX or $SGDM), and one buying more junior gold mining companies (like $GDXJ or $SGDJ).

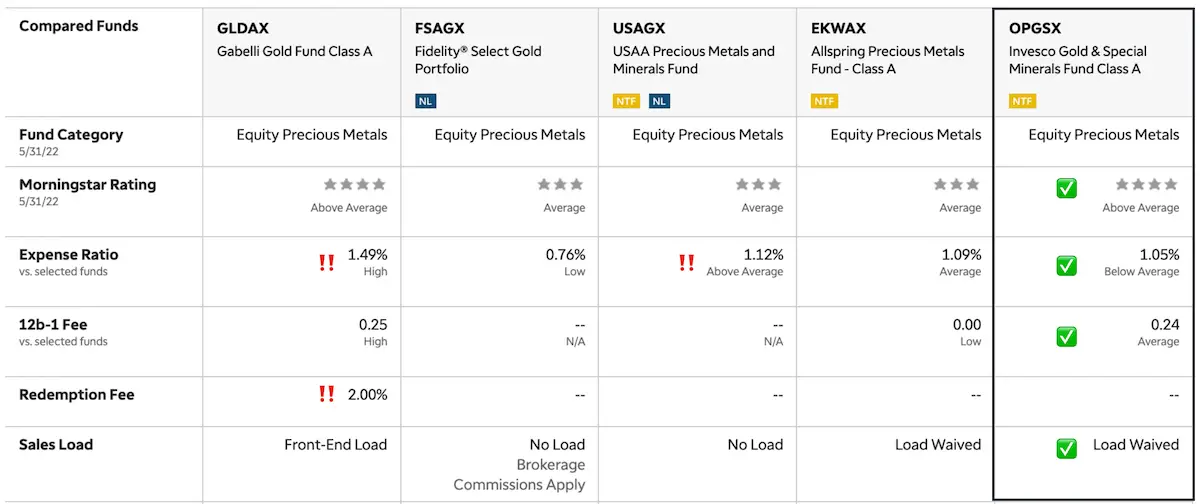

What Are Good Gold Mining Company Mutual Funds?

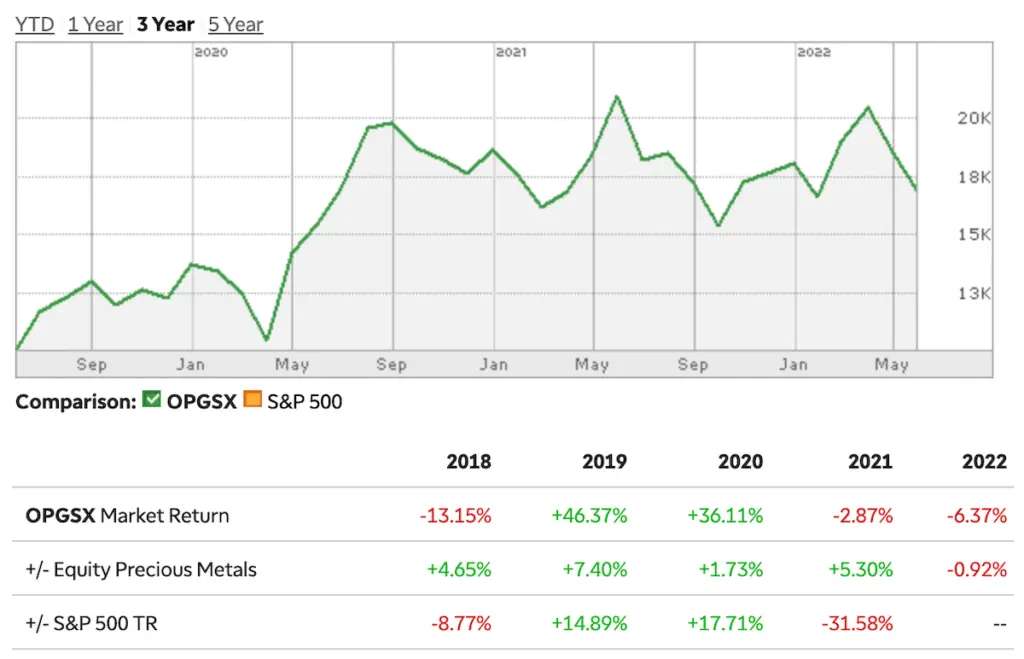

In general, I would stick to ETFs due to their lower expense ratios. For those preferring a good-old mutual fund, I created a quick comparison table. For mutual funds, I usually use the Fund Comparison Tool over at Groww, you can check it out here.

I don’t own it, but from a first quick glance, the Invesco Gold & Special Minerals Fund Class A looks good to me. As always, pay attention to the mutual fund’s Total Expense Ratio (often referred to as ‘TER’) – anything above 1,25% I would not touch. ETFs often have TERs of sub 0,5%. It has consistently outperformed its index, see below.

What are the best precious metal stocks?

Ask 10 people and you will get 10 different answers. But to me, the number 1 precious metal stock is Franco-Nevada, the world’s leading gold streaming company. Instead of investing in one mine or asset, you get exposure to 100s of different mines with which Franco has revenue-sharing deals. I use Gurufocus.com for years, and it happens extremely rarely that one stock reaches 100 out of 100 points. Franco did in 2022. There are only 11 other companies in the world with a rating of 100.

