Looking For The Best Gold Stock In The World?

Key Takeaways

☑️ Franco Nevada is arguably the best gold stock in the world

☑️ Debt-free and generating 742 Mio in net profit, with 42 employees

☑️ Has 112 cashflow-producing mines, 250 under development

☑️ Gives exposure to gold without single-mining operator risk

☑️Besides precious metals, also owns oil and nat gas royalties

Quick Profile

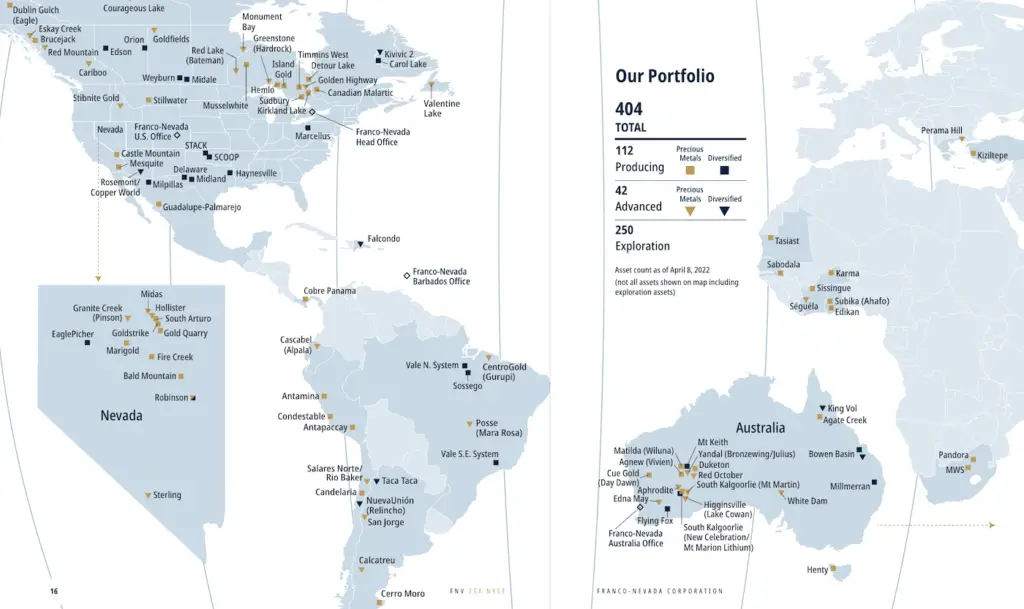

Franco Nevada (FNV) (website), is the world’s largest gold-focused royalty & streaming company. It has a massively diversified asset base of cash-flow-generating mining assets all over the world (see asset map below).

What makes royalty companies like Franco Nevada so unique is the exploration optionality to the mine’s assets without the company having to pay more money for its potential land-mark precious metal discoveries.

The hard asset element (gold, precious metals, oil, nat gas), also limits investors’ exposure to ever-increasing cost inflation.

The company has a total of 42 full-time associates. Not bad for a business with 22 Bio USD in market cap, 1.3 Bio USD in revenues, and 734 Mio USD in net income.

That’s a net margin after all expenses and tax of 56% net margin.

Reasons Why FNV Is The Best Gold Stock

Let’s look at the top reasons why I believe $FNV is simply the best gold stock in the world:

1/ Worldclass Asset Portfolio Of Diverse Mining Assets

As an old saying goes ‘”A mine is a hole in the ground with a liar standing next to it”. With mine operators developing or operating a single mine, you as an investor are taking on immense risk.

The sheer amount of variables operators have to deal with when developing or operating a mine is mind-boggling. And when things can go wrong, they do go wrong.

I have many scars to prove it. For example, just recently in 2021 I painfully experienced a complete and sudden melt-down of Aurcana, a gold stock I owned.

It experienced a ‘rock movement’, and the stock suddenly tanked by 40% within a day, and a further 59% in the subsequent weeks when all investors tried to figure out ‘how bad the rock movement really was’ (it was very bad).

This is the very reason why you don’t want to invest in single mine operators but in royalty and streaming companies like $FNV!

See the below’s map showing all the mines Franco has royalty and streaming agreements with:

I believe Franco Nevada’s asset base is impossible to replicate, as it includes some of the world’s best gold mines.

| 404 | Assets Total |

| 112 | Cashflow-Producing |

| 42 | Developing (Coming online soon) |

| 250 | Exploration |

It is noteworthy to mention that $FNV owns not only gold royalties but also energy-related agreements.

