The World’s Best Container Shipping Stocks

Key Takeaways

✅ The 5x best container shipping stocks are non-U.S. based

✅ 2020-2023 were abnormally good years

✅ Extremely high dividends will not be maintained

✅ Shipping stocks are very cyclical

Overview of Container Shipping Companies

Container shipping companies move containers from country A to country B. The container shipping industry, therefore, is a vital component of the global economy, allowing for the transportation of goods across the world. The COVID-19 pandemic has had a huge impact on supply chains, and in turn, a surge of demand for cargo ships to deliver goods to consumers in quarantine.

This underscores the global importance of this industry and the appealing investment opportunities it presents for investors.

4 Reasons Why Investing in Shipping Stocks Might be a Good Idea

1. High barriers to entry: The cost of entry into the maritime shipping industry is HUGE, meaning moat

2. Long-term contracts: Most ocean shipping companies have long-term, reliable contracts with major companies, meaning predictability

3. Global demand: The demand for ocean shipping is growing due to globalization and the need for transportation, meaning potential

4. Diversification: Investing in maritime shipping stocks provides diversification for your portfolio, meaning reducing risk

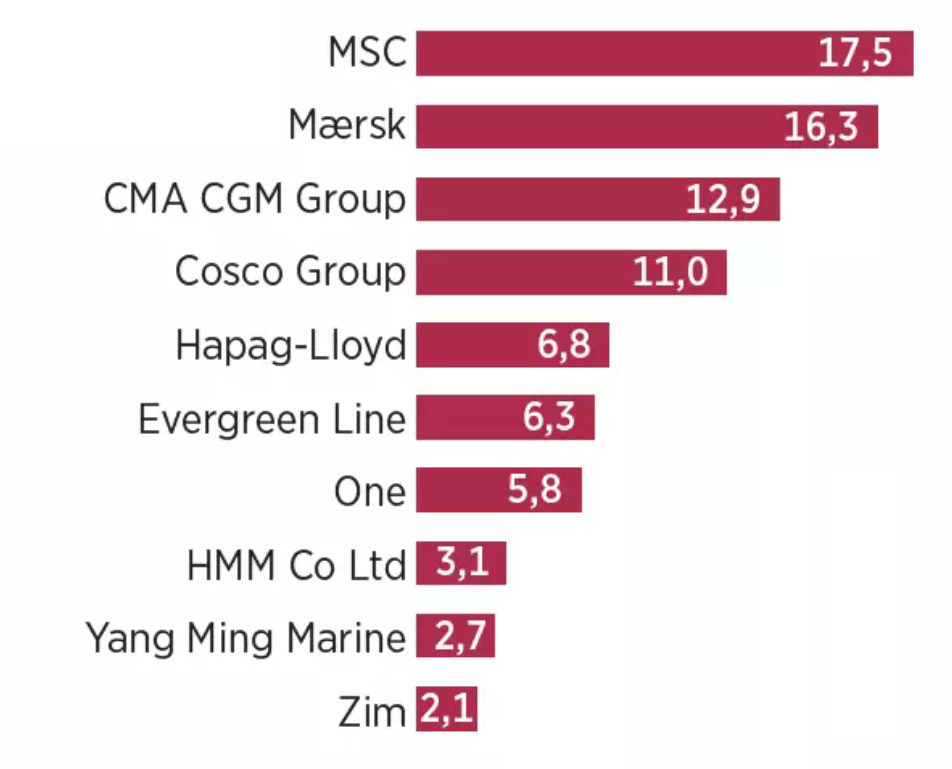

Market Shares of Shipping Companies

(Statista)

The ocean shipping company with the largest market share is a private company. MSC, which stands for Mediterranean Shipping Company S.A., is an international shipping line founded by Gianluigi Aponte in Italy in 1970, HQed in Switzerland since 1978. It is owned by the Aponte family.

Largest Listed Container Shipping Companies

|

Market Cap |

Revenue |

PS |

|

|

🇩🇰 A. P. Moller Maersk |

0.41 |

||

|

🇭🇰 COSCO Shipping |

0.35 |

||

|

🇩🇪 Hapag-Lloyd |

1.63 |

||

|

🇨🇳 Evergreen Marine |

0.62 |

||

|

🇮🇱 ZIM |

0.21 |

Interesting to note that a German company has the highest market cap. Usually, German companies are known for having relatively low market caps.