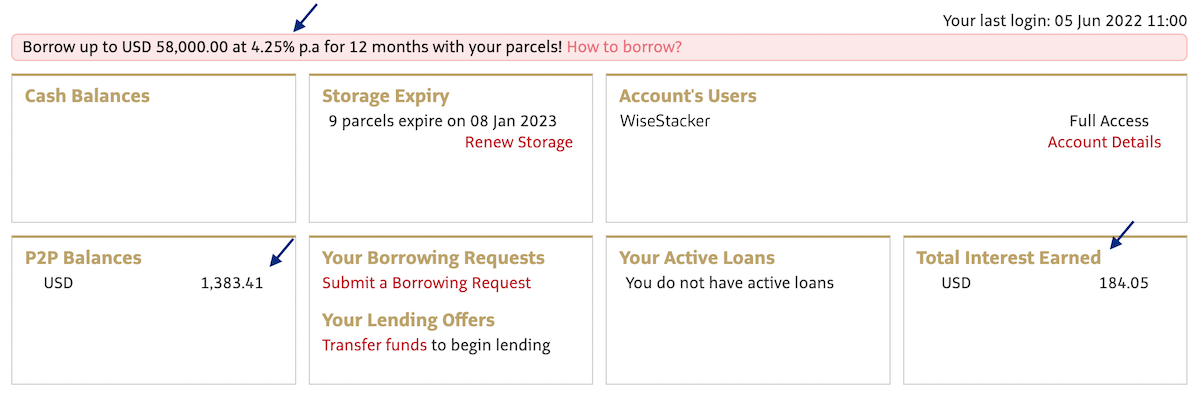

What are good physical metal storage companies?

There are many good ones to choose from. What I find important is that the storage facility also provides the option to buy, sell and even take out loans with your precious metals as collateral. See the below example showing my actual dashboard. I could take out a loan of up to 58,000 USD with a loan of 4,25% p.a. with my precious metal parcels as collateral. I don’t really need this, but it sure feels good to know that this option exists.

Who are the leading experts on gold mining companies?

I advise following some of the living gold mining legends, as we as up-and-coming precious metal legends. I watched hundreds of hours of interviews and investor presentations, and my precious metals living legend top picks are the following:

- Rick Rule (watch this masterclass video on Youtube)

- Ross Beaty (excellent interview)

- Eric Sprott (good keynote speech)

- Thomas Kaplan (awesome story 👉 good interview)

- John Hathaway(great conversation)

As for the up-and-coming precious metal legends, I’d pick the following:

- Clive Johnson (CEO of B2Gold)

- Sean Boyd (CEO of Agnico Eagle)

- Nolan Watson (CEO of Sandstorm)

- Ivan Bebek (CEO of Auryn/Fury Gold/Tier One)

How to buy physical precious metals?

You can go to your local precious metal dealer, or do what I do, which is to order it from a trusted precious metal store like Sprott, or the one I use, called GoldBroker.com. I only keep a small part of my physical precious metal stack at home. The majority is stored in GoldBroker’s world-class vaulting facility in Singapore.

Conclusion

If you enjoy researching single stocks, I’d follow the above-mentioned pyramid approach, and build up a portfolio of the world’s best gold mining companies, starting with gold streaming companies, major and junior producers, and maybe even sprinkle in some developers or explorers. Personally, I love this entire space and enjoy listening to videos of the various companies.

If you only like to buy one single stock to get exposure to gold, I’d hands-down go with the precious metal category pioneer Franco-Nevada ($FNV).

The most effective way to get exposure to gold mining companies is of course via an ETFs or a mutual fund. I’d keep it super simple, and go with Sprott’s $SGDM and $SGMJ.

📘Read Also

- How to invest in commodities incl. 15x stock ideas

- How to store precious metals at home – the right way?

- How to invest in battery metal stocks incl. one top pick

- Check out the five best inflation stocks I could find

FAQ

What allocation should precious metals have in your portfolio?

This is different for every investor, but a good rule of thumb is to have approx. 5% of your liquid net worth (excl. real estate) in precious metals. In our unique and crazy monetary times like this though, I’d advise on a higher number. My Natural Resource Portfolio is currently ~600k USD and my total net worth stands at ~6 Mio USD, hence it’s 10% for me.

What are the best precious metals ETFs?

As mentioned above, the two best options for major gold mining companies are either $GDX or the one I would recommend, the $SGDM. These two give you exposure to the major gold producers. Via the $GDXJ and Sprott’s $SGDJ, you can get exposure to junior gold mining companies (smaller, more potential, more risk).

What are good best penny stock gold mining companies?

Typically you refer to developers or gold explorers when referring to penny-stock gold mining companies. They are very high-risk investments. You can easily lose your entire investment! Only consider those after you built up a strong foundation of gold streaming companies, major producers, and junior producers.

How to buy physical precious metals?

You can go to your local precious metal dealer, or do what I do, which is to order it from a trusted precious metal store like Sprott, or the one I use, called GoldBroker.com. I only keep a small part of my physical precious metal stack at home. The majority is stored in GoldBroker’s world-class vaulting facility in Singapore.

Where to buy physical precious metals?

Personally, I order my precious metal online, see above, or buy it at a local precious metal dealer. You should feel comfortable with the store’s manager and team, and try to build up a small relationship with them so that they get to know you as a loyal customer. The spread between their distribution and sales price is usually relatively thin, therefore most trusted stores offer comparable prices. Websites dedicated to precious metals like Kitco.com are excellent source of information as well.

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love