In fact, $FNV has owned and invested in energy assets since its early beginnings. I believe this was a very smart move of the management because its energy investments allow Franco to be opportunistic through the (wild) ups and downs of the ‘commodity cycles’, complimenting and diversifying its asset and revenue base.

In 2021, the total energy revenue was 16% of Franco Nevada’s revenue.

2/ Locked-in Optionality For Further Discoveries

One aspect that is often not appreciated enough is that streaming companies like Franco Nevada earn a fixed percentage of the mine’s gold sales regardless of how much gold the mine can produce.

If the mine does well, and let’s say sells 100 gold, Franco earns a cut, let’s say 2. Should the mine find ways how to increase its production, and suddenly mines 150 gold, Franco would benefit from this and earn 3.

Now, should the mine make a gigantic new gold discovery, and suddenly mine 1,000, $FNV would simply say thank you and suddenly make 20. And that without the need to put down more money.

This is the very reason why Pierre Lassonde, Franco Nevada’s founder, keeps saying that the gold streaming model is the best business model ever invented.

Look at the below stats and you will get an understanding of what Mr. Lassonde is saying:

| Franco Nevada | Apple | |

| Net Income (2021) | 734 Mio USD | 95 Bio USD |

| Employees | 42 | 154,000 |

| Net Income per Employee | 17.4 Mio USD | 0.6 Mio USD |

With 1,3 Bio USD in sales, Franco has a net income of 734 Mio USD, with a total SGA (salaries, general administrative expenses, office rent, etc.), is just at 31 Mio USD. This is incredible!

It generates a net income after taxes of 734 Mio USD, with a total of 42 employees! Yes, forty-two in total (not 42 thousand). On a Net Income per Employee basis, Apple, arguably one of the most profitable businesses ever created, does not even do 10% of what Franco does.

Head-spinning!

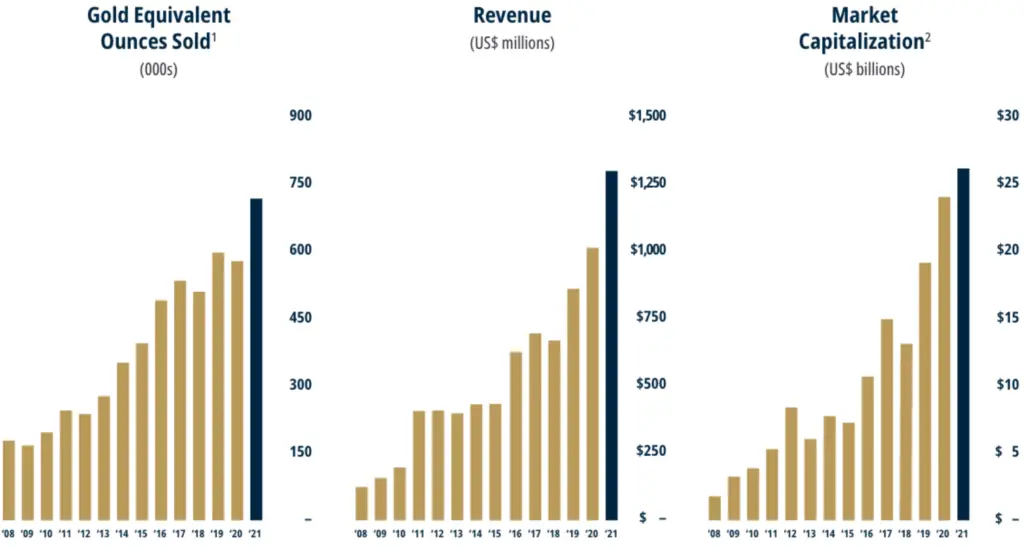

3/ Strong Fundamentals And Lots & Lots Of Cash

Franco has zero debt, pays dividends, is fantastically profitable, and has a very predictable business model.

As of the end of the 3rd quarter of 2022, $FNV has current assets of 1.1 Bio USD, total assets at 6.1 Bio USD, while its total liabilities are at 184 Mio. That brings the total stockholder equity to 6.2 Bio USD.

As Franco Nevada is in the business of owning royalties in gold mines producing precious metals, something that central banks can not simply print, I believe the company has extremely strong fundamentals, as gold is scarce, precious and simply put difficult to mine.