Also interesting to note is that there is no shipping company from the U.S. under the top 5 container shipping stocks! The largest U.S. ocean shipping company is Kirby (KEX), with about $2b in market cap, slightly less than Israel-based ZIM.

At a first glance, Maersk looks interesting. It has more than double the revenues of Hapag-Lloyd, but only half the market cap.

ZIM looks very cheap, only being valued at 20% of its yearly sales!

10-Year Net Profit Margins of Shipping Companies

When looking at the net profit margins of the ocean carrier companies over the last ten years, we can see that they range-bound between 5-10% from 2016 to 2021.

Starting in 2021, we can see that things just became abnormal, with the net margins increasing to 28-53% (!).

Why did net profit margins increase so much after 2021?

The pandemic had a major impact on global supply chains, and as a result, demand for cargo ships to transport goods to consumers in quarantine has surged.

This has enabled shipping companies to raise prices and increase their margins due to the high demand.

Also, the cost of fuel has decreased a lot after 2021, further increasing margins for shipping companies!

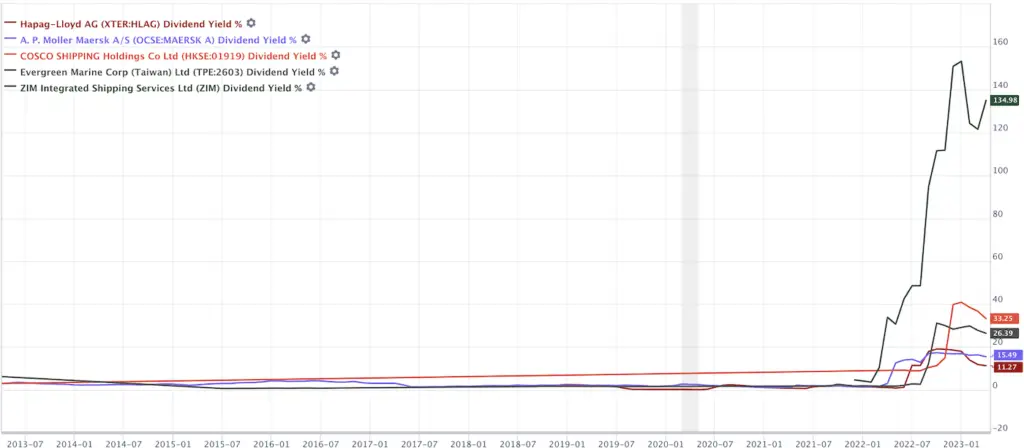

Gimme Dividends!

These unique circumstances resulted in record dividends paid by the largest maritime shipping companies. It becomes quickly obvious once we look at the 10-year development of the dividend yield.

I believe this situation will normalize in the coming months and years and we will go back to the pre-crazy time levels.

We should not make the mistake of projecting similar profit margins and dividends going forward – this won’t be the case!

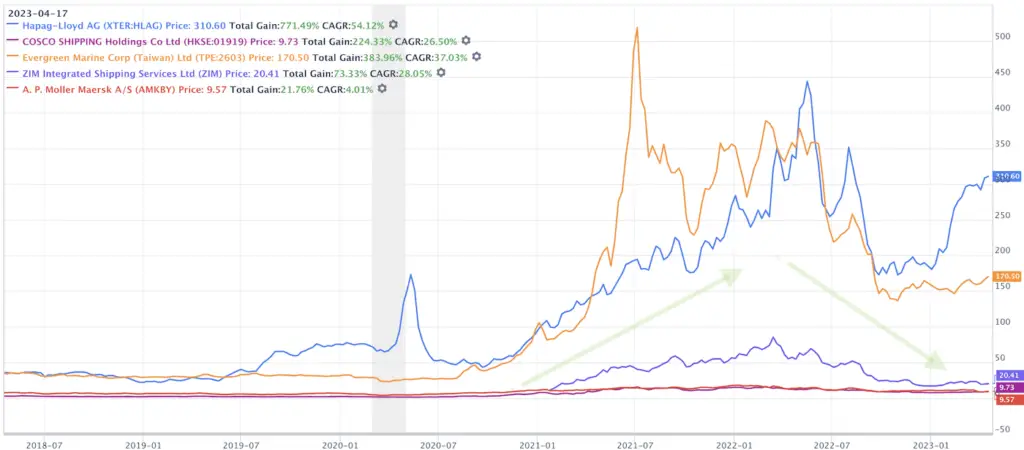

And the market already prices this reality, as you can see from the stock charts of the companies (see the green charts).