I believe it is vital for every investor to own gold, and with Franco’s strong fundamentals, it’s a good pick to be the best gold stock in the world.

From a quick glance we can see the positive trajectory of the company:

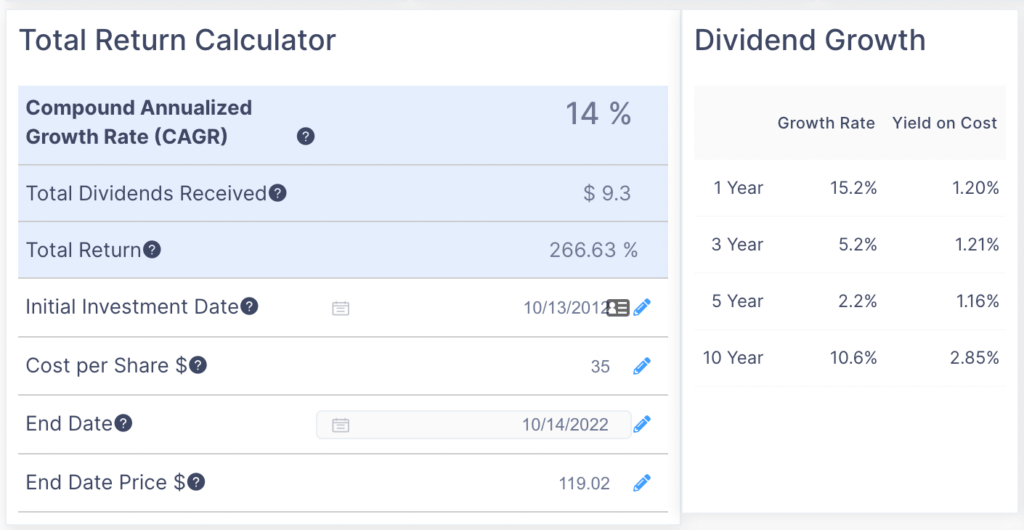

4/ A Sweet & Stable Dividend

The dividend $FNV is paying is not substantial, it’s 0.32 USD per quarter. See below for the most recent payments:

| Currency | Dividend | Pay Date |

|---|---|---|

| USD | 0.320 | 2022-09-29 |

| USD | 0.320 | 2022-06-30 |

| USD | 0.320 | 2022-03-31 |

| USD | 0.300 | 2021-12-23 |

| USD | 0.300 | 2021-09-30 |

| USD | 0.300 | 2021-06-24 |

| USD | 0.260 | 2021-03-25 |

Although it is only 1.28 USD for the entire year, the payout ratio is low (30%), meaning $FNV could increase the dividend whenever it seems fit.

If you’d had invested money ten years ago, you’d look at a CAGR of 14%:

And this calculation would have looked very different a couple of months ago when $FNV‘s stock was at 165 USD compared to today’s 120 USD.

5/ Attractive Valuation Compared To Its Peers

Let’s take a quick look at how $FNV compares to its key peers, whereas Wheaton Precious Metals in my opinion is another contender for the best gold stock of the world:

What’s noteworthy is that not surprisingly, $FNV has the highest ROIC (one of the ratios Warren Buffett pays more attention to than the PE ratio). The Return on Invested Capital gives you a sense of how well a business is deploying its capital to create profits.

6/ Strong Inflation Protection

If the five reasons above are not already convincing enough, there is a sixth one I feel is really the cherry on top: God knows what this decade will bring, but what we know for sure is that central banks around the world will keep printing money like there is (literally) no tomorrow.

Franco is able to also grow its revenues in phases where the gold price doesn’t go anywhere, see below’s chart:

With an investment in Franco, you get sort of natural protection from the harsh realities, because it “produces” a scarce precious metal (and on top also limited oil and nat gas!). All of this gives you strong protection against increasing inflation!

Check out which other good inflation stocks besides $FNV I recommend.

What is the largest gold streaming company in the world?

The largest and arguably best gold stock in the world is Franco Nevada (FNV). The 2nd largest is Wheaton Precious Metals (WPM), and the 3rd largest is Royal Gold (RGLD). All these three royalty companies are contenders for being the best gold stock in the world.

| Gold Streaming Companies | Market Cap | Sales |

| Franco Nevada | 22,6 B | 1.335 M |

| Wheaton Precious | 14,3 B | 1.157 M |

| Royal Gold | 6,1 B | 651 M |

| Osisko | 1,9 B | 163 M |

| Sandstorm | 1,4 B | 129 M |

| Metalla | 0.2 B | 3 M |

| EMX | 0.2 B | 4 M |

Risks

Any investment brings certain risks with it. In the case of $FNV, I see the main risk that gold might become hopelessly obsolete.

If central banks would dump all their gold, and the Millennials and Gen-Zs are only interested in Bitcoin (check out my digital asset portfolio), then Franco’s case would become weaker.

But the chance for this to happen is extremely low, in fact, I believe the opposite is the case.

Another risk might be the risks associated with mining. If a major earthquake would happen in a region where Franco owns many royalty agreements, this might have a strong impact on its financials.

However, Franco has cash-producing mines on four different continents! Should such a major earthquake happen, the future supply of gold would be severely impacted, driving the price of gold UP! Which again would benefit Franco greatly.

Overall I don’t see many risks, which is one of the reasons making Franco the best gold stock in the world.

Conclusion

Thinking long-term, I am 100% positive that Franco will do well. Especially in the coming decade. That’s why I hold it in my All-Weather Portfolio, adding to my position on weakness.

Gold has been the preferred store of value since ever people needed one – and during all this money-printing madness, gold should do well, and if gold does well, Franco will do extremely well.

Even at the current gold price, it is one of the most profitable companies ever created, hence just imagine what would happen to Franco’s market capitalization should the gold price really take off. I will be definitely on board when this ship sails!

📘 Read Also

- Check out the dividends I receive every month

- Check out how to store precious metals at home

- Learn how to build a portfolio of gold mining companies

- The 8 best oil & gas midstream stocks

- What are the best 5 best inflation stocks

FAQ

What is the weight of one cubic meter of gold?

The weight of one cubic meter of Gold, or 35 cubic feet, is 19,4T (=19,400 kg, or 42,500 pounds). The weight of one cubic meter of Platinum is 21,5T, one cubic meter of Palladium weighs 10T, one cubic meter of Titanium weighs 4.5T, one cubic meter of Silver weighs 10,5T, and one cubic meter of water weighs 1T.

How do gold streaming companies make money?

Franco owns streaming contracts with different gold mining operators (like Barrick, Newmont, etc.). These agreements give Franco the option and right to receive a part of the mining company’s revenue, in the case of royalties, or a portion of the production.

And in the case of a streaming agreement, usually at discounted prices. It’s this superior business model that makes streaming companies some of the best gold stocks in the world.

How much gold is owned by central banks?

The following countries own the most gold:

10 – Holland 0,6T

9 – Japan 0,7T

8 – Schweiz 1,0T

7 – China 1,0T (experts think really more like 10-20T)

6 – Russia 1,2T

5 – France 2,4T

4 – Italy 2,4T

3 – IMF 2,8T

2 – Germany 3,3T

1 – USA 8,1T

(source of 2016)

In which form is gold held?

There are essentially the following buckets of gold owners:

– central banks

– jewelry

– private ownership

– others (industrial, corporate ownership, etc.)

If you would put all the gold ever mined into one cube, how big would it be?

You’d melt all the gold ever mined (in thousands of years), and you’d get a cube with about 20 meters (65ft) in length/width/height

My Take on Franco Nevada

Franco Nevada is arguably the best gold stock in the world. It has streaming agreements with 110+ cashflow-producing mines, no debt, pays dividends, is led by a top-notch team, and has ample room to grow.

PROS

- Worldclass Asset Portfolio Of Mining Assets

- Locked-in Optionality For Further Discoveries

- Strong Fundamentals And Lots & Lots Of Cash

- A Sweet & Stable Dividend

- Attractive Valuation Compared To Its Peers

- Strong Inflation Protection

- Diverse Commodities (PMs & Energy)

CONS

- Gold Might Go Out Of Favour (Unlikely)

- Massive Natural Disaster Could Have A Negative Impact

Review Breakdown

-

Financial Strength

-

Predictability

-

Growth Rank

-

Dividend

-

Overall Rating

Age when reaching FI: 40 in 2018

Age when reaching FI: 40 in 2018 Left the rat race: May 2017

Left the rat race: May 2017 Living in: Singapore

Living in: Singapore Number of kids: 2

Number of kids: 2

Services I Love

Services I Love