🏆 My Container Shipping Stock Top Pick

If I could only choose one shipping stock, I’d go with A.P. Moeller Maersk at the moment.

This Danish powerhouse of a company has been navigating through rough waters for decades, and I believe the captains👨🏻✈️ at the helm are smart and experienced enough to keep on doing so for years or even decades to come.

About Maersk

| Name & Ticker | A.P. Moeller Maersk (AMKAF /FRA:DP4A) |

| Market Cap $ M | 32,854 Mio USD |

| Enterprise Value $ M | 37,402 Mio USD |

| PE | 1.1 |

| PE Ratio without NRI | 1.1 |

| Forward PE Ratio | 4.8 |

| Price/Book | 0.5 |

| Price/Sales | 0.4 |

| Payout Ratio % | 0.2 |

Why Maersk is maybe the best container shipping stock in the world:

1/ Financial Performance: it consistently performs well (financially), with strong revenue growth and healthy margins.

2/ Global Footprint: Maersk has a global presence with operations in +130 countries

3/ Strong Brand: Within the industry, Maersk enjoys good and strong brand recognition (good HR branding!)

4/ Innovative Solutions: Maersk continuously invests in new tech like blockchain and artificial intelligence (ie. coops with IBM)

5/ Cost Efficiency: Maersk keeps on implementing cost-saving strategies, allowing it to remain competitive

Conclusion

Overall, I believe Maersk is an excellent company that income investors can consider for their dividend portfolio.

Do I buy or own Maersk? No. Not at this point.

I believe container shipping stocks might have seen the best of times already.

Globalization is starting to retract, and with robotics & automation more and more things will be produced on-shore.

Large container ships are one of the worst polluters on the planet, and it will take super-massive investments to green up their fleets in the coming decades.

Drones might also chip away at market share, and the move from a unipolar world with one large hegemon to a multipolar world will mean less saving international waters.

Overall, to me, this is not the best risk/reward ratio. I pass on this one.

📘 Read Also

- Read about my recent Southeast Asian business trip

- My favorite European consumer stocks to buy

- The 5 Best Wall Street Movie Scenes Of All Times

- Check out my monthly dividend income portfolio (2023/04)

FAQ

What Is The Best Container Shipping Stock?

A.P. Moeller Maersk. The Danish company is considered to 800-pound gorilla of container shipping stocks. It consistently performs well (financially), with strong revenue growth and healthy margins, and has a global presence with operations in +130 countries.

Is Container Shipping Profitable?

In some times, yes, extremely profitable. The years 2020 to 2022 were a big anomaly – container shipping companies made a lot more money then in previous years. Global pandemics or geopolitical tensions can have a large influence on the prices marine shipping or ocean carriers can charge their customers.

What are the best global shipping stock?

The five top publicly-listed container global shipping stocks are

– 🇩🇰 A. P. Moller Maersk

– 🇭🇰 COSCO Shipping

– 🇩🇪 Hapag-Lloyd

– 🇨🇳 Evergreen Marine

– 🇮🇱 ZIM

Should I Invest In Shipping Companies?

The business of shipping companies can be quite volatile and cyclical. In certain times shipping companies can charge 15,000 – 20,000 USD per 40ft container (like between 2020-2022), in other times they can only charge 1,500 – 2,000 USD/container. This shows that external factors play a very big role.

Maersk - My Container Shipping Stock Top Pick

PROS

- Financial Performance

- Global Footprint

- Strong Brand

- Innovative Solutions

- Cost Efficiencies

CONS

- Cyclical Business Model

- Industry Seen As a Big Polluter

- Massive Investments to De-Carbonize Needed

- Globalization On The Decline

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love